Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PALOMAR MEDICAL TECHNOLOGIES INC | d503633d8k.htm |

| EX-2.1 - EX-2.1 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex21.htm |

| EX-4.1 - EX-4.1 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex41.htm |

| EX-10.4 - EX-10.4 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex104.htm |

| EX-10.3 - EX-10.3 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex103.htm |

| EX-99.2 - EX-99.2 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex992.htm |

| EX-10.1 - EX-10.1 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex101.htm |

| EX-99.1 - EX-99.1 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex991.htm |

| EX-10.2 - EX-10.2 - PALOMAR MEDICAL TECHNOLOGIES INC | d503633dex102.htm |

Exhibit 99.3

Cynosure Signs Definitive Agreement to Acquire Palomar Medical Technologies

March 18, 2013

Forward-Looking Statements

With the exception of the historical information contained in this presentation, the matters described herein contain forward-looking statements, including, but not limited to, statements relating to long-term growth and profitability, projected synergies, the expectation of an accretive transaction in calendar 2014, the tax-free nature of the transaction and the timing of the closing of the transaction. These forward-looking statements are neither promises nor guarantees, but involve risk and uncertainties that may individually or mutually impact the matters herein, and cause actual results, events and performance to differ materially from such forward-looking statements. These risk factors include, but are not limited to, results of future operations, difficulties or delays in developing or introducing new products and keeping them on the market, the results of future research, lack of product demand and market acceptance for current and future products, adverse events, product changes, the effect of economic conditions, challenges in managing joint ventures and research with third parties, the impact of competitive products and pricing, governmental regulations with respect to medical devices, including whether FDA clearance will be obtained for future products and additional applications, the results of litigation, difficulties in collecting royalties, potential infringement of third-party intellectual property rights, factors affecting future income and resulting ability to utilize Cynosure’s NOLs, difficulties in combining the operations of Cynosure and Palomar, failure to receive approval from the stockholders of Palomar or Cynosure, failure to receive regulatory approvals for the merger, and/or other factors, which are detailed from time to time in Cynosure’s and Palomar’s SEC reports, including their reports on Form 10-K for the year ended December 31, 2012 and their quarterly reports on Form 10-Q. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

2

Additional Information About the Transaction

In connection with the proposed transaction, Cynosure intends to file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S-4 that will include a joint proxy statement of Cynosure and Palomar that also constitutes a prospectus of Cynosure. Palomar and Cynosure also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Cynosure and Palomar with the SEC at the SEC’s website at www.sec.gov You may also obtain these documents by contacting Cynosure’s Investor Relations Department at (617) 542-5300 or CYNO@investorrelations.com, or by contacting Palomar’s Investor Relations Department at (781) 993-2411 or ir@palomarmedical.com.

Cynosure and Palomar and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about Cynosure’s directors and executive officers is available in Cynosure’s proxy statement dated March 30, 2012 for its 2012 Annual Meeting of Stockholders and its Current Report on Form 8-K dated November 21, 2012. As of March 15, 2013, Cynosure’s directors and executive officers beneficially owned approximately 2.86 million shares, or 17.7%, of Cynosure’s common stock. Information about Palomar’s directors and executive officers is available in Palomar’s proxy statement dated April 4, 2012 for its 2012 Annual Meeting of Stockholders. As of March 15, 2013, Palomar’s directors and executive officers beneficially owned approximately 2.7 million shares, or 13.6%, of Palomar’s common stock. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Cynosure or Palomar using the sources indicated above.

This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

3

Today’s Presenters

Michael Davin Chairman, President and CEO Cynosure

Joseph Caruso Chairman, President and CEO Palomar

Tim Baker Executive Vice President, and CFO Cynosure

4

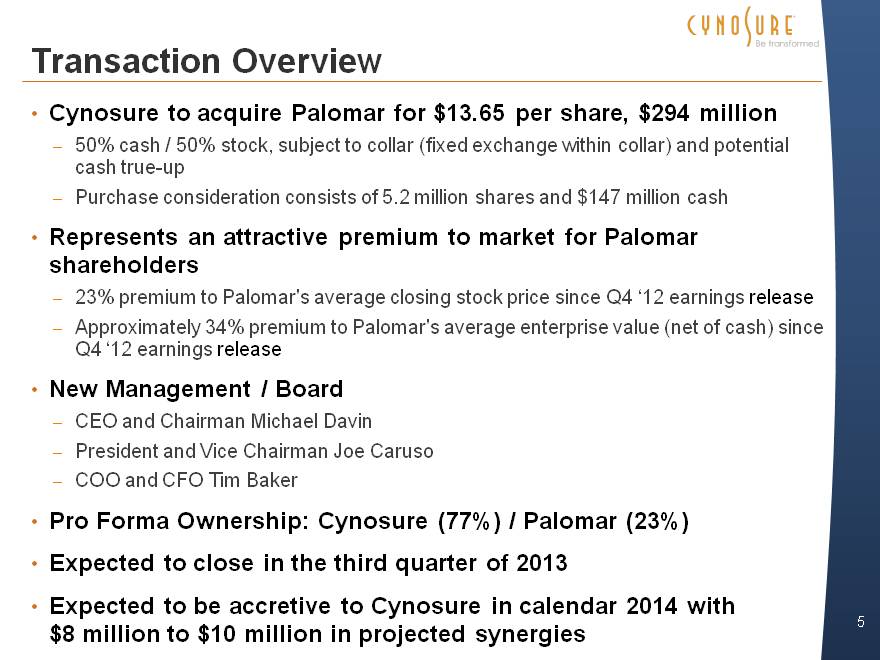

Transaction Overview

Cynosure to acquire Palomar for $13.65 per share, $294 million

50% cash / 50% stock, subject to collar (fixed exchange within collar) and potential cash true-up

Purchase consideration consists of 5.2 million shares and $147 million cash

Represents an attractive premium to market for Palomar shareholders

23% premium to Palomar’s average closing stock price since Q4 ‘12 earnings release

Approximately 34% premium to Palomar’s average enterprise value (net of cash) since Q4 ‘12 earnings release

New Management / Board

CEO and Chairman Michael Davin

President and Vice Chairman Joe Caruso

COO and CFO Tim Baker

Pro Forma Ownership: Cynosure (77%) / Palomar (23%)

Expected to close in the third quarter of 2013

Expected to be accretive to Cynosure in calendar 2014 with $8 million to $10 million in projected synergies

5

Transaction Rationale

For Cynosure’s shareholders:

Complements product portfolio and customer base

Provides new organic product and service revenues

Strengthens global distribution network

Opens new cross-selling opportunities

Enhances intellectual property position

Creates substantial cost synergies

For Palomar’s shareholders:

Attractive acquisition premium

Ownership in world’s premier aesthetic laser company

Participation in future growth opportunities

Broadens market reach of Palomar’s products and technologies

Opens new cross-selling opportunities

Industry’s broadest aesthetic laser capabilities and most comprehensive product portfolio

6

Combination Creates Market Leader

Both companies share a 20+ year heritage

Installed base of more than 20,000 systems

Portfolio spans laser and light-based energy sources

More than 80 patents

Global distribution network

Sales in more than 100 countries

Direct operations in nine countries

Diversified geographic mix

Attractive financial portfolio

Pro-forma 2012 revenue of $234 million

2012 revenue growth: Cynosure (+39%), Palomar professional revenue growth (+16 %, excluding royalties and other revenues)

GAAP profitability

Strong balance sheet: pro forma for the transaction $87 million net cash(1)

(1) Includes proceeds from in-the-money Palomar options assumed to be exercised and impact of change-of-control agreements and transaction costs.

7

Cynosure and Palomar Have Defined The Industry

The use of aesthetic lasers today has expanded by the innovation and execution of new applications of light based technologies.

Cynosure created new markets by introducing

The first minimally invasive laser lipolysis technology

The first minimally invasive cellulite reduction technology

The first picosecond technology for tattoo removal

Palomar created new markets by introducing

The first laser hair removal system

The first fractional technology

(1) Includes proceeds from in-the-money Palomar options assumed to be exercised and impact of change-of-control agreements and transaction costs.

8

Significant Market Opportunities

Sales of Light-Based Device Worldwide Procedure Volume for Platforms By Application Light-Based Aesthetic Treatments

($ in millions) (in millions)

Source: Medical Insight, Inc.

9

Complementary Aesthetic Franchises

Broad laser portfolio Intense pulsed light (IPL) heritage

Differentiated minimally invasive Advanced diode technology portfolio (Cellulaze, SmartLipo)

Fractional lasers / entry into low

Picosecond technology platform price segment (PicoSure)

Onychomycosis product

2012 Revenue: Publicly Traded Companies

10

Worldwide Distribution

2012 Pro Forma Professional Product Revenue

52%

North RoW

RoWAmerica 48%

48% 52%

11

Key Strengths of Combined Company

1 Hair removal franchise covering all three key modalities

2 Intense pulsed light (IPL) with emphasis on skin rejuvenation

3 Minimally invasive technologies

Cellulite reduction, Laser lipolysis and Body shaping

4 Innovative PicoSure picosecond multi-application laser platform

5 Low-cost non-ablative fractional laser

6 Advanced diode technology capabilities

7 Intelligent delivery systems

8 Home-use consumer market initiative

12

1 Case Study: Hair Removal

Launched in September 2012

13

1 Vectus Diode Hair Removal Laser

Launched in September 2012

State of the art Graphic User Interface

Skintel melanin optical density system to enhance efficacy and safety

Advanced contact cooling for increased client comfort

High peak power

Short-pulse capability

Uniform beams without “hot spots” for greater comfort

Interchangeable spot sizes

Large spot size option for fast coverage

Small spot size option for precise treatments

Photon Recycling for maximum treatment results

Fastest system on the market

14

2 A Leader in Intense Pulsed Light (IPL)

Legacy laser and IPL platform

Factory refurbished systems to address the lower priced market

Sold to certain countries until Icon receives registration

Replacement handpiece business provides an ongoing revenue stream

Next generation IPL + solid state laser platform

Launched Q2 2011

Interchangeable handpieces

Multiple applications

High peak powers for vessels

High average powers for hair

Non ablative and ablative skin resurfacing

Advanced cooling

Treatment tracking software

15

3 Leadership in Minimally Invasive Solutions

Laser lipolysis for removal of unwanted fat

First launched in 2006

Current 3rd generation SmartLipo TriPlex launched in Q4 2009

Long-lasting reduction of cellulite

US: Q1 2012 510(k) / Launch

Europe: 2011 CE Mark / Launch

Cellulite affects an estimated 85% of women over age 20

Intelligent energy delivery and disposable fibers

16

3 Leadership in Minimally Invasive Solutions

Laser-assisted lipolysis system

SlimLipo : Selective Laser Induced Melting Procedure

Addresses fastest growing segment of the cosmetic light-based market

Single use proprietary fiber tip with interchangeable tip designs for specific treatment areas

Fat transfer system

Unique filtering mechanism and optimized centrifugation to yield a higher quality of adipose tissue for reinjection

Higher graft volume survival and more predictable outcomes with less need to overfill

High margin disposable

17

4 Picosecond Technology Platform

Launched at AAD Annual Meeting (March 1, 2013)

Initial focus: Removal of tattoos and benign pigmented lesions

Future: Other aesthetic applications

Picosecond laser expected advantages:

Preserves skin integrity while achieving clear resolution of ink

Delivers photothermal and significant photomechanical effects

100x shorter pulse than current technology

Under development for ~10 years

Before

3 Month Post 4 Tx

An estimated 20% of the 45 million Americans with at least one tattoo want to have it removed

18

4 Differentiated Tattoo Removal

*Company estimates based on industry publications.

19

5 Emerge Fractional Laser

Easy to use

Portable

Small footprint

Low cost non-ablative fractional laser

High ROI

Complements Botox and fillers to build an aesthetic practice

Pay per procedure

Additional applications under development

20

6 Advanced Diode Technology

Under development for ~10 years

High powered diode lasers

Semiconductor material; Similar to computer chips producing very high intense light vs. electrical signals

Key attributes:

Very efficient energy source

Up to 70% efficient converting electrical power to light as compared to only a few percent efficiency for other lasers

Reliable

Ability to operate for thousands of hours or up to 10 times longer than other lasers without service

Low Cost

More powerful devices than competitors at the same price point

Size

Compact portable products that have a relatively small footprint

Speed

High average power means more shorter treatment times and profitable for physician

21

6 Advanced Diode Products

Vectus

High-powered diode hair removal system

Emerge

Non-ablative fractional laser

SlimLipo

Non-invasive laser lipolysis system

PaloVia

Home use skin rejuvenation laser

22

7 Intelligent Delivery Systems

Skintel Melanin • For use with Icon and Vectus Optical Density Reader

The only FDA-cleared melanin reader for use with light-based treatments

Enables treatment outcomes to be consistent and predictable to a level previously not attained

Accurately measures the melanin levels in skin

Wirelessly sets suggested treatment parameters for the best and safest clinical outcome

Provides additional safety and efficacy

Intelligent motion and temperature monitoring

Side-firing laser allows greater physician control

23

8 Home Use Initiative

Aesthetic market leader

Leadership through innovation Harmonious vision and mission Financial strength

Cynosure’s first home-use over the counter device for the treatment of facial wrinkles Received 510(k) clearance in July 2012 Expected to be launched commercially by Unilever in 2013

The first FDA cleared at-home laser clinically proven to reduce fine lines and wrinkles around the eyes

Provides a low cost platform for additional consumer applications

Low cost diode technology that can be leveraged in the professional market

24

Historical Revenues

Palomar

($ in millions)

Cynosure

$153.5

($ in millions)

Excludes $29.8MM in royalty revenues from settlement of Candela/Syneron litigation

Product Revenue CAGR: 13.1%

Product Revenue CAGR: 27.2%

Pro Forma Revenue

Combined revenue information as of 12/31/2012

Total revenue $234MM

Product revenue $184MM

($ in millions)

(Totals may not add due to rounding)

26

Acquisition Synergies

Expected cost synergies

Public company expenses

Board of directors

Administrative $8MM to $10MM in Facility synergies

Management Marketing

International distribution

Includes transaction costs, change-of-control costs and anticipated exercise of in-the-money Palomar options

Acquisition expected to be accretive to Cynosure in 2014

Post transaction (pro forma)

Shares outstanding: 22MM Cash balance: $87MM*

27

Combined Company Headquarters

28

Cynosure’s Successful History of Integration

Track record of successful business development

Acquisitions in 2011:

Eleme Medical (2/11): SmoothShapes

ConBio (6/11): RevLite and MedLite C Series

Exclusive worldwide distribution rights for PinPointe Foot Laser

Opportunistically will continue to evaluate strategic transactions

29

Summary

Combination of Cynosure and Palomar creates premier global aesthetic laser and light-based company

Comprehensive product/technology portfolio

Seasoned management team

Valuable intellectual property portfolio

Direct operations in nine countries

Best-in-class, worldwide network of international distributors

Strong balance sheet

Momentum with recent and pending product launches

PicoSure and Cellulaze

Vectus, ICON and Emerge

Home-use product in partnership with Unilever

Ample bandwidth for additional growth

30

Cynosure Signs Definitive Agreement to Acquire Palomar Medical Technologies

March 18, 2013