Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PATHEON INC | d496420dex991.htm |

| 8-K - FORM 8-K - PATHEON INC | d496420d8k.htm |

Exhibit 99.2

Patheon

Fiscal 2013 First Quarter Results

March 8, 2013

Forward-looking statements

This presentation contains forward-looking statements or information which reflect our expectations regarding possible events, conditions, our future growth, results of operations, performance, and business prospects and opportunities. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause our actual results in future periods to differ materially from those expressed or implied by such forward-looking statements. These risks are described in our 2012 Form 10-K and our subsequent filings with the U.S. Securities and Exchange Commission and the Canadian Securities Administration. Accordingly, you are cautioned not to place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof, and except as required by law, we assume no obligation to update or revise them to reflect new events or circumstances.

Use of Non-GAAP Financial Measures

Commencing with the first quarter of fiscal 2013, we revised our calculation of Adjusted EBITDA to exclude stock-based compensation expense, consulting costs related to our operational initiatives and purchase accounting adjustments. We believe that excluding these items from Adjusted EBITDA better reflects our underlying performance. Based on the revisions to the definition of Adjusted EBITDA, we have recast the presentation of Adjusted EBITDA for prior periods to be consistent with the current period presentation. Our Adjusted EBITDA (as revised) is now income (loss) from continuing operations before repositioning expenses, interest expense, foreign exchange losses reclassified from other comprehensive income (loss), refinancing expenses, acquisition-related costs, gains and losses on sale of capital assets, income taxes, asset impairment charges, depreciation and amortization, stock-based compensation expense, consulting costs related to our operational initiatives, purchase accounting adjustments and other income and expenses. “Adjusted EBITDA margin” is Adjusted EBITDA as a percentage of revenues. Since Adjusted EBITDA is a non-GAAP measure that does not have a standardized meaning, it may not be comparable to similar measures presented by other issuers. Readers are cautioned that Adjusted EBITDA should not be construed as an alternative to net income (loss) determined in accordance with U.S. GAAP as an indicator of performance. Adjusted EBITDA is used by management as an internal measure of profitability. We have included Adjusted EBITDA because we believe that this measure is used by certain investors to assess our financial performance before non-cash charges and certain costs that we do not believe are reflective of our underlying business. Reconciliations of Adjusted EBITDA to the closest GAAP measures are included in the Appendix to this presentation.

1

Fiscal 2013 first quarter highlights

• Revenue increased by 38.7% from prior year

– Patheon standalone grew by 23.6% from prior year

• Conversion to a gross profit increase of 194.4% from prior year

– Patheon standalone increased by 152.8% from prior year

• Adjusted EBITDA increase of $21.7 million from prior year

– Patheon standalone increased by over $20 million from prior year

• Transformation continues to yield benefits

2

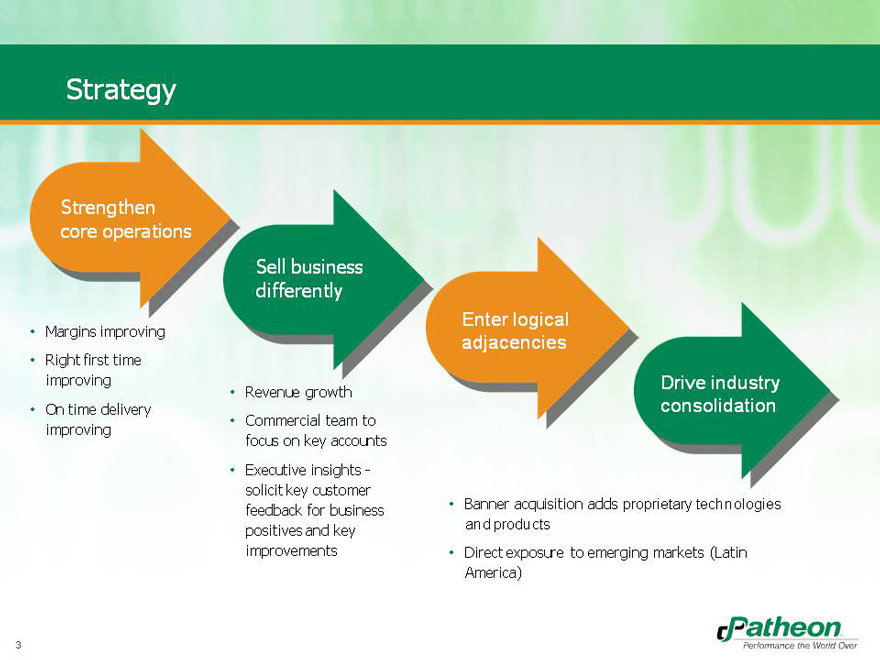

Strategy

Strengthen core operations

• Margins improving

• Right first time improving

• On time delivery improving

Sell business differently

• Revenue growth

• Commercial team to focus on key accounts

• Executive insights -solicit key customer feedback for business positives and key improvements

Enter logical adjacencies

• Banner acquisition adds proprietary technologies and products

• Direct exposure to emerging markets (Latin America)

Drive industry consolidation

3

Banner Integration Update

• We are working toward the full integration of Banner, at which time we expect the combined enterprise will be structured as three distinct business units

– CMO, PDS and Proprietary Products and Technology

• Combined enterprise will have a clear vision to drive value-creation through proprietary products and technology added by the Banner acquisition

• Banner manufacturing sites have been transitioned to CMO structure

• Launching operational efficiency initiatives to increase cost savings

• Consolidation of Olds, Alberta facility is consistent with our strategy to strengthen core operations through network rationalization

Fueling growth beyond a USD 1 billion enterprise

4

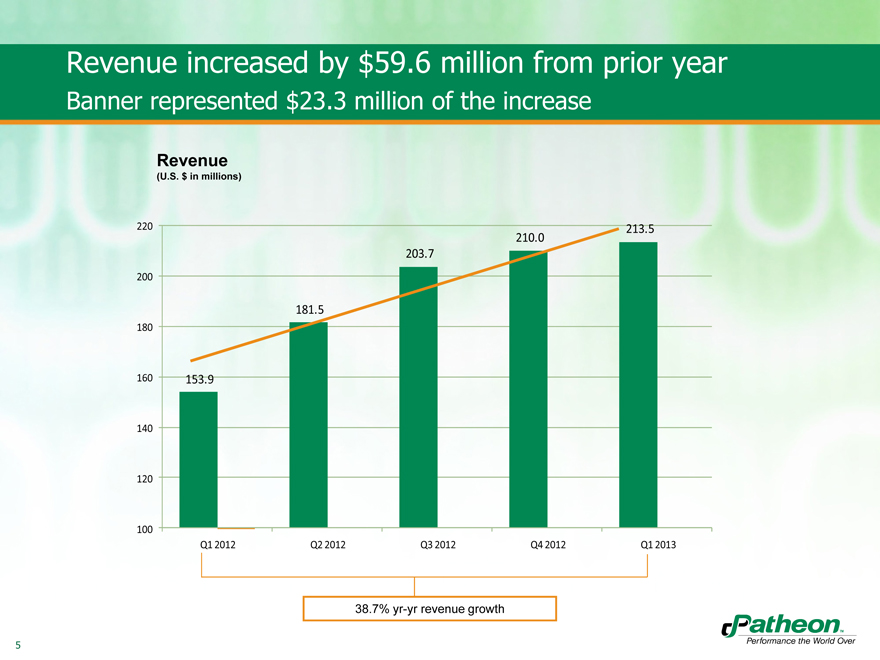

Revenue increased by $59.6 million from prior year

Banner represented $23.3 million of the increase

Revenue

(U.S. $ in millions)

220 213.5

210.0

203.7

200

181.5

180

160 153.9

140

120

100

Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013

38.7% yr-yr revenue growth

5

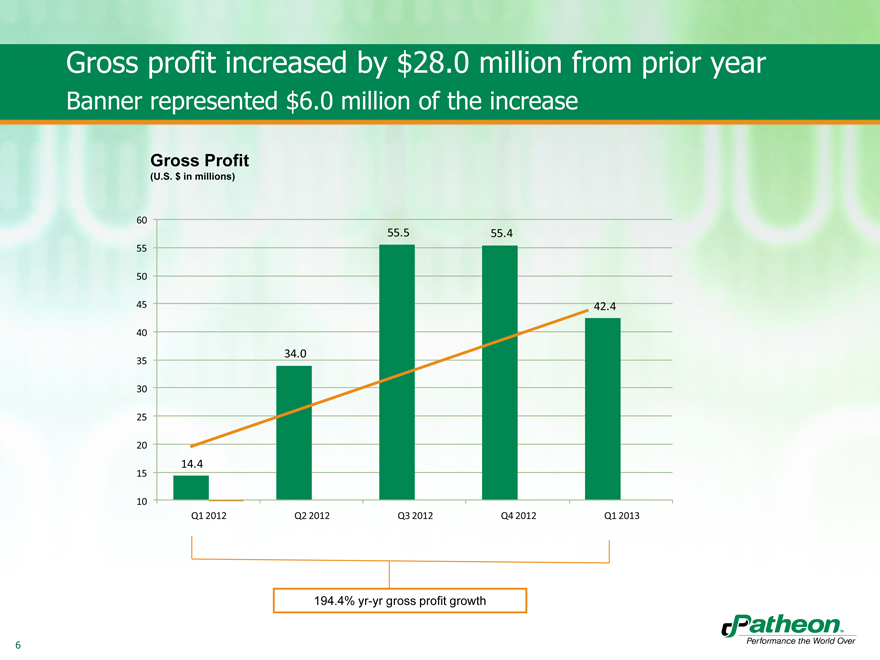

Gross profit increased by $28.0 million from prior year

Banner represented $6.0 million of the increase

Gross Profit

(U.S. $ in millions)

60

55.5 55.4

55

50

45 42.4

40

34.0

35

30

25

20

14.4

15

10

Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013

194.4% yr-yr gross profit growth

6

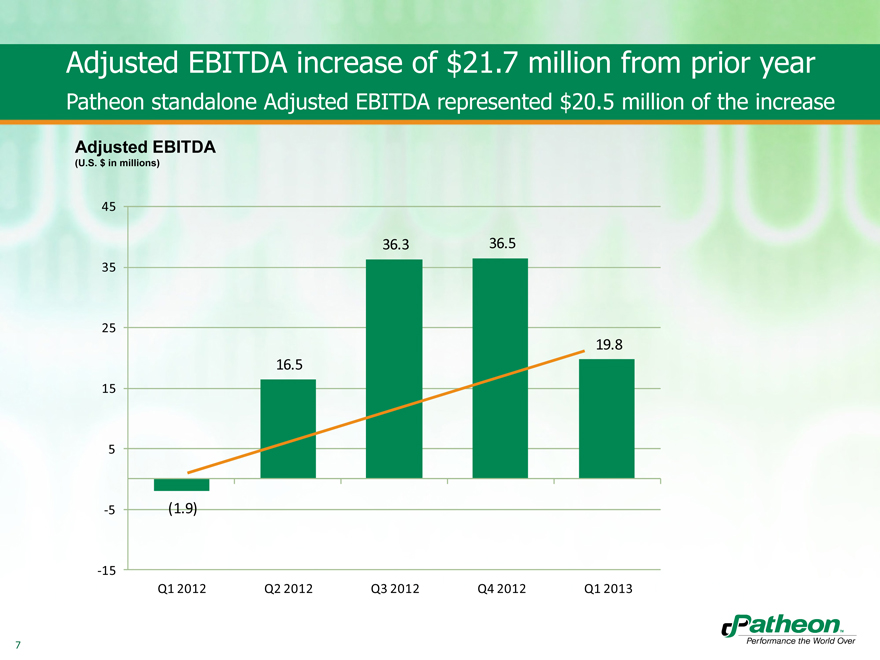

Adjusted EBITDA increase of $21.7 million from prior year

Patheon standalone Adjusted EBITDA represented $20.5 million of the increase

Adjusted EBITDA

(U.S. $ in millions)

45

36.3 36.5

35

25

19.8

16.5

15

5

-5(1.9)

-15

Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013

7

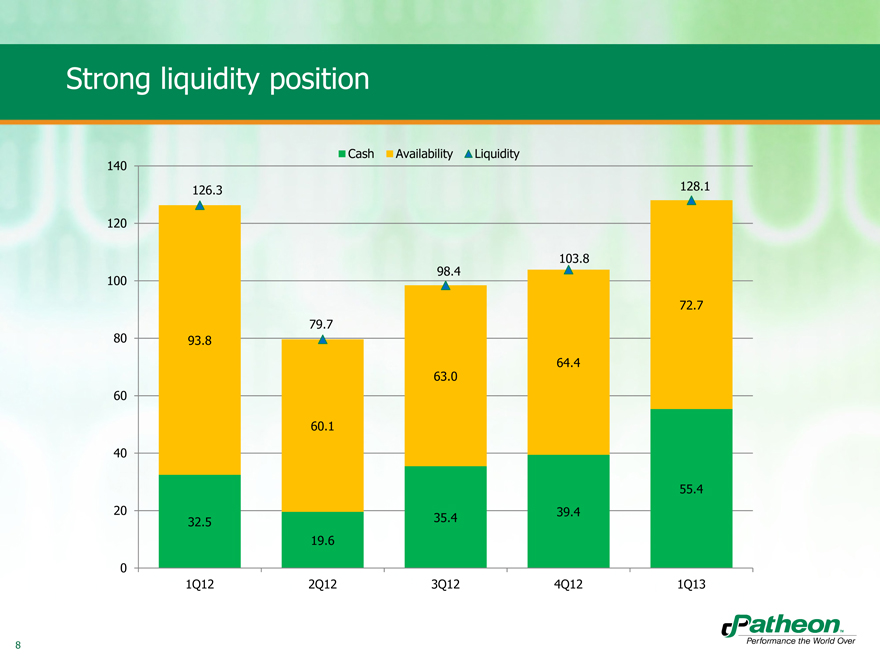

Strong liquidity position

Cash Availability Liquidity

140

126.3 128.1

120

103.8

98.4

100

72.7

79.7

80 93.8

64.4

63.0

60

60.1

40

55.4

20 39.4

32.5 35.4

19.6

0

1Q12 2Q12 3Q12 4Q12 1Q13

8

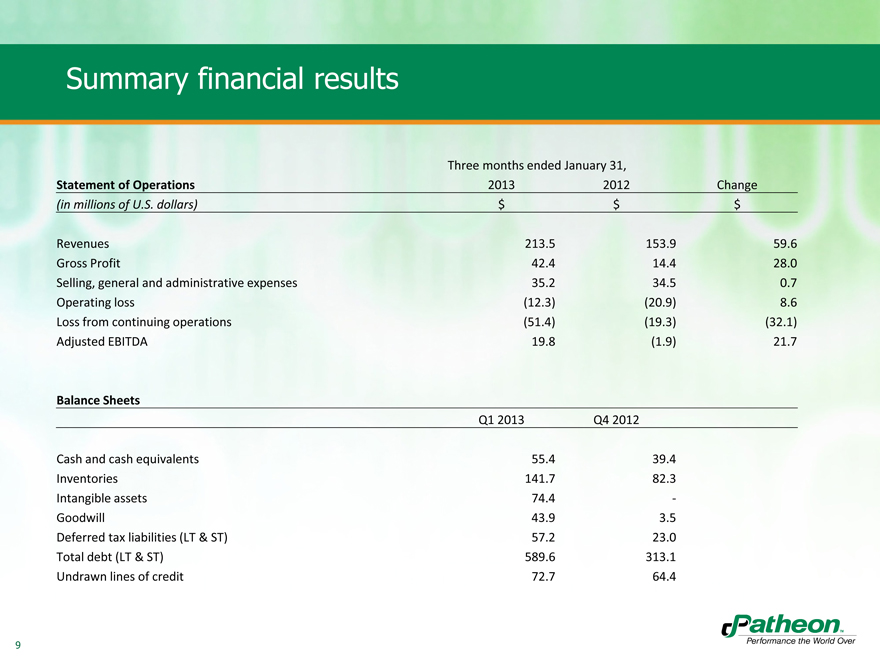

Summary financial results

Three months ended January 31,

Statement of Operations 2013 2012 Change

(in millions of U.S. dollars) $ $ $

Revenues 213.5 153.9 59.6

Gross Profit 42.4 14.4 28.0

,

Operating loss(12.3)(20.9) 8.6

Loss from continuing operations(51.4)(19.3)(32.1)

Adjusted EBITDA 19.8(1.9) 21.7

Balance Sheets

Q1 2013 Q4 2012

Cash and cash equivalents 55.4 39.4

Inventories 141.7 82.3

Intangible assets 74.4 -

Goodwill 43.9 3.5

Deferred tax liabilities (LT & ST) 57.2 23.0

Total debt (LT & ST) 589.6 313.1

Undrawn lines of credit 72.7 64.4

9

2013 priorities

• Drive customer performance

• Exceed industry growth rates

• Complete Banner integration

• Deliver strong financials

10

Thank you

11

Appendix

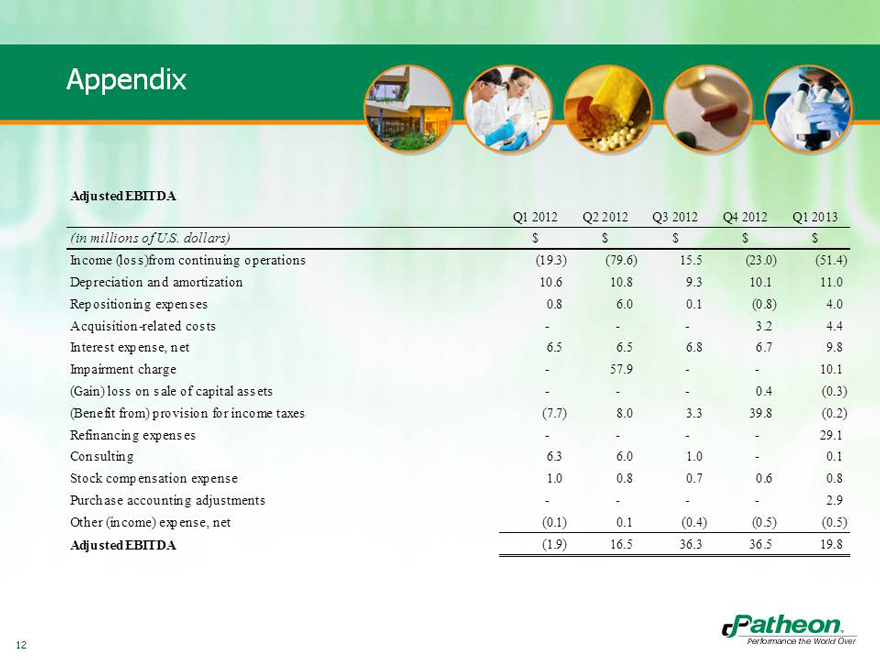

Adjusted EBITDA

Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013

(in millions of U.S. dollars) $ $ $ $ $

Income (loss)from continuing operations(19.3)(79.6) 15.5(23.0)(51.4)

Depreciation and amortization 10.6 10.8 9.3 10.1 11.0

Repositioning expenses 0.8 6.0 0.1(0.8) 4.0

Acquisition-related costs ——3.2 4.4

Interest expense, net 6.5 6.5 6.8 6.7 9.8

Impairment charge—57.9 — 10.1

(Gain) loss on sale of capital assets ——0.4(0.3)

(Benefit from) provision for income taxes(7.7) 8.0 3.3 39.8(0.2)

Refinancing expenses — — 29.1

Consulting 6.3 6.0 1.0—0.1

Stock compensation expense 1.0 0.8 0.7 0.6 0.8

Purchase accounting adjustments — — 2.9

Other (income) expense, net(0.1) 0.1(0.4)(0.5)(0.5)

Adjusted EBITDA(1.9) 16.5 36.3 36.5 19.8

12