Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - Annie's, Inc. | d492994dex51.htm |

| EX-23.1 - EX-23.1 - Annie's, Inc. | d492994dex231.htm |

| EX-10.33 - EX-10.33 - Annie's, Inc. | d492994dex1033.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 1, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ANNIE’S, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2000 | 20-1266625 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1610 Fifth Street

Berkeley, CA 94710

(510) 558-7500

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Kelly J. Kennedy

Chief Financial Officer

Annie’s, Inc.

1610 Fifth Street

Berkeley, CA 94710

(510) 558-7500

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Julie M. Allen, Esq. Proskauer Rose LLP Eleven Times Square Telephone: (212) 969-3000 |

Kris F. Heinzelman, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||

| Title of Securities to be Registered | Amount to be Registered(1) |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee | |||

| Common Stock, $0.001 par value per share |

4,025,000 | $163,837,625 | $22,348 | |||

|

| ||||||

|

| ||||||

| (1) | Includes 525,000 shares of common stock that the underwriters have the option to purchase to cover overallotments, if any. |

| (2) | Estimated pursuant to Rule 457(c) under the Securities Act of 1933 (based on the average high and low prices of the registrant’s common stock on the New York Stock Exchange on February 25, 2013) solely for the purpose of calculating the registration fee pursuant to Rule 457(a) of the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 1, 2013

3,500,000 Shares

Annie’s, Inc.

Common Stock

This is a public offering of shares of common stock of Annie’s, Inc. The shares of common stock are being sold by the selling stockholders identified in this prospectus, all of whom are our affiliates. We will not receive any proceeds from the sale of shares by the selling stockholders.

We have entered into an agreement with the selling stockholders to repurchase 500,000 shares of our common stock, concurrently with the closing of this offering, directly from such selling stockholders in a private, non-underwritten transaction at a price per share equal to the price paid by the underwriters in this offering. The closing of the share repurchase is contingent on the closing of this offering. The closing of this offering is not contingent on the closing of the share repurchase.

Our common stock is listed on the New York Stock Exchange under the symbol BNNY. On February 28, 2013, the last sale price of our common stock on the New York Stock Exchange was $41.96 per share.

The underwriters have an option to purchase a maximum of 525,000 additional shares from the selling stockholders to cover overallotments of shares. We will not receive any proceeds from the exercise of the underwriters’ option to purchase additional shares.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12.

| Price to Public | Underwriting Discounts and Commissions |

Proceeds, before expenses, to the Selling | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

Delivery of the shares of common stock will be made on or about , 2013.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Credit Suisse | J.P. Morgan | |||

| Stifel | William Blair | RBC Capital Markets | ||

The date of this prospectus is , 2013.

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

37 | |||

| 64 | ||||

| 75 | ||||

| 84 | ||||

| 103 | ||||

| 105 | ||||

| 107 | ||||

| 110 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK |

112 | |||

| 115 | ||||

| 119 | ||||

| 119 | ||||

| 119 | ||||

| F-1 | ||||

You should rely only on the information contained in this document or to which we have referred you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or any free-writing prospectus prepared by us or on our behalf. We do not, and the selling stockholders and the underwriters do not, take any responsibility for, and can provide no assurances as to, the reliability of any information that others provide to you. The selling stockholders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

Statements made in this prospectus regarding our #1 natural and organic market position in four product lines are based on data that, although obtained from a leading industry source, does not account for all the retailers that carry natural and organic products, some of which are major retailers with whom we do business. However, we believe this industry source is the best available source for this kind of data, and, although not all major retailers are covered by this research, we do not have any reason to believe that including more retailers would materially change the results.

In addition, statements in this prospectus that our consumers “spend more on food and buy higher margin items than the average consumer” and that our products “attract new customers to the categories in which we compete,” “are profitable and attractive to retailers” and “offer better profitability for retailers compared to conventional packaged foods” are based on commissioned studies that utilize surveys of consumers of our macaroni and cheese products. Such macaroni and cheese products make up our largest product line, and many of our macaroni and cheese consumers also purchase other Annie’s products. In addition, while these studies did not incorporate surveys from consumers of our other products, we believe the studies’ methodologies and analyses provide valuable information about our consumers’ characteristics, their views of our brand and how they make purchasing decisions. We use this information internally and with our customers to make decisions about business strategy and marketing, among other things, across our product lines. Although it is possible that a broader sampling of our customers could lead to different results, we do not have any reason to believe that a broader sampling would lead to materially different conclusions.

Finally, statements made in this prospectus regarding our presence in over 25,000 retail locations and the increase in number of retail locations over the past three years in which our products can be found are based on

i

Table of Contents

all-commodity volume data, which is based on a representative sample of retailers and reflects the percentage of sales volume across participating grocery and natural food retailers in the U.S. that is attributable to stores in which our products are sold. When multiplied by the total number of food retailers in the U.S., this data, although not a direct measure of retail locations, is generally regarded within our industry as the best approximation of such information, and we do not have any reason to believe that any other measure or survey of retailer penetration would materially change the results.

ii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before deciding to invest in our common stock. You should read the entire prospectus carefully, including “Risk Factors” and our consolidated financial statements included elsewhere in this prospectus, before making an investment decision. In this prospectus, the terms “Annie’s,” “we,” “us,” “our” and “the company” refer to Annie’s, Inc. and our consolidated subsidiaries, and all references to a “fiscal year” refer to a year beginning on April 1 of the previous year and ending on March 31 of such year (for example, “fiscal 2012” refers to the year from April 1, 2011 to March 31, 2012).

Our Company

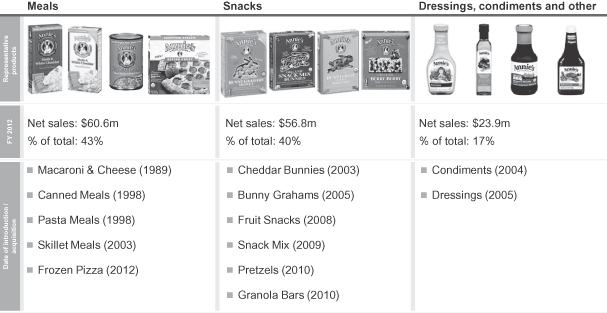

Annie’s, Inc. is a rapidly growing natural and organic food company with a widely recognized brand, offering consumers great-tasting products in large packaged food categories. We sell premium products made from high-quality ingredients at affordable prices. Our products appeal to health-conscious consumers who seek to avoid artificial flavors, synthetic colors and preservatives that are used in many conventional packaged foods. We have the #1 natural and organic market position in four product lines: macaroni and cheese, snack crackers, fruit snacks and graham crackers.

Our loyal and growing consumer following has enabled us to migrate from our natural and organic roots to a brand sold across the mainstream grocery, mass merchandiser and natural retailer channels. Today, we offer over 125 products and are present in over 25,000 retail locations in the United States and Canada. Over the past three years, we have significantly increased both the number of retail locations where our products can be found and the number of our products found in individual stores. We expect that increasing penetration of the mainstream grocery and mass merchandiser channels, combined with greater brand awareness, new product introductions, line extensions and favorable consumer trends, will continue to fuel sales growth in all channels.

Innovation, including new product development, is a key component of our growth strategy. We invest significant resources to understand our consumers and develop products that address their desire for natural and organic alternatives to conventional packaged foods. We have a demonstrated track record of extending our product offerings into large food categories, such as fruit snacks and snack mix, and introducing products in existing categories with new sizes, flavors and ingredients. In order to quickly and economically introduce our new products to market, we partner with contract manufacturers that make our products according to our formulas and specifications.

Our brand and premium products appeal to our consumers, who tend to be better-educated and more health-conscious than the average consumer. In addition, we believe that many of our consumers spend more on food and buy higher margin items than the average consumer. We believe that our products attract new consumers to the categories in which we compete, and that our products are profitable and attractive to retailers. As a result, we believe we can continue to expand in the mainstream grocery and mass merchandiser channels, while continuing to innovate and grow our sales in the natural retailer channel.

We are committed to operating in a socially responsible and environmentally sustainable manner, with an open and honest corporate culture. Our mission is to cultivate a healthier, happier world by spreading goodness through nourishing foods, honest words and conduct that is considerate and forever kind to the planet. Our corporate culture embodies these values and, as a result, we enjoy a highly motivated and skilled work force that is committed to our business and our mission. Our colorful, informative and whimsical packaging featuring our iconic mascot, Bernie, the “Rabbit of Approval,” conveys these values. We believe our consumers connect with us because they love our products and relate to our values, resulting in loyal and trusting relationships.

1

Table of Contents

We have experienced strong sales and profit growth over the past few years. We increased our net sales from $76.8 million in fiscal 2008 to $141.3 million in fiscal 2012, representing a 16.5% compound annual growth rate. Over the same period, our income from operations increased from $1.4 million in fiscal 2008 to $17.9 million in fiscal 2012. Our net sales for the twelve months ended December 31, 2012 were $160.2 million as compared to $134.9 million for the twelve months ended December 31, 2011, representing an increase of 18.8%.

Industry Overview

According to a leading industry source, the U.S. is the world’s largest organic food market, with sales of natural and organic foods exceeding $45 billion in 2011. From 2000 to 2010, the U.S. natural and organic food market grew at a compound annual growth rate of approximately 12% and was found by the same industry source to have grown by approximately 10% in 2011. We believe growth rates for the U.S. natural and organic food market have been, and will continue to be, higher than those for the overall U.S. food market.

We believe growth in the natural and organic food market is driven by various factors, including heightened awareness of the role that food and nutrition play in long-term health and wellness. Many consumers prefer natural and organic products due to increasing concerns over the purity and safety of food. The development and implementation of U.S. Department of Agriculture, or USDA, standards for organic certification has increased consumer awareness of, and confidence in, products labeled as organic. According to a well regarded consumer research firm, 75% of adults in the U.S. purchased natural or organic foods in 2010, with 33% of consumers using organic products at least once a month as compared to 22% ten years before.

Historically, natural and organic foods were primarily available at independent organic retailers or natural and organic retail chains. Mainstream grocery stores and mass merchandisers have expanded their natural and organic product offerings because of increasing consumer demand for natural and organic products, which command a higher margin for the retailer. The percentage of natural and organic food sales has been rising, and, according to an industry source, in 2010, 73% of consumers purchased organic products at grocery stores as compared to 25% at natural food stores. We believe the emergence of strong natural and organic brands, driven by a loyal and growing consumer base, will act as an additional catalyst for higher penetration in the mainstream grocery and mass merchandiser channels.

We believe Annie’s is well positioned to benefit from these market trends and preferences in the coming years.

Our Competitive Strengths

We believe that the following strengths differentiate our company and create the foundation for continued sales and profit growth:

Leading natural and organic brand. We are a market-leading premium natural and organic brand with proven success in large categories across multiple channels. We have the #1 natural and organic market position in four product lines: macaroni and cheese, snack crackers, fruit snacks and graham crackers. Our brand is reinforced by distinctive packaging that communicates the fun and whimsical nature of the brand with bright colors and our iconic mascot, Bernie, the “Rabbit of Approval.”

Strong consumer loyalty. Many of our consumers are loyal and enthusiastic brand advocates. Our consumers trust us to deliver great-tasting products made with natural and organic ingredients. We believe that consumer enthusiasm for our brand inspires repeat purchases, attracts new consumers and generates interest in our new products.

Track record of innovation. Since the introduction of our original macaroni and cheese products in 1989, we have successfully extended our brand into a number of large product lines, such as snack crackers,

2

Table of Contents

graham crackers, fruit snacks and granola bars, and introduced extensions of our existing product lines. One of our most recent new products is frozen organic rising crust pizza, which we introduced in January 2012. In October 2012, we expanded our selection of family-friendly snack options with organic graham crackers and cheddar squares. We maintain an active new product pipeline, and our relationships with our ingredient suppliers and manufacturing partners enable us to efficiently introduce new products. In fiscal 2012, we estimate that 19% of our net sales were generated by products introduced since the beginning of fiscal 2010.

Strategic and valuable brand for retailers. Our brand is valuable to retailers in the mainstream grocery, mass merchandiser and natural retailer channels. We believe retailers carry our products for several reasons, including that our products satisfy consumer demand for premium natural and organic products and many of our consumers spend more on food and buy higher margin items than average consumers. Further, we believe our products offer better profitability for retailers compared to conventional packaged foods.

Core competency in organic sourcing. We have long-standing strategic relationships with key suppliers of organic ingredients. We have significant knowledge and experience sourcing these ingredients and, for some key ingredients, our supply chain relationships extend to farmers and farmer cooperatives. We consider our sourcing relationships and our knowledge of the complex organic supply chain to be a competitive advantage and barrier to entry.

Experienced management team. We have a proven and experienced senior management team. Our Chief Executive Officer, John M. Foraker, has been with us since 1999 and has significant experience in the natural and organic food industry. The members of our senior management team have extensive experience in the food industry and with leading consumer brands.

Our Business Strategy

Pursue top line growth. We are pursuing three growth strategies as we continue to build our business:

Expand distribution and improve placement. We intend to increase sales by expanding the number of stores that sell our products in the mainstream grocery and mass merchandiser channels and by securing placements adjacent to conventional products in the mainstream aisle. We believe increased distribution and enhanced shelf placement will lead more consumers to purchase our products and will expand our market share.

Expand household penetration and consumer base. We intend to increase the number of consumers who buy our products by using grassroots marketing, social media tools and advertising. We believe these efforts will educate consumers about our brand and the benefits of natural and organic food, create demand for our products and, ultimately, expand our consumer base.

Continue innovation and brand extensions. Our market studies, analyses and consumer testing enable us to identify attractive product opportunities. We intend to continue to introduce products in both existing and new product lines that appeal to the whole family.

Remain authentic: stay true to our values. We believe authentic brands are brands that win. We are a mission-driven business with long-standing core values. We strive to operate in an honest, socially responsible and environmentally sustainable manner because it is the right thing to do and it is good for business. We believe our authenticity better enables us to build loyalty and trust with current consumers and helps us attract new ones.

Invest in infrastructure and capabilities. We invest in our people, supply chain and systems to ensure that our business is scalable and profitable. We expect to add new employees to our sales, marketing, operations and finance teams as necessary to support our growth. We actively seek opportunities to invest in the specific capabilities of our supply chain partners to reduce costs, increase manufacturing efficiencies and improve quality. Additionally, we continue to invest in our systems and technology, including an enterprise resource planning, or ERP, system, to support growth and increase efficiency.

3

Table of Contents

The Share Repurchase

We have entered into an agreement with the selling stockholders, Solera Partners, L.P. and SCI Partners, L.P., to repurchase 500,000 shares of our common stock, concurrently with the closing of this offering, directly from such selling stockholders in a private, non-underwritten transaction at a price per share equal to the price paid by the underwriters in this offering. We refer to this repurchase as the share repurchase. We intend to fund the share repurchase primarily with borrowings under our credit facility and also from cash on hand. The closing of the share repurchase is contingent on the closing of this offering and the satisfaction of certain other customary conditions. The funding of the share repurchase will, if completed, increase the amount of debt on our balance sheet.

The closing of this offering is not conditioned on the closing of the share repurchase, and there can be no assurance that the share repurchase will be completed.

The description and the other information in this prospectus regarding the share repurchase is included in this prospectus solely for informational purposes. Nothing in this prospectus should be construed as an offer to sell, or the solicitation of an offer to buy, any of our common stock subject to the share repurchase.

Amendment to our Credit Facility

We expect to enter into an amendment to our credit facility that will increase our line of credit to $40.0 million prior to the closing of this offering and the share repurchase. See “Risk Factors—Risks Related to Our Indebtedness—Our substantial indebtedness could adversely affect our financial condition.”

Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described in “Risk Factors” before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose part or all of your investment. Below is a summary of some of the principal risks we face:

| • | we may not be able to successfully implement our growth strategy; |

| • | we may fail to develop and maintain our brand; |

| • | our brand may be diminished if we encounter quality or health concerns about our food products; |

| • | we are vulnerable to economic conditions and consumer preferences that may change; |

| • | we may not have the resources to compete successfully in our highly competitive markets; |

| • | we may not be able to improve our existing products or develop and introduce new products that appeal to consumer preferences; |

| • | ingredient and packaging costs are volatile and may rise significantly; |

| • | we rely on a small number of third-party suppliers and contract manufacturers to produce our products and we have limited control over them; and |

| • | seasonal fluctuations and changes in our promotional activities may impact our financial performance and quarterly results of operations. |

4

Table of Contents

Our Sponsor

Solera Capital, LLC is a private equity firm based in New York City that provides growth capital to entrepreneurial companies poised to take advantage of changing industry dynamics. Through disciplined research, Solera seeks to develop forward-thinking ideas to identify companies that can become leaders in rapidly growing markets. Solera typically acquires strategic or controlling stakes and takes an active, hands-on role in the development of these businesses. Solera has invested over $245 million of equity capital in companies in natural and organic food, specialty retail, consumer healthcare, Latin-focused media and green lifestyle. Molly F. Ashby has been Chairman and Chief Executive Officer and the controlling member of Solera since the firm was founded in 1999. Following Solera’s investment in 2002, Ms. Ashby joined the board of directors of Annie’s Homegrown and has been the Chairman of our board of directors since 2004. Solera’s investment and business practices are driven by core values that include a commitment to diversity, integrity, mentorship and collaboration and social and environmental responsibility. We sometimes refer to Solera Capital, LLC and its affiliates as Solera in this prospectus.

Upon the closing of this offering and the share repurchase, Solera will continue to have significant influence over us and decisions made by our stockholders. Solera may have interests that conflict with those of our other stockholders. See “Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock” and “Principal and Selling Stockholders.”

Conflicts of Interest

This offering is being conducted in accordance with the applicable provisions of Rule 5121, or Rule 5121, of the Financial Industry Regulatory Authority, Inc., or FINRA. An affiliate of J.P. Morgan Securities LLC, one of the underwriters, has an approximately 10% ownership stake in Solera Partners, L.P., which is a selling stockholder in this offering, and, as such, will receive 5% or more of the net proceeds in this offering. Solera Partners, L.P. is also one of the stockholders participating in the share repurchase. Pursuant to Rule 5121, the appointment of a qualified independent underwriter is not necessary in connection with this offering, as the offering is of a class of equity securities for which a “bona fide public market,” as defined by FINRA Rule 5121(f)(3), exists. See “Underwriting (Conflicts of Interest).”

Our Corporate Information

Annie’s, Inc. is a Delaware corporation and our principal executive offices are located at 1610 Fifth Street, Berkeley, CA 94710. Our telephone number is (510) 558-7500. Our website address is www.annies.com. The information contained on or accessible through our website is not part of this prospectus or the registration statement of which this prospectus forms a part, and potential investors should not rely on such information in making a decision to purchase our common stock in this offering.

5

Table of Contents

The Offering

| Common Stock Offered by the Selling Stockholders |

3,500,000 shares |

| Common Stock to be Outstanding Immediately after this Offering and the Share Repurchase |

16,828,797 shares |

| Overallotment Option |

The underwriters have an option to purchase a maximum of 525,000 additional shares of our common stock from certain selling stockholders to cover overallotments. The underwriters could exercise this option at any time within 30 days from the date of this prospectus. |

| Use of Proceeds |

The selling stockholders will receive all the proceeds from the sale of shares in this offering. We will not receive any proceeds from the sale of shares in this offering. See “Use of Proceeds.” |

| Share Repurchase |

We have entered into an agreement with the selling stockholders to repurchase 500,000 shares of our common stock, concurrently with the closing of this offering, directly from such selling stockholders in a private, non-underwritten transaction at a price per share equal to price paid by the underwriters in this offering. The closing of the share repurchase is contingent on the closing of this offering. The closing of this offering is not contingent on the closing of the share repurchase. |

| Dividend Policy |

We expect to retain future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. See “Dividend Policy.” |

| Risk Factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Symbol for Trading on the New York Stock Exchange |

BNNY |

As of December 31, 2012, 17,328,797 shares of our common stock are outstanding, excluding:

| • | 1,135,532 shares of our common stock issuable upon the exercise of options outstanding under our Amended and Restated 2004 Stock Option Plan, or 2004 Plan, our Omnibus Incentive Plan and certain non-plan options, with a weighted average exercise price of $11.24 per share; |

| • | 546,481 shares of our common stock available for future issuance under our Omnibus Incentive Plan; |

| • | 21,756 shares of our common stock issuable pursuant to outstanding restricted stock units under our Omnibus Incentive Plan; and |

6

Table of Contents

| • | 47,795 shares of our common stock (subject to adjustment from zero shares to 71,699 shares based on achievement of specified percentage of targeted cumulative compounded earnings per share growth rate of the Company) issuable pursuant to outstanding performance share units under our Omnibus Incentive Plan. |

Unless otherwise indicated, the information in this prospectus assumes:

| • | no exercise of outstanding options since December 31, 2012 (except as otherwise disclosed in “Principal and Selling Stockholders”); and |

| • | no exercise by the underwriters of their option to purchase additional shares of our common stock from the selling stockholders to cover overallotments. |

7

Table of Contents

Summary Consolidated Financial Data

The following table presents summary consolidated financial data for the periods and at the dates indicated. The summary consolidated financial data as of March 31, 2012 and for each of the three years then ended have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the nine months ended December 31, 2011 and 2012 and the summary consolidated balance sheet data as of December 31, 2012 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The unaudited condensed consolidated financial statements were prepared on the same basis as our audited consolidated financial statements and, in the opinion of management, reflect all adjustments that we consider necessary for a fair statement of the financial information. You should read the following financial information together with the information under “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of results to be expected for any future period.

| Fiscal Year Ended March 31, | Nine Months Ended December 31, |

|||||||||||||||||||

| 2010 | 2011 | 2012 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 96,015 | $ | 117,616 | $ | 141,304 | $ | 98,320 | $ | 117,262 | (3) | |||||||||

| Cost of sales |

63,083 | 71,804 | 85,877 | 60,034 | 72,539 | (3) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

32,932 | 45,812 | 55,427 | 38,286 | 44,723 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Selling, general and administrative expenses |

25,323 | 30,674 | 36,195 | 25,206 | 32,437 | |||||||||||||||

| Advisory agreement termination fee |

— | — | 1,300 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

25,323 | 30,674 | 37,495 | 25,206 | 32,437 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

7,609 | 15,138 | 17,932 | 13,080 | 12,286 | |||||||||||||||

| Interest expense |

(1,207 | ) | (885 | ) | (161 | ) | (66 | ) | (120 | ) | ||||||||||

| Other income (expense), net |

21 | 155 | (1,594 | ) | (428 | ) | 116 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before provision for (benefit from) income taxes |

6,423 | 14,408 | 16,177 | 12,586 | 12,282 | (3) | ||||||||||||||

| Provision for (benefit from) income taxes |

400 | (5,747 | ) | 6,588 | 4,926 | 4,965 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 6,023 | $ | 20,155 | $ | 9,589 | $ | 7,660 | $ | 7,317 | (3) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to common stockholders(1) |

$ | 177 | $ | 596 | $ | 290 | $ | 233 | $ | 7,317 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per share attributable to common stockholders—Basic(2) |

$ | 0.38 | $ | 1.29 | $ | 0.62 | $ | 0.50 | $ | 0.43 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per share attributable to common stockholders—Diluted(2) |

$ | 0.20 | $ | 0.50 | $ | 0.26 | $ | 0.24 | $ | 0.41 | (3) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares of common stock outstanding used in computing net income per share attributable to common stockholders |

||||||||||||||||||||

| Basic |

461,248 | 461,884 | 469,089 | 467,206 | 17,085,833 | |||||||||||||||

| Diluted |

899,539 | 1,201,125 | 1,111,088 | 988,915 | 17,702,221 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends per common share |

$ | 0.22 | $ | 0.80 | $ | 0.86 | $ | 0.86 | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

8

Table of Contents

| Fiscal Year Ended March 31, | Nine Months Ended December 31, |

|||||||||||||||||||

| 2010 | 2011 | 2012 | 2011 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| EBITDA(4) |

$ | 7,975 | $ | 15,787 | $ | 17,183 | $ | 13,230 | $ | 13,151 | ||||||||||

| Adjusted EBITDA(4) |

9,277 | 16,560 | 21,315 | 14,608 | 16,805 | |||||||||||||||

| As of December 31, 2012 |

||||

| (in thousands) | ||||

| Consolidated Balance Sheet Data: |

||||

| Cash |

$ | 12,960 | ||

| Working capital |

38,806 | |||

| Total assets |

93,512 | |||

| Total stockholders’ equity |

79,645 | |||

| (1) | Net income attributable to common stockholders was allocated using the two-class method for the periods presented, except for the nine-month period ended December 31, 2012, since our capital structure included common stock and convertible preferred stock with participating rights. Under the two-class method, we reduced income from operations by (i) the dividends paid to convertible preferred stockholders and (ii) the rights of the convertible preferred stockholders in any undistributed earnings based on the relative percentage of weighted average shares of outstanding convertible preferred stock to the total number of weighted average shares of outstanding common and convertible preferred stock. |

| (2) | For the calculation of basic and diluted income per share, see notes 2 and 14 to our consolidated financial statements and notes 2 and 13 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

| (3) | We recorded an estimated accrual for product returns and recall-related costs of approximately $2.3 million for the nine months ended December 31, 2012 as follows (in thousands except per share amount): |

| Amount | ||||

| Reduction of net sales |

$ | 1,570 | ||

| Incremental cost of sales |

690 | |||

|

|

|

|||

| Total reduction to income before income taxes |

$ | 2,260 | ||

|

|

|

|||

| Impact on net income |

$ | 1,346 | ||

|

|

|

|||

| Impact on net income per diluted share |

$ | 0.08 | ||

|

|

|

|||

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Voluntary Product Recall” and note 15 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus.

| (4) | EBITDA and Adjusted EBITDA are not financial measures prepared in accordance with U.S. generally accepted accounting principles, or GAAP. As used herein, EBITDA represents net income plus interest expense, provision for (benefit from) income taxes and depreciation and amortization. As used herein, Adjusted EBITDA represents EBITDA plus reduction in net sales and increase in cost of sales due to product recall, management fees, advisory agreement termination fee, stock-based compensation, secondary offering costs and change in fair value of convertible preferred stock warrant liability. |

We present EBITDA and Adjusted EBITDA because we believe each of these measures provides an additional metric to evaluate our operations and, when considered with both our GAAP results and the reconciliation to net income set forth below, provides a more complete understanding of our business than could be obtained absent this disclosure. We use EBITDA and Adjusted EBITDA, together with financial

9

Table of Contents

measures prepared in accordance with GAAP, such as sales and cash flows from operations, to assess our historical and prospective operating performance, to provide meaningful comparisons of operating performance across periods, to enhance our understanding of our core operating performance and to compare our performance to that of our peers and competitors.

EBITDA and Adjusted EBITDA are presented because we believe they are useful to investors in assessing the operating performance of our business without the effect of non-cash depreciation and amortization expenses and, in the case of Adjusted EBITDA, the adjustments described above.

EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net income, income from operations or any other measure of financial performance calculated and presented in accordance with GAAP. Neither EBITDA nor Adjusted EBITDA should be considered as a measure of discretionary cash available to us to invest in the growth of our business. Our Adjusted EBITDA may not be comparable to similarly titled measures of other organizations because other organizations may not calculate Adjusted EBITDA in the same manner as we do. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by the expenses that are excluded from that term or by unusual or non-recurring items. We recognize that both EBITDA and Adjusted EBITDA have limitations as analytical financial measures. For example, neither EBITDA nor Adjusted EBITDA reflects:

| • | our capital expenditures or future requirements for capital expenditures; |

| • | the interest expense, or the cash requirements necessary to service interest or principal payments, associated with indebtedness; |

| • | depreciation and amortization, which are non-cash charges, although the assets being depreciated and amortized will likely have to be replaced in the future, nor does EBITDA or Adjusted EBITDA reflect any cash requirements for such replacements; and |

| • | changes in, or cash requirements for, our working capital needs. |

The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net income, which is the most directly comparable financial measure presented in accordance with GAAP:

| Fiscal Year Ended March 31, | Nine Months

Ended December 31, |

|||||||||||||||||||

| 2010 | 2011 | 2012 | 2011 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net income |

$ | 6,023 | $ | 20,155 | $ | 9,589 | $ | 7,660 | $ | 7,317 | ||||||||||

| Interest expense |

1,207 | 885 | 161 | 66 | 120 | |||||||||||||||

| Provision for (benefit from) income taxes |

400 | (5,747 | ) | 6,588 | 4,926 | 4,965 | ||||||||||||||

| Depreciation and amortization |

345 | 494 | 845 | 578 | 749 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

7,975 | 15,787 | 17,183 | 13,230 | 13,151 | |||||||||||||||

| Net sales reduction related to product recall(a) |

— | — | — | — | 1,570 | |||||||||||||||

| Cost of sales related to product recall(a) |

— | — | — | — | 690 | |||||||||||||||

| Management fees(b) |

400 | 400 | 600 | 450 | — | |||||||||||||||

| Advisory agreement termination fee(b) |

— | — | 1,300 | — | — | |||||||||||||||

| Stock-based compensation(c) |

902 | 373 | 506 | 390 | 677 | |||||||||||||||

| Secondary offering costs(d) |

— | — | — | — | 704 | |||||||||||||||

| Change in fair value of convertible preferred stock warrant liability(e) |

— | — | 1,726 | 538 | 13 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 9,277 | $ | 16,560 | $ | 21,315 | $ | 14,608 | $ | 16,805 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

10

Table of Contents

| (a) | Represents a reduction in net sales of $1.6 million due to a voluntary product recall of our frozen pizza products and a corresponding increase in cost of sales of $0.7 million for estimated costs associated with the product recall. The estimated costs associated with the product recall are comprised of inventory write-off of $0.6 million and costs incurred by contract manufacturers of $0.1 million. |

| (b) | Represents management fees and advisory agreement termination fee paid to Solera. The advisory agreement was terminated upon the consummation of our IPO in exchange for a payment of $1.3 million. |

| (c) | Represents non-cash, stock-based compensation expense. |

| (d) | Represents costs incurred in connection with the secondary public offering of shares of our common stock that closed on August 6, 2012. |

| (e) | Represents non-cash charge due to the increase in fair value of a warrant to purchase 80,560 shares of our common stock. See note 9 to our consolidated financial statements included elsewhere in this prospectus. |

11

Table of Contents

Investing in our common stock involves a high degree of risk. The most significant risks include those described below; however, additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business operations. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in shares of our common stock. If any of the following risks actually occurs, our business, results of operations and financial condition could be materially adversely affected. In this case, the trading price of our common stock would likely decline and you might lose part or all of your investment in our common stock.

Risks Related to Our Business and Industry

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our growth strategy of expanding distribution and improving placement of our products, attracting new consumers to our brand and introducing new product lines and product extensions. Our ability to implement this growth strategy depends, among other things, on our ability to:

| • | enter into distribution and other strategic arrangements with third-party retailers and other potential distributors of our products; |

| • | continue to compete in conventional grocery and mass merchandiser retail channels in addition to the natural and organic channel; |

| • | secure shelf space in mainstream aisles; |

| • | increase our brand recognition; |

| • | expand and maintain brand loyalty; and |

| • | develop new product lines and extensions. |

We may not be able to successfully implement our growth strategy. Our sales and operating results will be adversely affected if we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful.

If we fail to develop and maintain our brand, our business could suffer.

We believe that developing and maintaining our brand is critical to our success. The importance of our brand recognition may become greater as competitors offer more products similar to ours. Our brand-building activities involve increasing awareness of our brand, creating and maintaining brand loyalty and increasing the availability of our products. If our brand-building activities are unsuccessful, we may never recover the expenses incurred in connection with these efforts, and we may be unable to implement our business strategy and increase our future sales.

Our brand and reputation may be diminished due to real or perceived quality or health issues with our products, which could have an adverse effect on our business and operating results.

We believe our consumers rely on us to provide them with high-quality natural and organic food products. Concerns regarding the ingredients used in our products or the safety or quality of our products or our supply chain may cause consumers to stop purchasing our products, even if the basis for the concern is unfounded, has been addressed or is outside of our control. Although we believe we have a rigorous quality control process, there can be no assurance that our products will always comply with the standards set for our products. For example, although we strive to keep our products free of genetically modified organisms, they may not be easily detected

12

Table of Contents

and contamination can occur through cross-pollination. Also, we use epoxy linings that contain bisphenol-A, commonly called BPA, as part of the protective barrier between the metal can and food contents in our canned pasta meals. Although the Food and Drug Administration, or FDA, currently allows the use of BPA in food packaging materials and has not approved a BPA-free can for use with our type of products, public reports and concerns regarding the potential hazards of BPA could contribute to a perceived safety risk for products packaged using BPA. Adverse publicity about the quality or safety of our products, whether or not ultimately based on fact, may discourage consumers from buying our products and have an adverse effect on our brand, reputation and operating results.

We have no control over our products once purchased by consumers. Accordingly, consumers may prepare our products in a manner that is inconsistent with our directions or store our products for long periods of time, which may adversely affect the quality of our products. If consumers do not perceive our products to be of high quality, then the value of our brand would be diminished, and our business, results of operations and financial condition would be adversely affected.

Any loss of confidence on the part of consumers in the ingredients used in our products or in the safety and quality of our products would be difficult and costly to overcome. Any such adverse effect could be exacerbated by our position in the market as a purveyor of high-quality natural and organic food products and may significantly reduce our brand value. Issues regarding the safety of any of our products, regardless of the cause, may have a substantial and adverse effect on our brand, reputation and operating results.

We may be subject to significant liability if the consumption of any of our products causes illness or physical harm.

The sale of food products for human consumption involves the risk of injury or illness to consumers. Such injuries or illness may result from inadvertent mislabeling, tampering or product contamination or spoilage. Under certain circumstances, we may be required to recall or withdraw products, which may have a material adverse effect on our business. For example, in 2008, we carried out an FDA Class I recall for approximately 680 cases of our salad dressing due to ingredient mislabeling, and we recently carried out an FDA Class II recall for our frozen pizza products. See “—Our voluntary recall of certified organic and made with organic pizza products has affected our third quarter of fiscal 2013 financial results and will continue to impact our financial results in future quarters.” Even if a situation does not necessitate a recall or market withdrawal, product liability claims may be asserted against us. If the consumption of any of our products causes, or is alleged to have caused, a health-related illness, we may become subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful, the negative publicity surrounding any assertion that our products caused illness or physical harm could adversely affect our reputation with existing and potential distributors, retailers and consumers and our corporate image and brand equity. Moreover, claims or liabilities of this sort might not be covered by insurance or by any rights of indemnity or contribution that we may have against others. A product liability judgment against us or a product recall or market withdrawal could have a material adverse effect on our business, reputation and operating results.

Our voluntary recall of certified organic and made with organic pizza products has affected our third quarter of fiscal 2013 financial results and will continue to impact our financial results in future quarters.

On January 22, 2013, we initiated a voluntary recall of our certified organic and made with organic pizza products due to the possible presence of fragments of flexible metal mesh from a faulty screen at a third-party flour mill. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Voluntary Product Recall.” We have accounted for the voluntary recall primarily as a reduction to net sales to account for customer and consumer returns and an increase in cost of sales to account for the destruction of finished goods and raw materials inventory. In addition, we will record administrative costs associated with the management of the recall, including fees and incentives to customers and legal expenses, in our fourth fiscal quarter ending March 31, 2013. Certain of these accounting charges are based on our best estimates and may be

13

Table of Contents

subject to change as we move forward in completing the voluntary recall. We will also incur some additional costs in future quarters. While we expect to recover a substantial portion of the charges for costs related to the voluntary recall in future quarters through our existing recall insurance and from the third-party supplier, we cannot guarantee that the amounts we recover will cover all costs associated with the voluntary recall. While we have restarted the production and began shipping replacement product into distributors and retailers as of February 11, 2013 in order to replenish retail shelves and inventories, we anticipate that pizza sales will be reduced in the fourth quarter ending March 31, 2013, as compared to our original expectations for the product line. Additionally, we may find it challenging to re-establish strong growth in pizza product sales for a period of time following the voluntary recall. Further, while there have been no illnesses or injuries reported to date, the occurrence of any illnesses or injuries could have serious consequences on pizza product sales and sales of our other products, our brand and reputation, any of which could harm our business.

Disruptions in the worldwide economy may adversely affect our business, results of operations and financial condition.

Adverse and uncertain economic conditions may impact distributor, retailer and consumer demand for our products. In addition, our ability to manage normal commercial relationships with our suppliers, contract manufacturers, distributors, retailers, consumers and creditors may suffer. Consumers may shift purchases to lower-priced or other perceived value offerings during economic downturns. In particular, consumers may reduce the amount of natural and organic products that they purchase where there are conventional offerings, which generally have lower retail prices. In addition, consumers may choose to purchase private label products rather than branded products because they are generally less expensive. Distributors and retailers may become more conservative in response to these conditions and seek to reduce their inventories. For example, during the economic downturn from 2007 through 2009, distributors and retailers significantly reduced their inventories, and inventory levels have not returned to, and are not expected to return to, pre-downturn levels. Our results of operations depend upon, among other things, our ability to maintain and increase sales volume with our existing distributors and retailers, to attract new consumers and to provide products that appeal to consumers at prices they are willing and able to pay. Prolonged unfavorable economic conditions may have an adverse effect on our sales and profitability.

Consumer preferences for our products are difficult to predict and may change, and, if we are unable to respond quickly to new trends, our business may be adversely affected.

Our business is focused on the development, manufacture, marketing and distribution of a line of branded natural and organic food products. If consumer demand for our products decreased, our business would suffer. In addition, sales of natural and organic products are subject to evolving consumer preferences. Consumer trends that we believe favor sales of our products could change based on a number of possible factors, including a shift in preference from organic to non-organic and from natural to non-natural products, a loss of confidence by consumers in what constitutes “organic,” economic factors and social trends. A significant shift in consumer demand away from our products could reduce our sales or the prestige of our brand, which would harm our business.

We may not have the resources to compete successfully in our highly competitive markets.

We operate in a highly competitive market. Numerous brands and products compete for limited retailer shelf space and consumers. In our market, competition is based on, among other things, product quality and taste, brand recognition and loyalty, product variety, interesting or unique product names, product packaging and package design, shelf space, reputation, price, advertising, promotion and nutritional claims.

The packaged food industry is dominated by multinational corporations with substantially greater resources and operations than us. We cannot be certain that we will successfully compete with larger competitors that have greater financial, sales and technical resources. Conventional food companies, including Kraft Foods Inc., General Mills, Inc., Campbell Soup Company, PepsiCo, Inc., Nestle S.A. and Kellogg Company, may be able to

14

Table of Contents

use their resources and scale to respond to competitive pressures and changes in consumer preferences by introducing new products, reducing prices or increasing promotional activities, among other things. We also compete with other natural and organic packaged food brands and companies, including The Hain Celestial Group, Inc., Newman’s Own, Inc., Nature’s Path Foods, Inc., Clif Bar & Company and Amy’s Kitchen, and with smaller companies, which may be more innovative and able to bring new products to market faster and to more quickly exploit and serve niche markets. Retailers also market competitive products under their own private labels, which are generally sold at lower prices and compete with some of our products. As a result of competition, we may need to increase our marketing, advertising and promotional spending to protect our existing market share, which may adversely impact our profitability. We may not have the financial resources to increase such spending when necessary.

Failure to introduce new products or improve existing products successfully would adversely affect our ability to continue to grow.

A key element of our growth strategy depends on our ability to develop and market new products and improvements to our existing products that meet our standards for quality and appeal to consumer preferences. The success of our innovation and product development efforts is affected by our ability to anticipate changes in consumer preferences, the technical capability of our product development staff in developing and testing product prototypes, including complying with governmental regulations, and the success of our management and sales team in introducing and marketing new products. Failure to develop and market new products that appeal to consumers may lead to a decrease in our growth, sales and profitability.

Additionally, the development and introduction of new products requires substantial research, development and marketing expenditures, which we may be unable to recoup if the new products do not gain widespread market acceptance. If we are unsuccessful in meeting our objectives with respect to new or improved products, our business could be harmed. For example, our breakfast cereals line of products did not meet our growth objectives, and we discontinued it in fiscal 2012. Additionally, we cannot assure you that our most recent new product line, frozen rising crust pizza, will gain widespread market acceptance or be successful.

Ingredient and packaging costs are volatile and may rise significantly, which may negatively impact the profitability of our business.

We purchase large quantities of raw materials, including ingredients such as wheat and flour, dairy products, oils and sugar. In addition, we purchase and use significant quantities of cardboard, film and glass to package our products. Costs of ingredients and packaging are volatile and can fluctuate due to conditions that are difficult to predict, including global competition for resources, weather conditions, consumer demand and changes in governmental trade and agricultural programs. In fiscal 2012 and the nine months ended December 31, 2012, our ingredient costs were higher than in the corresponding prior periods, and we expect that the cost of certain of our key ingredients will continue to increase. Continued volatility in the prices of raw materials and other supplies we purchase could increase our cost of sales and reduce our profitability. Moreover, we may not be able to implement price increases for our products to cover any increased costs, and any price increases we do implement may result in lower sales volumes. If we are not successful in managing our ingredient and packaging costs, if we are unable to increase our prices to cover increased costs or if such price increases reduce our sales volumes, then such increases in costs will adversely affect our business, results of operations and financial condition.

Our future business, results of operations and financial condition may be adversely affected by reduced availability of organic ingredients.

Our ability to ensure a continuing supply of organic ingredients at competitive prices depends on many factors beyond our control, such as the number and size of farms that grow organic crops or raise organic livestock, the vagaries of these farming businesses (including poor harvests), changes in national and world economic conditions and our ability to forecast our ingredient requirements. The organic ingredients used in

15

Table of Contents

many of our products are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes, hurricanes and pestilences. Adverse weather conditions and natural disasters can lower crop yields and reduce crop size and quality, which in turn could reduce the available supply of, or increase the price of, organic ingredients. For example, in fiscal 2011, organic wheat and sunflower oil were in shorter supply than we expected. In addition, we purchase some ingredients offshore, and the availability of such ingredients may be affected by events in other countries, including Colombia, Paraguay, Thailand and Brazil. In addition, we compete with other food producers in the procurement of organic ingredients, which are often less plentiful in the open market than conventional ingredients. This competition may increase in the future if consumer demand for organic products increases. If supplies of organic ingredients are reduced or there is greater demand for such ingredients from us and others, we may not be able to obtain sufficient supply on favorable terms, or at all, which could impact our ability to supply products to distributors and retailers and may adversely affect our business, results of operations and financial condition.

We rely on sales to a limited number of distributors and retailers for the substantial majority of our sales, and the loss of one or more significant distributors or retailers may harm our business.

A substantial majority of our sales are generated from a limited number of distributors and retailers. For the nine months ended December 31, 2012, sales to our three largest customers represented approximately 26%, 13% and 12% of our net sales. Although the composition of our significant distributors and retailers will vary from period to period, we expect that most of our sales will continue to come from a relatively small number of distributors and retailers for the foreseeable future. We do not have commitments or minimum volumes that ensure future sales of our products. Consequently, our financial results may fluctuate significantly from period to period based on the actions of one or more significant distributors or retailers. For example, in fiscal 2010, sales to a significant customer were $3.2 million lower than in fiscal 2009, which contributed to lower sales growth. A distributor or retailer may take actions that affect us for reasons that we cannot always anticipate or control, such as their financial condition, changes in their business strategy or operations, the introduction of competing products or the perceived quality of our products. In addition, despite operating in different channels, our retailers sometimes compete for the same consumers. As a result of actual or perceived conflicts resulting from this competition, retailers may take actions that negatively affect us. Our agreements with our distributors and retailers may be canceled if we materially breach the agreements or for other reasons, including reasons outside of our control. In addition, our distributors and retailers may seek to renegotiate the terms of current agreements or renewals. The loss of, or a reduction in sales or anticipated sales to, one or more of our most significant distributors or retailers may have a material adverse effect on our business, results of operation and financial condition.

Loss of one or more of our contract manufacturers or our failure to identify timely new contract manufacturers could harm our business and impede our growth.

We derive all of our sales from products manufactured at manufacturing facilities owned and operated by our contract manufacturers. During fiscal 2012, we paid $62.4 million in the aggregate to our top three contract manufacturers. We do not have written contracts with all of our contract manufacturers, including Lucerne Foods, one of our top three contract manufacturers that manufactures several of our top selling products. Any of our contract manufacturers could seek to alter its relationship with us. If we need to replace a contract manufacturer, there can be no assurance that additional capacity will be available when required on acceptable terms, or at all.

An interruption in, or the loss of operations at, one or more of our contract manufacturing facilities, which may be caused by work stoppages, disease outbreaks or pandemics, acts of war, terrorism, fire, earthquakes, flooding or other natural disasters at one or more of these facilities, could delay or postpone production of our products, which could have a material adverse effect on our business, results of operations and financial condition until such time as such interruption is resolved or an alternate source of production is secured.

The success of our business depends, in part, on maintaining a strong manufacturing platform. We believe there are a limited number of competent, high-quality contract manufacturers in the industry that meet our strict

16

Table of Contents

standards, and if we were required to obtain additional or alternative contract manufacturing arrangements in the future, there can be no assurance that we would be able to do so on satisfactory terms, in a timely manner or at all. Therefore, the loss of one or more contract manufacturers, any disruption or delay at a contract manufacturer or any failure to identify and engage contract manufacturers for new products could delay or postpone production of our products, which could have a material adverse effect on our business, results of operations and financial condition. For example, in the past, changing the contract manufacturer for one of our product lines took approximately six months to implement. At present, we do not have back-up contract manufacturers identified for certain of our product lines, and the loss of contract manufacturers for any of these product lines would result in our inability to produce and deliver the products to our customers until we could identify and retain an alternative contract manufacturer and until that contract manufacturer was able to produce the products to our specifications.

Because we rely on a limited number of third-party suppliers, we may not be able to obtain raw materials on a timely basis or in sufficient quantities to produce our products.

We rely on a limited number of vendors to supply us with raw materials. Our financial performance depends in large part on our ability to arrange for the purchase of raw materials in sufficient quantities at competitive prices. We are not assured of continued supply, pricing or exclusive access to raw materials from these sources. Any of our suppliers could discontinue or seek to alter their relationship with us. For example, we may be adversely affected if they raise their prices, stop selling to us or our contract manufacturers or enter into arrangements that impair their ability to provide raw materials for us.

Although we have multiple suppliers for cheese, we have a single manufacturer for the cheese powders used in our products, including macaroni and cheese, cheddar crackers and snack mix. During fiscal 2012 and the nine-month period ended December 31, 2012, products that contain these cheese powders represented a significant portion of our net sales. Any disruption in the manufacturing of cheese powders would have a material adverse effect on our business.

Events that adversely affect our suppliers could impair our ability to obtain raw material inventory in the quantities that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations, ability to import raw materials, costs, production, insurance and reputation, as well as natural disasters or other catastrophic occurrences.

If we experience significant increased demand for our products, or need to replace an existing supplier, there can be no assurance that additional supplies of raw materials will be available when required on acceptable terms, or at all, or that any supplier would allocate sufficient capacity to us in order to meet our requirements, fill our orders in a timely manner or meet our strict quality standards. Even if our existing suppliers are able to expand their capacity to meet our needs or we are able to find new sources of raw materials, we may encounter delays in production, inconsistencies in quality and added costs. Any delays or interruption in, or increased costs of, our supply of raw materials could have an adverse effect on our ability to meet consumer demand for our products and result in lower net sales and profitability both in the short and long term.

We may not be able to protect our intellectual property adequately, which may harm the value of our brand.

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. Our trademarks, including our “Annie’s®,” “Annie’s Homegrown®,” “Annie’s Naturals®” and “Bernie Rabbit of Approval®” marks, are valuable assets that reinforce our brand and consumers’ favorable perception of our products. We also rely on unpatented proprietary expertise, recipes and formulations and other trade secrets and copyright protection to develop and maintain our competitive position. Our continued success depends, to a significant degree, upon our ability to protect and preserve our intellectual property, including our trademarks, trade dress, trade secrets and copyrights. We rely on confidentiality agreements and trademark, trade secret and copyright law to protect our intellectual property rights.

17

Table of Contents

Our confidentiality agreements with our employees, and certain of our consultants, suppliers and independent contractors, including some of our contract manufacturers who use our recipes to manufacture our products, generally require that all information made known to them be kept strictly confidential. Nevertheless, trade secrets are difficult to protect. Although we attempt to protect our trade secrets, our confidentiality agreements may not effectively prevent disclosure of our proprietary information and may not provide an adequate remedy in the event of unauthorized disclosure of such information. In addition, others may independently discover our trade secrets, in which case we would not be able to assert trade secret rights against such parties. Further, some of our recipes and ingredient formulations have been developed by or with our suppliers and contract manufacturers and are not exclusive to us. Finally, we do not have written confidentiality agreements with all of our contract manufacturers. As a result, we may not be able to prevent others from using our recipes or formulations.

From time to time, third parties have used names or packaging similar to ours, have applied to register trademarks similar to ours and, we believe, have infringed or misappropriated our intellectual property rights. We respond to these actions on a case-by-case basis, including, where appropriate, by sending cease and desist letters and commencing opposition actions and litigation.

We cannot assure you that the steps we have taken to protect our intellectual property rights are adequate, that our intellectual property rights can be successfully defended and asserted in the future or that third parties will not infringe upon or misappropriate any such rights. In addition, our trademark rights and related registrations may be challenged in the future and could be canceled or narrowed. Failure to protect our trademark rights could prevent us in the future from challenging third parties who use names and logos similar to our trademarks, which may in turn cause consumer confusion or negatively affect consumers’ perception of our brand and products. In addition, if we do not keep our trade secrets confidential, others may produce products with our recipes or formulations. Moreover, intellectual property disputes and proceedings and infringement claims may result in a significant distraction for management and significant expense, which may not be recoverable regardless of whether we are successful. Such proceedings may be protracted with no certainty of success, and an adverse outcome could subject us to liabilities, force us to cease use of certain trademarks or other intellectual property or force us to enter into licenses with others. Any one of these occurrences may have a material adverse affect on our business, results of operations and financial condition.

Failure by our suppliers of raw materials or contract manufacturers to comply with food safety, environmental or other laws and regulations may disrupt our supply of products and adversely affect our business.

If our suppliers or contract manufacturers fail to comply with food safety, environmental or other laws and regulations, or face allegations of non-compliance, their operations may be disrupted. Any such failure could also cause us to recall our products. See “–Our voluntary recall of certified organic and made with organic pizza products has affected our third quarter of fiscal 2013 financial results and will continue to impact our financial results in future quarters.” For example, the USDA requires that our certified organic products be free of genetically modified organisms, but unavoidable cross-pollination at one of our suppliers may result in genetically modified organisms in our supply chain. In the event of actual or alleged non-compliance, we might be forced to find an alternative supplier or contract manufacturer. As a result, our supply of raw materials or finished inventory could be disrupted or our costs could increase, which would adversely affect our business, results of operations and financial condition. Additionally, actions we may take to mitigate the impact of any such disruption or potential disruption, including increasing inventory in anticipation of a potential supply or production interruption, may adversely affect our business, results of operations and financial condition.

Changes in existing regulations and the adoption of new regulations may increase our costs and otherwise adversely affect our business, results of operations and financial condition.

The manufacture and marketing of food products is highly regulated. We and our suppliers and contract manufacturers are subject to a variety of laws and regulations. These laws and regulations apply to many aspects

18

Table of Contents

of our business, including the manufacture, packaging, labeling, distribution, advertising, sale, quality and safety of our products, as well as the health and safety of our employees and the protection of the environment.