Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - SUPERMEDIA INC. | a13-7969_18k.htm |

| EX-99.1 - EX-99.1 - SUPERMEDIA INC. | a13-7969_1ex99d1.htm |

Exhibit 99.2

|

|

Q4 2012 Earnings Presentation March 21, 2013 Peter McDonald, CEO Dee Jones, CFO |

|

|

Safe Harbor Statement Some statements included in this release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the federal securities laws. Statements that include the words “may,” “will,” “could,” “should,” “would,” “believe,” “anticipate,” “forecast,” “estimate,” “expect,” “preliminary,” “intend,” “plan,” “project,” “outlook” and similar statements of a future or forward-looking nature identify forward-looking statements. You should not place undue reliance on these statements. These forward-looking statements include statements that reflect the current views of our senior management with respect to our financial performance and future events with respect to our business and industry in general. Forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the risks related to the following: the potential adverse impacts of failure to complete, or delay in completing, the proposed merger with Dex One Corporation (“Dex One”) as a result of obtaining consents from the stockholders and secured creditors of Dex One or the Company; the business uncertainties and contractual restrictions arising from the timing and closing of the proposed merger with Dex One, including the possible inability to consummate the proposed merger on the terms originally contemplated; the risk that anticipated cost savings, growth opportunities and other financial and operating benefits as a result of the proposed merger may not be realized or may take longer to realize than expected; the risk that benefits from the transaction may be significantly offset by costs incurred in integrating Dex One and the Company; difficulties in connection with the process of integrating Dex One and the Company if the transaction with Dex One is consummated, including: coordinating geographically separate organizations; integrating business cultures, which could prove to be incompatible; difficulties and costs of integrating information technology systems; and the potential difficulty in retaining key officers and personnel; the risks related to the impact either Dex One’s or the Company’s voluntary case under Chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) to consummate the proposed merger (together, “Chapter 11 cases”) could have on the Company’s business operations, financial condition, liquidity or cash flow; the risks related to other parties objecting to the Chapter 11 cases and the resulting cost and expenses of delays in either Chapter 11 case; and risks that the combined company will incur significant, non-recurring costs in connection with the administration of the Chapter 11 cases. our inability to provide assurance for the long-term continued viability of our business; reduced advertising spending and increased contract cancellations by our clients, which causes reduced revenue; declining use of print yellow pages directories by consumers; competition from other yellow pages directory publishers and other traditional and new media; our ability to anticipate or respond to changes in technology and user preferences; changes in our operating performance; limitations on our operating and strategic flexibility and the ability to operate our business, finance our capital needs or expand business strategies under the terms of our credit agreement; failure to comply with the financial covenants and other restrictive covenants in our credit agreement; limited access to capital markets and increased borrowing costs resulting from our leveraged capital structure and debt ratings; changes in the availability and cost of paper and other raw materials used to print our directories; our reliance on third-party providers for printing, publishing and distribution services; credit risk associated with our reliance on small- and medium-sized businesses as clients; our ability to attract and retain qualified key personnel; our ability to maintain good relations with our unionized employees; changes in labor, business, political and economic conditions; changes in governmental regulations and policies and actions of federal, state and local municipalities; the outcome of pending or future litigation and other claims; The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in the reports we file with the Securities and Exchange Commission (the “SEC”), including the information in “Item 1A. Risk Factors” in Part I of our Annual Report on Form 10K for the year ended December 31, 2012 and in all subsequent filings with the SEC. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. All forward-looking statements included in this release are expressly qualified in their entirety by these cautionary statements. The forward-looking statements speak only as of the date made and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. |

|

|

Peter McDonald, CEO |

|

|

Dee Jones, CFO |

|

|

Financial Overview - Revenue Comparison Q4 revenue declined 18.8 percent Full year 2012 revenue declined 17.5 percent 2011 Q4 2012 2012 Q4 2011 QTD Revenues Full Year Revenues |

|

|

Financial Overview – Net Advertising Sales¹ Net ad sales exclusive of the CMR impact² -19.1% -19.9% -19.7 % -15.9% -19.5% (2) Advertising sales for the year ended December 31, 2011 include negative adjustments of $11 million, related to the financial distress and operational wind down of a single certified marketing representative in our third-party national sales channel. Excluding this impact, advertising sales for the year ended December 31, 2012 would have reflected a decline of 19.5%. As of June 2011, these accounts were transitioned to other certified marketing representative firms. (1) Net advertising sales is an operating measure used by the Company to compare advertising sales for current advertising periods to corresponding sales for previous periods. It is important to distinguish net advertising sales from operating revenue, which on our financial statements is recognized under the deferral and amortization method -19.1% -15.9% |

|

|

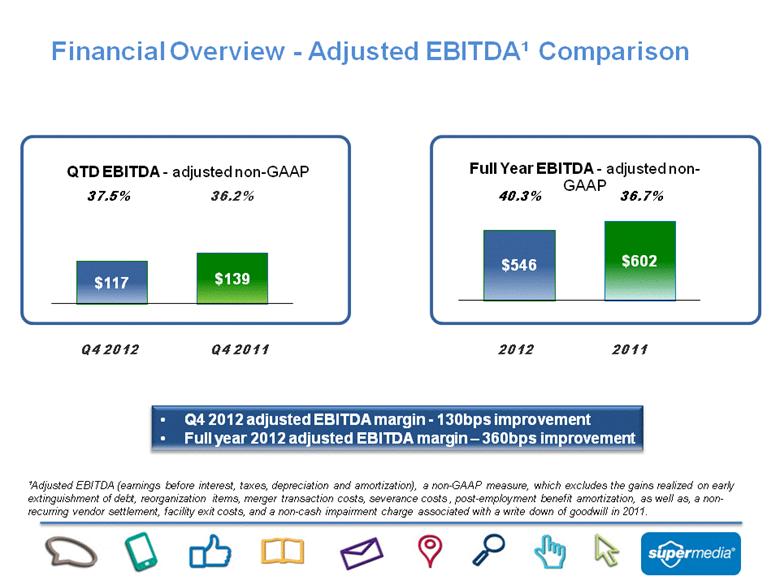

Financial Overview - Adjusted EBITDA¹ Comparison QTD EBITDA 37.5%-adjusted non-GAAP Full Year EBITDA-adjusted non-GAAP 40.3% 2011 Q4 2012 2012 Q4 2011 Q4 2012 adjusted EBITDA margin - 130bps improvement Full year 2012 adjusted EBITDA margin – 360bps improvement ¹Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization), a non-GAAP measure, which excludes the gains realized on early extinguishment of debt, reorganization items, merger transaction costs, severance costs , post-employment benefit amortization, as well as, a non-recurring vendor settlement, facility exit costs, and a non-cash impairment charge associated with a write down of goodwill in 2011. 36.2% 40.3% 36.7% |

|

|

Financial Overview – Full Year Adjusted Expenses¹ Selling – continued improvement in sales force efficiencies and reduced advertising programs Cost of Sales – primarily lower print volumes and distribution costs; efficiencies in partnership agreements G&A – lower bad debt expense; lower contract services costs ¹ Adjusted expenses exclude severance costs, merger transaction costs, post-employment benefits amortization, a non recurring vendor settlement, facility exit costs, non-cash impairment charges and depreciation and amortization. 20.7% 20.3% 29.9% 22.3% Expense Reductions |

|

|

Financial Overview – Debt Deleverage Total debt principal reduced by $303M Total cash impact $252M includes transaction fees of $1M Principal reductions 2010/2011/2012 - Total retired debt $1.3B |

|

|

Financial Overview – 2012 Cash Flow Continued strong cash flow and resulting debt reductions Ending cash $105M |

|

|

Q&A |