UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITY EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 25, 2013

(Exact name of registrant as specified in its charter)

Kentucky (State of incorporation) | 001-33998 (Commission file number) | 61-0156015 (IRS Employer Identification No.) |

600 North Hurstbourne Parkway, Suite 400, Louisville, Kentucky 40222 (Address of principal executive offices) (Zip Code) | ||

(502) 636-4400 (Registrant's telephone number, including area code) | ||

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] | Written communications pursuant to Rule 425 under the Securities Act (18 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Company (“CHDN”) long-term incentive compensation plan (“Company LTIP”) was created in 2008 to provide certain executive officers with the opportunity to earn incentive compensation over a five-year performance period, from 2008 through 2012, for the Company achieving significant performance improvements. Under the Company LTIP, the Company's Board of Directors (the “Board”), through its Compensation Subcommittee, established certain performance targets tied to Company Earnings Before Interest, Taxes, Depreciation and Amortization (“Company EBITDA”). Over the five-year term of the Company LTIP, reported Company EBITDA grew at a 22.42% compounded annual rate from $55.1 million in 2007 to $151.5 million in 2012. December 31, 2012, marked the final year for the Company LTIP.

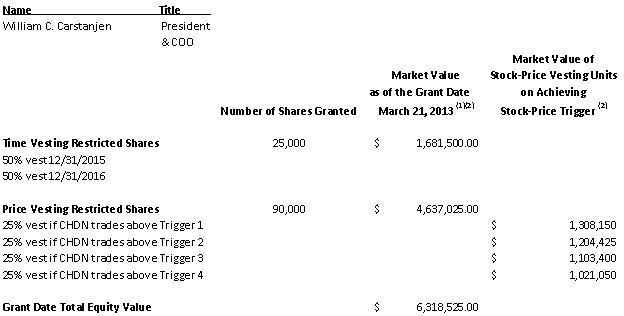

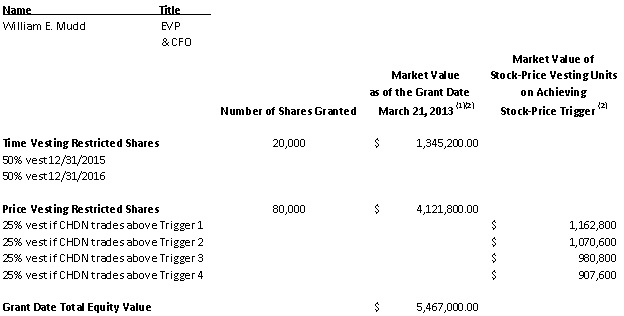

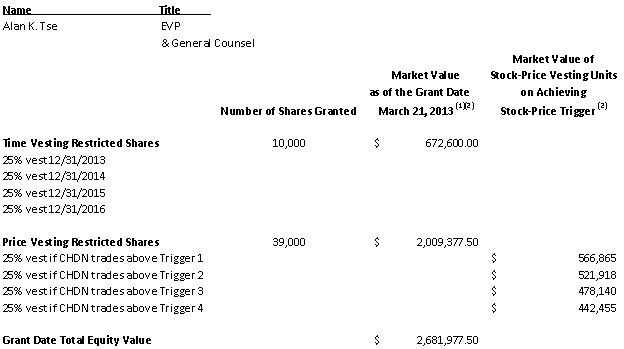

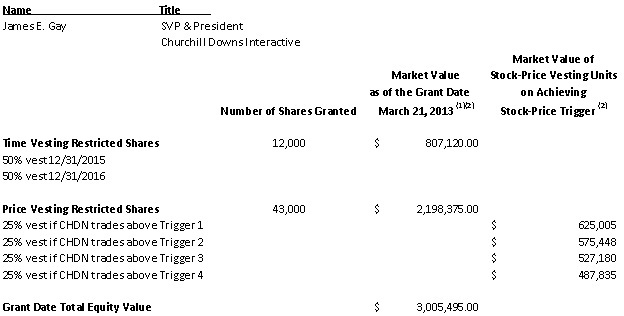

As of January 1, 2013, the Company, in lieu of initiating a new plan, opted to develop a new long-term incentive program utilizing the 2007 Omnibus Stock Incentive Plan. As a way to continue to encourage innovation, an entrepreneurial approach, and careful risk assessment, in addition to the retention of key executives, the Board's new incentive program offers long-term incentive compensation to the Company's named executive officers, as reported in the Company's Schedule 14A Proxy Statement filing, with the exception of Robert L. Evans (individuals referred to as “Grantee” and collectively referred to as the “Grantees”). Restricted stock awards were issued, to the Grantees, on March 21, 2013 under the new incentive program. The restricted stock awards are divided between time-vesting and stock price-vesting restricted stock. The compensation window, for the vesting of the time-vesting restricted shares is four (4) years ending December 31, 2016, and the stock-price vesting restricted shares, is five (5) years, beginning March 21, 2013 and continuing for five (5) years from such date (the “Compensation Cycle”). For each Grantee, with the exception of Alan K. Tse, vesting of the time-based restricted shares is back-loaded to the third and fourth years (2015 and 2016, respectively). In the case of Mr. Tse, his time-based restricted shares vest in increments of twenty-five percent (25%) in 2013, 2014, 2015, and 2016. The vesting schedules for the stock-price based restricted share awards are tied to stock-price triggers. The stock-price triggers, for the Grantees, are comprised of four (4) triggers tied to the daily closing NASDAQ stock market price for CHDN (collectively referred to as the “Stock Price Triggers”). Stock Price Trigger 1 is at least 10% above the trailing 20-day average NASDAQ market closing price on the date of grant and each successive Stock Price Trigger, 2, 3 and 4, is at least 10% above the preceding Stock Price Trigger. In order for a Stock Price Trigger to be reached the Company must successfully achieve a specific daily share closing price value, and maintain said closing price value for no less than twenty (20) consecutive trading days. As an additional key executive retention device, any Stock-Price Triggers achieved in 2013 will not result in a stock-price restricted stock award vesting. Instead any Stock Price Triggers achieved, in 2013, will result in a stock-price restricted stock award vesting on the first anniversary of the grant date. If the Company does not achieve a Stock Price Trigger(s), during the Compensation Cycle, Grantees under this program will forfeit any incentive compensation opportunity tied to the respective Stock Price Trigger(s). Each grant of restricted stock varies by Grantee; however, the total award amount, for each Grantee, is approximately seventy-five percent (75%) stock price-vesting, and twenty-five percent (25%) time-vesting restricted stock. Furthermore, the stock-price based restricted shares vest in equal multiples of twenty-five percent (25%) upon the achievement of each Stock Price Trigger. Time-vesting restricted shares are valued in the tables at the closing NASDAQ market price on March 20, 2013. Since these time-vesting shares vest over the next four (4) years, the actual value received by the Grantee may be higher or lower than the amount shown in the tables below depending on whether the NASDAQ stock market price of CHDN stock is higher or lower at the time the Grantee receives the shares.

The market value of the stock price-vesting restricted shares shown in the tables below is determined utilizing the assumptions underlying the Black-Scholes methodology to produce a Monte-Carlo simulation with a five-year volatility assumption, which allows for stock price-vesting targets to be met. Furthermore, the market values of the stock price-vesting restricted shares, shown in the tables below, are estimations. The actual value realized by the Grantee is determined by whether or not the future NASDAQ closing prices of CHDN stock trades at or above the various Stock Price Triggers. If CHDN's stock price does not increase, these stock price-vesting restricted shares will be forfeited.

The tables below illustrate the grant date market value of the overall awards, division between stock-price and time-vesting restricted stock, vesting schedules, and the total at-risk/contingent compensation for each Grantee:

In each case above, the fair market value, as of the date of vesting, may vary materially from the grant date fair market value of both the time and stock price-vesting restricted share awards.

(1) | The market value of the Time-Vesting Restricted Shares, in the above tables, was calculated utilizing the closing price of CHDN as of March 20, 2013 ($67.26) multiplied by the total number of time-vesting restricted shares awarded. |

(2) | The market values for the Price Vesting Restricted Shares, in the above tables, were calculated utilizing the following values for Trigger 1 ($58.14), Trigger 2 ($53.53), Trigger 3 ($49.04), and Trigger 4 ($45.38) as determined from the formulas and simulations described above. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto, duly authorized.

CHURCHILL DOWNS INCORPORATED | ||

March 25, 2013 | /s/ Alan K. Tse | |

By: Alan K. Tse | ||

Title: Executive Vice President, General | ||

Counsel and Secretary | ||