Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CARRIAGE SERVICES INC | csv8k-march2013xcarriagein.htm |

Carriage Services Investor Presentation 2013

Forward-Looking Statements Certain statements made herein or elsewhere by, or on behalf of, the Company that are not historical facts are intended to be forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on assumptions that the Company believes are reasonable; however, many important factors, as discussed under “Forward‐Looking Statements” in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2012, could cause the Company’s results in the future to differ materially from the forward‐looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. Forward-looking statements contained herein regarding acquisitions include assumptions about the pricing, timing, and terms and conditions of such acquisitions. We can provide no assurances that our growth strategy will be successfully implemented. In particular, we can provide no assurances that we will find attractive acquisition targets, that we will succeed in negotiating the terms and conditions reflected in the model, or that we will execute any acquisitions during the next five years (including 2013). Forward-looking statements contained herein regarding the performance of our acquisition and same store businesses include assumptions related to future revenue growth. We can provide are no assurances that our acquisition and same store businesses will generate the revenue growth set forth herein, or any revenue growth at all. The Company assumes no obligation to update or publicly release any revisions to forward-looking statements made herein or any other forward‐looking statements made by, or on behalf of, the Company. A copy of the Company’s Form 10‐K, and other Carriage Services information and news releases, are available at www.carriageservices.com.”

Who is Carriage? • A national funeral home and cemetery operating company • Founded in 1991 by Chairman and CEO Mel Payne • Carriage operates 167 funeral homes and 33 cemeteries in 26 states • Funeral home and cemetery field operations drives success under a decentralized operating framework • Carriage’s success has and will continue to be defined by three strategic models – Standards Operating Model – 4 E Leadership Model – Strategic Acquisition Model 3

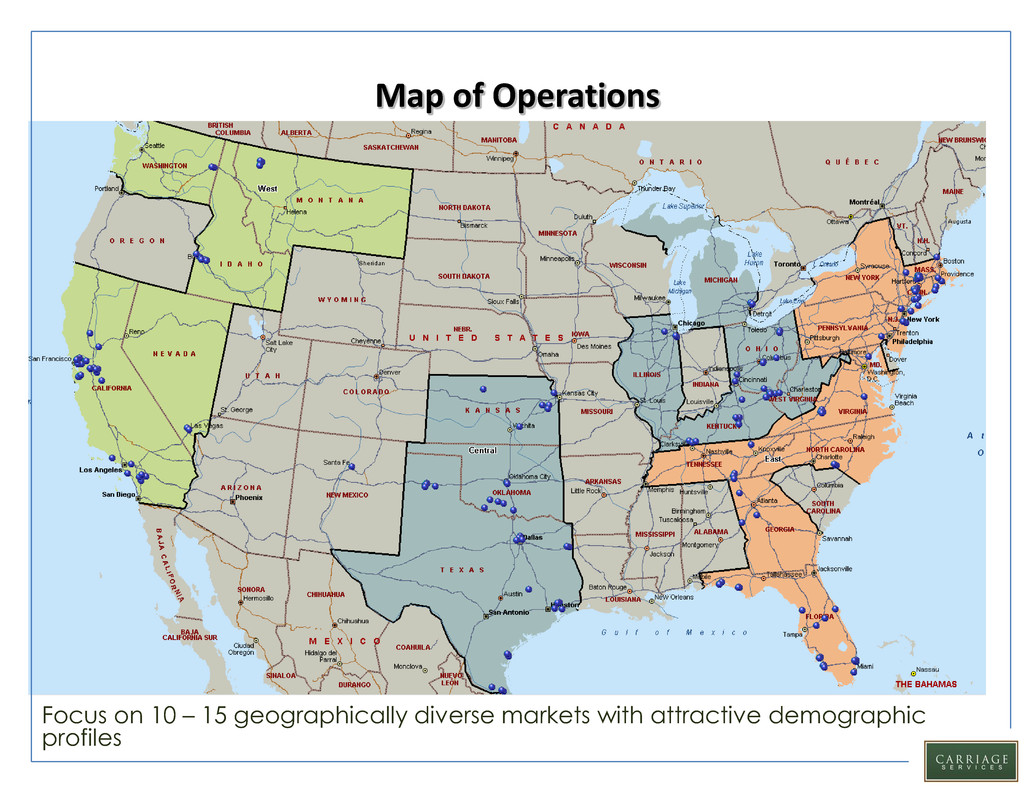

Map of Operations Focus on 10 – 15 geographically diverse markets with attractive demographic profiles

Leveraged Investment Returns • Operating Leverage – Relatively fixed regional and corporate overhead allows for modest increases in Same Store Sales to a have greater impact on Consolidated EBITDA – A majority of Acquired Field EBITDA (Gross Profit excluding Depreciation & Unallocated Expenses) falls to Consolidated EBITDA due to operating leverage 5

Capital Structure • Carriage Services, Inc. has raised $235 million through Senior Secured Credit Facilities due 2017 – $105 million 5-year Revolver with a $40 million accordion – $130 million 5-year Term Loan A • Proceeds from the transaction were used to refinance Carriage’s Revolver and redeem its outstanding $130 million of 7.875% Senior Notes • The transaction reduces the Company’s overall cost of capital, extends debt maturities and increases liquidity for future growth opportunities • Cost of Equity reduced with increasing size and improved performance - Cost of Debt reduced with new credit facility • Improving capital structure notwithstanding significant increase in acquisitions. 6

Our Growth Strategy • Adopt a pro-growth business model within an industry that is characterized by its low growth • Modest growth in sales of our base businesses • Make targeted and strategic acquisitions to accelerate growth while maintaining financial discipline 7

Industry Key Statistics • Industry wide funeral home revenue of $13.4 billion representing 1.5% CAGR since 2010 • Industry wide cemetery revenue of $4 billion representing -3.7% CAGR since 2010 • Highly fragmented industry with a majority of the more than 24,000 funeral homes represented by small locally owned independent operations 8

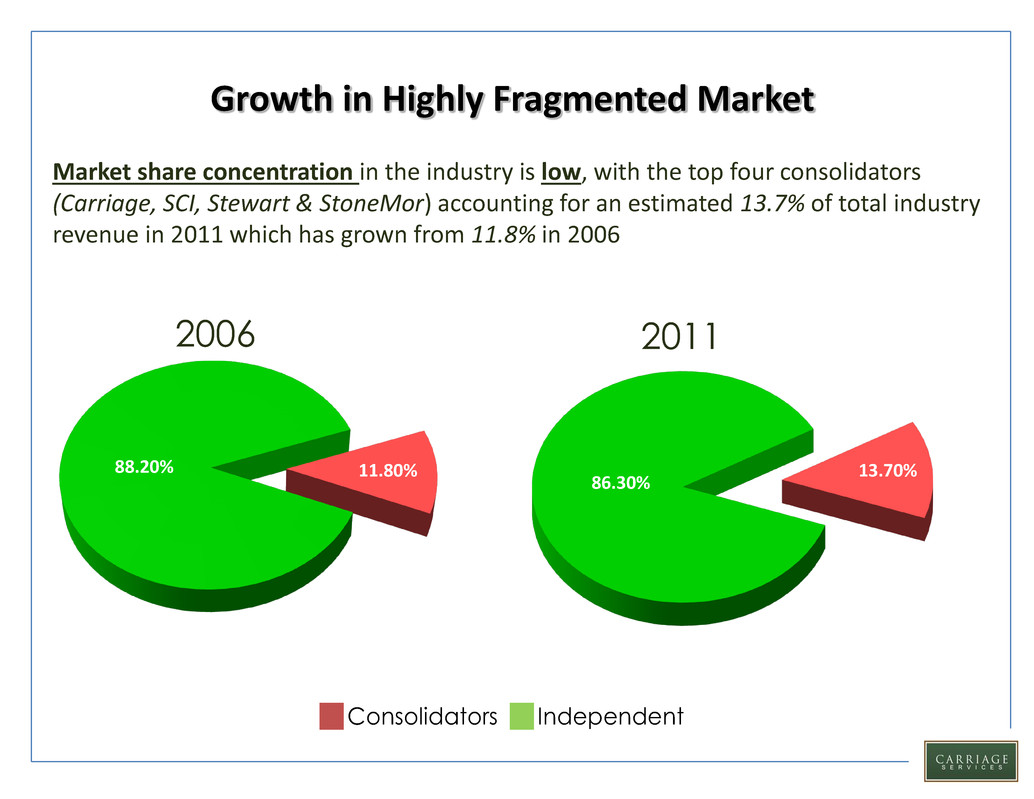

Growth in Highly Fragmented Market Market share concentration in the industry is low, with the top four consolidators (Carriage, SCI, Stewart & StoneMor) accounting for an estimated 13.7% of total industry revenue in 2011 which has grown from 11.8% in 2006 9 2006 2011 Consolidators Independent 11.80% 88.20% 13.70% 86.30%

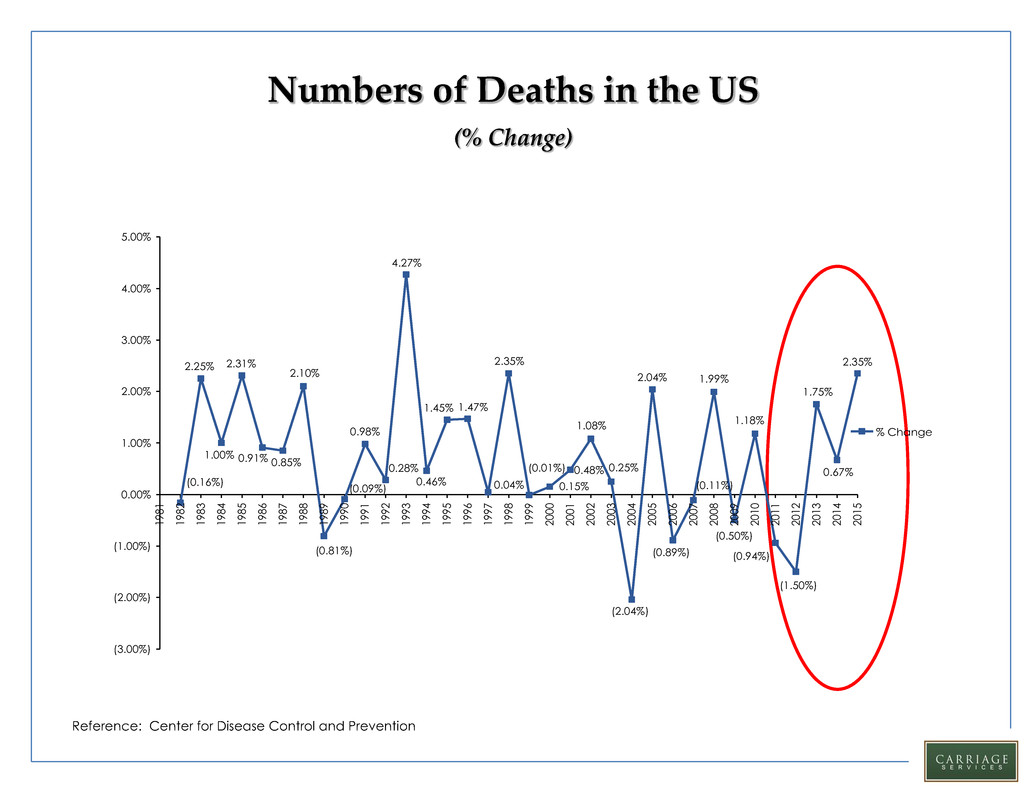

(1.50%) 1.18% 1.99%2.04% (2.04%) 0.48% 1.08% 2.10% 2.31% 2.35%2.25% 0.25% 0.67% 1.75% (0.94%) (0.50%) (0.11%) (0.89%) (0.01%) 0.15% 2.35% 0.04% 1.47%1.45% 0.46% 4.27% 0.28% 0.98% (0.09%) (0.81%) 0.85%0.91% 1.00% (0.16%) (3.00%) (2.00%) (1.00%) 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 % Change Numbers of Deaths in the US (% Change) 10 Reference: Center for Disease Control and Prevention

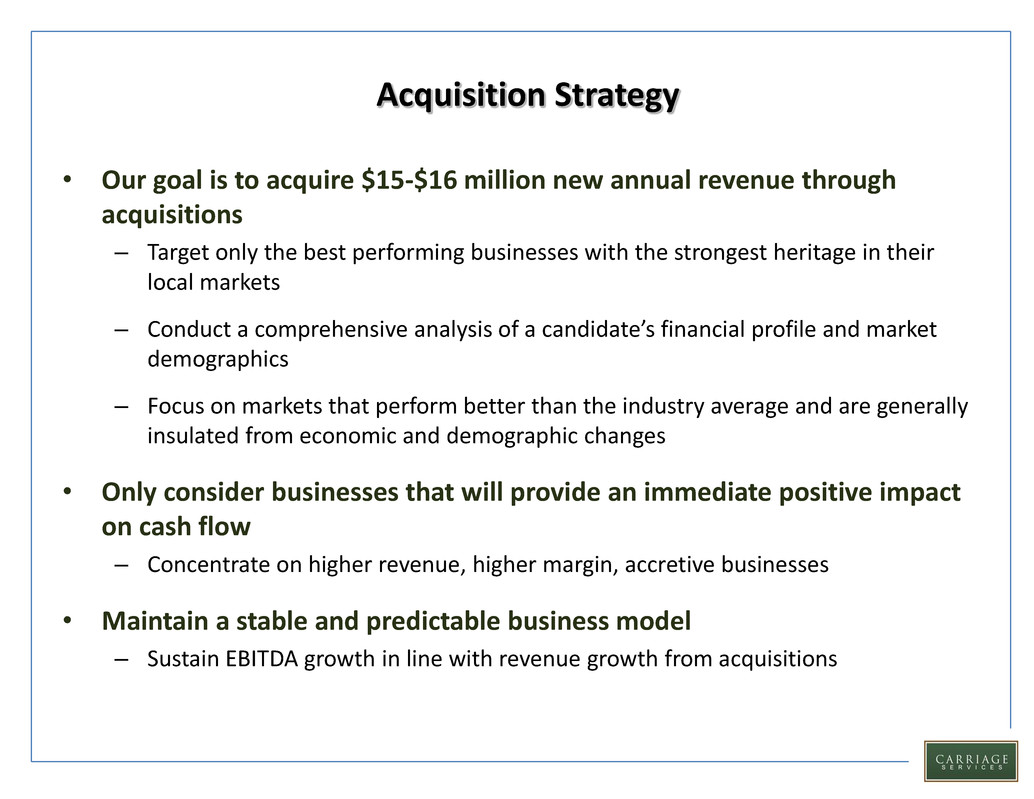

Acquisition Strategy • Our goal is to acquire $15-$16 million new annual revenue through acquisitions – Target only the best performing businesses with the strongest heritage in their local markets – Conduct a comprehensive analysis of a candidate’s financial profile and market demographics – Focus on markets that perform better than the industry average and are generally insulated from economic and demographic changes • Only consider businesses that will provide an immediate positive impact on cash flow – Concentrate on higher revenue, higher margin, accretive businesses • Maintain a stable and predictable business model – Sustain EBITDA growth in line with revenue growth from acquisitions 11

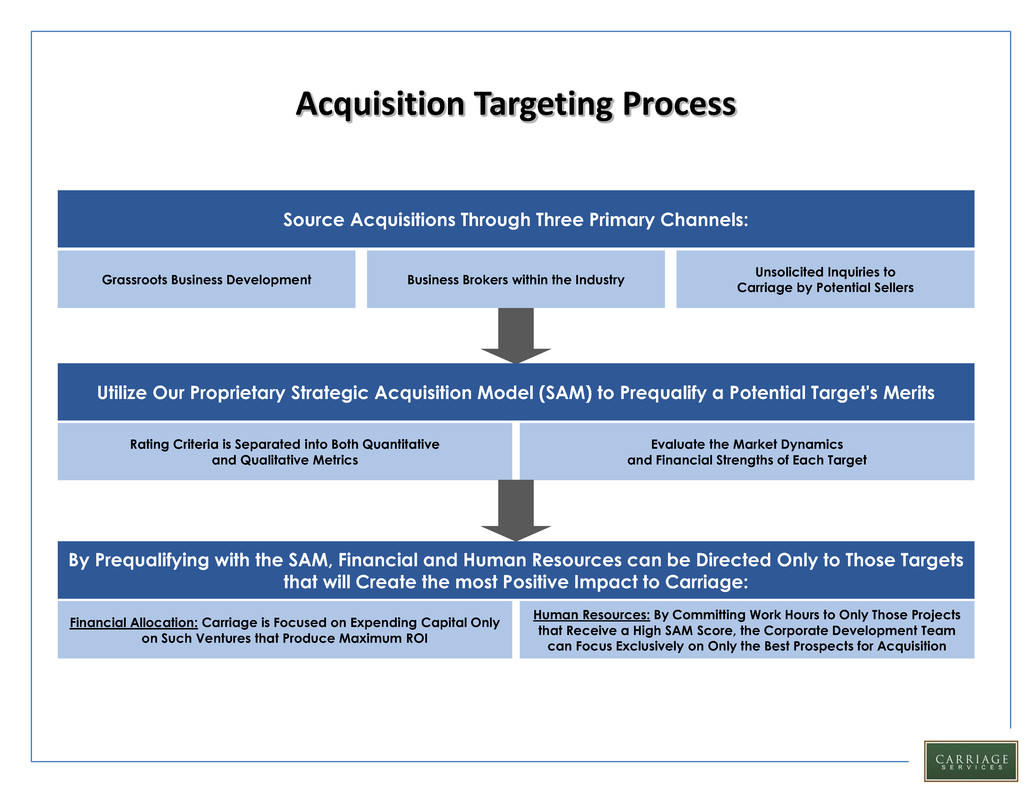

Acquisition Targeting Process 12 Source Acquisitions Through Three Primary Channels: Utilize Our Proprietary Strategic Acquisition Model (SAM) to Prequalify a Potential Target's Merits By Prequalifying with the SAM, Financial and Human Resources can be Directed Only to Those Targets that will Create the most Positive Impact to Carriage: Human Resources: By Committing Work Hours to Only Those Projects that Receive a High SAM Score, the Corporate Development Team can Focus Exclusively on Only the Best Prospects for Acquisition Financial Allocation: Carriage is Focused on Expending Capital Only on Such Ventures that Produce Maximum ROI Evaluate the Market Dynamics and Financial Strengths of Each Target Rating Criteria is Separated into Both Quantitative and Qualitative Metrics Grassroots Business Development Business Brokers within the Industry Unsolicited Inquiries to Carriage by Potential Sellers

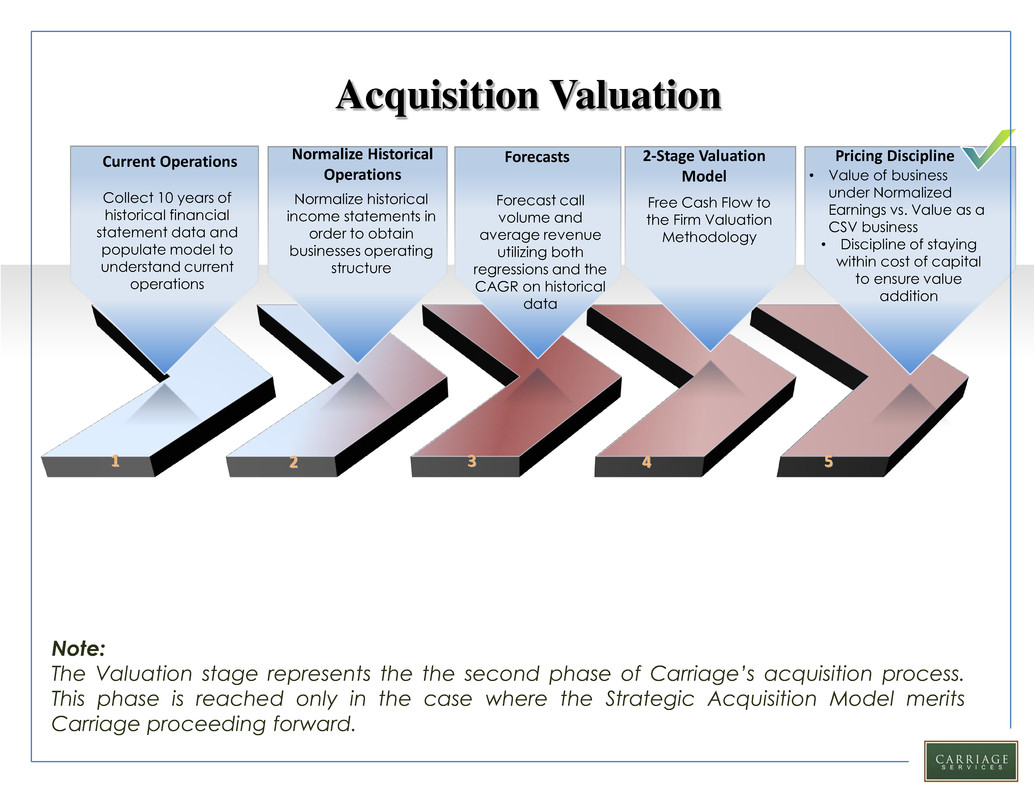

Pricing Discipline • Value of business under Normalized Earnings vs. Value as a CSV business • Discipline of staying within cost of capital to ensure value addition 2-Stage Valuation Model Forecasts Forecast call volume and average revenue utilizing both regressions and the CAGR on historical data Normalize Historical Operations Current Operations 1 2 3 4 5 Acquisition Valuation Note: The Valuation stage represents the the second phase of Carriage’s acquisition process. This phase is reached only in the case where the Strategic Acquisition Model merits Carriage proceeding forward. Collect 10 years of historical financial statement data and populate model to understand current operations Normalize historical income statements in order to obtain businesses operating structure Free Cash Flow to the Firm Valuation Methodology 13 13

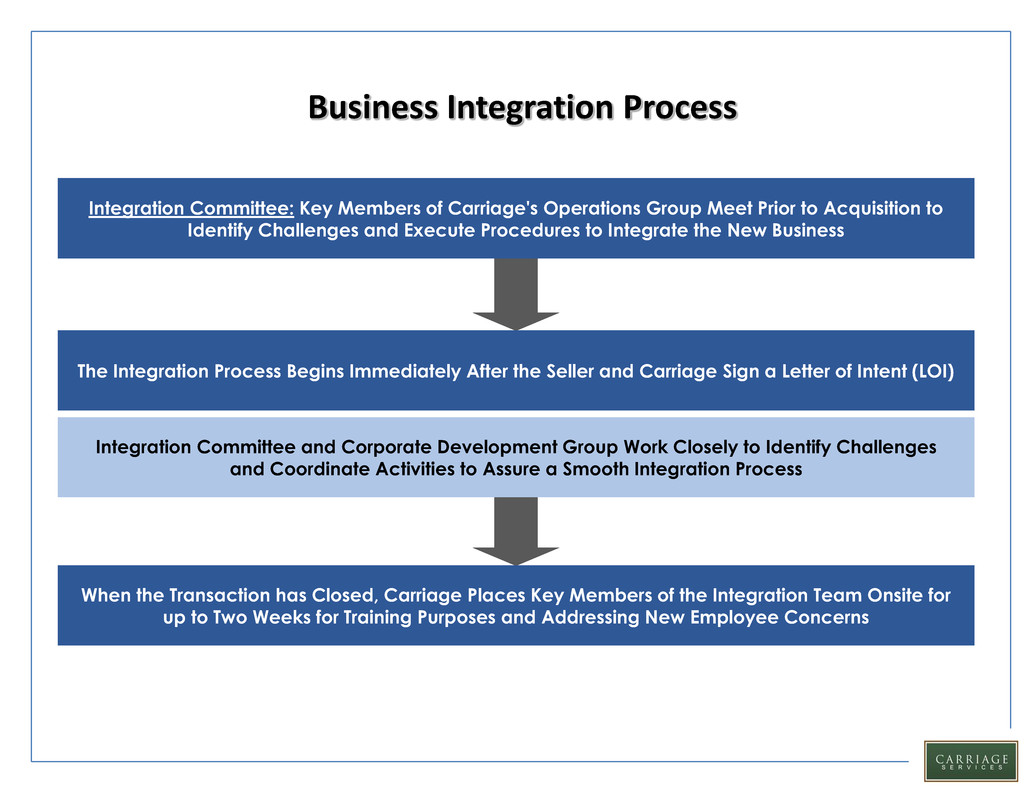

Business Integration Process 14 Integration Committee: Key Members of Carriage's Operations Group Meet Prior to Acquisition to Identify Challenges and Execute Procedures to Integrate the New Business The Integration Process Begins Immediately After the Seller and Carriage Sign a Letter of Intent (LOI) Integration Committee and Corporate Development Group Work Closely to Identify Challenges and Coordinate Activities to Assure a Smooth Integration Process When the Transaction has Closed, Carriage Places Key Members of the Integration Team Onsite for up to Two Weeks for Training Purposes and Addressing New Employee Concerns

Financial Overview 15

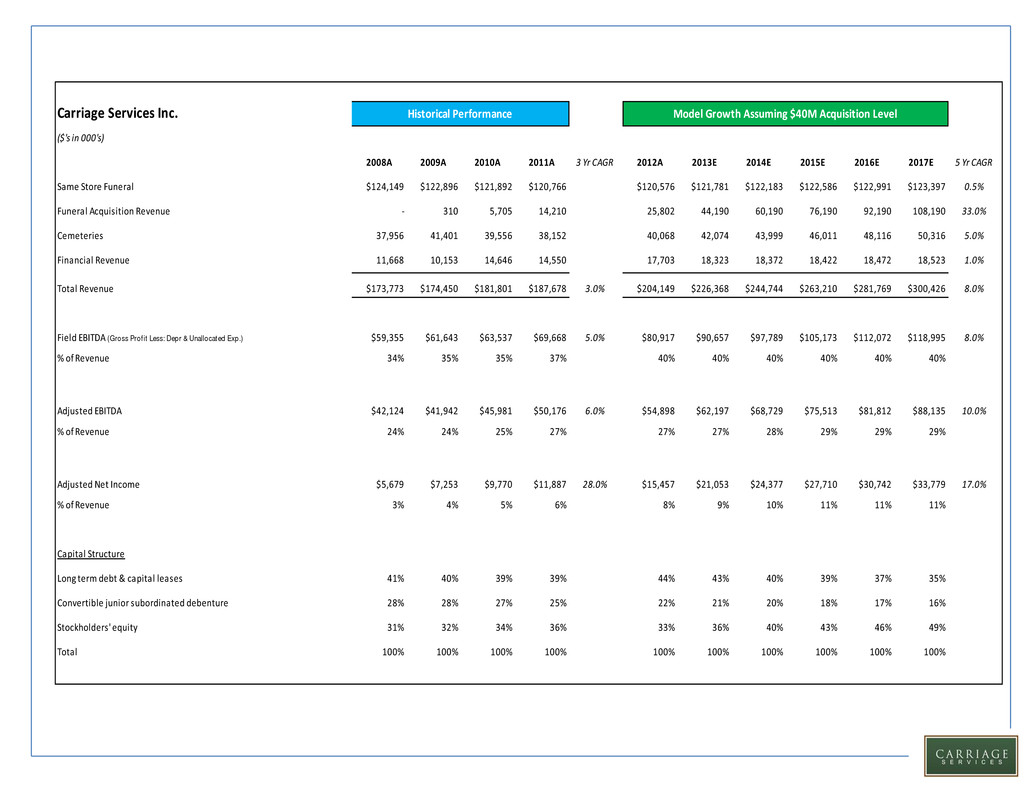

16 The following slides are solely intended to demonstrate the possible impact on our financial results of the successful implementation of our growth strategy by the hypothetical acquisition of businesses aggregating $40 million in assets per year for each of the next five years (including 2013). The model presented on the following slides incorporates several assumptions regarding the pricing, timing, and terms and conditions of such acquisitions, as well as the financial performance of both acquisition and same store businesses. We can provide no assurances that our growth strategy will be successfully implemented. In particular, we can provide no assurances that we will find attractive acquisition targets, that we will succeed in negotiating the terms and conditions reflected in the model, or that we will execute any acquisitions during the next five years (including 2013). Additionally, we can provide are no assurances that our acquisition and same store businesses will generate the revenue growth reflected in the model, or any revenue growth at all.

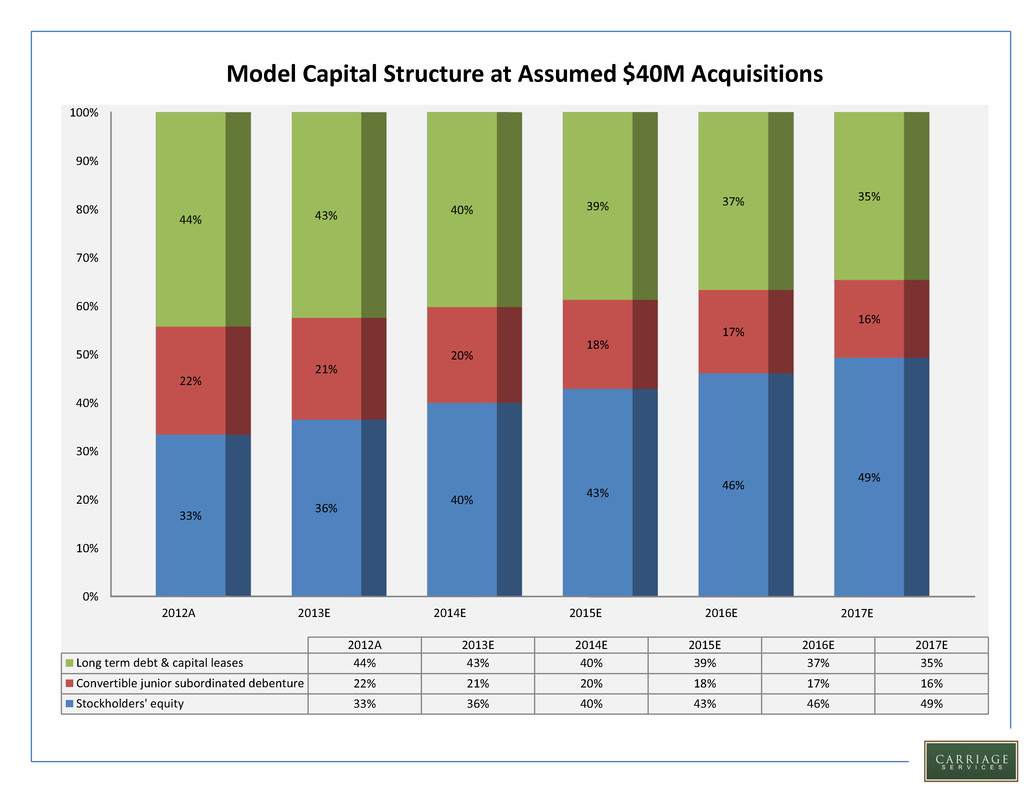

17 Carriage Services Inc. ($'s in 000's) 2008A 2009A 2010A 2011A 3 Yr CAGR 2012A 2013E 2014E 2015E 2016E 2017E 5 Yr CAGR Same Store Funeral $124,149 $122,896 $121,892 $120,766 $120,576 $121,781 $122,183 $122,586 $122,991 $123,397 0.5% Funeral Acquisition Revenue - 310 5,705 14,210 25,802 44,190 60,190 76,190 92,190 108,190 33.0% Cemeteries 37,956 41,401 39,556 38,152 40,068 42,074 43,999 46,011 48,116 50,316 5.0% Financial Revenue 11,668 10,153 14,646 14,550 17,703 18,323 18,372 18,422 18,472 18,523 1.0% Total Revenue $173,773 $174,450 $181,801 $187,678 3.0% $204,149 $226,368 $244,744 $263,210 $281,769 $300,426 8.0% Field EBITDA (Gross Prof it Less: Depr & Unallocated Exp.) $59,355 $61,643 $63,537 $69,668 5.0% $80,917 $90,657 $97,789 $105,173 $112,072 $118,995 8.0% % of Revenue 34% 35% 35% 37% 40% 40% 40% 40% 40% 40% Adjusted EBITDA $42,124 $41,942 $45,981 $50,176 6.0% $54,898 $62,197 $68,729 $75,513 $81,812 $88,135 10.0% % of Revenue 24% 24% 25% 27% 27% 27% 28% 29% 29% 29% Adjusted Net Income $5,679 $7,253 $9,770 $11,887 28.0% $15,457 $21,053 $24,377 $27,710 $30,742 $33,779 17.0% % of Revenue 3% 4% 5% 6% 8% 9% 10% 11% 11% 11% Capital Structure Long term debt & capital leases 41% 40% 39% 39% 44% 43% 40% 39% 37% 35% Convertible junior subordinated debenture 28% 28% 27% 25% 22% 21% 20% 18% 17% 16% Stockholders' equity 31% 32% 34% 36% 33% 36% 40% 43% 46% 49% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Historical Performance Model Growth Assuming $40M Acquisition Level

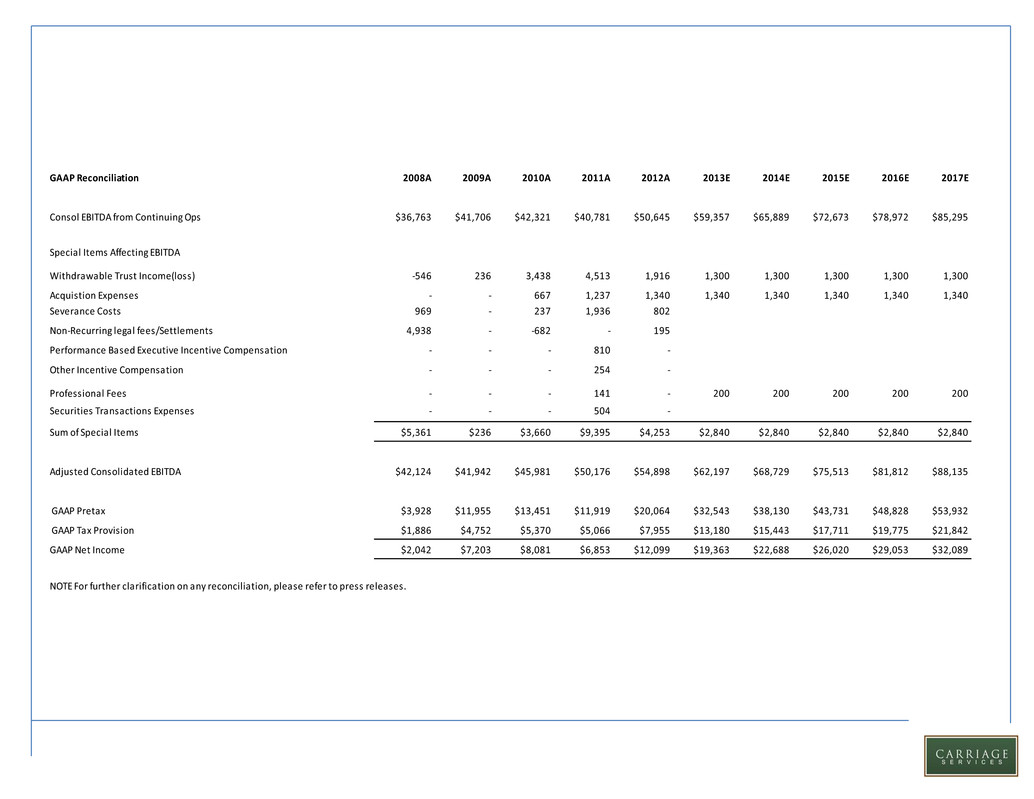

18 GAAP Reconciliation 2008A 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E Consol EBITDA from Continuing Ops $36,763 $41,706 $42,321 $40,781 $50,645 $59,357 $65,889 $72,673 $78,972 $85,295 Special Items Affecting EBITDA Withdrawable Trust Income(loss) -546 236 3,438 4,513 1,916 1,300 1,300 1,300 1,300 1,300 Acquistion Expenses - - 667 1,237 1,340 1,340 1,340 1,340 1,340 1,340 Severance Costs 969 - 237 1,936 802 Non-Recurring legal fees/Settlements 4,938 - -682 - 195 Performance Based Executive Incentive Compensation - - - 810 - Other Incentive Compensation - - - 254 - Professional Fees - - - 141 - 200 200 200 200 200 Securities Transactions Expenses - - - 504 - Sum of Special Items $5,361 $236 $3,660 $9,395 $4,253 $2,840 $2,840 $2,840 $2,840 $2,840 Adjusted Consolidated EBITDA $42,124 $41,942 $45,981 $50,176 $54,898 $62,197 $68,729 $75,513 $81,812 $88,135 GAAP Pretax $3,928 $11,955 $13,451 $11,919 $20,064 $32,543 $38,130 $43,731 $48,828 $53,932 GAAP Tax Provision $1,886 $4,752 $5,370 $5,066 $7,955 $13,180 $15,443 $17,711 $19,775 $21,842 GAAP Net Income $2,042 $7,203 $8,081 $6,853 $12,099 $19,363 $22,688 $26,020 $29,053 $32,089 NOTE For further clarification on any reconciliation, please refer to press releases.

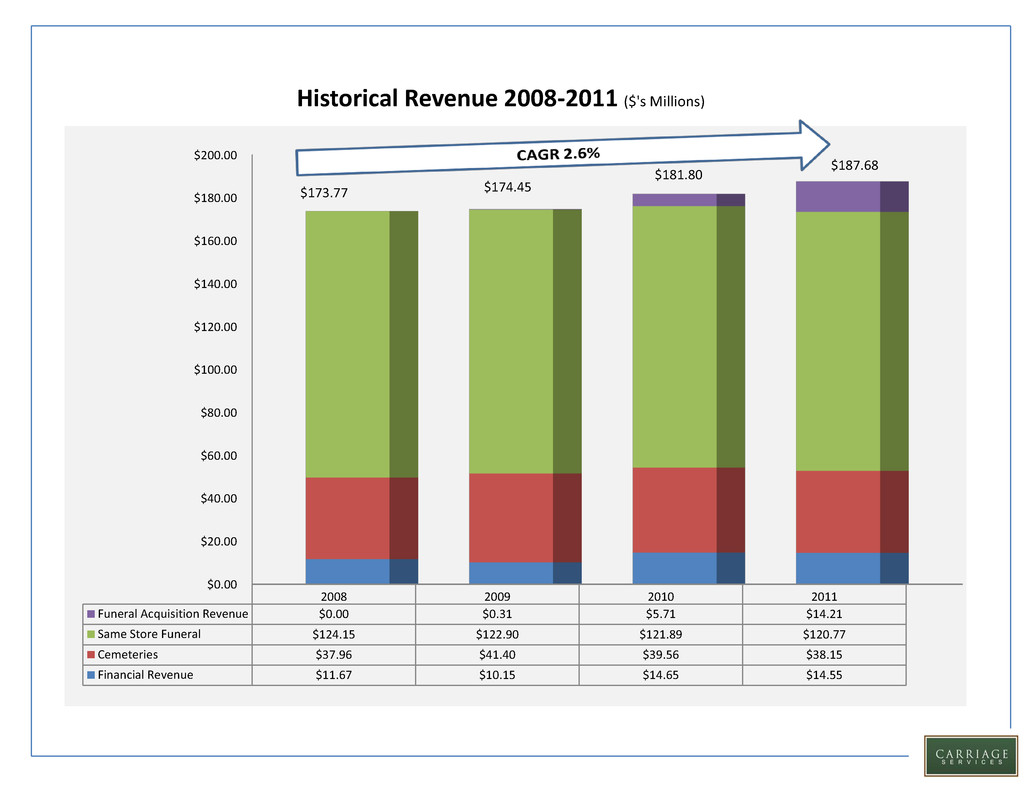

19 $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 $180.00 $200.00 2008 2009 2010 2011 Funeral Acquisition Revenue $0.00 $0.31 $5.71 $14.21 Same Store Funeral $124.15 $122.90 $121.89 $120.77 Cemeteries $37.96 $41.40 $39.56 $38.15 Financial Revenue $11.67 $10.15 $14.65 $14.55 Historical Revenue 2008-2011 ($'s Millions) $173.77 $174.45 $181.80 $187.68

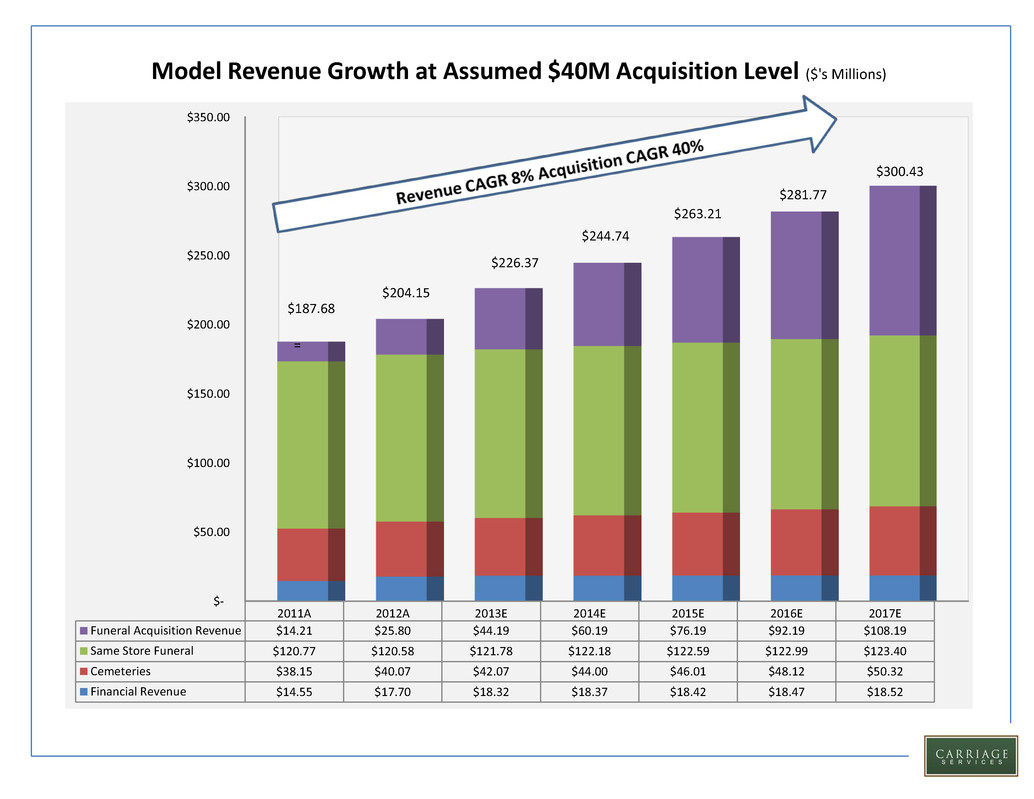

20 $- $50.00 $100.00 $150.00 $200.00 $250.00 $300.00 $350.00 2011A 2012A 2013E 2014E 2015E 2016E 2017E Funeral Acquisition Revenue $14.21 $25.80 $44.19 $60.19 $76.19 $92.19 $108.19 Same Store Funeral $120.77 $120.58 $121.78 $122.18 $122.59 $122.99 $123.40 Cemeteries $38.15 $40.07 $42.07 $44.00 $46.01 $48.12 $50.32 Financial Revenue $14.55 $17.70 $18.32 $18.37 $18.42 $18.47 $18.52 Model Revenue Growth at Assumed $40M Acquisition Level ($'s Millions) = $187.68 $204.15 $226.37 $244.74 $263.21 $281.77 $300.43

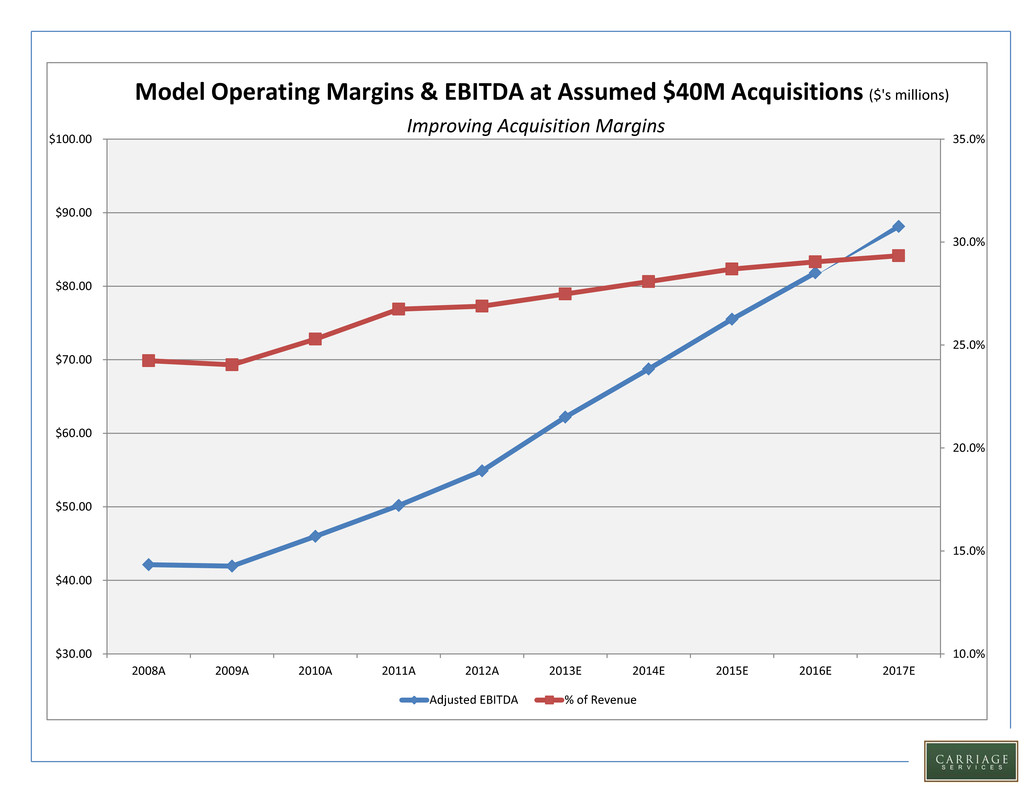

21 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 2008A 2009A 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E Adjusted EBITDA % of Revenue Model Operating Margins & EBITDA at Assumed $40M Acquisitions ($'s millions) Improving Acquisition Margins

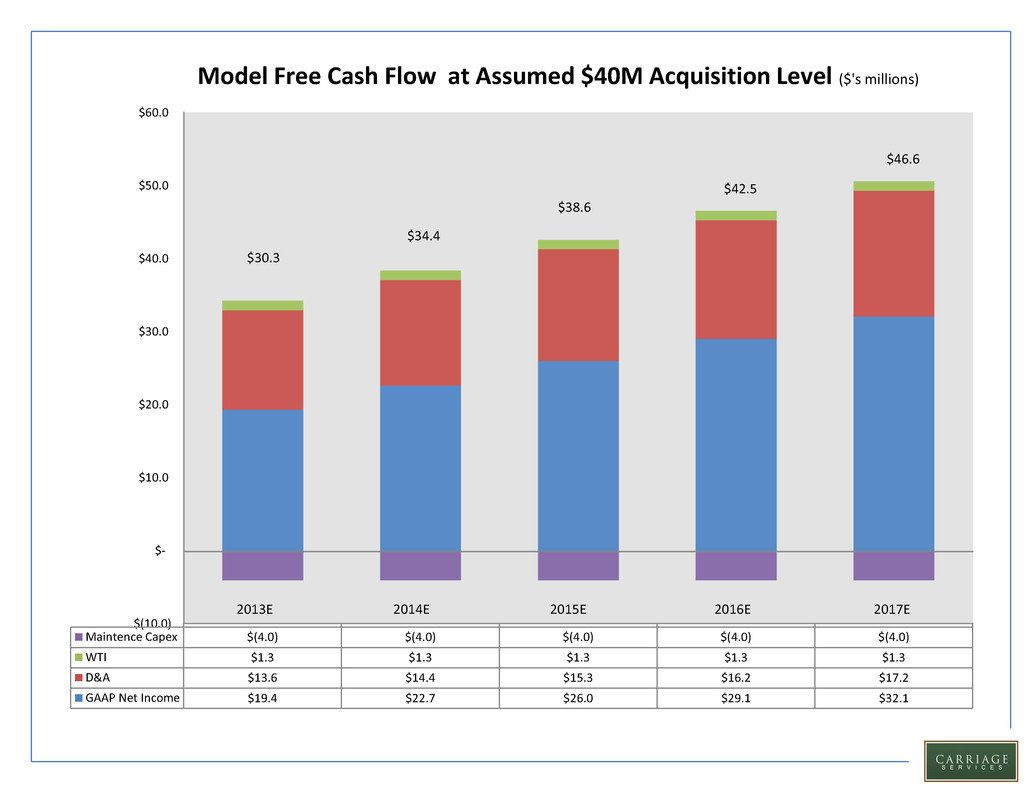

22 $(10.0) $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Maintence Capex $(4.0) $(4.0) $(4.0) $(4.0) $(4.0) WTI $1.3 $1.3 $1.3 $1.3 $1.3 D&A $13.6 $14.4 $15.3 $16.2 $17.2 GAAP Net Income $19.4 $22.7 $26.0 $29.1 $32.1 Model Free Cash Flow at Assumed $40M Acquisition Level ($'s millions) 2013E 2014E 2015E 2016E 2017E $30.3 $34.4 $38.6 $42.5 $46.6

23 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2012A 2013E 2014E 2015E 2016E 2017E 33% 36% 40% 43% 46% 49% 22% 21% 20% 18% 17% 16% 44% 43% 40% 39% 37% 35% 2012A 2013E 2014E 2015E 2016E 2017E Long term debt & capital leases 44% 43% 40% 39% 37% 35% Convertible junior subordinated debenture 22% 21% 20% 18% 17% 16% Stockholders' equity 33% 36% 40% 43% 46% 49% Model Capital Structure at Assumed $40M Acquisitions

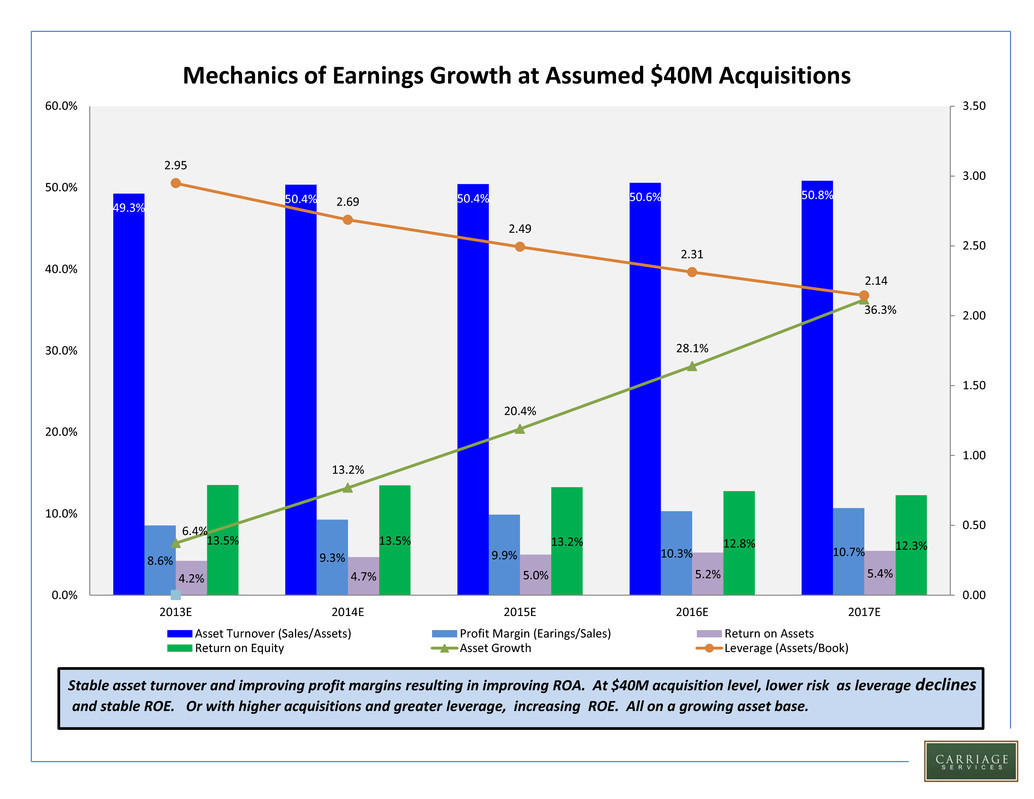

24 49.3% 50.4% 50.4% 50.6% 50.8% 8.6% 9.3% 9.9% 10.3% 10.7% 4.2% 4.7% 5.0% 5.2% 5.4% 13.5% 13.5% 13.2% 12.8% 12.3% 6.4% 13.2% 20.4% 28.1% 36.3% 2.95 2.69 2.49 2.31 2.14 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 2013E 2014E 2015E 2016E 2017E Mechanics of Earnings Growth at Assumed $40M Acquisitions Asset Turnover (Sales/Assets) Profit Margin (Earings/Sales) Return on Assets Return on Equity Asset Growth Leverage (Assets/Book) Stable asset turnover and improving profit margins resulting in improving ROA. At $40M acquisition level, lower risk as leverage declines and stable ROE. Or with higher acquisitions and greater leverage, increasing ROE. All on a growing asset base.

25 SUMMARY * The Industry * Carriage Services Inc position in the Industry * Future