Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEAPACK GLADSTONE FINANCIAL CORP | form8k-128492_pgfc.htm |

Exhibit 99.1

|

annual report 2012

|

Peapack-Gladstone Financial Corporation, headquartered in Bedminster, New Jersey, is the holding company for Peapack-Gladstone Bank, which operates 23 branch offices throughout Hunterdon, Middlesex, Morris, Somerset and Union counties. The Bank’s wealth management division, PGB Trust & Investments, operates at the Bank’s corporate offices in Bedminster as well as three other locations in Clinton, Morristown, and Summit, New Jersey, and at the Bank’s new subsidiary, PGB Trust & Investments of Delaware, in Greenville, Delaware.

Established in 1921, Peapack-Gladstone Bank is one of the premier community banks in the marketplace, serving the needs of a loyal and growing client base. The Bank provides an array of wealth management services as well as a complete range of commercial and retail banking services.

The Company’s stock trades on the NASDAQ Global Select Market under the symbol PGC.

|

STRATEGIC VISION A high-performing boutique bank, leaders

in wealth,

|

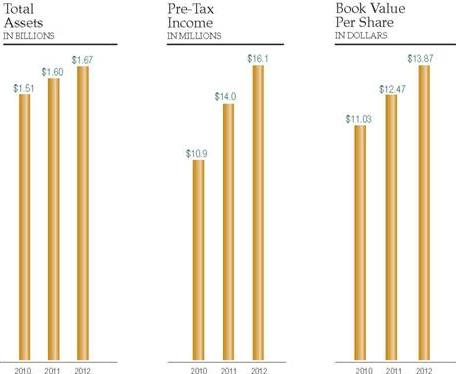

Financial Highlights

(In Thousands, Except Per Share Data)

| Selected Year-End Data: | 2012 | 2011 | 2010 | |||||||||

| Pre-Tax Income | $ | 16,101 | 13,982 | $ | 10,895 | |||||||

| Net Income | 9,696 | 12,168 | 7,664 | |||||||||

| Net Income Available to Common Shareholders | 9,222 | 10,940 | 5,978 | |||||||||

| Total Assets | 1,667,836 | 1,600,335 | 1,505,425 | |||||||||

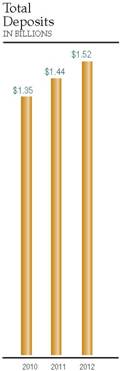

| Total Deposits | 1,516,427 | 1,443,892 | 1,351,546 | |||||||||

| Total Investment Securities | 304,479 | 420,239 | 415,353 | |||||||||

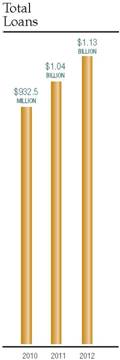

| Total Loans | 1,132,584 | 1,038,345 | 932,497 | |||||||||

| Total Shareholders’ Equity | 122,057 | 122,971 | 117,716 | |||||||||

| PGB Trust & Investments Assets under Administration (Market Value) | 2,303,612 | 1,957,146 | 1,940,404 | |||||||||

| Per Common Share: | ||||||||||||

| Earnings-Basic | $ | 1.05 | $ | 1.25 | $ | 0.68 | ||||||

| Earnings-Diluted | 1.05 | 1.25 | 0.68 | |||||||||

| Book Value | 13.87 | 12.47 | 11.03 | |||||||||

| Financial Ratios: | ||||||||||||

| Net Interest Margin | 3.50 | % | 3.47 | % | 3.64 | % | ||||||

| Return on Average Assets | 0.61 | 0.79 | 0.52 | |||||||||

| Return on Average Common Equity | 8.03 | 10.74 | 6.26 | |||||||||

Regulatory Capital Ratios: | ||||||||||||

| Total Capital to Risk-Weighted Assets | 13.08 | % | 13.76 | % | 14.16 | % | ||||||

| Tier 1 Capital to Risk-Weighted Assets | 11.83 | 12.51 | 12.91 | |||||||||

| Tier 1 Capital to Average Assets | 7.27 | 7.73 | 7.96 | |||||||||

For complete financial information, please see the Company’s Annual Report on Form 10-K.

To Our Shareholders | |

|

Dear Shareholders and Friends, 2012 was an important year for our Company. The year was one of solid achievement, both strategically and financially. EARNINGS Despite the challenging interest rate environment, net interest income grew $2.5 million or over 5 percent from 2011 to 2012. This contributed to pre-tax earnings growth of $2.1 million or 15 percent in 2012. BALANCE SHEET GROWTH AND MANAGEMENT 2012 total loan originations were a record $397 million. Much of our longer duration residential mortgage loan originations were sold benefitting noninterest income, as well as benefitting our interest rate risk position. Total loans grew $94 million or over 9 percent in 2012. That growth was funded by core deposit growth and cash flows from the lower yielding investment portfolio. The Company’s Pooled Trust Preferred Securities portfolio was sold resulting in a gain on sale, a significant reduction in risk-weighted assets for regulatory capital purposes and the realization of a majority of the Company’s deferred tax assets. CAPITAL The remaining TARP/CPP funds taken from the Treasury in January 2009 were fully repaid in January 2012, without diluting one single shareholder. As of December 31, 2012, our regulatory capital ratios were all above the levels to be considered well capitalized under regulatory guidelines applicable to Banks. Additionally, the Company’s common equity ratio (common equity to total assets) at the end of 2012 was 7.32 percent, up from 6.81 percent at the end of 2011. PGB TRUST & INVESTMENTS PGB Trust & Investments, our wealth management division, posted strong performance once again, ending the year with $2.3 billion of assets under administration. Gross fees for 2012 were $12.3 million, up 15 percent from 2011’s results. In December, we announced that we had received approval to establish PGB Trust & Investments of Delaware, a subsidiary of Peapack-Gladstone Bank, located in Greenville, DE. PGB Trust & Investments of Delaware provides our clients the opportunity to realize the advantages of Delaware trusts, which offer significant income and estate tax benefits, as well as greater flexibility to establish multi-generational trusts. The subsidiary allows us to help our clients find the most efficient ways to protect and perpetuate their assets and maximize the amount they are able to pass onto their heirs. We encourage you to speak with our wealth management division to learn more. |

FRANK A. KISSEL Chairman of the Board

Our wealth

|

|

Strengthening Our Infrastructure | |

|

The

|

ASSET QUALITY We made great strides in 2012. In comparing year end 2011 to year end 2012, we saw a $17 million or 35 percent reduction in classified loans, including a $7 million or 38 percent reduction in nonaccrual loans. There is much more on this and all other financial aspects of the Company provided in the accompanying Annual Report on Form 10-K. As you all know, in July, after almost 25 years as Chairman and Chief Executive Officer, I made the decision to step aside from the role of CEO. It has been my privilege to lead our Company for all these years, and I am very proud of the organization we have built and of all the people who have contributed to the effort. I am pleased to continue on as your Chairman as we move into the future with confidence and great strength. Some of you have had the opportunity to meet our new CEO, Douglas L. Kennedy, who took the reins in October of 2012. I can promise you that he has tremendous energy and a vision for our Company that will ensure exceptional services for our clients and strong results for our investors. Together, we look forward to the challenges and opportunities ahead. We also welcomed two new Board Members to our team in October, Edward A. Gramigna, Jr. and Beth Welsh, both of whom bring a tremendous amount of experience to our organization. Lastly, we would be remiss if we did not thank Pamela Hill who retired from our Board in December after more than 20 years of dedicated service. Ms. Hill is the daughter of T. Leonard Hill, a former Chairman and longtime board member, and granddaughter of Garner F. Hill, a key founder of the Bank. Pam will be greatly missed. The Company is well-positioned to meet the challenges of the future. We are distinguished by the breadth and depth of our talented professionals who work together rather than as individuals to provide responsive and value-added solutions and meet the multifaceted needs of our clients. We have the right approach, the right scope of services and the right people in place to build and retain lasting relationships. As we look toward the year ahead, we remain committed to building future value. We thank each of you for your continued confidence and support.

FRANK A. KISSEL Chairman of the Board

|

2012 was a very busy year at Peapack-Gladstone Bank

|

From the Desk of the Chief Executive Officer

|

Dear Fellow Shareholders, Together, my leadership team and I have recently begun the process of charting our strategy for the future. We believe there are three major headwinds that must be addressed in order for us to succeed and provide ongoing shareholder value. First, the current interest rate environment is continuing to put pressure on our interest margin. Approximately 75 percent of our revenue is derived from the spread we generate between the interest we pay for funds and the rate at which we lend or invest. As you know, the amount we pay now for money is very low. We believe there is little room to reduce rates further. On the asset side, our clients continue to refinance loans at low rates. When rates eventually increase, a strategy to maintain our margin by lending money for longer periods of time would expose us to considerable risk. Instead, we will focus on decreasing the average maturity of our loans and build out a Commercial & Industrial (C&I) Lending business, both of which will better serve us. Second, technology is transforming our industry. Traditional retail transaction volume has been declining for several years, and our clients are availing themselves of internet and digital channels. The adoption rate for digital has been brisk, and we plan to stay in step with changes as they emerge. Having said this, our long-established reputation as a Company that provides a high level of personal service will remain intact, and we will look for ways to more proactively enhance how we support our clients in person, as well as through these alternative channels. We will make improvements to our Call Center, enhance the branch level account opening process, provide online “chat” support, and continue to explore what the “branch of the future” looks like. The third headwind we face is the tsunami of increased regulations confronting our industry. We all understand the genesis of this regulation, and we accept that managing our business properly is non-negotiable. As a Company, we believe that we have invested sufficient resources to meet this challenge. In fact, beginning in 2013, we took steps to increase risk oversight by establishing a Risk Committee at the Board of Directors level and a Risk Committee within the Bank itself. |

|

We have also recently hired a risk veteran to build out and head a newly-formed Enterprise Risk Management Division. We will invest more resources as needs arise and rely on this enhanced risk management team to lay the foundation for managing financial and nonfinancial risks company-wide. We believe this rigorous approach will help drive shareholder value over time. OUR STRATEGIC VISION “A high-performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for unparalleled client service, integrity and trust.” We believe we are good; our vision now is to become great. Based on my short time at our Company, I already know this can be accomplished. We have the best people, period. This vision, which we have created as a team, will serve as a beacon for our Company’s future growth. During the fourth quarter, we took stock in what makes us special to our clients and communities. We believe our Company has a unique, competitive advantage and that our wealth business, which has been built over many years, is not easily replicated. Much of our competition lacks a wealth management capability. Those companies that do offer wealth management solutions often operate in silos with high minimum balance requirements. Our plan is to combine our wealth offering with our commercial lending efforts in an integrated way, which will provide a differentiated value proposition. OUR STRATEGY After an extensive assessment of our Company and the market, we developed and presented a comprehensive plan for our future to our Board of Directors. The plan is exciting. It promises a steady stream of increased revenue and profitability by focusing on great client service. Over 50 employees at all levels of the Company were enlisted to help draft the plan, which includes the following key elements: • Enhanced risk management • Expansion of our Multi-Family and Commercial Real Estate Lending business • Expansion of our C&I business through Private Banking teams, who will lead with deposit gathering and wealth management • Establishment of a sales force that supports our branches and will serve as a primary contact for clients. • Growing our residential mortgage business Our strategic plan - “Expanding Our Reach” - relies on organic growth rather than growth through acquisition as many of our competitors are actively pursuing. Ultimately, we believe that our strategy stays true to who we are.

|

We believe we I know that we

|

|

I am also

|

WHAT WE WANT TO ACCOMPLISH IN 2013 We started our work in the fourth quarter of 2012. To invest in our strategy, we took steps to take risk out of the balance sheet and eliminate $1.4MM in annualized costs. We will make additional investments in 2013 that will support our future growth. Our goals include: • Enhancing risk management • Enhancing the client experience through innovative technology • Expanding our Commercial Real Estate, Multi-Family and C&I Lending businesses • Growing our Wealth Management business • Establishing a robust sales culture WHY YOU SHOULD WANT TO OWN OUR STOCK We are implementing a very unique business model located in an enviable market. Our market share is small, but technology and people will enable us to grow. Based on our current revenue mix, we can easily justify a higher valuation in our share price, but the market has not yet bought in. Our strategy to invest in our product capabilities and recruit high-level talent will enable us to achieve future growth and visibly demonstrate our ability to deliver consistent profitability over time. We will accomplish this while managing risk and delivering growth, which will be sustainable in future years. We believe that this growth and our advantageous mix of spread and noninterest income will create a better valuation of our shares. CLOSING Over the past several months, I have witnessed how hard your Board of Directors works in providing governance. Know that the entire leadership team values and respects the counsel and guidance your Board provides, helping us to generate value for our shareholders. I am thankful for the confidence you have given our Company over the past several years and believe that our future holds great promise. In my role as CEO, I take the responsibility of communication seriously and commit to providing transparency. I will endeavor to continually share our progress as we execute our exciting plan – “Expanding Our Reach.”

DOUGLAS L. KENNEDY Chief Executive Officer

|

|

A History of Success Peapack-Gladstone Bank has been in the business of building relationships with clients and the communities it serves since 1921. We are positioned well for the future. Our core operating base is strong, and as we prepare to embark on a plan to grow our wealth management, commercial lending and retail business lines, we remain dedicated to maintaining and enhancing our high levels of client service. Our history is solid, built on long-term relationships and loyalty. Our future promises to be bright as we embrace our strategic vision: a high-performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for unparalleled client service, integrity and trust. Wealth Management PGB Trust & Investments, the wealth management division of Peapack-Gladstone Bank, is one of the largest New Jersey-based asset managers with $2.3 billion of assets currently under administration. It is headquartered in Bedminster, with additional offices in Clinton, Morristown and Summit, NJ, as well as at the Bank’s new subsidiary, PGB Trust & Investments of Delaware, in Greenville, DE. This division is known for its integrity, client service and broad range of fiduciary, investment management and tax services, designed specifically to meet the needs of high net-worth individuals, families, foundations and endowments. Our wealth management business differentiates us from our competition and adds significant value. We will grow this business further both in and around our market areas assisted by our new Delaware Trust subsidiary; through our existing wealth, loan and depository client base; and through our innovative Private Banking platform, which utilizes teams of Private Bankers working together to provide fully integrated client solutions. Throughout the wealth management division and all other business lines, we will continue to provide the unparalleled personalized, high-touch service our valued clients have come to expect.

|

Private Banking

Platform:

|

|

Commercial Lending We have been helping businesses emerge, expand and evolve for many years. We plan to continue this by moving more aggressively and growing our multi-family and other commercial real estate lending businesses, and introducing a comprehensive Commercial & Industrial (C&I) Lending program designed to service individuals, professional service firms, foundations, and privately owned businesses. This C&I Lending program, similar to our wealth management business, will be fully integrated into our Private Banking platform with a C&I Lending Private Banker, a Wealth Advisor Private Banker and a Deposit Private Banker who will work together to provide high-touch “white-glove” client service.

|

|

|

Retail Banking - Deposits We see a lot of opportunity for growth in our core markets. We have recently introduced the concept of high-touch concierge-style banking to support the affluent segment of our branch network. Much like the Private Banking platform, this team is intimately knowledgeable of all Bank products and services and serves as the primary contact for clients seeking wealth, lending and deposit solutions. The structure of this team will enable our existing branch network to maintain its primary objective of providing unique and unparalleled client service. Additionally, it is our expectation that our new Private Banking platform will contribute significantly to our retail deposit growth, not only through stand-alone deposit relationships, but through comprehensive new relationships associated with C&I Lending.

|

|

Retail Banking - PGB Mortgage |

|

|

Over the course of 2013 and beyond, we plan to aggressively grow our residential mortgage division. To that end, we have recently begun a rebranding effort to more effectively position this line of business, creating an opportunity for us to move into contiguous markets and expand our lending reach into northern New Jersey and beyond. PGB Mortgage opens the door for us to more easily and proactively reinvest in communities with the greatest need and joins PGB Trust & Investments as an extension of the Peapack-Gladstone Bank brand that has been a well-respected and integral part of the communities we serve for more than 90 years.

|

Reinvesting

|

| |

| Portraits In Client Loyalty | |

|

VAN DOREN OIL “We have been a loyal client of Peapack-Gladstone Bank for over 35 years. I can remember how the quaint Pottersville Branch had just one employee and used to close for lunch breaks back in the 1970s. The friendly, courteous staff and great customer service are just two of the reasons we bank here and will continue to do so for many years to come.” Vanessa Van Doren, Van Doren Oil Co.

“Long-term relationships between two parties say a lot about a business. At Van Doren Oil, we pride ourselves on the friendships we’ve created with our customers throughout the years, and we appreciate a loyal business partnership like the one we have with Peapack-Gladstone Bank.” Jack Van Doren, Van Doren Oil Co. |

|

|

Van Doren Oil Co. was established in 1939 by Ben Van Doren and continues operations today with second and third generation family members and over 30 valued employees. From its humble beginnings with just a single delivery truck to a current heating oil storage capacity of one million gallons, it is one of the largest inland storage facilities in New Jersey, able to provide customers in Hunterdon, Somerset and parts of Warren and Morris counties with a reliable source of home heating oil in the event of service disruptions. This could not have been more evident than during Hurricane Sandy (October 2012) when Van Doren Oil Co. helped keep many generators running, including Peapack-Gladstone Bank’s, so our clients could continue banking and secure the money they needed to survive the crisis. | |

|

JAMES F. HURLEY INSURANCE AGENCY CORPORATION “Not only are we clients of Peapack-Gladstone Bank and PGB Trust & Investments, we are partners in business. The personal service the Bank provides is unique, and that makes all the difference in our relationship.” Candyce J. Forster, EVP Commercial Lines Manager, Nancy L. Peterson, VP Accounting/Systems Manager, and R. Craig Sutherland, President

The James F. Hurley Insurance Agency Corporation has been serving NJ residents and businesses for more than five decades. The professionals at Hurley are dedicated to providing the kind of personalized service that ensures a fast, knowledgeable response when it’s needed most. Peapack-Gladstone Bank appreciates that commitment and is driven by the same core values – providing personalized service along with unmatched responsiveness and flexibility. Partnering with businesses like the James F. Hurley Insurance Agency Corporation allows Peapack-Gladstone Bank the opportunity to create valuable relationships based on common goals.

|

|

TEAM WELSH JEEP/CHRYSLER “Whenever we go to the bank, they somehow always seem to be able to work out whatever we need…no matter how complicated.” Peter Welsh, Dealer Principal, 3rd Generation

Team Welsh Jeep/Chrysler, established in 1909, began as a livery stable in bucolic Far Hills, New Jersey. In 1916, the livery stable was transformed into an automobile dealership selling Model T Fords. Today, the fourth generation of Welshes runs the oldest Jeep dealership in the state. The Welsh family chose Peapack-Gladstone Bank long ago because of the Bank’s personal service and attention. Peapack-Gladstone Bank is proud to share its 92 year history with the Welsh family, one of several multi-generation corporate relationships.

|

A Strong Bank, A Successful Community

|

AHA National Wear Red Day Each year Peapack-Gladstone Bank participates in the American Heart Association’s “National Wear Red Day.” The Bank and its employees “wear red” and donate money to promote awareness of the number one killer of women – heart disease and stroke. Our clients have jumped onboard with donations as well and helped position Peapack-Gladstone Bank as one of the largest fundraisers in the State. The Bank has been recognized by the American Heart Association for its efforts, and in 2012 was named the #1 fundraiser in the New Jersey Banking/Financial Team category and the #18 fundraiser overall for statewide initiatives. |

Peapack-Gladstone Bank Joins United Way Holiday Gift Drive During the 2012 holiday season, Peapack-Gladstone Bank teamed up with the United Way of Northern New Jersey to collect new toys, clothing and books at its Somerset County branches for distribution to local needy families. For those lacking financial resources, purchasing holiday gifts may not be easy. Items distributed by the United Way of Northern New Jersey are often the only presents low-income residents receive during this time of year. Volunteers are essential to the success of any program, so when the time came to sort through the hundreds of collected items, Peapack-Gladstone Bank employees stepped up. On December 11, the Peapack-Gladstone Bank Gifts of the Season Holiday Team assisted at the United Way’s consolidation warehouse sorting and tagging donations for distribution. We are dedicated to supporting the communities in which we do business and look forward to supporting those individuals and organizations that form the fabric of our communities in 2013.

|

Providing Support When It Was Needed Most

|

Peapack-Gladstone Bank and Its Clients Provide Aid to St. Hubert’s Animal Welfare Center In the fall of 2012, Peapack-Gladstone Bank’s Four Paws Pet Supply Drive to benefit St. Hubert’s Animal Welfare Center in North Branch and Madison ended just before Hurricane Sandy hit the east coast. The culmination of this initiative could not have been timelier and allowed the Bank to support St. Hubert’s efforts to provide assistance to hundreds of New Jersey’s displaced pets and pet owners most impacted by the storm. The Bank along with its clients donated countless items including 250 pounds of dry dog food, 150 pounds of dry cat foot, 23 cases of canned food as well as boxes of blankets, toys, cat litter and cleaning products. St. Hubert’s packed our donations and transported them to pet owners, animals in shelters and foster care facilities throughout our storm-damaged State. Peapack-Gladstone Bank is proud to partner with clients like St. Hubert’s Animal Welfare Center to ensure our communities survive and thrive.

|

Employees take Hurricane Sandy Personally Hurricane Sandy affected many of our clients and as a Bank, we felt it was our duty to get back in business quickly, helping our clients survive the crisis without having to worry about underwriting its costs. Our employees, who are deeply vested in their communities, also took it upon themselves to physically assist clients in need. Consider Tracey Goodroad, our longtime Pottersville Branch Manager, known in the community as a caring individual. When Tracey realized that one of her regular clients, an elderly woman, had not visited the branch since the storm, she worried for her safety. Tracey drove to her home and found the woman without heat or power. Determined to help, she tried to persuade her client to make alternate arrangements, and when that wasn’t possible, she began arranging for a generator to be delivered to the cold home. Fortunately, power was restored that same afternoon and the generator was not needed, but it is stories like this that illustrate our employee dedication and commitment to providing support – no matter what kind – when it is needed most. |

Condolidated Statements of Condition

| December 31, | ||||||||

| (In Thousands, Except Share Data) | 2012 | 2011 | ||||||

| ASSETS

Cash and Due from Banks | $ | 6,733 | $ | 7,097 | ||||

| Federal Funds Sold | 100 | 100 | ||||||

| Interest-Earning Deposits | 112,395 | 35,856 | ||||||

| Total Cash and Cash Equivalents | 119,228 | 43,053 | ||||||

| Investment Securities Held to Maturity (Fair Value of $99,427 in 2011) | — | 100,719 | ||||||

| Securities Available for Sale | 304,479 | 319,520 | ||||||

| FHLB and FRB Stock, at cost | 4,639 | 4,569 | ||||||

| Loans Held for Sale, at fair value | 6,461 | 2,841 | ||||||

| Loans Held for Sale, at lower of cost or fair value | 13,749 | — | ||||||

| Loans | 1,132,584 | 1,038,345 | ||||||

| Less: Allowance for Loan Losses | 12,735 | 13,223 | ||||||

| Net Loans | 1,119,849 | 1,025,122 | ||||||

| Premises and Equipment | 30,030 | 31,941 | ||||||

| Other Real Estate Owned | 3,496 | 7,137 | ||||||

| Accrued Interest Receivable | 3,864 | 4,078 | ||||||

| Bank Owned Life Insurance | 31,088 | 27,296 | ||||||

| Deferred Tax Assets, net | 9,478 | 26,731 | ||||||

| Other Assets | 21,475 | 7,328 | ||||||

| Total Assets | $ | 1,667,836 | $ | 1,600,335 | ||||

| LIABILITIES

Deposits: Noninterest-Bearing Demand Deposits | $ | 298,095 | $ | 297,459 | ||||

| Interest-Bearing Deposits: Checking | 346,877 | 341,180 | ||||||

| Savings | 109,686 | 92,322 | ||||||

| Money Market Accounts | 583,197 | 516,920 | ||||||

| Certificates of Deposit $100,000 and over | 68,741 | 71,783 | ||||||

| Certificates of Deposit less than $100,000 | 109,831 | 124,228 | ||||||

| Total Deposits | 1,516,427 | 1,443,892 | ||||||

| Federal Home Loan Bank Advances | 12,218 | 17,680 | ||||||

| Capital Lease Obligation | 8,971 | 9,178 | ||||||

| Accrued Expenses and Other Liabilities | 8,163 | 6,614 | ||||||

| Total Liabilities | 1,545,779 | 1,477,364 | ||||||

| SHAREHOLDERS’

EQUITY Preferred Stock (No Par Value; Authorized 500,000 Shares; No Shares Issued at December 31, 2012 and 14,341 Shares Issued at December 31, 2011; Liquidation Preference of $1,000 Per Share) | — | 13,979 | ||||||

| Common Stock (No Par Value; Stated Value $0.83 Per Share; Authorized 21,000,000 Shares; Issued Shares, 9,325,977 at December 31, 2012 and 9,240,889 at December 31, 2011; Outstanding Shares, 8,917,799 at December 31, 2012 and 8,832,711 at December 31, 2011) | 7,755 | 7,685 | ||||||

| Surplus | 97,675 | 96,323 | ||||||

| Treasury Stock at Cost (408,178 Shares at December 31, 2012 and 2011) | (8,988 | ) | (8,988 | ) | ||||

| Retained Earnings | 21,316 | 13,868 | ||||||

| Accumulated Other Comprehensive Income, Net | 4,299 | 104 | ||||||

| Total Shareholders’ Equity | 122,057 | 122,971 | ||||||

| Total Liabilities and Shareholders’ Equity | $ | 1,667,836 | $ | 1,600,335 | ||||

For complete financial information, please see the Company’s Annual Report on Form 10-K.

Condolidated Statements of Income

| Years Ended December 31, | ||||||||||||

| (In Thousands, Except Per Share Data) | 2012 | 2011 | 2010 | |||||||||

| INTEREST

INCOME Loans, including fees | $ | 48,010 | $ | 46,628 | $ | 50,455 | ||||||

| Loans Held for Sale | 123 | 56 | N/A | |||||||||

| Investment Securities Held to Maturity: Taxable | 1,648 | 2,066 | 2,037 | |||||||||

| Tax-Exempt | 187 | 354 | 467 | |||||||||

| Securities Available for Sale: Taxable | 5,385 | 6,285 | 7,278 | |||||||||

| Tax-Exempt | 639 | 518 | 535 | |||||||||

| Interest-Earning Deposits | 98 | 144 | 150 | |||||||||

| Total Interest Income | 56,090 | 56,051 | 60,922 | |||||||||

| INTEREST

EXPENSE Checking Accounts | 379 | 1,045 | 1,586 | |||||||||

| Savings and Money Market Accounts | 1,092 | 2,215 | 3,908 | |||||||||

| Certificates of Deposit over $100,000 | 900 | 1,060 | 1,620 | |||||||||

| Other Certificates of Deposit | 1,337 | 1,755 | 2,666 | |||||||||

| Overnight and Short-term Borrowings | 39 | 3 | — | |||||||||

| Federal Home Loan Bank Advances | 509 | 739 | 1,046 | |||||||||

| Capital Lease Obligation | 431 | 319 | 206 | |||||||||

| Total Interest Expense | 4,687 | 7,136 | 11,032 | |||||||||

| Net Interest Income Before Provision for Loan Losses | 51,403 | 48,915 | 49,890 | |||||||||

| Provision for Loan Losses | 8,275 | 7,250 | 10,000 | |||||||||

| Net Interest Income After Provision for Loan Losses | 43,128 | 41,665 | 39,890 | |||||||||

| OTHER

INCOME Trust Fees | 12,282 | 10,686 | 9,901 | |||||||||

| Service Charges and Fees | 2,756 | 2,908 | 2,798 | |||||||||

| Bank Owned Life Insurance | 1,064 | 1,427 | 863 | |||||||||

| Gain on Loans Sold | 1,195 | 502 | 1,041 | |||||||||

| Other Income | 196 | 156 | 329 | |||||||||

| Other-Than-Temporary Impairment Loss: Total Impairment Charges on Securities | — | — | (941 | ) | ||||||||

| Loss Recognized in Other Comprehensive Income | — | — | — | |||||||||

| Net Impairment Loss Recognized in Earnings | — | — | (941 | ) | ||||||||

| Securities Gains, Net | 3,810 | 1,037 | 124 | |||||||||

| Total Other Income | 21,303 | 16,716 | 14,115 | |||||||||

| OPERATING

EXPENSES Salaries and Employee Benefits | 27,595 | 23,230 | 22,529 | |||||||||

| Premises and Equipment | 9,467 | 9,371 | 9,624 | |||||||||

| Other Operating Expenses | 11,268 | 11,798 | 10,957 | |||||||||

| Total Operating Expenses | 48,330 | 44,399 | 43,110 | |||||||||

| Income Before Income Tax Expense | 16,101 | 13,982 | 10,895 | |||||||||

| Income Tax Expense | 6,405 | 1,814 | 3,231 | |||||||||

| Net Income | 9,696 | 12,168 | 7,664 | |||||||||

| Dividends on Preferred Stock and Accretion | 474 | 1,228 | 1,686 | |||||||||

| Net Income Available to Common Shareholders | $ | 9,222 | $ | 10,940 | $ | 5,978 | ||||||

| EARNINGS PER COMMON SHARE | ||||||||||||

| Basic | $ | 1.05 | $ | 1.25 | $ | 0.68 | ||||||

| Diluted | 1.05 | 1.25 | 0.68 | |||||||||

For complete financial information, please see the Company’s Annual Report on Form 10-K.

Products

|

Wealth

|

Cash Management Charitable Trusts and Private Foundations Custody Estate Administration Estate and Trust Administration Financial Planning Individual Retirement Planning

|

Investment Management Reporting Tax Preparation The Delaware Advantage through Trust Establishment Wealth Management

|

| *Securities and mutual funds are not FDIC insured, are not obligations of or guaranteed by Peapack-Gladstone Bank, and may involve investment risk, including possible loss of principal. Information provided for educational purposes only. This should not be relied upon as tax and/or investment advice. We encourage you to consult your personal legal, tax or financial advisors for information specific to your situation. | ||

|

Commercial

|

Commercial Lending Commercial Revolving Lines of Credit Commercial Mortgages Commercial Fixed-Rate Term Loans Commercial Letters of Credit Mixed-Use Building Lending Multi-Family Lending Small Business Administration and New Jersey Economic Development Authority Lending Small Business Fixed-Rate Term Loans Small Business Lines of Credit Small Business Vehicle Loans Access 24 Phone Banking ATM Banking Automated Clearing House (ACH) Business Debit Card Cash Management Services Certificates of Deposit Customer Payment Portal

|

Direct Deposit Electronic Deposit and Debit Origination Electronic Statements Free Small Business Checking Interest-Bearing Business Checking Escrow Management (IOLTA) Merchant Services Mobile Banking Money Market Accounts Online Account Opening Online Check Reorder Online Interbank Transfers PGB Mobile Deposit PGB NetAccess Internet Banking PGB Remote Deposit Small Business Online Bill Pay Statement Savings Accounts Wire Transfer Services

|

Member FDIC  |

Products

|

Retail

|

Access 24 Phone Banking ATM Banking Chairman’s Club Checking Certificates of Deposit Certificate of Deposit Account Registry Service ® (CDARS) Coin Machines Direct Deposit Electronic Statements Free Personal Checking Holiday Club Accounts Interest-Bearing Personal Checking IRA Certificates of Deposit IRA Savings Mobile Banking Money Market Accounts New Jersey Consumer Checking Night Deposit Online Account Opening Online Check Reorder Online Interbank Transfers PGB Mobile Deposit PGB NetAccess Internet Banking and Bill Pay Personal Debit Card Pony Club Savings Accounts Safe Deposit Boxes Sensible Savings Accounts Statement Savings Accounts Vacation Club Accounts

|

Consumer Lending Home Equity Fixed-Term Loans Home Equity Lines of Credit Overdraft Lines of Credit Secured Loans Unsecured Loans Vehicle Loans Mortgage Lending through PGB Mortgage Adjustable-Rate Mortgages Construction-Permanent Mortgages Fixed-Rate Mortgages Interest-Only Mortgages Jumbo Mortgages Low- and Moderate-Income Programs Brokerage Services through PGB Financial Services** Annuities Brokerage College Planning Investment Review Income Tax Reduction Strategies Long-Term Care Mutual Funds Retirement Accounts Retirement Planning Tax Advantage Accounts **Securities and insurance products offered through LPL

| ||

| Not FDIC Insured | No Bank Guarantee | |||

| May Lose Value | Not A Deposit | |||

| Not Insured by any Federal Government Agency | ||||

Member FDIC  |

OFFICERS

|

EXECUTIVE

Frank

A. Kissel kissel@pgbank.com

Douglas

L. Kennedy dkennedy@pgbank.com

Jeffrey

J. Carfora jcarfora@pgbank.com

Finn

M. W.

Caspersen, Jr. (908) 719-6559 caspersen@pgbank.com

Vincent

A. Spero vspero@pgbank.com

SENIOR

Martin

J. Brady mbrady@pgbank.com

Robert

A. Buckley buckley@pgbank.com

Karen

M. Chiarello (908) 470-3320 chiarello@pgbank.com Hubert P. Clarke Senior Vice President Chief

Information Officer clarke@pgbank.com

Gada

Elkenani gelkenani@pgbank.com

|

Michael

J. Giacobello (908) 719-4320 giacobello@pgbank.com

Marc

R. Magliaro mmagliaro@pgbank.com

Loretta

A. Moylan (908) 234-0700 lmoylan@pgbank.com

Richard

J. Ragoza rragoza@pgbank.com

Mary

M. Russell (908) 719-4309 russell@pgbank.com

Bridget J. Walsh Senior Vice President Human

Resources Director walsh@pgbank.com

Randall

J. Williams rwilliams@pgbank.com

OFFICERS Candida R. Almeida Vice President (908) 719-6557 calmeida@pgbank.com

Richard B. Barfuss Vice President (908) 470-3328 rbarfuss@pgbank.com

Joseph B. Barrett, Jr. Vice President (908) 234-0700 jbarrett@pgbank.com

John

W. Brun jbrun@pgbank.com

Todd T. Brungard Vice President, Bank Secrecy Act

Compliance Officer brungard@pgbank.com

|

Sheryl

L. Cappa cappa@pgbank.com

Michael J. Coakley Vice President (908) 306-8077 mcoakley@pgbank.com

Karen

A. Collier kcollier@pgbank.com

Lynda

A. Cross cross@pgbank.com

Michael D’Antuono Vice President Audit Officer (908) 234-0700 ext.6332 mdantuono@pgbank.com

Mary E. Donovan Vice President Executive Assistant

to the CEO mdonovan@pgbank.com

Karen

M. Ferraro ferraro@pgbank.com

Ronald

F. Field field@pgbank.com

Lauren T. Giacobbe Vice President (973) 543-9630 lgiacobbe@pgbank.com

Donna

I. Gisone gisone@pgbank.com

Amy

E. Glaser glaser@pgbank.com

Deborah M. Heins Vice President (908) 719-6546 dheins@pgbank.com

Ann

W. Kallam kallam@pgbank.com

Thomas N. Kasper Vice President (908) 306-8580 kasper@pgbank.com

|

Valerie

L. Kodan kodan@pgbank.com

Deborah J. Krehely Vice President (908) 439-3291 krehely@pgbank.com

Teresa

M. Lawler lawler@pgbank.com

Doreen A. Macchiarola Vice President Director

of Corporate (908) 719-3317 dmacchiarola@pgbank.com

Rohinton E. Madon Vice President (908) 781-1018 madon@pgbank.com

Nicholas

Maiorana nmaiorana@pgbank.com

Annette F. Malanga Vice President (908) 719-3309 malanga@pgbank.com

Jean

McDonnell jmcdonnell@pgbank.com

Rene

B. Merghart rmerghart@pgbank.com

Amy

A. Messler messler@pgbank.com

Elizabeth

Miller emiller@pgbank.com

Stephen

S. Miller smiller@pgbank.com

Elaine Muldowney Vice President (908) 719-4322 muldowney@pgbank.com

|

OFFICERS

|

Nancy A. Murphy Vice President (908) 306-8084 nmurphy@pgbank.com Janine Murtha Vice President (908) 306-4244 jmurtha@pgbank.com Valerie A. Olpp Vice President (973) 273-0077 olpp@pgbank.com Denise M. Pace-Sanders Vice President Brand and (908) 470-3322 dpace@pgbank.com Denise Parella-Wright Vice President (908) 306-4241 dparella@pgbank.com Christopher P. Pocquat Vice President (908) 470-3330 pocquat@pgbank.com Diane M. Ridolfi Vice President (908) 306-8062 ridolfi@pgbank.com Lorraine M. Romano Vice President (908) 470-6411 lromano@pgbank.com Scott T. Searle Vice President (908) 719-4319 searle@pgbank.com Geraldine Segars Vice President (908) 470-3332 gsegars@pgbank.com Susan K. Smith Vice President (908)719-6548 ssmith@pgbank.com James S. Stadtmueller Vice President (908) 719-4315 stadtmueller@pgbank.com Charles A. Studdiford, III Vice President (908) 766-8925 studdiford@pgbank.com Margaret O. Volk Vice President Mortgage Officer (908) 719-6541 volk@pgbank.com

|

Mary Beth Watkins Iodice Vice President (908) 303-7178 mwatkins@pgbank.com Jesse D. Williams Vice President (908) 719-4307 jwilliams@pgbank.com Joan S. Wychules Vice President (908) 879-8601 wychules@pgbank.com Todd E. Young Vice President (908) 658-4501 toddy@pgbank.com Marie S. Arney Assistant Vice President (908) 306-8090 marney@pgbank.com Janet E. Battaglia Assistant Vice President (908) 719-4332 battaglia@pgbank.com Alexandra A. Buono Assistant Vice President (908) 719-6555 abuono@pgbank.com Julie A. Burt Assistant Vice President (908) 719-4324 burt@pgbank.com Betty J. Cariello Assistant Vice President (908) 470-3329 bcariello@pgbank.com Marjorie A. Dzwonczyk Assistant Vice President CRA and Compliance Officer (908) 719-6558 dzwonczyk@pgbank.com Ann M. Ficken Assistant Vice President (908) 719-4323 aficken@pgbank.com Rachel B. Fyock Assistant Vice President (908) 470-3338 rfyock@pgbank.com Maria Goncalves Assistant Vice President (973) 467-8901 mgoncalves@pgbank.com Tracey L. Goodroad Assistant Vice President (908) 439-2265 tgoodroad@pgbank.com

|

Audrey E. Gunter Assistant Vice President (908) 719-6549 agunter@pgbank.com Mary Lashine Assistant Vice President (908) 534-6848 mlashine@pgbank.com James F. Meissner, Jr. Assistant Vice President (908) 719-4306 jmeissner@pgbank.com Eram F. Mirza Assistant Vice President (908) 719-4333 Michael Moreland Assistant Vice President (908) 306-4245 mmoreland@pgbank.com Vita M. Parisi Assistant Vice President (908) 306-8087 parisi@pgbank.com Michele Ravo Assistant Vice President (908) 719-4303 ravo@pgbank.com Ana P. Ribeiro Assistant Vice President (908) 719-6551 anar@pgbank.com Carol E. Ritzer Assistant Vice President (908) 234-0700 ext. 5292 ritzer@pgbank.com Victoria Scalera Assistant Vice President (908) 719-4318 scalera@pgbank.com Adam Skillin Assistant Vice President (908) 719-6553 askillin@pgbank.com Margaret A. Trimmer Assistant Vice President (908) 306-8066 trimmer@pgbank.com Eleanor B. Velasquez Assistant Vice President (908) 719-4327 evelasquez@pgbank.com Kim M. Waldron Assistant Vice President (908) 876-5728 kwaldron@pgbank.com Laura M. Watt Assistant Vice President (908) 234-0700 ext.5242 watt@pgbank.com

|

Jessica L. Ballentine Assistant Cashier (908) 234-0700 ext. 5277 ballentine@pgbank.com Krista L. Bullard Assistant Cashier (908) 234-0700 ext. 5293 bullard@pgbank.com James A. Ciccone Assistant Cashier (908) 234-0700 ext. 5601 ciccone@pgbank.com Maria C. Dentici Assistant Cashier (908) 234-0700 ext.5221 mdentici@pgbank.com Patricia Enzmann Assistant Cashier (908) 234-0700 ext. 5263 penzmann@pgbank.com Kerline B. Gourdet Assistant Cashier (908) 234-0700 ext. 5901 gourdet@pgbank.com Toni Jay-Choynake Assistant Cashier (908) 234-0700 ext. 5420 tjay-choynake@pgbank.com Truong Le Assistant Cashier (908) 719-4339 le@pgbank.com Thomas W.S. Logan, III Assistant Cashier (908) 234-0700 ext. 5701 logan@pgbank.com Robert Lynch Assistant Cashier (908) 719-4304 rlynch@pgbank.com Sabine Mehta Assistant Cashier (908) 234-0700 ext. 5235 smehta@pgbank.com Anna M. Mentes Assistant Cashier (908) 234-0700 ext. 5287 mentes@pgbank.com Scott Moore Assistant Cashier (908) 306-8092 smoore@pgbank.com Sharon Murphy Assistant Cashier (908) 306-8074 smurphy@pgbank.com

|

OFFICERS

|

Rosanne Schwab Assistant Cashier (908) 719-6543 rschwab@pgbank.com Christie Sedita Assistant Cashier (908) 635-8522 sedita@pgbank.com Marilyn A. Suitt Assistant Cashier (908) 306-8002 suitt@pgbank.com Louise C. Takacs Assistant Cashier (908) 234-0700 ext. 5401 takacs@pgbank.com Marjorie J. Takleszyn Assistant Cashier (908) 234-0700 ext. 5501 mtakleszyn@pgbank.com Lisa A. Treich Assistant Cashier (908) 234-0700 ext. 5431 treich@pgbank.com Erin E. Villagra Assistant Cashier (908) 234-0700 ext. 5404 evillagra@pgbank.com PGB TRUST & Craig C. Spengeman President & Chief (908) 719-3301 spengeman@pgbank.com John M. Bonk First Vice President Director of Wealth (908) 719-3318 bonk@pgbank.com John E. Creamer First Vice President (908) 470-6402 creamer@pgbank.com Stephen M. Kozuch First Vice President Co-Director of Wealth (908) 719-3314 skozuch@pgbank.com Daniel J. Leary, III First Vice President (908) 719-4331 dleary@pgbank.com

|

Kurt G. Talke First Vice President (908) 719-3304 talke@pgbank.com Catherine M. Denning Vice President Trust Officer (908) 470-6416 cdenning@pgbank.com Glenn C. Guerin Vice President (908) 719-3316 guerin@pgbank.com Michael E. Herrmann Vice President (908) 719-3303 herrmann@pgbank.com James R. Housman Vice President (908) 719-3313 jhousman@pgbank.com Sarah A. Krieger Vice President (908) 306-8811 skrieger@pgbank.com Carolyn Larke Vice President Trust Officer (973) 470-6404 cllarke@pgbank.com John J. Lee Vice President (908) 306-8817 johnl@pgbank.com Joseph Markovich Vice President (908) 306-8826 jmarkovich@pgbank.com Scott A. Marshman Vice President (908) 470-3323 marshman@pgbank.com Edward P. Nicolicchia Vice President (908) 719-3315 nicolicchia@pgbank.com David C. O’Meara Vice President Trade Systems Manager (908) 719-3310 o’meara@pgbank.com

|

Liza M. Rosenzweig Vice President (908) 719-3308 lrosenzweig@pgbank.com Patricia K. Sawka Vice President Trust Officer (908) 470-6403 sawka@pgbank.com Anne M. Smith Vice President (908) 470-6400 asmith@pgbank.com MJ Sully Vice President Trust Officer (908) 306-8819 mjsully@pgbank.com John W. Tarver Vice President (908) 306-4268 jtarver@pgbank.com Michael T. Tormey Vice President (908) 306-8816 tormey@pgbank.com Erik Vadeika Vice President (908) 306-8812 evadeika@pgbank.com Bruce B. Ficken Assistant Vice President (908) 470-6406 bficken@pgbank.com Anthony D. Pasculli Assistant Vice President Trust Officer (908) 306-8813 apasculli@pgbank.com Rosalie De Benedetto Assistant Tax Officer (908) 470-6410 rdebenedetto@pgbank.com Rita Cuyegkeng Assistant Trust Officer (908) 470-6405 rcuyegkeng@pgbank.com Daniel J. Prasnal Assistant Trust Officer (908) 306-8824 dprasnal@pgbank.com

|

Polly S. Sumerfield Assistant Trust (908) 719-3307 sumerfield@pgbank.com PGB TRUST & Lisa K. Berry Vice President Private Wealth Advisor (302) 255-1506 lberry@pgbank.com Raj Shah Assistant Trust Officer (302) 255-1507 rshah@pgbank.com

*Denotes a holding company

|

Board of Directors

|

Our thanks to our Board

of Directors for

their

Anthony

J. Consi, II

Finn

M. W.

Caspersen, Jr.

Edward A. Gramigna, Jr. Managing

Partner Rath LLC, Florham Park

Douglas L. Kennedy Chief Executive Officer

|

Frank A. Kissel Chairman of the Board

John

D. Kissel

James

R. Lamb, Esq.

Edward

A. Merton

F. Duffield Meyercord Managing Director and Partner, Carl Marks Consulting Group, LLC

|

John

R. Mulcahy

Craig C. Spengeman President PGB Trust & Investments

Philip

W. Smith,

III Far Hills, NJ

Beth

Welsh

NOT PICTURED Pamela

Hill

Jack

D. Stine

|

Shareholder Information

|

Corporate Address 500 Hills Drive Bedminster, NJ 07921 (908) 234–0700 www.pgbank.com

Stock Listing Peapack-Gladstone Financial Corporation common stock is traded on the NASDAQ Global Select Market under the symbol PGC.

Independent Registered Public Accounting Firm Crowe Horwath LLP 345 Eisenhower Parkway, Plaza 1 Livingston, New Jersey 07039-1027

Transfer Agent Registrar and Transfer Company 10 Commerce Drive Cranford, New Jersey 07016-3572 (800) 368-5948

Shareholder Relations Jeffrey J. Carfora, Executive Vice President and Chief Financial Officer (908) 719-4308 jcarfora@pgbank.com

Participation in our Dividend Reinvestment Plan (DRP) is a convenient and easy way to purchase shares of PGC at a discount to market and with no commissions. To sign up for our DRP, call the Investor Relations Department of Registrar and Transfer Company at 800-368-5948 or visit www.rtco.com and click on “Dividend Reinvestment Plans.”

Annual Meeting The Annual Meeting of Shareholders of Peapack-Gladstone Financial Corporationwill be held on April 23, 2013 at 2:00 p.m. on the first floor of its headquarters building, located at 500 Hills Drive, Bedminster, NJ.

|