Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TIDEWATER INC | d506834d8k.htm |

March

19, 2013 HOWARD WEIL 41

ST

ANNUAL

ENERGY CONFERENCE

Joseph M. Bennett

Executive Vice President and

Chief Investor Relations Officer

Jeffrey M. Platt

President and CEO

Exhibit 99.1 |

2

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

2

Phone:

504.568.1010

•

Fax:

504.566.4580

In accordance with the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, the Company notes that certain statements set forth in this

presentation provide other than historical information and are forward looking. The

actual achievement of any forecasted results, or the unfolding of future economic or

business developments in a way anticipated or projected by the Company, involve

numerous risks and uncertainties that may cause the Company’s actual performance

to be materially different from that stated or implied in the forward-looking

statement. Among those risks and uncertainties, many of which are beyond the control of

the Company, include, without limitation, volatility in worldwide energy demand and oil

and gas prices; fleet additions by competitors and industry overcapacity; changes in

capital spending in the energy industry for offshore exploration, field development

and production; changing customer demands for vessel specifications, which may make

some of our older vessels technologically obsolete for certain customer projects or in

certain markets; uncertainty of global financial market conditions and difficulty in

accessing credit or capital; acts of terrorism and piracy; significant weather

conditions; unsettled political conditions, war, civil unrest and governmental actions,

such as expropriation or enforcement of customs or other laws that are not well-

developed or consistently enforced, especially in higher political risk countries where

we operate; foreign currency fluctuations; labor changes proposed by international

conventions; increased regulatory burdens and oversight; and enforcement of laws

related to the environment, labor and foreign corrupt practices. Readers should

consider all of these risk factors as well as other information contained in this report.

Web:www.tdw.com

•

Email:connect@tdw.com |

3

KEY TAKEAWAYS

KEY TAKEAWAYS

•

Focus on safety, compliance & operating excellence

•

“The Tide is Turning”–

continued improvement

in

working rig count is positively impacting deepwater and

jackup support vessels globally

•

History of earnings growth and solid returns

•

Unmatched scale and scope of operations

•

World’s largest and newest fleet provides basis for

continued earnings growth

•

Strong balance sheet allows us to continue to act upon

available opportunities |

4

SAFETY RECORD RIVALS

SAFETY RECORD RIVALS

LEADING COMPANIES

LEADING COMPANIES |

5

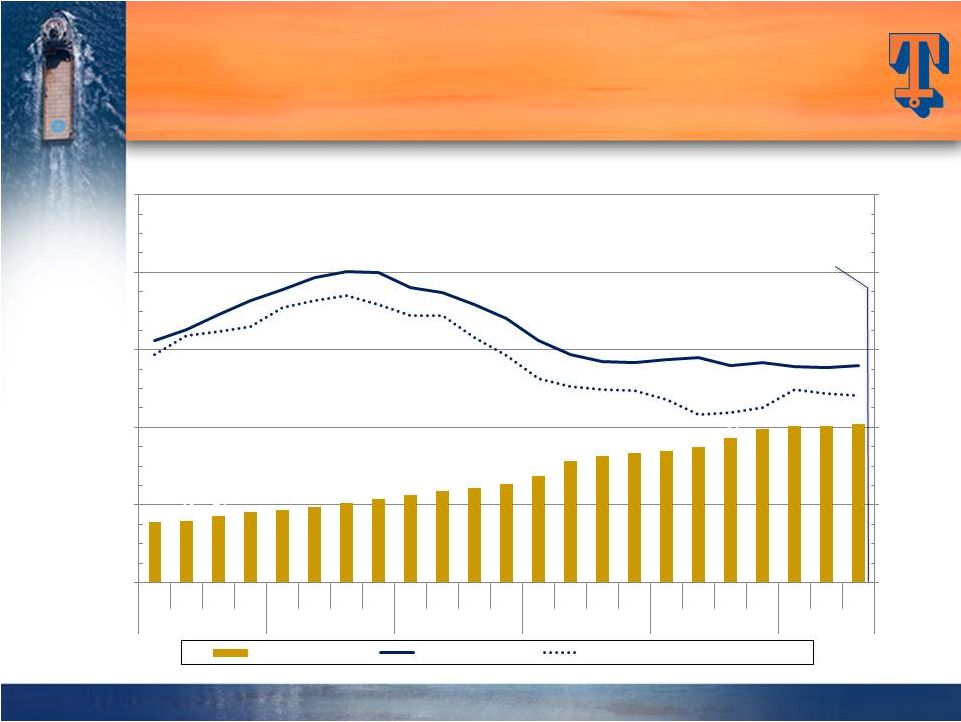

WORKING OFFSHORE RIG TRENDS

WORKING OFFSHORE RIG TRENDS

Floaters

Jackups

Prior peak (summer 2008)

Source: ODS-Petrodata

Note: 48 “Other”

rigs, along with the Jackups and Floaters, provide a total working rig count of 677

in early March 2013. 380

249 |

6

Source: ODS-Petrodata and Tidewater

July 2008

(Peak)

Jan. 2011

(Trough)

March

2013

Working Rigs

603

538

677

Rigs Under

Construction

186

118

192

OSV Global

Population

2,033

2,599

2,886

OSV’s Under

Construction

736

367

423

OSV/Rig Ratio

3.37

4.83

4.26

DRIVERS OF OUR BUSINESS

“Peak to Present” |

7

Source: ODS-Petrodata and Tidewater

As of March 2013, there are approximately 423 additional AHTS and

PSV’s (~15% of the global fleet) under construction.

Global fleet is estimated at 2,886 vessels, including ~750

vessels that are 25+ yrs old (26%). Vessels > 25 years old

today THE WORLDWIDE OSV FLEET –

THE WORLDWIDE OSV FLEET –

RETIREMENTS

RETIREMENTS

EXPECTED TO EXCEED NEW DELIVERIES

EXPECTED TO EXCEED NEW DELIVERIES

(Includes AHTS and PSV’s only) Estimated as of early March 2013

|

8

TIDEWATER’S ACTIVE FLEET

TIDEWATER’S ACTIVE FLEET

as of December 31, 2012

as of December 31, 2012

Year Built

Deepwater vessels

Towing Supply/Supply

Other vessels

226 “New”

vessels –

5.4 avg yrs

38 “Traditional”

vessels –

27.3 avg yrs |

9

VESSEL POPULATION BY OWNER

(AHTS and

PSV’s

only)

–

Estimated

as

of

early

March

2013

Source: ODS-Petrodata and Tidewater

Tidewater

Competitor #2

Competitor #3

Competitor #4

Competitor # 5

Competitor #1

Avg.

All Others (2,159 total

vessels for

370+ owners) |

10

**

EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge.

EPS in Fiscal 2006 is exclusive of the $.74 per share after tax gain from the

sale of six KMAR vessels. EPS in Fiscal 2007 is exclusive of $.37 per share of after

tax gains from the sale of 14 offshore tugs. EPS in Fiscal 2010 is

exclusive of $.66 per share Venezuelan provision, a $.70 per share tax benefit

related to favorable resolution of tax litigation and a $0.22 per share charge for

the proposed settlement with the SEC of the company’s FCPA matter. EPS in Fiscal

2011 is exclusive of total $0.21 per share charges for settlements with DOJ

and Government of Nigeria for FCPA matters, a $0.08 per share charge related to participation in a multi-company U.K.-based pension plan and a $0.06

per share impairment charge related to certain vessels. EPS in Fiscal 2012 is

exclusive of $0.43 per share goodwill impairment charge. Adjusted Return

On Avg. Equity

4.3% 7.2% 12.4%

18.9% 18.3%

19.5%

11.4% 5.0% 4.3%

Adjusted EPS**

Adjusted EPS**

HISTORY OF EARNINGS GROWTH

HISTORY OF EARNINGS GROWTH

AND SOLID THROUGH-CYCLE RETURNS

AND SOLID THROUGH-CYCLE RETURNS |

11

GLOBAL STRENGTH

GLOBAL STRENGTH

Unique global footprint; 50+ years of Int’l experience

Unmatched scale and scope of operations

Strength of International business complements U.S.

activity

Secular growth

Longer contracts

Better utilization

Higher day rates

Solid customer base of NOC’s and IOC’s |

12

OUR GLOBAL FOOTPRINT

OUR GLOBAL FOOTPRINT

Vessel Distribution by Region

Vessel Distribution by Region

(excludes stacked vessels –

(excludes stacked vessels –

as of 12/31/12)

as of 12/31/12)

In 3Q FY 2013, ~9% of vessel revenue was generated in the U.S. by < 15 vessels;

however, ~20 other U.S.-flagged vessels are currently operating in

International regions that could be re-deployed to the U.S. GOM.

Americas

63(24%)

SS Africa/Europe

134(51%)

Asia/Pac

29(11%)

MENA

38(14%) |

13

Vessel Count (2)

Total Cost (2)

Deepwater PSVs

82

$2,030m

Deepwater AHTSs

11

$358m

Towing Supply/Supply

106

$1,565m

Other

57

$289m

TOTALS:

256

$4,242m

(1)

.

At 12/31/12, 227 new vessels were in our fleet with ~5.5 year average age

Vessel Commitments

Jan. ’00 –

December ’12

(1)

$3,706m (87%) funded through 12/31/12

THE LARGEST MODERN OSV FLEET

THE LARGEST MODERN OSV FLEET

IN THE INDUSTRY….

IN THE INDUSTRY….

(2)

Vessel count and total cost is net of 23 vessel dispositions ($217m of original

cost, sold for a total of $252m) |

14

Count

Deepwater PSVs

18

Deepwater AHTSs

-

Towing Supply/Supply

4

Other

7

Total

29

Vessels Under Construction*

As

of

December

31,

2012

* Includes

4

new

vessel

purchase

commitments

at

12/31/12

…. AND MORE TO COME

Estimated delivery schedule – 6 remaining in FY ‘13, 11 in FY ‘14 and 12

thereafter.

CAPX of $110m remaining in FY ‘13, $258m in FY ‘14 and $167m in FY ’15. |

15

Over a 13-year period, Tidewater has invested $4.1 billion in CapEx($3.6 billion

in the “new” fleet),

and paid out ~$1 billion through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.6 billion and $732

million, respectively $ in millions

Fiscal Year

FLEET RENEWAL & EXPANSION

FLEET RENEWAL & EXPANSION

FUNDED BY CFFO THROUGH FISCAL 2012

FUNDED BY CFFO THROUGH FISCAL 2012

CFFO |

16

As of December 31, 2012

Cash & Cash Equivalents

$54 million

Total Debt

$930 million

Shareholders Equity

$2,526 million

Net Debt / Net Capitalization

27%

Total Debt / Capitalization

26%

~$500 million of available liquidity as of 12/31/12, including $450 million of unused

capacity under committed bank credit facilities.

STRONG FINANCIAL POSITION PROVIDES

STRONG FINANCIAL POSITION PROVIDES

STRATEGIC OPTIONALITY

STRATEGIC OPTIONALITY |

17

Total Revenue and Margin

Total Revenue and Margin

Fiscal

Fiscal

2008

2008

–

–

2013

2013

3

$300 million

$150 million

50.0%

Prior peak period (FY2009)

averaged quarterly revenue of

$339M,

Prior peak period (FY2009)

averaged quarterly revenue of

$339M, quarter operating

margin of $174M at 51.3%

52.7%

46.2%

55.9%

46.0%

36.3%

39.3%

35.1%

43.4%

40.7%

$-

$100

$200

$300

$400

$500

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

FY08

FY09

FY10

FY11

FY12

FY13

Vessel Revenue ($)

Vessel Operating Margin ($)

Vessel Operating Margin (%)

Note: Vessel operating margin is defined as vessel revenue less vessel operating expenses |

18

New Vessel Trends by Vessel Type

New Vessel Trends by Vessel Type

Deepwater PSVs

Deepwater PSVs

$122 million, or 40%, of Vessel Revenue in Q3 Fiscal 2013

Q3 Fiscal 2013

Avg Day Rate: $27,223

Utilization: 78.3%

22

23

24

25

25

25

25

28

29

32

34

38

40

43

44

45

47

49

51

54

55

57

62

-

40

80

120

160

200

240

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

FY08

FY09

FY10

FY11

FY12

FY13

Average Day Rate, Adjusted Average Day Rate, and Average Fleet Size

Average Fleet Size

Average Day Rate

Utilization-Adjusted Average Day Rate |

19

New Vessel Trends by Vessel Type

New Vessel Trends by Vessel Type

Deepwater AHTS

Deepwater AHTS

$25 million, or 8%, of Vessel Revenue in Q3 Fiscal 2013

Q3 Fiscal 2013

Avg Day Rate: $30,366

Utilization: 81.8%

5

5

5

5

5

5

5

5

6

8

9

9

11

11

11

11

11

11

11

11

11

11

11

-

40

80

120

160

200

240

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

FY08

FY09

FY10

FY11

FY12

FY13

Average Day Rate, Adjusted Average Day Rate, and Average Fleet Size

Average Fleet Size

Average Day Rate

Utilization-Adjusted Average Day Rate |

20

New Vessel Trends by Vessel Type

New Vessel Trends by Vessel Type

Towing Supply/Supply Vessels

Towing Supply/Supply Vessels

$113 million, or 37%, of Vessel Revenue in Q3 Fiscal 2013

Q3 Fiscal 2013

Avg Day Rate: $13,969

Utilization: 86.3%

39

40

43

46

47

49

51

54

57

59

61

63

68

78

81

83

85

88

93

99

101

101

102

-

50

100

150

200

250

$0

$5,000

$10,000

$15,000

$20,000

$25,000

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

FY08

FY09

FY10

FY11

FY12

FY13

Average Day Rate, Adjusted Average Day Rate, and Average Fleet Size

Average Fleet Size

Average Day Rate

Utilization-Adjusted Average Day Rate |

21

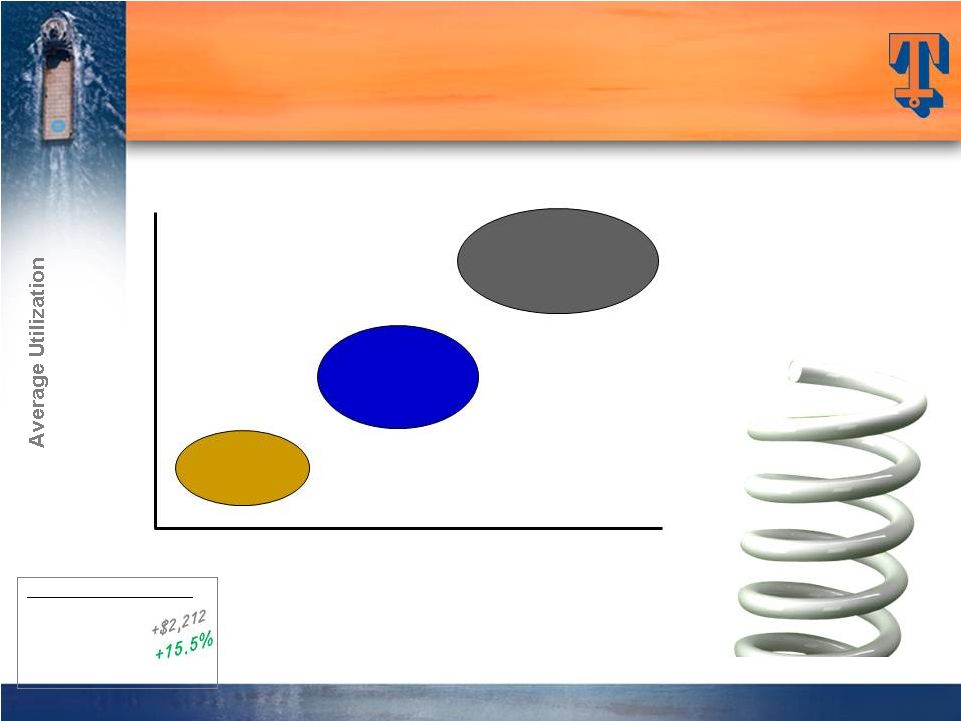

POTENTIAL FOR FUTURE

POTENTIAL FOR FUTURE

EARNINGS ACCELERATION

EARNINGS ACCELERATION

Average Day rates

$16,503*

$18,153

(+ 10%)

$19,969

(+ 10%)

82.1%*

85.0%

90.0%

~$4.15

EPS

~$6.15

EPS

~$10.50

EPS

276 vessel assumption (227 current new vessels + 29 under construction + 20

additional new vessels next year). * 12/31/12

quarterly actual stats This info is not meant to be a

prediction of future earnings

performance, but simply an

indication of earning sensitivities

resulting from future fleet

additions and reductions and

varying operating assumptions

~$445M+

EBITDA

+$560M

EBITDA

+$820M

EBITDA

Actual Avg Qtrly Day rates

6/30/11 $14,291

12/31/12 $16,503 |

March 19, 2013

HOWARD WEIL 41

ST

ANNUAL

ENERGY CONFERENCE

Joseph M. Bennett

Executive Vice President and

Chief Investor Relations Officer

Jeffrey M. Platt

President and CEO |

23

APPENDIX

APPENDIX |

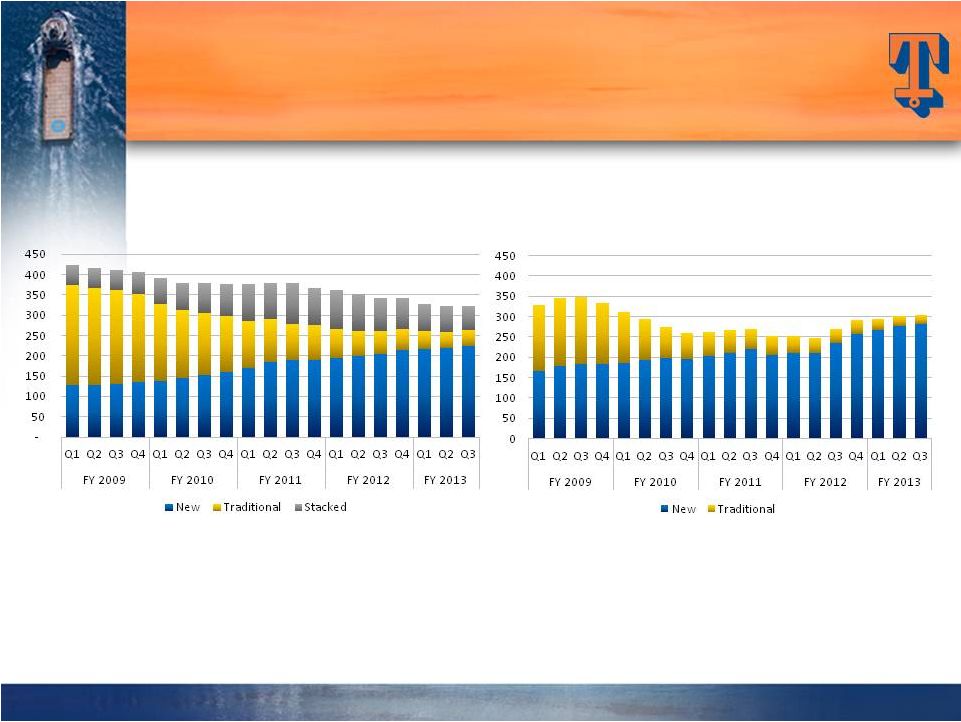

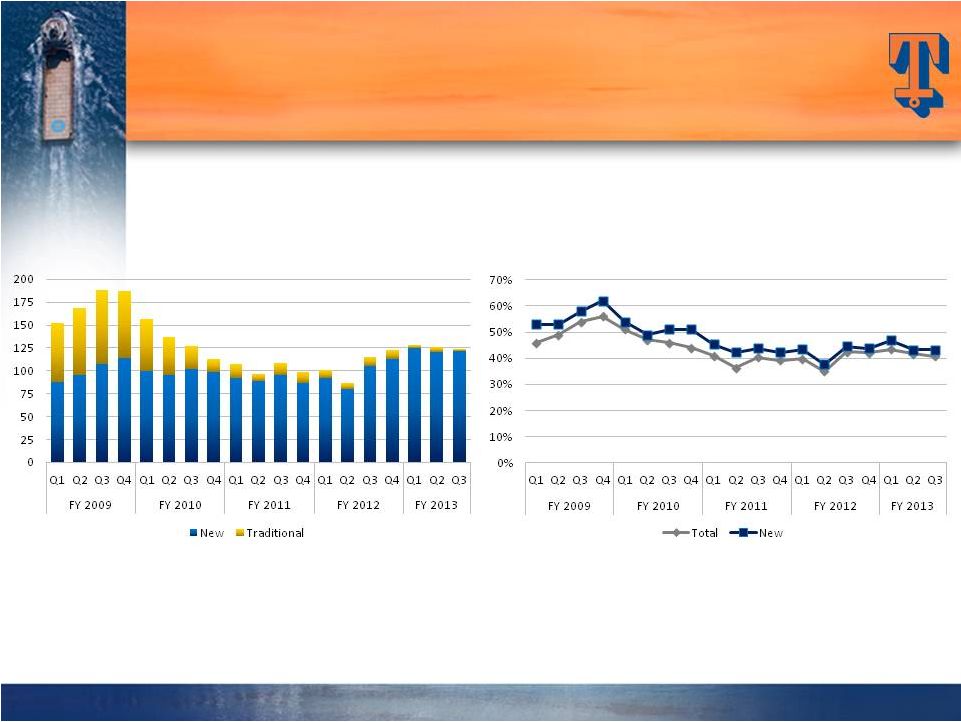

24

Vessel Revenue ($)

Average Fleet Count

NEW FLEET DRIVING RESULTS

NEW FLEET DRIVING RESULTS

224 Average New Vessels in Q3 2013

$305 million Vessel Revenue in Q3 2013

(92% from New Vessels) |

25

Vessel Cash Operating Margin ($)

Vessel Cash Operating Margin (%)

CYCLICAL UPTURN

CYCLICAL UPTURN

SHOULD DRIVE MARGIN EXPANSION

SHOULD DRIVE MARGIN EXPANSION

$124 million Vessel Margin in Q3

FY2013 (98% from New Vessels)

Q3 FY2013 Vessel Margin: 41% |

26

VESSEL UTILIZATION BY SEGMENT

VESSEL UTILIZATION BY SEGMENT |

27

VESSEL DAYRATES BY SEGMENT

VESSEL DAYRATES BY SEGMENT

Impact of $7.4 million of retroactive revenue recorded in September 2012 quarter is excluded

from 9/12 average dayrates and included in the respective March 2012 and June 2012

quarterly average dayrates. |

28

CURRENT REVENUE MIX

CURRENT REVENUE MIX

Quality of Customer Base

Quality of Customer Base

Our top 10 customers in Fiscal 2012 (4 Super Majors,

3 NOC’s and 3 IOC’s) accounted for 59% of our revenue

Super Majors

35%

NOC's

23%

Others

42% |

29

FINANCIAL STRATEGY FOCUSED

FINANCIAL STRATEGY FOCUSED

ON CREATING LONG-TERM

ON CREATING LONG-TERM

SHAREHOLDER VALUE

SHAREHOLDER VALUE

Maintain

Maintain

Financial Strength

Financial Strength

EVA-Based Investments

EVA-Based Investments

On Through-cycle Basis

On Through-cycle Basis

Deliver Results

Deliver Results |