Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d493897d8k.htm |

Fourth

Quarter 2012 Earnings Conference Call

February 28, 2013

Exhibit 99.1

©

2013 Oldemark LLC |

©

2013 Oldemark LLC

JOHN BARKER

Chief Communications Officer

2 |

Today’s Agenda

Opening Comments

Emil Brolick

Financial Update

Steve Hare

CEO Overview

Emil Brolick

Q&A

3 |

This

presentation, and certain information that management may discuss in connection with this presentation,

contains certain statements that are not historical facts, including information

concerning possible or assumed

future

results

of

our

operations.

Those

statements

constitute

“forward-looking

statements”

within

the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform

Act”). For all forward-looking statements, we claim the protection of the

safe harbor for forward-looking statements contained in the Reform Act.

Many

important

factors

could

affect

our

future

results

and

could

cause

those

results

to

differ

materially

from

those expressed in or implied by our forward-looking statements. Such factors, all of

which are difficult or impossible to predict accurately, and many of which are

beyond our control, include but are not limited to those

identified

under

the

caption

“Forward-Looking

Statements”

in

our

news

release

issued

on

February

28,

2013

and

in

the

“Special

Note

Regarding

Forward-Looking

Statements

and

Projections”

and

“Risk

Factors”

sections of our most recent Form 10-K / Form 10-Qs.

In addition, this presentation and certain information management may discuss in

connection with this presentation reference non-GAAP financial measures, such

as adjusted earnings before interest, taxes, depreciation and amortization, or

adjusted EBITDA, and adjusted earnings per share. Adjusted EBITDA and adjusted

earnings per share exclude certain expenses, net of certain benefits. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measures are provided

in the Appendix to this presentation, and are included in our news release issued

on February 28, 2013 and posted on www.aboutwendys.com.

Forward-Looking Statements and Non-GAAP

Financial Measures

4 |

EMIL

BROLICK President & CEO

5

©

2013 Oldemark LLC |

FY

Adjusted EBITDA* $333.3 mil

vs.

$331.1 mil

Q4 Adjusted EBITDA*

$

95.9

mil

vs.

$ 80.9 mil

FY Adjusted EPS*

$0.17

vs.

$0.15

FY SSS

1.6%

vs.

2.0%

Q4 SSS

(0.2)%

vs.

5.1%

2012 and Fourth-Quarter Highlights

6

2012

2011

*See reconciliation of Adjusted EBITDA from continuing operations and Adjusted

EPS in the appendix. Doubled Quarterly Dividend Rate in Q4 2012: $0.04 per

share |

7

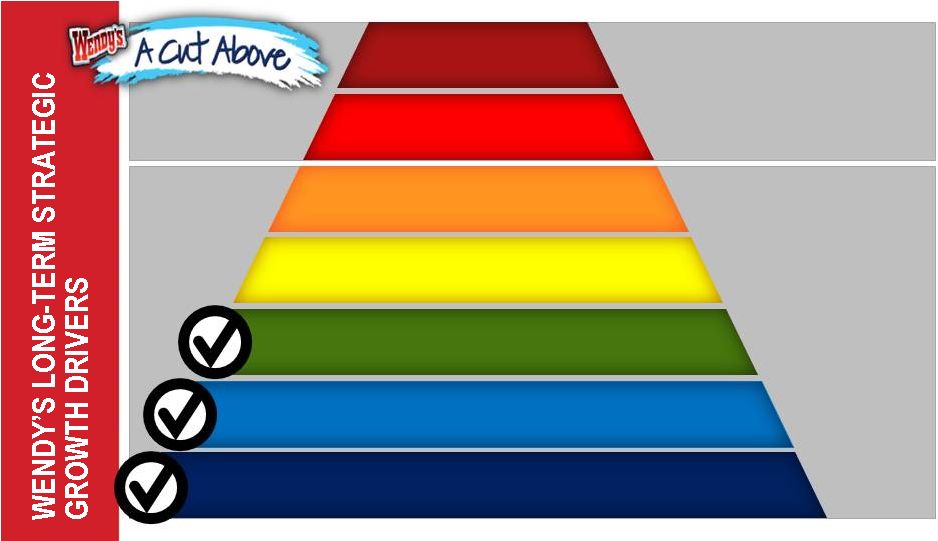

Core Organic

Growth

Strategies

Shareholder

Value-Enhancing

Initiatives

Image / Experience Activation

Restaurant Ownership

Optimization

Financial Management

Global Growth

Global Growth

Restaurant Utilization

& Daypart Expansion

New Restaurant Development

North America Same-Store Sales Growth |

PRICE

New QSR Quality at QSR Price

PRODUCT

Play a different game …

Superior

perceived quality, competitive price

PEOPLE

5-Star Performers

PERFORMANCE

Keeping the brand promise

PROMOTION

Strategically driven, tactically brilliant

PLACE

The complete brand experience

8

Enabling Profitable Growth

THE RECIPE TO WIN |

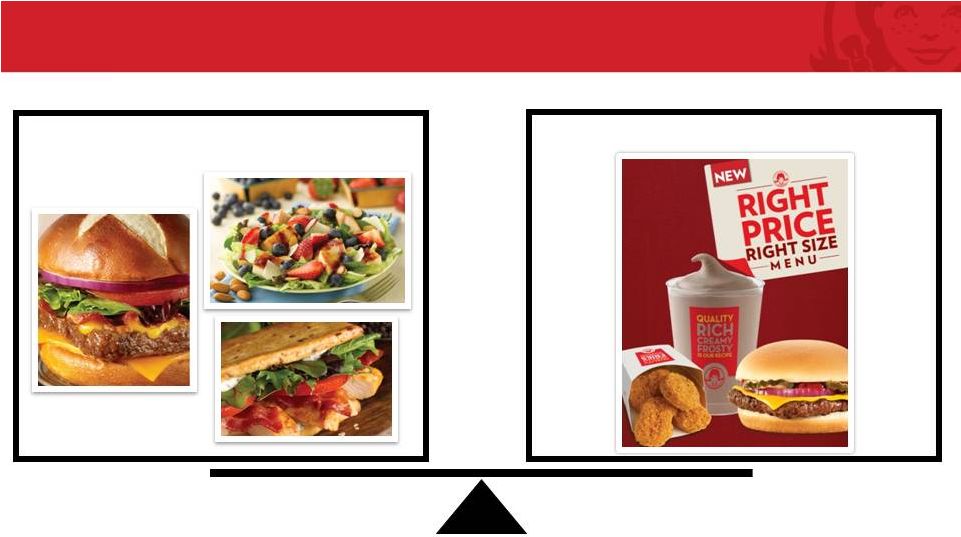

Product /

Price Segmentation Core and LTO Innovation

Value Menu

High

Low

9 |

10

Right Price, Right Size |

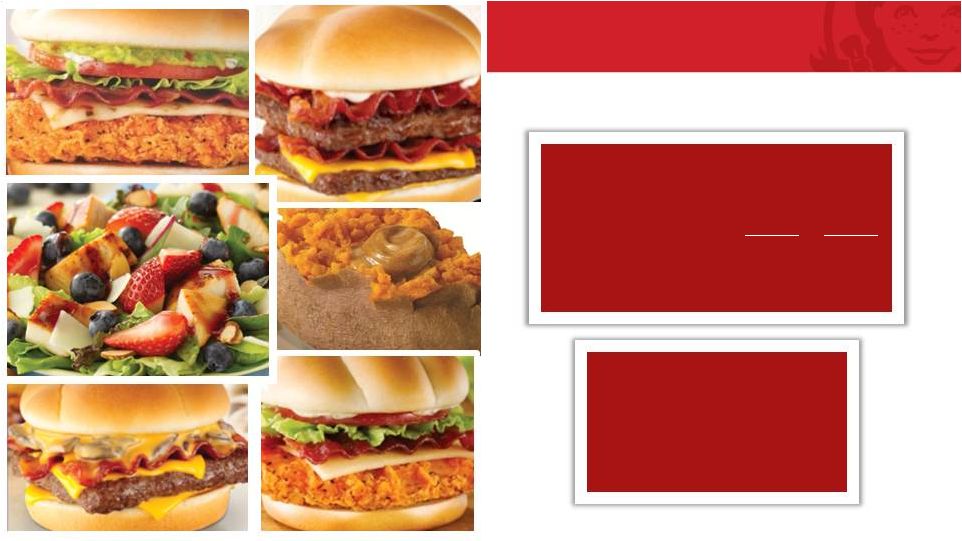

Innovation: Premium Limited-Time Offerings

11

New QSR

Quality at a QSR

Price |

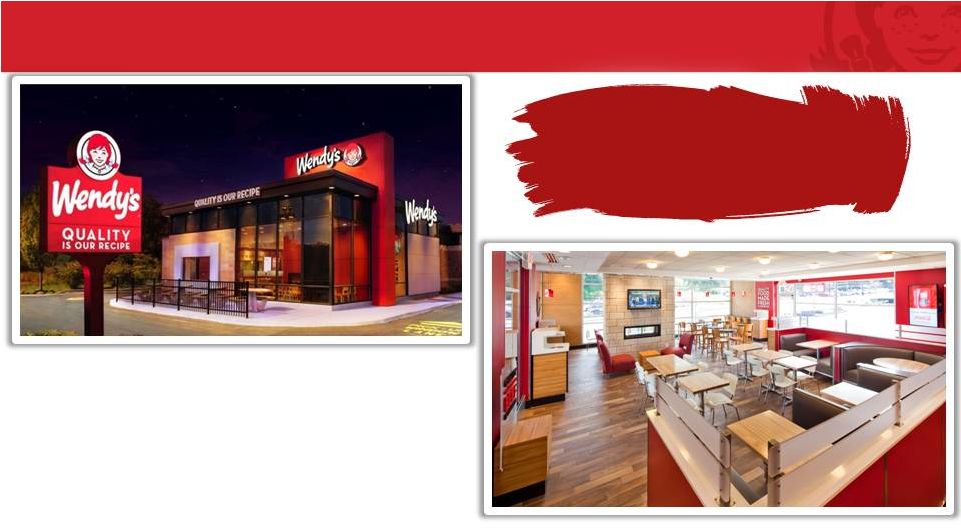

Image

Activation Update 12

2011: 10 company prototypes

2012: 48 company Tier I reimages

Reimages averaging

+25% sales growth |

2013

Company Image Activation 13

Estimates based on Company’s current outlook.

32 Tier II Remodels in 2013

20 Tier III Remodels in 2013

Tier II

Tier III |

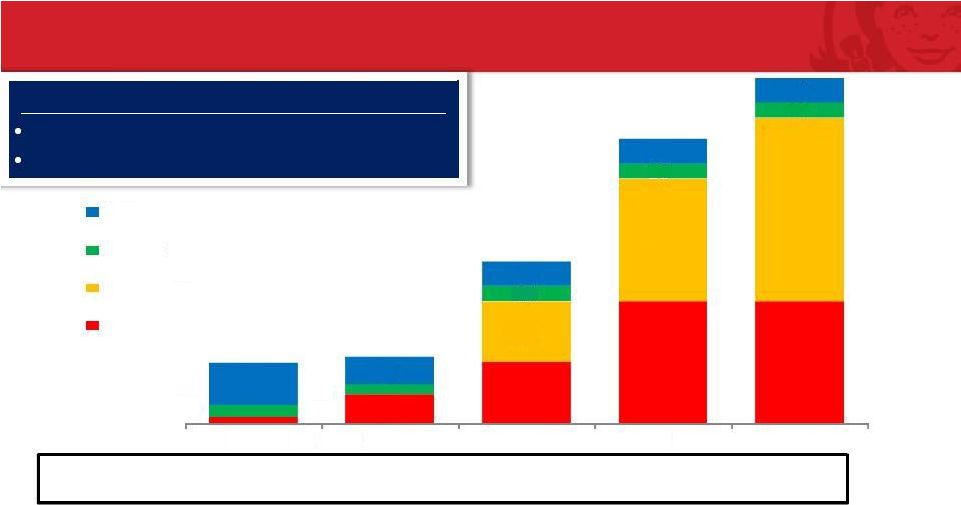

Image

Activation Multi-Year Growth Plan Image Activation Multi-Year Growth

Plan 14

Cumulative

IA Restaurants

10

76

301

766

1,331

Image Activation Progress by Year-End 2015:

Note: New Company restaurants were Image Activation building design beginning

in 2012; 2 of 45 new Franchise restaurants were Image Activation in

2012. Estimates based on Company’s current outlook.

10

48

100

200

200

100

200

300

20

16

25

69

45

40

40

40

2011

2012

2013

2014

Fr. New

Co. New

Fr. Reimage

Co. Reimage

25

25

50% of Company restaurants

1 out of 5 of the Wendy’s System restaurants

2015 |

STEVE

HARE Chief Financial Officer

15

©

2013 Oldemark LLC |

Q4 2012

Financial Summary 16

Q4 2012

Q4 2011

Better/

(Worse)

Sales

554.0

$

538.5

$

15.5

$

Franchise revenues

75.9

76.5

(0.6)

Total revenues

629.9

$

615.0

$

14.9

$

growth rate

2.4%

Adjusted EBITDA from continuing operations*

95.9

$

80.9

$

15.0

$

Adjusted EPS*

0.09

$

0.04

$

0.05

$

(Unaudited)

($ in millions except per share amounts)

*See reconciliation of Adjusted EBITDA from continuing operations and Adjusted

EPS in the appendix. *See reconciliation of Adjusted EBITDA from

continuing operations and Adjusted EPS in the appendix. |

FY 2012

Highlights 17

2012 North America

Same-Store Sales

1-Year

2-Year

2012 Company

Restaurant Margin

2012 14.0%

2011 14.0%

Franchise

1.6%

3.5%

3.6%

Company-Operated

1.6% |

FY 2012

Financial Summary 18

18

2012

2011

Better/

(Worse)

Sales

2,198.3

$

2,126.6

$

71.7

$

Franchise revenues

306.9

304.8

2.1

Total revenues

2,505.2

$

2,431.4

$

73.8

$

growth rate

3.0%

Adjusted EBITDA from continuing operations*

333.3

$

331.1

$

2.2

$

Adjusted EPS*

0.17

$

0.15

$

0.02

$

($ in millions except per share amounts)

*See reconciliation of Adjusted EBITDA from continuing operations and Adjusted

EPS in the appendix. |

Income from

Continuing Operations and Special Items 20

(Unaudited)

($ in Thousands, Except per Share Amounts)

Per share

Per share

Per share

Per share

Adjusted income and adjusted earnings per share from continuing operations

33,629

$

0.09

$

16,425

$

0.04

$

65,316

$

0.17

$

62,080

$

0.15

$

(Less) plus:

Loss on early extinguishment of debt

-

-

-

-

(46,547)

(0.12)

-

-

Facilities relocation costs and other transactions

(8,311)

(0.02)

(9,288)

(0.02)

(25,349)

(0.07)

(28,514)

(0.07)

Gain on sale of investment, net

-

-

-

-

17,978

0.05

-

-

Impairment of long-lived assets

(8,216)

(0.02)

(2,847)

(0.01)

(13,017)

(0.04)

(7,936)

(0.02)

Benefits of prior years' tax matters

5,439

0.01

-

-

7,620

0.02

-

-

Dividend from Arby's

2,868

0.01

-

-

2,868

0.01

-

-

Costs associated with closed restaurants in other operating expense, net

-

-

-

-

(911)

(0.00)

-

-

Arby's indirect corporate overhead in general and administrative (G&A)

-

-

-

-

-

-

(9,140)

(0.02)

SSG purchasing cooperative expenses in G&A

-

-

-

-

-

-

1,422

0.00

Total adjustments

(8,220)

(0.02)

(12,135)

(0.03)

(57,358)

(0.15)

(44,168)

(0.11)

Income from continuing operations

25,409

0.07

4,290

0.01

7,958

0.02

17,912

0.04

Net income (loss) from discontinued operations

979

0.00

(306)

(0.00)

1,509

0.00

(8,037)

(0.02)

Net income

26,388

0.07

3,984

0.01

9,467

0.02

9,875

0.02

Net income attributable to noncontrolling interests

-

-

-

-

(2,384)

(0.00)

-

-

Net income and earnings per share attributable to The Wendy's Company

26,388

$

0.07

$

3,984

$

0.01

$

7,083

$

0.02

$

9,875

$

0.02

$

2012

2011

2012

2011

Three Months

Twelve Months

*See reconciliation of Adjusted EPS in the appendix.

19 |

FY 2012

Cash Flow Highlights 20

2012 IA Cap Ex

Image Activation -

New $27

Image Activation -

Reimages 45

Total Image

Activation $72 ($

in millions) Cash flow from operations

190.4

$

Capital expenditures

197.6

Beginning cash balance

475.2

$

Change in cash

(21.8)

Ending cash balance

453.4

$

2012 |

Selected

Balance Sheet Highlights 21

($ in millions)

Cash

453

$

Senior Debt

1,425

$

Capital Leases and Other Debt

33

Total Debt

1,458

$

2012 Adjusted EBITDA*

333

$

Total Debt / 2012 Adjusted EBITDA*

4.4x

Net Debt / 2012 Adjusted EBITDA*

3.0x

Dec. 30, 2012

*See reconciliation of Adjusted EBITDA from continuing operations in the

appendix. 21

*See reconciliation of Adjusted EBITDA from continuing operations in the

appendix. |

•

SSS +2% to 3%

•

Traffic and check growth from core business: new products, marketing, operations

•

Image Activation benefit, offset by fewer breakfast restaurants

•

Commodities +90 to 120 bps

•

Increases in beef and chicken, partially offset by cost-savings initiatives

•

Renewable

Fuel

Standard

diverting

more

than

40%

of

U.S.

corn

crop

to

gasoline

production

•

Company-Operated Restaurant Margin 14.2% to 14.5% (+20 to 50 bps from

14.0% in 2012)

•

Sales leverage, Image Activation impact, discontinuation of breakfast at certain

restaurants and cost savings initiatives

•

Adj. EBITDA $350 to $360 million, +5% to 8% vs. $333.3 million in 2012

•

Adj. EPS $0.18 to $0.20, +6% to 18% vs. $0.17 in 2012

2013 Outlook

22

Estimates based on Company’s current outlook.

|

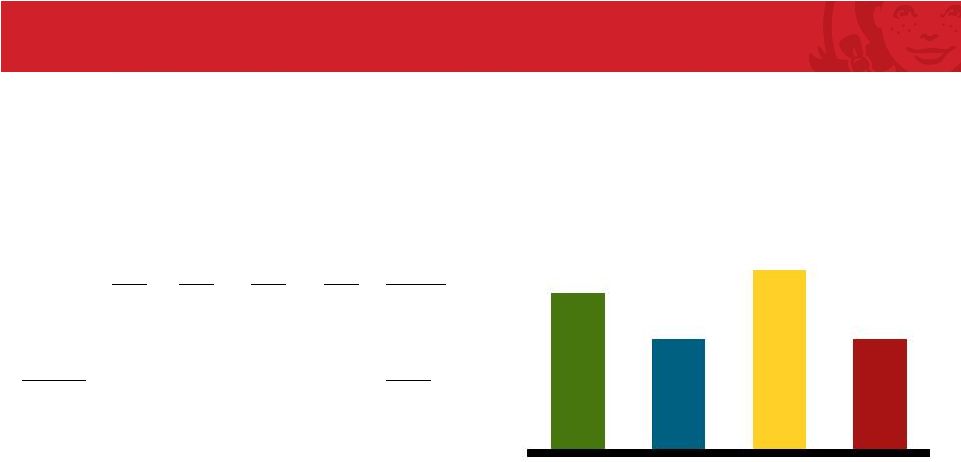

•

2013: Higher Adjusted EBITDA growth in Q1, lower growth in

Q4 Factors Affecting 2013 Outlook vs. 2012

23

•

Unusually soft results in Q1 2012, but expect Q1 2013 Adjusted

EBITDA more in line with historical trends

•

Expect $10 million of Image Activation incentives will increase Q4

2013 G&A expense

Q1

Q2

Q3

Q4

2012

SSS

0.8%

3.2%

2.7%

-0.2%

1.6%

Adj. EBITDA*

$63.9

$89.1

$84.5

$95.9

$333.3

2012 SSS and Adjusted EBITDA*

*See reconciliation of Q4 2012 and 2012 Adjusted EBITDA from continuing

operations and Adjusted EPS in the appendix. *See reconciliation of Q4

2012 and 2012 Adjusted EBITDA from continuing operations in the appendix. |

2013

Image Activation Outlook 24

Q1

Q2

Q3

Q4

2013

Co.

6

35

37

22

100

Fran.

100

Total

200

Image Activation Quarterly Reopenings

Company Image Activation Plan

Estimates based on Company’s current outlook

Estimates based on Company’s current outlook.

Scrape &

Rebuilds

Tier I

Reimages

Tier II

Reimages

Tier III

Reimages

28

20

32

20 |

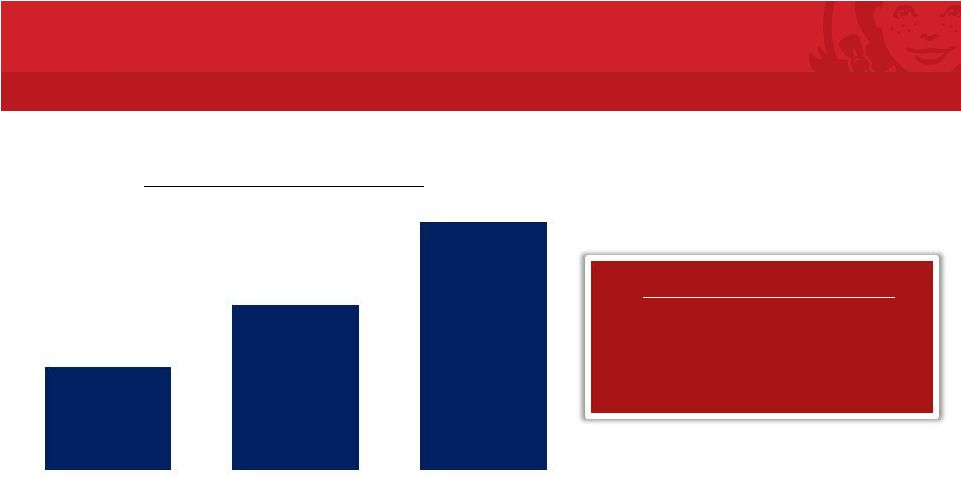

2013 New

Restaurant Development 25

Expect 120 to 130 New System Restaurants in 2013

Company

Franchise

Global Note: New restaurant

numbers represent the midpoint of the expected range; Estimates based on Company’s current outlook.

2013 New Restaurants

25

40

60

2013 Expected Closures

N.A. Company: 20 to 30

N.A. Franchise: 90 to 100

Global: 15 to 20 |

2013

Capital Expenditures 26

Restaurant Equipment & Maintenance

$40

Product Dev./Equipment Upgrades/Other

20

Technology/POS

40

Base Cap Ex

100

New Restaurants

50

Reimages

95

Image Activation Cap Ex

145

Total Projected Cap Ex

$245

2012

Cap Ex

$198 mil

Estimates based on Company’s current outlook

Estimates based on Company’s current outlook. |

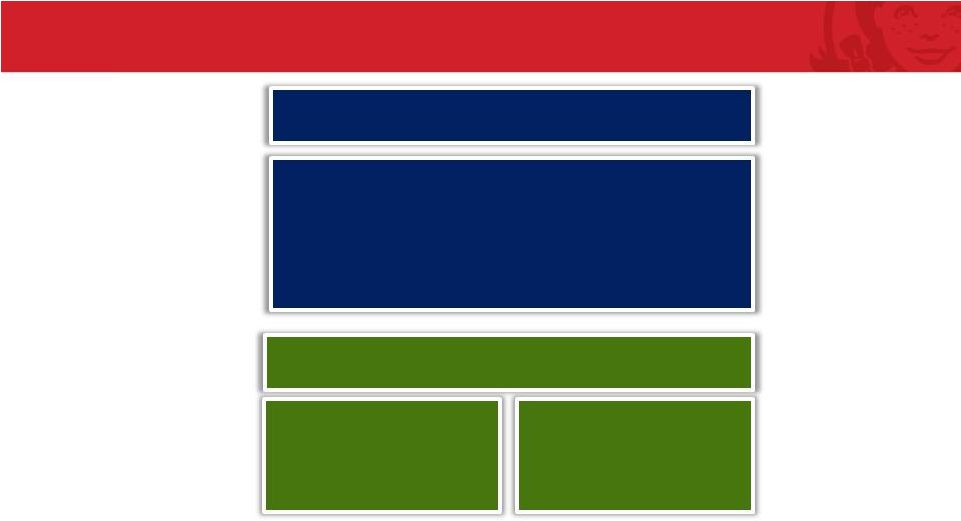

Strong

Free Cash Flow & Balance Sheet 27

Accelerating Investment in

Image Activation:

Expect $440 to $500 million

2013 to 2015

Return Capital to Shareholders

Estimates based on Company’s current outlook.

$100 million share

repurchase program

authorized through

12/29/13

100% increase in

quarterly dividend

rate effective

Q4 2012

Core Growth Priority |

2013 and

Long-Term Earnings Outlook 28

Adjusted EBITDA:

$350 to $360 million

Adjusted EPS:

$0.18 to $0.20

Average annual

Adjusted EBITDA

and Adjusted EPS

growth rates in

high-single-digit to

low-double-digit

range

2013

Long-Term

Estimates based on Company’s current outlook

28

Estimates based on Company’s current outlook. |

EMIL

BROLICK President & CEO

29

©

2013 Oldemark LLC |

A Total

Brand Transformation 30 |

JOHN

BARKER Chief Communications Officer

31

©

2013 Oldemark LLC |

2013

Events March 13:

Bank of America Merrill Lynch Consumer Conference

March 14:

UBS Global Consumer Conference

April 3-5:

Morgan Stanley Retail Conference

May 8:

Q1 2013 Earnings Release

May 23:

Annual Shareholder Meeting

Investor Relations Calendar

32 |

Q&A

33 |

Appendix

34 |

Reconciliation of Adjusted EBITDA from Continuing Operations

to Net Income Attributable to The Wendy’s Company

36

35

(Unaudited)

($ in Thousands)

2012

2011

2012

2011

Adjusted EBITDA from continuing operations

95,883

$

80,870

$

333,328

$

331,055

$

(Less) plus:

Depreciation and amortization

(36,840)

(32,020)

(146,976)

(122,992)

Impairment of long-lived assets

(13,316)

(4,621)

(21,097)

(12,883)

Costs associated with closed restaurants in other operating

expense, net

-

-

(1,477)

-

Facilities relocation costs and other transactions

(13,470)

(14,949)

(41,031)

(45,711)

Arby's indirect corporate overhead in general and

administrative (G&A)

-

-

-

(14,623)

SSG purchasing cooperative expense reversal in G&A

-

-

-

2,275

Operating profit

32,257

29,280

122,747

137,121

Interest expense

(20,801)

(28,195)

(98,604)

(114,110)

Loss on early extinguishment of debt

-

-

(75,076)

-

Investment income, net

6,786

296

36,243

484

Other, net

551

239

1,565

945

Income (loss) from continuing operations before

income taxes and noncontrolling interests

18,793

1,620

(13,125)

24,440

Benefit from (provision for) income taxes

6,616

2,670

21,083

(6,528)

Income from continuing operations

25,409

4,290

7,958

17,912

Discontinued operations:

Income (loss) from discontinued operations, net of income taxes

1,167

(356)

1,951

762

(Loss) income on disposal of discontinued operations, net of income taxes

(188)

50

(442)

(8,799)

Net income (loss) from discontinued operations

979

(306)

1,509

(8,037)

Net income

26,388

3,984

9,467

9,875

Net income attributable to noncontrolling interests

-

-

(2,384)

-

Net income attributable to The Wendy's Company

26,388

$

3,984

$

7,083

$

9,875

$

Three Months

Twelve Months |

Reconciliation of Adjusted Income and Adjusted Earnings Per Share

from Continuing Operations to Net Income and Earnings Per Share

Attributable to The Wendy’s Company

36

(Unaudited)

($ in Thousands, Except per Share Amounts)

Per share

Per share

Per share

Per share

Adjusted income and adjusted earnings per share from continuing operations

33,629

$

0.09

$

16,425

$

0.04

$

65,316

$

0.17

$

62,080

$

0.15

$

(Less) plus:

Loss on early extinguishment of debt

-

-

-

-

(46,547)

(0.12)

-

-

Facilities relocation costs and other transactions

(8,311)

(0.02)

(9,288)

(0.02)

(25,349)

(0.07)

(28,514)

(0.07)

Gain on sale of investment, net

-

-

-

-

17,978

0.05

-

-

Impairment of long-lived assets

(8,216)

(0.02)

(2,847)

(0.01)

(13,017)

(0.04)

(7,936)

(0.02)

Benefits of prior years' tax matters

5,439

0.01

-

-

7,620

0.02

-

-

Dividend from Arby's

2,868

0.01

-

-

2,868

0.01

-

-

Costs associated with closed restaurants in other operating expense, net

-

-

-

-

(911)

(0.00)

-

-

Arby's

indirect

corporate

overhead

in

general

and

administrative

(G&A)

-

-

-

-

-

-

(9,140)

(0.02)

SSG purchasing cooperative expenses in G&A

-

-

-

-

-

-

1,422

0.00

Total adjustments

(8,220)

(0.02)

(12,135)

(0.03)

(57,358)

(0.15)

(44,168)

(0.11)

Income from continuing operations

25,409

0.07

4,290

0.01

7,958

0.02

17,912

0.04

Net income (loss) from discontinued operations

979

0.00

(306)

(0.00)

1,509

0.00

(8,037)

(0.02)

Net income

26,388

0.07

3,984

0.01

9,467

0.02

9,875

0.02

Net income attributable to noncontrolling interests

-

-

-

-

(2,384)

(0.00)

-

-

Net income and earnings per share attributable to The Wendy's Company

26,388

$

0.07

$

3,984

$

0.01

$

7,083

$

0.02

$

9,875

$

0.02

$

2012

2011

2012

2011

Reconciliation of Adjusted Income and Adjusted Earnings Per Share from Continuing

Operations to Net Income and Earnings Per Share Attributable to The Wendy's

Company (In Thousands Except Per Share Amounts)

(Unaudited)

Three Months

Twelve Months |