Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACCURIDE CORP | a13-8005_18k.htm |

Exhibit 99.1

|

|

Investor Presentation March 2013 |

|

|

Forward Looking Statements Statements contained in this news release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding Accuride’s expectations, hopes, beliefs and intentions with respect to future results. Such statements are subject to the impact on Accuride’s business and prospects generally of, among other factors, market demand in the commercial vehicle industry, general economic, business and financing conditions, labor relations, governmental action, competitor pricing activity, expense volatility and other risks detailed from time to time in Accuride’s Securities and Exchange Commission filings, including those described in Item 1A of Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012. Any forward-looking statement reflects only Accuride’s belief at the time the statement is made. Although Accuride believes that the expectations reflected in these forward-looking statements are reasonable, it cannot guarantee its future results, levels of activity, performance or achievements. Except as required by law, Accuride undertakes no obligation to update any forward-looking statements to reflect events or developments after the date of this news release. AccurideCorp.com |

|

|

Industry Conditions AccurideCorp.com |

|

|

AccurideCorp.com Industry Fundamentals ISM has been hovering at or above 50 for several months Expect moderate economic growth in the near-term The age of the U.S. fleet is 6.7 years The median age of the U.S. fleet over the past 25 years is 5.8 years Maintenance costs typically rise sharply at the 5 years/500K miles Freight volumes have expanded for four months running Freight volumes are expected to continue to accelerate in 2013 ISM Manufacturing Index Fleet Age (Class 8) Freight Loadings Underpinnings for commercial vehicle recovery remain intact Source: ACT Research & FTR Associates 4 |

|

|

2012 & 2013 Class 8 Build Projections Sources: ACT, FTR 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 2012 FTR 73,306 77,720 63,895 58,267 52,900 60,700 62,200 64,500 2012 ACT 77,701 78,268 64,901 57,850 57,305 65,806 68,506 71,506 2012 Full Year FTR 273,036 ACT 278,720 2013 Full Year FTR 240,300 ACT 263,123 AccurideCorp.com Indications are that 1Q13 is the trough as demand builds throughout the year |

|

|

AccurideCorp.com Industry Build Forecasts Class 8 Builds Medium Duty Builds Trailer Builds Source: ACT Research & FTR Associates Fleets remain cautious in light of uncertain timing for economic recovery Year-over-year declines in Class 8 productions are expected in 2013 Strong Medium-Duty orders in 4Q13 Recent strength in housing should help the Medium-Duty segment continue its modest growth trend Trailer orders rebounded during 4Q12 from a soft 3Q12 Demand for trailers is expected to remain healthy ACT FTR |

|

|

“Fix & Grow” AccurideCorp.com |

|

|

Our capital intensive restructuring of operations are substantially complete CAPEX requirements will be between 3.5 – 4.0% of revenue beginning in 2013 AccurideCorp.com Critical “Fix & Grow” Activity Status Q1 ‘12 Q3 Q3 Q4 Q1 ‘13 Imperial Consolidation Brillion Improvements Aluminum Expansion Gunite Machining Complete April 15th Complete Complete April 1st Significant Progress – More Opportunity Consolidate Gunite Plants Completed Ahead of Schedule ERP Migration Q4 ‘13 ----> Launching New Hub Line |

|

|

Facility Report Card (Delivery, Quality, Profitability) Location Business function Owned/ Leased 2011 2012 London, Ontario Light Truck Steel Wheels Owned Henderson, KY Heavy- and Medium-duty Steel Wheels and R&D Owned Monterrey, Mexico Heavy- and Medium-duty Steel and Aluminum Wheels Owned Camden, SC Forging and Machining-Aluminum Wheels Owned Erie, PA Forging and Machining-Aluminum Wheels Leased Springfield, OH Assembly Line and Sequencing Owned Whitestown, IN Distribution Warehouse Leased Rockford, IL Wheel-end Foundry and Machining Owned Brillion, WI Hub and Rotor Machining Owned Closed Elkhart, IN Machining and Assembling-Hub, Drums and Rotors Owned Closed Brillion, WI Molding and Finishing Owned Portland, TN Metal Fabricating, Stamping and Assembly Leased Closing (3/31/13) Portland, TN Plating and Polishing Owned Decatur, TX Metal Fabricating, Stamping, Assembly, Machining and Polishing Owned Denton, TX Assembly Line and Sequencing Leased Dublin, VA Tube Bending, Assembly and Line Sequencing Owned Chehalis, WA Metal Fabricating, Stamping, Assembly Owned AccurideCorp.com |

|

|

Achieving Reliable Performance AccurideCorp.com Improving quality, delivery and capability across the organization On Time Delivery % Quality PPM Up +3% 1Q-4Q Down -10% 1Q-4Q Scrap %KPIV > 1.33Cpk Down 6% Year-Over-Year Cost of Poor Execution Down 22% 1Q-4Q Up 35% 1Q-4Q >700 Features Tracked |

|

|

Dependable Performance is Winning Over Customers: New 3-year agreement with VIPAR Heavy Duty for Wheels, Gunite & Imperial Secured 3-year competitive wheel LTAs with: Three leading truck OEMs Two large trailer OEMs Secured new aluminum wheel opportunity for up to $30M/year Taps newly-expanded aluminum capacity Capacity available for customer demand when industry recovers in 2013 Renewed opportunities to regain share at Gunite: Designated as preferred AM source at key OEM $8-10M opportunity Taken off new business hold at OEMs allowing Fleets to spec Gunite product Private label opportunities at multiple OEMs Winning back Aftermarket customers: “Made in USA” – cast, machined and assembled by Gunite Competitively priced to both U.S. and off-shore competition Shortest lead-times in the industry on popular models Dependable Quality and Delivery performance Restoring Customer Trust AccurideCorp.com We are building a solid operational track record, regaining customer confidence |

|

|

2012 Results AccurideCorp.com |

|

|

Consolidated Results AccurideCorp.com 2012 Consolidated Revenue (1) 2012 Consolidated Adjusted EBITDA (1) Consolidated Revenue Breakout (2012 Full Year) Business Segment Customer Market Segment (1) From continuing operations |

|

|

Trade Working Capital AccurideCorp.com Historical Working Capital Requirements Q4 2012 Working Capital Breakout Q4 2011 Working Capital Breakout 2012 Average = $89.1 $10 million target |

|

|

Free Cash Flow AccurideCorp.com Positive FCF in spite of heavy CAPEX QTD Period Ending December 31st 2011 2012 $ Millions Actual Actual Adjusted EBITDA $24.3 $5.1 Cash Interest Paid (0.4) (0.7) Cash Taxes Paid 0.5 0.2 Excess Pension Contributions (2.1) 0.1 Change in Trade W/C 21.9 29.3 Transaction Fees (0.8) (2.1) Other (9.6) (10.5) Cash from Operations $33.6 $21.5 Capital Expenditures (15.4) (15.0) Free Cash Flow $18.2 $6.5 |

|

|

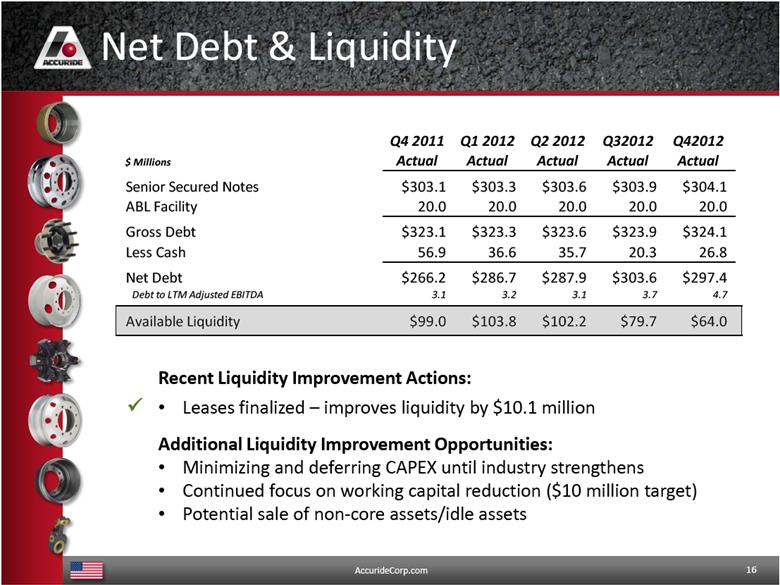

Net Debt & Liquidity AccurideCorp.com Recent Liquidity Improvement Actions: Leases finalized – improves liquidity by $10.1 million Additional Liquidity Improvement Opportunities: Minimizing and deferring CAPEX until industry strengthens Continued focus on working capital reduction ($10 million target) Potential sale of non-core assets/idle assets Q4 2011 Q1 2012 Q2 2012 Q32012 Q42012 $ Actual Actual Actual Actual Actual Senior Secured Notes $303.1 $303.3 $303.6 $303.9 $304.1 ABL Facility 20.0 20.0 20.0 20.0 20.0 Gross Debt $323.1 $323.3 $323.6 $323.9 $324.1 Less Cash 56.9 36.6 35.7 20.3 26.8 Net Debt $266.2 $286.7 $287.9 $303.6 $297.4 Debt to LTM Adjusted 3.1 3.2 3.1 3.7 4.7 Available Liquidity $99.0 $103.8 $102.2 $79.7 $64.0 |

|

|

2013 Outlook AccurideCorp.com |

|

|

Full Year Guidance AccurideCorp.com Class 8 230K to 250K Class 5-7 175K to 185K Trailer 200K to 220K Net Sales $800 to $850 Adjusted EBITDA $65 to $75 CAPEX 3.5% to 4.0% Depreciation & Amortization $47 Cash Interest Expense $33 Excess Pension Contributions $10 Free Cash Flow Breakeven |

|

|

Strategic Focus AccurideCorp.com |

|

|

Strategic Objectives AccurideCorp.com Accuride Vision: Accuride will be the premier supplier of wheel-end system solutions to the global commercial vehicle industry #1-2 globally in wheel-end systems ROIC > 20% through a cycle >80% of revenue from CORE products Balanced geographical revenues: 40% North America 30% Asia 20% Europe 10% South America >25% of annual revenues from new & evolutionary products >95% retention of personnel Maximize ACW share price OUR FOCUS |

|

|

Strategic Progress AccurideCorp.com Brillion Farm Camden $22 M Bostrom Fabco NOV 2010 JAN 2011 JUN 2011 SEP 2011 Aluminum Expansion $33 Million CAPEX Q4 2012 Gunite Upgrades $45 Million CAPEX 13-15 Steel Wheel Upgrades $40 Million CAPEX Other Non-Core Assets? “Fix & Divest” Non-Core Assets “Fix & Grow” Core Assets Global Growth |

|

|

Summary AccurideCorp.com Core North American operations restored to competitive position: Heavy duty Steel wheel capacity consolidated to USA and Mexico Aluminum wheel capacity and footprint expanded Gunite consolidation and new process capability complete 1Q13 Imperial consolidation complete by 2Q13 Brillion returned to profitability New Wheel LTAs secured at key customers 1Q13 appears to be cycle trough, strong long-term industry trends: North American recovery expected in 2H13 Continued growth in global commercial vehicle industry Long-term strategic focus: Adequate liquidity to execute our plan; leases provide additional cushion Non-core asset divestiture opportunities Selective global growth targets - BRICs |

|

|

Questions AccurideCorp.com |