Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CARDINAL FINANCIAL CORP | a13-6119_18k.htm |

Exhibit 99.1

|

|

Raymond James Institutional Investors Conference March 4, 2013 |

|

|

Statements contained in this presentation which are not historical facts are forward-looking statements as that item is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from estimated results. For an explanation of the risks and uncertainties associated with forward-looking statements, please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 and other reports filed and furnished to the Securities and Exchange Commission. Forward Looking Statements | 2 |

|

|

Investment Summary Well-positioned for growth Franchise value in premier market Resilient local economy Opportunities for organic and M&A growth Strong, experienced management team Excellent asset quality and diversified loan portfolio Diversified revenue stream Shareholder-focused Attractive valuation Dividend has increased 400% since 2009 53% compound annual EPS growth rate over past 5 years | 3 |

|

|

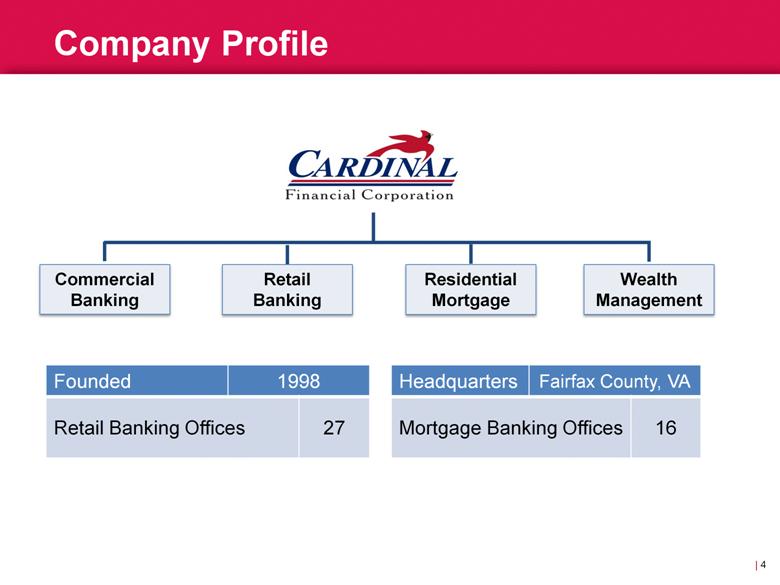

Company Profile | 4 Founded 1998 Headquarters Fairfax County, VA Retail Banking Offices 27 Mortgage Banking Offices 16 Commercial Banking Retail Banking Residential Mortgage Wealth Management |

|

|

Management Team Industry Experience Years in Market Bernard Clineburg Chairman & CEO 41 years 41 Chris Bergstrom EVP, CCO/CRO 30 years 22 Alice Frazier EVP, COO 24 years 21 Dennis Griffith EVP, Chief Lending Officer 38 years 38 Kevin Reynolds EVP, Director of Sales 30 years 30 Mark Wendel EVP, CFO 30 years 6 Bob Brower CEO, George Mason Mortgage 21 years 21 | 5 |

|

|

Financial Highlights 12/31/2012 12/31/2011 % Change Net Income $45.3 million $28.0 million 62% EPS (Fully Diluted) $1.51 $0.94 61% Assets $3.04 billion $2.60 billion 17% Loans $1.80 billion $1.63 billion 11% Deposits $2.24 billion $1.78 billion 26% | 6 |

|

|

Aggressive on Sales, CONSERVATIVE ON RISK | 7 Our Operating Philosophy |

|

|

Strong Fifth largest economy in the U.S. 59 Inc. “500 Fastest-Growing Companies” Stable 2001-2009 Regional GRP growth of 25% Unemployment rate consistently below national average The Greater Washington Economy: | 8 Source: Greater Washington Initiative |

|

|

The Greater Washington Economy | 9 1Forbes.com 2MRIS 3SNL Financial, June 30, 2012 Map: Greater Washington Initiative Home to five of the “Top 10” counties with the highest median income in the U.S.1 Housing trends year over year2 Median sales price increased 10.7% Average days on market decreased 26.7% $154.7 billion deposit base3 |

|

|

The Greater Washington Economy | 10 Growing 5 major corporate headquarter relocations in recent years1 Gained more than 285,000 jobs (8.87% growth) since 2000 Greater Washington Jobs by Sector, 20122 1Greater Washington Initiative 2GMU Center for Regional Analysis |

|

|

Unemployment Rate | 11 Source: GMU Center for Regional Analysis |

|

|

Projected Major Sources of Job Growth | 12 Sectors Jobs (in Thousands) Percent Change 2012 2017 Change Professional & Business Services 697.4 841.2 143.8 20.6% Federal Government 380.4 358.4 -22.0 -5.8% Education/Health 380.2 419.0 38.8 10.2% State & Local Government 309.7 321.6 11.9 10.2% Hospitality 276.8 285.0 8.2 3.0% Retail Trade 254.1 266.6 12.5 4.9% Financial Services 150.0 154.7 4.7 3.1% Construction 146.4 201.8 55.4 37.8% Information Services 80.6 87.6 7.0 8.7% Other Services 182.8 185.3 2.5 1.4% Other Sectors (3) 175.0 193.2 18.2 10.4% Total Jobs 3,033.4 3,314.4 281.0 9.3% Source: GMU Center for Regional Analysis Washington Area, 2012-2017 |

|

|

Integrated Business Model | 13 6 Regional Teams of dedicated business-line representatives, led by established Market Executives: Commercial Retail Mortgage Wealth Management Niche Industry Expertise Medical Practices Title Companies Nonprofits Specialty Groups Government Contracting Real Estate Lending |

|

|

Public Recognition | 14 * 3rd Consecutive Appearance 2011, 2012 2012 Bank Performance Scorecard Overall Financial Performance Ranked 12th of 195 Banks Nationwide $1 billion to $5 billion in assets. Top-Rated Community Lender Washington Metropolitan Area 4 Consecutive Quarters 4Q2011- 3Q2012 |

|

|

Banking and Mortgage Office Locations | 15 |

|

|

Our Markets Region Median Household Income 20111 Total Population 20111 Projected Population Increase 2010 – 20152 Retail Branches Fairfax County, VA $103,010 1,081,726 7.37% 11 Loudoun County, VA $119,540 312,311 18.33% 4 Prince William County, VA $92,655 402,002 7.32% 3 Arlington County, VA $94,986 207,626 8.33% 4 Alexandria, VA $77,793 139,966 7.55% 1 Montgomery County , MD $89,155 971,777 3.78% 1 District of Columbia $60,903 601,723 2.78% 1* Stafford and Spotsylvania Counties, VA $83,267 251,358 6.61% 2 1Source: Greater Washington Initiative 2Source: SNL Financial | 16 * Georgetown Branch scheduled opening 2Q2013. |

|

|

Our Deposit Market Share | 17 Region 3Q2012 Deposit Growth, 3Q2011-3Q2012 CFNL Deposits Total Deposits in Market Market Growth CFNL Growth Greater Washington MSA $2.04 billion $154.7 billion 10.47% 39.64% Fairfax County, VA $1.2 billion $46.3 billion 24.58% 51.99% Loudoun County, VA $219.7 million $4.8 billion 9.69% 29.25% Prince William County, VA $59.13 million $3.48 billion 12.85% 20.16% Arlington County, VA $119.8 million $5.8 billion 17.23% 34.13% Alexandria, VA $54 million $5.1 billion 4.76% 33.49% Montgomery County, MD $72.7 million $31.2 billion 3.58% 116.66% District of Columbia $77.2 million $33.1 billion 4.64% 20.39% Fredericksburg (City) and Stafford County, VA $77.2 million $1.9 billion 7.23% 25.43% Source: SNL Financial |

|

|

Quality Annual Growth 1From 12/31/2008 through 12/31/2012 | 18 CAGR1 Loans: 11.65% Deposits: 15.39% Total Assets: 12.45% |

|

|

Deposit Profile Emphasis on core deposits and increasing relationships 6 Business Deposit Officers Aggressive deposit campaigns with strategic follow-up marketing Peer Deposit Growth Comparison: Y2011 to Y2012 Complete Peer Listing in Appendix Source: SNL Financial | 19 Area # of Officers Average Industry Experience Average Years In-Market Retail 27 19 Years 16 Business Deposit 6 15 Years 10 Leadership 2 25 Years 25 |

|

|

Core Deposit Base and Cost of Deposits1 Cost of Deposits | 20 1Excludes Brokered CDs Money Market/ Savings |

|

|

Net Interest Margin | 21 |

|

|

Peer Asset Growth Comparison Source: Y2011 to Y2012 | 22 Complete Peer Listing in Appendix Source: SNL Financial |

|

|

Loan Portfolio of $1.80 billion 27 Loan Officers Commercial Real Estate Government Contract Small Business Retail Commercial Lending Profile Peer Loan Growth Comparison: Y2011 to Y2012 CFNL excludes Loans held for Sale Complete Peer Listing in Appendix Source: SNL Financial | 23 Loan Officers Average Industry Experience Average Years In-Market 27 21 Years 18 |

|

|

Loan Portfolio Mix (12/31/2012) | 24 |

|

|

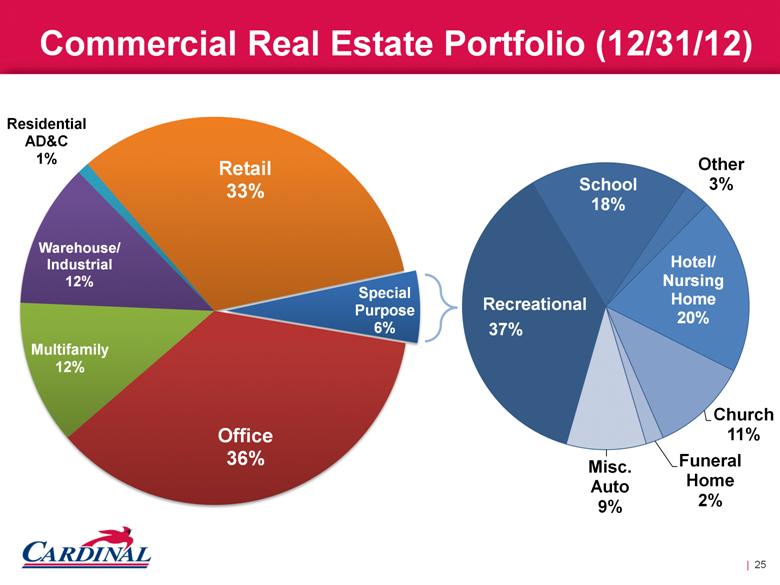

Commercial Real Estate Portfolio (12/31/12) Recreational | 25 |

|

|

Strong Conservative Credit Culture Source: Nonperforming Assets to Assets | 26 |

|

|

Credit Quality Ranking National Peers NPAs/Assets (%) Y2012 Century Bancorp, Inc. MA 0.14 Cardinal Financial Corporation VA 0.25 Southside Bancshares, Inc. TX 0.36 Financial Institutions, Inc. NY 0.73 Wilshire Bancorp, Inc. CA 0.87 Lakeland Bancorp, Inc. NJ 1.03 Lakeland Financial Corporation IN 1.03 City Holding Company WV 1.04 Washington Trust Bancorp, Inc. RI 1.07 Hudson Valley Holding Corp. NY 1.21 Community Bank CA 1.26 ViewPoint Financial Group, Inc. TX 1.27 Kearny Financial Corp. (MHC) NJ 1.27 Northfield Bancorp, Inc. NJ 1.30 Hanmi Financial Corporation CA 1.34 StellarOne Corporation VA 1.38 Republic Bancorp, Inc. KY 1.41 First Financial Holdings, Inc. SC 1.43 BNC Bancorp NC 1.53 MainSource Financial Group, Inc. IN 1.54 Eagle Bancorp, Inc. MD 1.65 Virginia Commerce Bancorp, Inc. VA 1.78 First Bancorp NC 2.50 Ameris Bancorp GA 2.61 Enterprise Financial Services Corp MO 2.88 Sun Bancorp, Inc. NJ 3.12 Customers Bancorp, Inc. PA 3.16 First Financial Corporation IN 3.49 Mechanics Bank CA 3.78 Anchor BanCorp Wisconsin Inc. WI 11.47 Source: SNL Financial | 27 Regional Peers NPAs/Assets (%) Y2012 Cardinal Financial Corporation VA 0.25 Monarch Financial Holdings, Inc. VA 0.30 American National Bankshares Inc. VA 0.90 First Community Bancshares, Inc. VA 1.09 National Bankshares, Inc. VA 1.32 Sandy Spring Bancorp, Inc. MD 1.36 StellarOne Corporation VA 1.38 Carter Bank & Trust VA 1.39 Eagle Bancorp, Inc. MD 1.65 Union First Market Bankshares Corporation VA 1.66 Virginia Commerce Bancorp, Inc. VA 1.78 TowneBank VA 1.80 Eastern Virginia Bankshares, Inc. VA 2.45 Middleburg Financial Corporation VA 2.64 Community Bankers Trust Corporation VA 2.81 First United Corporation MD 3.54 Shore Bancshares, Inc. MD 3.76 Franklin Financial Corporation VA 4.58 First Mariner Bancorp MD 6.34 Hampton Roads Bankshares, Inc. VA 6.36 |

|

|

George Mason Mortgage operates 17 branches in 10 counties, in Virginia, Maryland and the District of Columbia Marketing gains have ranged between 1.9% and 2.1% in 2012 Mortgage Banking Profile | 28 # Loan Officers Average Closings per Loan Officer per Quarter Q42010 59 $8,652,779 Q42011 102 $7,632,000 Q42012 160 $7,947,819 |

|

|

Brokerage Services1 Investment Management Wealth Management Profile 1 Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, and are: • Not deposits • Not insured by FDIC or any other government agency • Not guaranteed by Cardinal Bank • Subject to risk, may lose value. Cardinal Bank and Cardinal Wealth Services are independent of Raymond James Financial Services. | 29 Senior Management Average Industry Experience Average Years In-Market 2 23 Years 17 |

|

|

Revenue Trends | 30 Thousands |

|

|

Cardinal is Well Capitalized Average Tang. Common Equity/Tang. Assets Regional Banks $1-4 billion in assets reported as of 2/13/13 Source: SNL Financial | 31 |

|

|

Last Bank Standing? Local Target Acquirer Deposits1 (000s) Branches Year Virginia Commerce Bank United Bank $2,264,000 28 2013 Alliance Bank (VA) WashingtonFirst Bank $382,759 5 2012 Chevy Chase Bank Capital One (Converted 10/2010) $12,983,932 250 2009 Provident M&T (Converted 2009) $3,092,007 63 2009 Wachovia Wells $19,660,882 152 2008 Mercantile / MD PNC $1,662,476 240 2007 James Monroe Bank Mercantile / MD $449,374 6 2006 Community Bank Mercantile / MD $661,857 14 2005 Riggs Bank PNC / PA $4,374,122 48 2005 Southern Financial Provident / MD $756,949 28 2004 First Virginia BB&T / NC $3,907,382 364 2003 F&M / MD Mercantile / MD $916,789 49 2003 Total Consolidation $51,112,529 1,247 1FDIC Deposit Market Share | 32 |

|

|

Expansion of Montgomery County market team New Market Executive and two additional commercial lenders with regional expertise Additional branch locations under consideration Banking office expansion in key markets within Washington MSA Georgetown, Washington, DC (Second Quarter, 2013) Additional Virginia locations under consideration Deeper market penetration with additions to staff in existing mortgage offices Leverage opportunities with targeted expertise and marketing to niche industries Strategic Growth: De Novo | 33 Map: SNL Financial • Existing Cardinal Banking Offices • Existing George Mason Mortgage Offices |

|

|

| 34 Acquisition Strategy Markets with growth potential Strong local management to lead regional market teams Complementary product line offering Attractive branch network Strategic Growth Map: SNL Financial • Existing Cardinal Banking Offices • Existing George Mason Mortgage Offices |

|

|

Stock Profile Share Price (2/15/2013) $16.54 52 Week Range $10.28 - $16.90 Shares Outstanding 30,247,056 Market Capitalization $500.3 million Average Daily Volume 124,587 Price (2/15/13)/Book 1.62x Price (2/15/13)/ Tangible Book (12/31/12) 1.68x CFNL (NASDAQ) | 35 |

|

|

Aggressive on Sales, CONSERVATIVE ON RISK | 36 Our Operating Philosophy |

|

|

APPENDIX |

|

|

Appendix A: Regional Peer Group Company Name Ticker State Total Assets Reported Y2012 ($000) American National Bankshares Inc. AMNB VA 1,283,687 Cardinal Financial Corporation CFNL VA 3,039,187 Carter Bank & Trust CARE VA 4,442,296 Community Bankers Trust Corporation BTC VA 1,153,288 Eagle Bancorp, Inc. EGBN MD 3,409,441 Eastern Virginia Bankshares, Inc. EVBS VA 1,075,002 First Community Bancshares, Inc. FCBC VA 2,731,097 First Mariner Bancorp FMAR MD 1,378,420 First United Corporation FUNC MD 1,315,223 Franklin Financial Corporation FRNK VA 1,070,781 Hampton Roads Bankshares, Inc. HMPR VA 2,054,092 Middleburg Financial Corporation MBRG VA 1,236,781 Monarch Financial Holdings, Inc. MNRK VA 1,215,578 National Bankshares, Inc. NKSH VA 1,101,345 Sandy Spring Bancorp, Inc. SASR MD 3,955,206 Shore Bancshares, Inc. SHBI MD 1,185,807 StellarOne Corporation STEL VA 3,023,204 TowneBank TOWN VA 4,405,923 Union First Market Bankshares Corporation UBSH VA 4,095,865 Virginia Commerce Bancorp, Inc. VCBI VA 2,823,692 Source: SNL Financial Includes VA/MD/DC Banks with Assets between $1b and $4.5b |

|

|

Appendix B: National Peer Group Company Name Ticker State Total Assets Reported Y 2012 ($000) Ameris Bancorp ABCB GA 3,019,052 Anchor BanCorp Wisconsin Inc. ABCW WI 2,789,452 BNC Bancorp BNCN NC 3,083,788 Cardinal Financial Corporation CFNL VA 3,039,187 Century Bancorp, Inc. CNBKA MA 3,086,209 City Holding Company CHCO WV 2,917,466 Community Bank CYHT CA 3,060,641 Customers Bancorp, Inc. CUUU PA 3,197,334 Eagle Bancorp, Inc. EGBN MD 3,409,441 Enterprise Financial Services Corp EFSC MO 3,325,786 Financial Institutions, Inc. FISI NY 2,764,034 First Bancorp FBNC NC 3,244,910 First Financial Corporation THFF IN 2,793,023 First Financial Holdings, Inc. FFCH SC 3,215,558 Hanmi Financial Corporation HAFC CA 2,882,520 Hudson Valley Holding Corp. HVB NY 2,891,246 Kearny Financial Corp. (MHC) KRNY NJ 2,937,006 Lakeland Bancorp, Inc. LBAI NJ 2,918,703 Lakeland Financial Corporation LKFN IN 3,064,144 MainSource Financial Group, Inc. MSFG IN 2,769,288 Mechanics Bank MCHB CA 3,182,474 Northfield Bancorp, Inc. NFBK NJ 2,813,201 Republic Bancorp, Inc. RBCAA KY 3,394,399 Southside Bancshares, Inc. SBSI TX 3,237,403 StellarOne Corporation STEL VA 3,023,204 Sun Bancorp, Inc. SNBC NJ 3,224,031 ViewPoint Financial Group, Inc. VPFG TX 3,662,420 Virginia Commerce Bancorp, Inc. VCBI VA 2,823,692 Washington Trust Bancorp, Inc. WASH RI 3,071,884 Wilshire Bancorp, Inc. WIBC CA 2,750,863 Source: SNL Financial Includes Banks with Assets between $2.75b and $3.5b |