Attached files

| file | filename |

|---|---|

| 8-K - EQUAL ENERGY LTD. | equal8k.htm |

Equal Energy Ltd.

Annual Information Form

For the year ended December 31, 2012

March 14, 2013

(I)

TABLE OF CONTENTS

|

ABBREVIATIONS, CONVENTIONS AND CONVERSION FACTORS

|

1

|

|

GLOSSARY OF TERMS

|

2

|

|

FORWARD LOOKING STATEMENTS

|

3

|

|

CORPORATE STRUCTURE

|

6

|

|

BUSINESS AND STRATEGY

|

8

|

|

PRINCIPAL PROPERTIES

|

10

|

|

STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION

|

11

|

|

RISK FACTORS

|

23

|

|

CAPITAL STRUCTURE

|

30

|

|

DIVIDENDS

|

32

|

|

DIRECTORS AND OFFICERS

|

32

|

|

LEGAL PROCEEDINGS

|

37

|

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

|

37

|

|

REGISTRAR AND TRANSFER AGENT

|

37

|

|

MATERIAL CONTRACTS

|

37

|

|

INTEREST OF EXPERTS

|

37

|

|

AUDIT COMMITTEE INFORMATION

|

38

|

|

ADDITIONAL INFORMATION

|

|

|

Appendix A – Audit Committee Mandate

|

A-1

|

|

Appendix B – Report on Reserves Data by Independent Qualified Reserves Evaluator on Form 51-102F2

|

B-1

|

|

Appendix C – Report of Management and Directors on Reserve Data on Form 51-101F3

|

C-1

|

|

Appendix D – Cease Trade Orders, Bankruptcies, Penalties or Sanctions

|

D-1

|

Unless otherwise indicated, all of the information provided in this Annual Information Form is stated as at December 31, 2010.

|

491097 v1

|

(II) - -

ABBREVIATIONS, CONVENTIONS AND CONVERSION FACTORS

ABBREVIATIONS

|

Oil and Natural Gas Liquids

|

Natural Gas

|

||

|

bbl

|

barrel

|

Bcf

|

Billion cubic feet of natural gas

|

|

bbls

|

barrels

|

GJ

|

gigajoule

|

|

bbls per day

|

barrels of oil per day

|

GJ per day

|

gigajoule per day

|

|

bbls/d

|

barrels of oil per day

|

LNG

|

Liquefied Natural Gas

|

|

boe

|

barrels of oil equivalent

|

mcf

|

thousand cubic feet of natural gas

|

|

boe/d

|

barrels of oil equivalent per day

|

mcf/d

|

thousand cubic feet of natural gas per day

|

|

Mstb

|

thousand stock tank barrels

|

Mmcf

|

million cubic feet of natural gas

|

|

mbbl

|

Thousand barrels of oil

|

Mmcf/d

|

million cubic feet of natural gas per day

|

|

Mboe

|

Thousands of barrels of oil equivalent

|

||

|

mmbtu

|

millions of British Thermal Units

|

||

|

NGL

|

natural gas liquid

|

||

|

NGLs

|

natural gas liquids

|

||

|

Other

|

|

|

API

|

American Petroleum Institute

|

|

°API

|

an indication of the specific gravity of crude oil measured on the API gravity scale. Liquid petroleum with a specified gravity of 28°API or higher is generally referred to as light crude oil

|

|

NI 51-101

|

National Instrument 51-101

|

|

NYMEX

|

New York Mercantile Exchange

|

|

Q1

|

first quarter of the year - January 1 to March 31

|

|

Q2

|

second quarter of the year - April 1 to June 30

|

|

Q3

|

third quarter of the year - July 1 to September 30

|

|

Q4

|

fourth quarter of the year - October 1 to December 31

|

|

SEC

|

Securities and Exchange Commission

|

|

US$

|

United States dollars

|

|

WTI

|

West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for crude oil of standard grade

|

BOE’s may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 mcf to one boe is based on an energy equivalency conversion method primarily applicable at the burner tip and does not necessarily represent a value equivalence at the wellhead.

CONVENTIONS

Unless otherwise indicated, all references herein to dollar amounts are in Canadian dollars (CDN$) and references herein to “$” or “dollars” are to Canadian dollars or “M$” are to a thousand Canadian dollars or “MM$” are to a million Canadian dollars.

The information set out in this AIF is stated as at December 31, 2012 unless otherwise indicated. Capitalized terms used but not defined in the text are defined in the Glossary.

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

CONVERSION FACTORS

The following table sets forth certain standard conversions from Standard Imperial Units to the International System of Units (or metric units):

|

To Convert from

|

To

|

Multiply by

|

|

Mcf

|

Cubic metres

|

28.174

|

|

Cubic metres

|

Cubic feet

|

35.494

|

|

Bbls

|

Cubic metres

|

0.159

|

|

Cubic metres

|

Bbls oil

|

6.290

|

|

Feet

|

Metres

|

0.305

|

|

Metres

|

Feet

|

3.281

|

|

Miles

|

Kilometres

|

1.609

|

|

Kilometres

|

Miles

|

0.621

|

|

Acres

|

Hectares

|

0.4047

|

|

Hectares

|

Acres

|

2.471

|

GLOSSARY

The following are defined terms used in this Annual Information Form (“AIF”):

“6.75% Debentures” means the convertible unsecured junior subordinated debentures of the Company due March 31, 2016;

“ABCA” means the Business Corporations Act (Alberta);

“COGE Handbook” means the standards set out in the Canadian Oil and Gas Evaluation Handbook;

“Common Shares” means common share in the capital stock of the corporation;

“Credit Facility” means (A) a $105.0 million revolving credit facility with a syndicate of lenders, and (B) a $20.0 million operating facility with Bank of Nova Scotia, as lender, provided pursuant to the Second Amended and Restated Credit Agreement;

“Debentures” means the 6.75% Debentures;

“Delaware GCL” means Delaware general corporation law;

“EEC” means Enterra Energy Corp., a corporation amalgamated under the ABCA;

“EEFI” means Equal Energy Finance Inc., a corporation incorporated under the laws of the State of Delaware;

“EEF(D)I” means Equal Energy Finance (Delaware) Inc., a corporation incorporated under the laws of the State of Delaware;

“EEPP” means the Equal Energy Production Partnership, a partnership organized pursuant to the laws of Alberta;

“EEPC” means Equal Energy Partner Corp., a corporation incorporated under the ABCA;

“EEUSHI” means Equal Energy US Holdings Inc., a corporation incorporated under the laws of the State of Delaware;

“EEUSI” means Equal Energy US Inc., a corporation incorporated under the laws of the State of Oklahoma;

“Equal”, “Equal Energy”, the “Corporation” or the “Company” means Equal Energy Ltd., a corporation amalgamated under the laws of the Province of Alberta;

“GAAP” means generally accepted accounting principles in Canada;

“Haas” means Haas Petroleum Engineering Services, Inc., independent petroleum engineering consultants;

“Haas Report” means the independent engineering evaluation of certain oil, NGL and natural gas interests of the Corporation prepared by Haas dated February 6, 2013 and effective December 31, 2012;

“Non-Resident” means (a) a person who is not a resident of Canada for the purposes of the Tax Act and any applicable income tax convention; or (b) a partnership that is not a Canadian partnership for the purposes of the Tax Act;

“Operating Subsidiaries” means collectively, the direct and indirect subsidiaries of the Corporation that own and operate assets for the benefit of the Corporation (with the material Operating Subsidiaries being EEPC, EEPP, EEUSI, EEUSHI, EEFI, and EEF(D)I;

“Reserve Reports” means, collectively, the McDaniel Report and Haas Report;

“Second Amended and Restated Credit Agreement” means the second amended and restated syndicated credit agreement dated June 25, 2010, between Equal Energy and the Bank of Nova Scotia;

“Shareholder” means a holder of Common Shares;

“Tax Act” means the Income Tax Act (Canada) and the regulations thereunder, as amended from time to time;

“Trust” means Enterra Energy Trust, an unincorporated open-ended investment trust established under the laws of Alberta pursuant to the Trust Indenture;

“Trust Indenture” means the amended and restated trust indenture dated November 25, 2003 among Olympia Trust Company, as trustee, Luc Chartrand as settlor, and EEC, as may be amended, supplemented, and restated from time to time;

“Trust Units” means trust units of the Trust;

Exchange Rate Information

Except where otherwise indicated, all references to dollar amounts in this AIF are stated in Canadian dollars. The following table sets forth the US/Canada exchange rates on the last trading day of the years indicated as well as the high, low and average rates for such years. The high, low and average exchange rates for each year were identified or calculated from spot rates in effect on each trading day during the relevant year. The exchange rates shown are expressed as the number of U.S. dollars required to purchase one Canadian dollar. These exchange rates are based on those published on the Bank of Canada’s website as being in effect at approximately the

closing rate on each trading day.

|

Year Ended December 31

|

||||||||||||

|

2012

|

2011

|

2010

|

||||||||||

|

Year End

|

1.0051 | 0.9832 | 1.0054 | |||||||||

|

High

|

0.9576 | 0.9430 | 0.9278 | |||||||||

|

Low

|

1.0371 | 1.0583 | 1.0054 | |||||||||

|

Average

|

1.0105 | 1.0117 | 0.9709 | |||||||||

In the preparation of the reserve tables in the section ‘Statement of Reserves Data and Other Oil and Gas Information” there are certain tables which present the net present value of the future revenue streams of the Oklahoma reserves. In order to combine the reserves in the Canada assets with the reserves in the U.S. assets, the future cash flows of the Oklahoma assets must be translated into Canadian dollars using a future exchange rate. The Company used a rate of $1.0051 U.S. to $1.00 Canadian for the forecast price tables and for the constant price table unless expressly noted otherwise, prices and costs used in an estimate that are the arithmetic average of the first-day-of-the-month price of the

applicable commodity for each of the twelve months in 2012, held constant throughout the estimated lives of the properties to which the estimate applies.

FORWARD LOOKING STATEMENTS

Various statements contained in this report, including those that express a belief, expectation, or intention, as well as those that are not statements of historical fact, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements express a belief, expectation or intention and generally are accompanied by words that convey projected future events or outcomes. These forward-looking statements may include projections and estimates concerning capital expenditures, the Company’s liquidity, capital

resources, and debt profile, pending acquisitions or dispositions, the timing and success of specific projects, outcomes and effects of litigation, claims and disputes, elements of the Company’s business strategy, compliance with governmental regulation of the oil and natural gas industry, including environmental regulations, acquisitions and divestitures and the effects thereof on the Company’s financial condition and other statements concerning the Company’s operations, economic performance and financial condition. Forward-looking statements are generally accompanied by words such as “estimate,” “assume,” “target,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “could,” “may,” “foresee,”

“plan,” “goal,” “should,” “intend” or other words that convey the uncertainty of future events or outcomes. The Company has based these forward-looking statements on its current expectations and assumptions about future events. These statements are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments as well as other factors the Company believes are appropriate under the circumstances. The actual results or developments anticipated may not be realized or, even if substantially realized, may not have the expected consequences to or effects on the Company’s business or results. Such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in

such forward-looking statements. These forward-looking statements speak only as of the date hereof. The Company disclaims any obligation to update or revise these forward-looking statements unless required by law, and it cautions readers not to rely on them unduly. While the Company’s management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties relating to, among other matters, the risks and uncertainties discussed in “Risk Factors” in Item 1A of this report, including the following:

|

•

|

risks associated with drilling oil and natural gas wells;

|

|

•

|

the volatility of oil and natural gas prices;

|

|

•

|

uncertainties in estimating oil and natural gas reserves;

|

|

•

|

the need to replace the oil and natural gas the Company produces;

|

|

•

|

the Company’s ability to execute its growth strategy by drilling wells as planned;

|

|

•

|

risks and liabilities associated with acquired properties and risks related to the integration of acquired businesses;

|

|

•

|

amount, nature and timing of capital expenditures, including future development costs, required to develop the Company’s undeveloped areas;

|

|

•

|

concentration of operations in Central Oklahoma;

|

|

•

|

inability to retain drilling rigs and other services;

|

|

•

|

risk of currency fluctuations;

|

|

•

|

the potential adverse effect of commodity price declines on the carrying value of the Company’s oil and natural gas properties;

|

|

•

|

severe or unseasonable weather that may adversely affect production and drilling activities;

|

|

•

|

availability of satisfactory oil and natural gas marketing and transportation;

|

|

•

|

availability and terms of capital to fund capital expenditures;

|

|

•

|

amount and timing of proceeds of asset sales and asset monetizations;

|

|

•

|

ability to fund ongoing dividends;

|

|

•

|

limitations on operations resulting from debt restrictions and financial covenants;

|

|

•

|

potential financial losses or earnings reductions from commodity derivatives;

|

|

•

|

potential elimination or limitation of tax incentives;

|

|

•

|

competition in the oil and natural gas industry;

|

|

risks associated with consent solicitations and proxy contests conducted by dissident stockholders;

|

|

•

|

general economic conditions, either internationally or domestically or in the areas where the Company operates;

|

|

•

|

inability to obtain required regulatory approvals for development activities;

|

|

•

|

costs to comply with current and future governmental regulation of the oil and natural gas industry, including environmental, health and safety laws and regulations, and regulations with respect to hydraulic fracturing; and

|

|

•

|

the need to maintain adequate internal control over financial reporting.

|

The reader is further cautioned that the preparation of the financial statements in this report that are in accordance with GAAP requires management to make certain judgments and estimates that affect the reported amounts of assets, liabilities, revenues and expenses. Estimating reserves is also critical to several accounting estimates and requires judgments and decisions based upon available geological, geophysical, engineering and economic data. These estimates may change, having either a negative or positive effect on the financial status of the Company as further information becomes available, and as the economic environment changes.

Many of these risk factors and other specific risks and uncertainties are discussed in further detail throughout this AIF and in the Corporation’s management’s discussion and analysis for the year ended December 31, 2012 (the “MD&A”), which is available through the internet on the Corporation’s SEDAR profile at www.sedar.com, on EDGAR at www.sec.gov as part of the annual report on Form 10-K filed with the SEC together with this AIF, and on the Corporation’s website at www.equalenergy.ca.

Readers are also referred to the risk factors described in this AIF under ”Risk Factors” and in other documents the Corporation’s files from time to time with securities regulatory authorities. Copies of these documents are available without charge from the Corporation’s or electronically on the internet on the Corporation’s SEDAR profile at www.sedar.com on EDGAR at www.sec.gov and on the Corporation’s website at www.equalenergy.ca.

NOTICE TO U.S. READERS

DATA ON OIL AND NATURAL GAS RESERVES CONTAINED IN THIS ANNUAL INFORMATION FORM HAS GENERALLY BEEN PREPARED IN ACCORDANCE WITH CANADIAN DISCLOSURE STANDARDS, WHICH ARE NOT COMPARABLE IN ALL RESPECTS TO UNITED STATES OR OTHER FOREIGN DISCLOSURE STANDARDS. FOR EXAMPLE, ALTHOUGH THE SEC NOW GENERALLY PERMITS OIL AND GAS ISSUERS, IN THEIR FILINGS WITH THE SEC, TO DISCLOSE BOTH PROVED RESERVES AND PROBABLE RESERVES (EACH AS DEFINED IN THE SEC RULES), THE SEC DEFINITIONS OF PROVED RESERVES AND PROBABLE RESERVES MAY DIFFER FROM THE DEFINITIONS OF "PROVED RESERVES" AND "PROBABLE RESERVES" UNDER CANADIAN SECURITIES LAWS. IN ADDITION, UNDER CANADIAN DISCLOSURE REQUIREMENTS AND INDUSTRY PRACTICE, RESERVES

AND PRODUCTION ARE REPORTED USING GROSS (OR, AS NOTED ABOVE WITH RESPECT TO PRODUCTION INFORMATION, "COMPANY INTEREST") VOLUMES, WHICH ARE VOLUMES PRIOR TO DEDUCTION OF ROYALTY AND SIMILAR PAYMENTS. THE PRACTICE IN THE UNITED STATES IS TO REPORT RESERVES AND PRODUCTION USING NET VOLUMES, AFTER DEDUCTION OF APPLICABLE ROYALTIES AND SIMILAR PAYMENTS. MOREOVER, IN ACCORDANCE WITH CANADIAN DISCLOSURE REQUIREMENTS, THE CORPORATION HAS DETERMINED AND DISCLOSED ESTIMATED FUTURE NET REVENUE FROM ITS RESERVES USING FORECAST PRICES AND COSTS, WHEREAS THE SEC NOW GENERALLY REQUIRES THAT RESERVE ESTIMATES BE PREPARED USING AN UNWEIGHTED AVERAGE OF THE CLOSING PRICES FOR THE APPLICABLE COMMODITY ON THE FIRST DAY OF EACH OF THE TWELVE MONTHS PRECEDING THE COMPANY'S FISCAL YEAR-END, WITH THE OPTION OF ALSO DISCLOSING RESERVE ESTIMATES BASED UPON FUTURE OR OTHER PRICES. AS A CONSEQUENCE OF THE

FOREGOING, THE CORPORATION'S RESERVE ESTIMATES AND PRODUCTION VOLUMES MAY NOT BE COMPARABLE TO THOSE MADE BY COMPANIES UTILIZING UNITED STATES REPORTING AND DISCLOSURE STANDARDS. ADDITIONALLY, THE SEC PROHIBITS DISCLOSURE OF OIL AND GAS RESOURCES, INCLUDING CONTINGENT RESOURCES, WHEREAS CANADIAN ISSUERS MAY DISCLOSE OIL AND GAS RESOURCES.

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

CORPORATE STRUCTURE

Equal Energy is an exploration and production company with oil and gas properties located in Oklahoma.

Equal Energy is the successor to the Trust following the completion of the reorganization of the Trust from an income trust structure to a corporate structure by way of court approved plan of arrangement under the ABCA on May 31, 2010 (the Arrangement”). The Arrangement involved the exchange, on a three-for-one basis (the “Consolidation”), of all outstanding Trust Units for Common Shares.

Equal Energy was incorporated on April 8, 2010 under the ABCA and did not carry on any active business prior to the Arrangement, other than executing the arrangement agreement pursuant to which the Arrangement was implemented. On January 1, 2011, Equal Energy amalgamated with its wholly-owned subsidiary, Equal Energy Corp. (the successor of EEC). The Company’s head office is located at Suite 2600, 500 - 4th Avenue S.W., Calgary, Alberta, Canada T2P 2V6. The Company’s registered office is located at 4300 Bankers Hall West, 888 – 3rd Street S.W., Calgary, Alberta, Canada T2P

5C5.

EEUSHI is an indirect, wholly-owned subsidiary of Equal Energy. EEUSHI holds all of Equal’s Oklahoma oil and gas properties and associated assets through its wholly owned subsidiary, Equal Energy US Inc., corporation incorporated under the laws of the state of Oklahoma. Equal Energy also has a U.S. office located at 4801 Gaillardia Parkway, Suite 325 Oklahoma City, Oklahoma.

On December 12, 2012 Equal Energy Ltd. was amalgamated with Equal Energy Partner Corp. and Equal Energy Production Partnership.

ORGANIZATIONAL CHART

The following chart illustrates the corporate structure as at December 31, 2012.

[Missing Graphic Reference]

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

GENERAL DEVELOPMENTS OF THE BUSINESS

Equal Energy is engaged in the exploration for, and acquisition, development and production of, petroleum and natural gas with operations in Oklahoma. See “Statement of Reserves Data and Other Oil and Gas Information.” The Company also reviews new drilling opportunities and potential acquisitions to supplement its exploration and development activities.

Three Year History

The following is a description of the general development of the business of the Company over the last three financial years. For a description of the business of Equal Energy, see “Description of the Business”.

2010

On May 31, 2010, the Trust completed the Arrangement. Unitholders of the Trust received one Common Share for every three Trust Units held. The Trust’s Board of Directors and management team continued as Equal’s Board of Directors and management team. Immediately subsequent to the completion of the Arrangement, former unitholders of the Trust held 100 percent of the Common Shares. Readers are referred to the Trust’s information circular and proxy statement dated April 13, 2010 for additional information in respect of the Arrangement, which may be found on SEDAR at www.sedar.com.

During 2010, Equal closed the sale of several non-core assets which had net proceeds of $26.3 million and completed a bought deal equity offering which raised net proceeds of $35.6 million. The proceeds from the sale of the non-core assets were used to pay down amounts owing under the Credit Facility and the proceeds from the equity offering were used to support the ongoing capital program; both of which gave Equal additional financial flexibility. In Oklahoma, additional working interests on existing properties were purchased for approximately US$5.5 million.

2011

In the first quarter of 2011, Equal issued $45.0 million aggregate principal amount of 6.75% Debentures with a face value of $1,000 per 6.75% Debenture that mature on March 31, 2016 and bear interest at 6.75% per annum paid semi-annually on March 31 and September 30 of each year. The 6.75% Debentures are convertible at the option of the holder into Common Shares at any time prior to the maturity date at a conversion price of $9.00 per Common Share. The proceeds from the issuance of the 6.75% Debentures were used to redeem a portion of a $79.9 million outstanding principal amount of an 8.00% Debentures for $83.2 million which included the requisite early redemption premium and unpaid

interest. The remaining balance of the 8.00% Debenture redemption was funded from the Credit Facility.

In the second quarter of 2011, Equal closed the acquisition of Hunton assets in Oklahoma from Petroflow Energy Ltd for $92.4 million. The acquisition increased the Corporation’s production by approximately 3,100 boe/d and was partially funded by a bought deal common share financing which was issued for net proceeds of $47.8 million. The Corporation filed a Business Acquisition Report on SEDAR under the requirements of Form 51-102F4. The remaining balance of the acquisition was funded from the Credit Facility.

In the fourth quarter of 2011, Equal sold non-core assets in Alberta and British Columbia for proceeds of $40.3 million. With the proceeds from the asset sale, the Corporation redeemed $39.1 million outstanding 8.25% Debentures for $41.5 million which included the requisite early redemption premium and unpaid interest.

2012

In the first quarter of 2012, Equal sold non-core assets in Saskatchewan and Oklahoma for proceeds of $9.7 million which was used to reduce amounts outstanding on the credit facility.

In the second quarter of 2012, Equal through its 100% owned subsidiary EEUSHI, sold 50% of its interest in approximately 14,500 net undeveloped acres prospective for Mississippian light oil for total cash consideration of approximately US$18.0 million. Concurrently with the sale, Equal entered into a joint venture with Atlas Resource Partners LP to embark on drilling program in the Mississippian play. On May 3, 2012 Equal’s Board of Directors initiated a strategic review process to identify, examine and consider alternatives with the view to enhancing shareholder value. Strategic alternatives considered but were not limited to, the sale of all or a portion of the Company's assets, the outright sale of the

corporation, a merger or other business combination, a recapitalization, acquisitions, as well as continued execution of its business plan, or any combination thereof.

In the third quarter of 2012, Equal, through its 100% subsidiary EEUSHI, sold its interest in its Northern Oklahoma assets located in Grant, Garfield and Alfalfa counties for cash consideration of US$40.0 million. The assets sold included 1,400 barrels of oil equivalent per day from the Hunton formation, related infrastructure and interests in approximately 8,550 acres of Mississippian lands.

In the fourth quarter of 2012, Equal sold the following Canadian assets: Halkirk/Alliance/Wainwright/Clair assets for $15.4 million, Lochend Cardium assets for $62 million and its royalty fee title assets and the residual resource income tax pools for $12.13 million. As a result of these sales, Equal’s presence in Canada is considered to be insignificant.

On November 27, 2012, Equal announced the termination of its Strategic Review process and announced the initiation of a US$0.20 per share annual dividend beginning January 1, 2013 payable quarterly at the end of each calendar quarter.

2013

Anticipated Developments

On February 14, 2013 Equal declared a first quarter dividend of $US$0.05 payable March 31, 2013 to shareholders of record at the close of business on March 1, 2013.

For a discussion of anticipated developments for 2013, please see the subsequent events section of the MD&A which may be found on SEDAR at www.sedar.com.

DESCRIPTION OF THE BUSINESS AND PROPERTIES

General

Equal Energy is engaged in the exploration for, and acquisition, development and production of, petroleum and natural gas with operations in Oklahoma. See “Statement of Reserves Data and Other Oil and Gas Information”. The Company also reviews new drilling opportunities and potential property acquisitions in Oklahoma to supplement its exploration and development activities. Production during 2012 averaged 10,010 boe/d from both Oklahoma and Canada and was comprised of approximately 49% natural gas 40% NGLs and11% crude oil. For 2013, production is expected to be approximately 52% natural gas, 46% NGLs and 2% crude oil.

Business Strategy During 2013

Equal’s strategy is to provide a balance between production and reserves growth and return of capital by way of a dividend and is focused on executing its 2013 business plan. Equal is positioned to deliver production growth and supports its dividend in today’s current environment of weak commodity prices. The Company will relocate its head office to Oklahoma and plan to continue to exploit its proven Hunton liquids rich natural gas resource play with a 10 horizontal well program in 2013.

For 2013, Equal is anticipating production to average 7,900 boe/d (6,400 boe/d net of royalties). Cash flow estimated at $33.0 million based on the assumptions of Henry Hub natural gas: US$3.90/mmbtu (Equal realization 87% of Henry Hub), Propane at Conway Kansas: US$0.90/gallon (Equal NGL realization 89% of Conway Propane) and WTI Oil: US$90.00/bbl (Equal realization 96% of WTI). Capital spending of $36.0 million ($30.0 million for drilling and related infrastructure; $6.0 million for land and maintenance capital).Equal operates all of its drilling and can dictate the pace and targets of its drilling programs. The Company can adjust quickly to changing circumstances, including any changes in

commodity prices if necessary. Equal has an extensive drilling inventory so it can increase capital spending in a higher commodity price environment and has the financial flexibility to do so with cash balances in place and the Credit Facility which was undrawn at the end of 2012.

Competitive Conditions

The oil and natural gas industry is intensely competitive in all its phases. Equal Energy competes with numerous other participants in the search for, and the acquisition of, oil and natural gas properties and in the marketing of oil and natural gas. Equal Energy's competitors include resource companies which may have greater financial resources, staff and facilities than those of Equal Energy. Competitive factors in the distribution and marketing of oil and natural gas include price and methods and reliability of delivery. Equal Energy believes that its competitive position is equivalent to that of other oil and gas issuers of similar size and at a similar stage of

development. See "Competition" under “Risk Factors”.

Cycles

The development of oil and gas reserves is dependent on access to areas where exploration and production is to be conducted. Seasonal weather conditions and lease stipulations can limit the Company’s drilling and producing activities and other oil and natural gas operations in a portion of its operating areas.

Environmental Protection

The oil and gas industry is subject to environmental regulations pursuant to applicable legislation. Such legislation provides for restrictions and prohibitions on release or emission of various substances produced in association with certain oil and gas industry operations, and requires that well and facility sites be abandoned and reclaimed to the satisfaction of environmental authorities. As at December 31, 2012, Equal Energy recorded an obligation on its balance sheet of $5.5 million for asset retirement. The Corporation maintains an insurance program consistent with industry practice to protect against losses due to accidental destruction of assets, well blowouts, pollution and other

operating accidents or disruptions. The Corporation also has operational and emergency response procedures and safety and environmental programs in place to reduce potential loss exposure. No assurance can be given that the application of environmental laws to the business and operations of Equal Energy will not result in a curtailment of production or a material increase in the costs of production, development or exploration activities or otherwise adversely affect Equal Energy's financial condition, results of operations or prospects. See “Environmental Risks" and "Industry Conditions" under “Risk Factors”.

Employees

At December 31, 2012, Equal Energy employed or contracted 10 office personnel in its Canadian office and 25 office personnel and 23 field operations personnel in its U.S. operations for a total of 58 employees.

Social or Environmental Policies

The health and safety of employees, contractors and the public, and the protection of the environment, are of utmost importance to Equal Energy. To this end, the Corporation has instituted health and safety policies and programs and endeavours to conduct its operations in a manner that will minimize both adverse effects and consequences of emergency situations by:

|

·

|

complying with government regulations and standards, particularly relating to the environment, health and safety;

|

|

·

|

conducting operations consistent with industry codes, practices and guidelines;

|

|

·

|

ensuring prompt, effective response and repair to emergency situations and environmental incidents;

|

|

·

|

providing training to employees and contractors to ensure compliance with corporate safety and environmental rules and procedures; and

|

|

·

|

communicating openly with members of the public regarding its activities.

|

Equal Energy believes that all employees have a vital role in achieving excellence in environmental, health and safety performance. This is best achieved through careful planning and the support and active participation of everyone involved.

DEBT OF EQUAL ENERGY

The Company may, with the approval of its Board of Directors, borrow, incur indebtedness, give any guarantee or enter into any subordination agreement or pledge or provide any security interest or encumbrance on any property of the Company or its subsidiaries. At present all third party indebtedness of Equal Energy is incurred directly by the parent company, Equal Energy Ltd. As at December 31, 2012, Equal had the Credit Facilities and $45.0 million of outstanding 6.75% Debentures. The Credit Facilities are the legal obligation of Equal and are guaranteed by the Company’s subsidiaries.

Set forth below is a description of the material terms of the Credit Facility and the Debentures.

Credit Facility

The Credit Facility is a secured facility from a syndicate of financial institutions. The borrowing base under the Credit Facility is comprised of a $105.0 million revolving facility and a $20.0 million operating facility. The next scheduled review of the borrowing base is anticipated to be completed in June 2013. Changes to the amount of credit available under the Credit Facility may be made after these reviews are completed. The Credit Facility is secured with a first priority charge over the assets of Equal. The maturity date of the Credit Facility is June 24, 2013 and should the lenders decide not to renew the Credit Facility, any outstanding amounts under

the Credit Facility must be repaid by June 23, 2014.

Interest rates and standby fees for the credit facilities are set quarterly according to a grid based on the ratio of bank debt to cash flow with the interest rates based on Canadian dollar BA (“Bankers Acceptance”) or U.S. dollar LIBOR rate plus 2.0% to 4.0% depending on the ratio of bank debt to cash flow. For any unused balance of the credit facility, between 0.50% to 1.00% is charged as a standby fee which is recorded in interest expense. As at December 31, 2012, the marginal interest rate and standby fee were 3.00% and 0.625%, respectively.

As at December 31, 2012, there is no draw on the credit facility. (December 31, 2011 – US$136.5 million drawn at a closing rate of CDN$1.017 per US$1.00).

Equal is required to maintain several financial and non-financial covenants. The primary financial covenant is an interest coverage ratio of 3.0:1.0 as calculated pursuant to the terms of the credit agreement. For the year ended December 31, 2012, the interest coverage ratio was 5.32 (December 31, 2011 – 6.11). Equal is in compliance with the terms and covenants of the credit facilities as at December 31, 2012. Equal is in compliance with the terms and covenants of the Second Amended and Restated Credit Agreement as at the date of this AIF.

Convertible Debentures

As at December 31, 2012 Equal had $45.0 million of outstanding 6.75% Debentures. See “Description of Debentures” under “Capital Structure”.

PRINCIPAL PROPERTIES

The following is a description of the Company’s material oil and natural gas properties as at December 31, 2012. Production stated is sales production before deduction of royalties and includes royalty interests to the Company and, unless otherwise stated, is the average daily production for December 2012. Reserve amounts are total proved plus probable reserves based on forecast prices and costs, stated before deduction of royalties and include royalty interests as at December 31, 2012 based on forecast prices and costs as evaluated in the Reserve Reports. See “Reserves Data – Forecast Prices and Costs” under “Statement of Reserves Data and Other Oil

and Gas Information”. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as for all properties, due to the effects of aggregation. Unless otherwise specified, gross and net acres and well count information are as at December 31, 2012.

Overview

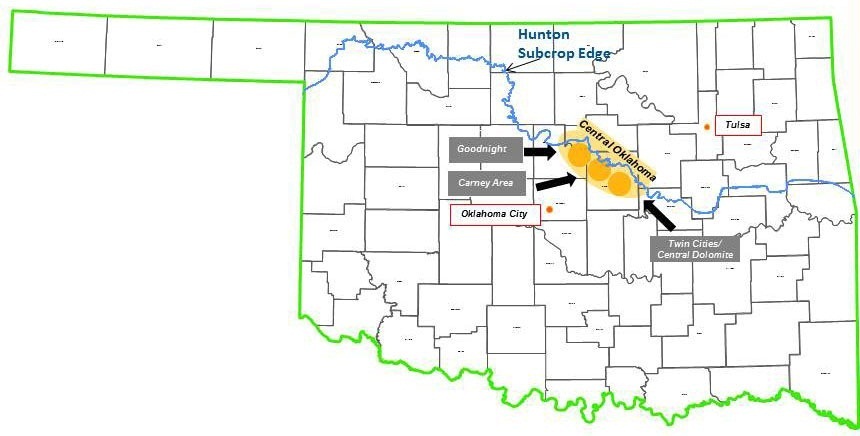

In December 2012 the Corporation’s production comes from its remaining U.S. based operations. The U.S. core area assets are located mainly in Lincoln and Logan Counties of Oklahoma. The Corporation also has an inventory of minor producing assets, minor royalty interests and various exploration and exploitation prospects on undeveloped lands in Oklahoma.

Oklahoma

Hunton

In Oklahoma, the key producing horizon is the Hunton formation. The Hunton is a carbonate rock formation which has been largely ignored by the industry due to high water/hydrocarbon production ratios. Over the last decade, new drilling and production techniques have enabled profitable development of the Hunton formation. Extensive dewatering lowers reservoir pressure allowing the liberation and mobilization of oil, natural gas and NGLs from smaller rock pores. Typical peak hydrocarbon production rates average 150 boe/d per horizontal well and are generally observed within six months of production commencement.

Average Hunton production for December 2012 in Oklahoma was 23.8 Mmcf/d of natural gas, 4,213 bbl/d of crude oil and NGLs. The Haas Report has attributed total proved and probable reserves of 348.5 Mbbl of crude oil, and 87.2 Bcf of natural gas and 12,210 mbbl of NGLs to the Hunton.

In Oklahoma, there are approximately 9,800 net undeveloped acres of land, at year end 2012. This acreage is centered in Lincoln and Logan Counties.

STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION

Disclosure of Reserves Data

The reserves data set forth below (the “Reserves Data”) is based upon evaluations conducted by Haas with an effective date of December 31, 2012, contained in the Haas Report. The Reserves Data summarizes the Company’s oil, NGL and natural gas reserves and the net present values of future net revenue for these reserves using constant prices and costs and forecast prices and costs. The Reserve Reports have been prepared in accordance with the standards contained in the COGE Handbook and the reserve definitions contained in National Instrument 51-101 – Standards of

Disclosure for Oil and Gas Activities of the Canadian Securities Administrators (“NI 51-101”). Information not required by NI 51-101 has been presented to provide continuity and additional information which the Company believes is important. The Company engaged Haas to provide an evaluation of its proved and proved plus probable reserves.

At December 31, 2012 the Company’s reserves were in the United States, specifically in the state of Oklahoma which Haas reviewed.

All evaluations and reviews of future net cash flow are stated prior to any provision for interest costs or general and administrative costs and after the deduction of estimate future capital expenditures for wells to which reserves have been assigned. It should not be assumed that the estimated future net cash flow shown below is representative of the fair market value of the Company’s properties. There is no assurance that such price and cost assumptions will be attained, and variances could be material. The recovery and reserve estimates of crude oil, NGL and natural gas reserves provided herein are estimates only and there is no guarantee that the

estimated reserves will be recovered. Actual crude oil, NGL and natural gas reserves may be greater than or less than the estimates provided herein.

The values shown for income taxes and future net revenue after income taxes were calculated on a stand-alone basis in the Reserve Reports. The values shown may not be representative of future income tax obligations, applicable tax horizon or after tax valuation.

Oil and Natural Gas Reserves and Net Present Value of Future Net Revenue

The tables below are summaries of the Company’s oil, NGL and natural gas reserves and the net present value of future net revenue attributable to such reserves as evaluated by McDaniel for the Canadian reserves for the years ended December 31, 2011 and earlier and Haas for the US reserves for the US reserves for all periods. These reports are based on constant and forecast price and cost assumptions. The data may contain slightly different numbers than the reports due to rounding. Additionally, the numbers in the tables may not add exactly due to rounding.

The Reserve Reports are based on certain factual data supplied by the Company and on McDaniel’s and Haas’ opinions of reasonable practice in the industry. The extent and character of ownership and all factual data pertaining to the petroleum properties and contracts (except for certain information residing in the public domain) were supplied by the Company to McDaniel and Haas and were accepted without any further investigation.

Reserves Data – Forecast Prices and Costs

Summary of Oil and Gas Reserves and Net Present Values of Future Net Revenue

Forecast Prices and Costs as of December 31, 2012

|

Light and Medium Crude Oil

|

Natural Gas Liquids

|

Natural Gas

|

Total

|

|||||||||||||||||||||||||||||

|

Reserves Category

|

Gross

(mbbls)

|

Net

(mbbls)

|

Gross

(mbbls)

|

Net

(mbbls)

|

Gross

(mmcf)

|

Net

(mmcf)

|

Gross

(mboe)

|

Net

(mboe)

|

||||||||||||||||||||||||

| (2) | (3) | (2) | (3) | (2) | (3) | (2) | (3) | |||||||||||||||||||||||||

|

OKLAHOMA(1)

|

||||||||||||||||||||||||||||||||

|

Producing

|

348.5 | 282.5 | 9,655.5 | 7,775.0 | 68,212.6 | 54,909.9 | 21,372.8 | 17,209.1 | ||||||||||||||||||||||||

|

Non-Producing

|

- | - | 98.6 | 78.2 | 421.9 | 335.3 | 168.9 | 134.1 | ||||||||||||||||||||||||

|

Proved Undeveloped

|

- | - | 1,926.5 | 1,541.2 | 14,430.7 | 11,544.5 | 4,331.6 | 3,465.3 | ||||||||||||||||||||||||

|

Proved

|

348.5 | 282.5 | 11,680.6 | 9,394.4 | 83,065.2 | 66,789.7 | 25,873.3 | 20,808.5 | ||||||||||||||||||||||||

|

Probable

|

- | - | 529.4 | 424.3 | 4,142.3 | 3,320.7 | 1,219.8 | 977.7 | ||||||||||||||||||||||||

|

Total Proved plus Probable

|

348.5 | 282.5 | 12,210.0 | 9,818.6 | 87,207.5 | 70,110.5 | 27,093.1 | 21,786.2 | ||||||||||||||||||||||||

Note:

|

(1)

|

Oklahoma from Haas Report.

|

|

(2)

|

Gross refers to the Corporation’s working interest including royalty interest volumes and before royalty charges.

|

|

(3)

|

Net refers to the Corporation’s working interest including royalty interest and after royalties charges.

|

Summary of Oil and Gas Reserves and Net Present Values of Future Net Revenue

Forecast Prices and Costs as of December 31, 2012

|

Before Income Taxes Discounted at (%/year)

|

After Income Taxes Discounted at (%/year)

|

|||||||||||||||||||||||||||||||||||||||

| 0 | 5 | 10 | 15 | 20 | 0 | 5 | 10 | 15 | 20 | |||||||||||||||||||||||||||||||

|

Reserves Category

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

||||||||||||||||||||||||||||||

|

OKLAHOMA(1)

|

||||||||||||||||||||||||||||||||||||||||

|

Producing

|

492.2 | 354.8 | 271.5 | 217.4 | 180.0 | 371.4 | 269.8 | 208.5 | 168.6 | 141.1 | ||||||||||||||||||||||||||||||

|

Non-Producing

|

2.7 | 1.9 | 1.4 | 1.0 | 0.8 | 2.0 | 1.4 | 1.0 | 0.8 | 0.6 | ||||||||||||||||||||||||||||||

|

Proved Undeveloped

|

99.1 | 51.4 | 27.3 | 13.7 | 5.5 | 58.7 | 30.2 | 15.5 | 7.0 | 1.8 | ||||||||||||||||||||||||||||||

|

Proved

|

594.1 | 408.1 | 300.2 | 232.1 | 186.3 | 432.1 | 301.4 | 224.9 | 176.4 | 143.5 | ||||||||||||||||||||||||||||||

|

Probable

|

33.1 | 19.5 | 12.4 | 8.3 | 5.8 | 18.7 | 10.7 | 6.6 | 4.2 | 2.7 | ||||||||||||||||||||||||||||||

|

Total Proved plus Probable

|

627.2 | 427.6 | 312.6 | 240.5 | 192.1 | 450.8 | 312.1 | 231.5 | 180.6 | 146.2 | ||||||||||||||||||||||||||||||

Note:

|

(1)

|

Oklahoma - from Haas Report.

|

|

(2)

|

Oklahoma dollar values have been converted to Cdn$ at 1.0051 exchange rate.

|

Undiscounted Future Net Revenue

Forecast Prices as of December 31, 2012

Total Reserves

|

Revenue

|

Royalties

|

Operating Costs

|

Capital Develop-ment Costs

|

Abandon-ment Costs

|

Future Net Revenue Before Income Taxes

|

Future Income Taxes

|

Future Net Revenue After Future Income Taxes

|

|||||||||||||||||||||||||

|

Reserves Category

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

||||||||||||||||||||||||

|

OKLAHOMA(1) (2)

|

||||||||||||||||||||||||||||||||

|

Total Proved

|

1,149.6 | 286.2 | 237.1 | 25.8 | 6.4 | 594.1 | 162.0 | 432.1 | ||||||||||||||||||||||||

|

Total Proved Plus Probable

|

1,205.0 | 299.9 | 241.7 | 29.7 | 6.5 | 627.2 | 176.4 | 450.8 | ||||||||||||||||||||||||

Note:

|

(1)

|

Oklahoma – from Haas Report.

|

|

(2)

|

Oklahoma net present values have been converted to Cdn$ at 1.0051 exchange rate.

|

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Oil and Gas Reserves and Net Present Values by Production Group

Forecast Prices as of December 31, 2012

Total Reserves

|

Oklahoma

|

||||||||

|

Unit Value

|

||||||||

|

Reserves Category

|

MM$

|

$/bbl, $/mcf

|

||||||

| (3) | (2) | |||||||

|

Proved

|

||||||||

|

Light and Medium Crude Oil (1)

|

10.0 | 35.30 | ||||||

|

Natural Gas Liquids

|

164.8 | 17.54 | ||||||

|

Natural Gas

|

125.4 | 1.88 | ||||||

|

Total

|

300.2 | 14.42 | ||||||

|

Proved Plus Probable

|

||||||||

|

Light and Medium Crude Oil (1)

|

10.0 | 35.30 | ||||||

|

Natural Gas Liquids

|

171.4 | 17.46 | ||||||

|

Natural Gas

|

131.2 | 1.87 | ||||||

|

Total

|

312.6 | 14.35 | ||||||

Note:

|

(1)

|

Including all by products.

|

|

(2)

|

Unit values are based on net reserve volumes in Cdn$.

|

|

(3)

|

Oklahoma net present values and unit values have been converted to Cdn$ at 1.0051 exchange rate.

|

|

(4)

|

Net Present Values discounted at 10% are before tax.

|

Oil and Gas Reserves and Net Present Values by Production Group

Forecast Prices as of December 31, 2012

Total Reserves

|

Reserves Group by Category

|

Oil

Gross

Mbbl

|

Net

Mbbl

|

Gas

Gross

Mmcf

|

Net

Mmcf

|

NGL

Gross

Mbbl

|

Net

Mbbl

|

Net Present Value

Before Income Tax @ 10%

M$

|

Unit Values

$/bbl or $/mcf

|

||||||||||||||||||||||||

| (4) | (4) | (45) | (2) | (2) (3) | ||||||||||||||||||||||||||||

|

OKLAHOMA(1)

|

||||||||||||||||||||||||||||||||

|

Natural Gas (including By-products)

|

||||||||||||||||||||||||||||||||

|

Proved Producing

|

348.5 | 282.5 | 68,212.6 | 54,909.9 | 9,655.5 | 7,775.0 | 271,501 | 4.94 | ||||||||||||||||||||||||

|

Proved Non-Producing

|

- | - | 421.9 | 335.3 | 98.6 | 78.2 | 1,375 | 4.10 | ||||||||||||||||||||||||

|

Proved Undeveloped

|

- | - | 14,430.7 | 11,544.5 | 1,926.5 | 1,541.2 | 27,287 | 2.36 | ||||||||||||||||||||||||

|

Total Proved

|

348.5 | 282.5 | 83,065.2 | 66,789.7 | 11,680.6 | 9,394.4 | 300,162 | 4.49 | ||||||||||||||||||||||||

|

Probable

|

- | - | 4,142.3 | 3,320.7 | 529.4 | 424.3 | 12,422 | 3.74 | ||||||||||||||||||||||||

|

Total Proved & Probable

|

348.5 | 282.5 | 87,207.5 | 70,110.5 | 12,210.0 | 9,818.6 | 312,584 | 4.46 | ||||||||||||||||||||||||

Note

|

(1)

|

Oklahoma - from Haas Report.

|

|

(2)

|

Oklahoma net present values and unit values have been converted to Cdn$ at 1.0051 exchange rate.

|

|

(3)

|

Unit values are based on net reserve volumes.

|

|

(4)

|

Gross refers to Corporations working interest.

|

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Pricing Assumptions (1)

Forecast Prices and Costs

Summary of Price Forecasts

January 1, 2013

|

Year

|

WTI Crude Oil US$/bbl

|

U.S. Henry Hub Gas Price $US/

Mmbtu

|

U.S. Conway Propane %

WTI

|

Inflation %

|

US/CAN Exchange Rate

US$/$

|

|

(2)

|

|||||

|

2013

|

92.50

|

3.75

|

41

|

2.00

|

1.000

|

|

2014

|

92.50

|

4.30

|

48

|

2.00

|

1.000

|

|

2015

|

93.60

|

4.85

|

54

|

2.00

|

1.000

|

|

2016

|

95.50

|

5.25

|

54

|

2.00

|

1.000

|

|

2017

|

97.40

|

5.70

|

54

|

2.00

|

1.000

|

|

2018

|

99.40

|

6.10

|

54

|

2.00

|

1.000

|

|

2019

|

101.40

|

6.20

|

54

|

2.00

|

1.000

|

|

2020

|

103.40

|

6.35

|

54

|

2.00

|

1.000

|

|

2021

|

105.40

|

6.45

|

54

|

2.00

|

1.000

|

|

2022

|

107.60

|

6.60

|

54

|

2.00

|

1.000

|

|

2023

|

109.70

|

6.70

|

54

|

2.00

|

1.000

|

|

2024

|

111.90

|

6.85

|

54

|

2.00

|

1.000

|

|

2025

|

114.10

|

7.00

|

54

|

2.00

|

1.000

|

|

2026

|

116.40

|

7.10

|

54

|

2.00

|

1.000

|

|

2027

|

118.80

|

7.25

|

54

|

2.00

|

1.000

|

|

Thereafter

|

+2%/yr.

|

+2%/yr.

|

54

|

2.00

|

1.000

|

Note:

|

(1)

|

West Texas Intermediate at Cushing Oklahoma 40 degrees API/0.5% sulphur.

|

|

(2)

|

Internal estimate of propane as a percent of WTI.

|

Effective January 1, 2013

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Reserves Data – Constant Prices and Costs

Summary of Oil and Gas Reserves and Net Present Value of Future Net Revenue

Constant Prices as of December 31, 2012

Total of All Areas

|

Light and Medium Crude Oil

|

Natural Gas Liquids

|

Natural Gas

|

Total

|

|||||||||||||||||||||||||||||

|

Reserves Category

|

Gross (mbbls)

|

Net (mbbls)

|

Gross (mbbls)

|

Net (mbbls)

|

Gross (mmcf)

|

Net (mmcf)

|

Gross (mboe)

|

Net (mboe)

|

||||||||||||||||||||||||

| (2) | (3) | (2) | (3) | (2) | (3) | (2) | (3) | |||||||||||||||||||||||||

|

OKLAHOMA(1)

|

||||||||||||||||||||||||||||||||

|

Producing

|

330.7 | 268.0 | 9,110.1 | 7,334.8 | 64,537.3 | 51,949.8 | 20,197.1 | 16,261.1 | ||||||||||||||||||||||||

|

Non-Producing

|

- | - | 95.3 | 75.6 | 394.1 | 313.0 | 161.0 | 127.8 | ||||||||||||||||||||||||

|

Proved Undeveloped

|

- | - | 1,853.9 | 1,483.2 | 13,887.1 | 11,109.7 | 4,168.5 | 3,334.8 | ||||||||||||||||||||||||

|

Total Proved

|

330.7 | 268.0 | 11,059.4 | 8,893.6 | 78,818.6 | 63,372.5 | 24,526.5 | 19,723.6 | ||||||||||||||||||||||||

|

Probable

|

- | - | 494.7 | 396.4 | 3,879.4 | 3,110.1 | 1,141.2 | 914.8 | ||||||||||||||||||||||||

|

Total Proved plus Probable

|

330.7 | 268.0 | 11,554.0 | 9,290.0 | 82,697.9 | 66,482.6 | 25,667.8 | 20,638.4 | ||||||||||||||||||||||||

Note:

|

(1)

|

Oklahoma - from Haas Report.

|

|

(2)

|

Gross refers to the Corporation’s working interest including royalty interest volumes and before royalty charges.

|

|

(3)

|

Net refers to the Corporation’s working interest after royalties plus royalty interest reserve.

|

Summary of Oil and Gas Reserves and Net Present Values of Future Net Revenue

Constant Prices Case as of December 31, 2012

Total of All Areas

|

Before Income Taxes Discounted at (%/year)

|

After Income Taxes Discounted at (%/year)

|

|||||||||||||||||||||||||||||||||||||||

|

Reserves Category

|

0 | 5 | 10 | 15 | 20 | 0 | 5 | 10 | 15 | 20 | ||||||||||||||||||||||||||||||

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

|||||||||||||||||||||||||||||||

|

OKLAHOMA(1) (2)

|

||||||||||||||||||||||||||||||||||||||||

|

Producing

|

237.1 | 184.8 | 149.8 | 125.3 | 107.4 | 217.2 | 166.9 | 134.2 | 111.8 | 95.7 | ||||||||||||||||||||||||||||||

|

Non-Producing

|

1.8 | 1.3 | 1.0 | 0.8 | 0.6 | 1.4 | 1.0 | 0.8 | 0.6 | 0.5 | ||||||||||||||||||||||||||||||

|

Proved Undeveloped

|

28.8 | 10.8 | 1.2 | (4.3 | ) | (7.5 | ) | 16.2 | 5.2 | (0.8 | ) | (4.3 | ) | (6.5 | ) | |||||||||||||||||||||||||

|

Total Proved

|

267.7 | 197.0 | 152.0 | 121.8 | 100.4 | 234.8 | 173.1 | 134.2 | 108.1 | 89.6 | ||||||||||||||||||||||||||||||

|

Probable

|

12.9 | 7.8 | 4.9 | 3.2 | 2.1 | 6.7 | 3.7 | 2.0 | 1.0 | 0.4 | ||||||||||||||||||||||||||||||

|

Total Proved plus Probable

|

280.6 | 204.8 | 157.0 | 125.0 | 102.5 | 241.5 | 176.8 | 136.2 | 109.1 | 90.0 | ||||||||||||||||||||||||||||||

Note:

|

(1)

|

Oklahoma - from Haas Report.

|

|

(2)

|

Oklahoma net present values have been converted to CDN$ at 1.0051 exchange rate.

|

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Total Future Net Revenue (Undiscounted)

Constant Prices as of December 31, 2012

Total Reserves

|

Revenue

|

Royalties

|

Operating Costs

|

Capital Development Costs

|

Abandonment Costs

|

Future Net Revenue Before Income Taxes

|

Income Taxes

|

Future Revenue After Income Taxes

|

|||||||||||||||||||||||||

|

Reserves Category

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

MM$

|

||||||||||||||||||||||||

|

OKLAHOMA(1) (2)

|

||||||||||||||||||||||||||||||||

|

Total Proved

|

603.6 | 149.7 | 158.2 | 23.8 | 4.3 | 267.7 | 32.9 | 234.8 | ||||||||||||||||||||||||

|

Total Proved plus Probable

|

629.8 | 156.2 | 161.7 | 27.1 | 4.3 | 280.6 | 39.1 | 241.5 | ||||||||||||||||||||||||

Note:

|

(1)

|

Oklahoma - from Haas Report.

|

|

(2)

|

Oklahoma dollar values have been converted to CDN$ at 1.0051 exchange rate.

|

Oil and Gas Reserves and Net Present Values by Production Group

Constant Prices as of December 31, 2012

Total Reserves

|

Oklahoma

|

||||||||

|

Unit Value

|

||||||||

|

Reserves Category

|

MM$

|

$/bbl or $/mcf

|

||||||

| (3) | (2) | |||||||

|

Proved

|

||||||||

|

Light and Medium Crude Oil (1)

|

9.2 | 34.24 | ||||||

|

Natural Gas Liquids

|

92.3 | 10.38 | ||||||

|

Natural Gas

|

50.6 | 0.80 | ||||||

|

Total

|

152.0 | 7.71 | ||||||

|

Proved Plus Probable

|

||||||||

|

Light and Medium Crude Oil (1)

|

9.2 | 34.24 | ||||||

|

Natural Gas Liquids

|

95.3 | 10.26 | ||||||

|

Natural Gas

|

52.4 | 0.79 | ||||||

|

Total

|

157.0 | 7.61 | ||||||

Note:

|

(1)

|

Including all by-products and NGLs.

|

|

(2)

|

The unit values are based on net reserve volumes in CDN$.

|

|

(3)

|

Oklahoma net present values and unit values have been converted to CDN$ at 1.0051 exchange rate.

|

|

(4)

|

Net present values discounted at 10% are before tax.

|

Pricing Assumptions (1)

Constant Prices and Costs

|

Year

|

WTI @ Cushing ($US/bbl)

|

US Henry Hub Gas Price

($US/Mmbtu)

|

Mount Belvieu Propane

($US/gal)

|

Conway Propane

($US/gal)

|

Exchange Rate ($US/$)

|

|||||||||||||||

| (1 | ) | (1 | ) | (1 | ) | (1 | ) | (2 | ) | |||||||||||

|

2012

|

94.71 | 2.76 | 1.03 | 0.83 | 1.0051 | |||||||||||||||

Note:

(1) Based on the average first-day-of-the-month price for the 12 months of 2012.

(2) Based on the average first-day-of-the month Bank of Canada noon exchange rate.

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Reserves Reconciliation

Reconciliation of Gross Reserves by Product Type

Forecast Prices and Costs

|

Light and Medium Crude Oil

|

Natural Gas Liquids

|

|||||||||||||||||||||||

|

Total Proved

|

Probable

|

Total Proved

|

Total Proved

|

Probable

|

Total Proved

|

|||||||||||||||||||

|

Reserves

|

Reserves

|

Plus Probable

|

Reserves

|

Reserves

|

Plus Probable

|

|||||||||||||||||||

|

[mbbl]

|

[mbbl]

|

[mbbl]

|

[mbbl]

|

[mbbl]

|

[mbbl]

|

|||||||||||||||||||

|

CANADA

|

||||||||||||||||||||||||

|

Opening balance – December 31, 2011

|

2,562.2 | 1,104.9 | 3,667.1 | 90.0 | 40.1 | 130.1 | ||||||||||||||||||

|

Extensions and Improved Recovery

|

101.3 | 36.9 | 138.2 | 3.8 | 1.6 | 5.4 | ||||||||||||||||||

|

Technical Revisions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Acquisitions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Dispositions

|

(2,356.3 | ) | (1,141.8 | ) | (3,498.1 | ) | (86.8 | ) | (41.7 | ) | (128.5 | ) | ||||||||||||

|

Production

|

(307.2 | ) | - | (307.2 | ) | (7.0 | ) | - | (7.0 | ) | ||||||||||||||

|

Closing balance – December 31, 2012

|

- | - | - | - | - | - | ||||||||||||||||||

|

UNITED STATES (1)

|

||||||||||||||||||||||||

|

Opening balance – December 31, 2011

|

497.9 | 0.9 | 498.8 | 13,326.3 | 603.5 | 13,929.9 | ||||||||||||||||||

|

Extensions and Improved Recovery

|

53.6 | - | 53.6 | 1,281.5 | 305.4 | 1,586.8 | ||||||||||||||||||

|

Technical Revisions

|

6.2 | (0.9 | ) | 5.3 | (989.0 | ) | (329.4 | ) | (1,318.4 | ) | ||||||||||||||

|

Acquisitions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Dispositions

|

(130.6 | ) | - | (130.6 | ) | (457.1 | ) | (50.1 | ) | (507.2 | ) | |||||||||||||

|

Production

|

(78.7 | ) | - | (78.7 | ) | (1,480.8 | ) | - | (1,480.8 | ) | ||||||||||||||

|

Closing balance – December 31, 2012

|

348.5 | - | 348.5 | 11,680.6 | 529.4 | 12,210.0 | ||||||||||||||||||

|

AGGREGATE

|

||||||||||||||||||||||||

|

Opening balance – December 31, 2011

|

3,060.1 | 1,105.8 | 4,165.9 | 13,416.3 | 643.6 | 14,060.0 | ||||||||||||||||||

|

Extensions and Improved Recovery

|

154.9 | 36.9 | 191.8 | 1,285.3 | 307.0 | 1,592.2 | ||||||||||||||||||

|

Technical Revisions

|

6.2 | (0.9 | ) | 5.3 | (989.0 | ) | (329.3 | ) | (1,318.4 | ) | ||||||||||||||

|

Acquisitions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Dispositions

|

(2,486.9 | ) | (1,141.8 | ) | (3,628.7 | ) | (543.9 | ) | (91.8 | ) | (635.7 | ) | ||||||||||||

|

Production

|

(385.9 | ) | - | (385.9 | ) | (1,487.8 | ) | - | (1,487.8 | ) | ||||||||||||||

|

Closing balance – December 31, 2012

|

348.5 | - | 348.5 | 11,680.6 | 529.4 | 12,210.0 | ||||||||||||||||||

Note:

|

(1)

|

United States - from Haas Report.

|

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Reconciliation of Company Gross Reserves by Product Type

Forecast Prices and Costs

|

Associated and Non-Associated Gas

|

Heavy Oil

|

|||||||||||||||||||||||

|

Total Proved

|

Probable

|

Total Proved

|

Total Proved

|

Probable

|

Total Proved

|

|||||||||||||||||||

|

Reserves

|

Reserves

|

Plus Probable

|

Reserves

|

Reserves

|

Plus Probable

|

|||||||||||||||||||

|

[mmcf]

|

[mmcf]

|

[mmcf]

|

[mbbl]

|

[mbbl]

|

[mbbl]

|

|||||||||||||||||||

|

CANADA (1)

|

||||||||||||||||||||||||

|

Opening balance – December 31, 2011

|

4,838.1 | 2,217.9 | 7,056.0 | 476.6 | 297.2 | 773.8 | ||||||||||||||||||

|

Extensions and Improved Recovery

|

151.6 | 62.7 | 214.3 | - | ||||||||||||||||||||

|

Technical Revisions

|

- | - | - | - | ||||||||||||||||||||

|

Acquisitions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Dispositions

|

(4,665.1 | ) | (2,280.6 | ) | (6,945.7 | ) | (469.0 | ) | (297.2 | ) | (766.2 | ) | ||||||||||||

|

Production

|

(324.6 | ) | - | (324.6 | ) | (7.6 | ) | - | (7.6 | ) | ||||||||||||||

|

Closing balance – December 31, 2012

|

- | - | - | - | - | - | ||||||||||||||||||

|

UNITED STATES (2)

|

||||||||||||||||||||||||

|

Opening balance – December 31, 2011

|

102,563.4 | 5,367.1 | 107,930.5 | - | - | - | ||||||||||||||||||

|

Extensions and Improved Recovery

|

13,666.4 | 2,287.5 | 15,953.8 | - | - | - | ||||||||||||||||||

|

Technical Revisions

|

(12,807.2 | ) | (2,587.1 | ) | (15,394.3 | ) | - | - | - | |||||||||||||||

|

Acquisitions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Dispositions

|

(9,986.4 | ) | (925.0 | ) | (10,911.4 | ) | - | - | - | |||||||||||||||

|

Production

|

(10,369.5 | ) | - | (10,369.5 | ) | - | - | - | ||||||||||||||||

|

Closing balance – December 31, 2012

|

83,065.2 | 4,142.3 | 87,207.5 | - | - | - | ||||||||||||||||||

|

AGGREGATE

|

||||||||||||||||||||||||

|

Opening balance – December 31, 2011

|

107,401.5 | 7,585.0 | 114,986.5 | 476.6 | 297.2 | 773.8 | ||||||||||||||||||

|

Extensions and Improved Recovery

|

13,818.0 | 2,350.2 | 16,168.1 | - | - | - | ||||||||||||||||||

|

Technical Revisions

|

(12,807.2 | ) | (2,587.1 | ) | (15,394.3 | ) | - | - | - | |||||||||||||||

|

Acquisitions

|

- | - | - | - | - | - | ||||||||||||||||||

|

Dispositions

|

(14,651.4 | ) | (3,205.6 | ) | (17,857.1 | ) | (469.0 | ) | (297.2 | ) | (766.2 | ) | ||||||||||||

|

Production

|

(10,694.3 | ) | - | (10,694.3 | ) | (7.6 | ) | - | (7.6 | ) | ||||||||||||||

|

Closing balance – December 31, 2012

|

83,065.2 | 4,142.3 | 87,207.5 | - | - | - | ||||||||||||||||||

Note:

|

(1)

|

Canada - from McDaniel Report.

|

|

(2)

|

United States - from Haas Report.

|

2011/2012 Reserves Reconciliation (000’s BOE @ Forecast Prices)

|

Proved

|

Probable

|

Total Reserves

|

||||||||||

|

December 31, 2011

|

34,853.3 | 3,310.3 | 38,164.0 | |||||||||

|

Discoveries and Extensions

|

3,743.2 | 735.6 | 4,478.7 | |||||||||

|

Purchases

|

- | - | - | |||||||||

|

Dispositions

|

(5,941.8 | ) | (2,065.1 | ) | (8,006.9 | ) | ||||||

|

Production

|

(3,663.6 | ) | - | (3,663.6 | ) | |||||||

|

Revisions

|

(3,117.4 | ) | (761.4 | ) | (3,878.8 | ) | ||||||

|

December 31, 2012

|

25,873.7 | 1,219.9 | 27,093.6 | |||||||||

Undeveloped Reserves

The Corporation’s undeveloped reserves were estimated by Haas in accordance with standards and procedures in the COGE Handbook and reserve definitions in NI 51-101. In general, undeveloped reserves are reserves scheduled to be developed within the next three years.

Proved undeveloped and probable undeveloped reserves have been assigned to the Corporation’s Oklahoma properties.

(IV) Equal Energy Ltd. 2012 Annual Information Form - -

Oklahoma

Proved undeveloped reserves of 4,331.6 Mboe (56% natural gas) have been assigned in the Haas Report, representing 16.7% of the Oklahoma proved reserves on a boe basis. These proved undeveloped reserves represent 23 gross (8.3 net) well locations. All of the locations are in Lincoln County.

Probable undeveloped reserves of 716.8 Mboe (56% natural gas) have been assigned in the Haas Report, representing 2.6% of the Oklahoma proved plus probable reserves on a boe basis. The probable undeveloped reserves are associated with 8 gross (1.4 net) well locations.

The Oklahoma assets provide a large inventory of undeveloped opportunity. As the current undeveloped location inventory is developed, it is anticipated that additional undeveloped locations will be recognized by Haas and added to the undeveloped inventory.

Significant Factors or Uncertainties Affecting Reserves Data

The process of estimating reserves is complex. It requires significant judgments and decisions based on available geological, geophysical, engineering, and economic data. These estimates may change substantially as additional data from ongoing development activities and production performance becomes available and as economic conditions impacting oil and gas prices and costs change. The reserve estimates contained herein are based on current production forecasts, prices, royalty rates and economic conditions. Haas, an independent engineering firm, evaluated the Corporation’s reserves.

Although every reasonable effort is made to ensure that reserve estimates are accurate, reserve estimation is an inferential science. As a result, the subjective decisions, new geological or production information and a changing environment may impact these estimates. Revisions to reserve estimates can arise from changes in year-end oil and gas prices, and reservoir performance. Such revisions can be either positive or negative.

Future Development Costs

The table below sets out the development costs deducted in the estimation of future net revenue attributable to proved reserves of Equal’s Oklahoma assets(using both constant prices and costs and forecast prices and costs) and proved plus probable reserves (using forecast prices and costs only).

| $ | M | |||

| (1) (2) | ||||

|

Constant Prices and Costs – Proved Reserves (1)

|

||||

|

2013

|

12,690 | |||

|

2014

|

6,341 | |||

|

2015

|

4,394 | |||

|

2016

|

376 | |||

|

2017

|

- | |||

|

Remaining Years

|

- | |||

|

Total Undiscounted

|

23,801 | |||

|

Total Discounted at 10% per Year

|

21,252 | |||

|

Forecast Prices and Costs – Proved Reserves (2)

|

||||

|

2013

|

12,784 | |||

|

2014

|

7,947 | |||

|

2015

|

4,638 | |||

|

2016

|

400 | |||

|

2017

|

- | |||

|

Remaining Years

|

- | |||

|

Total Undiscounted

|

25,770 | |||

|

Total Discounted at 10% per Year

|

22,938 | |||

|

Forecast Prices and Costs – Proved plus Probable Reserves

|

||||

|

2013

|

13,802 | |||

|

2014

|

9,473 | |||

|

2015

|

5,125 | |||

|

2016

|

1,028 | |||

|

2017

|

9 | |||

|

Remaining Years

|

- | |||

|

Total Undiscounted

|

29,707 | |||

|

Total Discounted at 10% per Year

|

26,279 |

Note:

|

(1)

|

Oklahoma constant present values have been converted to CDN$ at 1.0051 exchange rate.

|

|

(2)

|

Oklahoma forecast present values have been converted to CDN$ at 1.0051 exchange rate.

|

The Corporation typically has three sources of funding available to finance its capital expenditure program: internally generated cash flow from operations, debt financing when appropriate and new equity issues, if available on favourable terms.

The Corporation expects to fund its total 2013 capital program primarily with internally generated cash flow supplemented with borrowings on the Credit Facility and the cash held.

Oil and Gas Wells

The following table summarizes the Corporation’s interest as at December 31, 2012 in wells that are producing and non-producing:

|

Producing

|

Non-Producing

|

|||||||||||||||||||||||||||||||||||||||

|

Oil

|

Gas

|

Oil

|

Gas

|

Grand Total

|

||||||||||||||||||||||||||||||||||||

|

State/Province

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

||||||||||||||||||||||||||||||

|

Oklahoma

|

2 | 0.8 | 124 | 105.2 | - | - | 64 | 56.6 | 190 | 162.6 | ||||||||||||||||||||||||||||||

- Note this table does not include service/disposal wells.

Land Holdings

The following table summarizes land holdings in which the Corporation has an interest at December 31, 2012.

|

Area

|

Gross Acres

|

Net Acres

|

|

United States

|

83,803

|

54,211

|

The acreage to expire in 2013, in the U.S. gross 11,577 (net 5,899) acres.

Environmental Protection

The Company’s operations in Canada and the United States are subject to stringent government laws and regulations regarding pollution, protection of the environment and the handling and transport of hazardous materials. These laws and regulations may impose administrative, civil and criminal penalties as well as joint and several, strict liability for failure to comply, and generally require the Company to remove or remedy the effect of its activities on the environment at present and former operating sites, including dismantling production facilities and remediating damage caused by the use or release of specified substances. The applicable regulatory agencies review the

Company’s compliance with applicable laws and regulations. Monitoring and reporting programs, as wells as inspections and assessments for environment, health and safety performance in day-to-day operations, are designed to provide assurance that environmental and regulatory standards are met. Contingency plans are in place for a timely response to an environmental event, and remediation/reclamation programs are in place and utilized to restore the environment.

The Company currently owns or leases, and has in the past owned or leased, properties that have been used for oil and natural gas exploration and production activities for many years. Although operating and disposal practices have been used that were standard in the industry at the time, petroleum hydrocarbons or wastes may have been disposed of or released on or under the properties owned or leased by the Company. In addition, some of these properties have been operated by third parties, whose treatment and disposal or release of petroleum hydrocarbons and wastes were not under the Company’s control, including when these properties were owned or leased by any previous