UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): | March 8, 2013 | |

SunTrust Banks, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

Georgia | 001-08918 | 58-1575035 |

(State or other jurisdiction | (Commission File Number) | (I.R.S. Employer |

of incorporation) | Identification No.) | |

303 Peachtree Street, N.E., Atlanta, Georgia | 30308 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code | (404) 558-7711 | |

Not Applicable | ||||

Former name or former address, if changed since last report | ||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other.

SunTrust Banks, Inc. (the “Registrant” or “SunTrust”) today announced the results from its Company-run stress test. Pursuant to the Dodd-Frank Stress Test Final Rule, the Company estimated certain balance sheet, income statement, loan loss, and capital ratio items, based upon the economic conditions assumed in the Federal Reserve Board's Supervisory Severely Adverse scenario. This scenario constitutes a hypothetical, severe recession that is characterized by a substantial weakening in the economy. Despite the severely adverse conditions, SunTrust estimates that it would maintain a Tier 1 common ratio above 9% throughout the nine-quarter forecast horizon.

Overview

SunTrust regularly evaluates financial and capital forecasts under various baseline and stressed scenarios. This includes running multiple Company-specific scenarios, as well as multiple scenarios prescribed by the Federal Reserve as part of the annual Comprehensive Capital Analysis and Review (“CCAR”) process. In conjunction with the CCAR process and pursuant to the Dodd-Frank Stress Test Final Rule, SunTrust estimated the impacts to its financial performance under the hypothetical conditions prescribed in the Federal Reserve Board's Supervisory Severely Adverse scenario. The forecast time horizon of this stress test (hereafter referred to as the “D-F Stress Test”) covered the nine-quarter period beginning in the fourth quarter of 2012 and continuing through the fourth quarter of 2014.

The Federal Reserve Board's Supervisory Severely Adverse Scenario

As noted above, the macroeconomic backdrop against which the stress test was conducted was based upon the Federal Reserve Board's Supervisory Severely Adverse scenario. This is a hypothetical scenario designed to assess the strength of banking organizations and their resilience to severely adverse economic conditions. The full details of the Supervisory Severely Adverse scenario are found on the Federal Reserve website, www.federalreserve.gov. Hypothetical trends in some of the key economic indicators over the forecast horizon include:

• | The unemployment rate increasing to approximately 12%; |

• | Real GDP declining approximately 5% between the third quarter of 2012 and the end of 2013; |

• | Equity prices falling more than 50%; |

• | Significant weakening in the U.S. housing market, with housing prices and commercial real estate declining more than 20% by the end of 2014. |

D-F Stress Test Methodology and Review of Risks

To support the assessments used to create the D-F Stress Test projections, SunTrust utilized multiple forms of quantitative and qualitative analysis. As described above, the Federal Reserve Board provided hypothetical macroeconomic variables, and these served as key model inputs which informed SunTrust's financial forecasts for specific balance sheet, income statement, and loan loss categories. The financial forecasts employed multiple techniques including driver-based models, historical trend analysis, regression analysis, and Monte Carlo simulation. These forecasts were supplemented, as needed, with management judgment to ensure appropriate consideration of strategic initiatives and to mitigate any estimation limitations.

Per the D-F Stress Test, banks were required to use a formulaic approach with respect to any assumed return of capital to shareholders. Per this requirement, SunTrust assumed that its common stock dividend remained constant relative to the prior year and no share repurchases. It is important to note that the D-F Stress Test does not take into account any capital actions the Company requested as part of CCAR.

SunTrust also assessed various types of risks in the D-F Stress Test. As part of its ongoing capital management program, SunTrust utilizes a comprehensive risk identification process to help ensure that capital adequacy is evaluated based upon the Company's material risks, its associated risk profile, and the business operating environment. The Company carefully reviews the identified risks and determines the extent to which their impacts are captured in the capital measures utilized by SunTrust. This risk assessment was conducted for the D-F Stress Test and included the following broad categories:

1. | Liquidity - the ability to meet obligations under normal or stressed conditions; |

2. | Interest Rate - exposure to adverse movements in interest rates; |

3. | Market - exposure to changes in interest rates, equity markets, or other economic variables; |

4. | Credit - exposure to borrowers' failure to meet the terms of their contract with SunTrust. This also includes counterparty credit exposure arising from hedging activities and client needs; |

5. | Regulatory - violations of, or nonconformance with, laws, rules, regulations, prescribed practices, or ethical standards; |

6. | Operational - inadequacy or failure of internal processes, people and/or systems, or from external events that negatively impact internal processes, people and/or systems; |

7. | Legal - litigation stemming from either real or perceived wrongdoing in any line of business or functional area; |

8. | Model - flawed or faulty assumptions within decision-making tools, misuse of tools, or misinterpretation of results; |

9. | Strategic - poor decision-making or improper follow-through on decisions; |

10. | Reputational - negative publicity or negative client/market perceptions of the Company. |

Upon assessing its risks, forecasted credit losses, the allowance for loan and lease losses (“ALLL”), pre-provision net revenue (“PPNR”), and quarterly net income, SunTrust reviewed its pro-forma capital levels and confirmed they were within acceptable regulatory and Company-specific limits. As part of this determination, the Risk Committee of SunTrust's Board of Directors and other senior management members reviewed, challenged, and approved the risk assessment process and the financial forecasts at both the Bank and Bank Holding Company (“BHC”) levels, which are summarized below.

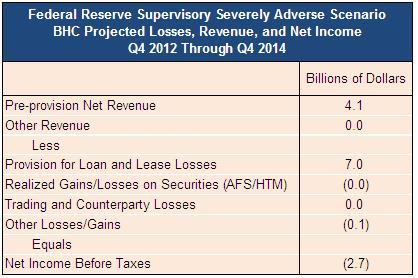

SunTrust Forecast Results under the D-F Stress Test

Due to the severe economic conditions in the hypothetical Supervisory Severely Adverse scenario, SunTrust estimates that both Bank and BHC financial results and capital ratios would decline during the D-F Stress Test forecast horizon. Entity-level forecasts include lower pre-provision net revenue, lower loan balances, reduced noninterest income, and higher operational risk expenses. Credit losses also increase due to higher frequency of borrower default and increased loan loss severity. Consequently, a net loss is forecast over the nine-quarter period, and capital ratios decline at both the Bank and the BHC. Specifically, the BHC Tier 1 Common capital ratio declines from 9.8% as of the third quarter 2012 to 9.0% in the fourth quarter of 2014.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SUNTRUST BANKS, INC. | |||||

(Registrant) | |||||

Date: March 8, 2013. | By: | /s/ David A. Wisniewski | |||

David A. Wisniewski, Senior Vice President, | |||||

Deputy General Counsel and Assistant Secretary | |||||