Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ADA-ES INC | d503536d8k.htm |

| EX-99.2 - EX-99.2 - ADA-ES INC | d503536dex992.htm |

Investor Presentation

March 2013

WWW.ADAES.COM

NASDAQ: ADES

Exhibit 99.1 |

Safe

Harbor ©

2013 ADA-ES, Inc.

This presentation includes forward-looking statements within the meaning of Section

21E of the Securities Exchange Act of 1934, which provides a "safe

harbor" for such statements in certain circumstances. The forward-looking statements

include statements or expectations regarding future contracts, projects, demonstrations

and technologies; amount and timing of production of RC; revenues, earnings,

cash flows and other financial measures; timing of the closing of contracts for

the lease or sale of RC facilities; future operations; our ability to capitalize on and expand our business to

meet opportunities in our target markets and profit from our proprietary technologies;

scope, timing and impact of current and anticipated regulations, legislation and

IRS guidance; future supply and demand; the ability of our technologies to

assist our customers in complying with government regulations and related matters. These statements

are based on current expectations, estimates, projections, beliefs and assumptions of

our management. Such statements involve significant risks and uncertainties.

Actual events or results could differ materially from those discussed in the

forward-looking statements as a result of various factors, including but not

limited to, changes in laws, regulations and IRS interpretations or guidance,

government funding, accounting rules, prices, economic conditions and market demand;

timing of laws, regulations and any legal challenges to or repeal of them; failure of

the RC facilities to produce coal that qualifies for tax credits; termination of

or amendments to the contracts for RC facilities; decreases in the production of

RC; failure to lease or sell the remaining RC facilities on a timely basis; our

inability to ramp up operations to effectively address expected growth in our

target markets; inability to commercialize our technologies on favorable terms; impact

of competition; availability, cost of and demand for alternative tax credit vehicles

and other technologies; technical, start-up and operational difficulties;

availability of raw materials and equipment; loss of key personnel; intellectual

property infringement claims from third parties; seasonality and other factors

discussed in greater detail in our filings with the Securities and Exchange

Commission (SEC). You are cautioned not to place undue reliance on such statements

and to consult our SEC filings for additional risks and uncertainties that may apply to

our business and the ownership of our securities. Our forward-looking

statements are presented as of the date made, and we disclaim any duty to update

such statements unless required by law to do so.

We refer to certain non-GAAP financial measures in this presentation.

Reconciliations of these non-GAAP financial measures to the most directly

comparable GAAP financial measures can be found within this presentation.

|

A

leader in providing emission control solutions serving the power generation

industry for more than 30 years Offers customers a portfolio of proprietary, low

CAPEX technologies to meet pollution control mandates

ADA-ES, Inc. (“ADA”) currently has 17 patents issued or

applications allowed

Clients include leading electric power utilities

We expect significant revenue, earnings and cash

flow growth as utilities respond to new regulations

Investment Highlights

-2-

©

2013 ADA-ES, Inc. |

28

Refined Coal (RC) facilities that qualify for Section 45 Tax Credits of

$6.47 / ton (2012 rate) of coal burned for 9 years, ending December 31,

2021 Currently operating 8 facilities, 5 of which are leased to RC investors

and operating at plants that have historically burned more than 15

MT/year in total. ADA receives between $1.50-$2.00/ton of pre-tax

income after payments to JV partners.

In final stages of contracts with an RC investor for two facilities

operating at plants that have historically burned 7.5 MT/year in

total. Finalization of the contracts is expected to trigger ~$15M in

prepayments.

These leased facilities are expected generate more than $75M in

annual revenues.

New

M-45-PC

TM

technology

significantly

expands

addressable

market

for remaining 12 facilities.

Investment Highlights

-3-

©

2013 ADA-ES, Inc. |

Emissions Control driven by Federal Mercury and Air Toxics

Standard (MATS) regulation (April 2012) which creates an

addressable equipment market of $1B in the next 3 years.

Won fleet wide contract for Activated Carbon Injection (ACI) systems

from a major US utility.

Acquired the assets of Bulk Conveyor Systems and a related entity in

August 2012 to enhance Dry Sorbent Injection (DSI) capabilities.

Won

DSI/ACI contract in November 2012 valued at up to $14M.

Enhanced Coal offering helps reduce mercury-

long-term revenue

potential through royalty and user fees.

CO

2

Capture technology development business partnering

with U.S. DOE, Electric Power Research Institute (EPRI) and

Southern Company.

Investment Highlights

-4-

©

2013 ADA-ES, Inc. |

Source:

U.S. EIA, March 2012 SOURCES

OF

U.S.

ELECTRICITY,

2011

Coal expected to provide ~ 40% of

America’s electricity in 2035 according

to Department of Energy

1,200 existing coal-fired power plants

in the US generate the majority of the

nation’s electricity, and consume

~ 900M to 1B tons of coal each year

EPRI estimates that the coal-fired

power industry will invest $275 billion

in retrofits through 2035

Lower coal prices benefit our

customers

11 new coal-fired power projects

currently have permits and are

expected to begin construction in the

next year

The energy in America’s recoverable

coal reserves is equivalent to 1 trillion

barrels of oil –

about equal 2/3rds of

the world’s known reserves

In order to maintain its leadership

position, coal must burn cleaner

Coal Energy

-5-

©

2013 ADA-ES, Inc.

42%

25%

19%

13%

1%

Coal

Natural Gas

Nuclear

Renewables

Petroleum |

-6-

©

2013 ADA-ES, Inc.

Wet Scrubber

$100M+

ADA’s ACI = $1.0M

ADA’s DSI = $3.0M

Refined Coal

$0 cost to utility

Enhanced Coal

No capital equipment

$1.0 -

$4.0M / year in

higher producer fuel cost

Benefits of $1.0 -

$4.0 / ton

of Western Coal burned

Emissions Control

Equipment

(NO

x

, SO2, Particulate)

ACI System for

mercury

VALUE PROPOSITION: LOW CAPEX EMISSIONS SOLUTIONS FOR EXISTING FLEET

ADA’s offerings do not require 10-20 years of extended plant life to justify

purchase Trades variable operating expenses for fixed capital costs Allows continued operation of plants that may otherwise be considered for closure |

-7-

©

2013 ADA-ES, Inc.

Scrubber

Additive

Filter

or ESP

SCR

DeNOx

Air

Preheater

Boiler

Flue Gas Desulfurization

(FGD) Scrubber

Coal

Bunker

Enhanced Coal

Refined Coal

Flue Gas

Conditioning

Activated Carbon

Injection (ACI)

Dry Sorbent

Injection (DSI)

PORTFOLIO OF EMISSIONS

CONTROL SOLUTIONS |

-8-

©

2013 ADA-ES, Inc.

R

EFINED

C

OAL

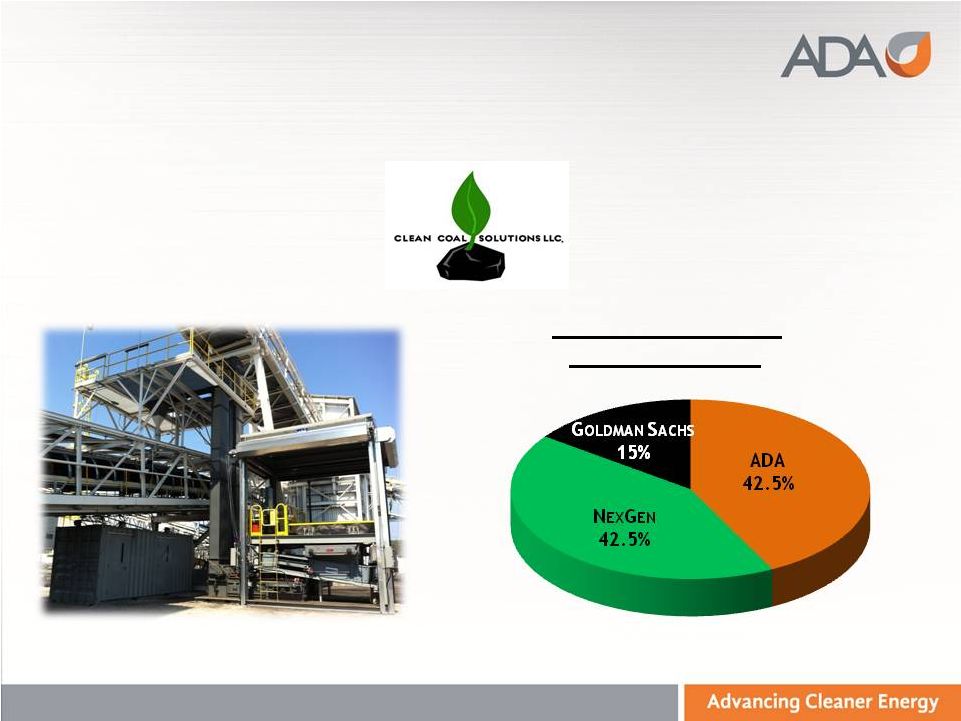

CLEAN

COAL SOLUTIONS JV

OWNERSHIP STRUCTURE

CLEAN COAL SOLUTIONS, LLC (CCS)

|

The

American

Jobs

Creation

Act

of

2004,

Section

45

of

the

IRC:

contains

provisions

to

incentivize

the

production

of

pollution

mitigating

Refined

Coal (RC)

via annually escalating tax credits per ton of coal burned. RC reduces mercury

by 40%+ and NOx emissions by 20%+ when that coal is burned.

Clean Coal Solutions (“CCS”) JV offers three technologies that produce

Section 45 Refined Coal

-

The

CyClean

,

M-45

and

M-45-PC

technologies

provide

on-site,

proprietary

pre-

treatment

to

Powder

River

Basin

(PRB)

and

Lignite

coals

for

use

in

cyclone

boilers,

circulating

fluid

bed

boilers

and

pulverized

coal

boilers.

Key Dates

June

2010:

Clean

Coal

Solutions

commences

operations

at

first

two

RC

facilities

December

2010:

Congress

extends

“placed-in-service”

deadline for new RC facilities

to 12/31/11

January

-

December

2011:

CCS

fabricates,

installs

and

“places-in-service”

26

additional RC units able to qualify for Section 45 tax credits

June

2011:

an

affiliate

of

Goldman

Sachs

purchases

a

15%

stake

in

CCS

for

$60M

2012

-

2014:

CCS

focused

on

capturing

the

value

of

Section

45

tax

credits

Refined Coal: Introduction & Overview

-9-

©

2013 ADA-ES, Inc. |

Requirements to

commence operations:

Operating permits obtained

from each relevant state

Approval from Public

Utilities Commissions (PUC)

in regulated states

Approval from coal and

transportation companies

Approval from plant owners

Contracts negotiated and

signed among CCS, RC

investor and power

companies

3 RC investors currently

engaged

Working with additional

RC investors for

remaining RC facilities

Utility

Receives:

value

of

$1.00 -

$4.00 / ton for

emissions reduction

Payment of ~$1/ton from

RC investor

RC Investor

Receives:

(a)$6.47 tax credit

through RC production, and

(b) tax deductions for rental,

utility and operating expenses

Pays:

~$1/ton to utility, ~$2/ton for

operating expenses and

~$3+/ton to CCS

CCS Receives:

~$3+/ton in consolidated

payments, net $1.50-$2/ton to

ADA of pre-tax income after

payments to ADA’s JV partners

Each RC facility can be monetized

(leased or sold) to generate revenue, or

operated by CCS for tax credit benefit to

offset future tax obligations

-10-

©

2013 ADA-ES, Inc.

REFINED

COAL: MONETIZATION

DYNAMICS |

Clean

Coal

operated

8

facilities

in

the

quarter,

4

of

which

were

leased

to

RC investors

In 4Q12 the four RC facilities operated by Clean Coal incurred operating expenses of

$6.5M but generated $13.3M in tax credits

The operation of these units included $51.4M in pass through coal

purchases/sales -11-

©

2013 ADA-ES, Inc.

2012

2011

2012

2011

$(000)

Rental income

9,802

$

3,203

$

36,855

$

20,110

$

Coal sales

51,365

16,865

157,898

19,952

Other income

11

191

147

191

Total RC Revenues

61,178

$

20,259

$

194,900

$

40,253

$

Cost of Revenues

57,984

$

16,126

$

179,204

$

20,201

$

Gross Profit

3,194

$

4,133

$

$15,696

$20,052

Gross Profit Margin Percentage

5%

20%

8%

50%

Adjusted Gross Profit*

$9,656

**

$36,105

**

Adjusted Gross Profit Margin Percentage*

98%

**

98%

**

* Adjusted gross profit and adjusted gross profit margin percentage excludes coal sales and

raw coal purchases and retained tonnage operating expenses. See Appendix for explanation

of non-GAAP measures. ** Information not meaningful. RC activities in 2011 were

focused on placing-in-service 26 additional RC facilities. Tons for leased

facilities 2.5

0.8

9.4

5.4

Tons retained

2.1

0.3

5.9

0.4

Total tons treated

4.6

1.1

15.3

5.8

Tax Credits generated by JV

$13.3

$1.8

$38.6

$2.8

Tax Credits to ADA (42.5%)

$5.7

$0.8

$16.4

$1.2

Operating Statistics (millions)

For the Three Months Ended

December 31,

December 31,

For the Year Ended

REFINED COAL |

REFINED COAL:

TO

P

ARTY

RC

I NVESTOR

Payment from

RC investor

CCS Self Monetization

3 Party RC Investor

CCS Consolidated financial example for a 3 MT/yr facility

Cash at Closing

(Pre-Paid Rent)

-12-

©

2013 ADA-ES, Inc.

rd

In final stages of contracts with two RC

investors for three facilities at plants that

historically burn more than 10MT/year. Two

of these facilities are currently being

operated by CCS

Payment from

RC investor

Operating

Expense

CAPEX

Cash at Closing

(Pre-Paid Rent)

($9M/yr)

$12M/yr

~$9M

F

INANCIAL

I

MPACT OF CONVERTING A

RC F

ACILITY FROM

CCS

O PERATION 3

($2M)

RD |

Impacts

of Leasing/Sales of Two Refined Coal Facilities in 1H13

-13-

©

2013 ADA-ES, Inc.

4Q12

1Q13

2Q13

Influx of Cash:

+$20M

+$8M

Income (Loss):

($5.4M)

($3.8M)

$6.6M

JV Retained Tons:

2.1M

1.6M

0

Tax Credits for JV

$13.3M

$10.2M

$0

Timing and impacts to future financial results from

leasing/sale of two RC Facilities burning approximately

7.5 MT/yr of RC operated by the JV in 2012 |

Clarity

on investment for RC Investors RC investors have some feedback from IRS on

parameters for RC investments Issuance of Private Letter Rulings (PLR) has

resumed IRS is considering publication of a formal Revenue Procedure to provide

Safe Harbor guidelines

Goldman affiliate and CCS have amended leases for first two RC facilities

Go forward PLR on one RC facility received, PUC approval needed

Expect to close two more facilities with Goldman affiliates in 2nd Q 2013

CCS has completed transactions with three different RC Investors

In negotiations for additional facilities with first three investors

In discussions with four additional RC investors

Potential for improved terms to CCS with continued success

Update on Refined Coal Activities

-14-

©

2013 ADA-ES, Inc. |

8 Units

currently in full-time operation With

closing

of

another

RC

facility

with

Goldman

affiliate,

6

of

the

8

will

have 3

party RC investors and are expected to generate on an annual basis:

•

Approximately 21 million tons of Refined Coal per year

•

Greater than $75 million in revenue

Two smaller facilities will continue to be operated by CCS generating

approximately $3 million in tax credits for ADA each year

8 Facilities committed to sites

Status ranges from initial contracts and permitting to final stages of contracts

One 3 MT facility expected to close 2Q13 once PUC approval is obtained

Other RC facilities could close late in 2013

A few facilities may be delayed until 2014 because of financial restructuring of the

plants

Final 12 facilities pursuing options to use new M-45-PC

technology

Significantly expands the addressable market to include many larger boilers

that use more than 5 MT of coal per year

Initial facilities using M-45-PC technology could be operating as

early as the second half of 2013

Update on Refined Coal Facilities

-15-

©

2013 ADA-ES, Inc.

rd

TM

TM |

($ IN

M) $20.1

$20.2

$158

$37

$300

$200

$7.0

$1.5

$16

$6

$30

$70

2011

2014-2021

(E)

2012

$500

$8.5

$40.3

$195

$22

$100

2011

2014-2021

(E)

2012

Coal Sales

Rental Revenue

Segment Income

Tax Credits

Equivalent

Annualized

MT

2011

2012

2014-2021

7

21

60

CCS revenues (consolidated)

ADA (excluding non-controlling interests)

-16-

©

2013 ADA-ES, Inc.

REFINED COAL PROGRESS

|

ACTIVATED CARBON INJECTION SYSTEMS

-17-

©

2013 ADA-ES, Inc.

Installed/installing ACI systems on over 60

boilers at coal-fired power plants

Sold through our BCSI subsidiary

EMISSIONS CONTROL DRY

SORBENT INJECTION SYSTEMS |

MATS

market for equipment continues to develop with bidding and award activity

accelerating EC backlog steadily increasing. Less than $1M at YE 2011, $4.5M at

6/30/2012 and $25.3M at YE 2012.

Won fleet-wide contracts

for ACI systems and DSI systems from different major US

utilities

Won joint ACI and DSI award highlighting company’s ability to provide a

comprehensive approach

ADA maintains its leadership position

$1-2 Billion annual chemical market expected to develop after 2015

following equipment installations

ADA’s Enhanced Coal offering will compete with AC and other coal additives

Could provide savings of $1-$4/ton of coal in reduced costs associated with

AC Offers non-corrosive alternative to other coal additives

Technology being proven out as part of Refined Coal technology

Marketing and testing currently ongoing

Update on Emissions Control

-18-

©

2013 ADA-ES, Inc. |

MATS is

projected to create $1 billion market for ACI & DSI Procurement/award activities

have commenced and ADA is responding to several RFPs 1) Total Expected Revenue

from Estimated Equipment Sales 2012-2015 (1)

-19-

©

2013 ADA-ES, Inc.

Chemical sales of~$1-2B/yr

starting in 2016

EMISSIONS CONTROL:

ACI & DSI MARKET

$350M

$50M

$285M

$600M

$0

$100

$200

$300

$400

$500

$600

$700

Expected Revenue

(~35% Market Share)

Wins to Date

Bids Outstanding

Expected Future RFPs |

Patented technology designed to enable Western

coals to burn with lower mercury emissions

U.S. burns up to 600 MT of Western Coal per year

$1.00-$4.00/ton in benefits to customer

Technology has been licensed to Arch Coal to apply

to their PRB coals at the mine

Royalty agreement: payments to ADA of up to $1.00/ton

based on a portion of the premium paid on Enhanced Coal

sales

ADA retained rights to apply technology at power

plants

Initial market: states with mercury regulations

already in place

MATS expected to expand market by 2015

Continued demonstration of technology to

customers

-20-

©

2013 ADA-ES, Inc.

MERCURY CONTROL:

ENHANCED COAL |

Developing proprietary solid sorbent capture

technology to capture CO2 from flue gas in

conventional coal-fired boilers

DOE and industry funding:

Phase I -

$3.8 M R&D at 1 KW pilot plant completed

in 2011

Phase II -

$20.5 M, 51-month contract to scale-up

technology to 1 MW

•

Entered Fabrication and Construction phase of 1 MW

plant in June 2012, estimated completion in October

2013

•

Testing in 2014

Advantages over competing technologies:

For customer: lower cost and less parasitic energy

For ADA: continuous revenues from sale of

proprietary chemical sorbents

-21-

©

2013 ADA-ES, Inc.

CO

2

CAPTURE

:

OVERVIEW |

-22-

©

2013 ADA-ES, Inc.

FINANCIAL RESULTS

OVERVIEW |

Retained tonnage has a dominating impact on GAAP Income Statement

~$158

million

of

2012

revenues

are

due

to

coal

sales

relating

to

retained

RC

facilities,

which

drive revenue growth

~$20 million of 2012 operating expenses are due to ~6 million retained

tons Financial benefit of tax credits generated will not been seen until future

quarters due to valuation allowance

*See appendix for explanation of non-GAAP financial measures

$ in Ms

2012

2011

Revenues

$212.5

$53.3

Gross Profit / Margin, Including Coal Sales

$19.9 / 9%

$24.4 /

46%

Adjusted Gross Profit / Margin, Excluding Coal Sales

and Retained Tonnage Operating Expense*

$40.4 / 74%

$26.7 /

80%

Operating (Loss) Income

$(8.4)

$3.0

-23-

©

2013 ADA-ES, Inc.

2012 VS. 2011

FINANCIAL SUMMARY:

|

in

Millions -24-

©

2013 ADA-ES, Inc.

12/31/12

12/31/11

Cash & Cash Equivalents

$9.7

$40.9

Long-term Liabilities

Shares Outstanding

$6.5

$9.5

10.0

8.0

BALANCE SHEET

HIGHLIGHTS |

RC

opportunities expected to provide substantial growth in revenues, profits and

cash flows in 2013, and consistent revenue streams through 2021

MATS compliance requirements are driving expected >$300

million total equipment revenues for ADA in next 3-4 years

Enhanced Coal technology and royalty opportunity expected

to produce additional growth in 2013 to 2015 and beyond

Developing solid sorbent capture technology to capture CO

2

from flue gas in conventional coal-fired boilers

Key Takeaways

-25-

©

2013 ADA-ES, Inc. |

Appendix

©

2013 ADA-ES, Inc. |

©

2013 ADA-ES, Inc.

For the

For the

Year Ended

Year Ended

$(000)

December 31, 2012

December 31, 2011

Coal sales and cost of raw coal

157,898

$

19,952

$

Operating costs of retained

tonnage 20,409

$

2,287

$

Adjusted gross profit and

adjusted gross margin percentage excludes coal sales and raw coal purchases and retained

tonnage operating expenses. Adjusted gross profit and adjusted gross profit percentage are

non-GAAP financial measures which are used to provide investors with greater

transparency with respect to the effect on gross margin from Clean Coal’s

operation of certain RC facilities for its own account. We believe these non-GAAP financial measures

provide meaningful supplemental information for investors regarding the performance of our

business and the effect on gross margin and gross margin percentage of the operation of

these RC facilities by Clean Coal for its own account.

NON-GAAP FINANCIAL

MEASURES |

Michael D. Durham, Ph.D., MBA

President & CEO

Mark H. McKinnies

SVP & CFO

(303) 734-1727

www.adaes.com

Graham Mattison

VP of Investor Relations

(646)-319-1417

graham.mattison@adaes.com

©

2013 ADA-ES, Inc.

CONTACTS

|