Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CEB Inc. | d511836d8k.htm |

Exhibit 99.1

| 2 MARCH 2013 Investor Presentation Supplemental Pro Forma Combined Results of Operations by Quarter for 2012 |

| 3 (c) 2013 The Corporate Executive Board Company. All Rights Reserved.^CEB5532513SYN "SAFE HARBOR" DISCLAIMER This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements using words such as "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts," and variations of such words or similar expressions are intended to identify forward-looking statements. In addition, all statements other than statements of historical fact are statements that could be deemed forward-looking statements. You are hereby cautioned that these statements are based upon our expectations at the time we make them and may be affected by important factors including, among others, the factors set forth below and in our filings with the U.S. Securities and Exchange Commission ("SEC"), and consequently, actual operations and results may differ materially from the results discussed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. Factors that could cause actual results to differ materially from those indicated by forward-looking statements include, among others, our dependence on renewals of our membership-based services, the sale of additional programs to existing members and our ability to attract new members, our potential failure to adapt to changing member needs and demands, our potential failure to develop and sell, or expand sales markets for our SHL tools and services, our potential inability to attract and retain a significant number of highly skilled employees or successfully manage succession planning issues, fluctuations in operating results, our potential inability to protect our intellectual property rights, our potential inability to adequately maintain and protect our information technology infrastructure and our member and client data, potential confusion about our rebranding, including our integration of the SHL brand, our potential exposure to loss of revenue resulting from our unconditional service guarantee, exposure to litigation related to our content, various factors that could affect our estimated income tax rate or our ability to use our existing deferred tax assets, changes in estimates, assumptions or revenue recognition policies used to prepare our consolidated financial statements, our potential inability to make, integrate and maintain acquisitions and investments, the amount and timing of the benefits expected from acquisitions and investments including our acquisition of SHL, our potential inability to effectively manage the risks associated with the indebtedness we incurred and the senior secured credit facilities we entered into in connection with our acquisition of SHL or any additional indebtedness we may incur in the future, our potential inability to effectively manage the risks associated with our international operations, including the risk of foreign currency exchange fluctuations, and our potential inability to effectively anticipate, plan for and respond to changing economic and financial markets conditions, especially in light of ongoing uncertainty in the worldwide economy and possible volatility of our stock price. Various important factors that could cause our actual results to differ from our expected or historical results are discussed more fully in the "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" sections of our filings with the SEC, including, but not limited to, our 2012 Annual Report on Form 10-K filed on 1 March 2013. The forward-looking statements in this presentation are made as of 28 March 2013, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise. |

| 4 (c) 2013 The Corporate Executive Board Company. All Rights Reserved.^CEB5532513SYN 2012 SUPPLEMENTAL PRO FORMA SEGMENT DATA In August 2012, we completed the acquisition of SHL Group Holdings I and its subsidiaries ("SHL"), including Personnel Decisions Research Institutes, Inc. ("PDRI"), and began reporting two reportable segments, CEB and SHL. While the results of operations post-acquisition have been and will continue to be provided on a historical basis in accordance with accounting principles generally accepted in the United States ("GAAP"), in future discussion and analysis we also intend to include a comparison of post-acquisition results to pre-acquisition pro forma combined results in order to provide the most meaningful comparison of period-to-period results by reportable segment. The unaudited supplemental pro forma segment data is based on the historical consolidated financial statements of both CEB and SHL and assumes the SHL acquisition had been consummated on 1 January 2012. The unaudited supplemental pro forma segment data has not been prepared in accordance with GAAP or the rules and regulations of the US Securities and Exchange Commission. Accordingly, the following unaudited pro forma amounts are for illustrative purposes only and do not purport to be indicative of the results that would have been obtained if the acquisition had occurred on 1 January 2012 and should not be construed as representative of the future consolidated results of operations or financial condition of the combined entity. The supplemental pro forma segment data for the CEB segment includes the results of operations for the historical CEB business plus PDRI. The SHL segment includes the results of operations for the acquired SHL business excluding PDRI. The additional information in the Appendix has been provided to show the breakdown of segment revenue and expenses between pre- and post-acquisition periods (i.e., before and after the completion of the August 2012 acquisition of SHL), as well to provide information on amounts for the PDRI business, which has been included as part of the CEB segment beginning with the fourth quarter of 2012. Total amounts shown in the Appendix correspond to total amounts presented in the supplemental pro forma segment data on slide 5. |

| 5 (c) 2013 The Corporate Executive Board Company. All Rights Reserved.^CEB5532513SYN 2012 SUPPLEMENTAL PRO FORMA SEGMENT DATA Q1 2012 Q2 2012 Q3 2012 Q4 2012 FY 2012 Segment Revenue CEB segment revenue $135,505 $143,105 $146,756 $155,660 $581,026 SHL segment revenue1 45,626 46,705 32,763 38,060 163,154 Impact of the deferred revenue fair value adjustment2 - - 8,386 8,748 17,134 SHL segment adjusted revenue 45,626 46,705 41,149 46,808 180,288 Total Adjusted Revenue $181,131 $189,810 $187,905 $202,468 $761,314 Segment Expenses CEB segment expenses Cost of services $47,709 $51,859 $50,902 $56,174 $206,644 Member relations and marketing 38,317 38,844 40,138 42,533 159,832 General and administrative 16,509 16,496 16,201 16,381 65,587 SHL segment expenses1 Cost of services $16,369 $16,445 $15,722 $16,431 $64,967 Member relations and marketing 10,657 10,841 10,132 11,964 43,594 General and administrative 6,802 7,295 4,996 6,022 25,115 Combined segment expenses Cost of services $64,078 $68,304 $66,624 $72,605 $271,611 Member relations and marketing 48,974 49,685 50,270 54,497 203,426 General and administrative 23,311 23,791 21,197 22,403 90,702 Unaudited and in $000s 1 The unaudited supplemental pro forma SHL segment data above is presented in US dollars and was translated from British pound sterling to US dollars using average exchange rates for the respective periods: 1Q12 = $1.57 to £1; 2Q12 = $1.58 to £1, 3Q12 = $1.58 to £1; 4Q12 = $1.61 to £1; FY12 = $1.59 to £1. 2 Deferred revenue at the acquisition date was recorded at fair value based on the estimated cost to provide the related services plus a reasonable profit margin. Consistent with our financial reporting presentation, SHL revenue recognized in the post-acquisition period has been adjusted to reflect the adjustment of deferred revenue at the SHL acquisition date to fair value (the "deferred revenue fair value adjustment"). |

| 6 (c) 2013 The Corporate Executive Board Company. All Rights Reserved.^CEB5532513SYN APPENDIX: SUPPLEMENTAL PRO FORMA SEGMENT DATA SEGMENT REVENUE Q1 2012 Q2 2012 Q3 2012 Q4 2012 FY 2012 CEB Segment Revenue CEB $128,467 $135,718 $139,129 $148,138 $551,452 PDRI Post-Acquisition - - 5,088 7,522 12,610 CEB Segment Revenue (as reported) 128,467 135,718 144,217 155,660 564,062 PDRI Pre-Acquisition 7,038 7,387 2,539 - 16,964 CEB Pro Forma Segment Revenue $135,505 $143,105 $146,756 $155,660 $581,026 SHL Segment Revenue1 SHL Post-Acquisition $- $- $20,532 $38,060 $58,592 Impact of the Deferred Revenue Fair Value Adjustment3 - - 8,386 8,748 17,134 SHL Segment Adjusted Revenue (as reported) - - 28,918 46,808 75,726 SHL Pre-Acquisition2 45,626 46,705 12,231 - 104,562 SHL Pro Forma Segment Adjusted Revenue $45,626 $46,705 $41,149 $46,808 $180,288 Combined Adjusted Revenue $181,131 $189,810 $187,905 $202,468 $761,314 SEGMENT EXPENSES Cost of Services CEB Segment Cost of Services CEB $43,607 $47,372 $46,654 $51,671 $189,304 PDRI Post-Acquisition - - 2,694 4,503 7,197 CEB Segment Cost of Services (as reported) 43,607 47,372 49,348 56,174 196,501 PDRI Pre-Acquisition 4,102 4,487 1,554 - 10,143 CEB Pro Forma Segment Cost of Services $47,709 $51,859 $50,902 $56,174 $206,644 SHL Segment Cost of Services1 SHL Segment Cost of Services (as reported)1 SHL Pre-Acquisition $- $- $10,834 $16,431 $27,265 SHL Pro Forma Segment Cost of Services1 16,369 16,445 4,888 - 37,702 $16,369 $16,445 $15,722 $16,431 $64,967 Unaudited and in $000s 1 The unaudited supplemental pro forma SHL segment data above is presented in US dollars and was translated from British pound sterling to US dollars using average exchange rates for the respective periods: 1Q12 = $1.57 to £1; 2Q12 = $1.58 to £1, 3Q12 = $1.58 to £1; 4Q12 = $1.61 to £1; FY12 = $1.59 to £1. 2 For Q1, Q2 and Q3 2012, all "SHL pre-acquisition" amounts reflect amounts reported historically by SHL, adjusted to exclude the PDRI amounts that have been added to the CEB segment. Beginning in Q4 2012, CEB reported PDRI as part of the CEB segment. 3 Deferred revenue at the acquisition date was recorded at fair value based on the estimated cost to provide the related services plus a reasonable profit margin. Consistent with our financial reporting presentation, SHL revenue recognized in the post-acquisition period has been adjusted to reflect the adjustment of deferred revenue at the SHL acquisition date to fair value (the "deferred revenue fair value adjustment"). |

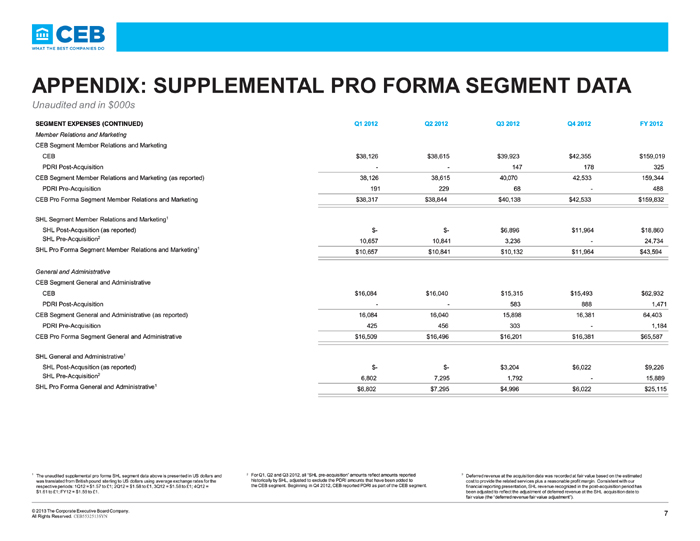

| 7 (c) 2013 The Corporate Executive Board Company. All Rights Reserved.^CEB5532513SYN APPENDIX: SUPPLEMENTAL PRO FORMA SEGMENT DATA SEGMENT EXPENSES (CONTINUED) Q1 2012 Q2 2012 Q3 2012 Q4 2012 FY 2012 Member Relations and Marketing CEB Segment Member Relations and Marketing CEB $38,126 $38,615 $39,923 $42,355 $159,019 PDRI Post-Acquisition - - 147 178 325 CEB Segment Member Relations and Marketing (as reported) 38,126 38,615 40,070 42,533 159,344 PDRI Pre-Acquisition 191 229 68 - 488 CEB Pro Forma Segment Member Relations and Marketing $38,317 $38,844 $40,138 $42,533 $159,832 SHL Segment Member Relations and Marketing1 SHL Post-Acqusition (as reported) $- $- $6,896 $11,964 $18,860 SHL Pre-Acquisition 10,657 10,841 3,236 - 24,734 SHL Pro Forma Segment Member Relations and Marketing1 $10,657 $10,841 $10,132 $11,964 $43,594 General and Administrative CEB Segment General and Administrative CEB $16,084 $16,040 $15,315 $15,493 $62,932 PDRI Post-Acquisition - - 583 888 1,471 CEB Segment General and Administrative (as reported) 16,084 16,040 15,898 16,381 64,403 PDRI Pre-Acquisition 425 456 303 - 1,184 CEB Pro Forma Segment General and Administrative $16,509 $16,496 $16,201 $16,381 $65,587 SHL General and Administrative1 SHL Post-Acqusition (as reported) $6,802 $7,295 $1,792 $- $15,889 SHL Pre-Acquisition - - 3,204 6,022 9,226 SHL Pro Forma General and Administrative1 $6,802 $7,295 $4,996 $6,022 $25,115 Unaudited and in $000s 1 The unaudited supplemental pro forma SHL segment data above is presented in US dollars and was translated from British pound sterling to US dollars using average exchange rates for the respective periods: 1Q12 = $1.57 to £1; 2Q12 = $1.58 to £1, 3Q12 = $1.58 to £1; 4Q12 = $1.61 to £1; FY12 = $1.59 to £1. 2 For Q1, Q2 and Q3 2012, all "SHL pre-acquisition" amounts reflect amounts reported historically by SHL, adjusted to exclude the PDRI amounts that have been added to the CEB segment. Beginning in Q4 2012, CEB reported PDRI as part of the CEB segment. 3 Deferred revenue at the acquisition date was recorded at fair value based on the estimated cost to provide the related services plus a reasonable profit margin. Consistent with our financial reporting presentation, SHL revenue recognized in the post-acquisition period has been adjusted to reflect the adjustment of deferred revenue at the SHL acquisition date to fair value (the "deferred revenue fair value adjustment"). |