Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EQUITY ONE, INC. | d498118d8k.htm |

Investor Presentation

March 2013

Exhibit 99.1 |

1

Forward Looking Statements

Certain matters discussed by Equity One in this presentation constitute forward-looking

statements within the meaning of the federal securities laws. Although Equity

One believes that the expectations reflected in such forward-looking

statements

are

based

upon

reasonable

assumptions,

it

can

give

no

assurance

that

these

expectations will be achieved. Factors that could cause actual results to differ materially

from current expectations include volatility of the capital markets; changes in

macro-economic and local economic conditions and the demand for retail space in

the states and communities in which Equity One owns properties; the continuing financial success

of Equity One’s current and prospective tenants and their decisions regarding store

locations, especially certain key current tenants; the risks that Equity One may not

be able to proceed with or obtain necessary approvals for development or

redevelopment projects or that it may take more time to complete such projects or incur costs

greater than anticipated; the availability of properties for acquisition; changes in

borrowing rates; the ability to sell non-core

assets

at

favorable

pricing;

the

extent

to

which

continuing

supply

constraints

occur

in

geographic

markets

where Equity One owns properties; the success of its efforts to lease up vacant space and

renew expiring leases at favorable

terms;

the

effects

of

natural

and

other

disasters;

the

ability

of

Equity

One

to

successfully

integrate

the

operations

and

systems

of

acquired

companies

and

properties;

the

loss

of

key

personnel;

the

ability

to

meet

its

substantial

debt

obligations

and

remain

compliant

with

financial

covenants;

continuing

to

meet

the

qualifications

as

a

REIT;

changes

in

Equity

One’s

credit

ratings;

and

other

risks,

which

are

described

in

Equity

One’s

filings

with

the

Securities and Exchange Commission.

This presentation also contains non-GAAP financial measures, including Funds from

Operations, or FFO. Reconciliations of these non-GAAP financial measures to the

most directly comparable GAAP measures can be found

in

Equity

One’s

quarterly

supplemental

information

package

and

in

filings

made

with

the

SEC

which

are

available on its website at www.equityone.net. This presentation also contains case

studies which include computations of estimated yield and value creation from

investment activities, and such estimates include assumptions of capital investments

and current and prospective property valuations and therefore the actual increase in

value that may be realized upon a future sale of such property may be materially different than the

estimates made. |

Mission Statement

2

Improving retail real estate in urban communities |

Corporate Snapshot

3

Equity One owns, manages, acquires, develops and redevelops quality retail properties

located in supply constrained communities primarily in major coastal markets of the

United States As

of

year

end

2012,

we

owned

143

operating

properties

in

13

states

(1)

As a result of our capital recycling program we have significantly improved our geographic

diversification and portfolio demographics

Our largest geographic markets as measured by approximate fair market values are Northeast

(29%), South Florida

(26%)

and

California

(22%)

(2)

–

Non-core

markets

in

the

Southeast

and

Florida

now

represent

only

11%

of

our

portfolio

Our

properties

have

average

population

density

within

3

miles

of

178k

and

average

household

income

within

3

miles of $96k

(3)

Our

total

equity

capitalization

and

total

enterprise

value

as

of

12/31/2012

were

$2.7

billion

and

$4.3

billion,

respectively

We

have

investment

grade

credit

ratings

of

Baa2

(stable)

from

Moody’s

and

BBB-

(stable)

from

S&P

(1)

Includes acquisitions and dispositions under contract as of 12/31/2012.

Excludes land and non-core assets not associated with retail centers. Additionally, we have joint

venture interests in twenty retail properties and two office buildings totaling

approximately 3.3 million sf. (2)

Based on total estimated fair value as of 12/31/2012. Includes acquisitions

and dispositions under contract as of 12/31/2012. Excludes land. Does not include

unconsolidated JV properties.

(3)

Demographic data based on weighted estimated fair market value of assets. Includes

acquisitions and dispositions under contract as of 12/31/2012. Source: Sites USA.

•

•

•

•

•

•

•

Our portfolio generates grocer sales in excess of $550 per square foot

• |

Investment Considerations

4

Proven management team that has successfully executed a stated transformation strategy to

become a national operator in attractive major metropolitan markets

Focused investment strategy within geographically diversified major coastal markets

Prudent

capital

recycling

which

significantly

improved

portfolio

quality

while

maintaining

financial

discipline

High quality, productive grocery anchored shopping centers located in markets with

attractive demographics Intensive focus on asset management and value creation

Attractive pipeline of redevelopment opportunities

Many anchor leases with below market rents and short term expirations

Diversified base of strong anchor tenants with only Publix accounting for more than 6% of

AMR Percentage rent comprises less than 1.5% of total revenue

Strong balance sheet with modest leverage, ample liquidity and well-laddered debt

maturities Financial capacity and proven ability to execute on additional opportunistic acquisitions

and redevelopments We are a premier operator of quality retail properties

and are positioned for continued growth •

•

•

•

•

•

•

•

•

•

• |

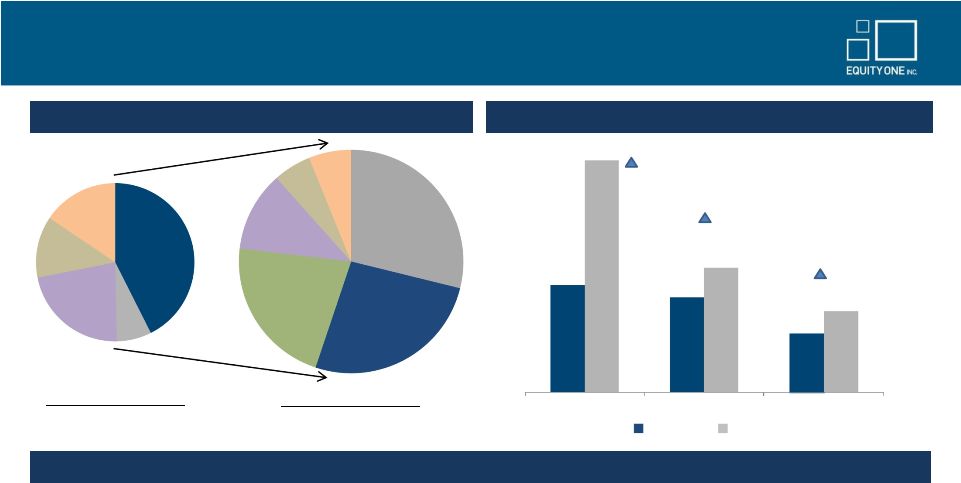

Northeast

29%

South Florida

26%

California

22%

Central/

North Florida

12%

Atlanta

5%

Other

6%

South Florida

43%

Northeast

7%

Central/

North Florida

22%

Atlanta

12%

Other

16%

82,368

$72,878

178,387

$95,986

$406

$558

117%

32%

37%

Dec 2008

Dec 2012

3-mile population

3

mile avg. HH income

Grocery sales per sq.ft.

Asset Composition by Region

(1)(2)

Portfolio Quality Metrics in 2012 vs. 2008

(3)

Significant Investment Activity has Transformed the Portfolio

Dec 2008 Portfolio

$2,365 Million

Dec 2012 Portfolio

$3,618 Million

Approximately

$2

billion

of

acquisitions

completed

since

2009

in

our

target

markets:

–

Approximately $1.1

billion of assets in West Coast markets –

Approximately $700

million of premium quality assets in Northeast portfolio –

Substantially completed ground up development of The Gallery at Westbury Plaza in Nassau

County, NY Sold approximately $900 million of non-strategic/non-core assets since 2009, the

most prominent being: –

$473 million sale of 36 non-strategic retail assets to Blackstone

–

$191 million asset dispositions related to non-retail CapCo assets

Equity One Transformation

5

•

•

(1)

Data includes non-core assets within each identified region. (2)

Data includes acquisitions and dispositions under contract as of 12/31/2012. Excludes land and

non-core assets not associated with retail centers. Based on IFRS fair market values

as of 12/31/2012. (3)

Demographic data based on weighted estimated fair market value of assets. Includes acquisitions

and dispositions under contract as of 12/31/2012. Source: Sites USA. |

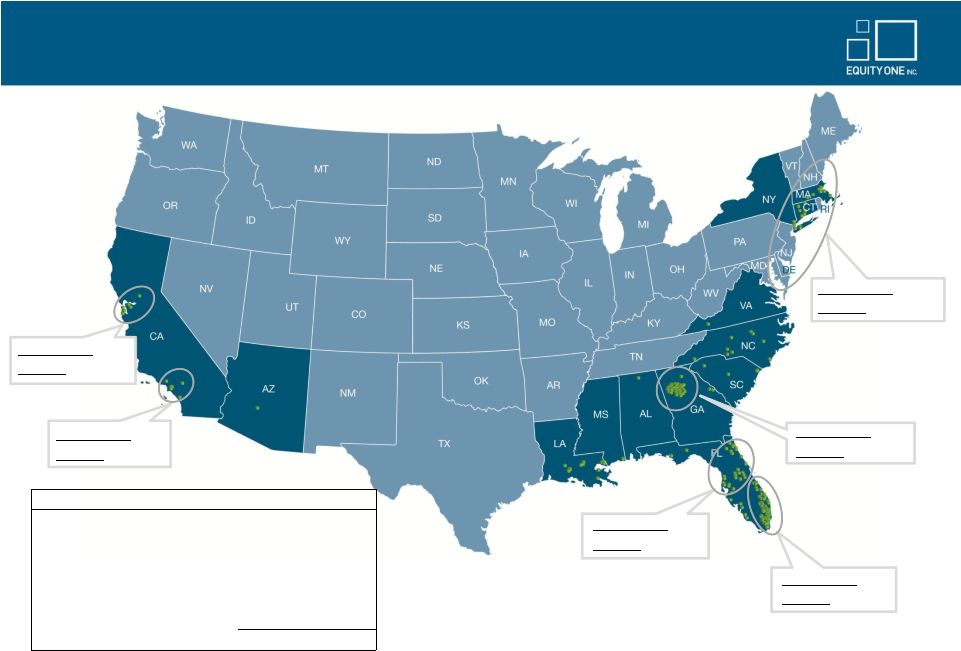

Assets

Primarily Located in Major Coastal Markets 6

Region

$ FMV

(1)

% FMV

Northeast

$1,043

29%

South Florida

$952

26%

West Coast

$812

22%

North Florida

$255

7%

Southeast (Atlanta)

$172

5%

Non-Core (Southeast, Florida)

$384

11%

Total

$3,618

100%

(1)

Data

includes

acquisitions

and

dispositions

under

contract

as

of

12/31/2012.

Excludes

land

and

non-core

assets

not

associated

with

retail

centers.

IFRS

fair

market

values are as of 12/31/2012.

Estimated

FMV:

$602

% of FMV: 17%

Estimated

FMV:

$185

% of FMV: 5%

Estimated

FMV:

$1,043

% of FMV: 29%

Estimated

FMV:

$172

% of FMV: 5%

Estimated

FMV:

$952

% of FMV: 26%

Estimated

FMV:

$255

% of FMV: 7%

($ In Millions) |

2013

Strategic Goals 7

Meet or exceed fundamental operating goals

SS NOI growth + 2% to 3%

SS Occupancy + 50 to 100 bps

Recurring FFO per fully diluted share $1.18 to $1.22

Continue to upgrade portfolio quality and demographic profile through strategic

transactions Core acquisition activity of $100 to $200 million

Non-core asset dispositions of $300 million

JV acquisition activity of $100 to $200 million

Continue to strengthen development and redevelopment pipeline

Complete lease up of The Gallery at Westbury Plaza

Significantly advance construction at the Broadway Plaza site in

the Bronx, NY

Establish additional redevelopment and densification plans at Serramonte Center in Daly

City, CA –

Substantially complete Dick’s Sporting Goods (83k sf) at a cost of $18 million

–

Develop expansion plans to add entertainment wing (movie theatres, restaurants)

Close on the Westwood Complex in Bethesda and work on redevelopment plans

Maintain

low

leverage

(~40%

total

debt

to

gross

real

estate)

and

ample

liquidity

Continue to strengthen credit metrics and maintain large unencumbered asset base

Upgrade information technology systems –

implement IT strategic plan that is aligned with our

operational strategy

Operating

Fundamentals

Portfolio

Quality

Value

Creation

Balance Sheet

Management

Operations

•

•

•

•

•

•

•

•

•

• |

Our

Path to Sustained NOI Growth 8

Increase occupancy with an emphasis on small shop space

Contractual rent steps

Below

market

leases

–

recent

acquisitions

provide

opportunity

to

capture

market

rents

in

coming

years

Increase

in

percentage

rent

–

higher

quality

assets

in

more

productive

markets

provide

greater

upside

Expense control and implementation of cost control initiatives within property

operations Continue to reduce concentration of assets in secondary and non-core markets

Expand tenant relations and marketing efforts with national and regional retailers

•

•

•

•

•

•

• |

Enhancing Portfolio Value by Improving Portfolio Quality

9

We

plan

to

further

build

and

diversify

our

portfolio

into

supply

constrained

urban

markets

Recent

acquisitions

in

California

and

New

York

highlight our focused

approach

on

properties

which

meet

the

following

key

criteria

aimed

at

enhancing

the

quality

and

performance

of

our

overall

portfolio:

–

Strong

demographics

–

average

3-mile

populations

of

nearly

200,000

as

compared

to

Equity

One’s

historical

portfolio

average

of

approximately

80,000

–

Strong

barriers

to

entry

due

to

scarcity

of

land

and

strict

zoning

restrictions

–

Highly

productive

anchor

sales

volumes

–

Below

market

anchor

rents

–

Redevelopment

and

densification

opportunities

These

acquisitions

have

enabled

us

to

diversify

our

portfolio

into

higher

quality

centers

in

major

MSAs

which

will

ultimately

result

in

greater

stability

and

higher

internal

growth

•

•

• |

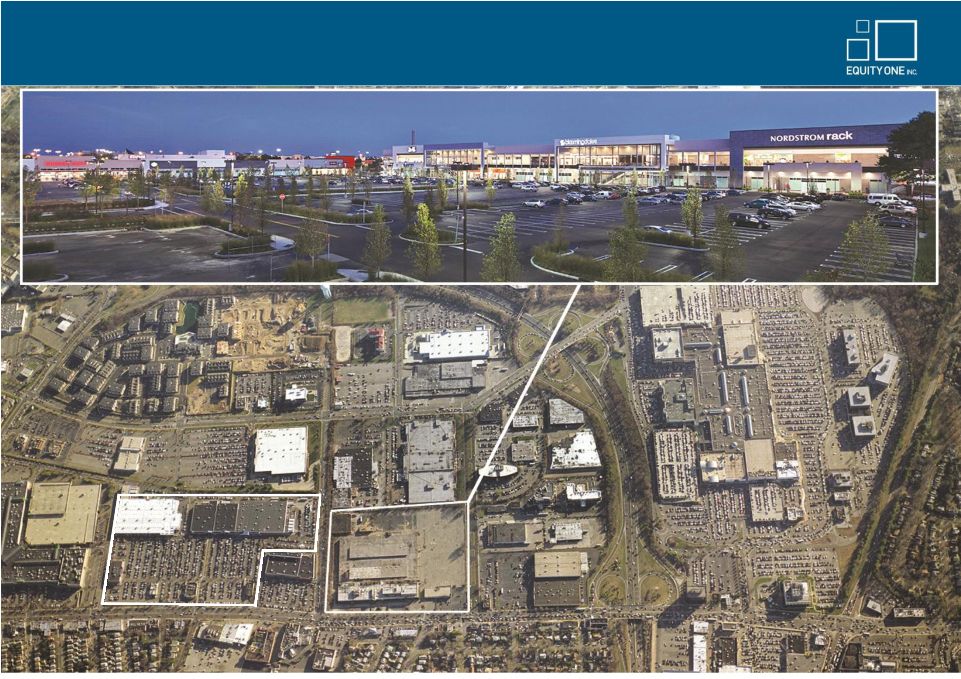

Case

Study 1: Westbury Plaza & The Gallery at Westbury Plaza 10

In

October

2009,

acquired

Westbury

Plaza,

a

400k

sf

power

center

in

Nassau

County,

New

York

–

Marked Equity One’s entry into the New York metropolitan market

–

Major tenants include: Walmart, Costco, Sports Authority and Marshalls

–

Tenants

generate

annual

sales

we

believe

to

be

in

excess

of

$500

million

–

Purchase price of $104 million, generating a going-in yield of 8% with future

upside In November 2009, acquired 22 acre land parcel adjacent to Westbury Plaza

–

Obtained entitlements within 12 months to build The Gallery at Westbury Plaza, a 313k sf

regional shopping center

–

Developed unique design with two story, big-box retail and underground parking

–

Major tenants include: Trader Joe’s, The Container Store, Saks Off Fifth,

Bloomingdale’s Outlet, Nordstrom Rack, Gap Outlet, Banana Republic Outlet, Old

Navy, Ulta and Shake Shack –

Expecting 11% yield on $129 million in net costs

•

•

Investment Thesis: $233 million total capital investment, generating ~10%

blended stabilized yield, implying ~$175 million in value creation at a 5.5%

capitalization rate. |

Case

Study 1: Westbury Plaza & The Gallery at Westbury Plaza 11

|

Case

Study 2: Capital & Counties 12

In May 2010, announced the acquisition of Capital & Counties, a $600 million California

portfolio of predominantly retail shopping centers

–

Largest asset is Serramonte Center, an 883k sf regional mall in Daly City, CA

–

Other retail assets include: Plaza Escuela in Walnut Creek, CA, Willows Shopping Center in

Concord, CA and The Marketplace in Davis, CA

–

Structured off-market stock transaction with seller becoming a 13% owner of Equity

One Marked Equity One’s entry into California

–

Provided critical mass for management platform and acted as catalyst for future

acquisitions including Potrero, Culver City and Long Beach

–

Positioned Equity One as one of the largest owners of open-air shopping centers in

California Transaction was accretive day one, but more importantly offered substantial value creation

opportunities –

Sold ~$200 million of non-core assets within 12 months, at pricing well in excess of

allocated values –

Increased retail occupancy from 83% at acquisition to 98% as of year end 2012

–

Redevelopment opportunities include Serramonte Center and Willows Shopping Center

•

•

•

Investment Thesis: ~$400 million net capital invested yielding ~8%, implying ~$180

million in value creation at a 5.5% capitalization rate. |

Case

Study 2: Capital & Counties (Serramonte) 13

Expansion |

Case

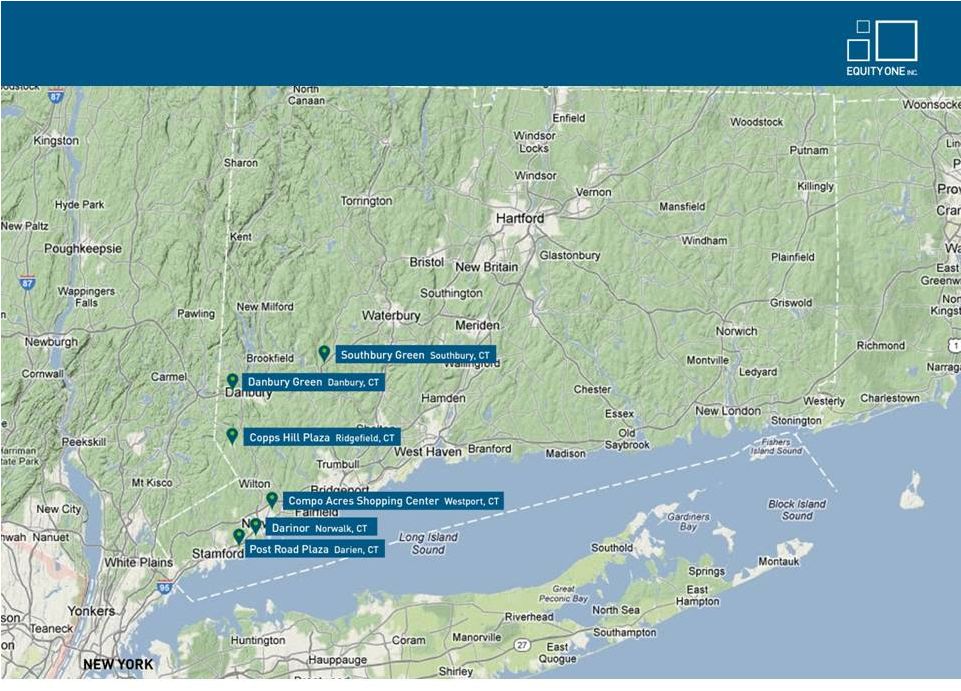

Study 3: Southern Connecticut 14

•

Since 2010, Equity One has acquired six properties in Southern Connecticut for $205

million •

Each center offers a value creation play

(1)

Ridgefield: Kohl’s pays $2.40 psf in rent, lease runs out of term in

2021 (2)

Danbury: 4,000 sf expansion opportunity, including Starbucks

drive-thru (3)

Southbury: 2,700 sf additional outparcel

(4)

Norwalk: 1,600 sf additional outparcel

(5)

Darien: Trader

Joe’s

expansion;

increased

bank

lease

from

$38

psf

to

$88

psf

(6)

Westport: Expanded Trader Joe’s, below market bank lease expiring in

2014 •

Centers are located in some of the most affluent markets in the New York

Metropolitan region, with an average HH income of $155k within 3 miles

Investment Thesis: $205 million initial investment at ~6% yield. Expect

to earn yield in excess of 7% beginning in 2015.

|

Case

Study 3: Southern Connecticut 15 |

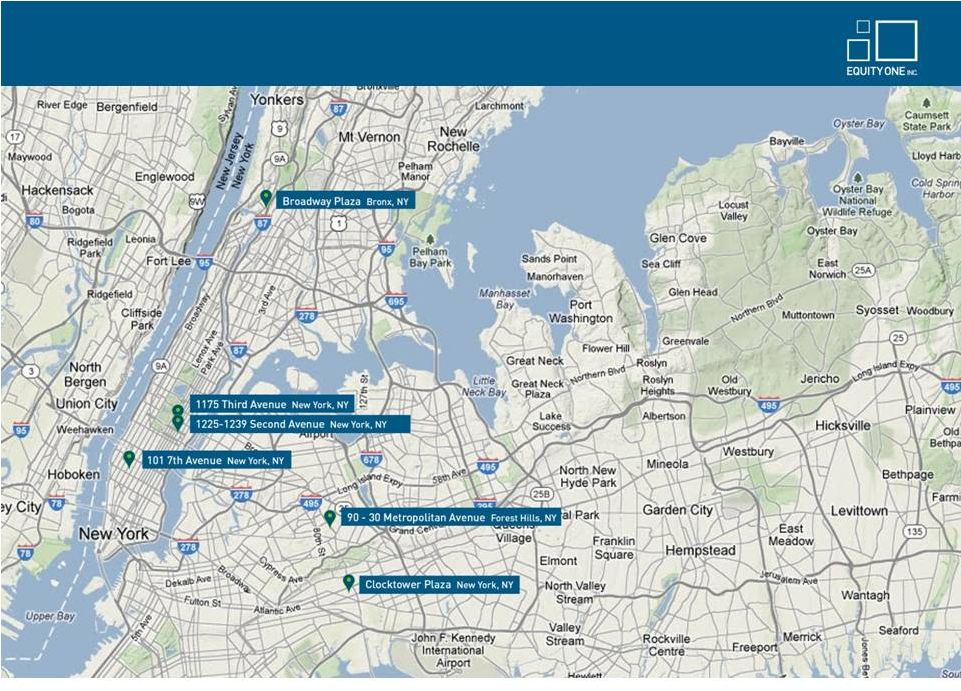

Future

Case Study - New York City

16

•

Equity

One

has

acquired

six

assets

for

$243

million

in

New

York

City,

including

the

planned

development

of

Broadway

Plaza

(1)

1175

Third

Avenue

(E

68

Street

&

3

Avenue)

–

In

2010,

purchased

25k

sf

retail

condominium

for

$21

million

–

Food

Emporium

pays

$40

psf;

market

rent

is

4x

greater

(2)

101

7

Avenue

(W

16

Street

&

7

Avenue)

–

In

2011,

purchased

57k

sf

retail

space

for

$55

million

–

Loehmann’s

lease

expires

in

2016

with

no

options

remaining

–

Contract

rent

is

$25

psf;

market

rent

is

4x

greater

(3)

90-30

Metropolitan

Avenue

–

In

2011,

acquired

60k

sf

Trader

Joe’s

anchored

center

for

$28.8

million

(4)

Broadway

Plaza

–

In

2012,

purchased

two

adjacent

land

parcels

totaling

2+

acres

for

$9.5

million

–

$55

million

planned

investment

in

ground-up

development

of

131k

sq

ft,

two-story,

multi-tenant

retail

center

–

Site

is

within

a

major

retail

corridor

served

by

subway,

buses

and

automobiles,

with

direct

access

off

the

Major

Deegan

Expressway

–

Strong

tenant

interest

from

box

retailers

(discounters,

fashion,

sporting

goods

and

gyms)

(5)

Clocktower

Plaza

–

In

2012,

purchased

79k

sq

ft

Pathmark

anchored

center

for

$56

million

–

Located

on

Atlantic

Avenue,

a

main

thoroughfare

in

Queens

–

Potential

to

expand

center

and

acquire

adjacent

properties

(6)

1225-1239

Second

Avenue

–

In

2012,

acquired

entire

retail

block

between

64th

and

65th

Streets

on

2nd

Avenue

for

$27.5

million

–

Anchored

by

CVS

and

7-

Eleven

Future

Investment

Thesis:

Within

3

years

we

expect

to

earn

a

7%

+

unleveraged

yield.

th

th

rd

th

th |

Future Case Study -

New York City

17 |

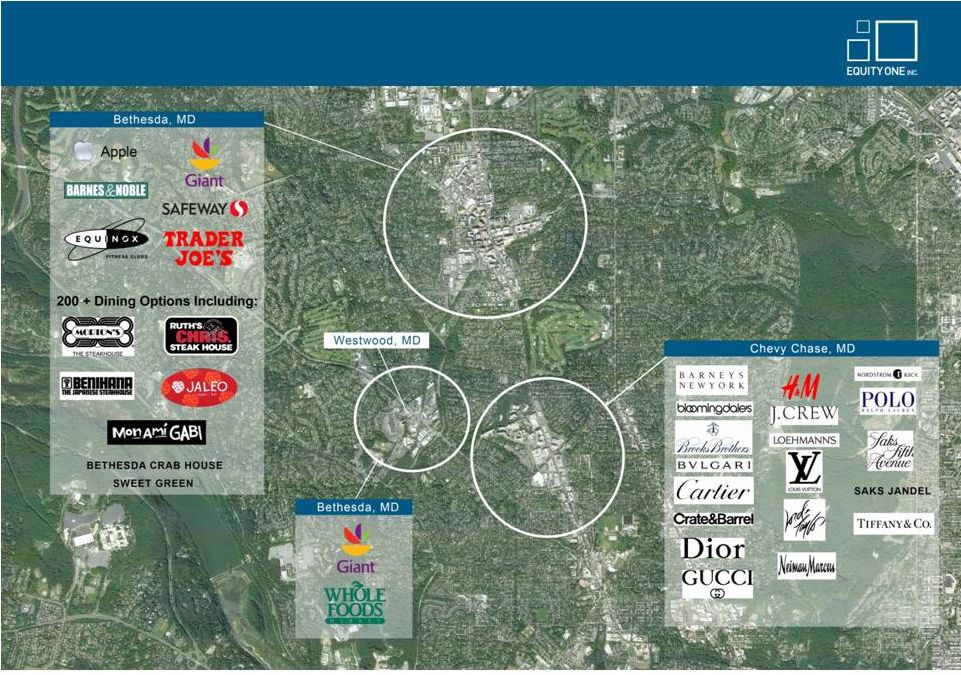

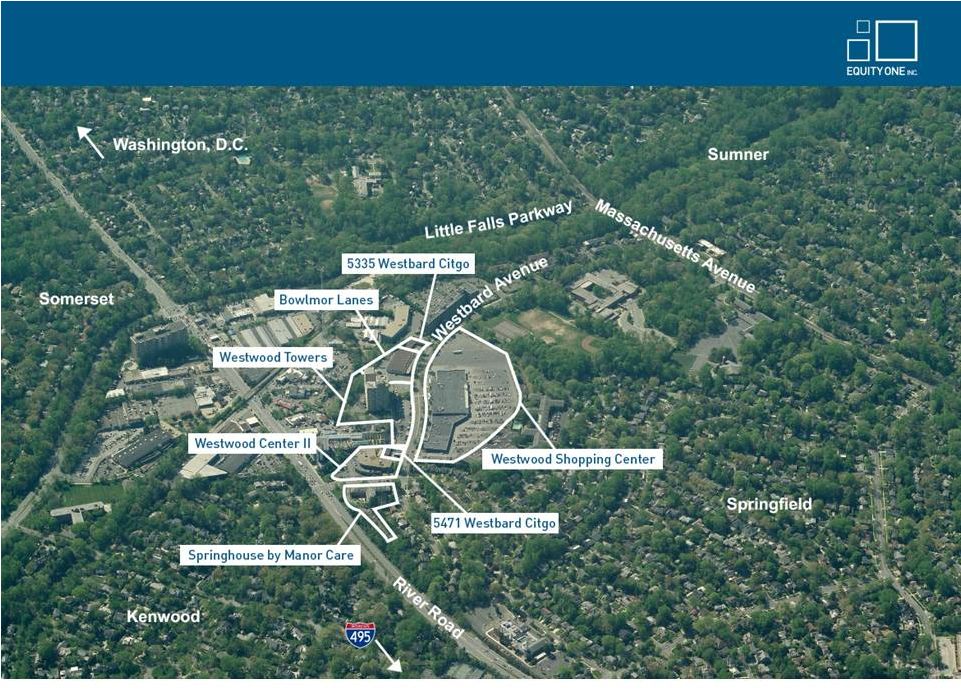

Future

Case Study - Bethesda, Maryland

18

•

In 2012, announced agreement to acquire Westwood Complex, a 22 acre property in

Bethesda, MD for $140 million

–

215k sf of retail space in the highly affluent and supply constrained market

outside Washington, D.C. –

Superior demographics with 140k population within 3 miles and average household

income of $200k –

Structured as $95 million funded mortgage loan, with outright purchase of property

anticipated in early 2014

•

Significant opportunities for value creation through below market rents,

redevelopment and expansion –

Asset has only had one owner and will benefit from capital investment and

intensive asset management

–

Anchored

by

high

volume

Giant

Food

since

1959,

with

below

market

lease

expiring

2019

–

Main center has parking ratio of 10 spaces per 1,000 sf, more than double typical

shopping centers |

Future Case Study -

Bethesda, Maryland

19 |

Future Case Study -

Bethesda, Maryland

20 |

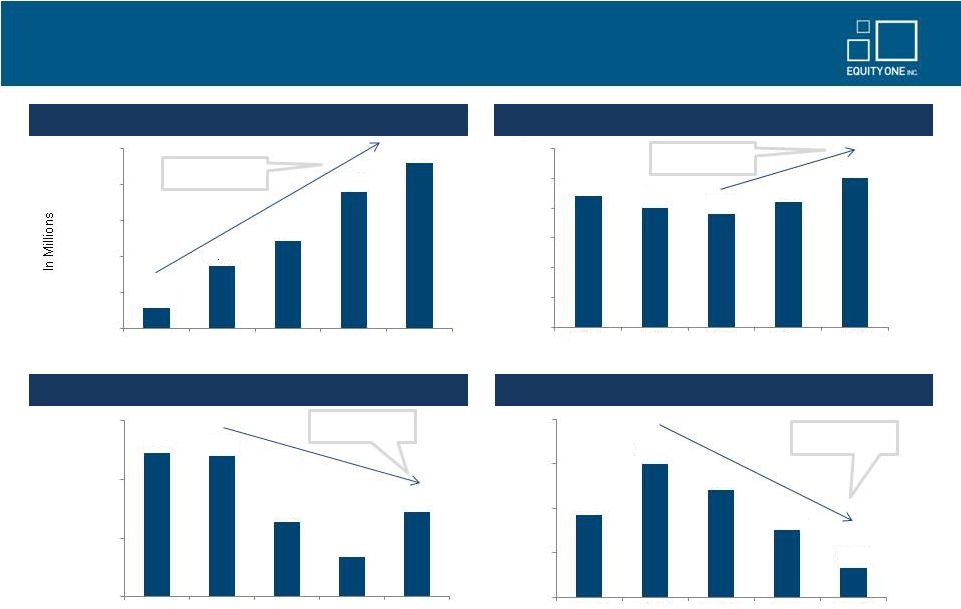

Disciplined Growth While Improving Leverage Metrics

21

Gross Assets

(1)

Fixed Charge Coverage

(2)

Total Debt to Gross Real Estate

(3)

Secured Debt to Gross Real Estate

(3)

0.6x improvement

Reflects Westwood

at 100% leverage

(4)

72% increase in

Gross Assets

930 bps reduction

$4,000

$3,600

$3,200

$2,800

$2,000

$2,400

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

$2,232

$2,692

$2,970

$3,518

$3,839

3.0x

2.5x

2.0x

1.5x

1.0x

0.5x

0.0x

2.2x

2.0x

1.9x

2.1x

2.5x

2008

2009

2010

2011

2012

52.0%

48.0%

44.0%

40.0%

49.8%

49.6%

45.1%

42.7%

45.8%

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

26.0%

22.0%

18.0%

14.0%

10.0%

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

17.4%

22.0%

19.6%

16.1%

12.7%

(1)

Gross Assets represents Total Assets plus Accumulated Depreciation. (2)

Represents Adjusted EBITDA to Fixed Charges. Adjusted EBITDA excludes gains/losses on property sales,

debt extinguishment, impairments, and other non-recurring items. (3)

Gross Real Estate represents Total Real Estate Assets plus Accumulated Depreciation. (4)

Ratio at December 31, 2012 includes Westwood Complex $95 million note in both Total Debt and Gross

Real Estate. |

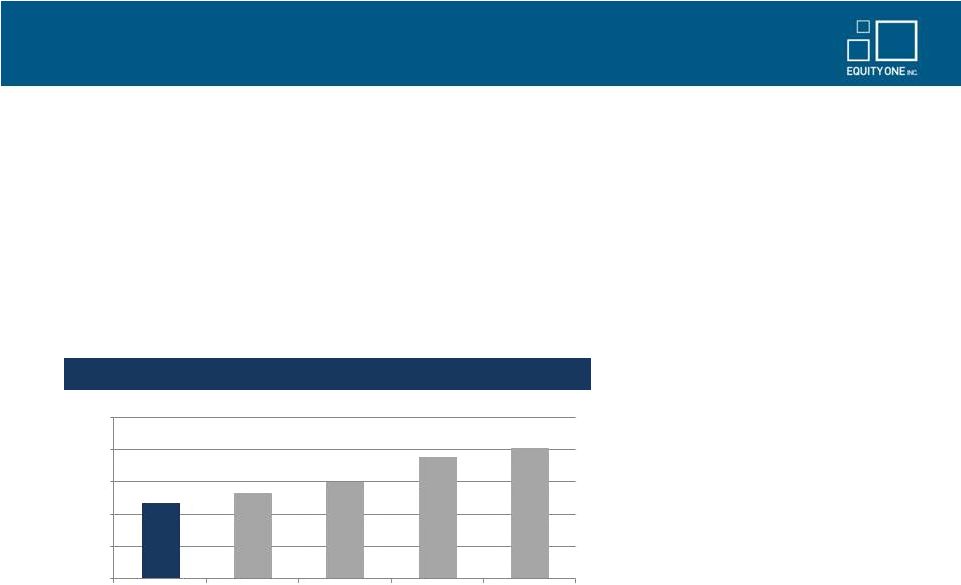

Balance Sheet Discipline –

Modest Leverage With Strong

Coverage Metrics

22

•

(1)

Based on Net Debt as of 12/31/2012 and Adjusted EBITDA (excluding gains/losses on

property sales, debt extinguishment, impairments, and other non-recurring items)

calculated by annualizing 4Q2012 Adjusted EBITDA as reported in the 12/31/2012

Supplement. (2)

Source: Eastdil Secured, based on Company filings and SNL financial. Credit

ratings from S&P and Moody's as of 12/31/2012. Q4

2012

Leverage

(Total

Debt

+

Preferred

/

Gross

Assets)

(2)

55.0%

50.0%

45.0%

40.0%

35.0%

30.0%

EQY (BBB-/Baa2)

FRT (BBB+/Baa1)

KIM (BBB+/Baa1)

REG (BBB/Baa3)

WRI (BBB/Baa2)

Key leverage ratios as of December 31, 2012

–

Net Debt to Total Market Cap: 36.4%

–

Net Debt to Gross Real Estate: 45.0%

–

Net

Debt

to

Adjusted

EBITDA

(1)

: 7.0x

–

Adjusted EBITDA to interest expense: 2.8x

–

Adjusted EBITDA to fixed charges: 2.5x

–

Weighted average term to maturity for total debt: 5.7 years

|

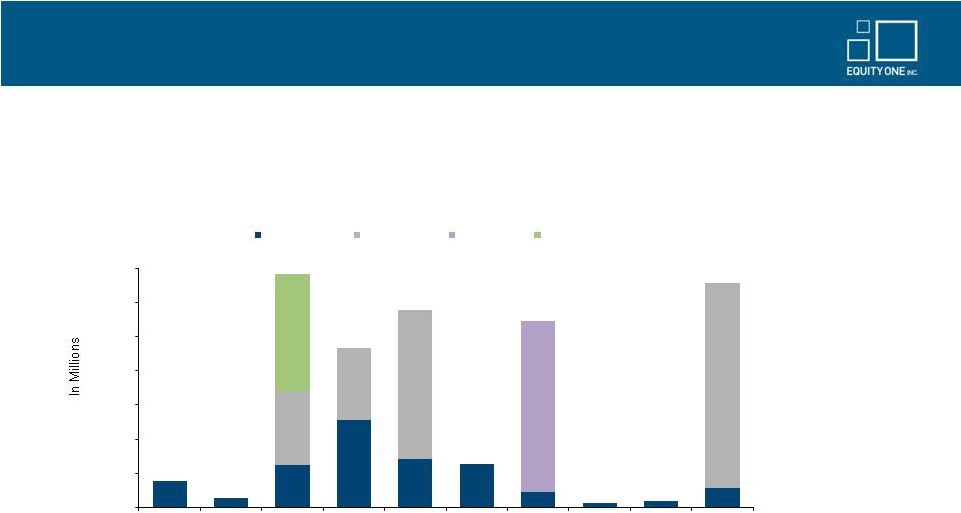

Current Liquidity Position

23

•

Cash

and

cash

equivalents

amounted

to

$28

million

as

of

December

31,

2012

•

Revolving

credit

facility

has

$575

million

capacity

and

matures

September

30,

2015

with

a

one

year

extension

option

•

We

maintain

a

manageable

debt

maturity

schedule

Note: Cash includes restricted cash and cash held in escrow. Debt maturity schedule

as of 12/31/2012. Includes scheduled principal amortization. Credit facilities are

shown as due on the initial maturity dates, although certain extension options may

be available. •

Strong lending relationships with both traditional banks and life insurance

companies •

Demonstrated access to the public markets

$350

$300

$250

$200

$150

$100

$50

$0

$38

$342

$233

$289

$273

$63

$6

$9

$328

Secured Debt

Senior Notes

Term Loan

Credit Facility

2013

2014

2015

2016

2017

2018

2019

2020

2021

Thereafter

$14 |

Appendix

24

•

Portfolio Metrics |

# of

centers

4Q12 Fair

Value

($M)

GLA

4Q12

Occ.

All

Anchor

Shop

Pop.

Avg HH

Income

Median

HH

Income

Grocer

Sales

Balance

Interest

Rate

Years to

Maturity

Core Markets

Northeast

Connecticut

7

$257.0

866,937

98.7%

$18.52

$13.33

$31.47

37,557

$140,431

$115,845

$891

$82.5

5.6%

5.5

Maryland

1

$140.0

466,919

98.3%

$13.84

N/A

N/A

139,570

$200,005

$183,860

$847

$0.0

-

-

Massachusetts

7

$142.6

600,879

99.1%

$18.80

$18.96

$17.48

189,085

$84,865

$71,977

$309

$7.1

8.1%

11.6

New York

7

$503.9

951,212

90.2%

$31.66

$29.85

$55.19

468,422

$105,490

$87,716

$1,321

$23.7

6.5%

4.3

Northeast Total

22

$1,043.5

2,885,947

95.9%

$21.72

$21.53

$32.82

280,013

$123,958

$105,392

$636

$113.2

6.0%

5.6

Southeast

North and Central Florida

7

$180.8

1,212,342

86.3%

$14.87

$11.27

$21.21

49,353

$91,206

$69,751

$460

$16.1

5.8%

3.4

Atlanta (Core)

5

$171.6

611,645

95.9%

$19.11

$15.24

$26.46

98,945

$116,795

$92,074

$574

$31.7

7.1%

2.5

Broward/Miami- Dade/Palm Beach Counties

40

$952.2

4,826,864

92.4%

$15.10

$10.44

$23.65

129,732

$76,785

$63,307

$605

$100.2

6.3%

6.8

Florida Treasure/Northeast Coast

6

$74.1

504,568

90.7%

$11.86

$8.35

$20.09

39,416

$70,778

$50,683

$646

$11.9

6.0%

5.5

Southeast Total

58

$1,378.7

7,155,419

91.5%

$15.20

$10.85

$23.35

110,505

$83,333

$67,054

$603

$159.8

6.4%

5.5

West Coast

Arizona

1

$26.0

210,396

64.4%

$16.44

$11.12

$29.55

35,703

$74,853

$76,522

$0

$0.0

-

-

Los Angeles

4

$184.5

489,239

98.5%

$22.00

$14.37

$37.75

263,113

$93,115

$69,598

$527

$74.8

5.5%

6.0

San Francisco

6

$601.6

1,595,070

97.4%

$27.22

$19.91

$40.05

218,636

$95,635

$81,084

$826

$71.4

6.0%

3.4

West Coast Total

11

$812.1

2,294,705

94.6%

$25.23

$17.86

$38.98

222,884

$94,397

$78,328

$661

$146.2

5.7%

4.7

Total

91

$3,234.3

12,336,071

93.1%

$18.54

$14.84

$27.61

193,411

$99,218

$82,254

$618

$419.2

6.1%

5.3

Non-core Markets

Atlanta

5

$25.8

358,082

83.0%

$9.78

$6.95

$13.84

68,907

$72,188

$62,556

$0

$0.0

-

-

Tampa/St. Petersburg/Venice/Cape Coral/Naples

7

$63.9

738,076

83.8%

$10.70

$7.43

$16.95

42,040

$85,138

$59,014

$354

$0.0

-

-

Louisiana

12

$98.0

1,321,277

95.4%

$8.64

$6.87

$13.21

58,343

$76,993

$59,983

$239

$0.0

-

-

Jacksonville/North Florida

8

$56.4

663,726

90.5%

$9.40

$6.95

$15.67

39,689

$58,979

$48,622

$489

$0.0

-

-

Orlando/Central Florida

5

$41.9

486,007

82.9%

$11.21

$6.06

$19.76

91,982

$56,932

$48,543

$313

$0.0

-

-

North Carolina

8

$50.7

835,286

79.1%

$8.00

$6.46

$12.35

27,931

$62,024

$49,434

$291

$6.5

6.3%

0.5

Central/ South Georgia

4

$29.5

624,662

78.7%

$8.16

$6.09

$12.39

61,564

$48,452

$36,884

$443

$0.0

-

-

AL/MS/VA

3

$17.7

258,535

97.9%

$7.32

$5.64

$13.48

21,471

$71,305

$54,645

$393

$0.0

-

-

Total

52

$383.9

5,285,651

86.7%

$9.07

$6.66

$14.61

51,800

$68,759

$53,664

$373

$6.5

6.3%

0.5

Grand Total

143

$3,618.1

17,621,722

91.2%

$15.84

$12.43

$23.79

178,387

$95,986

$79,221

$558

$425.8

6.1%

5.2

In-Place Debt (12/31/12)

Base Rent ($/sf)

25

Portfolio Metrics

(1)

Fair value of Westwood Center in Bethesda, MD is based on expected purchase price

when property is ultimately acquired. (2)

New York occupancy rate would be 98% excluding The Gallery at Westbury Plaza which

is currently 75% leased. (3)

Excludes land and non-core assets not associated with retail centers. Includes

acquisitions and dispositions under contract as of 12/31/2012. (1)

(3)

(2) |