Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - Viva Entertainment Group Inc. | v339763_ex10-1.htm |

| EX-10.2 - EXHIBIT 10.2 - Viva Entertainment Group Inc. | v339763_ex10-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: March 25, 2013

American Copper Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 333-163815 | 98-0642409 |

| (State or Other | (Commission File | (IRS Employer |

| Jurisdiction of | Number) | Identification No.) |

| Incorporation) |

1600 Broadway, Suite 1600

Denver, Colorado 80202

(Address of principal executive offices)(Zip Code)

Tel. (303)386-7203

Registrant's telephone number, including area code

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Property Acquisition Agreement

On March 25, 2013 (the “Closing Date”), American Copper Corp. (the “Company”), entered into a Mineral Property Acquisition Agreement (the “Acquisition Agreement”), with US Copper Investments Ltd. (the “Vendor”) whereby the Company acquired from the Vendor a right to acquire a 100% right, title, and interest in and to a certain property known as The Ridgestake Copper-Gold Prospect, which comprises 7 mineral claims covering, in aggregate, 7,733 acres (3,129.48 ha) (the “Property”). The Property, which is a copper-gold-silver-molybdenum prospect, is located 125 km south-west of Williams Lake in south-central British Columbia (BC), Canada. Pursuant to the Acquisition Agreement, in consideration of an undivided 100% interest in and to the Property, the Vendor will receive 5,000,000 restricted shares of the Company’s common stock (the “Shares”).

As a closing condition to the Acquisition Agreement, the Company entered into a Mineral Property Transfer Agreement (the “Transfer Agreement”), with the Vendor and Jaroslav Ruza, BC, a Canadian corporation (“Ruza”), whereby the Vendor transferred to the Company its right to acquire a 100% right, title, and interest the Property from Ruza. Pursuant to the Transfer Agreement, Ruza shall be entitled to receive 2.5% of any Net Smelter Return on the Property.

Ruza has agreed to transfer the Property, as further described in the Acquisition Agreement, on the Closing Date.

The foregoing description of the terms of the Acquisition Agreement and Transfer Agreement are qualified in their entirety by reference to the provisions of the agreement filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K (this “Report”), which is incorporated by reference herein.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

Acquisition of Properties

On March 25, 2013, the Company acquired a 100% right, title, and interest in the Property.

The terms of the Acquisition Agreement are qualified in its entirety by reference to the description of the agreement in Item 1.01, and to the provisions of the agreement filed as Exhibit 10.1 and 10.2 to this Report

Description of the Property

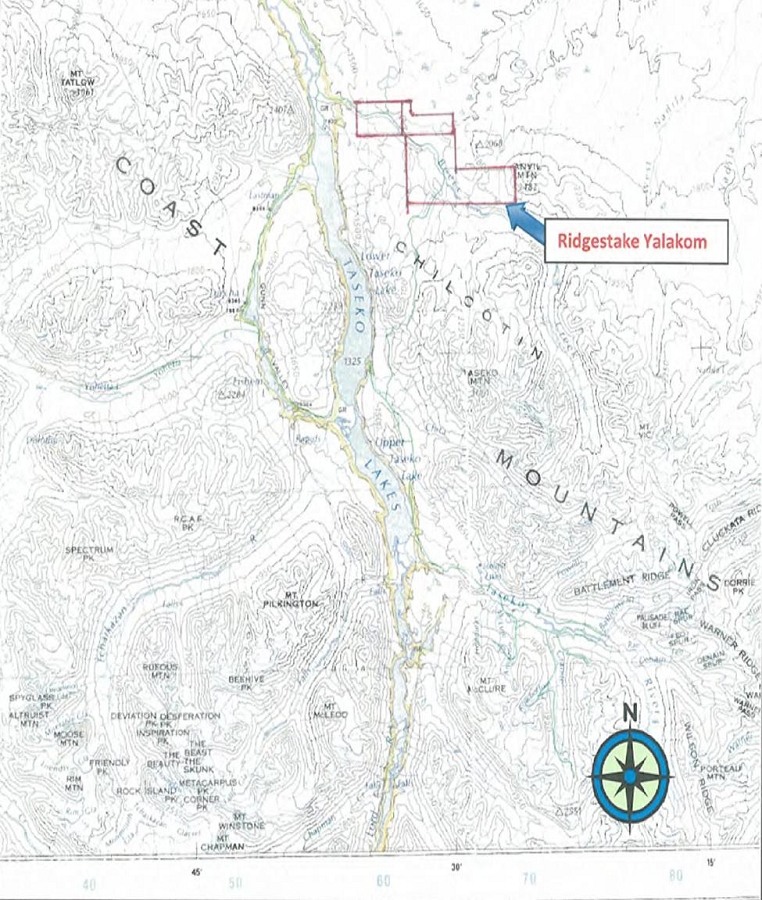

The location of the Property is shown in Figure 1 below, it is 125 km south-west of Williams Lake in the Cariboo-Chilcotin region of south central British Columbia (BC), Canada. The Property comprises 7 mineral claims, Taseko 1 and Taseko 2, and Cu, Cu1, Cu2, Cu3 and Cu4 totaling 7,733 acres (3,129.48 ha). The first two claims were renewed very recently and now expire on 14 March 2014, the subsequent five currently expire on 27 June 2013, but it is intended that they will be renewed prior to expiry.

Vehicle access, to the Property, is via Provincial Highway No.20 to Lee’s Corner and via forestry resource roadways. The Property lies approximately 15 km south-southeast of the New Prosperity Project of Taseko Mines Limited and lies on the east flank of North Taseko Lake. It lies along Reece Creek and on the west flank of Anvil Mountain. The Property also lies west of and adjacent to the Yalakom fault with sequence sediments and volcanic of Lower to Upper Cretaceous in age.

There are at least 2 types of potential mineralization on The Property. The first is copper-gold mineralization of the type related to porphyry copper systems. The second potential type of mineralization is complex gold-copper mineralization. Although possibly porphyry-related, this type of mineralization has strong stratigraphic and structural controls on mineralization distribution.

American Copper is developing an exploration program for the Property to provide an initial evaluation of the potential for a bulk tonnage copper-gold-molybdenum bearing porphyry and for structurally and stratigraphically controlled systems.

The program will include the evaluation of geological data from the property and region. Geological, geochemical and direct trenching work will be based on the results from the initial compilation and evaluation of data for the region. The application of modern ZTEM geophysics surveying will also be considered to obtain an in depth evaluation of potentially copper bearing alteration and sulphide zones, allowing for evaluation of geology to depth.

The Property is currently without known reserves and the proposed program is exploratory in nature.

Figure 1: Location of the Property

| Item 3.02 | Unregistered Sale of Equity Securities |

Reference is made to the disclosure set forth under Items 1.01 of this Report, which disclosure is incorporated herein by reference.

The Company believes that the issuance of the Shares was a transaction not involving a public offering and was exempt from registration with the Securities and Exchange Commission pursuant to Rule 4(2) of the Securities Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) |

Exhibits.

The following exhibit is furnished herewith: |

|

Exhibit Number |

Description | |

| 10.1 | Mineral Property Acquisition Agreement, dated March 25, 2013, by and among American Copper Corp., and US Copper Investments, Ltd. | |

| 10.2 | Mineral Property Transfer Agreement, dated March 25, 2013, by and among American Copper Corp., US Copper Investments, Ltd, and Ruza |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMERICAN COPPER CORP. | ||

| Dated: March 28, 2013 | /s/ Alexander Stanbury | |

|

Alexander Stanbury President, Chief Executive Officer, Secretary, Treasurer, and Chief Financial Officer. |