Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8k.htm |

Exhibit 99.1

Fourth Quarter 2012

Earnings Conference Call

March 6, 2013

Safe Harbor Statement

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech's filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in this presentation.

2012 Accomplishments

Strategic Business Growth Driving Results

üAcquired Idea One and integrated Fargo, No. Dakota operations

- Added 250 fiber route miles, 650 lit buildings

üInvested in strategic capital initiatives

- Expanded fiber network through middle-mile and last mile routes

- Constructed 450 fiber route miles across northern Minnesota

üGrew revenue 12%

- Fiber and Data revenue increased 33% in 2012

- Business and Broadband revenue accounts for 76% of 2012 revenue

üLaunched new consumer bundles; upgraded DTV middleware

- 87% new bundle customers chose 2-year agreements

üIncreased Q4 dividend 3.5% to $0.145/share

Q4 and Fiscal 2012 Highlights

Fourth Quarter 2012 compared to Fourth Quarter 2011

• Revenue totaled $46.6 M, +18%

– Fiber and Data revenue +36%

– Equipment segment revenue +44%

• Operating income totaled $5.1 M, +40%

• Net income totaled $2.5 M, +60%

Fiscal 2012 compared to Fiscal 2011

• Revenue totaled $183.2 M, +12%

- Fiber and Data revenue $60.9 M, + 33%

- Equipment segment revenue $60.1 M, +23%

• Operating income was $19.4 M, -1%

• Net income totaled $8.3 M, -1%

Consolidated Revenue

Q4 '12 compared to Q4 '11

• Fiber and Data revenue +36%

• Equipment Segment revenue

+44%

+44%

• Telecom revenue -10%

2012 compared to 2011

• Revenue +12% driven by

fiber/data and equipment

revenue increases

fiber/data and equipment

revenue increases

($ in millions)

Revenue by Segment

• Fiber and Data revenue

+33%

Excluding IdeaOne,

revenue +9%

+33%

Excluding IdeaOne,

revenue +9%

($ in millions) before intersegment eliminations

Equipment

Fiber and Data

Telecom

• Equipment Segment

revenue +23%

revenue +23%

• Equipment hardware

sales +31%

sales +31%

• Equipment support

services -13%

services -13%

• Telecom revenue -9%

• Broadband -3%

Network Access -15%

Local Service -10%

Network Access -15%

Local Service -10%

2012 revenue compared to 2011:

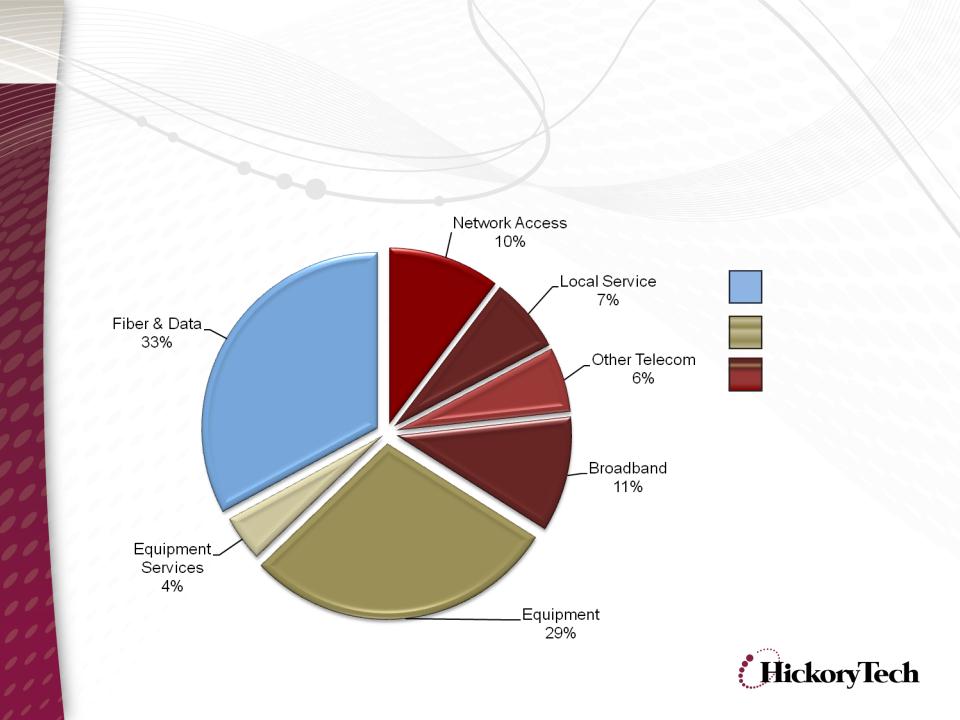

Revenue Diversification

76% of 2012 revenue is from Business & Broadband Services;

less reliance on regulated telecom revenue

less reliance on regulated telecom revenue

76%

69%

Business &

Broadband

Services

Broadband

Services

Telecom

Services

Services

Fiber & Data

Equipment

Broadband

Broadband revenue is included in Telecom Segment.

Revenue Diversification

Diverse revenue stream with growing business segments

Fiber and Data

Equipment

Telecom

Broadband revenue is included in Telecom Segment.

Earnings and Income

• Depreciation increases (due to

network investments) are moderating

EPS

network investments) are moderating

EPS

• 2010 EPS included tax reserve

release, excluding it, EPS would be

$0.71

release, excluding it, EPS would be

$0.71

• 2012 EBITDA increased 8%

• Fiber and data growth key driver in

EBITDA increase

EBITDA increase

($ in millions)

Debt Balance

($ in millions)

Debt is following historical patterns of decline, improving shareholder value

Net debt was $128.5 million at 12/31/12

Net Debt Balance

Total Debt Balance

Net Debt subtracts the cash balance from the outstanding debt.

Idea One

Acquisition

Acquisition

2012 Free Cash Flow

($ in millions)

Free Cash Flow: $4.7 M, Dividend Payout: 162%

Fiber Network Expansion

• Five-state regional fiber

network includes 4,100 fiber

route miles

network includes 4,100 fiber

route miles

• Greater Minnesota

Broadband Collaborative

Project added northern

Minnesota routes

Broadband Collaborative

Project added northern

Minnesota routes

• IdeaOne acquisition added

Fargo, ND fiber network

Fargo, ND fiber network

2013 Fiscal Outlook

Guidance as provided in Q4 earnings release on March 5, 2013.

|

2013 Guidance

|

2012

|

2013 Guidance

Change Y/Y |

|

Revenue

|

$183 M

|

(2%) to 3%

|

|

EBITDA

|

$46 M

|

2% to 8%

|

|

Net Income

|

$8.3 M

|

(7%) to 14%

|

|

Diluted EPS

|

$0.61

|

(7%) to 13%

|

|

Capital

Expenditures |

$30 M

|

(20%) to (6%)

|

|

Debt

|

$137 M

|

2013 Guidance

2012

2013 Guidance

Change Y/Y

Change Y/Y

$183 M

(3%) to (1%)

2013 Priorities

• Build Enventis brand to grow business services

• Moderate telecom spending and increase bundle

penetration

penetration

• Capitalize on past investments and continue to invest

efficiently, target on-network sales

efficiently, target on-network sales

• Manage free cash flow and costs

• Improve customer experience

• Deliver shareholder value

Key Strategic Initiatives

Strategic Growth through organic and external growth

HickoryTech Investment Strengths

Diverse revenue streams / markets, emerging

growth through business revenue stream and fiber

network expansion

growth through business revenue stream and fiber

network expansion

65+ years of dividend return, yield 6%

Increased dividend in 2012, 2011 and 2010

Experienced company with 115-year track record

of financial stability

of financial stability

Strong cash flow, strong balance sheet,

high level of recurring revenue

high level of recurring revenue

Focused on doubling the value of HickoryTech by

growing EBITDA, strategic services, managing debt

growing EBITDA, strategic services, managing debt

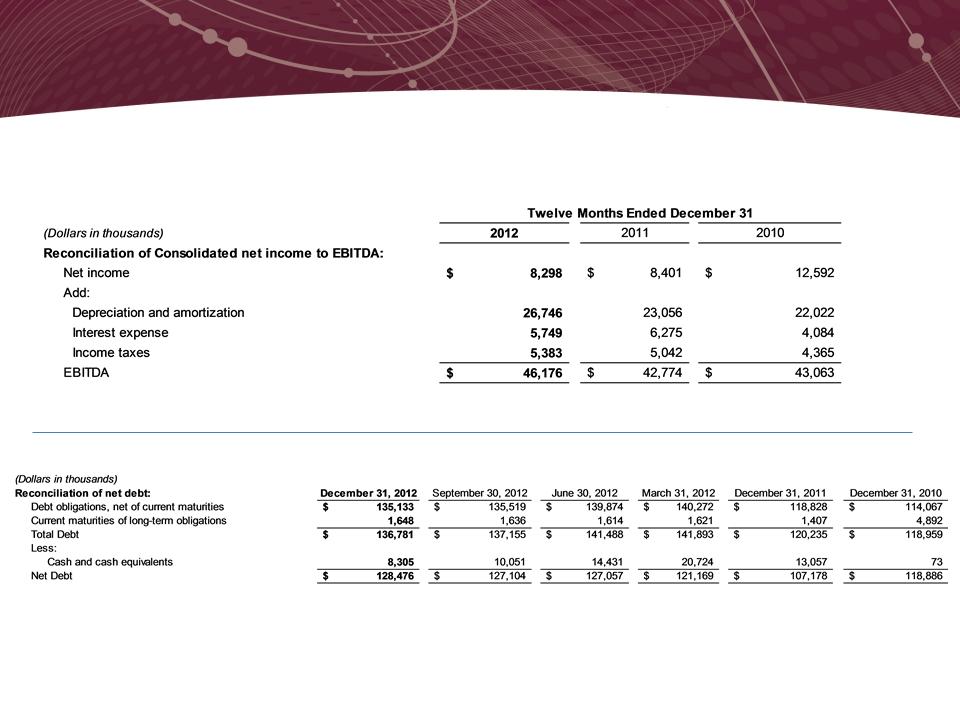

Supplemental Financial Information

Supplemental Financial Information

Reconciliation of Non-GAAP Measures

Appendix

Supplemental Financial Information

Supplemental Financial Information

Reconciliation of Non-GAAP Measures

Appendix

Supplemental Financial Information

Supplemental Financial Information

Reconciliation of Non-GAAP Measures

Appendix

Supplemental Financial Information

Supplemental Financial Information

Reconciliation of Non-GAAP Measures

Appendix

Supplemental Financial Information

Supplemental Financial Information

Reconciliation of Non-GAAP Measures

Appendix