Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - UNIVERSAL SOLAR TECHNOLOGY, INC. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - UNIVERSAL SOLAR TECHNOLOGY, INC. | v337652_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - UNIVERSAL SOLAR TECHNOLOGY, INC. | v337652_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - UNIVERSAL SOLAR TECHNOLOGY, INC. | v337652_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - UNIVERSAL SOLAR TECHNOLOGY, INC. | v337652_ex31-1.htm |

| EX-10.13 - EXHIBIT 10.13 - UNIVERSAL SOLAR TECHNOLOGY, INC. | v337652_ex10-13.htm |

| EX-10.12 - EXHIBIT 10.12 - UNIVERSAL SOLAR TECHNOLOGY, INC. | v337652_ex10-12.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

Commission file number: 333-150768

UNIVERSAL SOLAR TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 26-0768064 | |||

| (State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification Number) | |||

No. 1 Pingbei Road 2, Nanping Science & Technology Industrial Park Zhuhai City, Guangdong Province The People’s Republic of China 519060 |

||||

| (Address of principal executive offices and zip code) |

||||

| 86-756 8682610 | ||||

| (Registrant’s telephone number, including area code) |

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” or a smaller reporting company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2012, the registrant’s common stock was not trading on active markets and therefore had no readily determinable market value.

The number of shares outstanding of the registrant’s Common Stock on March 28, 2013: 22,599,974 shares.

TABLE OF CONTENTS

| PART I | 2 |

| ITEM 1. BUSINESS | 2 |

| ITEM 1A. RISK FACTORS | 13 |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | 24 |

| ITEM 2. PROPERTIES | 24 |

| ITEM 3. LEGAL PROCEEDINGS | 25 |

| ITEM 4. MINE SAFETY DISCLOSURES | 25 |

| PART II | 26 |

| ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 26 |

| ITEM 6. SELECTED FINANCIAL DATE | 26 |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 26 |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 33 |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 33 |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 33 |

| ITEM 9A. CONTROLS AND PROCEDURES | 33 |

| ITEM 9B. OTHER INFORMATION | 35 |

| PART III | 36 |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 36 |

| ITEM 11. EXECUTIVE COMPENSATION | 37 |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 38 |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 38 |

| ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES | 39 |

| PART IV | 41 |

| ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 41 |

| SIGNATURES | 42 |

| INDEX TO FINANCIAL STATEMENTS | 43 |

| 1 |

PART I

SPECIAL NOTE REGARDING FORWARD—LOOKING STATEMENTS

On one or more occasions, we may make forward-looking statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions identify forward-looking statements. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described elsewhere in this report and our other Securities and Exchange Commission filings.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent annual and periodic reports filed with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K.

Unless the context requires otherwise, references to “we,” “us,” “our,” the “Company” and “the Company” refer specifically to Universal Solar Technology, Inc.

ITEM 1. BUSINESS

ORGANIZATIONAL HISTORY

Universal Solar Technology, Inc. was incorporated in the State of Nevada on July 24, 2007. It operates through its wholly owned subsidiary, Kuong U Science & Technology (Group) Ltd. (“Kuong U”), a company incorporated in Macau, People’s Republic of China (“PRC”) on May 10, 2007 and its subsidiary, Nanyang Universal Solar Technology Co., Ltd. (“NUST”), a wholly foreign owned enterprise (“WFOE”) registered on September 8, 2008 under the wholly foreign-owned enterprises laws of the PRC.

In 2009, prior to construction of NUST’s factory, which is located in Henan province, PRC, we subcontracted the manufacture of photovoltaic (“PV”) modules and solar lighting systems to Zhuhai Yuemao Laser Facility Engineering Co., Ltd. (“Yuemao Laser”), a related party. In July 2010, NUST’s newly constructed factory started operations, and in September 2010, began shipping silicon wafers to the market in China. Since then, we have been devoting ourselves to extending our product lines to include higher value-added products, expanding production capacity, lowering production costs and increasing our market share.

OVERVIEW OF OUR BUSINESS

We primarily manufacture, market, and sell silicon wafers to manufacturers of solar cells. In addition, we manufacture PV modules with solar cells purchased from third parties.

Product Line 1 - Silicon Wafers

We produce silicon wafers by extracting purified mono-crystalline silicon from virgin poly-silicon feedstock utilizing mono-crystalline silicon ingot growers. Then, we cut the purified mono-crystalline silicon ingots into silicon wafers with multi-wire saws. Silicon wafers are one of the most important components in solar cells.

| 2 |

As of December 31, 2012, we have eleven mono-crystalline silicon ingot growers. The maximum production capacity of each mono-crystalline silicon ingot grower is approximately one ton of mono-crystalline silicon ingots per month. Our current mono-crystalline silicon ingot production capacity is approximately 132 tons per annum.

We are also equipped with five multi-wire saws, each of which can produce approximately 70 silicon wafers per kilogram of mono-crystalline silicon ingot. Based on an estimated 2.8 watts (W) per silicon wafer, our current silicon wafer production capacity is approximately 20MW per annum.

During 2012, due to a significant decrease in the selling price of our products, we were forced to reduce the capacity utilization rate of our silicon wafer production machines from 37% to approximately 23%.

Product Line 2 – PV Modules

We have two semi-automatic production lines that manufacture PV modules. Our existing production capacity is approximately 20MW of PV modules per annum. During 2012, we produced various types of PV module samples; however we did not produce PV module products in commercial quantities. Currently, we purchase solar cells from third parties that we use to manufacture PV modules.

Overview of Properties, Plant and Equipment

We have acquired land-use rights to 71,346 square meters in Henan Province, PRC for industrial usage. The land use rights expire on July 23, 2060. We began the construction of our manufacturing facilities on this site in 2008. As of December 31, 2012, we have completed the construction of five workshops. Two out of the five workshops are in operation with each comprises of 2,016 square meters.

As of December 31, 2012, the net book value of our property, plant and equipment was $3,003,289.

Operation

In fiscal 2012, we shipped our silicon wafers to customers primarily located in China. We plan to expand sales of our products to the EU, North America and Africa in the future.

We plan to expand the production capacity of our existing product lines through purchasing additional equipment and recruiting more employees. We also plan to produce solar cells by ourselves and provide advanced applications of solar energy to complete the value chain of this industry.

Key Financial Indicators

During fiscal 2012 and 2011, we had net sales of $649,616 and $3,282,270, respectively, representing a decrease of $2,632,654 or 80.2% for the fiscal year of 2012, compared to the prior comparable period. During fiscal 2012, our business generated a gross loss of $704,872; comparably, we realized a gross loss of $1,497,746 during fiscal year 2011. Losses from operations for fiscal 2012 and 2011 were $5,192,643 and $2,272,087, respectively. The net losses for fiscal 2012 and 2011 were $5,663,510 and $2,704,397, respectively.

| 3 |

As of December 31, 2012, we had cash of $160,927, and a net book value for property, plant, equipment and land-use rights of $3,424,709. At December 31, 2012, we had total liabilities of $15,564,801 and an accumulated deficit of $9,887,181.

During fiscal 2012, the net cash used in our operating activities was $1,289,137. We raised $1,829,328 through related parties’ loans and repaid short-term loans of $475,491 to local financial institutions.

STRATEGY

Our growth strategy covers various aspects of our business.

Operating Strategies

Our operating strategy is to increase our current products’ profitability by doing the following:

| (1) | Reduce production cost per unit by increasing existing production capacity and implementing tighter control over production costs; |

| (2) |

Increase selling price of our products by actively expanding our products to potential markets; and |

| (3) | Lower raw materials purchasing price by increasing the amount of purchase. It is estimated that unit price of raw materials will decrease by 10% if we buy in bulk. |

Expanding our production capacity will require additional equipment which will require significant cash. Also, we will need significant working capital to purchase raw materials and defray production overhead. In addition, increasing our market share will require significant marketing efforts which will also require significant capital. Our current financial condition makes raising the necessary capital extremely difficult and there is no guarantee that we will be able to do so in the near future or at all.

In fiscal 2012, the silicon wafers production industry in China underwent a major re-organization. As a result of this reorganization there are fewer although potentially stronger competitors.

Developing strategies

Our developing strategy aims to complete the value chain of solar energy industry by acquiring the ability to produce solar cells. There are two alternatives to achieve this goal.

| (1). | Construct a solar cell production facility. We have reserved a block of land within our existing manufacturing facility in Henan province of the PRC, which can be utilized for three to four new workshops to produce solar cells. The advantages of constructing our own solar cell production facility include: |

| a) | Complete product family – The completion of a solar cell manufacturing facility will enable us to produce a full range of products for the solar energy industry, including silicon ingots, silicon wafers, solar cells, and PV modules. |

| b) | Higher profitability - We will gain access to substantially all added-value of the industry chain. Moreover, our overall profitability will be increased due to lower transportation costs of semi-finished products within the production processes, and better quality control of products. |

Building our own solar cell manufacturing facility will require a significant investment in equipment and workshops. We estimate that we will need approximately $18 million to construct and equip a solar cell production facility. Other barriers also exist, including the lack of advanced technology, for instance, techniques to produce high quality solar cells in commercial quantities; and the shortage of qualified personnel.

| (2). | Alternatively, we will look for opportunities to form strategic relationships with existing solar cell manufacturers. Developing strategic relationships in the form of long-term supply agreements with solar cell manufacturers is a quick and flexible way to indirectly gain access to solar cell production capacity. |

| 4 |

OUR MARKET

As worldwide demand for electricity continues to increase, the electric power industry now faces several challenges:

| · | Fossil fuel supply constraints: Limited supply and escalating consumption of coal, oil, and natural gas continue to drive up wholesale electricity prices, resulting in higher electricity costs for consumers. |

| · | Infrastructure constraints: In many parts of the world, electricity demand exceeds the capacity of existing electricity generation, transmission and distribution infrastructure. |

| · | Desire for energy security: As political and economic instability in key oil and natural gas producing regions increases, governments are increasingly focusing on developing reliable and secure energy sources. |

| · | Environmental concerns: Long-term use of fossil fuels is associated with a range of environmental issues including global warming, air and water pollution, the increased prevalence of which is driving an increased environmental awareness. |

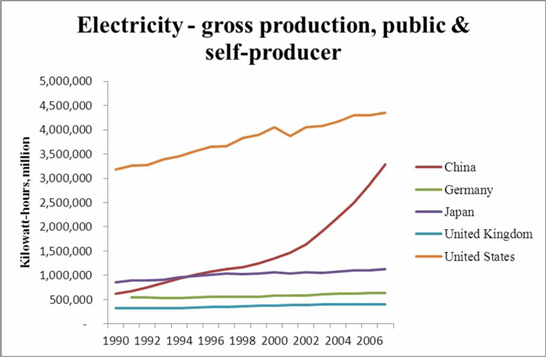

Electricity Production

The past two decades have witnessed China’s significant increase of electricity production. According to United Nations Statistical Commission, China’s gross electricity production increased from 621,200 million Kilowatt-hours in 1990 to 3,281,553 million Kilowatt-hours in 2007, with compound annual growth rate of 10.3%. Comparably, during the same period, United State’s gross electricity production increased from 3,179,247 million Kilowatt-hours to 4,348,856 million Kilowatt-hours, representing compound annual growth rate of 1.9%. Obviously, China is becoming one of the world’s largest producers of electricity. The following chart underlines gross electricity production of several major countries during the period of 1990 to 2007.

Data source: United Nations Statistical Commission (http://data.un.org)

| 5 |

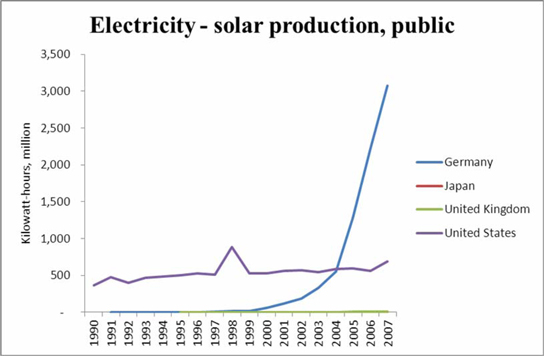

Electricity Production Using Solar Power

Solar power, or solar energy is a source of energy that uses radiation emitted by the Sun. It is a renewable energy source that has been used in many traditional technologies for centuries. Solar power is also in widespread use where other power supplies are absent, such as in remote locations and in space. In recent years, solar energy has been used greatly in the generation of electricity.

Producing electricity with solar power has the following benefits:

Environmental Friendliness and Renewability: Solar power is one of the most environmentally friendly renewable resources available for electricity generation. It does not produce air or water emissions, noise, vibrations or any waste generation.

Peak Energy Generation Ability: Solar power is well-suited to match peak energy needs as maximum sunlight hours generally correspond to peak demand periods when electricity prices are at their highest.

Easily Located with End Users: Unlike other renewable resources such as hydroelectric and wind power, solar power can be utilized anywhere that receives sunlight and directly at the site where the power will be shed. As a result, solar power avoids the expense of, and energy losses associated with, transmission and distribution of electricity from large-scale electrical plants to end users.

No Fluctuations in Operating Costs: Unlike fossil or nuclear fuel, solar energy does not have fuel price volatility. Although there is variability in the amount and timing of sunlight over the day, season and year, a properly sized and configured system can be designed for high reliability while supplying electricity on a long-term, fixed-cost basis.

Reliability and Durability: Without moving parts or the need for periodic maintenance, solar power systems are among the most reliable forms of electricity generation. Accelerated aging tests have shown that solar modules can operate for at least 25 to 30 years without requiring major maintenance.

Modularity: Solar systems are easily modularized and scalable, and therefore can be deployed in many different sizes and configurations to meet the specific needs of the user. Solar modules are increasingly used to serve as both a power generator and the exterior of a building. Like architectural glass, PV modules can be installed on the roofs and facades of residential and commercial buildings.

| 6 |

Given the apparent advantages of solar power-based electricity production, many countries across the world are developing their electricity production capability with solar energy. According to United Nations Statistical Commission, in 1997 Germany produced 8 million Kilowatt-hours with solar power, while it produced 3,075 million Kilowatt-hours in 2007, denoting annual compound annual growth rate of 81.3% but only accounts for 0.5% of Germany’s gross electricity production of the 2007.

Although China has been producing much more electricity than before, its ability of producing electricity with solar power remains weak.

Data source: United Nations Statistical Commission (http://data.un.org)

The market for solar electricity production in China is promising. We believe higher demand for solar energy, furthered by concerns about global warming, will drive increases in the annual revenues of the global solar equipment industry. The interest manifested by many electricity customers in solar cells as a “green” alternative to fossil fuels is also likely to spur increases in production of high-purity silicon required for the cells, according to the report by Photon Consulting, a German research group.

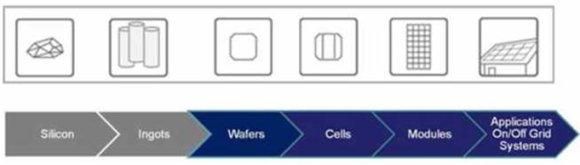

Value Chain of Solar Energy Industry

Currently, Universal Solar plans to emphasize the use of silicon based technologies in its products as a majority of installed solar systems around the world employ crystalline silicon technologies. Crystalline silicon cells are manufactured using mono-crystalline silicon, multi-crystalline silicon or string ribbon technology. The crystalline silicon-based solar power manufacturing value chain starts with the processing of quartz sand to produce metallurgical-grade silicon. This material is further purified into semiconductor-grade or solar-grade polysilicon feedstock.

In the most widely used crystalline silicon-based solar manufacturing process, feedstock is melted in mono-crystalline silicon ingot growers, and then formed into ingots through a crystallization process. Ingots are cut and shaped, then sliced into wafers using high precision cutting techniques. Wafers are manufactured into solar cells through a multiple step manufacturing process that entails etching, doping, coating and applying electrical contacts. Solar cells are then interconnected and packaged to form solar modules, which together with system components such as batteries and inverters, are distributed to installers, systems integrators, service providers or directly to end-users, for installation for on-grid or off-grid systems.

| 7 |

Currently, we are capable of producing silicon ingots with virgin poly-silicon feedstock; cutting silicon ingots into wafers; and manufacturing PV modules with solar cells purchased from outside vendors. We plan to manufacture solar cells and other advanced applications to complete the value chain of this industry.

OUR PRODUCTS

Currently, we have two primary product lines: (1) silicon wafers and (2) PV modules.

Silicon Wafers

|

Currently, we are producing various types of silicon wafers. Silicon wafers are made of mono-crystalline silicon with purity over 99.9999%. Resistivity varies from one to three ohms.

The shape of silicon wafer is a square with rounded corners. Side length of square is 125mm with diameter of rounded corners of 150mm or 165mm. |

PV Modules

Our PV modules are designed for large scale, grid-connected solar power plants. Currently, we purchase solar cells from outside vendors to produce PV modules.

|

Solar modules GYSP-160 Characteristics Open circuit voltage (Voc): 43.2V Optimum operating voltage (Vmp): 35V Short circuit current (Isc): 5.1A Optimum operating current (Imp): 4.59A Peak power(Pm): 160W |

Specifications Monocrystalline silicon Dimension (mm): 1588×802×45 Tolerance: ± 5% Weight: 15.6kg Maximum system voltage: 1000V DC |

| 8 |

|

Solar modules GYSP-175 Characteristics Open circuit voltage(Voc): 44.06V Optimum operating voltage:(Vmp) 35.5V Short circuit current (Isc): 5.25A Optimum operating current(Imp):4.95A Peak power(Pm): 175W |

Specifications Monocrystalline silicon Dimension(mm): 1580×808×37 Tolerance: ±5% Weight: 15.3kg Maximum system voltage: 1000V DC | ||

|

Solar modules GYSP-180 Characteristics Open circuit voltage(Voc): 44.9V Optimum operating voltage:(Vmp) 38.6V Short circuit current (Isc): 5.1A Optimum operating current(Imp): 4.68A Peak power(Pm): 180W |

Specifications Monocrystalline silicon Dimension(mm): 1715×802×45 Tolerance: ±5% Weight: 16.9kg Maximum system voltage: 1000V DC

|

OUR PROPERTIES

Land:

On December 1, 2008, NUST acquired approximately 71,345.70 square meters in Fangcheng County, Nanyang City, Henan province of the PRC for a cost of RMB 2,886,300 (approximately $422,843). On July 27, 2010, “Certificate of Right of Use of Land” for this land was issued to NUST.

Factory:

As of December 31, 2012, we have completed five workshops, two of which are in operation. We have also built office building, dormitory and canteen in NUST’s manufacturing facility in Nanyang City, Henan province of the PRC.

RAW MATERIALS

We do not currently have agreements with any suppliers for our raw materials. Currently, the raw materials used in the manufacture of our products are readily available and to date we have not experienced any difficulty in obtaining any raw materials. We believe that these raw materials will continue to be readily available for the foreseeable future, and we do not anticipate any difficulties in obtaining any raw materials.

TARGET MARKETS AND PRINCIPAL CUSTOMERS

Our management team has engineering, product development, and international sales backgrounds in advanced laser technologies, solar cell manufacturing, and solar manufacturing machinery design and sales. We intend to leverage our strong industry contacts and relationships to develop a strong global customer pipeline.

At current stage, we mainly provide our products to meet demand of the Chinese market. We also plan to sell our solar cell and solar PV module products to customers in the EU, North America, Asia and Africa when time is right.

| 9 |

In fiscal 2012, two customers accounted for approximately 52% and 25% of sales, no other customer accounted for over 10% of sales. During fiscal 2011, two customers accounted for approximately 53.1% and 10.5% of our sales, comparably.

SALES AND MARKETING

We intend to develop several sales channels - direct sales, industry specific / country specific manufacturer’s sales representatives, and international strategic partnerships. The Company’s sales strategy is designed to capitalize its existing strong management relationships, rapidly growing market segments and emerging trends. Currently, the Company is focusing most of its sales efforts on Chinese market and we plan to explore markets in other countries in the future.

Direct Sales

Our executive team has the unique advantage of being able to leverage relationships from our strategic partner, Yuemao, whose business interests include steel trade, silicon laser technologies, water purifying facilities and real estate investments. The team has developed strong domestic and international relationships through their success in launching and developing an advanced laser technology company, Yuemao Laser, which focuses on serving the needs of the solar wafer and solar industry.

The executive team also handles direct sales activities, while managing operations, product line enhancements, customer care, as well as vendor and agent relationships. A dedicated direct sales force and senior sales executives will be hired to sell to targeted trade channels in China, the US and Europe. This expanded direct sales team is expected to be the major force behind our growth. Emphasis will be given to growing and qualifying large accounts, and/or high margin products across markets in the European Union member countries.

Manufacturers’ Sales Representatives

We also intend to align ourselves with a number of specialized representatives and performance based contractors. These consist of individuals or small groups, who dedicate their respective sales and marketing efforts to either a limited number of companies or particular industry segments. They are small firms, each with 1-5 salespeople that we may have under contract. They will introduce our higher margin products to potential new customers in new industry segments.

International Distribution & Strategic Partners

We are evaluating potential contracts with a number of strategic distributors and partners in international markets in Asia (outside of China), South America, and Eastern Europe. These distributors will be encouraged to enter into agreements with the Company which require each organization to produce a minimum annual “dollar” sales amount per territory.

Public Relations

We are committed to raising our profile and leveraging additional publicity. To this end, we plan to expand our dialogue with leading industry analysts and trade publications. We plan to have members of our management speak at trade conferences, and contribute articles and press releases to market-specific publications. This will encourage industry analysts to view us as a keen innovator, activist, and campaigner in the promotion of solar power across a variety of applications.

We are planning a communications campaign focusing on trade events, panel discussions, speaking engagements, white papers, pitch letters, press announcements, direct marketing and advertising. The primary goal is to reinforce sales efforts by promoting positive testimonials and success stories from our initial base of clients, while also being an advocate and educator for renewable and sustainable energy sources. By participating in seminars and industry conferences, our management team intends to develop stronger awareness and relationships with current and potential customers.

| 10 |

Advertising

We intend to initiate a conservative, yet effective advertising campaign in major trade publications which will identify us as a quality purveyor of new, innovative, and attractively designed solar modules and technologies.

COMPETITION

The solar energy and renewable energy industries are both highly competitive and continually evolving as participants strive to distinguish themselves within their markets and compete within the larger electric power industry. Within the renewable energy industry, Universal Solar believes that the main sources of competition are crystalline silicon solar module manufacturers, other thin film solar module manufacturers and companies that develop solar thermal and concentrated photovoltaic technologies. Among photovoltaic module and cell manufacturers, the principal methods of competition are price per watt, production capacity, conversion efficiency and reliability. We believe that we can compete favorably with respect to these factors; however, we also believe that our growing focus on providing aesthetically pleasing modular solutions and an array of value added services and products helps further differentiate us from similar peers.

Our product designs, price points, relationships, infrastructure, quality control standards, and industry contacts represent substantial competitive advantages. We maintain a substantially lower cost structure than competitors based in the US and Europe. Foreign competitors currently cannot match us on pricing, technological innovation, and efficient use of low cost manufacturing resources. Furthermore, our competitive advantage in China is protected by significant knowledge of government regulations, business practices, and strong relationships.

With respect to our Chinese competitors, we view our strong marketing abilities and flexibility in rapidly bringing new products to market as our key advantages. It should be noted that many competitors are larger and have more financial resources, larger production capacities and greater brand name recognition which may, as a result, put them in a better position to adapt to changes in the industry or the economy as a whole. Additionally, because global supply of pure silicon is becoming scarce due to high demand in solar-powered appliances and technologies, we are evaluating opportunities to acquire and/or enter into a joint-venture with a silicon mine which will help control cost pressures of related rising silicon prices.

PRINCIPAL OFFICE

Our principal office is located at No. 1 Pingbei Road 2, Nanping Science & Technology Industrial Park, Zhuhai City, Guangdong Province, the People’s Republic of China 519060.

EMPLOYEES AND ORGANIZATION

As of December 31, 2012, we had 96 full-time employees. Senior management includes 5 senior officers. We have 14 employees in our administration and accounting departments and 77 employees dedicated to production at NUST. None of our employees are covered by a collective bargaining agreement and we have never experienced a work stoppage, and we consider our labor relations to be excellent.

RESEARCH AND DEVELOPMENT

Due to financial restraints, we were unable to devote any resources to research and development in 2012 and 2011 as planned.

| 11 |

Subject to receipt of additional financing, we plan to devote continuously a substantial amount of resources to research and development by focusing our efforts on the following areas.

Improving conversion efficiency of solar modules: One of the most promising ways of increasing the conversion efficiency of solar modules is to maximize the number of photons that reach the absorption layer of the semiconductor material so that they can be converted into electrons, maximizing the number of electrons that reach the surface of the cadmium telluride and minimizing the electrical losses between the semiconductor layer and the back metal conductor. We believe that our ability to achieve higher module efficiencies is primarily a function of rapidly transferring new technology developments into high-throughput module production and continuously making incremental improvements to the solar module and the manufacturing process internally or in conjunction with outsourced manufactures.

Optimization of Systems: We are planning to commit resources to reduce the cost and optimize the effectiveness of components in its photovoltaic system by collecting filed performance data to identify opportunities for module and process improvement and improve the performance of systems that use our modules. In addition, the Company uses this data to enhance predictive models and simulations for the end-users.

Flexibility in Design & Quick Implementation of Innovations: We are committed to being flexible to meet customer needs and being able to evolve quickly with market innovations and demands. The Company closely monitors trends and developing technologies in order to help insure its ability to meet both current and future customer preferences.

Providing Attractive & Flexible Lighting Systems and Solar Modules: Often overlooked by competitors, we are keen to implement and market new module designs and lighting systems that allow for better building and environmental integration. Staying in tune with architectural preferences and ahead of peers will help the Company thrive and prosper.

GOVERNMENT REGULATION

This section sets forth a summary of the most significant regulations or requirements that affect our business activities in China or our shareholders’ rights to receive dividends and other distributions from us.

Renewable Energy Law and Other Government Directives

In February 2005, China enacted its Renewable Energy Law, which became effective on January 1, 2006. The Renewable Energy Law sets forth policies to encourage the development and use of solar energy and other non-fossil energy. The renewable energy law sets out the national policy to encourage and support the use of solar and other renewable energy and the use of on-grid generation. It also authorizes the relevant pricing authorities to set favorable prices for the purchase of electricity generated by solar and other renewable power generation systems.

The law also sets out the national policy to encourage the installation and use of solar energy water-heating systems, solar energy heating and cooling systems, solar photovoltaic systems and other solar energy utilization systems. It also provides the general principles regarding financial incentives for the development of renewable energy projects. The projects, as listed in the renewable energy industry development guidance catalogue, may obtain preferential loans from financial institutions and can enjoy tax preferences. The State Council is authorized to stipulate the specific tax preferential treatments. However, so far, no rules have been issued by the State Council pertaining to this matter. In January 2006, China’s National Development and Reform Commission promulgated two implementation directives of the Renewable Energy Law. These directives set out specific measures in setting prices for electricity generated by solar and other renewal power generation systems and in sharing additional expenses occurred. The directives further allocate the administrative and supervisory authorities among different government agencies at national and provincial levels and stipulate responsibilities of electricity grid companies and power generation companies with respect to the implementation of the Renewable Energy Law.

| 12 |

China’s Ministry of Construction also issued a directive in June 2005, which seeks to expand the use of solar energy in residential and commercial buildings and encourages the increased application of solar energy in different townships. In addition, the State Council promulgated a directive in July 2005 which sets out specific measures to conserve energy resources.

Environmental Regulations

We are subject to a variety of foreign, federal, state and local governmental regulations related to environmental protection. The major environmental regulations applicable to our proposed manufacturing facility include the Environmental Protection Law of the PRC, the Law of PRC on the Prevention and Control of Water Pollution, Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution, the Law of PRC on the Prevention and Control of Air Pollution, Implementation Rules of the Law of PRC on the Prevention and Control of Air Pollution, the Law of PRC on the Prevention and Control of Solid Waste Pollution, and the Law of PRC on the Prevention and Control of Noise Pollution.

Our proposed research and development activities and manufacturing facility are expected to use, generate and discharge toxic, volatile or otherwise hazardous chemicals and wastes. If we failed to comply with present or future environmental laws and regulations, we could be subject to fines, suspension of production or a cessation of operations. In addition, under some foreign, federal, state and local statutes and regulations, a governmental agency may seek recovery and response costs from operators of property where releases of hazardous substances have occurred or are ongoing, even if the operator was not responsible for the release or otherwise was not at fault.

Intellectual Property Rights

The Patent Law (1984), as amended by the Decision on Amending the Patent Law (2000), and the Implementing Rules of the Patent Law (2001), as amended by the Decision on Amending the Implementing Rules of the Patent Law (2002) provide the application and protection of patents. An invention patent shall be valid for twenty years and an external design patent and a utility model patent shall be valid for ten years, commencing on their application dates, respectively. Any persons or entities using a patent without the consent of the patent owner, making counterfeits of patented products, or conducting other activities which infringe upon patent rights will be held liable for compensation to the patent owner, fines charged by the administrative authorities and even criminal punishment.

Our success depends, in part, on our ability to conduct business without infringing on the proprietary rights of others. We rely primarily on a combination of trade secrets, as well as employee and third party confidentiality agreements to safeguard our intellectual property.

ITEM 1A. RISK FACTORS

An investment in our common stock is speculative and involves an extremely high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this annual report, including the consolidated financial statements and notes thereto of our Company, before deciding to invest in our common stock. The risks described below are not the only ones facing our Company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our Company. If any of the following risks occur, our business, financial condition, results of operations, and the value of our common stock could be materially and adversely affected.

| 13 |

RISKS RELATED TO OUR COMPANY

We are an early stage company and have limited operating history from which to evaluate our potential for future success.

Our company was formed in July 2007, and has only a short period of formation, planning, analysis and testing. In addition, we have very limited operating history under our proposed business model from which you can evaluate our business and prospects.

There can be no assurance that we will derive significant revenues from products sales.

We are an early stage company. You must consider the risks and uncertainties frequently encountered by early stage companies in new and rapidly evolving markets, including competing technologies, lack of customer acceptance of a new or an improved service or product and obsolescence of the technology before it can be fully commercialized. If we failed to address these risks and uncertainties, our business, results of operations, and financial condition will be materially and adversely affected.

If we do not obtain additional capital, we may be unable to sustain our business.

We are actively seeking additional funding, but to date have not entered into any agreements or other arrangements for such financing. There can be no assurance that the required additional financing will be available on terms favorable to us or at all.

Without additional funding, the company will not be able to pursue its business model. If adequate funds are not available or are not available on acceptable terms when required, we would be required to significantly curtail our operations and would not be able to fund the development of the business envisioned by our business model. These circumstances could have a material adverse effect on our business and ability to continue to operate as a going concern. If additional funds are raised through the issuance of equity or convertible debt securities, our then existing shareholders may experience substantial dilution, and such securities may have rights, preferences, and privileges senior to those of our common stock.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

As we implement our growth strategies, we may experience increased capital needs and we may not have enough capital to fund future operations without additional capital investments. Our capital needs will depend on numerous factors, including (1) our profitability; (2) the release of competitive products by competitors; (3) the level of our investment in research and development; and (4) the amount of our capital expenditures. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to:

| · | reduce our investments in research and development; |

| · | limit our marketing efforts; and |

| · | decrease or eliminate capital expenditures. |

Such reductions could have a material adverse effect on our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate acceptable terms and conditions for receiving such capital. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

| 14 |

We may have difficulty raising necessary capital to fund operations as a result of market price volatility of our shares of common stock.

If our business development plans are successful, we may require additional financing to continue to develop and exploit existing and new technologies and to expand into new markets. The exploitation of our technologies may, therefore, be dependent upon our ability to obtain equity financing through debt and equity or other means. In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performance, underlying asset values or prospects of such companies.

For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces beyond our control. Such volatility may make it more difficult to find investors who are willing to invest in our common stock, or to negotiate equity financing or terms that are acceptable to us.

We have incurred losses in certain prior periods and may incur losses in the future.

We incurred a gross loss of $704,872, representing a gross loss margin of 108.5% during fiscal 2012; comparably our principal business generated gross loss of $1,497,746 during 2011, representing a gross loss margin of 45.6%. We have also incurred net losses of $5,663,510 and $2,704,397 for the years ended December 31, 2012 and 2011, respectively. We may incur losses in the future. We expect our costs and expenses to increase as we expand our operations. Our ability to achieve and maintain profitability depends on the growth rate of the solar power market, the continued global market acceptance of solar power products in general and our future products in particular, the pricing trend of solar power products, the competitiveness of our proposed products as well as our ability to provide new products to meet the demands of our customers and our ability to control our costs and expenses. We may not be able to achieve or sustain profitability on a quarterly or an annual basis.

There are significant risks in executing our business strategy and our business plans could change.

To execute our business plan, we will need to recruit additional employees, complete our manufacturing facility, establish a distribution channel and secure purchase orders from customers. Our ability to manage each of these factors is subject to substantial risks, including our ability to finance the costs. For example, the cost to equip our manufacturing facility and expand solar cells product lines is estimated to be approximately $18 million. If we are unable to successfully execute on our business plan, our business, results of operations, and financial condition will be materially and negatively impacted.

To maximize our potential for future growth and achieve our expected revenues, we need to manage growth in our current operations.

In order to maximize potential growth, we believe that we must establish our manufacturing and marketing operations. This will place a significant strain on our management and our operational, accounting, and information systems. We expect that as we grow we will need to improve our financial controls, operating procedures, and management information systems to handle increased operations. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

We cannot assure you that our organic growth strategy will be successful.

One of our growth strategies is to grow organically by increasing the distribution and sales of our products in new markets outside of China. However, entering new markets faces many obstacles, including the costs to entering into new markets, developing and implementing effective marketing efforts abroad, and maintaining attractive foreign exchange ratios. We cannot assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to successfully implement our organic growth strategy may have a negative impact on our growth strategy, our future financial condition, results of operations, and cash flows.

| 15 |

We cannot assure you that our acquisition growth strategy will be successful.

In addition to our organic growth strategy, we also expect to grow through strategic acquisitions. We intend to pursue opportunities to acquire businesses that are complementary or related to our existing product lines or may execute a potential joint venture or acquisition with a silicon mine or other strategic partner. We may not be able to locate suitable acquisition or joint venture candidates at prices that we successfully consider appropriate. If we do identify an appropriate candidate, we may not be able to successfully negotiate the terms of an acquisition, finance the acquisition on terms that are satisfactory to us or if the acquisition occurs successfully, integrate the acquired business into our existing business. Acquisitions of businesses or other material operations may require debt financing or additional equity financing, resulting in leverage or dilution of ownership. Integration of acquired business operations could disrupt our business by diverting management away from day-to-day operations. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures. We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits we anticipated when selecting our acquisition candidates. In addition, we may need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. At times, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition which will be required to comply with laws of the People’s Republic of China (“PRC”), to the extent applicable. There can be no assurance that any proposed acquisition will be able to comply with PRC requirements, rules and/or regulations, or that we will successfully obtain governmental approvals to the extent required, which may be necessary to consummate such acquisitions.

If we are not able to implement our strategies to achieve our business objectives, our business operations and financial performance may be adversely affected.

Our business plan and growth strategy are based on currently prevailing circumstances and the assumption that certain circumstances will or will not occur, as well as the inherent risks and uncertainties involved in various stages of development. However, there is no assurance that we will be successful in implementing our strategies or that our strategies, even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement our strategies, our business operations and financial performance may be adversely affected.

We depend on our key management personnel and the loss of their services could adversely affect our business.

Our business management and operations significantly relied on key personnel’s services. If key personnel terminated their services with the Company, we may have risk of inability to identify qualified suitable personnel to replace them in a timely manner, and therefore, our business could be adversely affected should that occur.

Failure to attract and retain personnel could have an adverse impact on our operations.

Our future success depends on our ability to identify, attract, hire, retain and motivate other well-qualified managerial, technical, sales and marketing personnel. There is intense competition for these individuals, and there can be no assurance that these professionals will be available in the market or that we will be able to meet their compensation requirements.

RISKS RELATED TO OUR BUSINESS

If PV technology is not suitable for widespread adoption, or sufficient demand for PV products does not develop or takes longer to develop than we anticipated, our sales may not continue to increase or may even decline, and we may be unable to sustain profitability.

| 16 |

The PV market is at a relatively early stage of development and the extent to which PV products will be widely adopted is uncertain. Market data in the PV industry are not as readily available as those in other more established industries where trends can be assessed more reliably from data gathered over a longer period of time. If PV technology proves unsuitable for widespread adoption or if demand for PV products fails to develop sufficiently, we may not be able to grow our business or generate sufficient revenues to achieve profitability. In addition, demand for PV products in our targeted markets, including China, may not develop or may develop to a lesser extent than we anticipated. Many factors may affect the viability of widespread adoption of PV technology and demand for PV products, including:

| · | availability of government subsidies and incentives to support the development of the PV industry; |

| · | cost-effectiveness of PV products compared to conventional and other non-solar energy sources and products; |

| · | performance and reliability of PV products compared to conventional and other non-solar energy sources and products; |

| · | success of other alternative energy generation technologies, such as fuel cells, wind power and biomass; |

| · | fluctuations in economic and market conditions that affect the viability of conventional and non-solar alternative energy sources, such as increases or decreases in the prices of oil, coal, natural gas and other fossil fuels; |

| · | cost and availability of credit, loans and other funding mechanisms to finance the installation and maintenance of PV systems. For example, a rise in interest rates would likely render existing financings more expensive and be an obstacle for potential financings that would otherwise spur the growth of the PV industry; |

| · | capital expenditures by end users of PV products, which tend to decrease when the economy slows down; and |

| · | deregulation of the electric power industry and broader energy industry. |

We potentially face intense competition from other companies producing solar energy and other renewable energy products.

The PV market is intensely competitive and rapidly evolving. According to Photon International’s survey in March 2006, as of the end of 2005, 94 companies in the world produced PV cells and 153 companies produced PV modules. The solar PV industry also saw a boom in silicon production facilities around the world, responding to silicon feedstock shortages of recent years. Solar PV manufacturers were signing long-term contracts to ensure a growing supply, and silicon manufacturers are consistently announcing plans to build new plants. By the end of 2007, more than 70 silicon manufacturing facilities were being constructed or planned. (http://www.ren21.net/pdf/RE2007_Global_Status_Report.pdf, Page 19). Many of our potential competitors have established more prominent market positions, and if we fail to attract and retain customers and establish successful distribution networks in our target markets for our products, we will be unable to generate sales. Our competitors include PV divisions of large conglomerates such as Royal Sanyo Group and Sharp Corporation, specialized cell manufacturers such as Q-Cells AG, as well as integrated manufacturers of PV products such as Renewable Energy Corporation and SolarWorld AG. Some of our potential competitors have also become vertically integrated, from upstream silicon wafer manufacturing to PV system integration. We expect to compete with future entrants to the PV market that offer new technological solutions. We may also face competition from semiconductor manufacturers, a few of which have already announced their intention to start production of PV cells. Many of our potential competitors are developing or currently producing products based on new PV technologies, including thin film, ribbon, sheet and nano-technologies, which they believe will ultimately cost the same as or less than crystalline silicon technologies similar to ours. In addition, the entire PV industry also faces competition from conventional and non-solar renewable energy technologies. Due to the relatively high manufacturing costs compared to most other energy sources, solar energy is generally not competitive without government incentive programs.

| 17 |

Most of our potential competitors have substantially greater financial, technical, manufacturing and other resources than we do. Greater size in some cases provides them with a competitive advantage with respect to manufacturing costs because of their economies of scale and their ability to purchase raw materials at lower prices. For example, those companies that also manufacture semiconductors may source both semiconductor grade silicon wafers and solar grade silicon wafers from the same supplier. As a result, those companies may have stronger bargaining power with the supplier and have an advantage over us in negotiating favorable pricing, as well as securing silicon ingot and silicon wafer supplies at times of shortages. Many of our potential competitors also have greater brand name recognition, more established distribution networks and larger customer bases. In addition, many of our potential competitors have well-established relationships with our current and potential distributors and have extensive knowledge of our target markets. As a result, they may be able to devote greater resources to the research, development, promotion and sale of their products or respond more quickly to evolving industry standards and changes in market conditions than we can. Our failure to adapt to changing market conditions and to compete successfully with existing or new entrants may materially and adversely affect our financial condition and results of operations. Our failure to develop and introduce new PV products could render our products uncompetitive or obsolete, and reduce our sales and market share.

The PV industry is rapidly evolving and competitive. We will need to invest significant financial resources in research and development to keep pace with technological advances in the PV industry and to effectively compete in the future. However, research and development activities are inherently uncertain, and we might encounter practical difficulties in commercializing our research results. Our significant expenditures on research and development may not reap corresponding benefits. A variety of competing PV technologies that other companies may develop could prove to be more cost-effective and have better performance than our PV products. Therefore, our development efforts may be rendered obsolete by the technological advances of others. Breakthroughs in PV technologies that do not use crystalline silicon could mean that companies such as us that currently rely entirely on crystalline silicon would encounter a sudden, sharp drop in sales. Our failure to develop and introduce new PV products could render our products uncompetitive or obsolete, and result in a decline in our market share.

Intense competition from existing and new entities may adversely affect our revenues and profitability.

We compete with other companies, many of whom are developing, or can be expected to develop, products similar to ours. Some of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We intend to create greater brand awareness for our brand name so that we can successfully compete with our competitors. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

Our dependence on a limited number of customers may cause significant fluctuations or declines in our revenues.

We plan to sell a substantial portion of our wafers and PV modules to a limited number of customers, including distributors, engineering design firms, system integrators, other value-added resellers, as well as integrated manufacturers of PV modules. To date, we have not had any customers or any sales. We plan to conduct our sales to customers typically through non-exclusive, short-term arrangements where the contract prices are typically agreed upon between our customers and us on a quarterly basis, and as such, our actual revenues can vary significantly. We anticipate that our dependence on a limited number of customers would continue for the foreseeable future. Consequently, any one of the following events may cause material fluctuations or declines in our revenues and have a material adverse effect on our results of operations:

| · | reduction, delay or cancellation of orders from one or more significant customers; |

| 18 |

| · | selection by one or more significant customers of products competitive with ours; |

| · | loss of one or more significant customers and our failure to identify additional or replacement customers; and |

| · | failure of any significant customers to make timely payment for our products. |

Changes to existing regulations over the utility sector and the PV industry may present technical, regulatory and economic barriers to the purchase and use of PV products, which may significantly reduce demand for our products.

The market for power generation products is heavily influenced by government regulations and policies concerning the electric utility industry, as well as the internal policies of electric utilities companies. These regulations and policies often relate to electricity pricing and technical interconnection of end user-owned power generation. In a number of countries, these regulations and policies are being modified and may continue to be modified. End users’ purchases of alternative energy sources, including PV products, could be deterred by these regulations and policies, which could result in a significant reduction in the potential demand for our PV products. For example, utility companies commonly charge fees to larger, industrial customers for disconnecting from the electricity transmission grid or for having the capacity to use power from the electricity transmission grid for back-up purposes. These fees could increase end users’ costs of using our PV products and make our PV products less desirable, thereby having an adverse effect on our business, prospects, results of operations and financial condition.

We anticipate that our PV products and their installation will be subject to oversight and regulation in accordance with national and local ordinances relating to building codes, safety, environmental protection, utility interconnection and metering and related matters in various countries. It is also burdensome to track the requirements of individual localities and design equipment to comply with the varying standards. Any new government regulations or utility policies pertaining to our PV products may result in significant additional expenses to us, our distributors and end users and, as a result, could cause a significant reduction in demand for our PV products.

The reduction or elimination of government subsidies and economic incentives for on-grid solar energy applications could cause demand for our products and our revenues to decline.

Almost all of our solar cells sold are eventually utilized in the on-grid market, where the solar power systems are connected to the utility grid and generate electricity to feed into the grid. We believe that the near-term growth of the market for on-grid applications depends in large part on the availability and size of government subsidies and economic incentives. The reduction or elimination of subsidies and economic incentives may adversely affect the growth of this market or result in increased price competition, either of which could cause our revenues to decline.

Today, when upfront system costs are factored into cost per kilowatt, the cost of solar power substantially exceeds the cost of power furnished by the electric utility grid in many locations. As a result, national and local governmental bodies in many countries, most notably in Germany, Spain, Italy, the United States and China, have provided subsidies and economic incentives in the form of feed-in tariffs, rebates, tax credits and other incentives to distributors, system integrators and manufacturers of solar power products to promote the use of solar energy in on-grid applications and to reduce dependence on other forms of energy. These government economic incentives could potentially be reduced or eliminated altogether. The solar power industry is currently moving towards the economies of scale necessary for solar power to become cost-effective in a non-subsidized market. Reductions in, or eliminations of, subsidies and economic incentives for on-grid solar energy applications could result in decreased demand for our products and cause our revenues to decline.

We may incur significant costs to ensure compliance with U.S. corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements and other rules implemented by the Securities and Exchange Commission and the NASDAQ OTCBB. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

| 19 |

We have limited insurance coverage and may incur losses resulting from product liability claims or business interruptions.

If we secure any PV product sales, we would be exposed to risks associated with product liability claims in the event that the use of the PV products sold results in injury. Since our proposed products are electricity producing devices, it is possible that users could be injured or killed by the products, whether by product malfunctions, defects, improper installation or other causes. We have not sold any products and, due to limited historical experience, we are unable to predict whether product liability claims will be brought against us in the future or the effect of any resulting adverse publicity on our business. Moreover, we may have only limited product liability insurance and may not have adequate resources to satisfy a judgment in the event of a successful claim against us. The successful assertion of product liability claims against us could result in potentially significant monetary damages and require us to make significant payments. In addition, as the insurance industry in China is still in an early stage of development, business interruption insurance available in China offers limited coverage compared to that offered in many other countries.

Acts of terrorism, responses to acts of terrorism and acts of war may impact our business and our ability to raise capital.

Future acts of war or terrorism, national or international responses to such acts, and measures taken to prevent such acts may harm our ability to raise capital or our ability to operate, especially to the extent we depend upon activities conducted in foreign countries, such as China. In addition, the threat of future terrorist acts or acts of war may have effects on the general economy or on our business that are difficult to predict. We are not insured against damage or interruption of our business caused by terrorist acts or acts of war.

RISKS RELATED TO DOING BUSINESS IN CHINA

Currency conversion and exchange rate volatility could adversely affect our financial condition.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the People’s Bank of China exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the People’s Bank of China exchange rate according to market conditions. Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, for use on current account items, including the distribution of profits to foreign investors, is permissible. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including Foreign Investment Enterprises) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

| 20 |

China’s economic policies could affect our business.

To the extent our assets will be located in China and to the extent our revenue will be derived from our operations in China, our results of business and prospects would be subject to the economic, political and legal developments in China.

While China’s economy has experienced a significant growth in the past twenty years, growth has been irregular, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of China, but may also have a negative effect on us. For example, our sales results and financial condition may be adversely affected by the government control over capital investments or changes in tax regulations with our future customers.

The economy of China has been transitioning from a planned economy to a more market-oriented economy. In recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets and the establishment of corporate governance in business enterprises; however, a substantial portion of productive assets in China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over China's economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Because our assets and operations might be located in China, you may have difficulty enforcing any civil liabilities against us under the securities and other laws of the U.S. or any state.

We are a holding company, and all of our assets might be located in the Republic of China. In addition, our directors and officers are non-residents of the United States, and all or a substantial portion of the assets of these non-residents are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon these non-residents, or to enforce against them judgments obtained in United States courts, including judgments based upon the civil liability provisions of the securities laws of the United States or any state.

There is uncertainty as to whether courts of the Republic of China would enforce:

| l | Judgments of United States courts obtained against us or these non-residents based on the civil liability provisions of the securities laws of the United States or any state; or |

| l | In original actions brought in the Republic of China, liabilities against us or non-residents predicated upon the securities laws of the United States or any state. Enforcement of a foreign judgment in the Republic of China also may be limited or otherwise affected by applicable bankruptcy, insolvency, liquidation, arrangement, moratorium or similar laws relating to or affecting creditors' rights generally and will be subject to a statutory limitation of time within which proceedings may be brought. |

The PRC legal system embodies uncertainties, which could limit law enforcement availability.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, decided legal cases have little precedence. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past 33 years has significantly enhanced the protections afforded to various forms of foreign investment in China. Each of our PRC operating subsidiaries and affiliates is subject to PRC laws and regulations. However, these laws and regulations change frequently and the interpretation and enforcement involve uncertainties. For instance, we may have to resort to administrative and court proceedings to enforce the legal protection that we are entitled to by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting statutory and contractual terms, it may be difficult to evaluate the outcome of administrative court proceedings and the level of law enforcement that we would receive in more developed legal systems. Such uncertainties, including the inability to enforce our contracts, could affect our business and operation. In addition, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with regard to the industries in which we operate, including the promulgation of new laws. This may include changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the availability of law enforcement, including our ability to enforce our agreements with the government entities and other foreign investors.

| 21 |

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.