Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Sierra Income Corp | d494418dex311.htm |

| EX-31.2 - EX-31.2 - Sierra Income Corp | d494418dex312.htm |

| EX-32.1 - EX-32.1 - Sierra Income Corp | d494418dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 814-00924

Sierra Income Corporation

(Exact Name of Registrant as Specified in its Charter)

| Maryland | 45-2544432 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 375 Park Avenue, 33rd Floor, New York, NY 10152 | 10152 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(212) 759-0777

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $0.001 per share

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

There is no established market for the Registrant’s shares of common stock. The Registrant is currently conducting an ongoing public offering of its shares of common stock pursuant to a Registration Statement on Form N-2, which shares are being sold at a price of $10.00 per share, with discounts available for certain categories of purchasers, or at a price necessary to ensure that shares are not sold at a price per share, after deduction of selling commissions and dealer manager fees, that is below net asset value per share.

As of March 1, 2013, the Registrant had 3,466,133 shares of common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2013 Annual Meeting of Stockholders, which will be filed subsequent to the date hereof, are incorporated by reference into Part III of this Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission not later than 120 days following the end of the Registrant’s fiscal year ended December 31, 2012.

Table of Contents

TABLE OF CONTENTS

2

Table of Contents

In this annual report on Form 10-K, except as otherwise indicated, the terms:

| • | “we”, “us”, “our”, “Sierra” and the “Company” refer to Sierra Income Corporation, a Maryland corporation. |

| • | “SIC Advisors” and the “Adviser” refer to SIC Advisors LLC, our investment advisor; and |

| • | “Medley” refers, collectively, to the activities and operations of Medley Capital LLC, Medley, LLC, associated investment funds and their respective affiliates. |

| Item 1. | Business |

GENERAL

Sierra Income Corporation is a non-diversified closed-end management investment company incorporated in Maryland that has elected to be treated and is regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company intends to elect to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”) commencing with our first taxable year as a corporation. We are externally managed and advised by our investment adviser, SIC Advisors LLC (“SIC Advisors”) pursuant to an investment advisory agreement.

Our investment objective is to generate current income, and to a lesser extent, long-term capital appreciation. We intend to meet our investment objective by investing primarily in the debt of privately owned U.S. companies with a focus on senior secured debt, second lien debt and, to a lesser extent, subordinated debt. We will originate transactions sourced through our existing SIC Advisors’ network, and expect to acquire debt securities through the secondary market. We may make equity investments in companies that we believe will generate appropriate risk adjusted returns, although we do not expect this to be a substantial portion of our portfolio.

Our Advisor

Our investment activities are managed by our investment adviser, SIC Advisors, which is a registered investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act, and a majority owned subsidiary of Medley, LLC. SIC Advisors is responsible for sourcing potential investments, conducting due diligence on prospective investments, analyzing investment opportunities, structuring investments and monitoring our portfolio on an ongoing basis.

Seth Taube, Robert Comizio, Andrew Fentress, Brook Taube and Jeff Tonkel serve as principals of the Advisor and bring an average of more than 20 years of experience in principal finance, investment sourcing, credit analysis, transaction structuring, due diligence and investing.

Medley serves as our administrator and provides us with office space, equipment and other office services. The responsibilities of our administrator include overseeing our financial records, preparing reports to our stockholders and reports filed with the Securities and Exchange Commission (the “SEC”) and generally monitoring the payment of our expenses and the performance of administrative and professional services rendered to us by others.

Formation

Sierra Income Corporation was incorporated under the general corporation laws of the State of Maryland on June 13, 2011.

3

Table of Contents

On April 17, 2012, we successfully reached our minimum escrow requirement and officially commenced our operations by receiving gross proceeds of $10,000,000 in exchange for 1,108,033 shares of common stock sold to SIC Advisors. Our offering period is currently scheduled to terminate two years after the initial offering date, or April 16, 2014, unless extended. Since commencing operations, we have sold a total of 3,466,133 shares of common stock for total gross proceeds of $33,933,030. The proceeds from the issuance of common stock as presented in our statements of changes in net assets and statements of cash flows are presented net of selling commissions and dealer manager fees.

Investment Process Overview

We have a disciplined and repeatable process for executing, monitoring, structuring and exiting investments.

Identification and Sourcing. The Advisor’s investment team’s experience and reputation have allowed it to generate a substantial and continuous flow of attractive investment opportunities. The principals of SIC Advisors maintain a strong and diverse network which results in sustained and high quality deal flow. We believe that SIC Advisors’ breadth and depth of experience across strategies and asset classes, coupled with its significant relationships built over the last 20 years, make it particularly qualified to uncover, evaluate and aggressively pursue attractive investment opportunities. Leveraging its deal-flow network, the principals of SIC Advisors have compiled a robust current pipeline of transactions ready for possible inclusion in our portfolio.

Analysis and Due Diligence. The Advisor’s investment team believes that its expertise in underwriting, financial analysis and enterprise valuation enables it to identify compelling transactions among the numerous opportunities in the private market. Typically, a principal of the Advisor will lead a transaction and work closely with other SIC Advisors’ investment professionals on the various aspects of the due diligence process.

SIC Advisors maintains a rigorous due diligence process. Prior to making each investment, SIC Advisors subjects each potential portfolio company to an extensive credit review process, including analysis of market and operational dynamics as well as both historical and projected financial analysis. Liquidity, margin trend, leverage, free cash flow and fixed charge coverage statistics as well as their relation to industry metrics are closely scrutinized. Sensitivity analysis is performed on borrower projections with a focus on downside scenarios involving liquidations and asset sales. Areas of additional focus include management or sponsor experience, management compensation, competitive landscape, regulatory threats, pricing power, defensibility of market share and tangible asset values. As the Advisor deems necessary, background checks and tax compliance checks may be conducted on portfolio company management teams and key employees. When appropriate, our investment team personally contacts customers, suppliers and competitors and performs on-site, primary and in-depth due diligence to prove or disprove its investment theses.

For secondary purchases of investments, SIC Advisors generally seeks to perform the same level of analysis and due diligence as it performs for newly originated investments, except to the extent not feasible given the nature of these investments.

SIC Advisors routinely uses third parties to corroborate valuation, audit and industry specific diligence. Reputable and experienced legal counsel is engaged to evaluate and mitigate any security, regulatory, insurance, tax or other company-specific risk. In reviewing each investment, one or more of the principals of the Advisor may conduct site visits to portfolio companies and their various assets. The principals of the Advisor’s will also analyze corporate documents and review any and all relevant contracts. Finally, multiple investment committee approvals, each requiring a unanimous decision, are necessary to close and fund a transaction. All reimbursements to SIC Advisors for any third-party consulting agreements shall be subject to the limitations set forth in “Discussion of Expected Operating Plans — Reimbursement of Medley for Administrative Services.”

Structuring. For newly originated investments, SIC Advisors strives to negotiate an optimal combination of current and deferred interest payments, equity participation and prepayment penalties, along with suitable

4

Table of Contents

covenants and creditor rights which will generally be greater than the rights normally obtained by institutional investors in comparable transactions and may include such provisions as: specific rights to consult with and advise management, the right to inspect company books, records or facilities, as well as the right to review balance sheets and/or statements of income and cash flows of the company. SIC Advisors determines whether the investment structure, particularly the amount of debt, is appropriate for the portfolio company’s business, sometimes reassessing the investment’s risk/return profile and adjusting pricing and other terms as necessary. The Advisor’s investment team has in-depth restructuring, liquidation and bankruptcy experience, which is vital to success as a lender over market cycles.

For secondary purchases of investments, SIC Advisors reviews the legal documentation relating to the investments to ensure that they contain appropriate covenants and creditors’ rights and that we can maintain adequate control over the investments through the exercise of voting and approval rights.

Investment Approval. After SIC Advisors completes its final due diligence, each proposed investment is presented to its investment committee and subjected to extensive discussion and follow-up analysis, if necessary. A formal memorandum for each investment opportunity, which includes the results of business due diligence, multi-scenario financial analysis, risk-management assessment, results of third-party consulting work, background checks and structuring proposals is prepared for the investment committee.

Investment Monitoring and Exit. SIC Advisors believes in an active approach to asset management. Investment professionals, each with deep restructuring and workout experience, will support SIC Advisors portfolio-monitoring effort. The monitoring process includes frequent interaction with management, attending board of directors’ meetings, consulting with industry experts, working with third-party consultants and developing portfolio company strategy with equity investors. SIC Advisors’ investment team also evaluates financial reporting packages from portfolio companies that detail operational and financial performance. Data is entered into SIC Advisors’ proprietary, centralized electronic database. Additionally, this information is reviewed monthly as part of our portfolio monitoring process. To further support this process, SIC Advisors’ investment team conducts regular third-party valuation analyses and continually monitors future liquidity, covenant compliance and leading industry or economic indicators to maintain a proactive rather than reactive approach to asset management. We believe this hands-on approach helps in the early identification of any potential problems.

Each transaction is presented to the Investment Committee in a formal written report. All of our new investments and the exit or sale of an existing investment must be approved unanimously by the Investment Committee. In certain instances, our board of directors may also determine that its approval is required prior to the making of an investment.

Investment Structure

For newly originated investments, SIC Advisors strives to negotiate an optimal combination of current and deferred interest payments, equity participation and prepayment penalties, along with suitable covenants and creditor rights which will generally be greater than the rights normally obtained by institutional investors in comparable transactions and may include such provisions as: specific rights to consult with and advise management, the right to inspect company books, records or facilities, as well as the right to review balance sheets and/or statements of income and cash flows of the company. SIC Advisors determines whether the investment structure, particularly the amount of debt, is appropriate for the portfolio company’s business, sometimes reassessing the investment’s risk/return profile and adjusting pricing and other terms as necessary. The Advisor’s investment team has in-depth restructuring, liquidation and bankruptcy experience which is vital to success as a lender over market cycles.

For secondary purchases of investments, SIC Advisors reviews the legal documentation relating to the investments to ensure that they contain appropriate covenants and creditors rights and that we can maintain adequate control over the investments through the exercise of voting and approval rights.

5

Table of Contents

Investment Committee

The purpose of the investment committee is to evaluate and approve all investments by SIC Advisors. The investment committee is comprised of Seth Taube, Robert Comizio, Andrew Fentress, Brook Taube and Jeff Tonkel. Approval of an investment requires a unanimous vote of the investment committee. The committee process is intended to bring the diverse experience and perspectives of the committee members to the analysis and consideration of every investment. The investment committee also serves to provide consistency and adherence to SIC Advisors’ investment philosophies and policies. The investment committee also determines appropriate investment sizing and suggests ongoing monitoring requirements.

In addition to reviewing investments, investment committee meetings serve as a forum to discuss credit views and outlooks. Potential transactions and deal flow are also reviewed on a regular basis. Members of the investment committee are encouraged to share information and views on credits with the investment committee early in their analysis. This process improves the quality of the analysis and assists the deal team members to work more efficiently.

Managerial Assistance

As a BDC, we will offer, and must provide upon request, managerial assistance to certain of our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. We may receive fees for these services and will reimburse Medley, as our administrator, for its allocated costs in providing such assistance subject to review and approval by our board of directors. Medley will provide such managerial assistance on our behalf to portfolio companies that request this assistance.

Competition

Our primary competitors to provide financing to private and middle-market companies are public and private funds, commercial and investment banks, commercial finance companies, other BDCs, small business investment companies (“SBIC”) and private equity and hedge funds. Some competitors may have access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC or to the distribution and other requirements we must satisfy to maintain our favorable RIC tax status.

Staffing

We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided by individuals who are employees of SIC Advisors and Medley, pursuant to the terms of the investment advisory agreement and the administration agreement. Our day-to-day investment operations are managed by our investment advisor. In addition, we reimburse Medley for our allocable portion of expenses incurred by it in performing its obligations under the administration agreement, including our allocable portion of the cost of our officers and their respective staffs.

Administration

We entered into an administration agreement with Medley Capital LLC (the “Administration Agreement”) pursuant to which Medley Capital LLC furnishes us with administrative services necessary to conduct our day-to-day operations. Medley Capital LLC is reimbursed for administrative expenses it incurs on the Company’s behalf in performing its obligations. Such costs are reasonably allocated to us on the basis of assets, revenues,

6

Table of Contents

time records or other reasonable methods. We do not reimburse Medley Capital LLC for any services for which it receives a separate fee or for rent, depreciation, utilities, capital equipment or other administrative items allocated to a controlling person of Medley Capital LLC. Medley Capital LLC is an affiliate of SIC Advisors.

Information Available

We maintain a website at http://www.sierraincomecorp.com . We make available, free of charge, on our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission, or SEC. Information contained on our website is not incorporated by reference into this annual report on Form 10-K and you should not consider information contained on our website to be part of this annual report on Form 10-K or any other report we file with the SEC.

INVESTMENTS

We have built a diverse portfolio that includes senior secured first lien term loans, senior secured second lien term loans, senior secured notes and warrants.

The following table shows the portfolio composition by industry grouping at fair value at December 31, 2012:

| Fair Value | Percentage of Total Portfolio |

|||||||

| Telecommunications |

3,241,338 | 10.5 | % | |||||

| Restaurant & Franchise |

3,220,943 | 10.4 | % | |||||

| Mining, Steel, Iron, and Nonprecious metals |

3,139,624 | 10.3 | % | |||||

| Oil and Gas |

2,994,449 | 9.8 | % | |||||

| Automobile |

2,923,700 | 9.6 | % | |||||

| Retail Stores |

1,508,330 | 4.9 | % | |||||

| Business Services |

1,495,145 | 4.9 | % | |||||

| Machinery (Nonagriculture, Nonconstruction, Nonelectric) |

1,364,001 | 4.5 | % | |||||

| Chemicals |

1,285,207 | 4.2 | % | |||||

| Retail |

1,179,375 | 3.9 | % | |||||

| Personal and Nondurable Consumer Products (Manufacturing Only) |

1,176,009 | 3.8 | % | |||||

| Healthcare, Education, and Childcare |

1,062,500 | 3.5 | % | |||||

| Gaming |

1,045,312 | 3.4 | % | |||||

| Industrial |

1,029,400 | 3.4 | % | |||||

| Energy |

1,010,000 | 3.3 | % | |||||

| Software |

985,343 | 3.2 | % | |||||

| Grocery |

964,535 | 3.2 | % | |||||

| Aerospace & Defense |

505,000 | 1.7 | % | |||||

| Electronics |

450,000 | 1.5 | % | |||||

|

|

|

|

|

|||||

| Total |

$ | 30,580,211 | 100.0 | % | ||||

|

|

|

|

|

|||||

7

Table of Contents

The following table sets forth certain information as of December 31, 2012 for each portfolio company in which we had an investment. Other than these investments, our only formal relationships with our portfolio companies are the managerial assistance that we provide upon request and the board observer or participation rights we may receive in connection with our investment.

| Portfolio Company |

Industry |

Interest |

Maturity |

Principal |

Amortized |

Fair Value |

Percentage of |

|||||||||||||||||

| Non-Controlled/non-Affiliated investments – 148.3%(3) |

||||||||||||||||||||||||

| Senior Secured Notes – 124.6%(3) |

||||||||||||||||||||||||

| Atkore International, Inc. (2) |

Mining, Steel, Iron, and Nonprecious Metals |

9.875% | 1/1/2018 | $ | 750,000 | $ | 733,129 | $ | 801,600 | 3.9 | % | |||||||||||||

| Bon-Ton Stores, Inc. |

Retail Stores | 10.625% | 7/15/2017 | 1,000,000 | 914,795 | 951,200 | 4.6 | % | ||||||||||||||||

| Cengage Learning, Inc. |

Healthcare, Education, and Childcare |

11.500% | 4/15/2020 | 1,250,000 | 1,348,108 | 1,062,500 | 5.2 | % | ||||||||||||||||

| Checkers Drive-In restaurants, Inc. |

Restaurant & |

11.000% | 12/1/2017 | 1,500,000 | 1,504,956 | 1,504,956 | 7.3 | % | ||||||||||||||||

| Dispensing Dynamics International, Inc.(2) |

Personal and Nondurable |

12.500% | 1/1/2018 | 1,200,000 | 1,176,009 | 1,176,009 | 5.7 | % | ||||||||||||||||

| EarthLink, Inc. |

Telecommunications | 10.500% | 4/1/2016 | 900,000 | 950,574 | 957,420 | 4.6 | % | ||||||||||||||||

| Exide Technologies(2) |

Machinery (Nonagriculture, Nonconstruction, Nonelectric) |

8.625% | 2/1/2018 | 1,600,000 | 1,336,979 | 1,364,001 | 6.6 | % | ||||||||||||||||

| Fifth and Pacific Companies, Inc. |

Retail Stores | 10.500% | 4/15/2019 | 500,000 | 557,130 | 557,130 | 2.7 | % | ||||||||||||||||

| Green Field Energy Services, Inc. |

Oil and Gas | 13.000% | 11/15/2016 | 512,000 | 494,791 | 494,791 | 2.4 | % | ||||||||||||||||

| IDQ Holdings, Inc. |

Automobile | 11.500% | 4/1/2017 | 1,000,000 | 1,044,468 | 1,078,200 | 5.2 | % | ||||||||||||||||

| Ineos Finance PLC. |

Chemicals | 7.500% | 5/1/2020 | 1,250,000 | 1,285,207 | 1,285,207 | 6.2 | % | ||||||||||||||||

| Innovation Ventures, Inc. |

Retail | 9.500% | 8/1/2019 | 1,250,000 | 1,224,724 | 1,179,375 | 5.7 | % | ||||||||||||||||

| Integra Telecom, Inc.(2) |

Telecommunications | 10.750% | 4/15/2016 | 750,000 | 722,600 | 757,500 | 3.7 | % | ||||||||||||||||

| Linc Energy Finance (USA), Inc.(2) |

Oil and Gas | 12.500% | 10/31/2017 | 1,000,000 | 980,715 | 980,715 | 4.8 | % | ||||||||||||||||

| Maxim Crane Works Holdings, Inc. |

Industrial | 12.250% | 4/15/2015 | 1,000,000 | 1,010,037 | 1,029,400 | 5.0 | % | ||||||||||||||||

| Mohegan Tribal Gaming Authority |

Gaming | 11.500% | 11/1/2017 | 1,000,000 | 1,045,312 | 1,045,312 | 5.1 | % | ||||||||||||||||

| Pittsburgh Glass Works, LLC |

Automobile | 8.500% | 4/15/2016 | 1,425,000 | 1,325,728 | 1,311,000 | 6.4 | % | ||||||||||||||||

| Prince Minerals Holding |

Mining, Steel, Iron, |

11.500% | 12/15/2019 | 1,200,000 | 1,186,001 | 1,248,000 | 6.1 | % | ||||||||||||||||

| Satmex Mexicanos, S.A. de C.V. |

Telecommunications | 9.500% | 5/15/2017 | 1,000,000 | 1,035,564 | 1,035,564 | 5.0 | % | ||||||||||||||||

| Shale-Inland Holdings, Inc. |

Energy | 8.750% | 11/15/2019 | 1,000,000 | 993,624 | 1,010,000 | 4.9 | % | ||||||||||||||||

| Sizzling Platter, LLC (2) |

Restaurant & Franchise |

12.250% | 4/15/2016 | 1,652,000 | 1,715,987 | 1,715,987 | 8.3 | % | ||||||||||||||||

| Tempel Steel Company(2) |

Mining, Steel, Iron, and Nonprecious Metals |

12.000% | 8/15/2016 | 1,115,000 | 1,102,986 | 1,090,024 | 5.3 | % | ||||||||||||||||

| Tower International, Inc.(2) |

Automobile | 10.625% | 9/1/2017 | 500,000 | 518,324 | 534,500 | 2.6 | % | ||||||||||||||||

| U.S. Well Services, LLC(2) |

Oil and Gas | 14.500% | 2/15/2017 | 1,518,405 | 1,504,921 | 1,503,828 | 7.3 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Senior Secured Notes |

25,712,669 | 25,674,219 | ||||||||||||||||||||||

8

Table of Contents

| Portfolio Company |

Industry |

Interest |

Maturity |

Principal |

Amortized |

Fair Value |

Percentage of |

|||||||||||||||||

| Senior Secured Loans - First Lien – 9.5%(3) |

||||||||||||||||||||||||

| Great Atlantic & Pacific Tea Company(2) |

Grocery | LIBOR + 9%, 2% Floor |

3/13/2017 | 942,875 | 964,535 | 964,535 | 4.7 | % | ||||||||||||||||

| WeLocalize, Inc.(2) |

Business Services | LIBOR + 8%, 2% Floor |

11/19/2015 | 459,478 | 459,478 | 459,478 | 2.2 | % | ||||||||||||||||

| WeLocalize, Inc.(2) |

Business Services | LIBOR + 9%, 2% Floor, 1.25% PIK |

11/19/2015 | 538,617 | 538,617 | 538,617 | 2.6 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Senior Secured Loans - First Lien |

1,962,630 | 1,962,630 | ||||||||||||||||||||||

| Senior Secured Loans - Second Lien – 14.2%(3) |

||||||||||||||||||||||||

| Aderant North America, Inc.(2) |

Electronics | LIBOR + 8.75%, 1.25% Floor |

6/20/2019 | 450,000 | 450,000 | 450,000 | 2.2 | % | ||||||||||||||||

| Camp Systems International, Inc. |

Aerospace & |

LIBOR + 8.75%, 1.25% Floor |

11/30/2019 | 500,000 | 490,523 | 505,000 | 2.4 | % | ||||||||||||||||

| Deltek, Inc(2). |

Software | LIBOR + 8.75%, 1.25% Floor |

10/31/2019 | 1,000,000 | 985,343 | 985,343 | 4.8 | % | ||||||||||||||||

| Securus Technologies, Inc. |

Communications | LIBOR + 9.00%, 1.75% Floor |

5/31/2018 | 500,000 | 490,854 | 490,854 | 2.4 | % | ||||||||||||||||

| Travelport LLC |

Business Services | LIBOR + 9.5%, 1.5% Floor | 11/22/2015 | 500,000 | 487,178 | 497,050 | 2.4 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Senior Secured Loans - Second Lien |

2,903,898 | 2,928,247 | ||||||||||||||||||||||

| Warrants/Equity - 0.1%(3) |

||||||||||||||||||||||||

| Green Field Energy Services, Inc., Warrants |

Oil & Gas | 20,000 | 20,000 | 15,115 | 0.1 | % | ||||||||||||||||||

| U.S. Well Services, LLC(2) |

Oil & Gas | 1,518 | 152 | 0 | 0.0 | % | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Warrants/Equity |

20,152 | 15,115 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Non-controlled/ non-affiliated investments - |

30,599,349 | 30,580,211 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| US Government Treasuries – 29.1%(3) |

||||||||||||||||||||||||

| US Treasury Bill |

US Government Treasuries | 1.375% | 1/15/2013 | 6,000,000 | 6,003,022 | 6,003,000 | 29.1 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Investments and US Government Treasuries – 177.4%(3) |

$ | 36,602,371 | $ | 36,583,211 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| (1) | All of our investments are domiciled in the United States except for Satmex Mexicanos S.A. de C.V., which is domiciled in Mexico. |

| (2) | An affiliated fund that is managed by an affiliate of SIC Advisors LLC also holds an investment in this security. |

| (3) | Percentage is based on net assets of $20,622,982 as of December 31, 2012. |

As of December 31, 2012, the weighted average yield based upon original cost on our portfolio investments was approximately 11.0%, and 16.0% of our income-bearing investment portfolio bore interest based on floating rates, such as LIBOR, and 84.0% bore interest at fixed rates. The weighted average yield on income producing investments is computed based upon a combination of the cash flows to date and the contractual interest payments, principal amortization and fee notes due at maturity without giving effect to closing fees received, base management fees, incentive fees or general fund related expenses. Each floating rate loan uses LIBOR as its floating rate index. For each floating rate loan, the projected fixed-rate equivalent coupon rate used to forecast

9

Table of Contents

the interest cash flows was calculated by adding the interest rate spread specified in the relevant loan document to the fixed-rate equivalent LIBOR rate, duration-matched to the specific loan, adjusted by the LIBOR floor and/or cap in place on that loan.

Overview of Portfolio Companies

Set forth below is a brief description of the business of our portfolio companies as of December 31, 2012.

| Portfolio Company |

Brief Description of Portfolio Company |

| Aderant, Inc. |

Aderant, Inc. is a provider of enterprise software solutions to law firms and other professional services organizations globally. Aderant’s software is tailored to address the industry-specific requirements of law firms and professional services organizations, with solutions spanning financial management, time and billing, practice management, rules based calendar, matter management systems, customer relationship management, business intelligence and performance management functions. |

| Atkore International, Inc. |

Atkore International is a global manufacturer of fabricated steel tubes, pipes, pre-wired armored cables, cable management systems and metal framing systems. Atkore operates 24 manufacturing facilities and 15 distribution facilities located predominantly in the Midwest region of the U.S., strategically near raw material suppliers and customers. |

| Bon-Ton Stores, Inc. |

The Bon-Ton Stores, Inc. is a regional department store company operating 272 stores in 23 states throughout the northern United States. The stores, carrying its namesake nameplate, serve the Mid-Atlantic and New England regions of the United States, extending to upstate New York and throughout Pennsylvania. Other chains operated by the company include Bergner’s, Boston Store, Carson Pirie Scott, Elder-Beerman, Herberger’s, Parisian (Detroit-area only) and Younkers. |

| CAMP Systems International, Inc. |

CAMP Systems International, Inc. provides aircraft maintenance tracking software in the United States and internationally. CAMP’s software solutions include various web-based software for aircraft maintenance management, flight scheduling systems and inventory management. CAMP’s maintenance software currently supports over 190 makes and models. |

| Cengage Learning |

Cengage Learning, formerly known as Thomson Learning, is the #2 higher education publisher in the United States and the #1 foreign education publisher in China. In the United States, Cengage produces a variety of print and digital education solutions and services for the academic, career, school, research and professional markets. In international markets, Cengage distributes educational solutions across all major academic disciplines. |

| Checkers Drive-In Restaurants |

Checkers Drive-In Restaurants, Inc. is an operator of drive-thru hamburger quick service restaurants. Checkers operates a unique drive-in format with no dining rooms to minimize rent expense. Most restaurants are located in high density areas and near other fast food chains such as McDonalds, Wendy’s and Burger King. |

10

Table of Contents

| Portfolio Company |

Brief Description of Portfolio Company |

| Deltek, Inc. |

Deltek, Inc. is a leading provider of project focused enterprise software and information solutions. Deltek’s software is a comprehensive solution in the service resource planning marketplace, providing end-to-end management of business development and project lifecycles. |

| Dispensing Dynamics International, Inc. |

Dispensing Dynamics International, Inc. is a leading designer and manufacturer of paper towel, bath tissue, soap and odor dispensing systems utilized in commercial Away-From-Home (“AFH”) washroom settings. Dispensing Dynamics International has the #1 market share in the North America value-added paper dispensing industry, including electronic, mechanical hands free, center pull dispensers and hybrid roll paper towel dispensers. Products are primarily located in high-traffic AFH washrooms found in airports, stadiums, office buildings, restaurants, schools and universities and general retail environments. |

| EarthLink, Inc. |

EarthLink, Inc. provides IT, network and communication services to individual and business consumers. In late 2010, EarthLink acquired ITC DeltaCom and One Communication and gained ownership or indefeasible rights of use to about 28,000 route miles of long haul or metro fiber, and in the process transformed itself into a competitive local exchange carrier that generates most of its revenue from selling to business customers. |

| Exide Technologies |

Exide Technologies is a global manufacturer of lead-acid batteries that include starting, lighting and ignition batteries for cars, trucks, off-road vehicles, agricultural and construction vehicles and industrial energy that supplies both motive power and network power applications. Exide operates 33 manufacturing plants, including 24 battery plants, in 11 countries located across the United States, Europe, Australia and India. |

| Fifth & Pacific Companies, Inc. |

Fifth & Pacific Companies, Inc. engages in the design and marketing of a range of apparel and accessories. Fifth & Pacific Companies provides luxurious and casual apparel and accessories for women, men and children. Fifth & Pacific Companies sells its products to department store chains and specialty retail store customers under the brand names Kate Spade, Juicy Couture and Lucky Brand. |

| Green Field Energy Services, Inc. |

Green Field Energy Services, Inc. is an independent oilfield services company that provides a wide range of services to oil and natural gas drilling and production companies to help develop and enhance the production of hydrocarbons. Green Field Energy Service’s services include hydraulic fracturing, cementing, coiled tubing, pressure pumping, acidizing and other pumping services. |

| IDQ Holdings, Inc. |

IDQ Holdings, Inc. is provider of high-quality and easy-to-use air conditioning (“A/C”) maintenance and repair solutions for the do-it-yourself automotive aftermarket in North America. IDQ Holdings |

11

Table of Contents

| Portfolio Company |

Brief Description of Portfolio Company |

| offers 650 SKUs over two product categories: value added products and complimentary products. Value added products include all-in-one A/C recharge kits and refrigerant blends with performance enhancing additives. Complimentary products include straight refrigerants, specialty chemicals, HVAC solutions, and commercial products and accessories. |

| Ineos Finance PLC |

Ineos Finance PLC owns and operates highly integrated, world-class chemical facilities and production technologies. Ineos Finance has leading global market positions for a majority of its key products, a strong and stable customer base and a highly experienced management team. Ineos Finance operates 29 manufacturing sites in eight countries throughout the world, including petrochemical facilities in Europe which are co-located and fully integrated with refineries. |

| Innovation Ventures, LLC |

Innovation Ventures, LLC is a producer of energy shots, marketed under the brand name 5-hour Energy. 5-hour Energy is a blend of B-vitamins, caffeine, amino acids and nutrients, contains no sugar or herbal stimulants and has 4 calories. The energy shots are sold in convenience stores, mass merchandisers, drug stores, warehouse clubs, supermarkets, dollar stores and other channels primarily in the United States. |

| Integra Telecom, Inc. |

Integra Telecom, Inc. is a regional fiber-based local exchange carrier that provides integrated communication services across 35 metropolitan areas in 11 states of the Western United States. Integra owns (directly or under indefeasible rights of use) a fiber optic network with over 8,000 route miles of fiber, consisting of 3,000 route miles of metro fiber and 5,000 route miles of long haul fiber. Within its metro network, Integra has direct fiber connection to approximately 1,847 locations. |

| Linc Energy Finance (USA), Inc. |

Linc Energy Finance (USA), Inc. was formed for the purpose of acquiring crude oil and gas producing properties in the United States. Linc Energy Finance is now engaged in the production, development and exploitation of crude oil and gas in Texas, Louisiana, Wyoming and Alaska. |

| Maxim Crane Holdings, Inc. |

Maxim Crane Holdings, Inc. is a leading U.S. provider of crane services that support maintenance and expansion needs of energy-related infrastructure, industrial and building construction markets. |

| Mohegan Tribal Gaming Authority |

Mohegan Tribal Gaming Authority owns, operates and develops gaming facilities in the United States. The Company is owned by the Mohegan Tribe of Indians of Connecticut, a federally-recognized Native American tribe with an approximately 507-acre reservation in Connecticut, including the Mohegan Sun, a 185-acre gaming facility and Pocono Downs, a 400,000 square foot facility in Pennsylviania. |

| Pittsburgh Glass Works, LLC |

Pittsburgh Glass Works, LLC is a manufacturer and distributor of a full range of automotive glass products including windshields, |

12

Table of Contents

| sidelites, backlites and sunroofs. Pittsburgh Glass Works has three business units, including Original Equipment Manufacturing, Automotive Replacement Glass and Insurance and Services. |

| Prince Mineral Holding Corporation |

Prince Mineral Holding Corporation is a global distributor of specialty mineral products and niche industrial additives. Prince Mineral sources, processes and distributes its products for use in brick, glass, agriculture, foundry, refractory and steel, oil and gas and coal end markets. |

| Satelites Mexicanos, S.A. de C.V. |

Satelites Mexicanos, S.A. de C.V. is a provider of fixed satellite services in the Americas. Satelites Mexicanos was formed in 1997 in connection with the Mexican government’s privatization of satellite communications. |

| Securus Technologies, Inc. |

Securus Technologies, Inc. is an independent provider of inmate telecommunications in North America, delivering turnkey solutions to over 850,000 inmates at roughly 2,200 correctional facilities across 44 states in the United States, the District of Columbia and Canada. |

| Shale-Inland Holdings, Inc. |

Shale-Inland Holdings, Inc. is a distributor and supplier of pipe, valves, fittings , related products and technical solutions to the energy and industrial sectors and a processor of stainless steel and aluminum products. |

| Sizzling Platter LLC |

Sizzling Platter LLC is a restaurant management company that operates 146 Little Caesars locations, 23 Sizzler locations and 13 other limited service restaurants in the Western United States as a franchisee. Sizzling Platter is the largest franchisee of Little Ceasars locations in the United States. |

| Tempel Steel Company |

Tempel Steel Company is an independent manufacturer of magnetic steel laminations used in the production of motors and transformers. Tempel Steel has manufacturing operations in the United States, Mexico, China and India, a distribution and steel services center in Canada and distribution centers in Pennsylvania and California. |

| The Great Atlantic & Pacific Tea Company, Inc. |

The Great Atlantic & Pacific Tea Company, Inc (“A&P”), was the first national food chain in the United States and is now a leading food retailer in the Northeastern United States. A&P holds a leading market share in the New York metro region, and in other regions in New York, New Jersey and Pennsylvania. |

| Tower International, Inc. |

Tower International, Inc. is an integrated global manufacturer of engineered structural metal components and assemblies primarily serving automotive original equipment manufacturers. Tower offers its automotive customers a broad product portfolio, supplying body-structure stampings, frames and other chassis structures, as well as complex welded assemblies, for small and large cars, crossovers, pickups and sport utility vehicles. |

13

| Portfolio Company |

Brief Description of Portfolio Company |

Table of Contents

| Travelport LLC |

Travelport LLC provides transaction processing solutions and data to companies operating in the travel industry worldwide. Travelport offers aggregation, search and transaction processing services to travel suppliers and travel agencies allowing travel agencies to search, compare, process and book itinerary and pricing options across various travel suppliers. |

| U.S. Well Services LLC |

U.S. Wells Services LLC is a Houston, Texas-based oilfield service provider currently contracted to engage in pressure pumping and related services, including high-pressure hydraulic fracturing in unconventional oil and natural gas basins. |

| Welocalize, Inc. |

Welocalize, Inc. provides technology-enabled localization services to large multinational clients through a suite of software as a service tools. Localization is the process of taking various forms of content designed for use in one country and making it linguistically and culturally appropriate. |

INVESTMENT ADVISORY AGREEMENT AND FEES

Investment Advisory Fees

We pay SIC Advisors a fee for its services under the Investment Advisory Agreement consisting of two components: a management fee and an incentive fee. We believe that this fee structure benefits stockholders by aligning the compensation of our Advisor with our overall investment performance. The cost of both the management fee and the incentive fee are ultimately borne by our stockholders.

Base Management Fee

The base management fee calculated at an annual rate of 1.75% of our gross assets payable quarterly in arrears. For purposes of calculating the base management fee, the term “gross assets” includes any assets acquired with the proceeds of leverage. The Advisor benefits when we incur debt or use leverage. For the first quarter of our operations, the base management fee was calculated based on the initial value of our gross assets. Subsequently, the base management fee is calculated based on our gross assets at the end of each completed calendar quarter. Base management fees for any partial quarter are appropriately prorated.

Incentive Fee

The incentive fee is divided into two parts: (i) a subordinated incentive fee on income and (ii) an incentive fee on capital gains. Each part of the incentive fee is outlined below.

The subordinated incentive fee on income is earned on pre-incentive fee net investment income and is determined and payable in arrears as of the end of each calendar quarter during which the Investment Advisory Agreement is in effect. If the Investment Advisory Agreement is terminated, the fee will also become payable as of the effective date of the termination.

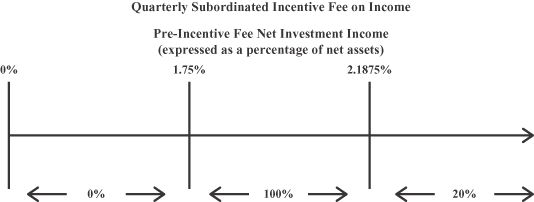

The subordinated incentive fee on income for each quarter is calculated as follows:

| • | No subordinated incentive fee on income is payable in any calendar quarter in which the pre-incentive fee net investment income does not exceed a quarterly return to investors of 1.75% per quarter on our net assets at the end of the immediately preceding fiscal quarter. We refer to this as the quarterly preferred return. |

14

| Portfolio Company |

Brief Description of Portfolio Company |

Table of Contents

| • | All of our pre-incentive fee net investment income, if any, that exceeds the quarterly preferred return, but is less than or equal to 2.1875% on our net assets at the end of the immediately preceding fiscal quarter in any quarter, is payable to the Advisor. We refer to this portion of our subordinated incentive fee on income as the catch up. It is intended to provide an incentive fee of 20% on all of our pre-incentive fee net investment income when our pre-incentive fee net investment income exceeds 2.1875% on our net assets at the end of the immediately preceding fiscal quarter in any quarter. |

| • | For any quarter in which our pre-incentive fee net investment income exceeds 2.1875% on our net assets at the end of the immediately preceding fiscal quarter, the subordinated incentive fee on income equals 20% of the amount of our pre-incentive fee net investment income, because the preferred return and catch up will have been achieved. |

| • | Pre-incentive fee net investment income is defined as interest income, dividend income and any other income accrued during the calendar quarter, minus our operating expenses for the quarter, including the base management fee, expenses payable under the Administration Agreement, any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. |

The following is a graphical representation of the calculation of the quarterly subordinated incentive fee on income:

Percentage of Pre-Incentive Fee Net Investment Income Allocated to Quarterly Incentive Fee

The incentive fee on capital gains is earned on investments sold and is determined and payable in arrears as of the end of each calendar year during which the Investment Advisory Agreement is in effect. In the case the Investment Advisory Agreement is terminated, the fee will also become payable as of the effective date of such termination. The fee equals 20% of our realized capital gains, less the aggregate amount of any previously paid incentive fee on capital gains. Incentive fee on capital gains is equal to our realized capital gains on a cumulative basis from inception, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis. In order to provide an incentive for our Advisor to successfully execute a merger transaction involving us that is financially accretive and/or otherwise beneficial to our stockholders even if our Advisor will not act as an investment adviser to the surviving entity in the merger, we may seek exemptive relief from the SEC to allow us to pay our Advisor an incentive fee on capital gains in connection with our merger with and into another entity. Absent the receipt of such relief, our Advisor will not be entitled to an incentive fee on capital gains or any other incentive fee in connection with any such merger transaction.

Because of the structure of the subordinated incentive fee on income and the incentive fee on capital gains, it is possible that we may pay such fees in a quarter where we incur a net loss. For example, if we receive pre-incentive fee net investment income in excess of the 1.75% on our net assets at the end of the immediately

15

Table of Contents

preceding fiscal quarter for a quarter, we will pay the applicable incentive fee even if we have incurred a net loss in the quarter due to a realized or unrealized capital loss. Our Advisor will not be under any obligation to reimburse us for any part of the incentive fee it receives that is based on prior period accrued income that we never receive as a result of a subsequent decline in the value of our portfolio.

The fees that are payable under the Investment Advisory Agreement for any partial period will be appropriately prorated. The fees will also be calculated using a detailed policy and procedure approved by our Advisor and our board of directors, including a majority of the independent directors, and such policy and procedure will be consistent with the description of the calculation of the fees set forth above.

Our Advisor may elect to defer or waive all or a portion of the fees that would otherwise be paid to it in its sole discretion. Any portion of a fee not taken as to any month, quarter or year will be deferred without interest and may be taken in any such other month prior to the occurrence of a liquidity event as our Advisor may determine in its sole discretion.

Reimbursements

In accordance with the terms of the Investment Advisory Agreement, SIC Advisors is responsible for paying all other organization and offering expenses incurred by the Company until such time that the Company has raised $300 million in gross proceeds from the offering of shares of its common stock in its public offering or one or more private offerings. After such time, the Company will be responsible for paying such expenses on its own behalf. In addition, the Company has agreed to reimburse SIC Advisors for other organization and offering expenses incurred by SIC Advisors on behalf of the Company in an amount equal to 1.25% of the gross proceeds raised by the Company in such offerings. Consequently, if we raise less than $300 million in gross proceeds from the offering of shares of our common stock, pursuant to the prospectus or one or more private offerings, we will reimburse SIC Advisors in an amount equal to 1.25% of the gross proceeds from such offerings and, as a result, only be required to pay other organization and offering expenses in an amount equal to such amount.

After the $300 million threshold has been surpassed, we will be responsible for paying all future other organization and offering expenses incurred by us and will continue to reimburse SIC Advisors for any other organization and offering expenses that it previously incurred on our behalf and for which it has not yet been reimbursed by us, at a rate of 1.25% of the gross proceeds from the offering of shares of our common stock in its public offering or one or more private offerings until the earlier of (a) the end of the offering period, or (b) such time that SIC Advisors has been repaid in full. We are targeting other organization and offering expense ratio of 1.25% over the course of the offering period for the offering of shares of our common stock in its public offering, which is currently scheduled to terminate two years from the initial public offering date, or April 16, 2014.

Advisory Services

Under the terms of the Investment Advisory Agreement, our Advisor is responsible for the following:

| • | determining the composition and allocation of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| • | identifying, evaluating, negotiating and structuring the investments we make; |

| • | performing due diligence on prospective portfolio companies; |

| • | executing, closing, servicing and monitoring the investments we make; |

| • | determining the securities and other assets that we will purchase, retain or sell; and |

| • | providing us with such other investment advisory, research and related services as we may, from time to time, reasonably require for the investment of our capital. |

Under the Investment Advisory Agreement, SIC Advisors has a fiduciary responsibility for the safeguarding and use of all of our funds and assets. SIC Advisors is also subject to liability under both the 1940 Act and the Advisors Act for a breach of these fiduciary duties.

16

Table of Contents

SIC Advisors is primarily responsible for initially identifying, evaluating, negotiating and structuring our investments. These activities are carried out by its investment team and subject to the oversight of SIC Advisors’ senior investment personnel. Each investment that we make will require the unanimous approval of the investment committee before the investment may be made. Certain affiliated co-investment transactions may require the additional approval of our independent directors.

SIC Advisors’ services under the Investment Advisory Agreement are not exclusive, and it is free to furnish similar services to other entities so long as its services to us are not impaired.

Indemnification of Our Advisor

The Investment Advisory Agreement provides that the Advisor and its officers, directors, persons associated with SIC Advisors, stockholders (and owners of the stockholders), controlling persons and agents are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) incurred by them in or by reason of any pending, threatened or completed action, suit, investigation or other proceedings arising out of or otherwise based on the performance of any of SIC Advisors’ duties or obligations under the Investment Advisory Agreement, as applicable, or otherwise as our investment adviser, (i) to the extent such damages, liabilities, cost and expenses (A) are not fully reimbursed by insurance and (B) do not arise by reason of misfeasance, bad faith, or negligence in SIC Advisors’ performance of such duties or obligations, or SIC Advisors’ reckless disregard of such duties or obligations, and (ii) otherwise to the fullest extent such indemnification is consistent with the provisions of our articles of incorporation, the 1940 Act, the laws of the State of Maryland and other applicable law.

Term; Effective Date

The Investment Advisory Agreement was approved by our board of directors on April 5, 2012 and became effective as of April 17, 2012. Unless earlier terminated as described below, the Investment Advisory Agreement will remain in effect for a period of two years from the date it first became effective and will remain in effect from year-to-year thereafter if approved annually by a majority of our directors who are not interested persons and either our board of directors or the holders of a majority of our outstanding voting securities.

Our board of directors held an in-person meeting on April 5, 2012, in order to consider and approve our Investment Advisory Agreement. In its consideration of the Investment Advisory Agreement, the board of directors focused on information it had received relating to, among other things: (a) the nature, quality and extent of the advisory and other services to be provided to us by our investment adviser, SIC Advisors; (b) comparative data with respect to advisory fees or similar expenses paid by other business development companies with similar investment objectives; (c) our projected operating expenses and expense ratio compared to business development companies with similar investment objectives; (d) any existing and potential sources of indirect income to SIC Advisors from its relationships with us and the profitability of those relationships; (e) information about the services to be performed and the personnel performing such services under the investment management agreement; (f) the organizational capability and financial condition of SIC Advisors and its affiliates; and (g) various other factors.

Based on the information reviewed and the discussions, the board of directors, including a majority of the non-interested directors, concluded that the investment management fee rates and terms are reasonable in relation to the services to be provided and approved the Investment Advisory Agreement as being in the best interests of our shareholders.

REGULATION

General

We have elected to be regulated as a BDC under the 1940 Act. A BDC is a special category of investment company under the 1940 Act that was added by Congress to facilitate the flow of capital to private companies

17

Table of Contents

and small public companies that do not have efficient or cost-effective access to public capital markets or other conventional forms of corporate financing. BDCs make investments in private or thinly-traded public companies in the form of long-term debt and/or equity capital, with the goal of generating current income or capital growth.

BDCs are closed-end funds that elect to be regulated as BDCs under the 1940 Act. As such, BDCs are subject to only certain provisions of the 1940 Act, as well as the Securities Act and the Exchange Act. BDCs are provided greater flexibility under the 1940 Act than are other investment companies in dealing with their portfolio companies, issuing securities, and compensating their managers. BDCs can be internally or externally managed and may qualify to elect to be taxed as RICs for federal tax purposes. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates, principal underwriters, and affiliates of those affiliates or underwriters. The 1940 Act requires that a majority of a BDC’s directors be persons other than “interested persons,” as that term is defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or withdraw our election as a BDC unless approved by a majority of our outstanding voting securities.

The 1940 Act defines “a majority of the outstanding voting securities” as the lesser of: (1) 67% or more of the voting securities present at a meeting if the holders of more than 50% of our outstanding voting securities are present or represented by proxy or (2) 50% of our voting securities.

We will generally not be able to issue and sell our common stock at a price below net asset value per share. We may, however, sell our common stock, or warrants, options, or rights to acquire our common stock, at a price below the then-current net asset value of our common stock if our board of directors determines that such sale is in our best interests and the best interests of our stockholders, and our stockholders approve such sale. In addition, we may generally issue new shares of our common stock at a price below net asset value in rights offerings to existing stockholders, in payment of dividends, and in certain other limited circumstances.

As a BDC, we will not generally be permitted to invest in any portfolio company in which our Advisor or any of their affiliates currently have a controlling interest or to make any co-investments with our Advisor or any of its affiliates without an exemptive order from the SEC. We may, however, invest alongside our Advisor and its affiliates’ other clients in certain circumstances where doing so is consistent with applicable law and SEC staff interpretations. For example, we may invest alongside such other clients’ accounts consistent with guidance promulgated by the SEC Staff permitting us and such other clients’ accounts to purchase interests in a single class of privately placed securities so long as certain conditions are met, including that no investment advisor, acting on our behalf or on behalf of other clients, negotiates any term other than price. We may also invest alongside such other clients as otherwise permissible under regulatory guidance, applicable regulations and our Advisor’s allocation policies. We and SIC Advisors have submitted an exemptive application to the SEC to permit us to participate in negotiated co-investments with other funds managed by Medley or affiliated advisers in a manner consistent with our investment objective, strategies and restrictions as well as regulatory requirements and other pertinent factors, subject to the conditions therein, including that, in each case, that our board of directors determines that it would be advantageous for us to do so. However, there is no assurance that we will obtain such exemptive relief.

Business Development Company Regulation: Qualifying Assets

Under the 1940 Act, a BDC may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company’s total assets. As discussed in greater detail below, the 1940 Act defines qualifying assets as principally including certain investments by a BDC in eligible portfolio companies. An eligible portfolio company is defined under the 1940 Act as any issuer which:

| 1. | is organized under the laws of, and has its principal place of business in, the United States; |

| 2. | is not an investment company (other than a small business investment company wholly owned by the BDC) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

18

Table of Contents

| 3. | satisfies any of the following: |

| a. | does not have any class of securities that is traded on a national securities exchange; |

| b. | has a class of securities listed on a national securities exchange, but has an aggregate market value of outstanding voting and non-voting common equity of less than $250 million; |

| c. | is controlled by a BDC, either alone or as part of a group acting together, and the BDC has an affiliated person who is a director of the eligible portfolio company; or |

| d. | is a small and solvent company having total assets of not more than $4 million and capital and surplus of not less than $2 million. |

As relevant to our proposed business, the principal categories of qualifying assets under the 1940 Act are the following:

| 1. | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. |

| 2. | Securities of any eligible portfolio company that we control. |

| 3. | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| 4. | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company. |

| 5. | Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities. |

| 6. | Cash, cash equivalents, U.S. government securities, or high-quality debt securities maturing in one year or less from the time of investment. |

In addition, a BDC must have been organized and have its principal place of business in the United States and be operated for the purpose of making investments in the types of securities described in (1), (2) or (3) above.

Business Development Company Regulation: Control and Managerial Assistance to Portfolio Companies

In order to count portfolio securities as qualifying assets for the purpose of the 70% test, we must either control the issuer of the securities or make available to the issuer of the securities significant managerial assistance without the issuer having to request such assistance. Where we purchase such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available managerial assistance includes any arrangement whereby the BDC, through its directors, officers, or employees, offers to provide, and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company.

Temporary Investments

Pending investment in other types of “qualifying assets,” as described above, our investments may consist of cash, cash equivalents, U.S. government securities, or high-quality debt securities maturing in one year or less from the time of investment so that 70% of our total assets are qualifying assets. Typically, we intend to invest in U.S. Treasury bills or in repurchase agreements, provided that such agreements are fully collateralized by cash or securities issued by

19

Table of Contents

the U.S. government or its agencies. A repurchase agreement involves the purchase by an investor, such as us, of a specified security and the simultaneous agreement by the seller to repurchase it at an agreed-upon future date and at a price that is greater than the purchase price by an amount that reflects an agreed-upon interest rate. There is no percentage restriction on the proportion of our assets that may be invested in such repurchase agreements. However, if more than 25% of our total assets constitute repurchase agreements from a single counterparty, we may not meet the diversification requirements in order to qualify as a RIC for federal income tax purposes. Thus, we do not intend to enter into repurchase agreements with a single counterparty in excess of this limit. We expect that our Advisor will monitor the creditworthiness of the counterparties with which we enter into repurchase agreement transactions.

Senior Securities

We are permitted, under specified conditions, to issue multiple classes of debt and one class of stock senior to our common stock if our asset coverage, as defined in the 1940 Act, is at least equal to 200% immediately after each such issuance. In addition, while any senior securities remain outstanding, we must prohibit any distribution to our stockholders or the repurchase of such securities or shares unless we meet the applicable asset coverage ratios at the time of the distribution or repurchase. We may also borrow amounts up to 5% of the value of our total assets for temporary or emergency purposes without regard to asset coverage.

Code of Ethics

We have adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act that establishes procedures for personal investments and restricts certain personal securities transactions. Persons subject to these codes may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements. We have attached our code of ethics as an exhibit to the registration statement. You may also read and copy our code of ethics at the SEC’s Public Reference Room located at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, our code of ethics is available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may also obtain copies of our code of ethics, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, NE, Washington, DC 20549.

Compliance Policies and Procedures

We and our Advisor have each adopted and implemented written compliance policies and procedures reasonably designed to prevent violation of the federal securities laws and are required to review these compliance policies and procedures annually for their adequacy and the effectiveness of their implementation. Our chief compliance officer is responsible for administering our compliance policies and procedures and our Advisor’s chief compliance officer is responsible for administering the compliance policies and procedures for the Advisor.

Proxy Voting Policies and Procedures

We have delegated our proxy voting responsibility to SIC Advisors. SIC Advisors will vote proxies according to our proxy voting policies and procedures which are set forth below. These guidelines are reviewed periodically by the Advisor as well as our board of directors, and, accordingly, are subject to change.

As an investment advisor registered under the 1940 Act, SIC Advisors has a fiduciary duty to act solely in the best interests of its clients. As part of this duty, it recognizes that it must vote client securities in a timely manner free of conflicts of interest and in the best interests of its clients. These policies and procedures for voting proxies for the investment advisory clients of SIC Advisors are intended to comply with Section 206 of, and Rule 206(4)-6 under, the 1940 Act.

20

Table of Contents

Proxy Policies

SIC Advisors will vote proxies relating to our securities in a manner that it believes, in its discretion, to be in the best interest of our stockholders. It will review on a case-by-case basis each proposal submitted for a stockholder vote taking into account relevant factors, including: (1) the impact on the value of the securities; (2) the anticipated costs and benefits associated with the proposal; (3) the effect on liquidity; and (4) customary industry and business practices. Although SIC Advisors will generally vote against proposals that may have a negative impact on its clients’ portfolio securities, it may vote for such a proposal if there exists compelling long-term reasons to do so.

The proxy voting decisions of SIC Advisors are made by its portfolio managers and investment professionals under the supervision of SIC Advisors legal/compliance department. To ensure that its vote is not the product of a conflict of interest, it will require that: (a) the recommended vote be approved by a member of SIC Advisors legal/compliance department prior to being submitted to the custodian; (b) associates involved in the decision making process or vote administration are prohibited from revealing how SIC Advisors intends to vote on a proposal in order to reduce any attempted influence from interested parties; and (c) where a material conflict of interest exists, the chief compliance officer designate an individual or group who can impartially help decide how to resolve such conflict.

Proxy Voting Records

You may obtain information, without charge, regarding how SIC Advisors voted proxies with respect to our portfolio securities by making a written request for proxy voting information to: Chief Compliance Officer, c/o Sierra Income Corporation at 375 Park Ave, 33rd Floor, New York, NY 10152.

Other

We expect to be periodically examined by the SEC for compliance with the 1940 Act.

We are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to us or our stockholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

We and SIC Advisors adopted written policies and procedures reasonably designed to prevent violation of the federal securities laws, and will review these policies and procedures annually for their adequacy and the effectiveness of their implementation. We and SIC Advisors have designated a chief compliance officer to be responsible for administering the policies and procedures.

Election to Be Taxed as a RIC

As a BDC, we intend to elect to be treated as a RIC under Subchapter M of the Code. As a RIC, we generally will not have to pay corporate-level federal income taxes on any income that we distribute to our stockholders from our tax earnings and profits. To obtain and maintain our qualification as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as described below). In addition, in order to obtain and maintain RIC tax treatment, we must distribute to our stockholders, for each taxable year, at least 90% of our “investment company taxable income,” which is generally our net ordinary income plus the excess, if any, of realized net short-term capital gains over realized net long-term capital losses, or the Annual Distribution Requirement.

21

Table of Contents

Taxation as a Regulated Investment Company

If we:

| • | maintain our qualification as a RIC; and |

| • | satisfy the Annual Distribution Requirement, |

then we will not be subject to federal income tax on the portion of our income we distribute (or are deemed to distribute) to stockholders. We will be subject to U.S. federal income tax at the regular corporate rates on any income or capital gains not distributed (or deemed distributed) to our stockholders.

We will be subject to a 4% nondeductible federal excise tax on certain undistributed income unless we distribute in a timely manner an amount at least equal to the sum of (1) 98% of our net ordinary income for each calendar year, (2) 98.2% of our capital gain net income for the one-year period ending October 31 in that calendar year and (3) any income recognized, but not distributed, in preceding years and on which we paid no federal income tax, or the Excise Tax Avoidance Requirement. We generally will endeavor in each taxable year to avoid any U.S. federal excise tax on our earnings.

In order to maintain our qualification as a RIC for federal income tax purposes, we must, among other things:

| • | continue to qualify as a BDC under the 1940 Act at all times during each taxable year; |

| • | derive in each taxable year at least 90% of our gross income from dividends, interest, payments with respect to certain securities, loans, gains from the sale of stock or other securities, net income from certain “qualified publicly traded partnerships,” or other income derived with respect to our business of investing in such stock or securities, or the 90% Income Test; and |

| • | diversify our holdings so that at the end of each quarter of the taxable year: |

| • | at least 50% of the value of our assets consists of cash, cash equivalents, U.S. Government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5% of the value of our assets or more than 10% of the outstanding voting securities of the issuer; and |

| • | no more than 25% of the value of our assets is invested in the securities, other than U.S. government securities or securities of other RICs, of one issuer, of two or more issuers that are controlled, as determined under applicable Code rules, by us and that are engaged in the same or similar or related trades or businesses or of certain “qualified publicly traded partnerships,” or the Diversification Tests. |