Attached files

| file | filename |

|---|---|

| 8-K - 8-K - General Motors Co | a2013marchanalystpresentat.htm |

CHUCK STEVENS CFO, GM North America Exhibit 99.1

FORWARD LOOKING STATEMENTS In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “projected,” “positioned,” “outlook” or similar expressions is intended to identify forward looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors may include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate financing sources, including as required to fund our planned significant investment in new technology; our ability to successfully integrate Ally Financials International Operations; the ability of our suppliers to timely deliver parts, components and systems; our ability to realize successful vehicle applications of new technology; overall strength and stability of our markets, particularly Europe; and our ability to continue to attract new customers, particularly for our new products. GM's most recent annual report on Form 10-K provides information about these and other factors, which we may revise or supplement in future reports to the SEC.

AGENDA GMNA Performance Since 2010 2013… A Transition Year The Road to 10% EBIT- Adjusted Margin

GMNA PERFORMANCE SINCE 2010 Design, Build, Sell Great Products Pricing/Incentive Discipline Fixed Cost Focus Maintain Low Break-Even Point Key Tenets of New Business Model And IPO

DESIGN, BUILD, SELL GREAT PRODUCTS Chevrolet Equinox Chevrolet Cruze Chevrolet Sonic Cadillac SRX Buick Lacrosse Segment Share Price Profitability

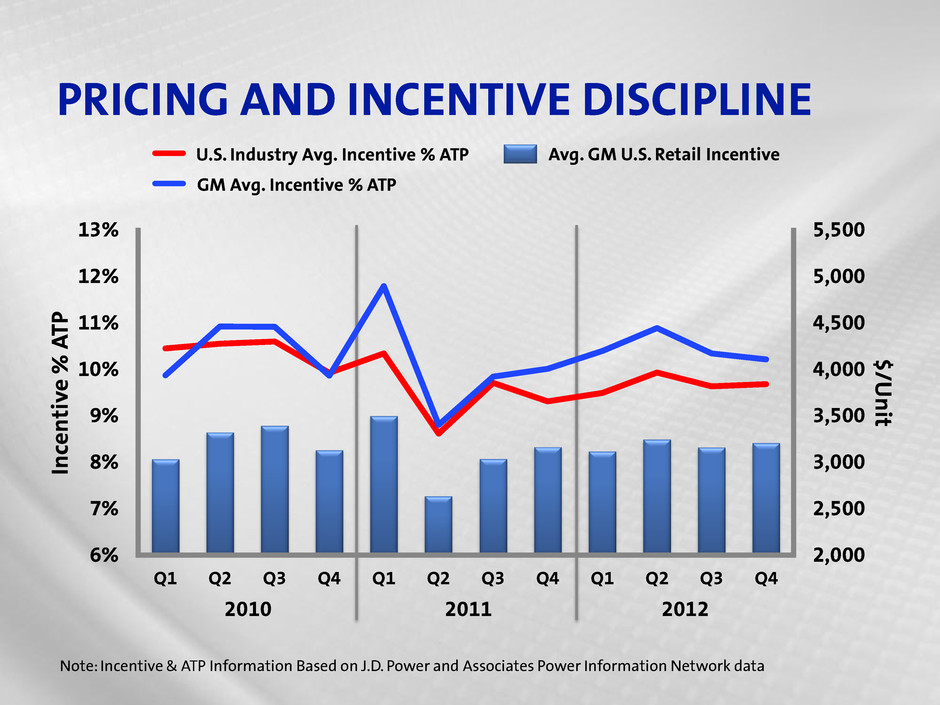

PRICING AND INCENTIVE DISCIPLINE 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6% 7% 8% 9% 10% 11% 12% 13% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 $ /U n it In ce n ti v e % A T P GM Avg. Incentive % ATP U.S. Industry Avg. Incentive % ATP Avg. GM U.S. Retail Incentive 2010 2012 2011 Note: Incentive & ATP Information Based on J.D. Power and Associates Power Information Network data

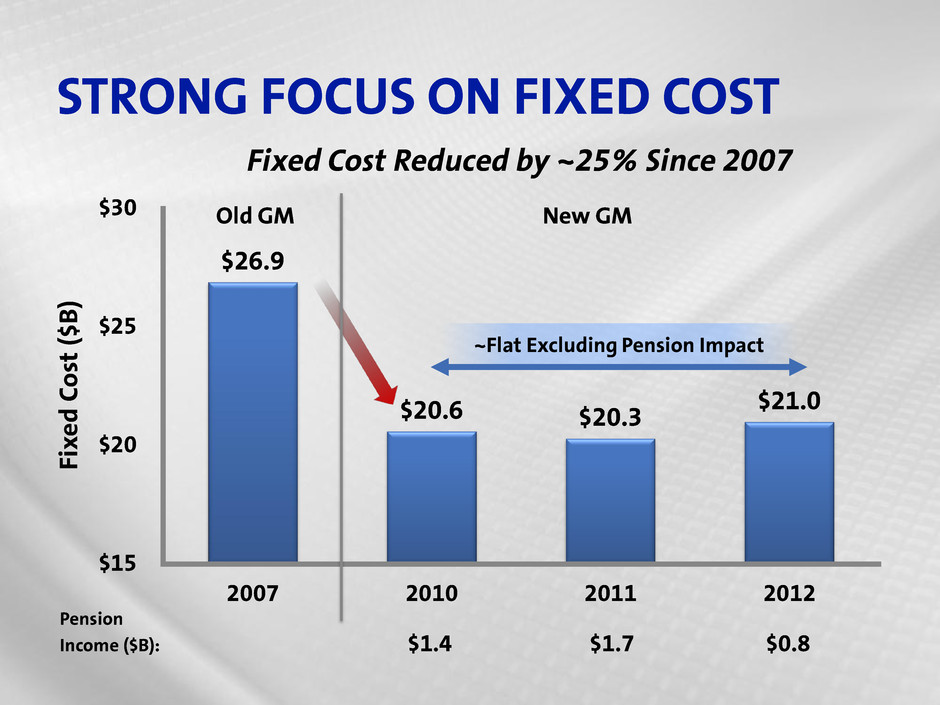

STRONG FOCUS ON FIXED COST $26.9 $20.6 $20.3 $21.0 $15 $20 $25 $30 2007 2010 2011 2012 Fi x e d C o st ( $ B ) Fixed Cost Reduced by ~25% Since 2007 Pension Income ($B): $1.4 $1.7 $0.8 ~Flat Excluding Pension Impact Old GM New GM

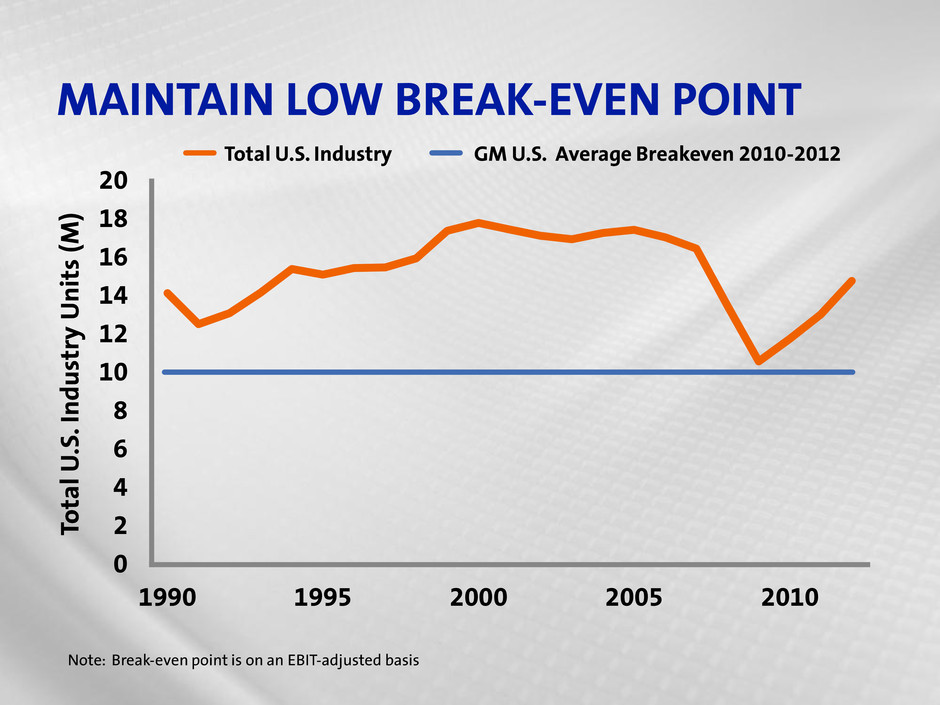

MAINTAIN LOW BREAK-EVEN POINT 0 2 4 6 8 10 12 14 16 18 20 1990 1995 2000 2005 2010 Tot a l U .S . I n d u st ry U n it s (M ) Note: Break-even point is on an EBIT-adjusted basis Total U.S. Industry GM U.S. Average Breakeven 2010-2012

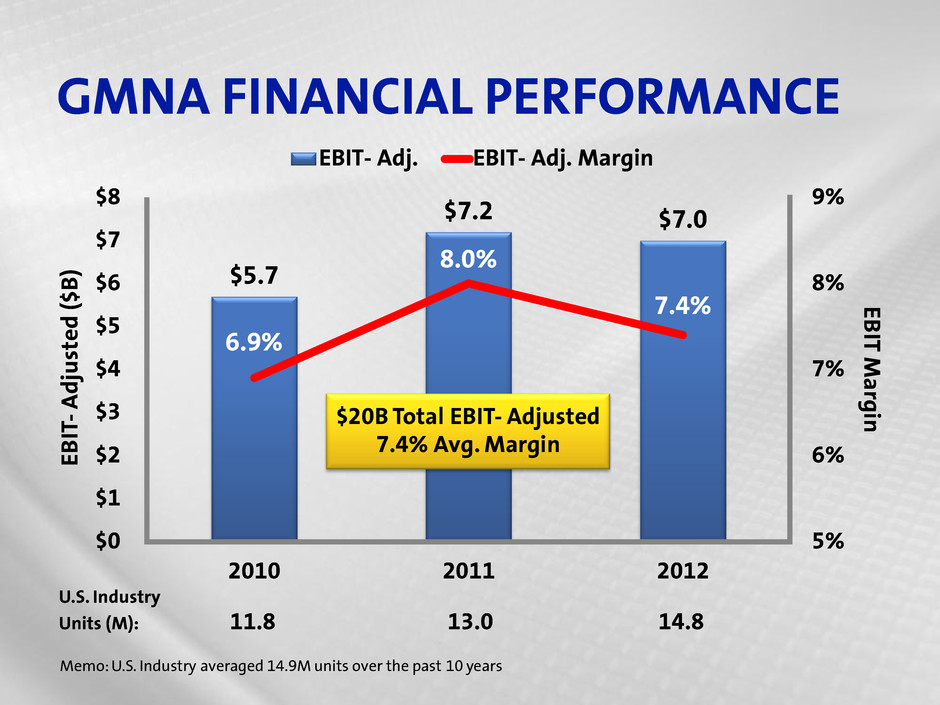

GMNA FINANCIAL PERFORMANCE $5.7 $7.2 $7.0 6.9% 8.0% 7.4% 5% 6% 7% 8% 9% $0 $1 $2 $3 $4 $5 $6 $7 $8 2010 2011 2012 E B IT Ma rg in E B IT - A d ju st e d ( $ B ) EBIT- Adj. EBIT- Adj. Margin U.S. Industry Units (M): 11.8 13.0 14.8 Memo: U.S. Industry averaged 14.9M units over the past 10 years $20B Total EBIT- Adjusted 7.4% Avg. Margin

AGENDA GMNA Performance Since 2010 2013… A Transition Year The Road to 10% EBIT- Adjusted Margin

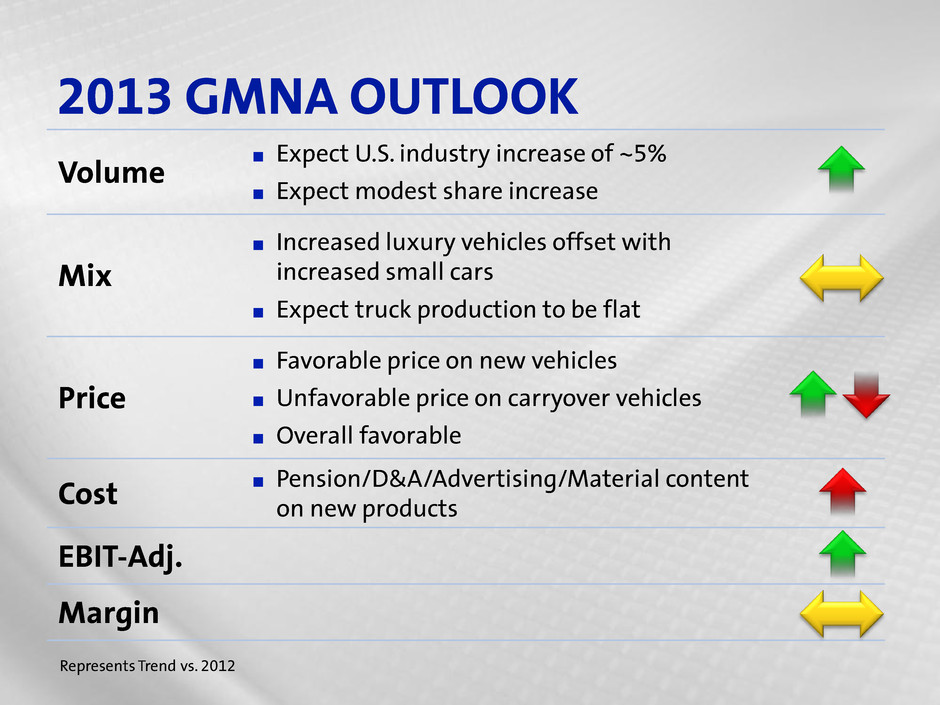

2013 GMNA OUTLOOK Volume ¶ Expect U.S. industry increase of ~5% ¶ Expect modest share increase Mix ¶ Increased luxury vehicles offset with increased small cars ¶ Expect truck production to be flat Price ¶ Favorable price on new vehicles ¶ Unfavorable price on carryover vehicles ¶ Overall favorable Cost ¶ Pension/D&A/Advertising/Material content on new products EBIT-Adj. Margin Represents Trend vs. 2012

CHEVROLET SILVERADO AND GMC SIERRA

DESIGN, BUILD, SELL GREAT PRODUCTS Buick Encore Cadillac ATS Chevrolet Impala Cadillac XTS Chevrolet Stingray

CADILLAC CTS

AGENDA GMNA Performance Since 2010 2013… A Transition Year The Road to 10% EBIT- Adjusted Margin

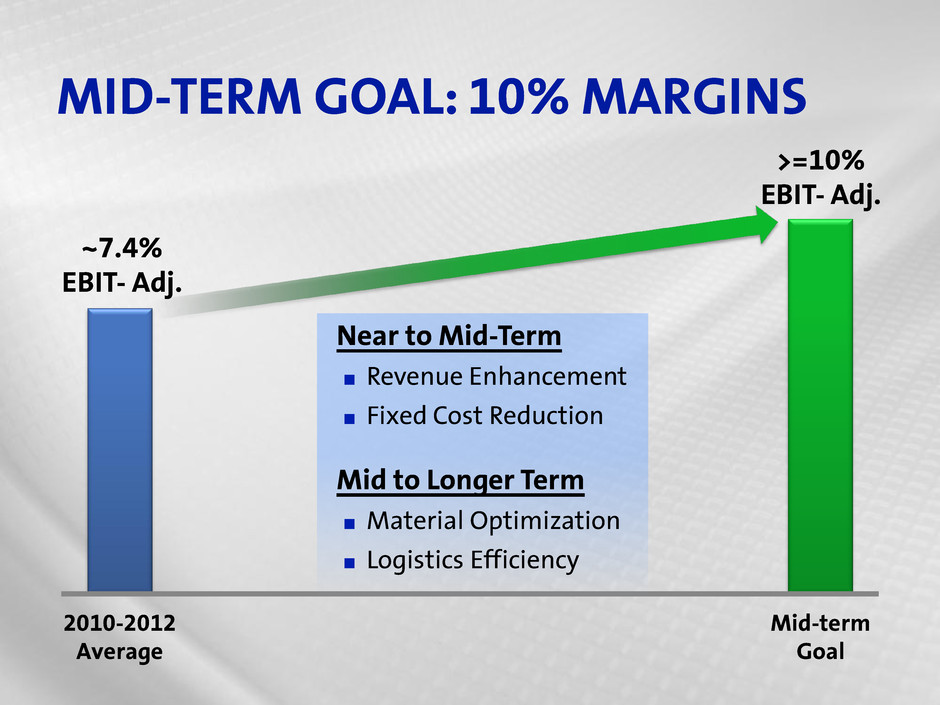

MID-TERM GOAL: 10% MARGINS 2010-2012 Average Mid-term Goal >=10% EBIT- Adj. ~7.4% EBIT- Adj. Near to Mid-Term ¶ Revenue Enhancement ¶ Fixed Cost Reduction Mid to Longer Term ¶ Material Optimization ¶ Logistics Efficiency

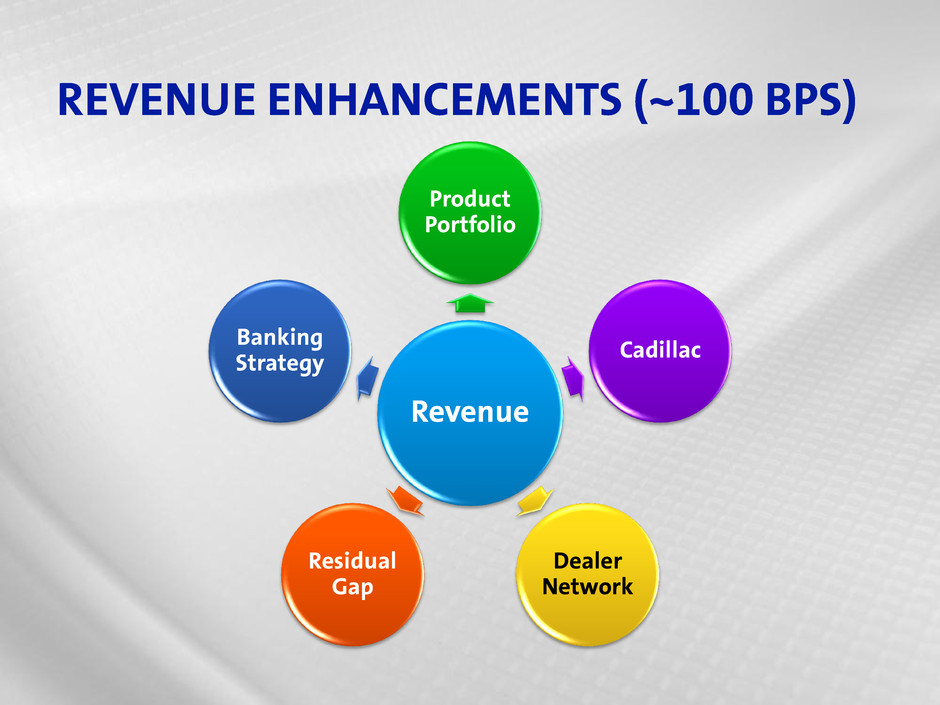

REVENUE ENHANCEMENTS (~100 BPS) Revenue Product Portfolio Cadillac Dealer Network Residual Gap Banking Strategy

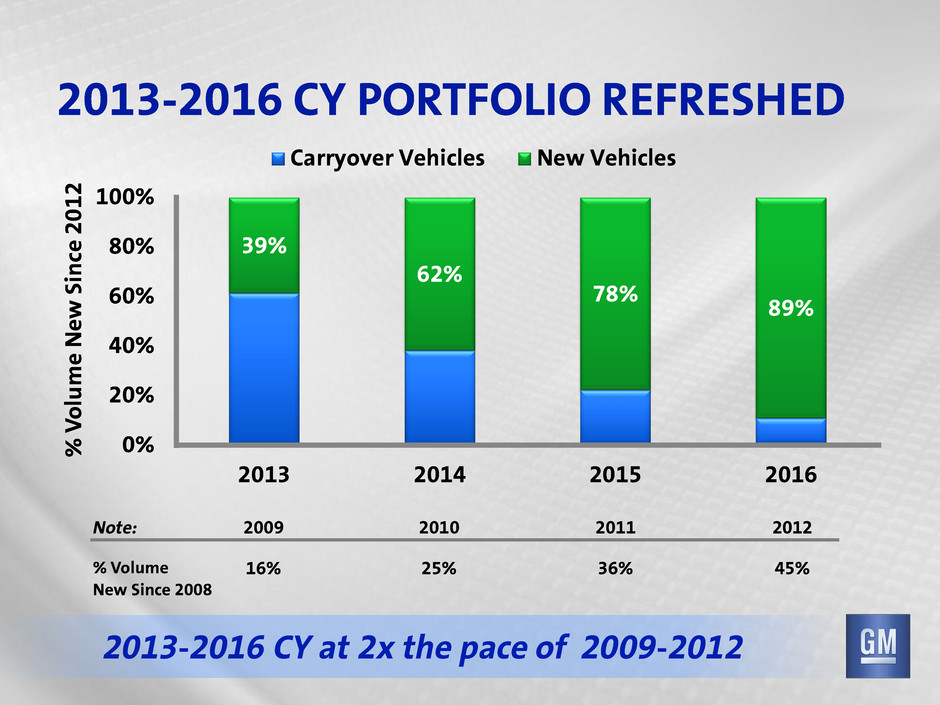

2013-2016 CY PORTFOLIO REFRESHED 39% 62% 78% 89% 0% 20% 40% 60% 80% 100% 2013 2014 2015 2016 % V o lu m e N e w S in ce 201 2 Carryover Vehicles New Vehicles 2013-2016 CY at 2x the pace of 2009-2012 Note: 2009 2010 2011 2012 % Volume 16% 25% 36% 45% New Since 2008

CADILLAC PORTFOLIO 2014 CY SRX CTS ESCALADE STS DTS ATS: 2013 Car of the Year SRX – Refreshed in 2012 Escalade – New in 2014 XTS – New in 2012 CTS – New in 2013 ELR – New in 2013 2010 CY

OTHER REVENUE ENHANCEMENT OPPORTUNITIES ¶ Enhanced dealer facilities – Over 4,000 dealers participating – Strong focus on California and New York ¶ Eliminate residual gap – currently 200 basis points ¶ Fully leverage banking strategy – GM Financial generating >20k incremental sales annually

FIXED COSTS (~100 BPS) Targeting 6% reduction in SG&A ¶ Overhead ¶ IT Expect manufacturing efficiencies in the range of 5% ¶ Tier I/Tier II mix ¶ Skilled trades competitiveness ¶ Footprint optimization ¶ Project expense Intended to offset D&A, marketing and pension headwinds in 2013

MATERIAL AND LOGISTICS (~100 BPS) Material cost optimization ¶ Global architectures from ~60% of today’s volume to ~95% by 2018 ¶ Supplier strategic sourcing ¶ Supplier footprint ¶ Further leverage scale Logistics efficiencies ¶ Premium freight ¶ Mode optimization ¶ Inbound freight optimization

SUMMARY – GMNA ¶ Generated $20B EBIT-adjusted in the last three years ¶ Launch of several key products makes 2013 an important transition year ¶ Sound foundation being laid for ~10% margins by mid-decade