Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CIL&D, LLC | Financial_Report.xls |

| EX-32 - EX-32 - CIL&D, LLC | d447732dex32.htm |

| EX-31.1 - EX-31.1 - CIL&D, LLC | d447732dex311.htm |

| EX-31.2 - EX-31.2 - CIL&D, LLC | d447732dex312.htm |

Table of Contents

United States

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2012 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-33433

KAISER VENTURES LLC

(Exact name of registrant as specified in its charter)

| DELAWARE | 33-0972983 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

337 N. Vineyard Ave., 4th Floor

Ontario, CA 91764

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (909) 483-8500

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of Each Class |

Name of Each Exchange on which Registered | |

| Class A Units | Not Applicable |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not herein, and will not be contained to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨ (The registrant is not yet required to submit Interactive Data)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The Class A Units are not publicly traded and thus, no public float exists and an aggregate market value of the Company’s Class A Units cannot be determined.

At March 1, 2013, 7,096,806 Class A Units were outstanding including 104,267 Class A Units outstanding but reserved for distribution to the general unsecured creditors in the Kaiser Steel Corporation bankruptcy and 113,101 Class A Units deemed outstanding and reserved for issuance to holders of Kaiser Ventures Inc. stock that have to convert such stock into Kaiser Ventures LLC Class A Units.

Documents Incorporated by Reference: Certain exhibits as identified in the Exhibit List to this Annual Report on Form 10-K are incorporated by reference.

Transitional Small Business Disclosure Format (Check One): Yes ¨ No x

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

TABLE OF CONTENTS TO FORM 10-K

| PAGE | ||||||||

| PART I | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| Item 1. | 1 | |||||||

| Item 1A. | 16 | |||||||

| Item 1B. | 16 | |||||||

| Item 2. | 17 | |||||||

| Item 3. | 23 | |||||||

| Item 4. | 25 | |||||||

| PART II | ||||||||

| Item 5. | MARKET FOR THE COMPANY’S EQUITY, RELATED OWNER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

26 | ||||||

| Item 6. | 27 | |||||||

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

28 | ||||||

| Item 7A. | 36 | |||||||

| Item 8. | 37 | |||||||

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

59 | ||||||

| Item 9A. | 59 | |||||||

| Item 9B. | 60 | |||||||

| PART III | ||||||||

| Item 10. | 61 | |||||||

| Item 11. | 65 | |||||||

| Item 12. | SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED MEMBER MATTERS |

78 | ||||||

| Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND MANAGER INDEPENDENCE |

79 | ||||||

| Item 14. | 80 | |||||||

| PART IV | ||||||||

| Item 15. | 81 | |||||||

i

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

PART I

Except for the historical statements and discussions contained herein, statements contained in this 10-K Report constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any 10-K Report, 10-KSB Report, 10-Q Report, 10-QSB Report, 8-K Report, website posting or press release of the Company and any amendment thereof may include forward-looking statements. In addition, other written or oral statements, which constitute forward-looking statements, have been made and may be made in the future by the Company. You should not put undue reliance on forward-looking statements. When used or incorporated by reference in this 10-K Report or in other written or oral statements, the words “anticipate,” “estimate,” “project,” and similar expressions are intended to identify forward-looking statements. Such statements are subject to certain risks, uncertainties, and assumptions. We believe that our current assumptions are reasonable. Nonetheless, it is likely that at least some of these assumptions will not come true. Accordingly, should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected, or projected. For example, our actual results could materially differ from those projected as a result of factors such as, but not limited to: the consequences of the adverse conclusion of the final federal litigation involving a previously completed federal land exchange and the Company’s decision not to provide additional funds to Mine Reclamation, LLC for purposes of pursuing a “fix” of the land exchange; the bankruptcy of Mine Reclamation, LLC and the claims that may be made in or as result of such bankruptcy; pre-bankruptcy activities of Kaiser Steel Corporation, the predecessor of Kaiser, and asbestos and environmental claims; insurance coverage disputes; the impact of existing or proposed federal, state, and local laws and regulations on any of our current and future projects and subsidiaries, and their permitting and development activities; competition; the challenge, reduction or loss of any claimed tax benefits, including the taxation of the Company as a partnership; the impact of natural disasters on our assets; the amount and nature of the mineral resources at Eagle Mountain and any inability to exploit such possible mineral and resource opportunities; the impacts and risks of the proposed dissolution and winding-up of the Company; and/or general economic conditions in the United States and Southern California. The Company disclaims any intention to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Unless otherwise noted: (1) the term “Kaiser LLC” refers to Kaiser Ventures LLC; (2) the term “Kaiser Inc.” refers to the former Kaiser Ventures Inc.; (3) the terms “Kaiser,” the “Company,” “we,” “us,” and “our,” refer to past and ongoing business operations conducted in the form of Kaiser Inc. or currently Kaiser LLC, and their respective subsidiaries. Kaiser Inc. merged with and into Kaiser LLC effective November 30, 2001; (4) the terms “Class A Units” and “members” refer to Kaiser LLC’s Class A Units and the beneficial owners thereof, respectively; and (5) the term the “merger” refers to the merger of Kaiser Inc. with and into Kaiser LLC effective November 30, 2001, in which Kaiser LLC was the surviving company Kaiser Steel Corporation, referred to as KSC, formerly was an integrated steel manufacturer that filed for Chapter 11 bankruptcy in 1987. Kaiser is the reorganized successor to a portion of the assets of the former KSC.

| Item 1. | BUSINESS |

Summary of Our Business

Overview. Our business has been to develop the remaining assets we received from the KSC bankruptcy and the possible opportunities related to such assets. In 2000 Kaiser’s then Board of Directors approved a cash maximization strategy with the goal of seeking to reasonably maximize future

1

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

distributions to our members. On January 15, 2013, our Board of Managers approved a Plan of Dissolution and Liquidation (the “Dissolution Plan”) and other documents that are necessary or appropriate to implement the Dissolution Plan as a final step in such cash maximization strategy. The Dissolution Plan and the attendant Second Amended and Restated Limited Liability Company Operating Agreement (“New Operating Agreement”), among other items, will require the approval of the Company’s Class A members. A meeting of the Company’s members will most likely will be held early in the second quarter of 2013. For additional information in this regard, see “Item 1. Business—Cash Maximization Strategy and Proposed Dissolution of the Company” below.

Currently, our remaining material projects and opportunities are summarized below.

| • | We own an 84.247% ownership interest in Mine Reclamation, LLC, (referred to as MRC), which has been seeking to develop a rail-haul municipal solid waste landfill at a property called the Eagle Mountain Site located in the California desert (the “Landfill Project”). On October 30, 2011, MRC filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for Central District of California, Riverside Division, bankruptcy case number 6:11-bk-43596 (the “Bankruptcy Court”). MRC continues to operate its business as a “debtor in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code, Rules and orders of the Bankruptcy Court. MRC has currently established a $500,000 line of credit with us but we have approved providing up to a $1 million line of credit. Any proceeds from permitted draws on the line of credit are to be used to complete, if necessary, the MRC bankruptcy process. MRC may not be able to repay any amounts loaned to it by the Company if MRC is not able to complete a transaction for the sale of its remaining assets or if the net sales price of any transaction should be less than the amount owed to the Company. |

The Landfill Project has been the subject of intense litigation in federal court over the course of more than ten years regarding the validity of a land exchange with the U.S. Bureau of Land Management (“BLM”). The land exchange is central to the development of the Landfill Project as permitted. On March 28, 2011, the U.S. Supreme Court denied the request of MRC for further review of the prior decision of the U.S. 9th Circuit Court of Appeals that had been adverse to the position of MRC and the BLM. Thus, the previous federal land exchange litigation is now final and concluded as there is no further right of appeal. Although the land exchange has been remanded to the BLM for further proceedings in accordance with the decision of the U.S. 9th Circuit Court of Appeals, there is no pending litigation and no current plan or process being undertaken by MRC to “fix” the land exchange since MRC does not have the funds or wherewithal to pursue such an objective. Additionally, Kaiser has decided that it will not make any further investment in MRC to fund a “fix” of the land exchange. However, other third parties may ultimately seek to “fix” the land exchange for purposes of the Landfill Project. For additional information on the nearly 20 years of administrative challenges and litigation involving the Landfill Project, see “Item 1. BUSINESS—Mine Reclamation and Eagle Mountain Landfill Project—Historical Landfill Project Litigation.”

As further background, MRC and the County Sanitation District No. 2 of Los Angeles County (the “District”) had entered into an Agreement for Purchase and Sale of Real Property and Related Personal Property in Regard to the Eagle Mountain Sanitary Landfill Project and Joint Escrow Instructions on August 9, 2000 (the “Landfill Project Sale Agreement”). The closing date under the Landfill Project Sale Agreement had been extended numerous times since December 31, 2000, pursuant to written extension agreements between MRC and the District. Under each of those extension agreements, the District had the right to either purchase the Landfill Project in its “as is” condition or to terminate its Landfill Project Sale Agreement with MRC. The last extension of the closing date under the Landfill Project Sale Agreement was set to expire on October 31, 2011. The then Chief Engineer and General Manager of the District had initially indicated that the District was not intending to proceed with the purchase of the Landfill Project;

2

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

then he later communicated that the District would be purchasing the Landfill Project on October 31, 2011. Subsequent to the verbal communications from the then Chief Engineer and General Manager, the District repudiated in writing the terms of the last extension agreement, and threatened to sue MRC to, among other things, compel MRC, at MRC’s sole expense and risk, to further proceed with fully permitting the landfill which would have involved substantial additional financial resources and time, neither of which MRC had. Thus, MRC filed for bankruptcy protection on October 30, 2011, in federal bankruptcy court in Riverside County, California in order to preserve and protect its assets and options with respect to such assets.

| • | We own or control millions of tons of iron ore resources at the Eagle Mountain Site. With the large amount of iron ore reserves at Eagle Mountain and with the current high market prices for minerals, including for iron ore, we continue to aggressively pursue possible opportunities with regard to the iron ore and other mineral resources. In this regard, the Company continues to work with an investment banking and advisory firm to assist it in exploring possible opportunities and transactions with regard to these resources. There may be a range of possible opportunities including some of which that may take several years to develop and implement. For additional information regarding the resources at Eagle Mountain please see “Item 2. PROPERTIES—Eagle Mountain, California;” |

| • | As a result of previous mining operations there are millions of tons of rock stockpiled at the Eagle Mountain Site. We are continuing to explore available markets for such rock. For additional information regarding the resources at Eagle Mountain, please see “Item 2. PROPERTIES—Eagle Mountain, California;” |

| • | We are continuing to seek to sell the Company’s other miscellaneous assets, such as our Lake Tamarisk property. Lake Tamarisk is an unincorporated community located approximately 70 miles east of Palm Springs, California, and approximately 8 miles from the Eagle Mountain Site. Our Lake Tamarisk land consists of 72 residential lots and approximately 420 acres of other undeveloped property. For additional information on Lake Tamarisk, please see “Item 2. PROPERTIES—Lake Tamarisk, California”; and |

| • | We are analyzing the issues created by the proposed hydro-electric pumped storage project at the Eagle Mountain Site including the threat of the taking of our property by eminent domain. |

Sale of Ownership Interest In West Valley MRF, LLC. We no longer own an interest in the West Valley MRF, LLC (“WVMRF, LLC”). On April 2, 2012, Kaiser Recycling, LLC, a wholly-owned subsidiary of Kaiser LLC, sold its fifty percent (50%) ownership interest in the WVMRF, LLC which owns and operates the West Valley Materials Recovery Facility and Transfer Station, a transfer station and materials recovery facility near Fontana, California. The gross cash sales price for Kaiser Recycling’s 50% ownership interest was approximately $25,769,000 with the Company recording a gain on the sale of $20,588,000 in the second quarter of 2012.

CASH MAXIMIZATION STRATEGY AND PROPOSED LIQUIDATION OF THE COMPANY

Cash Maximization Strategy. In September 2000, Kaiser Inc.’s Board of Directors approved a strategy to maximize the cash ultimately to be distributed to Kaiser Inc.’s stockholders. Consistent with this strategy, Kaiser Inc. historically completed or entered into a number of transactions. For additional information on these transactions see “Item 1. BUSINESS—Historical Operations and Completed Transactions” in this Annual Report on Form 10-K. Pursuit of the cash maximization strategy over the past 13 years, the Company has made distributions totaling $13.50 per unit/share as of March 1, 2013. Specifically: (i) a $2.00 per share return of capital distribution was made to shareholders in 2000; (ii) with the conversion of Kaiser Inc. to a limited liability company in November 2001, a distribution was made to shareholders of $10.00 per share plus one Class A Unit in Kaiser LLC upon surrender of their Kaiser Inc. stock; and (iii) with the sale of the ownership interest in the WVMRF, LLC in April 2012, a

3

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

distribution of $1.50 per unit was made in May 2012. In addition, we have also taken steps to minimize any exposure we may have to liabilities resulting from the historical operations of the former KSC.

In furtherance of the cash maximization strategy, the Company has been seeking to sell its ownership interest in MRC, in Kaiser Eagle Mountain, LLC (“KEM”); the owner of the property at Eagle Mountain, and in Lake Tamarisk Development, LLC (“Lake Tamarisk”), the owner of property at Lake Tamarisk. Any possible sale of the Kaiser Eagle Mountain property was subject, in all instances, to the rights of the District to acquire the Landfill Project on or before October 31, 2011. For additional information on these efforts, see “Item 2. PROPERTIES—Eagle Mountain, California.” The final implementation of the cash maximization strategy has been negatively impacted by, among other things, the adverse final decision in the federal land exchange litigation which has halted MRC’s ability to continue to pursue the Landfill Project, the adverse actions of the District, MRC’s bankruptcy and unsettled economic conditions. However, the Company’s Board of Managers has determined that the proposed dissolution of the Company is currently the best opportunity to achieve possible future distributions to its members. Additionally, if the dissolution of the Company occurs, the final implementation of the cash maximization strategy could take a significant additional period of time depending upon the timing of the resolution of MRC’s bankruptcy and the sale of our remaining assets. We are continuing to evaluate all reasonable options with regard to the disposition of our remaining assets.

Proposed Dissolution of the Company. On January 15, 2013, the Company’s Board of Managers approved the dissolution and liquidation of the Company pursuant to the Plan of Dissolution and approved the New Operating Agreement for the Company, both of which remain subject to approval by the Company’s Class A members. The Board of Managers concluded that it is currently in the best interests of the Company and its members to dissolve and liquidate as the final step in implementing the Company’s previously approved cash maximization strategy. Assuming the Plan of Dissolution is approved by the Company’s members, the Company plans on selling its remaining assets, discharging or making adequate provision for all of its known and contingent liabilities and distributing the net liquidation proceeds, if any, in one or more future distributions to members. However, there could be no further distributions to members if our remaining assets are sold for substantially less than we currently anticipate and/or if liquidation expenses and actual and contingent liabilities are higher than we currently understand and estimate. Accordingly, we are not able to predict with certainty the precise nature, amount or timing of any future distributions, primarily due to our inability to accurately predict (i) the amount of our remaining liabilities, (ii) the amount that we will expend during the course of the liquidation, or (iii) the net realizable value, if any, of our remaining non-cash assets. The Board has not established a firm timetable for any interim or final distributions to the Company’s members. If the Plan of Dissolution is approved by the Company’s members, the individuals serving on the Board of Managers will resign from the Board of Managers and the Board of Managers will be eliminated and replaced with a single Liquidation Manager with the power and authority to manage the liquidation and dissolution of the Company and the winding up of its affairs. The target date to complete dissolution is June 30, 2014, but that date could be extended to December 31, 2014, or beyond at the discretion of the Liquidation Manager.

Further details of the Plan of Dissolution and the New Operating Agreement will be provided in a proxy statement that will accompany the notice of the special members’ meeting that will be called to approve the Plan of Dissolution, the New Operating Agreement and a name change for the Company. The special members’ meeting would be the commencement of the final step in the Company’s cash maximization strategy.

4

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

MEMBERS OF THE COMPANY ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY ALL RELEVANT MATERIALS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE, BECAUSE THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS.

If the Plan of Dissolution is approved, we intend to immediately seek relief from the SEC to modify our reporting obligations under the Securities and Exchange Act of 1934, as amended, and in particular, to seek relief from the requirement to provide quarterly Form 10-Q Reports and audited annual financial statements. We anticipate that, if granted such relief, we would be required to continue filing current reports on Form 8-K to disclose material events relating to our dissolution and liquidation, along with any other reports that the SEC might require but we would no longer be filing audited financial statements. If the SEC does not grant us the requested relief, we will be required to continue filing all of our periodic and current reports as required by the Securities Exchange Act of 1934, as amended, and to provide

5

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

audited financial statements, both of which would reduce the amount of funds available, if any, for distribution to members because of the costs associated therewith.

As will be more fully detailed in the proxy statement that will be furnished to the Company’s Class A members prior to the members’ meeting at which the approval of the Plan of Dissolution, the New Operating Agreement and a name change will be considered, there are a number of risks associated with dissolving the Company and winding-up its business. These risks include, but are not limited to:

| • | We cannot assure members of any future distributions. The dissolution and liquidation process will be under the sole control of the Liquidation Manager and is subject to numerous uncertainties which may result in no, or less than anticipated, future distributions. The amount of any future distributions is impacted by the ability and price at which we are able to sell our remaining assets, the amount necessary to resolve or make reasonable provision for all known valid current and contingent obligations and claims, and the expenses of the dissolution and liquidation process; |

| • | We may not be able to resolve our current and contingent obligations. As a part of the winding up process, the Company will seek to identify, pay or make reasonable provision for the payment of all known valid current and contingent obligations and claims. If the Company cannot resolve such obligations and claims, the Company could be prevented from completing the Plan of Dissolution which would negatively impact the possibility of or the amount of future distributions; |

| • | We will continue to incur liabilities and expenses as we pursue the liquidation and winding up of the Company and such liabilities and expenses will reduce the amount available for any possible future distribution; |

| • | The governance of the dissolution and liquidation of the Company will be vested exclusively in one individual, the Liquidation Manager, which will be Richard E. Stoddard, our current President, Chief Executive Officer and Chairman of the Board of Managers. There will no longer be a Board of Managers and there will be no members’ meetings. Except for the covenants of good faith and fair dealing, all fiduciary duties of the Liquidation Manager will be eliminated upon approval of the New Operating Agreement; and |

| • | If a member knows that the Company has failed to create adequate reserves or to otherwise make reasonable adequate provision for its valid known and contingent obligations and claims, then any distribution received by such a member is subject to being repaid for a period of three years following the date of the distribution. |

MINE RECLAMATION AND EAGLE MOUNTAIN LANDFILL PROJECT

Description of the Eagle Mountain Site. Kaiser’s Eagle Mountain Site is located in the remote California desert approximately 200 miles east of Los Angeles, currently consists of approximately 10,800 acres, that contains three large open pit mines, the Eagle Mountain Townsite and a 52-mile private rail line that accesses the site. In 1988, Kaiser Eagle Mountain, Inc. (now Kaiser Eagle Mountain, LLC) leased what is now approximately 4,654 acres of the mine site and the rail line to MRC for development of a rail-haul solid-waste landfill. The lease between MRC and Kaiser Eagle Mountain, LLC, a wholly-owned subsidiary of Kaiser, as amended to date is often referred to as the (“MRC Lease”). On October 30, 2011, MRC filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code. The MRC Lease may be assumed or rejected in the MRC bankruptcy.

In 1988, in anticipation of Southern California’s need for new environmentally safe landfill capacity, MRC began the planning and permitting for a 20,000 ton per day rail-haul, non-hazardous solid waste landfill at Kaiser’s Eagle Mountain Site. The landfill project received all the major permits and approvals required for siting, constructing, and operating the landfill project in 1999. However, as discussed in

6

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

more detail below, the Landfill Project has been embroiled in extensive administrative challenges and state and federal litigation for over 20 years, with nearly $85 million having been spent by MRC in seeking to permit and defend the Landfill Project, of which approximately $28.6 million has been spent since Kaiser became a member of MRC in 1995.

Our Ownership Interest in MRC. We initially acquired our interest in MRC in 1995, as a result of the withdrawal of MRC’s previous majority owner, a subsidiary of Browning Ferris Industries. Before and in connection with this withdrawal, Browning Ferris invested approximately $45 million in MRC. In 2000, Kaiser assigned all of the economic benefits of the MRC lease and granted an option to buy the landfill property to MRC in exchange for an increase in Kaiser’s ownership interest in MRC (the “MRC Option”). The MRC Option is currently scheduled to expire March 29, 2013, if not extended by mutual agreement. We presently own 84.247% of MRC’s Class B Units and 100% of its Class A Units. See “Item 1. BUSINESS—Mine Reclamation and Eagle Mountain Landfill Project—MRC Financing” below.

Historical Landfill Project Litigation

State Litigation. After entering into the MRC Lease in 1988, MRC undertook activities including, but not limited to, negotiation and execution of a Memorandum of Understanding and Development Agreement with the County of Riverside (the “County”), preparation of an Environmental Impact Report (“EIR”)/Environmental Impact Study (“EIS”), numerous meetings and hearings with the Riverside County Planning Commission (the “Planning Commission”) and the Board of Supervisors of Riverside County (the “Board of Supervisors”), drilling and other field analysis to support environmental permit applications, and transportation and market development activities. On June 17, 1992, the Planning Commission recommended to the Board of Supervisors against approval of the Project. In September 1992, the Board of Supervisors held a series of public hearings regarding the Landfill Project and on October 6, 1992, the Board of Supervisors voted in favor of certain land use approvals required for the Landfill Project. On November 3, 1992, the Board of Supervisors officially adopted certain resolutions and ordinances certifying the EIR and the land use approvals for the Landfill Project.

Subsequent to the certification of the EIR in December 1992, three separate legal actions were commenced challenging the adequacy of the Project’s EIR as well as the review process leading to the Board of Supervisors’ approval of the EIR pursuant to the California Environmental Quality Act (“CEQA”). The legal actions were filed by local residents (Laurence R. and Donna J. Charpied), preservation groups and interested individuals (National Parks and Conservation Association, Eagle Mountain Landfill Opposition Coalition, City of Coachella, Steve W. Clute, Daniel S. Roman, and Richard M. Marsh), and the company that desires to use the Company’s property, a portion of which is covered by the MRC Lease, for a hydro-electric pump and storage project which company is now called Eagle Crest Energy Company (“ECEC”).

In June 1994, the San Diego County Superior Court issued a tentative ruling on the challenges to the EIR for the Eagle Mountain Landfill Project. Of the more than seventy areas of concerns initially raised by the plaintiffs in the cases, the Court announced that it had eight areas of concerns in which the EIR may be deficient and require future supplemental information and corrective action. After the Court’s tentative ruling, the Court held hearings on these legal challenges. On July 26, 1994, the Court issued its decisions in the cases which were adverse to the Landfill Project.

As a result of the San Diego Superior Court’s determinations, the Court set aside and declared void the Board of Supervisors’ certification of the EIR and all County approvals of the Project rendered in connection with the certification of the EIR, suspended permitting activities related to the development of the Landfill Project and directed the preparation of a new final environmental impact statement and report in compliance with applicable law and the Court’s conclusions.

MRC initially took steps to appeal the Court’s 1994 adverse decision. However, in late 1994 the Board of Supervisors voted not to appeal the Court’s decisions. As a result, the County took the steps

7

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

necessary to vacate the entitlements previously granted by the County to MRC in compliance with the Court’s decisions. Even though MRC initially took steps to appeal the Court’s decisions, MRC later determined that it would be in its best interest to focus its efforts on a new EIR/EIS and permitting the Landfill Project. Accordingly, MRC dropped all of its appeals.

While MRC had dropped its appeals in favor of focusing on the re-permitting, three issues were appealed by the plaintiffs. After ECEC dropped its appeal of the denial of its attorney’s fees, the remaining issues that were appealed were resolved in favor of the Company. In early 1996, the appeals court affirmed the trial court’s findings on the three issues that were favorable to the Company.

Prior to the adverse decisions of the San Diego Superior Court, MRC had received from a variety of federal, state and local regulatory agencies 17 of the 20 technical and environmental permits necessary to construct and operate the Project. In 1995, MRC re-initiated the necessary permitting process by filing its land use applications with the County and working with the County and BLM in securing the certification and approval of a new environmental impact report, or an EIR. After extensive public comment, the new EIR was released to the public in January 1997, and received final approval from the County Board of Supervisors in September 1997.

After the September 1997 approval of the new EIR for the Landfill Project by the Board of Supervisors, litigation with respect to MRC’s EIR certification resumed. In February 1998 the San Diego County Superior Court issued a final ruling with respect to this second round of EIR litigation, finding that the EIR certification did not adequately evaluate the Landfill Project’s impact on the Joshua Tree National Park and the threatened desert tortoise. KEM, MRC and the County appealed the Superior Court’s decision; opponents did not appeal.

On May 7, 1999, the Court of Appeal announced its decision to completely reverse the San Diego Superior Court’s prior adverse decision. The Court of Appeal’s decision, in effect, reinstated the EIR certification and reinstated the previous approval of the Landfill Project by the County. In June 1999, opponents to the Landfill Project requested that the California Supreme Court review and overturn the Court of Appeal’s decision. In July 1999, the California Supreme Court declined to review the Court of Appeal’s decision.

Federal Land Exchange Litigation. In October 1999, KEM completed a land exchange with the BLM. In this exchange, KEM transferred approximately 2,800 acres of KEM-owned property along its railroad right-of-way to the BLM and a nominal cash equalization payment in exchange for approximately 3,500 acres of land within the landfill project area. The land exchanged by KEM was identified as prime desert tortoise habitat and was a prerequisite to completion of the permitting of the Landfill Project. The land exchange also involved the grant of two rights-of-way by the BLM and the termination of a reversionary interest involving approximately 460 acres of the Eagle Mountain Townsite that was contained in the original grant of such property.

Following completion of the land exchange, two lawsuits were filed in the U.S. District Court for the Central District of California, Eastern Division challenging the land exchange and requesting its reversal. The plaintiffs argued that the land exchange should be reversed because the BLM failed to comply with the National Environmental Policy Act and the Federal Land Management Policy Act. Nearly three years after the final brief in the case was filed, on September 20, 2005, the U.S. District Court issued its opinion. The decision was adverse to the Landfill Project in that it “set aside” the land exchange completed between KEM and BLM as well as two BLM rights-of-way. The Company along with the U.S. Department of Interior appealed the decision to the U.S. 9th Circuit Court of Appeals. The briefing for the appeal was completed in 2007 and oral argument was heard before a three judge panel on December 6, 2007.

On November 10, 2009, a three-judge panel of the U.S. 9th Circuit Court of Appeals issued its decision in the Company’s land exchange litigation and landfill project appeal. In a 2 to 1 decision the

8

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

majority opinion was adverse to the Landfill Project in that it upheld portions of the prior U. S. District Court decision setting aside the completed land exchange. A 50-page dissenting opinion was filed. The dissenting judge found in the Company’s favor on all issues involving the land exchange and the Landfill Project.

We sought further review of the adverse U.S. 9th Circuit Court of Appeals decision by a broader panel of judges from the U.S. 9th Circuit Court of Appeals but the request for an en banc hearing by the U.S. 9th Circuit Court of Appeals was denied on July 30, 2010. In October 2010 we filed a petition with the U.S. Supreme Court asking the Court to review the decision of the U.S. 9th Circuit Court of Appeals. On March 28, 2011, the U.S. Supreme Court declined to accept our appeal. On May 10, 2011, the U.S. District Court issued its order remanding the actions “to the BLM for proceedings consistent with the Ninth Circuit’s May 19, 2010 amended opinion.” With the decision of the U.S. Supreme Court not to hear the appeal of the adverse decision of the 9th Circuit Court of Appeals, there is no longer any pending litigation and the adverse federal litigation is final and fully concluded as no further appeals are available.

Previously Anticipated Sale of Landfill Project

In August 2000 MRC entered into an agreement to sell the Landfill Project to the District for $41 million. The agreement for the sale of the Landfill Project was modified so that the purchase price began accruing interest in May 2001. The closing date under the Landfill Project Sale Agreement had been extended numerous times since December 31, 2000, pursuant to written extension agreements between MRC and the District. Under each of those extension agreements, the District had the right to either purchase the Landfill Project in its “as is” condition or to terminate its Landfill Project Sale Agreement with MRC. The last extension of the closing date under the Landfill Project Sale Agreement was set to expire on October 31, 2011. The then Chief Engineer and General Manager of the District in October 2011 had indicated that the District was not intending to proceed with the purchase of the Landfill Project. He later communicated that the District would be purchasing the Landfill Project on October 31, 2011. The District subsequently repudiated in writing the terms of the last extension agreement, and threatened to sue MRC to, among other things, compel MRC, at MRC’s sole expense and risk, to further proceed with the permitting of the landfill which would involve substantial additional financial resources and time, neither of which MRC had. Thus, MRC filed for bankruptcy protection on October 30, 2011, in federal bankruptcy court in Riverside County, California in order to preserve and protect its assets and options with respect to such assets.

Damage to Railroad

The Company owns an approximate 52-mile private railroad that runs from Ferrum Junction near the Salton Sea to the Eagle Mountain mine. The Eagle Mountain railroad is not abandoned. In late August and early September of 2003, portions of the railroad and related protective structures sustained considerable damage due to heavy rains and flash floods. This damage included having some rail sections being buried under silt while other areas had their rail bed undermined. In 2005 we conducted a more complete investigation of the damage and of the costs to return the railroad to the condition that it was in prior to the flood damage. As a result of that investigation, we estimated that the cost to repair such flood damage to be a minimum of $4.5 million for which an accrual has been made. Since the 2003 floods additional damage has been sustained by the railroad and in the fall of 2011 the Union Pacific Railroad removed the track and switching facilities at Ferrum Junction which is the location at which the Eagle Mountain railroad connects to the mainline of the Union Pacific Railroad. There have also been attempts to steal portions of the railroad for scrap value. MRC is obligated to repair and maintain the railroad under the terms of the MRC Lease. Kaiser and MRC are evaluating what actions should be taken against Union Pacific Railroad as a result of Union Pacific’s actions. At this time, the major repairs required to return the railroad to its condition prior to the flood damage will be deferred until a later date or until there is another project at Eagle Mountain that warrants such repairs.

9

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

MRC Financing

Since 1995 MRC has been funded through a series of private placements to its existing equity holders. As a result of prior MRC private placements and in exchange for releasing the economic benefits of the lease with MRC and granting MRC the option to acquire the landfill project site for $1.00, we have increased our original 70% ownership interest in MRC acquired in 1995 to 84.247%. A private placement for $1,300,000 was completed during the third quarter of 2011 in which Kaiser invested $1,146,344 increasing our ownership interest to the current 84.247%. Kaiser has made the determination that it will not make additional equity investments in MRC for the purpose of pursuing a “fix” of the federal land exchange. While Kaiser will not be providing additional funding to MRC for the purpose of pursing a “fix” of the land exchange, Kaiser is in the process to providing MRC with a line of credit currently in the amount of up to $500,000 (which could be increased up to $1,000,000) in order to fund certain activities to complete the MRC bankruptcy process. Draws under the line of credit would be completely in the discretion of Kaiser and bear interest at the rate of five percent (5%) per annum. Kaiser’s loan will not be secured but will be an administrative claim against the MRC bankruptcy estate meaning that it will have priority in payment over unsecured claims in the bankruptcy. Without a sale of any assets that MRC may have, there is a substantial risk that this loan will not be fully repaid.

MRC Assets and Bankruptcy. As of the date of this Report on Form 10-K, the primary assets of MRC consist of the MRC Lease, the MRC Option and certain landfill related permits and approvals. MRC is in default of certain of its obligations under the MRC Lease such as maintaining and repairing the Eagle Mountain railroad. The MRC Option currently expires March 29, 2013.

As previously noted, MRC filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for Central District of California, Riverside Division, bankruptcy case number 6:11-bk-43596 (the “Bankruptcy Court”). MRC will continue to operate its business as a “debtor in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code, Rules and orders of the Bankruptcy Court. As part of the proceedings in Bankruptcy Court, MRC will need to develop a plan of reorganization which will include decisions regarding the status of the MRC Lease, the MRC Option and the Landfill Project Sale Agreement, among other things. It is possible that the Landfill Project will continue in some form as a result of the reorganization of MRC or the sale of certain of MRC’s assets.

Write-down of Investment in Eagle Mountain Landfill Project. In accordance with the requirements of generally accepted accounting principles (“GAAP”), we wrote down the carrying cost of the investment in the Landfill Project on our financial statements effective June 30, 2010, and again effective as of March 31, 2011. For additional information, see “Part II.—Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS—OPERATING RESULTS—Write-Down of Investment in Eagle Mountain Landfill.” With the write downs in 2010 and in 2011, the total investment associated with the Landfill Project has been written down to $13,843,000. As future events unfold with regard to MRC, the Company will continue to evaluate if further write-downs may be necessary or appropriate.

Eagle Crest Energy Company. ECEC, one of the original opponents to the landfill project, is pursuing a license from the Federal Energy Regulatory Commission, referred to as FERC, for a proposed 1,300 mega-watt hydroelectric pumped storage project and ancillary facilities. The proposed ECEC project would utilize two of the mining pits and other property at the Eagle Mountain Site, that we own. The proposed lower reservoir for ECEC’s proposed project is located on land currently leased to MRC and is the subject of the MRC Option Agreement. We continue to believe that any landfill project and the resumption of large-scale mining would be adversely impacted by the ECEC project. ECEC has been pursuing this project off and on for over 20 years. The Company has not agreed to sell or lease this property to ECEC and we, along with others, object to the ECEC project. ECEC has filed for a necessary water quality certification from the State of California. In connection with ECEC seeking such water

10

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

quality certification, a draft environmental impact report was released in July 2010 and a draft final environmental impact report was released in January 2013. ECEC also filed its final license application with FERC in 2009. In December 2010 a draft environmental impact statement was released by FERC evaluating the environmental impacts and the economics of the proposed project. Additionally, the draft environmental impact statement contained the recommendation of FERC’s staff that the project be licensed by FERC. A final environmental impact statement was released by FERC on January 30, 2012.

If the project receives its water quality certification, it is likely that the grant of such certification will result in litigation. We understand that any grant of a water quality certification for ECEC’s project may occur in March or April 2013. Similarly, if the project is licensed by FERC, it is likely that litigation will be commenced over the issuance of the license. If the project is licensed by FERC it is likely that additional and separate litigation will be initiated by the Company over whether ECEC actually has the authority to take our property by eminent domain given the unique nature of ECEC’s project being located in the desert without any existing water way. Even if it is ultimately determined that ECEC would have the right to eminent domain under applicable law, there will be litigation to determine the amount of damages payable to us and others as a result of ECEC’s actions for its private benefit. There may also be adversarial proceedings involving ECEC in MRC’s bankruptcy. ECEC has already filed a suit seeking a request for a declaratory judgment in MRC’s bankruptcy seeking a determination that MRC’s bankruptcy will not prevent ECEC from exercising any eminent domain authority it may have if it received a license from FERC. ECEC’s lawsuit was dismissed by the Bankruptcy Court, without prejudice.

If the completed land exchange is ultimately and permanently reversed, certain lands currently owned in fee by Kaiser will revert back to federal lands, although a substantial amount of such lands will then be controlled by Kaiser because of its federal mining claims. As a result of any final reversal to federal ownership, the federal land may be subject to a title encumbrance resulting from the issuance of the preliminary permit to ECEC by FERC but Kaiser would continue to own in fee the mining pits that are critical to ECEC’s project.

Risk Factors

As discussed in this Annual Report on Form 10-K, there are numerous risks associated with MRC and the Landfill Project. The Landfill Project has been the subject of extensive litigation. MRC was ultimately successful in the state litigation in defending the Land Project, its permits and state and local approvals. However, the federal litigation challenging a completed federal land exchange was ultimately resolved adverse to the Landfill Project with the U.S. Supreme Court’s denial in March 2011 of our petition to review the adverse U.S. 9th Circuit Court of Appeals decision. With the adverse federal litigation involving the completed land exchange with the BLM concluded, the bankruptcy of MRC and the adverse actions of the District, the Company has determined that it would not invest further in MRC to pursue a “fix” of the land exchange. While the Company has determined that it will not invest further money in MRC to “fix” the land exchange for purposes of a landfill other third parties could fund or acquire the right to pursue the Landfill Project.

In addition, there are risks of the loss of certain critical Landfill Project permits due to the passage of time. The landfill project is also subject to being impacted by natural disasters like the floods that caused significant damage to the rail line in 2003. Certain risks may be uninsurable or are not insurable on terms which we believe are economical.

The ECEC pumped storage project is also a risk to MRC and the Landfill Project (as well as to other projects at the Eagle Mountain Site) and significant expenditures are anticipated to be incurred in opposition to this potential project.

As discussed above, MRC will need additional funding. There is no assurance that MRC will be funded in the future although we are providing MRC a line of credit of up to $500,000 (which could be

11

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

increased to $1 million) to complete its bankruptcy but funding of any draw requests is at the complete discretion of the Company

WEST VALLEY MATERIALS RECOVERY FACILITY AND TRANSFER STATION

Background

West Valley MRF, LLC, referred to as “West Valley,” was formed in June 1997 by Kaiser Recycling, Inc. (now Kaiser Recycling, LLC), a wholly-owned subsidiary of Kaiser, and West Valley Recycling & Transfer, Inc., a wholly-owned subsidiary of Burrtec Waste Industries, Inc. This entity was formed to construct and operate a materials recovery facility referred to as the West Valley MRF located on property that was a part of the former KSC steel mill site. In 2012, the West Valley MRF distributed a total of $750,000 in cash to Kaiser prior to the sale of Kaiser’s indirect ownership interest in the WVMRF in April 2012 which is discussed immediately below.

Sale of Ownership Interest. On April 2, 2012, Kaiser LLC, Kaiser Recycling, Burrtec Waste Industries (“Burrtec”) and West Valley Recycling & Transfer, Inc. (“Buyer”), a wholly owned subsidiary of Burrtec, entered into that certain Purchase Agreement (the “Purchase Agreement”) whereby Kaiser Recycling sold its ownership interest in WVMRF, LLC to Buyer. The sale transaction closed on the same day as the Purchase Agreement was entered into by the parties to the agreement. Kaiser Recycling sold its ownership interest in WVMRF, LLC for a gross cash sales price of approximately $25,769,000. The Company recorded a gain of $20,588,000 in the second quarter of 2012. The Company’s guaranty of the outstanding California Pollution Control Finance Authority bonds used to finance many of the improvements at West Valley MRF was terminated. However, existing environmental obligations and agreements of the Company and Kaiser Recycling benefiting WVMRF, LLC, Buyer and Union Bank remain in place and an escrow of $363,000 was established as a part of the sale transaction to provide certain financial assurances that we estimate will be sufficient to cover any future environmental obligations, particularly with respect to the Tar Pits Parcel located next to the WVMRF. This amount was charged against the Company’s environmental reserve which provided for such specific environmental expenses. Subsequently, an insurance policy covering certain possible contingent environmental and other related events that could arise and impact the WVMRF, LLC and others was purchased by Kaiser Recycling during the second quarter to cover certain of these exposures. The policy premium of $113,621 was paid from the escrow account. (See also, “Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION—Section 2: Liquidity and Capital Resources—Environmental Remediation.”)

Miscellaneous Business

The Company is occasionally able to generate miscellaneous income from time to time from various activities. Such activities have historically included leasing our fee owned land at Eagle Mountain for films, commercials and military and law enforcement training and the sale of rock and other materials. There were material rock sales to third parties from Eagle Mountain during 2012.

OTHER KAISER ASSETS

For a discussion of our other assets such as the Eagle Mountain Townsite, the substantial iron ore, rock, and other resources at the Eagle Mountain Site, and the Lake Tamarisk property, please see “Item 2. PROPERTIES.”

HISTORICAL OPERATIONS AND COMPLETED TRANSACTIONS

The following information is provided as historical background and to put into context our current activities including the Company’s anticipated dissolution to implement the cash maximization strategy.

12

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

Water Resources

Until the sale of its ownership interest in Fontana Union Water Company, or Fontana Union, to Cucamonga County Water District, referred to as “Cucamonga,” in March 2001 for $87.5 million the Company’s results of operations depended, in large part, on water rights and successfully leasing such rights. Concurrently with the sale of its Fontana Union stock, the Company also received approximately $2.5 million in payments under its water lease with Cucamonga. The sale was completed in the context of settling outstanding litigation between Cucamonga and the Company. Prior to that time Kaiser leased all of its shares in Fontana Union to Cucamonga under the terms of 102-year take-or-pay lease.

Fontana Union owns water rights to produce water from various sources of water near Fontana, California. Kaiser’s ownership of Fontana Union entitled it to receive, annually, a proportionate share of Fontana Union’s water, which water was historically used in connection with Kaiser’s steel making activities.

Mill Site Property

Background. From 1942 through 1983, KSC operated a steel mill in Southern California near the junction of the Interstate 10 and Interstate 15 freeways and approximately three miles to the northeast of Ontario International Airport. The original Mill Site Property owned by Kaiser after it emerged from the KSC bankruptcy consisted of approximately 1,200 acres and portions of the property required substantial environmental remediation. Except for the approximate five acre Tar Pits Parcel, we no longer own any portion of the Mill Site Property. The disposition of the Mill Site Property by us over the years is described below.

The California Speedway Property. In November 1995, the Company contributed approximately 480 acres of the Mill Site Property in exchange for common stock in the company that became Penske Motorsports, Inc., a leading promoter of motor sports activities and an owner and operator of automobile racetracks. In December 1996, the Company sold to PMI approximately 54 additional acres of the Mill Site Property, for cash and additional stock in PMI. The California Speedway, a world class motor sports speedway, was constructed on this approximate 534 acres of the Mill Site Property.

In July 1999 International Speedway Corporation, referred to as ISC, through a wholly owned subsidiary, acquired PMI. Kaiser Inc., as a stockholder in PMI, voted for the merger and elected to receive a portion of the merger consideration in cash and a portion in ISC stock. In the transaction Kaiser received approximately $24 million in cash and 1,187,407 shares of ISC Class A common stock, resulting in a gain of $35.7 million. Subsequent to PMI’s acquisition, we sold all of the shares we owned in ISC realizing an additional gain of approximately $6.6 million. The gross cash proceeds we received in 1999 from the merger and the subsequent sale of ISC stock totaled approximately $88 million.

The NAPA Lots. In conjunction with the permitting and development of the California Speedway, we permitted and developed three parcels known as the “NAPA Lots” for sale. In September 1997, the largest NAPA Lot, consisting of approximately 15.5 acres, was sold for a gross sale price of approximately $2.9 million. In November 1999, another of the NAPA Lots, consisting of approximately 7.8 acres, was sold for a gross cash sale price of approximately $1.7 million. The remaining NAPA Lot of approximately 5.2 acres was sold in December 1999 for a cash sale price of approximately $1.1 million.

CCG Ontario, LLC (CCG). In August 2000, we sold approximately 588 acres of our remaining Mill Site Property to CCG for $16 million in cash plus the assumption of virtually all known and unknown environmental obligations and risks associated with the property as well as certain other environmental obligations. Included in the land sold to CCG were ancillary items such as the sewer treatment plant and the water rights associated with the property. As part of the transaction, CCG obtained environmental insurance coverage and other financial assurance mechanisms related to the known and unknown

13

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

environmental obligations and risks associated with the transferred property as well as other environmental obligations subject to limited exceptions. In addition, before this sale transaction, we were party to a consent order with the California Department of Toxic Substances Control, referred to as the DTSC, which was essentially an agreement to investigate and remediate property. As part of the sale transaction, this consent order and our financial assurances to the DTSC were terminated, and CCG entered into a new consent order with the DTSC and provided the necessary financial assurances. CCG is a subsidiary of Catellus Corporation which in turn is owned by ProLogis. ProLogis is considered one of the world’s largest developers of commercial warehouse space. For additional information, see “Part I, Item 1. BUSINESS—Historical Operations and Completed Transactions—Environmental Matters” below.

Rancho Cucamonga Parcel. In October 2000, the Company completed the sale of approximately 37 acres of the Mill Site Property, known as the Rancho Cucamonga parcel, to The California Speedway Corporation. The gross cash sale price was approximately $3.8 million.

West Valley MRF Property. At the time of the formation of West Valley in 1997, Kaiser Inc. contributed 23 acres of the former Mill Site Property, on which a 62,000 square foot building, sorting equipment and related facilities were constructed during Phase 1 of the West Valley MRF development. Under the terms of our agreements with West Valley, we contributed additional land approximating 7 acres after that land’s environmental remediation in 2000. We are also obligated to contribute the Tar Pits Parcel to West Valley MRF at its option, upon the environmental remediation of the Tar Pits Parcel in a manner suitable for use by West Valley MRF. The ownership interest in WVMRF, LLC was sold in the second quarter of 2012.

The Tar Pits Parcel is the only acreage that we continue to indirectly own at the former Mill Site Property. However, effective April 2, 2012, WVMRF, LLC leased material portions for the Tar Pits Parcel from Kaiser Recycling, LLC, the subsidiary of Kaiser that owns the Tar Pits Parcel. The lease is for 50 years with the right to extend the lease for 50 years in exchange for: (i) payment of all the property taxes for the Tar Pits Parcel; (ii) insuring the Tar Pits Parcel and naming Kaiser Recycling LLC as an additional insured for general liability purposes; and (iii) performing various maintenance and security obligations on the property being leased.

Environmental Matters

The operation of a steel mill by the Company’s predecessor, KSC, resulted in known contamination of limited portions of the Mill Site Property. As discussed above, the Company’s consent order with the DTSC was terminated in connection with the sale of approximately 588 acres of the remaining Mill Site Property to CCG for $16 million in cash plus the assumption of virtually all known and unknown environmental obligations and risks associated with the property as well as certain other environmental obligations. Concurrently with that termination, CCG entered into a new consent order with the DTSC, in which CCG assumed responsibility for all future investigation and remediation of the Mill Site Property it purchased, as well as various other items covered under its CCG consent order. In addition, CCG assumed and agreed to indemnify the Company against various contractual environmental indemnification and operations and maintenance (“O&M”) obligations the Company has with purchasers of other portions of the Mill Site Property. In addition, CCG is obligated to remediate the Tar Pits Parcel pursuant to a solidification and capping strategy. Except for continuing inspection and maintenance obligations, and the continuing groundwater investigation, the remediation of the Tar Pits Parcel has been completed.

CCG has completed most of the required environmental investigations and remedial actions at the Mill Site Property. The remaining material items associated with the investigation and remediation of the Mill Site Property include continued implementation of a groundwater investigation program, and continuing O&M. The O&M obligations could continue for at least thirty years. In the second quarter of 2012 the DTSC provided CCG a letter confirming that CCG has satisfied the consent order for the Mill

14

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

Site property except for the continued implementation of the groundwater investigation program and continuing O&M. CCG is obligated to pay for the costs associated with any future O&M activities. In connection with the groundwater investigation in January 2013 the DTSC communicated to ProLogis that it believed that there were releases to groundwater of hazardous substances from several areas of the Mill Site Property, including the Tar Pits Parcel. However, it appears that the matters of concern are below maximum contamination levels. Since CCG is primarily responsible for groundwater at the former Mill Site Property it is addressing the DTSC’s concerns. If this should give rise to a claim, our current insurance should cover such claim.

Many of the environmental obligations assumed by CCG were originally backed, in whole or in part, by various financial assurance mechanisms or products. With the completion of much of the required investigation and remediation work at the Mill Site Property, several of the original financial assurances are no longer necessary or have been reduced. However, for example, a real estate environmental liability insurance policy with a policy limit of $50 million on which we are a named insured remains permanently in place for the Mill Site Property. This insurance policy is in addition to the $50 million insurance policy that expires on June 30, 2013, that is discussed below. All remaining financial assurance mechanisms or products are subject to their terms. In addition, there are certain exceptions to CCG’s assumption of the Company’s prior environmental obligations.

We have established reserves to address potential future environmental liabilities and obligations. These potential environmental liabilities include, among other things, environmental obligations at the Mill Site Property that were not assumed by CCG, such as any potential third party damages from the identified groundwater plume of total dissolved solids and organic carbon, environmental remediation work at the Eagle Mountain Site, and third-party bodily injury and property damage claims, including asbestos claims not covered by insurance and/or paid by the KSC bankruptcy estate. In 2004, this reserve was again reduced to approximately $2.4 million to reflect settlement of a third party claim related to the groundwater plume discussed above. This reserve was further reduced in 2005 as a result of reclassifying $500,000 to the Eagle Mountain Townsite Cleanup Reserve. This environmental reserve was increased by $1.2 million as of December 31, 2005, for Eagle Mountain Townsite environmental related matters. The reserve is reduced from time to time as a result of remediation and related actives that take place at Eagle Mountain and as a result of work conducted in association with the former Kaiser Mill Property. As of December 31, 2012, based upon current information, we estimate that our future environmental liability related to certain matters and risks not assumed by CCG, in its purchase of the Mill Site Property in August 2000, would be approximately $2.3 million for which a reserve has been established. We periodically review the adequacy of our environmental reserve and will be doing so in connection with the anticipated dissolution of the Company. As a result of these reviews, there may be adjustments in the environmental reserve during the projected dissolution of the Company.

In keeping with our goal to minimize our potential liabilities, including the potential liabilities outlined above, we purchased effective June 30, 2001, a 12-year $50 million insurance policy, which is expected to cover substantially any and all environmental claims (up to the $50 million policy limit) relating to the historical operations of the Company for claims made during the term of such policy. Such policy is in addition to the insurance policy that covers the Mill Site Property as discussed above. See “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” in Part II, Item 7, of this Annual Report on Form 10-K. Since this “claims made” policy terminates on June 30, 2013, the Company may not have insurance coverage for certain previously covered environmental and other claims made after the expiration of the policy term on June 30, 2013.

The Company is involved, from time-to-time, in legal proceedings concerning environmental matters. See “Part I, Item 3. LEGAL PROCEEDINGS.”

Tar Pits Parcel

Currently, the only remaining property owned at the Mill Site Property is an approximate 5 acre parcel known as the Tar Pits Parcel which is owned by Kaiser Recycling, LLC, a wholly-owned subsidiary of Kaiser. Under the agreement with the West Valley MRF, Kaiser Recycling is obligated to

15

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

contribute the Tar Pits Parcel to the West Valley MRF, at its option, upon the environmental remediation of the property. Except for ongoing inspection and monitoring activities, as well as the groundwater investigation that covers the Mill Site Property, including the Tar Pits Parcel all material remediation of the Tar Pits Parcel was completed in 2002 at CCG’s, expense. CCG is responsible for this property’s environmental remediation pursuant to the terms of the purchase agreement entered into between CCG and Kaiser in August 2000 relating to Kaiser’s sale of approximately 588 acres of the Mill Site Property and for the ongoing inspection and maintenance of the Tar Pits Parcel’s environmental remediation measures. As discussed in more detail above under “Item 1. BUSINESS - Historical Operations and Completed Transactions—West Valley MRF Property,” effective April 2, 2012, WVMRF, LLC leased material portions for the Tar Pits Parcel from Kaiser Recycling. The lease is for 50 years with the right to extend the lease for 50 years. See “Part I, Item 1. BUSINESS—Historical Operations and Completed Transactions—Environmental Matter.

Employees

As of March 1, 2013, Kaiser LLC had no employees. However, Kaiser LLC leases employees through Business Staffing, Inc., which was a subsidiary of Kaiser LLC until the close of business December 31, 2010, and reimburses Business Staffing for the actual costs associated with 5 full-time (3 at Ontario, California and 2 at Eagle Mountain, California) and 3 permanent part-time employees (1 at Eagle Mountain and 2 in Ontario, California). However, if the Plan of Dissolution is approved by the Company’s Class A members, it is anticipated that the number of permanent part-time employees will be reduced by two in Ontario, California, but such individuals will likely continue on a part-time consulting basis for the Company.

| Item 1A. | RISK FACTORS |

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item. However, we do discuss many of the risk factors that may impact the Company, its remaining projects and opportunities, and the anticipated dissolution and liquidation of the Company throughout this Annual Report on Form 10-K. In addition, please see the discussion under “Forward Looking Statements” on page 1 of this Report on Form 10-K.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

16

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

| Item 2. | PROPERTIES |

Eagle Mountain, California

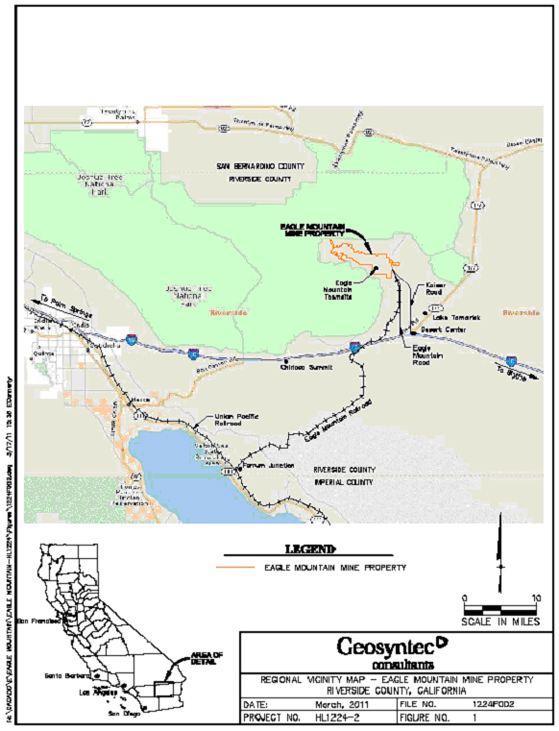

Overview and Regional Geography and Access. The Eagle Mountain Site which includes the Eagle Mountain mine and the adjoining townsite are located in Riverside County, approximately ten miles northwest of Desert Center, California. Desert Center is located on Interstate 10 between Indio and Blythe, California. See the vicinity map for the Eagle Mountain Site on the following page. Vehicular access to the Eagle Mountain Site is by a paved county road. Within the mine site, there are gravel and dirt roads that were built for the iron ore mining that took place. The mine is also accessed by a railroad as more fully described below.

The Eagle Mountain open-pit iron ore mine was operated by KSC on a full-time basis from approximately 1948 to 1983. However, even though iron ore mining was curtailed by 1983, the mine has remained active and has continued to ship rock, rock products, iron ore pellets, etc. as market conditions allow. Substantial shipments of rock products were made from KEM’s fee owned land at the Eagle Mountain Site in 2012.

The heavy duty maintenance shops and electrical power distribution system have been kept substantially intact since the 1982 shutdown of large-scale iron ore mining. Electrical power is provided to the Eagle Mountain Site by Southern California Edison. We also own several buildings, a water distribution system, a sewage treatment facility, and related infrastructure. However, virtually all of the equipment and all of the mining and processing facilities for large-scale iron ore mining are no longer in existence. There would be substantial costs associated with the improvement of the infrastructure and to build the facilities necessary to resume the previously suspended large-scale mining operation. The Eagle Mountain Townsite includes more than 300 mostly unoccupied single family homes, approximately 100 of which were partially renovated in the 1990s. Due to the passage of time and the impacts of weather, a number of the remaining buildings and houses at the Eagle Mountain Townsite are deteriorating at a faster rate than anticipated and may not be salvageable. Accordingly, we may need to demolish or rehabilitate a number of structures over the next several years. We currently have reserves recorded as of December 31, 2012, totaling $3.3 million ($1.0 for asbestos containing products abatement and $2.3 million for demolition) for such purposes.

Until December 31, 2003, a private prison was operated at the Eagle Mountain Townsite. With the closure of the private prison we implemented a plan in 2004 to reduce our activities at the Eagle Mountain Townsite. We are continuing to seek appropriate tenants for a lease of all or portions of the Eagle Mountain Townsite but have been unsuccessful to date in finding long-term permanent tenants. The completed adverse federal land exchange litigation has and may further hinder these efforts.

Other than possible future environmental remediation associated with asbestos containing products in certain structures for which a reserve has been recorded, we are not aware of any material environmental remediation required at the Eagle Mountain Townsite that could require us to expend substantial funds or that could lead to material liability. However, under the terms of an approved mine reclamation plan for a portion of the Eagle Mountain mine site there are ongoing reclamation activities for which the Company has also recorded a reserve for the current estimated cost of such activities and has posted appropriate financial assurances.

We own four deep water wells, two of which are operational, and two booster pump stations that serve the Eagle Mountain Site.

17

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

VICINITY MAP FOR THE EAGLE MOUNTAIN SITE

18

Table of Contents

KAISER VENTURES LLC AND SUBSIDIARIES

Land Ownership. In and around the Eagle Mountain Site, with the completed federal land exchange, the Company currently has various possessory federal mining claims of approximately 1,472 acres and holds approximately 8,644 acres in fee simple (which includes the approximate 1,300 acre Eagle Mountain Townsite). Approximately 4,654 acres of this property would be sold as a part of sale of the Landfill Project, assuming such sale is ever completed. See “Part I, Item 1. BUSINESS—Mine Reclamation and Eagle Mountain Landfill Project.” However, if the completed adverse federal land exchange is ultimately unwound it will impact the amount and nature of our land holdings. In such instance we would be placed back to the same position as prior to the land exchange, we would own or control in and around Eagle Mountain approximately 1,800 acres in fee and 9,550 acres in various possessory federal mining claims. In addition, the reversal of the land exchange would reinstate a reversionary interest contained in the original grant of approximately 460 acres of the Eagle Mountain Townsite. The reversionary interest means that this land could be returned to the federal government in very limited circumstances.

Eagle Mountain Geology Overview. California is divided into 10 Geological Provinces that define areas of similar structure and bed rock. The Eagle Mountain Site is located in the northeastern portion of the Eagle Mountains near the lower western edge of the Mojave Desert Physiographic Province of California, slightly east of the southern limits of the adjacent Transverse Ranges Physiographic Province. The major rock units in the region include Jurassic to Cretaceous-age plutonic intrusive rocks and Paleozoic and Precambrian metamorphic and meta-sedimentary rocks. At the Eagle Mountain Site, the meta-sedimentary rocks generally trend northwest and are surrounded and underlain by intrusive granitic rocks. The meta-sedimentary rock units have been folded into a northwest-trending anticline, which continues into the north-central Eagle Mountains.

In general, the Eagle Mountain iron ore deposits are in contact with metamorphized sedimentary rocks that show much folding, faulting, uplift and repeated injections of magnetic and hydrothermal fluids. The iron ore is not continuous and occurs in many narrow to wide segregations separated by various amounts of waste rock. Magnetite plus pyrite comprised the primary iron mineralization, which was subsequently oxidized into hematite and goethite in the higher elevation zones of the deposit.

Iron Ore. The Eagle Mountain mine is the site of what was the largest iron ore mining operation west of the Mississippi River. KSC recovered more than 225 million tons of iron ore from four pits (i.e., the East Pit, Central Pit, Black Eagle Pit [North], and Black Eagle Pit [South]). Regular iron ore mining was suspended at the Eagle Mountain Site by 1983 due to the pending closure of the KSC steel mill near Fontana, California. Thus, mining was suspended due to market conditions and not due to a lack of iron ore.