Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - AUGUSTA GOLD CORP. | Financial_Report.xls |

| EX-32 - AUGUSTA GOLD CORP. | q1100991_ex32.htm |

| EX-31 - AUGUSTA GOLD CORP. | q1100991_ex31.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO THE

FORM 10-K

|

R

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2011

OR

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File No. 000-54653

BULLFROG GOLD CORP.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

41-2252162

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer Identification

|

|

|

Of Incorporation or Organization)

|

Number)

|

|

|

897 Quail Run Drive

Grand Junction, CO

|

81505

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (970) 628-1670

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

(Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in 12b-2 of the Exchange Act.) Yes o No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $6,089.66.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 29,897,846 shares of common stock, par value $0.0001, were outstanding on February 27, 2012.

EXPLANATORY NOTE

This amended Annual Report on Form 10-K/A is being filed as Amendment No. 2 to our Annual report on Form 10-K which was originally filed on February 27, 2012 (the “Original Report”). Management of Bullfrog Gold Corp. (the “Company”, “we”, “us”, or “our”), determined that: (i) the unaudited consolidated financial statements for the period ended September 30, 2011 included in the Quarterly Report on Form 10-Q for the quarter ended September 30, 2011, (ii) the audited consolidated financial statements for the year ended December 31, 2011 included in its Annual Report on Form 10-K for the year ending December 31, 2011 and, (iii) the unaudited consolidated financial statements for the periods ended March 31, 2012, June 30, 2012 and September 30, 2012, respectively, included in the Quarterly Reports on Form 10-Q for the periods ending on March 31, 2012, June 30, 2012 and September 30, 2012, respectively, could no longer be relied upon. This determination was made after a review of the proper accounting treatment as it relates to the Company’s warrant liability.

We have determined that a restatement of our previously recorded values of our warrant liability and revaluation of warrant was required after a review of the proper accounting treatment. On September 30, 2011, the Company sold an aggregate of 9,127,250 units in a Private Placement (the “Private Placement”) at a per unit price of $0.40, with each unit consisting of (i) one share of the Company’s common stock (except that certain investors elected to receive in lieu of common stock, one share of the Company’s Series A Convertible Preferred Stock) and (ii) a three year warrant to purchase shares of common stock equal to 50% of the number of shares purchased in the Private Placement at an exercise price of $0.60 per share resulting in 4,563,625 warrants. The Company sold a total of 5,252,250 units consisting of common shares and a total of 3,875,000 units consisting of Series A Preferred Stock, resulting in total proceeds of $3,650,900. The Private Placement included the conversion of debt owed by the Company in the aggregate amount of $940,900 which was converted on a dollar for dollar basis into the Private Placement. The net proceeds were allocated based on the relative fair values of the common stock or preferred stock and the warrants on the date of issuance. This resulted in a warrant liability of $671,928 as of September 30, 2011 and a revaluation of warrant liability of $1,689,997 for the period ending December 31, 2011.

However, management determined that such transaction should be accounted pursuant to ASC 815 “Derivatives and Hedging” and related subtopics for allocating the carrying amount of the hybrid instrument between the host contract and the derivative. As a result the warrant liability as of September 30, 2011 should be recorded at a fair value of $1,235,229 and the December 31, 2011 revaluation of warrant liability would be $1,126,696. We anticipate the effects on our consolidated balance sheets, statements of operations, and statements of cash flows as of and for the periods ended September 30, 2011 and December 31, 2011. Such adjustment resulted in (i) an increase in our warrant liability of $563,301, decrease in our additional paid in capital of $563,301, and a zero effect on net loss for the period ending September 30, 2011 and (ii) a decrease in our loss on revaluation of warrant liability of $563,301, and decrease in net loss of $563,301 for the period ending December 31, 2011. The restatement adjustment is non-cash in nature. We believe that the recording of the warrant liability and all related matters are now correctly recorded and presented on our consolidated balance sheet, statement of operations, statement of stockholders’ equity and statement of cash flows.

Please see Note 5 - Restatement contained in the Notes to Consolidated Financial Statements appearing later in this Form 10-K/A which further describes the effect of these restatements.

No other changes have been made to the Original Report. This Amendment speaks as of the original date of the Original Report, does not reflect events that may have occurred subsequent to the filing of the Original Report and does not modify or update in any way disclosures made in the Original Report other than as described above.

TABLE OF CONTENTS

|

PART I

|

|

Item 1.

|

Business

|

2

|

|

|

Item 1a.

|

Risk Factors

|

4

|

|

|

Item 1b.

|

Unresolved Staff Comments

|

12

|

|

|

Item 2.

|

Properties

|

13

|

|

|

Item 3.

|

Legal Proceedings

|

23

|

|

|

Item 4.

|

Mine Safety Disclosures

|

23

|

|

PART II

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

24

|

|

|

Item 6.

|

Selected Financial Data

|

27

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

27

|

|

|

Item 7a.

|

Quantitative and Qualitative Disclosures About Market Risk

|

29

|

|

|

Item 8.

|

Financial Statements

|

29

|

|

|

Item 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

29

|

|

|

Item 9a.

|

Controls and Procedures

|

29

|

|

|

Item 9b.

|

Other Information

|

30

|

|

PART III

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

31

|

|

|

Item 11.

|

Executive Compensation

|

34

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

35

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

37

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

38

|

|

PART IV

|

|

Item 15.

|

Exhibits

|

39

|

|

|

Signatures

|

41

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K or as incorporated by reference contains “forward-looking statements” as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent our expectations or beliefs, including but not limited to, statements concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “could,” “might,” “plan,” “predict” or “project” or the negative of these words or other variations on these words or comparable terminology.

Such forward-looking statements include statements regarding, among other things, (1) our estimates of mineral reserves and mineralized material, (2) our projected sales and profitability, (3) our growth strategies, (4) anticipated trends in our industry, (5) our future financing plans, (6) our anticipated needs for working capital, (7) our lack of operational experience and (8) the benefits related to ownership of our common stock. These statements constitute forward-looking statements within the meaning of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as in this filing generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Item 1A. Risk Factors” below and other risks and matters described in this filing and in our other SEC filings. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur as projected. We do not undertake any obligation to update any forward-looking statements.

1

PART I

Corporate History; Recent Events

As used in this Annual Report on Form 10-K, unless otherwise indicated, the terms “we,” “us,” “our,” “Bullfrog Gold” and “the Company” refer to Bullfrog Gold Corp, a Delaware corporation.

Bullfrog Gold Corp., (“Bullfrog Gold” or, the “Company") was incorporated under the laws of the State of Delaware on July 23, 2007 as Kopr Resources Corp. On July 19, 2011, Bullfrog Gold's board of directors approved an Amended and Restated Certificate of Incorporation of the Company to authorize (i) the change of the name of the Company to "Bullfrog Gold Corp." from "Kopr Resources Corp." (ii) the increase in the authorized capital stock to 250,000,000 shares and (iii) the change in par value of the capital stock to $0.0001 per share. The Company is in the exploration stage of its resource business.

On March 17, 2011 the Board of Directors of Bullfrog Gold unanimously approved the reverse stock split of the Company's issued and outstanding stock as of April 4, 2011 at a ratio of 1 for 5.75. The par value and total number of authorized shares were unaffected by the reverse stock split. All shares and per share amounts in these financial statements and notes thereto have been retrospectively adjusted to all periods presented to give effect to the reverse stock split.

On July 19, 2011, Bullfrog Gold's board of directors authorized a 51.74495487 for one forward split of our outstanding common stock in the form of a dividend, whereby an additional 50.74495487 shares of common stock, par value $0.0001 per share, was issued on each one share of common stock outstanding as of July 25, 2011. All shares and per share amounts in these financial statements and notes thereto have been retrospectively adjusted to all periods presented to give effect to the forward stock split.

On September 30, 2011, the Company entered into an Agreement of Merger and Plan of Reorganization (the “Merger Agreement”) with Standard Gold Corp., a privately held Nevada corporation (“Standard Gold”), and Bullfrog Gold Acquisition Corp., the Company’s newly formed, wholly-owned Delaware subsidiary (“Acquisition Sub”), pursuant to which Standard Gold merged with and into Acquisition Sub, with Standard Gold as the surviving entity, causing Standard Gold to become the Company’s wholly-owned subsidiary (the “Merger”). Following the closing of the Merger the Company conducted a private placement (the “Private Placement”) pursuant to which it sold units at a per unit price of $0.40 with each unit consisting of one share of the Company’s common stock (except that certain investors elected to receive, in lieu of common stock, one share of Series A Preferred Stock), and one warrant to purchase 50% of the number of shares purchased at an exercise price of $0.60 per share. Immediately following the closing of the Merger, under an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations, the Company transferred substantially all of its pre-exchange assets and liabilities to a wholly-owned subsidiary, Kopr Resources Holdings, Inc. (“SplitCo”) and thereafter, pursuant to a stock purchase agreement, transferred all of the outstanding capital stock of SplitCo to our former officer and director in exchange for the cancellation of shares of our common stock she owned. See Note 2 in the Notes to Financial Statements for additional details concerning the reverse merger transaction.

We are primarily an exploration stage company engaged in the acquisition and exploration of properties that may contain gold mineralization in the United States. Our target properties are those that have been the subject of historical exploration. We have acquired exploration permits on state lands and Federal patented and unpatented mining claims in the states of Arizona and Nevada for the purpose of exploration and potential development of gold on a total of approximately 6,860 acres. We plan to review opportunities and acquire additional mineral properties with current or historic precious and base metal mineralization with meaningful exploration potential. The Company has acquired two projects, as described below.

2

Newsboy Project, Arizona

The Newsboy Project comprises 5,240 acres of state and federal lands located 45 miles northwest of Phoenix, Arizona. The closest towns, Wickenburg and Morristown, are located 10 miles and 3 miles respectively from the site and provide excellent infrastructure. Approximately 1.2 million ounces of gold and 1 million ounces of silver have been produced within 25 miles of the Newsboy Project from several historic mines, including the Vulture, Congress, Octave and Yarnell.

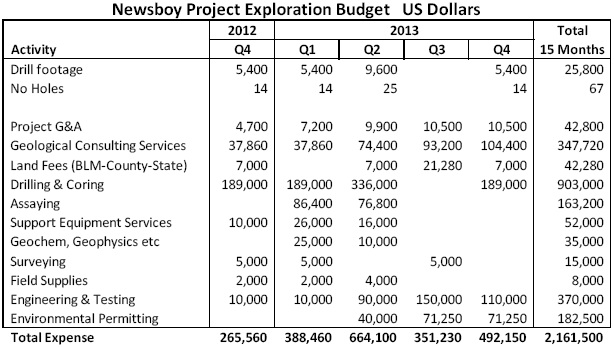

In September 2011, the Company obtained the working right and option to earn a 100% interest in and to the Newsboy Project. Terms of this Agreement include the payment of $3,425,000 during the next five years plus a 2% net smelter royalty.

In addition to the main mineral zone drilled by predecessors, the Newsboy Project has eight relatively shallow priority drill targets and other secondary targets below existing drill depths. The Company and its independent consultants have developed a detailed exploration drilling program to confirm and expand mineralized zones and collect additional environmental and technical data. The first phase of confirmation and expansion drilling started in early November 2011 and was completed in January 2012. The Company intends to continue drilling, metallurgical testing, engineering and environmental programs and studies during 2012 and soon thereafter update the historic feasibility study and environmental permit applications. For further details and description of the Newsboy Project, please see Item 2, Properties, herein.

Bullfrog Gold Project

The Bullfrog Gold Project lies approximately 3 miles northwest of the town of Beatty and 116 miles northwest of Las Vegas, Nevada. Standard Gold acquired a 100% right, title and interest in and to 1,650 acres of mineral claims and patents known as the “Bullfrog Project” subject to a 3% net smelter royalty. The Company proposes to drill 25 holes during the last half of 2012 to test for potential mineralization that may extend from Barrick’s Montgomery-Shoshone open pit mine onto the Company’s adjacent property. For further details and description of the Bullfrog Gold Project, please see Item 2, Properties, herein.

Competition

We do not compete directly with anyone for the exploration or removal of minerals from our property as we hold all interest and rights to the claims. Readily available commodities markets exist in the U.S. and around the world for the sale of minerals. Therefore, we will likely be able to sell minerals that we are able to recover. We will be subject to competition and unforeseen limited sources of supplies in the industry in the event spot shortages arise for supplies such as explosives or large equipment tires, and certain equipment such as bulldozers and excavators and services, such as contract drilling that we will need to conduct exploration. If we are unsuccessful in securing the products, equipment and services we need, we may have to suspend our exploration plans until we are able to secure them.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the United States generally. We will also be subject to the regulations of the Bureau of Land Management (“BLM”) and Arizona with respect to mining claims on Federal lands and four exploration permits on Arizona state lands at the Newsboy Project.

We are required to pay annual maintenance fees to the BLM to keep our Federal lode and placer mining claims in good standing. The maintenance period begins at noon on September 1st through the following September 1st and payments are due by the first day of the maintenance period. The annual fee is $140.00 per claim. The Arizona state exploration permits currently are $6,280 per year.

3

Future exploration drilling on any of our properties that consist of BLM land will require us to either file a Notice of Intent or a Plan of Operations with the BLM, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is required for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

Research and Development

During the fiscal year ended December 31, 2011 and the period from inception until December 31, 2010, we have had no expense related to research and development.

Corporate Office

Our principal executive office is 897 Quail Run Drive, Grand Junction, CO 81505. Our main telephone number is (970) 628-1670. Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are available free of charge through the Securities and Exchange Commission’s website at www.sec.gov as soon as reasonably practicable after those reports are electronically filed with or furnished to the SEC.

Employees

As of the date of this filing, we currently employ 2 full-time employees, including our Chief Executive Officer. We have contracts with various independent contractors and consultants to fulfill additional needs, including investor relations, exploration, development, permitting, and other administrative functions, and may staff further with employees as we expand activities and bring new projects on line.

Legal Proceedings

We are not involved in any pending legal proceeding or litigations and, to the best of our knowledge, no governmental authority is contemplating any proceeding to which we are a party or to which any of our properties is subject, which would reasonably be likely to have a material adverse effect on the Company.

ITEM 1A. RISK FACTORS

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

Risks Relating to Our Business

We are a new company with a short operating history and have only lost money.

Standard Gold Corp., our exploration and operating subsidiary, was formed in January 2010. Our operating history consists of starting our preliminary exploration activities. We have no income-producing activities from mining or exploration. We have already lost money because of the expenses we have incurred in acquiring the rights to explore our properties and starting our preliminary exploration activities. Exploring for gold and other minerals or resources is an inherently speculative activity. There is a strong possibility that we will not find any commercially exploitable gold or other deposits on our properties. Because we are an exploration company, we may never achieve any meaningful revenue.

Since we have a limited operating history, it is difficult for potential investors to evaluate our business.

Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. Since our formation, we have not generated any revenues. As an early stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

4

Exploring for gold is an inherently speculative business.

Natural resource exploration, and exploring for gold in particular, is a business that by its nature is very speculative. There is a strong possibility that we will not discover gold or any other resources which can be mined or extracted at a profit. Even if we do discover gold or other deposits, the deposit may not be of the quality or size necessary for us or a potential purchaser of the property to make a profit from actually mining it. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological formations, geological formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits.

We will need to obtain additional financing to fund our exploration program.

We do not have sufficient capital to fund our exploration program as it is currently planned or to fund the acquisition and exploration of new properties. Based on results of our exploration phases and limits of only using funds raised to date, we plan to spend a minimum of $1,500,000 and up to $3,200,000 through 2012, including the costs of being a public company. We will require additional funding. We do not have any sources of funding. We may be unable to secure additional financing on terms acceptable to us, or at all. Our inability to raise additional funds on a timely basis could prevent us from achieving our business objectives and could have a negative impact on our business, financial condition, results of operations and the value of our securities. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership of existing stockholders may be diluted and the securities that we may issue in the future may have rights, preferences or privileges senior to those of the current holders of our common stock. Such securities may also be issued at a discount to the market price of our common stock, resulting in possible further dilution to the book value per share of common stock. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility.

The global financial crisis may have an impact on our business and financial condition in ways that we currently cannot predict.

The continued credit crisis and related turmoil in the global financial system may have an impact on our business and financial position. The recent high costs of fuel and other consumables may negatively impact costs of our operations. In addition, the financial crisis may limit our ability to raise capital through credit and equity markets. As discussed further below, the prices of the metals that we may produce are affected by a number of factors, and it is unknown how these factors will be impacted by a continuation of the financial crisis.

We do not know if our properties contain any gold or other minerals that can be mined at a profit.

The properties on which we have the right to explore for gold are not known to have any deposits of gold which can be mined at a profit (as to which there can be no assurance). Whether a gold deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of gold, which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection.

5

We are a junior gold exploration company with no mining operations and we may never have any mining operations in the future.

Our business is exploring for gold and to a lesser extent, other minerals. In the event that we discover commercially exploitable gold or other deposits, we will not be able to make any money from them unless the gold or other minerals are actually mined or we sell all or a part of our interest. Accordingly, we will need to find some other entity to mine our properties on our behalf, mine them ourselves or sell our rights to mine to third parties. Mining operations in the United States are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. In the event we assume any operational responsibility for mining our properties, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

Our business is subject to extensive environmental regulations which may make exploring for or mining prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations which can make exploration expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities on our properties. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploration. This may adversely affect our financial position, which may cause you to lose your investment. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine our properties and we retain any operational responsibility for doing so, our potential exposure for remediation may be significant, and this may have a material adverse effect upon our business and financial position. We have not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities). However, if we mine one or more of our properties and retain operational responsibility for mining, then such insurance may not be available to us on reasonable terms or at a reasonable price. All of our exploration and, if warranted, development activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws.

We may be denied the government licenses and permits which we need to explore on our properties. In the event that we discover commercially exploitable deposits, we may be denied the additional government licenses and permits which we will need to mine our properties.

Exploration activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented mineral claims requires a permit to be obtained from the United States Bureau of Land Management, which may take several months or longer to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. As with all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted at all. Delays in or our inability to obtain necessary permits will result in unanticipated costs, which may result in serious adverse effects upon our business.

6

The values of our properties are subject to volatility in the price of gold and any other deposits we may seek or locate.

Our ability to obtain additional and continuing funding, and our profitability in the unlikely event we ever commence mining operations or sell our rights to mine, will be significantly affected by changes in the market price of gold. Gold prices fluctuate widely and are affected by numerous factors, all of which are beyond our control. Some of these factors include the sale or purchase of gold by central banks and financial institutions; interest rates; currency exchange rates; inflation or deflation; fluctuation in the value of the United States dollar and other currencies; speculation; global and regional supply and demand, including investment, industrial and jewelry demand; and the political and economic conditions of major gold or other mineral producing countries throughout the world, such as Russia and South Africa. The price of gold or other minerals have fluctuated widely in recent years, and a decline in the price of gold could cause a significant decrease in the value of our properties, limit our ability to raise money, and render continued exploration and development of our properties impracticable. If that happens, then we could lose our rights to our properties and be compelled to sell some or all of these rights. Additionally, the future development of our properties beyond the exploration stage is heavily dependent upon the level of gold prices remaining sufficiently high to make the development of our properties economically viable. You may lose your investment if the price of gold decreases. The greater the decrease in the price of gold, the more likely it is that you will lose money.

Our property titles may be challenged. We are not insured against any challenges, impairments or defects to our mineral claims or property titles. We have not fully verified title to our properties.

Our properties in Arizona and Nevada are comprised of two patented parcels, four State exploration permits, twelve unpatented placer claims, and one hundred and sixty nine unpatented lode claims. These unpatented claims were created and maintained in accordance with the federal General Mining Law of 1872. Unpatented claims are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the General Mining Law. Although the annual payments and filings for these claims, permits and patents have been maintained, we have conducted limited title search on our Newsboy and Bullfrog project properties. The uncertainty resulting from not having comprehensive title searches on the properties leaves us exposed to potential title suits. Defending any challenges to our property titles may be costly, and may divert funds that could otherwise be used for exploration activities and other purposes. In addition, unpatented claims are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting our discovery of commercially extractable gold. Challenges to our title may increase our costs of operation or limit our ability to explore on certain portions of our properties. We are not insured against challenges, impairments or defects to our property titles, nor do we intend to carry extensive title insurance in the future. Potential conflicts to our mineral claims are discussed in detail elsewhere herein.

Possible amendments to the General Mining Law could make it more difficult or impossible for us to execute our business plan.

The U.S. Congress has considered proposals to amend the General Mining Law of 1872 that would have, among other things, permanently banned the sale of public land for mining. The proposed amendment would have expanded the environmental regulations to which we are subject and would have given Indian tribes the ability to hinder or prohibit mining operations near tribal lands. The proposed amendment would also have imposed a royalty of 8% of gross revenue on new mining operations located on federal public land, which would have applied to substantial portions of our properties. The proposed amendment would have made it more expensive or perhaps too expensive to recover any otherwise commercially exploitable gold deposits which we may find on our properties. While at this time the proposed amendment is no longer pending, this or similar changes to the law in the future could have a significant impact on our business model.

7

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold and other resources.

Gold exploration, and resource exploration in general, has demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Fuel prices are extremely volatile as well. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in our activities may adversely affect our exploration activities and financial condition.

We may not be able to maintain the infrastructure necessary to conduct exploration activities.

Our exploration activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our exploration activities and financial condition.

Our exploration activities may be adversely affected by the local climates, which could prevent or impair us from exploring our properties year round.

The local climates in Arizona and Nevada may impair or prevent us from conducting exploration activities on our properties year round. Because of their rural locations and limited infrastructure in these areas, our properties are generally impassible for several days per year as a result of significant rain or snow events. Earthquakes, heavy rains, snowstorms, and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our properties, or may otherwise prevent us from conducting exploration activities on our properties.

We do not carry any property or casualty insurance and do not intend to carry such insurance in the future.

Our business is subject to a number of risks and hazards generally, including but not limited to adverse environmental conditions, industrial accidents, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to our properties, equipment, infrastructure, personal injury or death, environmental damage, delays, monetary losses and possible legal liability. You could lose all or part of your investment if any such catastrophic event occurs. We do not carry any property or casualty insurance at this time, nor do we intend to carry this type of insurance in the future (except that we will carry all insurances that we are required to by law, such as motor vehicle and workers compensation plus other coverage that may be in the best interest of the Company). Even if we do obtain insurance, it may not cover all of the risks associated with our operations. Insurance against risks such as environmental pollution or other hazards as a result of exploration and operations are often not available to us or to other companies in our business on acceptable terms. Should any events against which we are not insured actually occur, we may become subject to substantial losses, costs and liabilities which will adversely affect our financial condition.

8

Risks Relating to our Organization and our Common Stock

Exercise of options and warrants and/or conversion of preferred stock will dilute your percentage of ownership.

We have authorized for issuance options to purchase 4,060,000 shares of our common stock and may issue options to purchase up to an aggregate of 4,500,000 shares of common stock under our 2011 Equity Incentive Plan. We also have warrants to purchase 4,563,625 shares of our common stock issued and outstanding and 4,586,539 shares of Series A Preferred Stock outstanding which are convertible into shares of common stock on a one for one basis. In the future, we may grant additional stock options, warrants and convertible securities. The exercise or conversion of stock options, warrants or convertible securities will dilute the percentage ownership of our other stockholders. The dilutive effect of the exercise or conversion of these securities may adversely affect our ability to obtain additional capital. The holders of these securities may be expected to exercise or convert them when we would be able to obtain additional equity capital on terms more favorable than these securities.

Difficulties we may encounter managing our growth could adversely affect our results of operations.

As our business needs expand, we may need to hire a significant number of employees. This expansion may place a significant strain on our managerial and financial resources. To manage the potential growth of our operations and personnel, we will be required to:

|

|

·

|

improve existing, and implement new, operational, financial and management controls, reporting systems and procedures;

|

|

|

·

|

install enhanced management information systems; and

|

|

|

·

|

train, motivate and manage our employees.

|

We may not be able to install adequate management information and control systems in an efficient and timely manner, and our current or planned personnel, systems, procedures and controls may not be adequate to support our future operations. If we are unable to manage growth effectively, our business would be seriously harmed.

If we lose key personnel or are unable to attract and retain additional qualified personnel we may not be able to successfully manage our business and achieve our objectives.

We believe our future success will depend upon our ability to retain our key management, including Mr. Beling, our Chief Executive Officer, President, Chief Financial Officer, Treasurer, Secretary and director, and Mr. Lindsay, the Chairman of our Board of Directors. We may not be successful in attracting, assimilating and retaining our employees in the future.

As a result of the reverse merger on September 30, 2011, Standard Gold became a subsidiary of ours and since we are subject to the reporting requirements of federal securities laws, this can be expensive and may divert resources from other projects, thus impairing its ability to grow.

As a result of the reverse merger consummated on September 30, 2011, Standard Gold became a subsidiary of ours and, accordingly, is subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission (including reporting of the reverse merger) and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if Standard Gold had remained privately held and did not consummate the merger.

The Sarbanes-Oxley Act and new rules subsequently implemented by the Securities and Exchange Commission have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs in 2012 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

9

Our stock price may be volatile.

The stock market in general has experienced volatility that often has been unrelated to the operating performance of any specific public company. The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

|

|

·

|

changes in our industry;

|

|

|

·

|

competitive pricing pressures;

|

|

|

·

|

our ability to obtain working capital financing;

|

|

|

·

|

additions or departures of key personnel;

|

|

|

·

|

limited “public float” in the hands of a small number of persons who sales or lack of sales could result in positive or negative pricing pressure on the market prices of our common stock;

|

|

|

·

|

sales of our common stock;

|

|

|

·

|

our ability to execute our business plan;

|

|

|

·

|

operating results that fall below expectations;

|

|

|

·

|

loss of any strategic relationship;

|

|

|

·

|

regulatory developments;

|

|

|

·

|

economic and other external factors; and

|

|

|

·

|

period-to-period fluctuations in our financial results.

|

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

We have never paid nor do we expect in the near future to pay dividends.

We have never paid cash dividends on our capital stock and do not anticipate paying any cash dividends on our common stock for the foreseeable future. Investors should not rely on an investment in our Company if they require income generated from dividends paid on our capital stock. Any income derived from our common stock would only come from rise in the market price of our common stock, which is uncertain and unpredictable.

There is currently no liquid trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

To date there has been no liquid trading market for our common stock. We cannot predict how liquid the market for our common stock might become. Since August 11, 2011, our common stock has been quoted for trading on the OTC Bulletin Board under the symbol BFGC.OB, and, as soon as is practicable, we intend to apply for listing of our common stock on either the NYSE Amex, The Nasdaq Capital Market or other national securities exchange, assuming that we can satisfy the initial listing standards for such exchange. We currently do not satisfy the initial listing standards, and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing and remain listed on the OTC Bulletin Board or suspended from the OTC Bulletin Board, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility. Furthermore, for companies whose securities are traded in the OTC Bulletin Board, it is more difficult (1) to obtain accurate quotations, (2) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (3) to obtain needed capital.

10

Our common stock is subject to the “Penny Stock” rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Our common stock is considered a “Penny Stock”. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock. The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock. In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit investors’ ability to buy and sell our stock and have an adverse effect on the market for our shares.

Our common stock may be affected by limited trading volume and price fluctuation which could adversely impact the value of our common stock.

There has been limited trading in our common stock and there can be no assurance that an active trading market in our common stock will either develop or be maintained. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations which could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially. These fluctuations may also cause short sellers to periodically enter the market in the belief that we will have poor results in the future. We cannot predict the actions of market participants and, therefore, can offer no assurances that the market for our common stock will be stable or appreciate over time.

11

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market upon the expiration of any statutory holding period, under Rule 144, or issued upon the exercise of outstanding options or warrants or upon the conversion of our Series A Preferred Stock, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity related securities in the future at a time and price that we deem reasonable or appropriate.

Investor relations activities, nominal “float” and supply and demand factors may affect the price of our stock.

The Company expects to utilize various techniques such as non-deal road shows and investor relations campaigns in order to create investor awareness for the Company. These campaigns may include personal, video and telephone conferences with investors and prospective investors in which our business practices are described. The Company may provide compensation to investor relations firms and pay for newsletters, websites, mailings and email campaigns that are produced by third-parties based upon publicly-available information concerning the Company. The Company does not intend to review or approve the content of such analysts’ reports or other materials based upon analysts’ own research or methods. Investor relations firms should generally disclose when they are compensated for their efforts, but whether such disclosure is made or complete is not under our control. In addition, investors in the Company may, from time to time, also take steps to encourage investor awareness through similar activities that may be undertaken at the expense of the investors. Investor awareness activities may also be suspended or discontinued which may impact the trading market of our common stock.

The SEC and FINRA enforce various statutes and regulations intended to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and carefully scrutinize trading patterns and company news and other communications for false or misleading information, particularly in cases where the hallmarks of “pump and dump” activities may exist, such as rapid share price increases or decreases. We, and our shareholders may be subjected to enhanced regulatory scrutiny due to the small number of holders who initially will own the registered shares of our common stock publicly available for resale, and the limited trading markets in which such shares may be offered or sold which have often been associated with improper activities concerning penny-stocks, such as the OTC Bulletin Board or the OTCQB Marketplace (Pink OTC) or pink sheets. Until such time as our restricted shares are registered or available for resale under Rule 144, there will continue to be a small percentage of shares held by a small number of investors, many of whom acquired such shares in privately negotiated purchase and sale transactions, which will constitute the entire available trading market. The Supreme Court has stated that manipulative action is a term of art connoting intentional or willful conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities. Often times, manipulation is associated by regulators with forces that upset the supply and demand factors that would normally determine trading prices. Since a small percentage of the outstanding common stock of the Company will initially be available for trading, held by a small number of individuals or entities, the supply of our common stock for sale will be extremely limited for an indeterminate amount of time, which could result in higher bids, asks or sales prices than would otherwise exist. Securities regulators have often cited factors such as thinly-traded markets, small numbers of holders, and awareness campaigns as hallmarks of claims of price manipulation and other violations of law when combined with manipulative trading, such as wash sales, matched orders or other manipulative trading timed to coincide with false or touting press releases. There can be no assurance that the Company’s or third-parties’ activities, or the small number of potential sellers or small percentage of stock in the “float,” or determinations by purchasers or holders as to when or under what circumstances or at what prices they may be willing to buy or sell stock will not artificially impact (or would be claimed by regulators to have affected) the normal supply and demand factors that determine the price of the stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

12

ITEM 2. PROPERTIES

Our principal executive office occupies approximately 230 square feet in Grand Junction, CO for a monthly payment of $600 per month. Total rent payments for 2011 at this location was approximately $3,600 and are anticipated to be approximately $7,200 in 2012. We believe that our facilities are adequate to meet our needs for the foreseeable future.

We are primarily engaged in the acquisition and exploration of properties that may contain gold mineralization in the United States. Our target properties are those that have been the subject of historical exploration. We have acquired State Exploration Permits and Federal patented and unpatented mining claims in the states of Arizona and Nevada for the purpose of exploration and potential development of gold on a total of approximately 6,860 acres. We plan to review opportunities and acquire additional mineral properties with current or historic precious and base metal mineralization with meaningful exploration potential.

Our properties do not have any reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of our properties contain economic concentrations of precious and base metals that are prospective for mining.

Bullfrog Gold Project

(1) Location

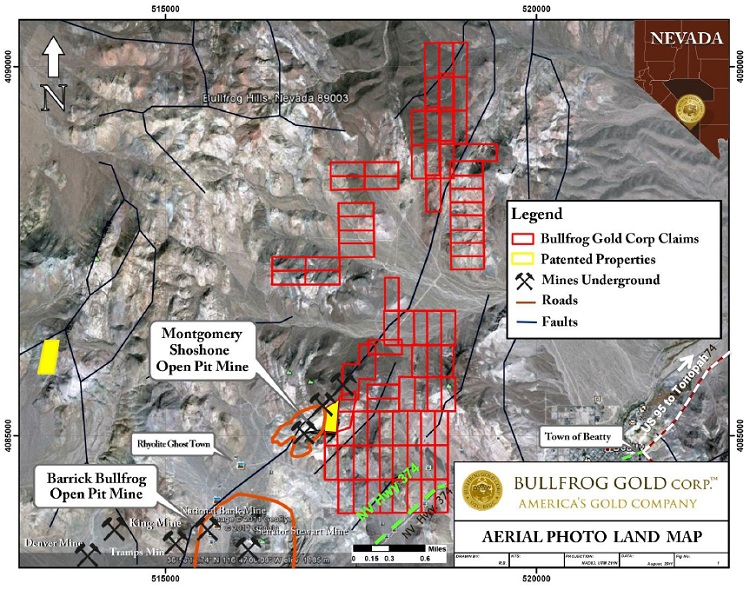

The central part of the Bullfrog Mining District lies approximately 2-1/2 miles northwest of the town of Beatty, which is in southwestern Nevada (Figure 1). Beatty lies 116 miles northwest of Las Vegas, via U.S. Highway 95, and 93 miles south of Tonopah, also via U.S. Highway 95. The property is accessed by traveling 2 miles west from Beatty on Nevada Highway 374, which intersects the southern block of the Company’s claims. The remaining claims are accessed by traveling north for four miles on various improved and unimproved roads to the northern end of the Company’s claims.

13

Figure 1. Bullfrog Project Location Map

(2) Title & Holding Requirements

On September 29, 2011, Standard Gold entered into an Amended and Restated Agreement of Conveyance, Transfer and Assignment with Bullfrog Holdings, Inc. and NPX Metals, Inc., pursuant to which Standard Gold acquired 100% right, title and interest in and to certain mineral claims known as the “Bullfrog Project” in consideration for 923,077 (post-reverse split on a 1 for 3.25 basis) shares of Standard Gold’s common stock which were issued to NPX Metals, Inc. and a 3% Net Smelter Royalty in the Bullfrog Project to Bullfrog Holdings, Inc. To retain the property, the Company must pay the annual claim maintenance fees and file a Notice of Intent to Hold with the BLM and Nye County, Nevada. The Company must also pay the county taxes on the two patented properties.

14

(3) History

In 1904 the Original Bullfrog and Montgomery-Shoshone mines were discovered by local prospectors. Prospecting activity was widespread over the Bullfrog Hills, and encompassed a 200 square mile area but centered within a two mile radius around the town of Rhyolite. The Montgomery-Shoshone mine reportedly produced about 94,000 ounces of gold prior to its closure in 1911, but there was no significant production from the other mines. Mines in the district were sporadically worked from 1911 through 1941.

With the rise of precious metal prices in the early 1970's, the Bullfrog District again underwent intense prospecting and exploration activity for gold as well as uranium. Companies exploring the area included Texas Gas Exploration, Inc., Phillips Uranium, Tenneco /Copper Range, U.S. Borax, Western States Minerals, Rayrock, St. Joe American and successors Bond, Lac and Barrick Minerals, Noranda, Angst Mining Company, Placer Dome, Lac-Sunshine Mining Company Joint Venture, Homestake, and others. In addition to these major companies, several junior mining companies and individuals were involved as prospectors, promoters and owners. These scientific investigations yielded a new deposit model for gold ore bodies in the Bullfrog District. The identification and understanding of the detachment fault system led to significant changes in exploration program techniques, focus, and success. The discovery of the Bullfrog deposit was the direct result of reevaluation of the area and the development of the dilatant zone ore deposit model.

In 1982 St. Joe American, Inc. initiated drilling in the Montgomery-Shoshone mine area. By 1986, sixty holes had been drilled and a mineral inventory was defined. Subsequent drilling outlined a reported 2.9 million ounces of gold equivalent in the Bullfrog deposit. A series of corporate takeovers went from St. Joe, to Bond Gold, to Lac Minerals and eventually to Barrick Minerals. Production started in 1989 and recovered approximately 200,000 ounces of gold annually from a conventional, 8,000 ton/day cyanidation mill mainly fed from open pit operations and later supplemented with underground production. Barrick discontinued production operations in 1999 and completed reclamation in 2003. Thereafter several groups continued exploration on a limited basis.

(4) Property Status and Plans

The Montgomery-Shoshone open pit mine remains open for possible access to additional mineralization that may occur on the Company’s adjacent property to the northeast of Barrick’s pit limit. The Company has conducted limited field examinations on its property to date but has evaluated all relevant available information. An exploration program has been developed and is scheduled to start by the end of 2012. Our primary targets are deposits that may be mined by open pit methods while assessing secondary targets that have potential for underground mining. The Company’s claims and patents cover approximately 1,620 acres but contain no known reserves and no plant or equipment. Electric power is available within two to five miles of the Company’s property.

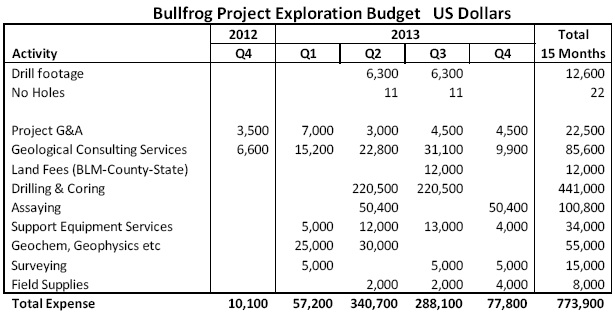

The exploration program planned for the Bullfrog Project at the initial filing of this Annual Report on Form 10-K, as amended, has been updated and additional information is provided below.

15

The Company intends to file by the end of of 2012 a Plan of Operation to the US BLM to allow drilling to start in Q2 in 2013. The geological justifications for the proposed exploration program are:

|

|

·

|

Our property is adjacent to an open pit that Barrick Gold (“Barrick”) mined in the late 1990’s and this area has significant potential for mineral extensions. It is noted that when Barrick ceased operations at their Bullfrog Mine, the price of gold was less than $300 per ounce compared to the current price of $1,750+ per ounce. Barrick also did not control the patented claim that is adjacent to the Montgomery-Shoshone open pit and five other claims in the area which are now part of the Company’s property.

|

|

|

·

|

Several mineralized trends and structures occur on other areas of the Company’s property that further justify additional drilling, see Figure 1.

|

Each of the calendar quarters are phased programs whereby results from Q1(phase 1) in 2013 must justify the continuation of activities in Q2 (phase 2) and likewise for Q3 (phase 3). Exploration thereafter has not yet been planned and is dependent on results and other technical and economic considerations in early 2014.

The exploration programs will be funded from debt and equity programs that the Company is currently working on. In the event sufficient funds are not obtained, the programs will be deferred accordingly.

The company has engaged Chip Allender to manage the exploration activities on the Bullfrog Project. Mr. Allender has 33 years of experience in the mining industry, has a BS in Geology from the Colorado State University, is a Registered Professional Geologist in Utah and Washington, is a member of the Society of Mining Engineers, is a Certified Professional Geologist (AIPG) and is recognized as a Qualified Person in Canada and a Competent Person under the European code.

The Company has not performed any drilling programs on the Bullfrog Project but will use comparable Quality Assurance/Quality Control (QA/QC) procedures and protocols as described under the Newsboy Project.

16

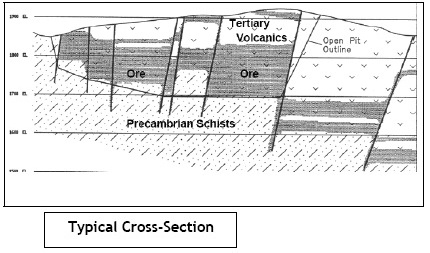

(5) Geology

The Bullfrog Hills, in which the Bullfrog Project is located, are characterized by a complex geologic environment. The Hills are composed of complexly folded and faulted Tertiary volcanic rocks overlying a basement core complex of Paleozoic sedimentary and metamorphic rocks. The geologic structure is distinguished by widespread detachment faulting associated with tectonic events that formed the Basin and Range Geomorphic Province. The Bullfrog area mineral deposits occupy dilatant zones caused by tension faulting associated with the large detachment fault underlying the area. This detachment displacement and tension faulting resulted in the fracturing of brittle volcanic rocks that then became a suitable conduit for the movement of mineralizing hydrothermal fluids. This fracturing and fluid movement allowed for the saturation of a large volume of rock with mineral bearing solutions. The structural framework of the area also shows that classic strike slip faulting associated with movement of the upper plate of the detachment fault caused north south tension fractures and additional dilatant zones. It appears that the historic Barrick Bullfrog and Montgomery-Shoshone ore bodies were formed in either separate dilatant zones or the same zone which was subsequently dissected and displaced by tension faulting. There is compelling evidence that other dilatant zones, perhaps a continuation of the Bullfrog Mine dilatant zone, continue toward the north. Much technical work has been completed by government as well as private entities in the district since the early 1970's. This work includes geophysics, airborne radiometric surveys, geologic mapping, drilling and geochemistry.

Newsboy Gold Project

|

|

(1)

|

Location

|

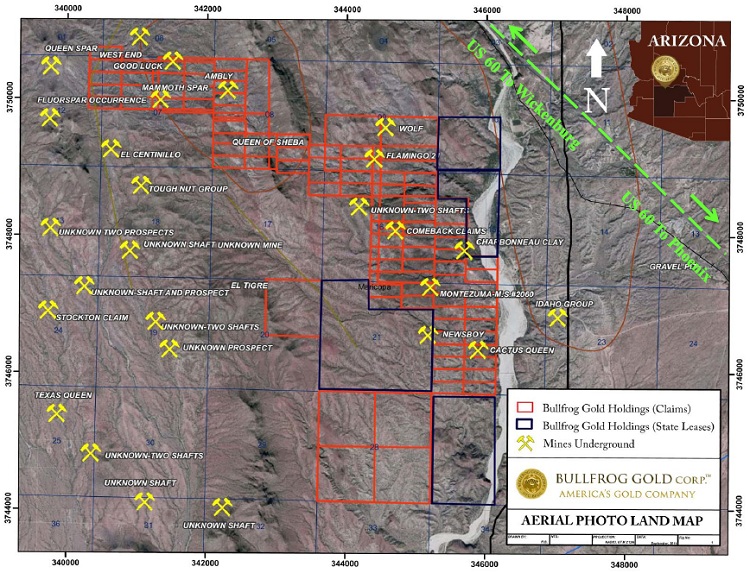

The Newsboy Gold Project is located in the Vulture Mountains of Arizona and consists of approximately 5,240 acres of state and federal lands located 45 miles northwest of the City of Phoenix, Arizona in Maricopa County. The closest towns, Wickenburg and Morristown, are located 10 miles and 3 miles respectively from the site. The Project is accessed by traveling on paved and gravel roads for 3 miles due west of Morristown. This route includes an unimproved crossing of the Hassayampa River, which flows a few days per year after severe rain storms. The Newsboy Project is located close to several well-known historical gold mines including: the Vulture, Congress and Yarnell mines.

17

Figure 2. Newsboy Project Location Map

|

|

(2)

|

Title & Holding Requirements

|

On August 30, 2011, Standard Gold entered into an Agreement of Conveyance, Transfer and Assignment with Aurum National Holdings Ltd. (“Aurum”), pursuant to which Standard Gold purchased an option held by Aurum under that certain Option to Purchase and Royalty Agreement dated as of August 13, 2009 and as amended on June 30, 2011, between Aurum and Southwest Exploration, Inc. (“Southwest”), which gave Aurum the option to purchase a 100% right, title and interest in and to certain mineral claims known as the “Newsboy Project”. In consideration for the assignment of the option, Standard Gold issued to Aurum and its designees an aggregate of 4,000,000 (post-reverse split) shares of its common stock.

On September 28, 2011, Standard Gold and Southwest entered into an Option to Purchase and Royalty Agreement pursuant to which Southwest granted to Standard Gold, the sole and immediate working right and option to earn a One Hundred Percent (100%) interest in and to the Newsboy Project property free and clear of all charges encumbrances and claims. In order to maintain the working right and option, Standard Gold is obligated to pay Southwest an aggregate of $3,425,000. $500,000 has previously been paid by a third party. The balance of $2,925,000 is payable on the following schedule:

18

|

(i)

|

on January 1, 2012, the sum of US $150,000.00; July 1, 2012 the sum of US $150,000.00;

|

|

|

(ii)

|

on January 1, 2013, the sum of US $200,000.00; July 1, 2013 the sum of US $200,000.00;

|

|

(iii)

|

on January 1, 2014, the sum of US $250,000.00; July 1, 2014 the sum of US $250,000.00;

|

|

|

(iv)

|

on January 1, 2015, the sum of US $300,000.00; July 1, 2015 the sum of US $300,000.00;

|

|

(v)

|

on January 1, 2016, the sum of US $350,000.00; July 1, 2016 the sum of US $350,000.00; and

|

|

|

(vi)

|

on January 1, 2017, the sum of US $425,000.00.

|

The first option payment of $150,000 was paid in December 2011. Upon the full payment of the $2,775,000 balance, the option will be considered automatically exercised and Standard Gold will have earned a 100% interest in and to the Newsboy Project property free and clear of all liens and encumbrances. Notwithstanding the foregoing, Standard Gold is obligated to pay a Net Smelter Royalty payment equal to two percent (2%) of the proceeds from the sale or other disposition from any purchaser of any mineral derived from the ore mined from the Newsboy Project property. To retain the property, the Company must also pay the annual claim maintenance fees and file a Notice of Intent to Hold with the BLM and Maricopa County. The Company must also make annual payments for the lands under exploration permits from the State of Arizona.

|

|

(3)

|

History

|

Recorded historic mining activity is limited to a mineralized breccia exposed in the central zone of the deposit. Miscellaneous workings dating from 1915 include adits, a raise, a winze, trenches and an irregular inclined shaft. From 1940 to 1941 an estimated 11,000 tons of ore was shipped as flux to smelters in Arizona. The average grade of this material was 0.07 ounces of gold and 8.1 ounces of silver per ton. Several smaller prospects consisting of shafts, adits and shallow pits (likely of limited production) are scattered throughout the Project.

During the 1980’s several junior mining companies conducted evaluation work on the Project. In 1985 a 22-hole (4,170 feet) rotary percussion drill program by the Checkmate Resources Ltd. /Little Bear Resources Ltd. joint venture (“CLB”). Subsequently, Westmont Mining Company (“Westmont” or “WMC”) recovered and assayed duplicate samples from the CLB holes. Westmont secured title to the Project and in 1987 began a program of geologic mapping, aerial photography and photogrammetry, rock chip sampling of outcrops and 83 reverse circulation drill holes totaling 19,080 feet. In 1989 Lupine Minerals Corporation (“LM”) secured a joint venture with Westmont and drilled 19 additional reverse circulation holes totaling 4,530 feet. By the end of 1989 a total of 102 holes (23,610 feet) had been drilled on the Project.

During 1990 and 1991, Newsboy Gold Mining Company (NGMC), a 100% owned subsidiary of the Australian listed Pima Mining NL executed a purchase option on the Newsboy Project from Westmont. NGMC drilled 12 diamond core holes (1,681 feet), 40 reverse circulation holes (6,560 feet), conducted metallurgical test work, re-interpreted the geology and completed resource/reserve and mine planning studies. NGMC also completed the following studies in 1991 and 1992 in preparation for mining the Newsboy Project:

|

·

|

Feasibility Study from Signet Engineering Pty Ltd. of Perth, Australia;

|

|

|

·

|

Metallurgical Study from Kappes, Cassiday & Associates of Reno, Nevada;

|

|

·

|

Resource and Reserve Calculation from Computer Aided Geoscience Pty. Ltd. of Sydney, Australia;

|

|

|

·

|

Environmental Assessment from Fletcher Associates;

|

|

·

|

Arizona Aquifer Protection by Lyntek Inc. Harding Lawson Associates, Water Resources Associates Inc.;

|

|

|

·

|

Socioeconomic Impact of the Newsboy Gold Mine from the Western Economic Analysis Center;

|

|

·

|

Mining Plan of Operations by Lyntek Inc. Harding Lawson Associates;

|

|

|

·

|

Due Diligence Review of Newsboy Gold Project by Pincock, Allen & Holt Inc. (“PAH”); and,

|

|

·

|

Newsboy Gold Project, Plan of Execution by Signet Engineering.

|

A total of 31,851 feet of drilling has been completed on the Newsboy Project over five programs at an expenditure of more than $5 million.

19

|

Year

|

Operator

|

Drill Method

|

No. Holes

|

Total Footage

|

|

1987

|

WMC

|

RC

|

29

|

5,910

|

|

1988

|

WMC

|

RC

|

54

|

13,170

|

|

1989

|

LM/WMC

|

RC

|

19

|

4,530

|

|

1990

|

NGMC

|

DD

|

12

|

1,681

|

|

1992

|

NGMC

|

RC

|

40

|

6,560

|

|

Total

|

154

|

31,851

|