Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ERICKSON INC. | d505825d8k.htm |

| EX-99.1 - EX-99.1 - ERICKSON INC. | d505825dex991.htm |

Announcing Signed Purchase Agreement for Evergreen Helicopters, Inc.

March 19, 2013

Disclaimer

This presentation may contain forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical fact, such as statements regarding our growth opportunities, our potential acquisitions, our future operations, financial position and revenues, other financial guidance, and our other prospects, plans and management objectives, are forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. There are a number of important factors that could cause our actual results to differ materially from those indicated by these forward-looking statements. We disclose many of these risk factors in our most recent annual report on Form 10-K and the registration statement we filed with the Securities and Exchange Commission. All of the information provided in this presentation is as of today’s date and we undertake no duty to update this information.

| 1 |

|

Company Overview

Emerging as a Diversified, Global Aviation Services Provider

Management, Operations and Balance Sheet Support Rapid Growth

Two Announced Acquisitions that Transform the Company

Leader In Heavy-Lift

Acquisitions Provide Scale & Diversification

Construction

Oil and Gas

Air Amazonia

Evergreen

Revenue = ~$430 million

| 2 |

|

EAC 11 Months Post-IPO : Strong Results and Powerful Growth Initiatives

Full Year 2012 Revenues Increased 18% to a $181 million

2012 Operating Income and EBITDA Approximately Double Compared to 2011

Full Year 2012 EPS of $1.56 Doubled Initial Guidance of $0.72-$0.82

Business Momentum Seen Extending into Strong First Quarter of 2013

Two Large Accretive, Transformative Acquisitions Expected to Close in 2Q13

Stock Price Up Approximately 75% from April, 2012 IPO to Today

| 3 |

|

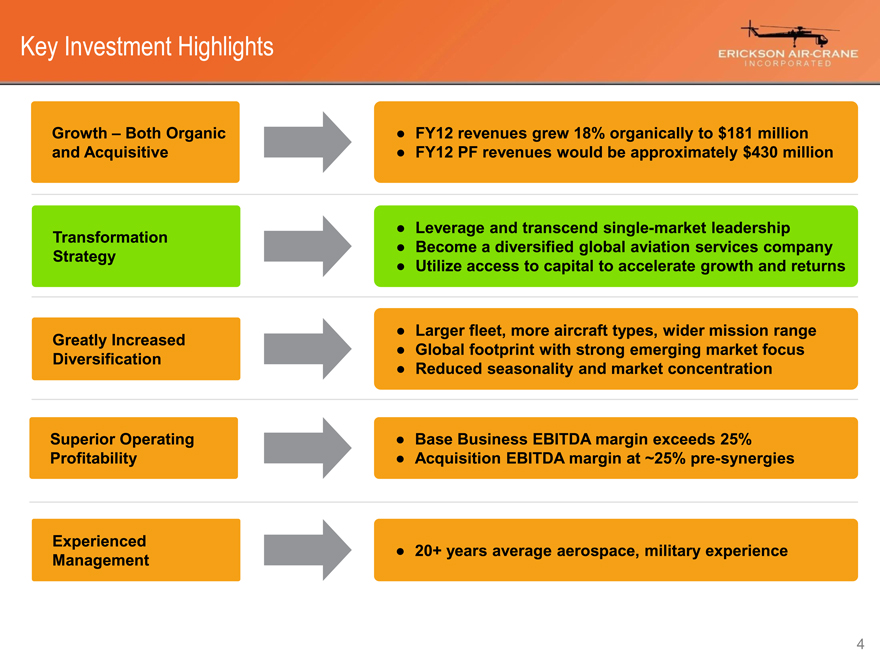

Key Investment Highlights

Growth – Both Organic and Acquisitive

Transformation Strategy Greatly Increased Diversification Superior Operating Profitability Experienced Management

FY12 revenues grew 18% organically to $181 million FY12 PF revenues would be approximately $430 million

Focus on long-term contracts (duration of six Leverage and transcend single-market leadership months or more) Become a diversified global aviation services company

Many contracts include both fixed (daily) and

Utilize access to capital to accelerate growth and returns variable (flight hour-based) revenue

Larger fleet, more aircraft types, wider mission range Global footprint with strong emerging market focus Reduced seasonality and market concentration Base Business EBITDA margin exceeds 25% Acquisition EBITDA margin at ~25% pre-synergies

20+ years average aerospace, military experience

| 4 |

|

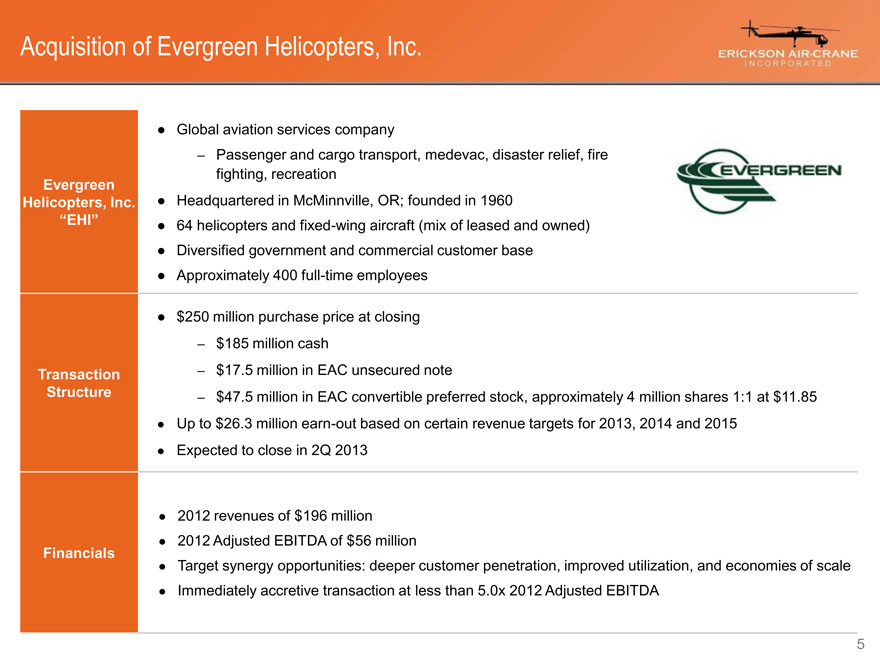

Acquisition of Evergreen Helicopters, Inc.

Evergreen Helicopters, Inc.

“EHI”

Transaction Structure

Financials

Global aviation services company

Passenger and cargo transport, medevac, disaster relief, fire fighting, recreation Headquartered in McMinnville, OR; founded in 1960 64 helicopters and fixed-wing aircraft (mix of leased and owned) Diversified government and commercial customer base Approximately 400 full-time employees

$250 million purchase price at closing

$185 million cash

$17.5 million in EAC unsecured note

$47.5 million in EAC convertible preferred stock, approximately 4 million shares 1:1 at $11.85 Up to $26.3 million earn-out based on certain revenue targets for 2013, 2014 and 2015 Expected to close in 2Q 2013

2012 revenues of $196 million

2012 Adjusted EBITDA of $56 million

Target synergy opportunities: deeper customer penetration, improved utilization, and economies of scale Immediately accretive transaction at less than 5.0x 2012 Adjusted EBITDA

| 5 |

|

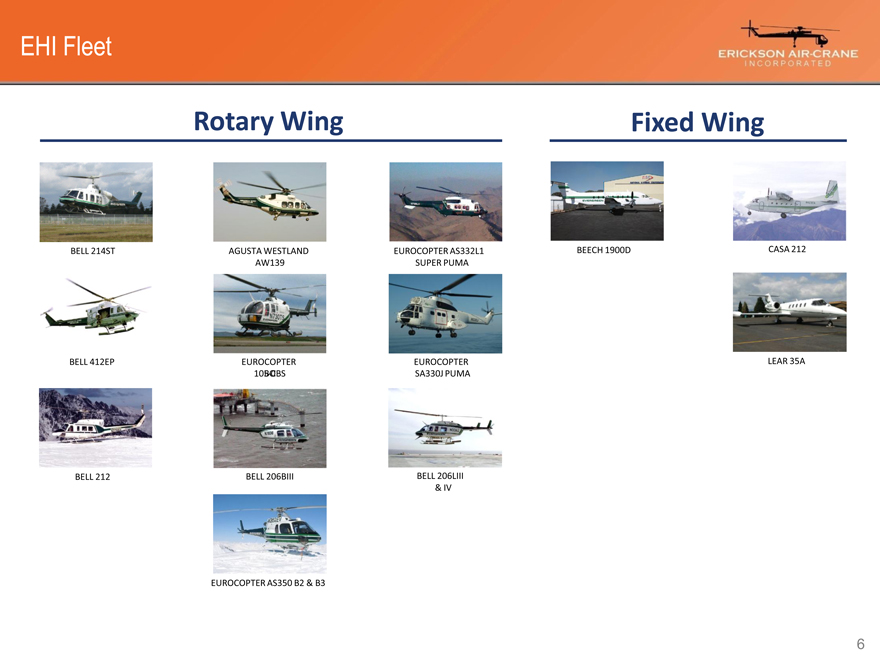

EHI Fleet

Rotary Wing

Fixed Wing

BELL 214ST

AGUSTA WESTLAND AW139

EUROCOPTER AS332L1 SUPER PUMA

BEECH 1900D

CASA 212

BELL 412EP

EUROCOPTER BO-105 CBS

EUROCOPTER SA330J PUMA

LEAR 35A

BELL 212

BELL 206BIII

BELL 206LIII

& IV

EUROCOPTER AS350 B2 & B3

| 6 |

|

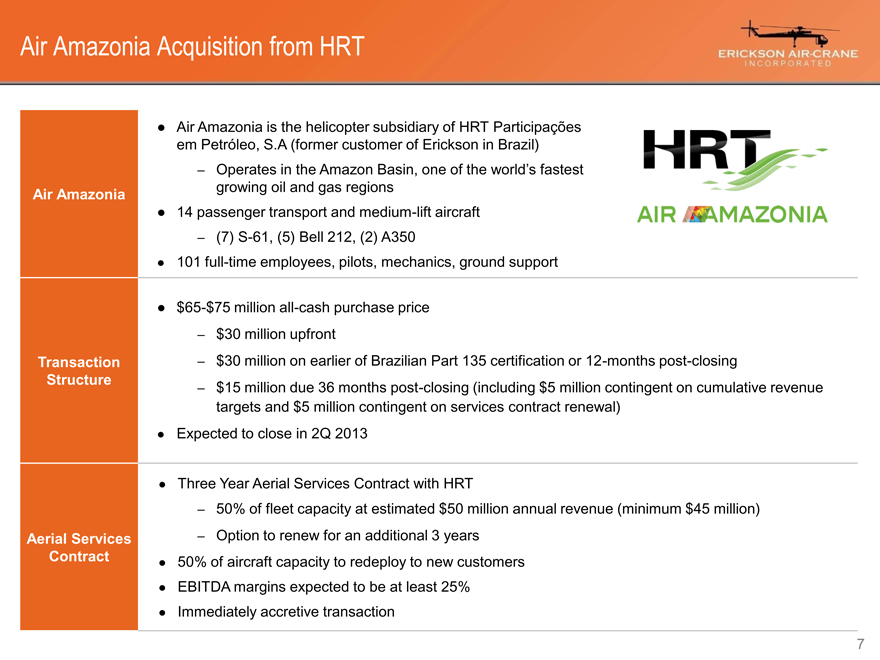

Air Amazonia Acquisition from HRT

Air Amazonia

Transaction Structure

Aerial Services Contract

Air Amazonia is the helicopter subsidiary of HRT Participações em Petróleo, S.A (former customer of Erickson in Brazil)

Operates in the Amazon Basin, one of the world’s fastest growing oil and gas regions 14 passenger transport and medium-lift aircraft

| (7) |

|

S-61, (5) Bell 212, (2) A350 |

101 full-time employees, pilots, mechanics, ground support

$65-$75 million all-cash purchase price

$30 million upfront

$30 million on earlier of Brazilian Part 135 certification or 12-months post-closing

$15 million due 36 months post-closing (including $5 million contingent on cumulative revenue targets and $5 million contingent on services contract renewal) Expected to close in 2Q 2013

Three Year Aerial Services Contract with HRT

50% of fleet capacity at estimated $50 million annual revenue (minimum $45 million)

Option to renew for an additional 3 years

50% of aircraft capacity to redeploy to new customers EBITDA margins expected to be at least 25% Immediately accretive transaction

| 7 |

|

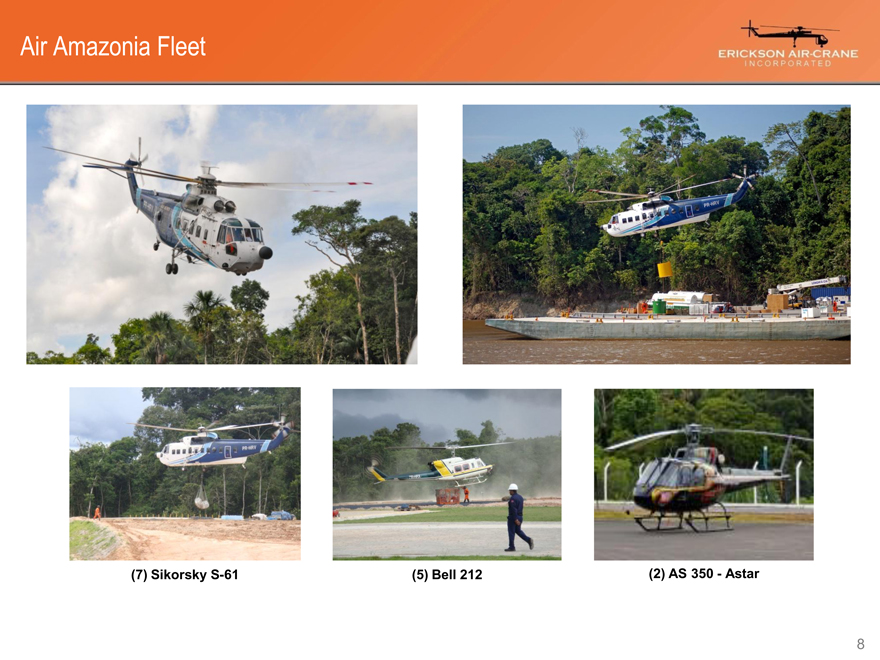

Air Amazonia Fleet

| (7) |

|

Sikorsky S-61 |

| (5) |

|

Bell 212 |

| (2) |

|

AS 350—Astar |

| 8 |

|

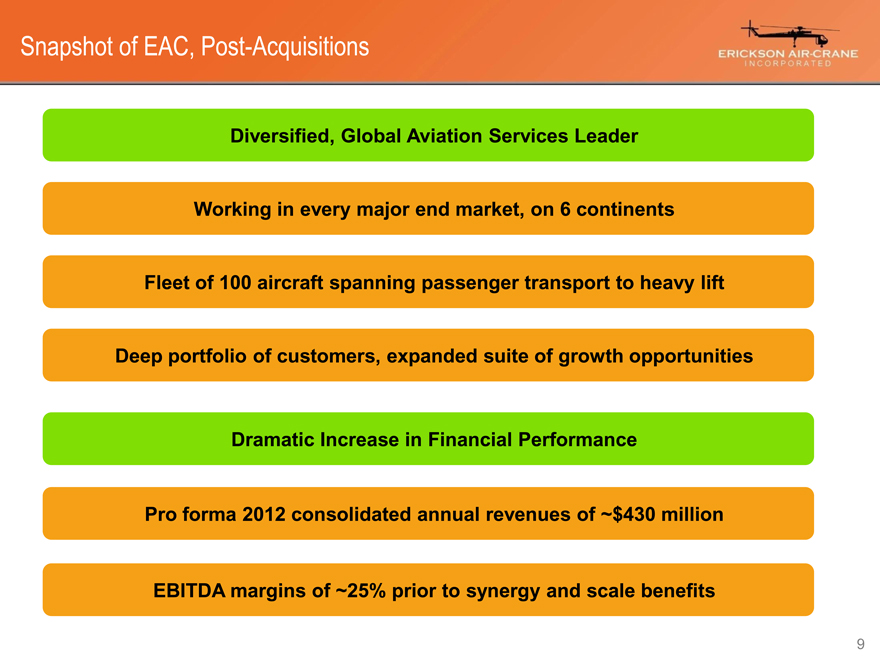

Snapshot of EAC, Post-Acquisitions

Diversified, Global Aviation Services Leader

Working in every major end market, on 6 continents

Fleet of 100 aircraft spanning passenger transport to heavy lift

Deep portfolio of customers, expanded suite of growth opportunities

Dramatic Increase in Financial Performance

Pro forma 2012 consolidated annual revenues of ~$430 million

EBITDA margins of ~25% prior to synergy and scale benefits

9

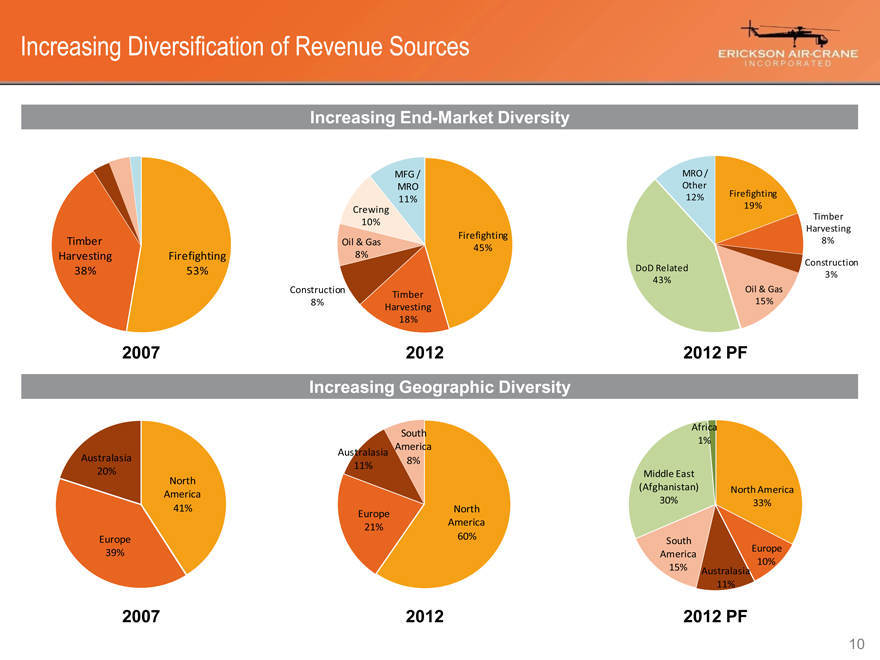

Increasing Diversification of Revenue Sources

Increasing End-Market Diversity

Increasing Geographic Diversity

Timber Harvesting 38%

Firefighting 53%

2007

Crewing 10%

Oil & Gas 8%

MFG / MRO 11%

Construction 8%

Firefighting 45%

Timber Harvesting 18%

2012

MRO / Other

12% Firefighting

19%

DoD Related

43%

Oil & Gas 15%

Timber

Harvesting 8%

Construction 3%

2012 PF

Australasia 20%

North America 41%

Europe 39%

2007

South America Australasia 8% 11%

North Europe America 21% 60%

2012

Africa

1%

Middle East

(Afghanistan) North America 30% 33%

South Europe

America 10% 15% Australasia

11%

2012 PF

10

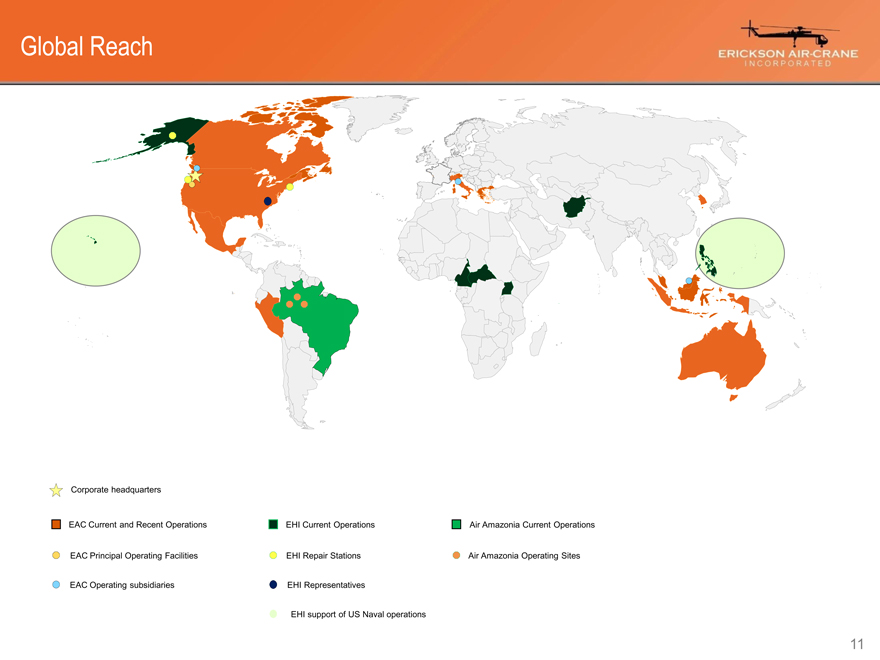

Global Reach

Corporate headquarters

EAC Current and Recent Operations EAC Principal Operating Facilities EAC Operating subsidiaries

EHI Current Operations EHI Repair Stations EHI Representatives

EHI support of US Naval operations

Air Amazonia Current Operations

Air Amazonia Operating Sites

11

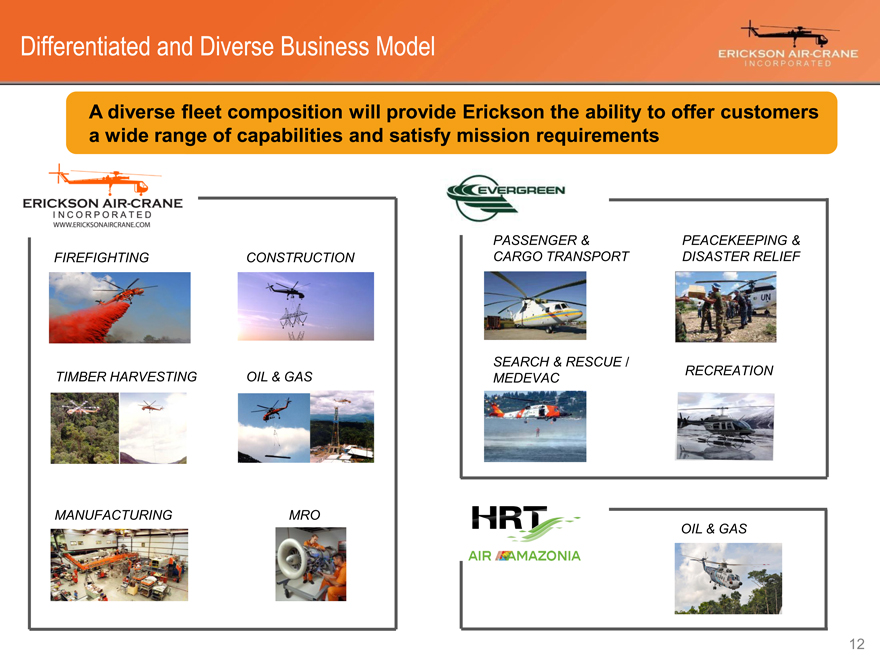

Differentiated and Diverse Business Model

A diverse fleet composition will provide Erickson the ability to offer customers a wide range of capabilities and satisfy mission requirements

FIREFIGHTING

CONSTRUCTION

TIMBER HARVESTING

OIL & GAS

MANUFACTURING

MRO

PASSENGER & CARGO TRANSPORT

PEACEKEEPING & DISASTER RELIEF

SEARCH & RESCUE / MEDEVAC

RECREATION

OIL & GAS

12

ERICKSON AIR-CRANE

INCORPORATED