Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOLOGIC INC | d495775d8k.htm |

Presentation to Lenders

March 5, 2013

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation contains forward-looking information that involves risks and uncertainties,

including statements about the Company’s plans, objectives, expectations and intentions.

Such statements include, without limitation: financial or other information included herein based upon or otherwise incorporating

judgments or estimates relating to future performance, events or expectations; the anticipated

benefits of the Gen-Probe acquisition, including anticipated synergies; the expected timing

of the completion of the Company's LIFECODES' sale; the anticipated timing of a reimbursement code for 3D tomosynthesis and

any other governmental or regulatory approvals or clearances; and the Company's outlook and financial

and other guidance. These forward-looking statements are based upon assumptions made by the

Company as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual

results to differ materially from those anticipated.

Risks and uncertainties that could adversely affect the Company’s business and prospects, and

otherwise cause actual results to differ materially from those anticipated, include without

limitation: U.S., European and general worldwide economic conditions and related uncertainties; the Company’s reliance on third-party

reimbursement policies to support the sales and market acceptance of its products, including the

possible adverse impact of government regulation and changes in the availability and amount of

reimbursement and uncertainties for new products or product enhancements; uncertainties regarding the recently enacted or

future healthcare reform legislation, including associated tax provisions, or budget reduction or

other cost containment efforts; changes in guidelines, recommendations and studies published by

various organizations that could affect the use of the Company’s products; uncertainties inherent in the development of

new products and the enhancement of existing products, including FDA approval and/or clearance and

other regulatory risks, technical risks, cost overruns and delays; the risk that products may

contain undetected errors or defects or otherwise not perform as anticipated; risks associated with acquisitions, including without

limitation, the Company’s ability to successfully integrate acquired businesses, the risks that

the acquired businesses may not operate as effectively and efficiently as expected even if

otherwise successfully integrated, the risks that acquisitions may involve unexpected costs or unexpected liabilities, including the risks and

challenges associated with the Company’s recent acquisition of Gen-Probe and operations in

China; the risk that prospective acquisitions or dispositions may not close when anticipated,

if at all, including as a result of failure to fulfill conditions closing, obtaining the necessary regulatory approvals or clearances, or otherwise;

manufacturing risks, including the Company’s reliance on a single or limited source of supply for

key components, and the need to comply with especially high standards for the manufacture of

many of its products; the Company’s ability to predict accurately the demand for its products, and products under development,

and to develop strategies to address its markets successfully; the early stage of market development

for certain of the Company’s products; the Company’s leverage risks, including the

Company’s obligation to meet payment obligations and financial covenants associated with its debt; risks related to the use and

protection of intellectual property; expenses, uncertainties and potential liabilities relating to

litigation, including, without limitation, commercial, intellectual property, employment and

product liability litigation; technical innovations that could render products marketed or under development by the Company obsolete; competition;

the risks of conducting business internationally, including the effect of exchange rate fluctuations

on those operations; and the Company’s ability to attract and retain qualified personnel.

The risks included above are not exhaustive. Other factors that could adversely affect the combined

company's business and prospects are described in the filings made by the Company with the SEC.

The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such

statements presented herein to reflect any change in expectations or any change in events, conditions

or circumstances on which any such statements are based. Hologic, APTIMA, Dimensions, Gen-Probe, LIFECODES, PANTHER, Prodesse ProGastro SSCS and TIGRIS and

associated logos, as may be used throughout this presentation, are trademarks and/or registered

trademarks of Hologic, Inc. and/or its subsidiaries in the United States and/or other countries.

|

Transaction Overview

¹

See the definition of non-GAAP financial measures and the reconciliation of

GAAP to non-GAAP in the Appendix. 3

Hologic, Inc. ("Hologic" or "the Company") (NASDAQ: HOLX) is a

leading developer, manufacturer and supplier of premium diagnostics

products, medical imaging systems and surgical products dedicated to serving

the healthcare needs of women Hologic has continued to demonstrate strong

financial performance Hologic is seeking to reprice its Revolver and Term

Loan A pricing In conjunction with the repricing, the Company is seeking an

amendment to certain other provisions of the Credit Agreement

For the LTM period ended December 29, 2012, the Company generated $2,186 million

of non- GAAP revenue, $761 million of Adjusted EBITDA and $980 million

of Consolidated Adjusted EBITDA as defined in the Credit Agreement. The

Company's GAAP Revenue and GAAP net Hologic has total secured

leverage of 2.5x and net total leverage of 4.9x 1

loss for the same LTM period were $2,161 million and $91 million,

respectively |

Pro

Forma Capitalization 4

Leverage

Current

CCR: B1 / BB

Amount

Coupon

Floor

Cash

$718.5

Revolver ($300)

-

L+300

-

Term Loan A

979.7

L+300

-

Term Loan B

1,482.0

L+350

1.00%

Total Secured Debt

2,461.7

2.5 x

Senior Unsecured Notes

1,000.0

6.25%

Total Guaranteed Debt

3,461.7

3.5 x

2.00%

Convertible

Sr.

Notes

(1)

734.5

2.00%

2.00%

Exchange

Convertible

Sr.

Notes

(2)

379.8

2.00%

2.00%

Exchange

Convertible

Sr.

Notes

(3)

460.0

2.00%

Total Debt

5,036.0

5.1 x

Net

Debt

(4)

4,786.0

4.9 x

LTM

12/29/12

Consolidated

Adjusted EBITDA

(5)

$ 980.0

Maturity

Put Date

Aug-17

Aug-17

Aug-19

Aug-20

Dec-37

Dec-13

Dec-37

Dec-16

Mar-42

Mar-18

Amounts as of December 29, 2012

($ in millions)

Source: Public filings

¹

Principal amount is $775 million. Principal amount listed net of the unamortized discount. Conversion

price of approximately $38.59 per share. Effective 02/21/2013, the

Company retired $370 million of notes due 2037 in exchange for $370 million of new notes due

2043. Leverage ratios could change once the accounting for the exchange

is completed.

²

Principal amount is $450 million. Principal amount listed net of the unamortized discount.

Conversion price of approximately $23.03 per share.

³ Principal amount is $500 million. Principal amount listed net of the unamortized

discount. Conversion price of approximately $31.18 per share.

4

Debt net of $250 million of cash as permitted by Credit Agreement for covenant compliance.

As defined in the Credit Agreement. Includes an increase to the Company’s non-GAAP Adjusted

EBITDA of $219 million, as calculated pursuant to the terms of the Credit Agreement, to

reflect the Company's acquisition of Gen-Probe and certain other adjustments.

|

Non-GAAP

Adjusted

Q1’13

Revenues

of

$644.6M

(unaudited)

Consumables/Service ~81%

Capital Equipment ~19%

Consumables/Service ~81%

Capital Equipment ~19%

Total Diagnostics $319.2M*

49%

Breast Health $220.8M

34%

GYN Surgical $80.9M

13%

Skeletal Health $23.7M

4%

* See the definition of non-GAAP financial measures and the reconciliation of

GAAP to non-GAAP in the Appendix. Total Revenues by Business Segment

5

Consumables

$427.9

Service

$96.2M

Capital

$120.5M

Consolidated |

Business and Product Update

PANTHER launch progressing smoothly with positive early traction

FDA

approval

of

APTIMA

16

18/45

Genotype

Assay

for

use

on

TIGRIS

announced

on

October 16, 2012

Definitive agreement announced on January 3, 2013 to sell the Company’s

LIFECODES business to Immucor, Inc. for $85 million in cash, subject to

certain adjustments, and $10 million in a potential contingent payment

FDA clearance of APTIMA Trichomonas vaginalis Assay for use on our

fully-automated PANTHER System announced on January 14, 2013

FDA clearance of Prodesse ProGastro SSCS assay, a real-time multiplex

polymerase chain reaction (PCR) in vitro diagnostic test for the

qualitative detection of the most common bacterial pathogens associated

with gastroenteritis Oslo

study

published

on

January

7,

2013,

in

Radiology,

reporting

that

the

addition

of

the

Company’s 3D mammography screening technology to a 2D breast screening exam

significantly increased cancer detection while reducing the number of false

positives 6

—

Expected to close in Q2 FY 2013 |

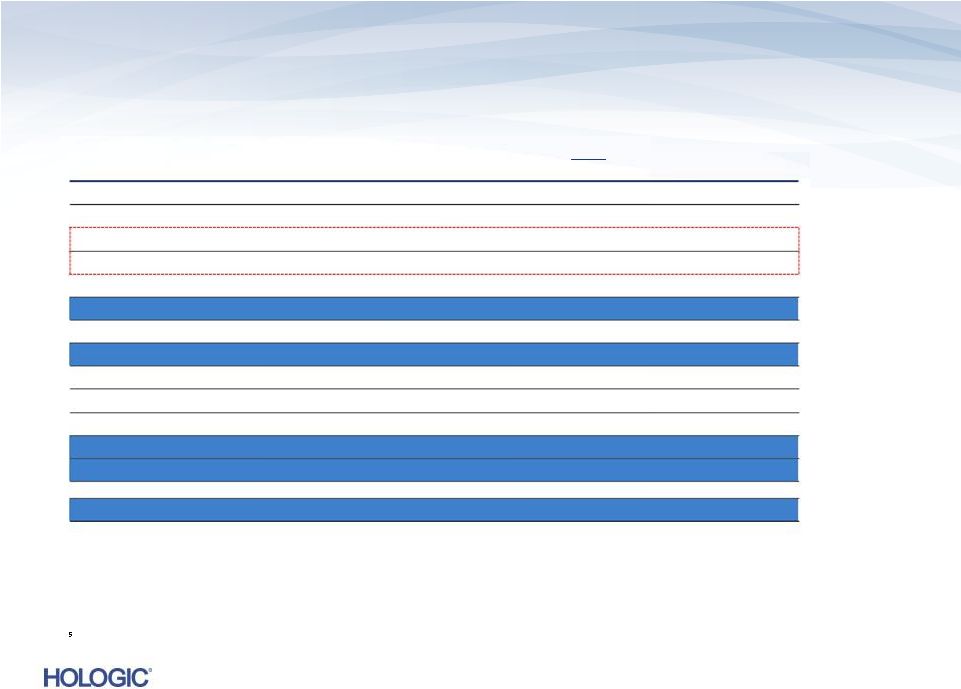

Advancing Breast Cancer Screening

7 |

8

3D Dimensions Tomosynthesis

Superior

Next-Generation

Digital

Mammography

Superiority

Superiority

over 2D Digital

over 2D Digital

Mammography

Mammography

Improved

Tissue

Visualization

and Detection

Lower

Recall Rates

8

Tomosynthesis…uptake ahead of expectations

•

U.S.

installed

base

of

~

11,000

digital

systems

–

potential

for

conversion

to

Tomo

•

On track to ship 500 to 700 units within first two years of approval

(by end of fiscal Q2’13)

•

Expect to double installed base during FY’13 |

Tomosynthesis Clinical Efficacy

Oslo Tomosynthesis Screening Trial

reported breast cancer screening

with Hologic’s Tomosynthesis significantly

improves

cancer

detection

•

All

age

groups

and

breast

densities

benefit

from

the

addition

of

Hologic’s

Tomosynthesis

screening

1

•

Body of clinical evidence continuing to grow

Compared to 2D, U.S. sites report a

significant reduction in recalls with

Hologic’s

tomosynthesis

9

1

2-3

in invasive

cancer detection

40%

overall in

cancer detection

27%

20-40% reduction

in recall rates

(based on site practices)

1

2

3

Skaane P. et. al. Comparison of Digital Mammography Alone and Digital Mammography

Plus Tomosynthesis in a Population-based Screening Program. Radiology. 2013 Jan 7

(published electronically).

Philpotts

L.

et

al.

Initial

Experience

With

Digital

Breast Tomosynthesis

in

Screening

Mammography.

Presented

at

the

ARRS

2012,

Scientific

Session

22

-

Breast

Imaging:

Screening/Emerging Technologies.

Destounis S. et al. Experience with Combination 2D/3D Breast Tomosynthesis vs

FFDM in the Screening Environment. Radiological Society of North America annual meeting.

Chicago, Il, 2012. |

Q1

2013 Financial Results Consolidated non-GAAP adjusted revenues were

$644.6 million, a year-over-year increase of $171.9 million, or

36.4%, and at the high-end of our guidance range of $640 to

$645

million.

The

Company's

GAAP

revenues

for

the

same

period

were

$631.4

million

1

Non-GAAP adjusted EPS was $0.38, a year-over-year increase of $0.04,

or 11.8%, and exceeded our guidance of $0.37. The Company's GAAP EPS for

the same period was $0.01

1

Year-over-year growth in each of our three primary business segments

On track to achieve over $40 million in first-year cost synergies

related to the Gen-Probe acquisition

Cash and equivalents totaled $721 million, up $154 million from the end of fiscal

2012 reflecting

another

quarter

of

focused

working

capital

management

and

solid

operational

results, both of which contributed to strong free cash flow generation

¹

See the definition of non-GAAP financial measures and the reconciliation of

GAAP to non-GAAP in the Appendix. 10

—

Reinstatement of federal research tax credit added $0.01 to non-GAAP adjusted

EPS |

Key

Performance Metrics Q1 FY 2013

Revenues

GAAP revenues of $631.4 million and non-GAAP

revenues of $644.6 million

Net Income

GAAP net income of $3.1 million and

non-GAAP net income of $101.8 million

Adjusted EBITDA

$227.5 million

Quarter Ended December 29, 2012 (unaudited)

1

On a constant currency basis, total revenues would have increased to

$631.7M*, or 33.6% (non-GAAP revenues would have increased to $645.0M*, or 36.4%) compared to

Q1’12. The constant currency revenue amount for Q1’13 is a non-GAAP

number that reflects what revenues in that quarter would have been had the Company applied the foreign

currency exchange rates it used for determining its revenues in Q1’12.

See the definition of non-GAAP financial measures and the reconciliation of

GAAP to non-GAAP in the Appendix. Q1 FY 2013 Overview

11

•

Non-GAAP

revenues

up

$171.9

million,

or

36.4%,

vs.

Q1’12

1

•

Non-GAAP revenues up $44.5 million, or 7.4%, vs. Q4’12

•

Non-GAAP net income up $11.7 million, or 13.0%, vs. Q1’12

•

Non-GAAP net income up $3.4 million, or 3.5%, vs. Q4’12

•

Up $65.2 million, or 40.2%, vs. Q1’12

•

Up $17.5 million, or 8.3%, vs. Q4’12 |

Fiscal 2013 Guidance

Non-GAAP

*

$s in millions

(except EPS)

FY 2013

FY 2013

(Guidance)*

(Guidance)*

Q2 2013

Q2 2013

(Guidance) *

(Guidance) *

Revenues

Revenues

$2,610 –

$2,610 –

$2,640

$2,640

$635 –

$635 –

$640

$640

Gross Margins

Gross Margins

63.0%

63.0%

62.5% –

62.5% –

63.0%

63.0%

Operating Expenses

Operating Expenses

$785 –

$785 –

$810

$810

$205 –

$205 –

$210

$210

Interest Expense

Interest Expense

$220

$220

$56

$56

Diluted EPS

Diluted EPS

$1.58 –

$1.58 –

$1.60

$1.60

$0.33 -

$0.33 -

$0.34

$0.34

Quarter Ending March 30, 2013 and Year Ending September 28, 2013

12

Note: Estimate diluted shares outstanding of approximately 271 million and 272 million for Q2’13

and FY 2013, respectively. Estimate a 32% annual effective tax rate.

* See the definition of non-GAAP financial measures and discussion of future non-GAAP

adjustments in the Appendix. |

Balance Sheet & Debt Paydown Road Map

Focus on de-leveraging

—

Total

debt

obligations

of

$5.0

billion,

including

$3.5

billion

borrowed

for

acquisition

of Gen-Probe

—

Goal to reduce total debt to EBITDA from approximately 5.1x to 2.5x during the

three-year period post-acquisition (down to 4.5x at the end of

Q1’13) Expect to generate $600 million in free cash flow in

FY’13 Debt paydown roadmap

—

Initial focus on $405 million tranche of our convertible notes putable in December

2013

—

$65 million in scheduled payments for Term Loan A and Term Loan B in

FY’13 —

Build cash through FY’13 and FY’14, then focus on paying down remaining

Gen- Probe-related debt

13 |

Amendment Overview

Hologic is seeking to reprice its Revolver and Term Loan A

In addition, the amendment would make certain other changes in the Credit

Agreement, including: 14

—

Allow the Company to purchase or repurchase its Convertible Notes during the

eighteen months prior to their respective put dates and at any such time

such Convertible Notes are otherwise callable, subject to no event of

default and pro forma covenant compliance —

Modify the Asset Sale covenant general basket to remove the transaction and annual

caps on asset sales

—

Allow unsecured debt to be assumed as part of a Permitted Acquisition, subject to

no event of default and pro forma covenant compliance

|

|

In

thousands, except earnings per share In thousands, except earnings per

share Continued on next page

Reconciliation of GAAP to Non-GAAP (unaudited)

16 |

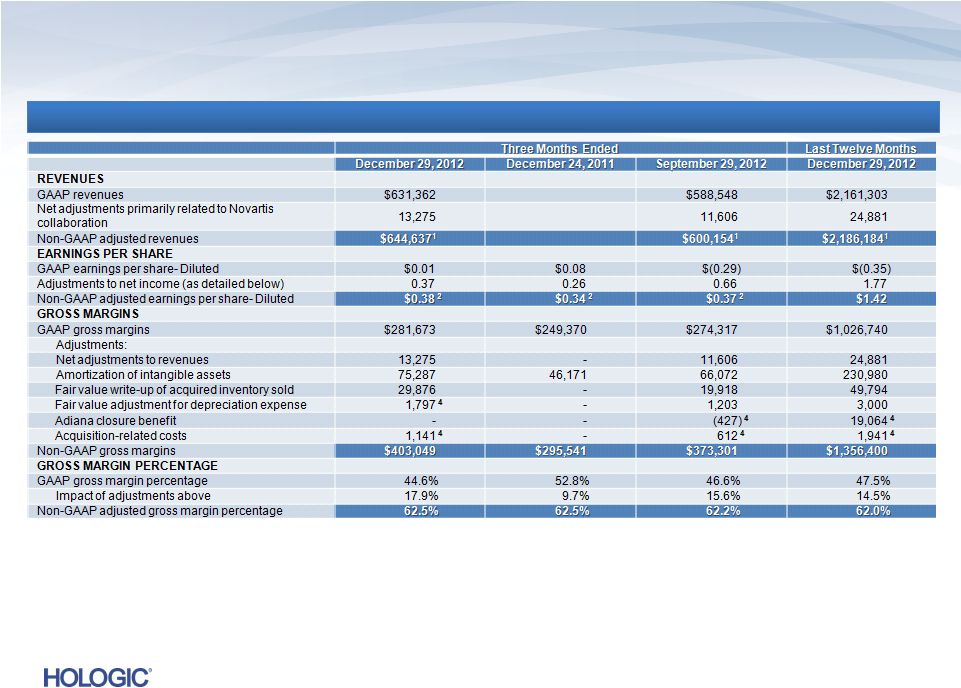

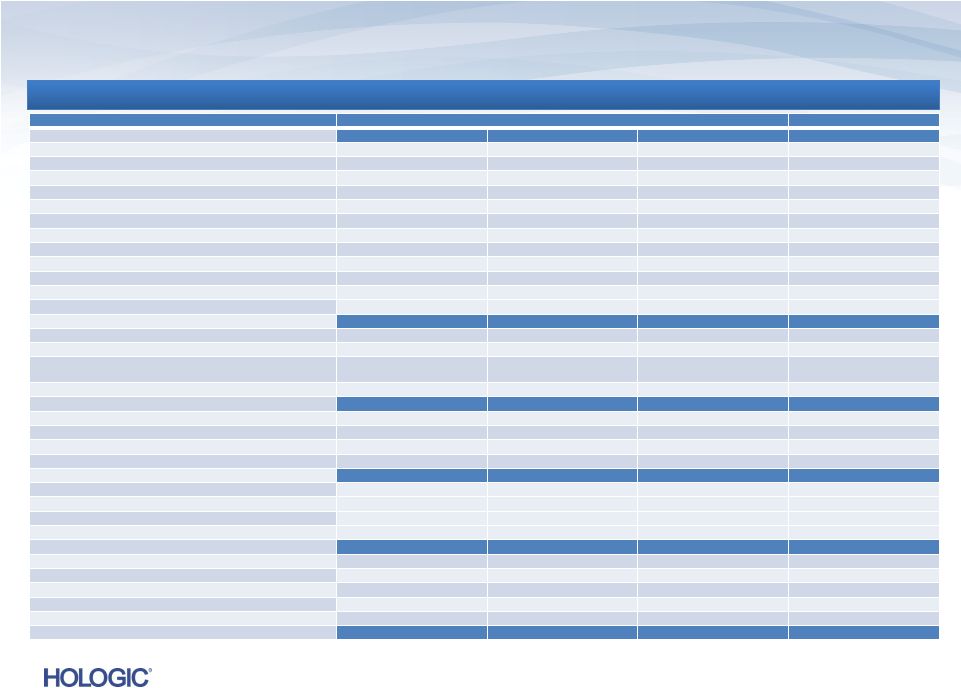

In

thousands, except earnings per share In thousands, except earnings per

share Three Months Ended

Three Months Ended

Last Twelve Months

Last Twelve Months

December 29, 2012

December 29, 2012

December 24, 2011

December 24, 2011

September 29, 2012

September 29, 2012

December 29, 2012

December 29, 2012

OPERATING EXPENSES

GAAP operating expenses

$218,444

$182,611

$318,020

$916,553

Adjustments:

Amortization of intangible assets

(28,526)

(14,842)

(24,832)

(85,720)

Contingent consideration

(39,526)

(15,563)

(40,399)

(143,460)

Acquisition-related costs

(4,380)

4

(913)

4

(37,901)

4

(47,772)

4

Restructuring costs

(3,933)

91

(16,697)

(21,060)

Goodwill impairment

-

-

(5,826)

(5,826)

Gain on sale of intellectual property, net

53,884

-

-

66,308

In-process research and development

-

-

(4,500)

(4,500)

Fair value adjustment for depreciation expense

(892)

4

-

(1,300)

4

(2,192)

4

Other gains (charges)

3,200

-

(2)

2,269

Non-GAAP adjusted net operating expenses

$198,271

$198,271

$151,384

$151,384

$186,563

$186,563

$674,600

$674,600

INTEREST EXPENSE, NET

GAAP interest expense

$72,081

$29,509

$56,673

$182,859

Adjustment for non-cash interest expense relating to

convertible notes

(15,644)

(18,953)

(16,514)

(65,223)

Other interest expense

-

(171)

-

(357)

Non-GAAP interest expense, net

$56,437

$56,437

$10,385

$10,385

$40,159

$40,159

$117,279

$117,279

PRE-TAX (LOSS) INCOME

GAAP pre-tax (loss) income

$(7,353)

$39,904

$(97,964)

$(108,918)

Adjustments to pre-tax (loss) income as detailed above

157,193

96,522

246,955

637,193

Other gains

(167)

-

-

(167)

Non-GAAP pre-tax income

$149,673

$149,673

$136,426

$136,426

$148,991

$148,991

$570,455

$570,455

NET INCOME (LOSS)

GAAP net income (loss)

$3,118

$20,812

$(77,767)

$(91,328)

Adjustments to pre-tax (loss) income as detailed above

157,026

96,522

246,955

679,373

Income tax effect of reconciling items

(58,366) ³

(27,293) ³

(70,854) ³

(208,551)

Non-GAAP adjusted net income

$101,778

$101,778

$90,041

$90,041

$98,334

$98,334

$379,494

$379,494

EBITDA

Non-GAAP adjusted net income

$101,778

$90,041

$98,334

$379,494

Interest expense, net, not adjusted above

56,177

9,723

39,766

115,341

Provision for income taxes

47,895

46,385

50,657

190,961

Depreciation expense, not adjusted above

21,653

16,110

21,241

74,891

Adjusted EBITDA

$227,503

$227,503

$162,259

$162,259

$209,998

$209,998

$760,687

$760,687

Reconciliation of GAAP to Non-GAAP (unaudited)

Continued on next page

17 |

Reconciliation

of

GAAP

to

Non-GAAP

(unaudited)

Footnotes:

1

To primarily reflect a fair value adjustment recorded in purchase accounting

relating to contingent revenue earned and received under the Novartis

collaboration post acquisition, which was eliminated under purchase accounting.

2

Non-GAAP adjusted earnings per share was calculated based on: 269,379; 264,958;

and 268,106 weighted average diluted shares outstanding for the three months

ended December 29, 2012, December 24, 2011, and September 29, 2012,

respectively. 3

To reflect an annual effective tax rate of 32.0%, 34.0% and 34.0% on a non-GAAP

basis for the three months ended December 29, 2012, December 24, 2011, and

September 29, 2012, respectively. 4

The breakdown of this expense by P&L line item is as follows:

18

In thousands, except tax rates

In thousands, except tax rates

Three Months Ended

Three Months Ended

Last Twelve Months

Last Twelve Months

December 29, 2012

December 29, 2012

December 24, 2011

December 24, 2011

September 29, 2012

September 29, 2012

December 29, 2012

December 29, 2012

Acquisition-related costs

R&D

$1,253

-

$805

$2,291

S&M

770

-

691

1,495

G&A

2,357

$913

36,405

43,986

Total OpEx

$4,380

$913

$37,901

$47,772

COGS

1,141

-

612

1,941

Total Adjustment

$5,521

$913

$38,513

$49,713

Fair value adjustment for depreciation expense

R&D

$439

-

$293

$732

S&M

66

-

44

110

G&A

387

-

963

1,350

Total OpEx

$892

-

$1,300

$2,192

COGS

1,797

-

1,203

3,000

Total Adjustment

$2,689

-

$2,503

$5,192 |

Use

of Non-GAAP Financial Measures 19

Hologic has presented the following non-GAAP financial measures in this presentation: adjusted

revenues; adjusted gross margins; adjusted operating expenses; adjusted operating income;

adjusted interest expense; adjusted pre-tax income; adjusted net income; adjusted EPS; and

adjusted EBITDA. Hologic defines adjusted EBITDA as its non-GAAP adjusted net income plus interest

expense, net, income taxes, and depreciation and amortization expense included in its

non-GAAP adjusted net income. Hologic defines its non-GAAP adjusted revenues to

primarily include contingent revenue earned under the Novartis collaboration post-acquisition

which was eliminated under purchase accounting. Hologic defines its non-GAAP adjusted gross

margins, adjusted operating expenses, adjusted operating income, adjusted interest expense,

adjusted pre-tax income and adjusted EPS to exclude, as applicable: (i) the amortization of

intangible assets; (ii) acquisition-related charges and effects, such as charges for

contingent consideration (comprised of (a) adjustments for changes in the fair value of the contingent consideration

liabilities initially recorded as part of the purchase price of an acquisition as required by GAAP,

and (b) contingent consideration that is tied to continuing employment of the former

shareholders and employees which is recorded as compensation expense), transaction costs, integration

costs including retention, and credits and/or charges associated with the write-up of acquired

inventory and fixed assets to fair value, and the effect of a reduction in revenue related to

contingent revenue under the Novartis collaboration, described above; (iii) non-cash interest expense

related to amortization of the debt discount for convertible debt securities; (iv) divestiture and

restructuring charges; (v) non-cash loss on exchange of convertible notes; (vi) litigation

settlement charges (benefits); (vii) other-than-temporary impairment losses on investments; and (viii) other one-

time, nonrecurring, unusual or infrequent charges, expenses or gains that may not be indicative of

Hologic’s core business results; and to include income taxes related to such adjustments.

Hologic believes the use of non-GAAP adjusted net revenues is useful to investors as it eliminates

certain effects of purchase accounting on its recognition of revenue. Hologic believes the use

of non-GAAP adjusted net income is useful to investors by eliminating certain of the more

significant effects of its acquisitions and related activities, non-cash charges resulting from

the application of GAAP to convertible debt instruments with cash settlement features, charges

related to debt extinguishment losses, investment impairments, litigation settlements, and divestiture and

restructuring initiatives. These non-GAAP measures also reflect how Hologic manages its businesses

internally. In addition to the adjustments set forth in the calculation of Hologic’s

non-GAAP adjusted net income and adjusted EPS, its non-GAAP adjusted EBITDA eliminates the effects of

financing, income taxes and the accounting effects of capital spending. As with the items eliminated

in its calculation of non-GAAP adjusted net income, these items may vary for different

companies for reasons unrelated to the overall operating performance of a company’s business. When

analyzing Hologic’s operating performance, investors should not consider these non-GAAP

financial measures as a substitute for net income (loss) prepared in accordance with

GAAP. |

Financial Guidance

20

The Company’s guidance includes its current operations, including revenues

from its approved/cleared products and its recently acquired businesses.

Hologic may not generate expected revenues and may incur expenses or

charges, realize income or gains, or execute acquisitions or dispositions

in fiscal 2013 that could cause actual results to vary from the guidance

provided in this presentation. In addition, the Company is continuing to monitor the

effects

of

the

U.S.,

European

and

general

worldwide

economic

and

regulatory

conditions

and

related

uncertainties, including the implementation of healthcare cost containment

measures and healthcare reform legislation, as well as foreign currency

fluctuations, which, along with other uncertainties facing the

Company’s business including those referenced elsewhere herein and its filings with the

Securities and Exchange Commission, could adversely affect anticipated results.

Future Non-GAAP Adjustments:

Future GAAP EPS may be affected by changes in ongoing assumptions and judgments

relating to the

Company’s

acquired

businesses,

and

may

also

be

affected

by

nonrecurring,

unusual

or

unanticipated charges, expenses or gains, all of which are excluded in the

calculation of non-GAAP adjusted EPS as described in this presentation.

It is therefore not practicable to reconcile non-GAAP adjusted EPS

guidance to the most comparable GAAP measure. |