Attached files

| file | filename |

|---|---|

| 8-K - EXELIS INC. 8-K - Exelis Inc. | a50581528.htm |

| EX-99.1 - EXHIBIT 99.1 - Exelis Inc. | a50581528ex99_1.htm |

Exhibit 99.2

Fourth Quarter / Full-Year

2012 David Melcher President and Chief Executive Officer Peter Milligan

Senior Vice President and Chief Financial Officer March 1, 2013

Safe Harbor Statement 2

Safe Harbor Statement under the Private Securities Litigation Reform Act

of 1995 (the “Act”): Some of the information included herein includes

forward-looking statements intended to qualify for the safe harbor from

liability established by the Private Securities Litigation Reform Act of

1995 (the “Act”). Whenever used, words such as “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe,” “target,” “may,”

“could,” “outlook” and other terms of similar meaning are intended to

identify such forward-looking statements. Forward-looking statements are

uncertain and to some extent unpredictable, and involve known and

unknown risks, uncertainties and other important factors that could

cause actual results to differ materially from those expressed in, or

implied from, such forward-looking statements. The Company undertakes no

obligation to update any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required by

law. In addition, forward-looking statements are subject to certain

risks and uncertainties that could cause actual results to differ

materially from the Company’s historical experience and our present

expectations or projections. These risks and uncertainties include, but

are not limited to: The forward-looking statements in this release are

made as of the date hereof and the company undertakes no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise. In addition, forward-looking

statements are subject to certain risks and uncertainties that could

cause actual results to differ materially from the company’s historical

experience and our present expectations or projections. These risks and

uncertainties include, but are not limited to, those described in the

Exelis Inc. Form 10-K for the fiscal year ended December 31, 2012, and

those described from time to time in our future reports filed with the

Securities and Exchange Commission. Our dependence on the defense

industry and the business risks peculiar to that industry, including

changing priorities or reductions in the U.S. Government or

international defense budgets; Government regulations and compliance

therewith, including changes to the Department of Defense procurement

process; Our international operations, including sales to foreign

customers; Competition, industry capacity and production rates;

Misconduct of our employees, subcontractors, agents and

businesspartners; The level of returns on postretirement benefit plan

assets and potential employee benefit plan contributions and other

employment and pension matters; Changes in interest rates and other

factors that affect earnings and cash flows; The mix of our contracts

and programs, our performance, and our ability to control costs;

Governmental investigations; Our level of indebtedness and our ability

to make payments on or service our indebtedness; Subcontractor

performance; Economic and capital markets conditions; The availability

and pricing of raw materials and components; Ability to retain and

recruit qualified personnel; Protection of intellectual property rights;

Changes in technology; Contingencies related to actual or alleged

environmental contamination, claims and concerns; Security breaches and

other disruptions to our information technology and operations; and

Unanticipated changes in our tax provisions or exposure to additional

income tax liabilities.

2012 – A Solid Foundation

Financial results at high-end of 2012 guidance range Strong financial

position heading into 2013 Cash from operations up 15% over 2011 Net

debt down 33% from 2011 $600M undrawn credit facility 2012 strategic

awards in electronic warfare, ISR, and critical networks Integrated

Defensive Electronic Countermeasures (IDECM) Advanced Integrated

Defensive Electronic Warfare Suite (AIDEWS) Adaptive Persistent

Awareness Systems (APAS) Generation-3 Aviation Night Vision Goggle and

Spiral Enhanced Night Vision Goggle (SENVG) Enterprise Acquisition

Gateway for Leading Edge Solutions (EAGLE) Global Tactical Advanced

Communication Systems (GTACS) Investment in growth platforms;

acquisition and integration of twocompanies into the C4ISR segment in

2012; January 2013 acquisitionof C4i expands global presence in air

traffic management 3

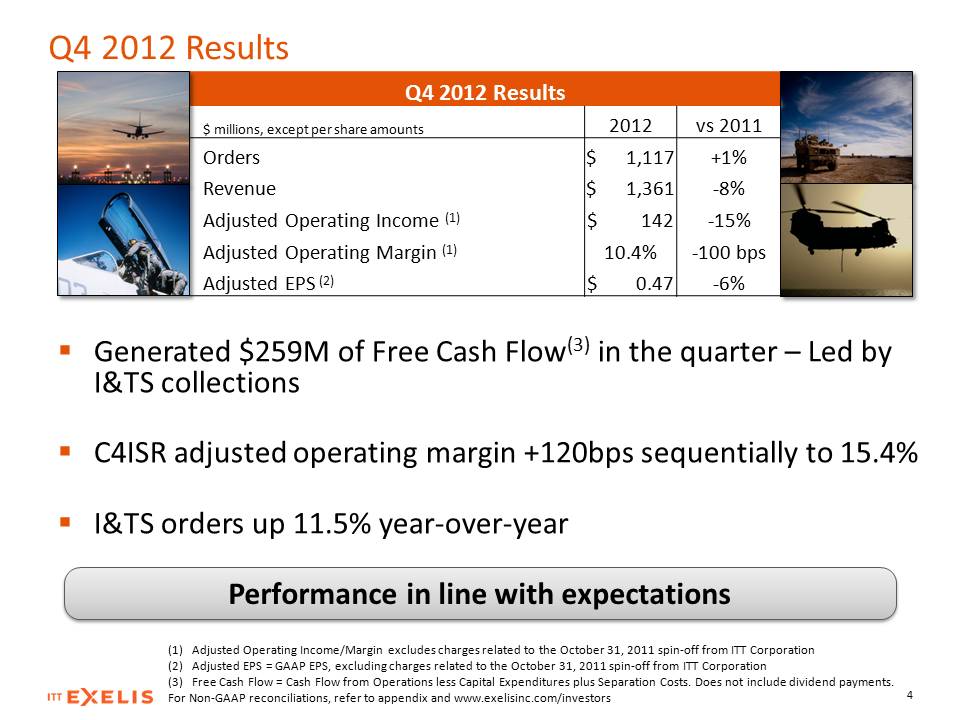

Q4 2012 Results Q4 2012

Results $ millions, except per share amounts 2012 vs 2011 Orders $ 1,117

+1% Revenue $ 1,361 -8% Adjusted Operating Income (1) $ 142 -15%

Adjusted Operating Margin (1) 10.4% -100 bps Adjusted EPS (2) $ 0.47 -6%

(1) Adjusted Operating Income/Margin excludes charges related to the

October 31, 2011 spin-off from ITT Corporation (2) Adjusted EPS = GAAP

EPS, excluding charges related to the October 31, 2011 spin-off from ITT

Corporation (3) Free Cash Flow = Cash Flow from Operations less Capital

Expenditures plus Separation Costs. Does not include dividend payments.

For Non-GAAP reconciliations, refer to appendix and

www.exelisinc.com/investors 4 Generated $259M of Free Cash Flow(3) in

the quarter – Led by I&TS collections C4ISR adjusted operating margin

+120bps sequentially to 15.4% I&TS orders up 11.5% year-over-year

Performance in line with expectations

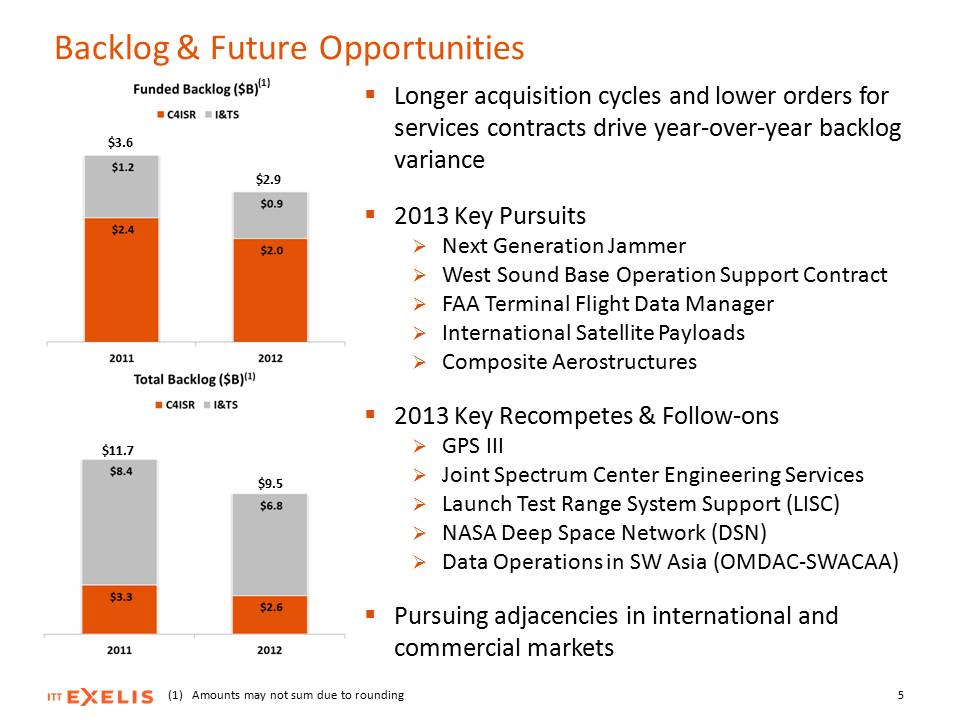

Backlog& Future

Opportunities 5 $3.6 $2.9 $11.7 $9.5 Longer acquisition cycles and lower

orders for services contracts drive year-over-year backlog variance 2013

Key Pursuits Next Generation Jammer West Sound Base Operation Support

Contract FAA Terminal Flight Data Manager International Satellite

Payloads Composite Aerostructures 2013 Key Recompetes & Follow-ons GPS

III Joint Spectrum Center Engineering Services Launch Test Range System

Support (LISC) NASA Deep Space Network (DSN) Data Operations in SW Asia

(OMDAC-SWACAA) Pursuing adjacencies in international and commercial

markets (1) Amounts may not sum due to rounding

(1)

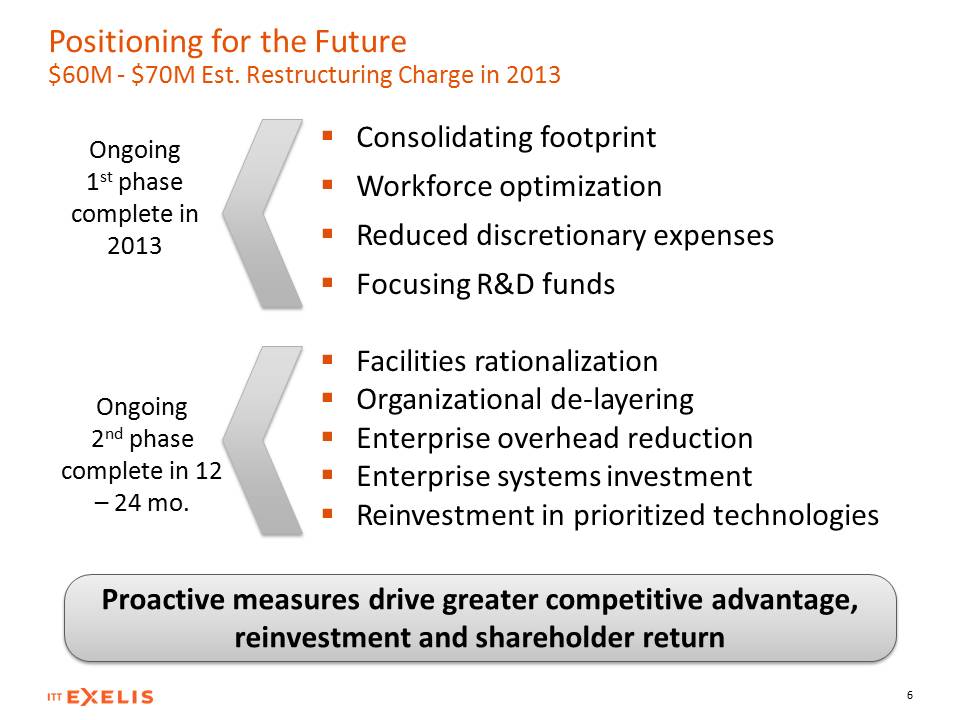

Positioning for the

Future $60M - $70M Est. Restructuring Charge in 2013 6 Consolidating

footprint Workforce optimization Reduced discretionary expenses Focusing

R&D funds Proactive measures drive greater competitive advantage,

reinvestment and shareholder return Ongoing 2nd phase complete in 12 –

24 mo. Facilities rationalization Organizational de-layering Enterprise

overhead reduction Enterprise systems investment Reinvestment in

prioritized technologies Ongoing 1st phase complete in 2013

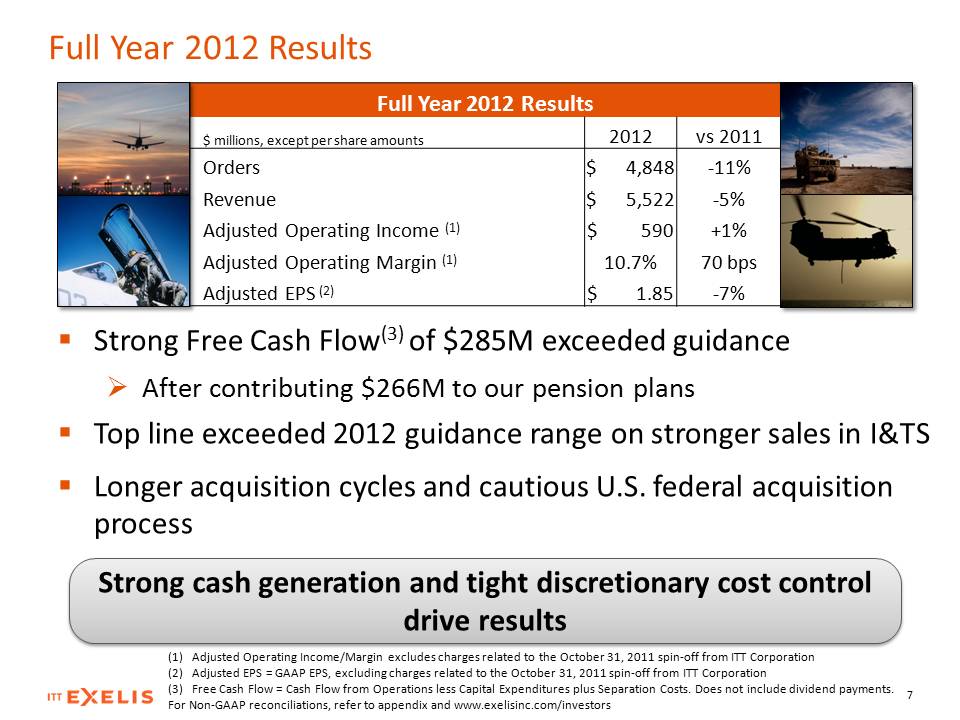

Full Year 2012 ResultsStrong Free Cash Flow(3) of $285M exceeded guidance ¾ After contributing $266M to our pension plans Top line exceeded 2012 guidance range on stronger sales in I&TS Longer acquisition cycles and cautious U.S. federal acquisition process

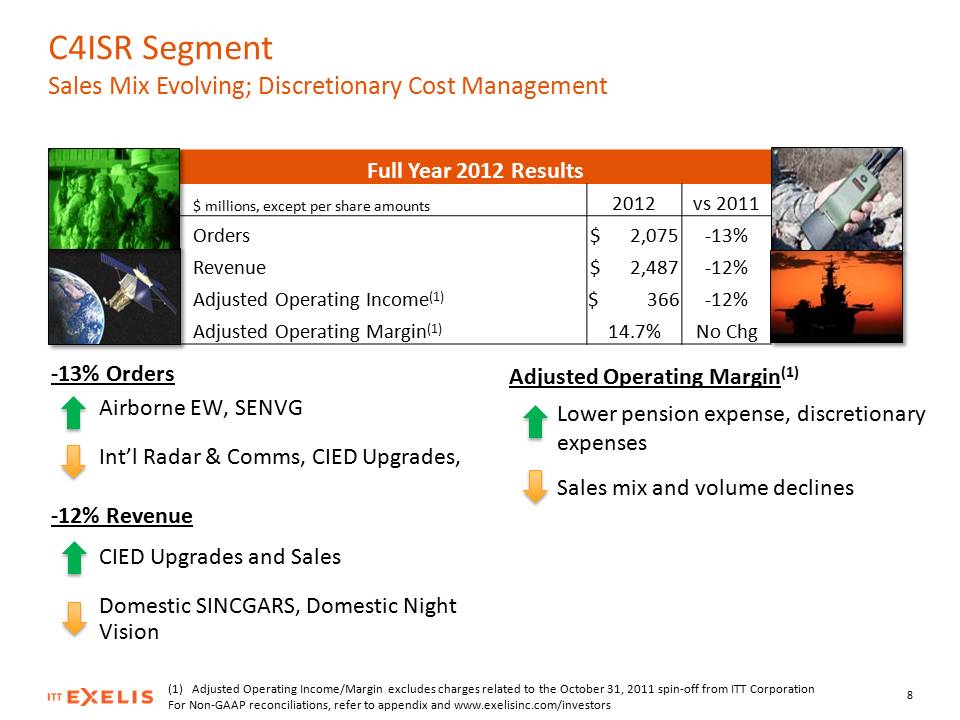

C4ISR Segment Sales Mix Evolving; Discretionary Cost Management

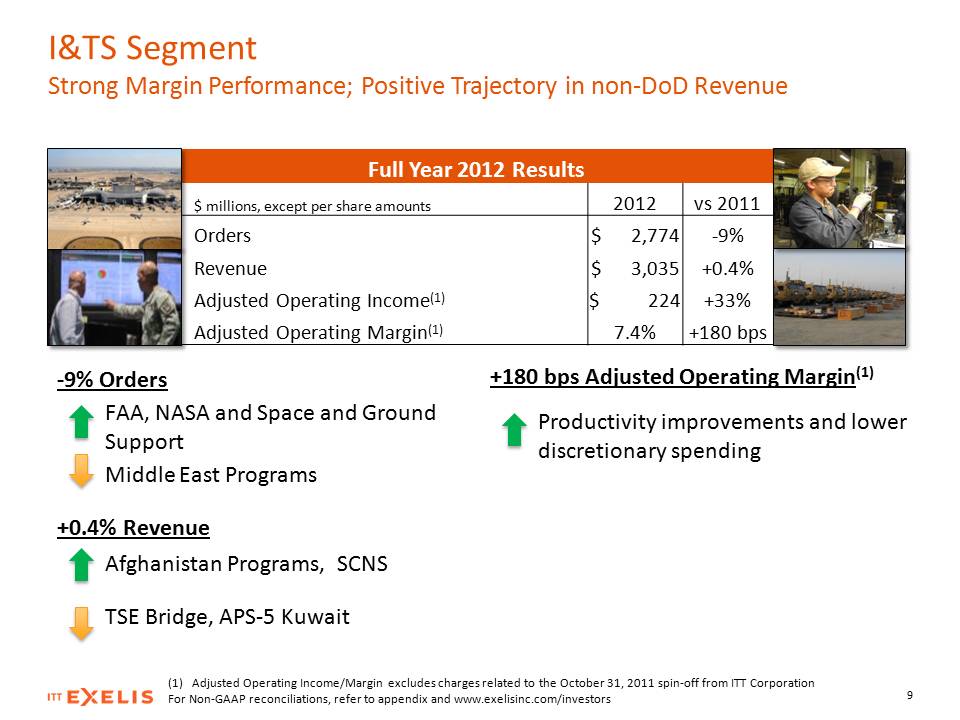

I&TS Segment Strong Margin Performance; Positive Trajectory in non-DoD Revenue Full Year 2012 Results $ millions, except per share amounts 2012 vs 2011 Orders $ 2,774 -9% Revenue $ 3,035 +0.4% Adjusted Operating Income(1) $ 224 +33% Adjusted Operating Margin(1) 7.4% +180 bps -9% Orders FAA, NASA and Space and Ground Support Middle East Programs +180 bps Adjusted Operating Margin(1) Productivity improvements and lower discretionary spending +0.4% Revenue Afghanistan Programs, SCNS TSE Bridge, APS-5 Kuwait (1) Adjusted Operating Income/Margin excludes charges related to the October 31, 2011 spin-off from ITT Corporation For Non-GAAP reconciliations, refer to appendix and www.exelisinc.com/investors

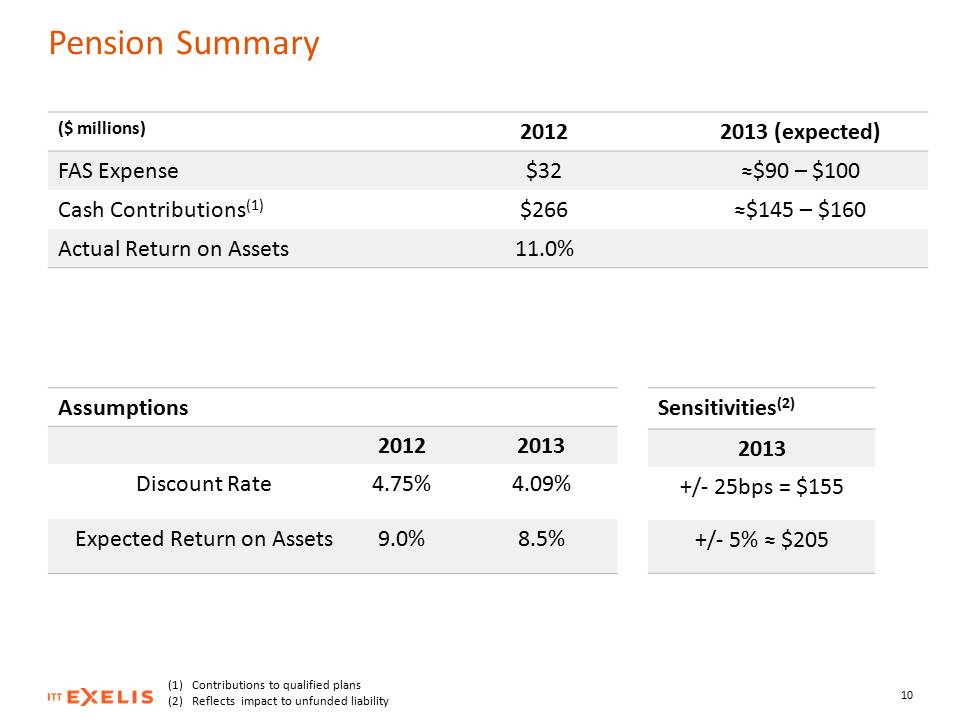

Pension Summary ($ millions) 2012 2013 (expected) +/- 25bps = $155(1) Contributions to qualified plans (2) Reflects impact to unfunded liability Assumptions Sensitivities(2

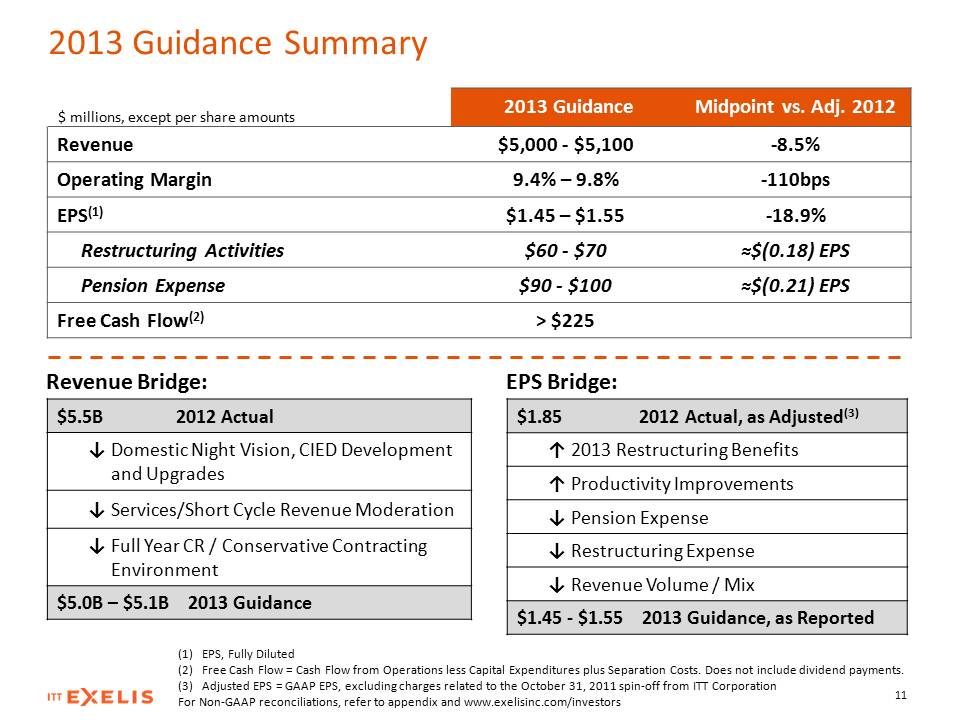

2013 Guidance Summary $ millions, except per share amounts Revenue 2013 Guidance $5,000 -$5,100 Midpoint vs. Adj. 2012 -8.5% Operating Margin 9.4% – 9.8% -110bps EPS(1) $1.45 – $1.55 -18.9% Restructuring Activities $60 - $70 у$(0.18) EPS Pension Expense $90 - $100 у$(0.21) EPS Free Cash Flow(2) > $225 Revenue Bridge: $5.5 B 2012 Actual љ Domestic Night Vision, CIED Development and Upgrades љ Services/Short Cycle Revenue Moderation љ Full Year CR / Conservative Contracting Environment $5.0B – $5.1B 2013 Guidance EPS Bridge: $1.85 2012 Actual, as Adjusted(3) ј 2013 Restructuring Benefits ј Productivity Improvements љ Pension Expense љ Restructuring Expense љ Revenue Volume / Mix $1.45 - $1.55 2013 Guidance, as Reported EPS, Fully Diluted Free Cash Flow = Cash Flow from Operations less Capital Expenditures plus Separation Costs. Does not include dividend payments. Adjusted EPS = GAAP EPS, excluding charges related to the October 31, 2011 spin-off from ITT Corporation For Non-GAAP reconciliations, refer to appendix and www.exelisinc.com/investors

Appendix

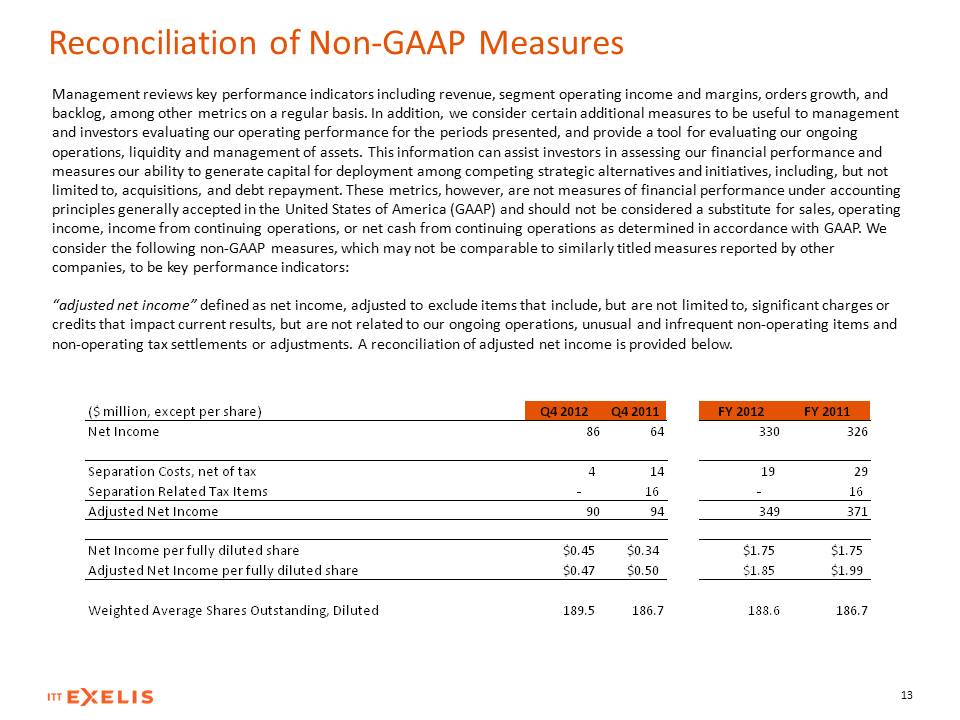

Reconciliation of Non-GAAP Measures Management reviews key performance indicators including revenue, segment operating income and margins, orders growth, and backlog, among other metrics on a regular basis. In addition, we consider certain additional measures to be useful to management and investors evaluating our operating performance for the periods presented, and provide a tool for evaluating our ongoing operations, liquidity and management of assets. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives, including, but not limited to, acquisitions, and debt repayment. These metrics, however, are not measures of financial performance under accounting principles generally accepted in the United States of America (GAAP) and should not be considered a substitute for sales, operating income, income from continuing operations, or net cash from continuing operations as determined in accordance with GAAP. We consider the following non-GAAP measures, which may not be comparable to similarly titled measures reported by other companies, to be key performance indicators: “adjusted net income” defined as net income, adjusted to exclude items that include, but are not limited to, significant charges or credits that impact current results, but are not related to our ongoing operations, unusual and infrequent non-operating items and non-operating tax settlements or adjustments. A reconciliation of adjusted net income is provided below. ($ million, except per share) Q4 2012 Q4 2011 FY 2012 FY 2011 Net Income 86 64 330 326 Separation Costs, net of tax 4 14 19 29 Separation Related Tax Items - 16 - 16 Adjusted Net Income 90 94 349 371 Net Income per fully diluted share $0.45 $0.34 $1.75 $1.75 Adjusted Net Income per fully diluted share $0.47 $0.50 $1.85 $1.99 Weighted Average Shares Outstanding, Diluted 189.5 186.7 188.6 186.7

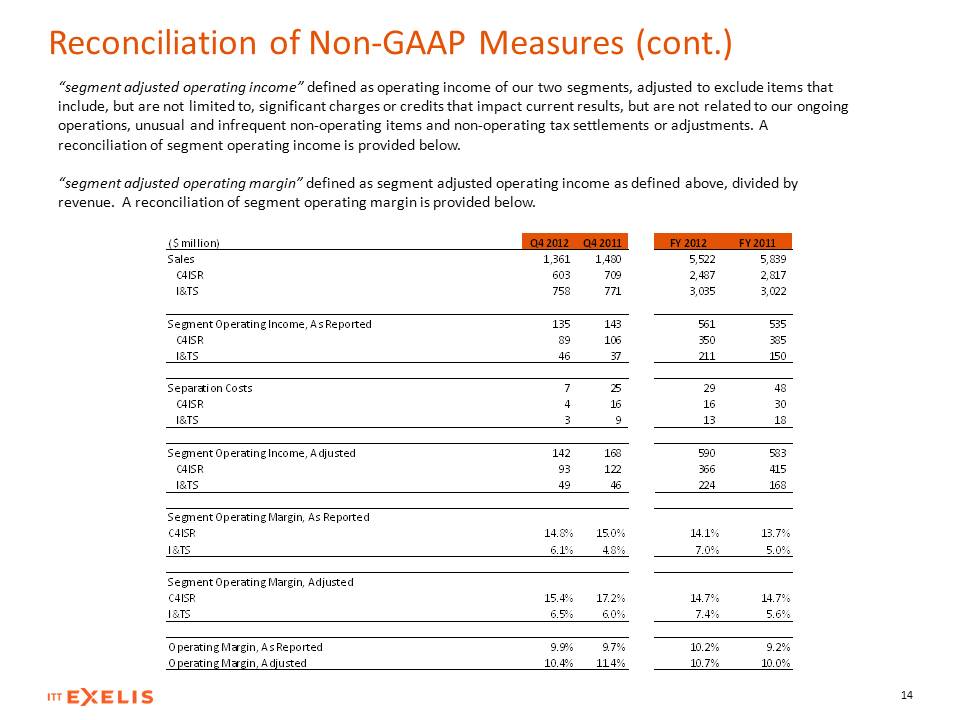

Reconciliation of Non-GAAP Measures (cont.) “segment adjusted operating income” defined as operating income of our two segments, adjusted to exclude items that include, but are not limited to, significant charges or credits that impact current results, but are not related to our ongoing operations, unusual and infrequent non-operating items and non-operating tax settlements or adjustments. A reconciliation of segment operating income is provided below. “segment adjusted operating margin” defined as segment adjusted operating income as defined above, divided by revenue. A reconciliation of segment operating margin is provided below. ($ million) Q4 2012 Q4 2011 FY 2012 FY 2011 Sales 1,361 1,480 5,522 5,839 C4ISR 603 709 2,487 2,817 I &TS 758 771 3,035 3,022 Segment Operating Income, As Reported 135 143 561 535 C4ISR 89 106 350 385 I &TS 46 37 211 150 25 29 48 Separation Costs 7 C4ISR 4 16 16 30 I &TS 3 9 13 18 168 590 583 Segment Operating Income, Adjusted 142 C4ISR 93 122 366 415 I &TS 49 46 224 168

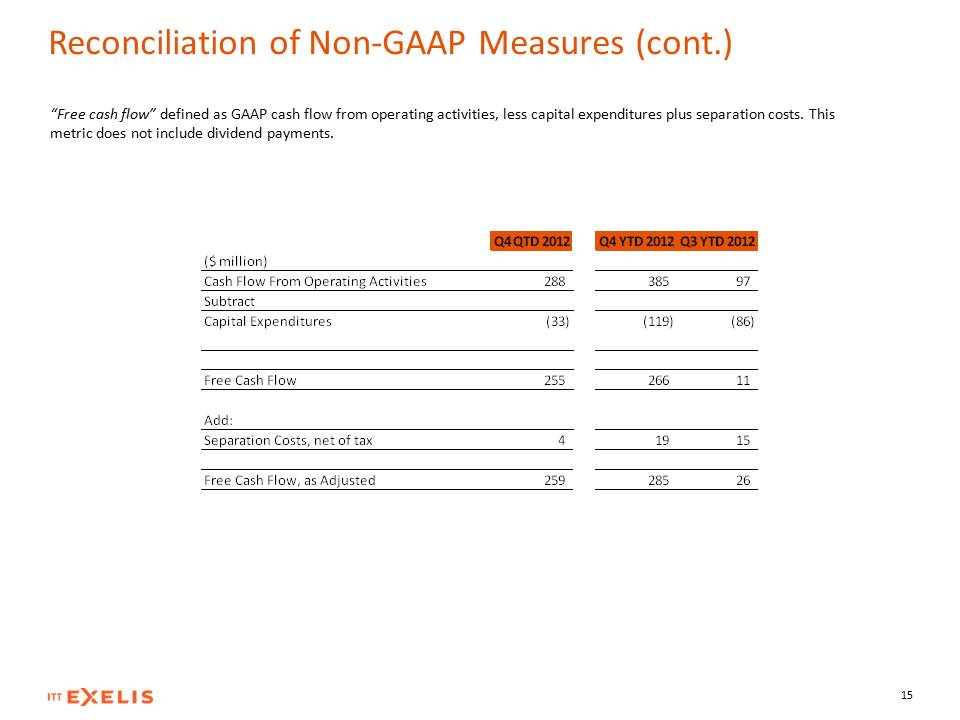

“Free cash flow” defined as GAAP cash flow from operating activities, less capital expenditures plus separation costs. This metric does not include dividend payments. Q4 QTD 2012 Q4 YTD 2012 Q3 YTD 2012 ($ million) Cash Flow From Operating Activities 288 385 97 Subtract Capital Expenditures (33) (119) (86) Free Cash Flow 255 266 11 Add: Separation Costs, net of tax 4 19 15 Free Cash Flow, as Adjusted 259 285 26

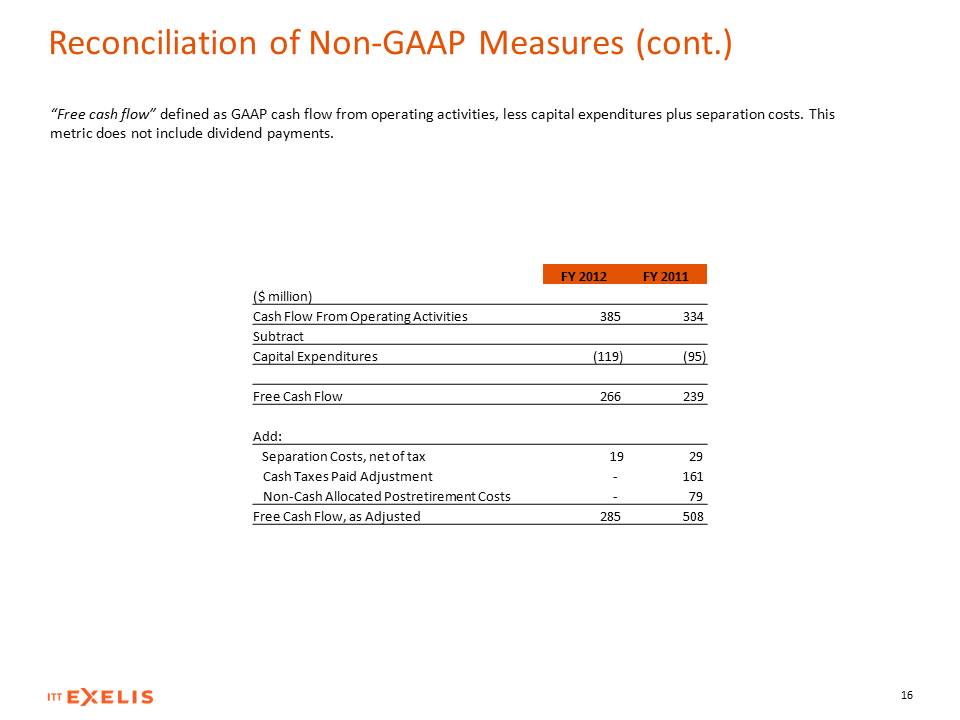

“Free cash flow” defined as GAAP cash flow from operating activities, less capital expenditures plus separation costs. This metric does not include dividend payments. FY 2012 FY 2011 ($ million) Cash Flow From Operating Activities 385 334 Subtract Capital Expenditures (119) (95) Free Cash Flow 266 239 Add: Separation Costs, net of tax Cash Taxes Paid Adjustment Non-Cash Allocated Postretirement Costs 19 - - 29 161 79 Free Cash Flow, as Adjusted 285 508