Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Globalstar, Inc. | v338167_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Globalstar, Inc. | v338167_ex99-1.htm |

U n s a v e d D o c u m e n t / 2 / 2 2 / 2 0 1 2 / 1 7 : 4 2 2012 Earnings Call Presentation March 14, 2013

Safe Harbor Language Thispresentationcontainscertainstatementsthatare“forward-lookingstatements”withinthemeaningof thePrivateSecuritiesLitigationReformActof1995. Theseforward-lookingstatementsarebasedon currentexpectationsandassumptionsthataresubjecttorisksanduncertaintieswhichmaycauseactual resultstodiffermateriallyfromtheforward-lookingstatements.Forward-lookingstatements,suchasthe statementsregardingourabilitytodevelopandexpandourbusiness,ouranticipatedcapitalspending (including for future satellite procurements and launches), our ability to manage costs, our ability to exploitandrespondtotechnologicalinnovation,theeffectsoflawsandregulations(includingtaxlaws andregulations)andlegalandregulatorychanges,theopportunitiesforstrategicbusinesscombinations and the effects of consolidation in our industry on us and our competitors, our anticipated future revenues,ouranticipatedfinancialresources,ourexpectationsaboutthefuturelaunchesandoperational performanceofoursatellites(includingtheirprojectedoperationallives),theexpectedstrengthofand growthprospectsforourexistingcustomersandthemarketsthatweserve,commercialacceptanceof ournewSimplexproducts,includingourSPOTfamilyofproducts,problemsrelatingtotheground-based facilities operated by us or by independent gateway operators, worldwide economic, geopolitical and businessconditionsandrisksassociatedwithdoingbusinessonaglobalbasisandotherstatements containedinthispresentationregardingmattersthatarenothistoricalfacts,involvepredictions. Any forward-looking statements made in this presentation speak as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectationsexpressedorimpliedintheforward-lookingstatements,andweundertakenoobligationto updateanysuchstatements.Additionalinformationonfactorsthatcouldinfluenceourfinancialresultsis includedinourfilingswiththeSecuritiesandExchangeCommission,includingourAnnualReporton Form10-K,QuarterlyReportsonForm10-QandCurrentReportsonForm8-K. 1

2 Globalstar’s Successful Launch Campaign Launch 1 –Oct ‘10 Launch 4 –Feb ‘13Launch 2 –July ‘11 Launch 3 –Dec ‘11 With the successful fourth launch in February, Globalstar is the first MSS provider to successfully launch a second-generation constellation of LEO satellites, placing the Company years ahead of the competition

2012 Results Summary Summary Performance Revenue growth of 5% and Adjusted EBITDA improvement of $16.2 million year over year Duplex ARPU hit lows of $14.99 and $15.35 in Q4 2011 and Q1 2012 –increased to $18.95 and $18.49 in Q3 and Q4 2012, respectively Significant improvement in operational expenses year over year (excluding EBITDA adjustments) Q4 2012 revenue growth of $1.7 million and Adjusted EBITDA increase of $0.9 million 3 (1) Adjusted to exclude non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new consumer products and certain other significant charges. See reconciliation to GAAP on Annex A. ($ in millions except ARPU data) INCOME STATEMENT SUMMARY Q1 2011A Q2 2011A Q3 2011A Q4 2011A 2011A Q1 2012A Q2 2012A Q3 2012A Q4 2012A 2012A Revenue: Service revenue Duplex $5.1 $5.4 $5.2 $4.2 $19.8 $4.2 $4.5 $5.0 $4.8 $18.4 SPOT 4.2 4.9 4.9 5.7 19.8 5.3 6.5 6.6 6.9 25.2 Simplex 1.2 1.2 1.6 1.5 5.5 1.3 1.4 1.7 1.8 6.1 Other 3.7 1.9 2.5 2.2 10.4 1.8 1.8 2.1 1.9 7.7 Total Service Revenue $14.2 $13.4 $14.2 $13.6 $55.4 $12.6 $14.2 $15.4 $15.3 $57.5 Equipment revenue $4.1 $5.6 $4.0 $3.8 $17.4 $4.1 $5.8 $5.2 $3.7 $18.9 Total revenue $18.3 $19.0 $18.2 $17.4 $72.8 $16.7 $20.0 $20.5 $19.1 $76.3 Cost of services $7.1 $7.3 $8.3 $6.6 $29.2 $5.4 $5.8 $5.6 $6.5 $23.2 Cost of subscriber equipment sales plus value reduction 2.9 4.0 3.8 10.0 20.8 3.0 3.8 4.7 3.3 14.7 Marketing, general, and administrative 10.2 11.6 12.2 8.4 42.4 8.5 8.8 9.3 7.8 34.3 Contract termination charge 0.0 0.0 0.0 0.0 0.0 0.0 22.0 0.0 0.0 22.0 Depreciation, amortization, and accretion 10.6 12.8 12.1 14.5 50.0 14.7 15.9 18.7 20.5 69.8 Other operating expenses 0.3 0.2 3.0 0.1 3.6 0.1 7.1 0.0 0.0 7.2 Total operating expenses $31.0 $35.8 $39.6 $39.7 $146.1 $31.7 $63.4 $38.2 $38.1 $171.3 Loss from operations ($12.8) ($16.8) ($21.4) ($22.3) ($73.2) ($14.9) ($43.4) ($17.7) ($19.0) ($95.0) Other income (expense) 6.4 2.8 20.7 (11.7) 18.2 (9.4) 16.0 (23.5) 0.1 (16.8) Income tax expense (0.1) (0.1) 0.0 0.3 0.1 (0.2) (0.1) (0.1) (0.1) (0.4) Net loss ($6.5) ($14.1) ($0.7) ($33.7) ($54.9) ($24.5) ($27.5) ($41.2) ($19.0) ($112.2) Adjusted EBITDA (1) ($2.5) ($2.0) ($3.5) $1.6 ($6.4) $1.4 $2.9 $3.1 $2.5 $9.8 ARPU Duplex $17.83 $18.87 $18.37 $14.99 $17.54 $15.35 $16.74 $18.95 $18.49 $17.42 SPOT 8.83 9.57 8.86 9.67 9.29 8.57 9.91 9.44 9.60 9.47 Simplex 3.09 3.12 3.98 3.65 3.37 3.03 2.88 3.24 3.23 3.11 IGO / Wholesale 2.34 3.43 3.01 1.74 2.67 1.45 1.54 1.60 1.81 1.59

$3.6 $27.3 $33.8 $21.8 ($14.2) ($12.6) ($8.5) ($6.4) $9.8 ($20.0) ($10.0) $0.0 $10.0 $20.0 $30.0 $40.0 Historical Annual Financial Summary 4 (1) Adjusted to exclude non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D costs associated with the development of new consumer products and certain other significant charges. See reconciliation to GAAP on Annex A. 2006 2007 2008 2009 2010 2011 2005 2004 Constellation service degradation 2012 Adjusted EBITDA (1) Revenue $84.4 $127.1 $136.7 $98.4 $86.1 $64.3 $67.9 $72.8 $76.3 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 2006 2007 2008 2009 2010 2011 2005 2004 2012 ($ in millions)

Fourth Launch Summary Constellation Update On February 6, 2013, Globalstar successfully completed the fourth launch of second-generation satellites from the Baikonur Comsodrome 12 th successful launch on the Soyuz vehicle with long- standing partner Arianespace and their affiliate Starsem Initial testing on all six satellites completed Two new satellites already placed into commercial service with the final satellites set to enter service over the following few months All previous launched satellites from Launches 1-3 are now in service New constellation will offer increased transmitted data speeds of 25x with new ground network Network cost is approximately 1/4th of the first constellation and 1/3rd of the nearest competitor’s new program Coverage and quality improvements will drive customer usage, market adoption and increased ARPU on a larger subscriber base 5

Petition for Rulemaking Summary FCC completed the comment cycle in January Certain interested parties filed initial comments –prior to the submission of reply comments, Globalstar addressed many of the issues raised in its hosted Webinar entitled “Globalstar’s New Wi-Fi Super Highway” Any remaining concerns regarding our near-term plans to provide terrestrial services, including Terrestrial Low Power Service (“TLPS”) are manageable and will be handled thoroughly in the future rulemaking We expect to hear from the FCC shortly regarding how the Commission will proceed with our petition and believe that they will issue a Notice of Proposed Rulemaking in the near future TLPS significantly expands the spectral capacity in the U.S. and can help to significantly relieve existing Wi-Fi congestion TLPS offers inherently beneficial spectral characteristics including a low noise floor, resulting in high data throughput and will be able to leverage existing device-level components / network infrastructure to quickly deploy this spectrum for consumer broadband use On November 13th, Globalstar filed a Petition for Rulemaking with the Federal Communications Commission (“FCC” or the “Commission”) for authority to provide a host of terrestrial mobile broadband services over its spectrum 6

Existing Wi-Fi Channels are Saturated with High Usage High channel crowding in existing public Wi-Fi channels (2401-2473), shown below in red and green, is now typical in many parts of the United States and acts as a fundamental limiting factor for both throughput and service quality. Globalstar’s spectrum together with adjacent unlicensed spectrum represents an effective “clear channel”, which offers considerable data speed and range advantages over interference limited public channels –lower interference characteristics means that transmission speeds can be maintained at a multiple of the range of the other adjacent channels. Frequency (MHz) 2400.0 2500.0 2450.0 0.0 30.0 Time (min) Amplitude (dBm) 22 MHz combination of AWS-5 & unlicensed ISM spectrum Wideband 3D Spectrogram 42.36022 deg -71.06438 deg (Boston, MA) START: 2.40 GHz STOP: 2.50 GHz Anritsu MS2721A / Broadband Omni Existing ISM Band 802.11 Wi-Fi Channels 2473.0 7

Representative New Product Summaries 8 Throughout 2013, Globalstar will continue to roll out new products to the consumer, industrial and government markets including the 3 rd generation of SPOT Satellite GPS Messenger. Globalstar will also introduce the satellite industry’s first consumer focused asset tracking device and its next generation STX. Product Features New Products Battery life 2x SPOT 2 Enhanced customization features Smaller form factor USB connection for line power allows for an indefinite life span New movement messaging, theft alerting capabilities Device shown in relative size next to a smartphone. Consumer asset tracking device Broadens addressable market and leverages retail distribution network Offers consumers the ability to track anything, anywhere, anytime Consumer Asset Tracker STX3 Smallest and most efficient simplex transmitter ever Will result in greater market penetration and will broaden customer base ASIC based device which makes it smaller, lighter, cost effective and power efficient SPOT 3

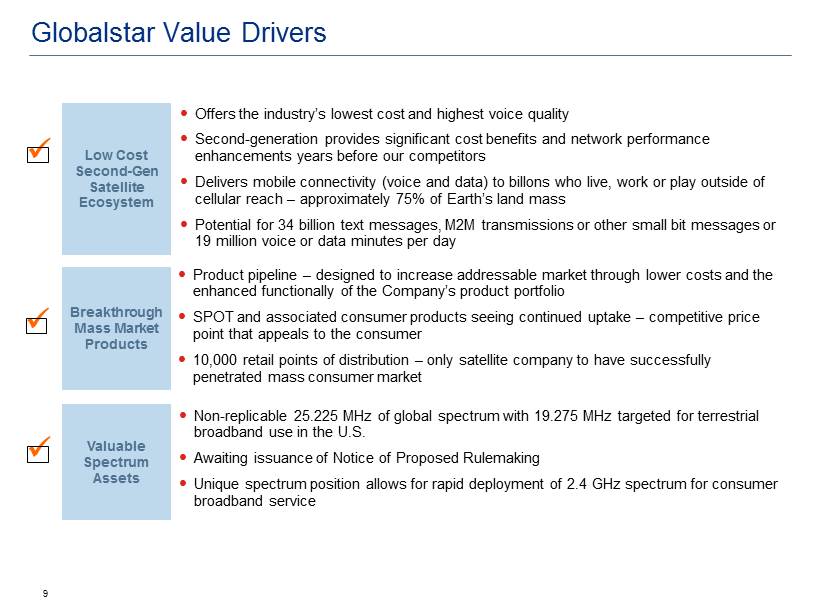

Globalstar Value Drivers Low Cost Second-Gen Satellite Ecosystem x Breakthrough Mass Market Products x Valuable Spectrum Assets x Offers the industry’s lowest cost and highest voice quality Second-generation provides significant cost benefits and network performance enhancements years before our competitors Delivers mobile connectivity (voice and data) to billons who live, work or play outside of cellular reach –approximately 75% of Earth’s land mass Potential for 34 billion text messages, M2M transmissions or other small bit messages or 19 million voice or data minutes per day Product pipeline –designed to increase addressable market through lower costs and the enhanced functionally of the Company’s product portfolio SPOT and associated consumer products seeing continued uptake –competitive price point that appeals to the consumer 10,000 retail points of distribution –only satellite company to have successfully penetrated mass consumer market 9 Non-replicable 25.225 MHz of global spectrum with 19.275 MHz targeted for terrestrial broadband use in the U.S. Awaiting issuance of Notice of Proposed Rulemaking Unique spectrum position allows for rapid deployment of 2.4 GHz spectrum for consumer broadband service

Annex A –Adjusted EBITDA Reconciliation 10 ($ in millions) 2004 2005 2006 2007 2008 2009 2010 2011 2012 EBITDA ($0.7) $26.5 $26.3 ($2.9) ($35.3) ($31.3) ($35.1) ($24.0) ($27.5) Reduction in the value of long-lived assets & inventory 0.1 0.1 1.9 19.1 0.4 0.9 16.0 12.4 8.6 Stock Compensation (non-cash) - - 1.2 9.6 12.9 10.6 1.0 2.2 1.3 Research & Development - - - - 2.7 4.3 3.7 1.8 0.3 Severence - - - - - 1.6 2.1 1.3 0.1 Foreign exchange & other losses - - 4.0 (8.7) 4.5 (0.7) - 0.6 2.3 Revenue recognized from Open Range lease termination - - - - - - - (2.0) - Thales arbitration expenses - - - - - - - 1.0 1.8 Contract termination charge - - - - - - - - 22.0 Write off of deferred financing costs - - - - - - - - 0.8 Other one-time non-recurring charges 4.1 0.6 0.4 4.7 0.6 1.9 3.7 0.3 - Adjusted EBITDA $3.6 $27.3 $33.8 $21.8 ($14.2) ($12.6) ($8.5) ($6.4) $9.8