Attached files

| file | filename |

|---|---|

| 8-K - 2-27-13 KBW PRESENTATION - INDEPENDENT BANK CORP | investorpresentationcover8.htm |

Keefe, Bruyette & Woods 2013 Boston Bank Conference February 27, 2013 Christopher Oddleifson President & Chief Executive Officer Denis K. Sheahan Chief Financial Officer Exhibit 99.1

• Main Sub: Rockland Trust • Market: Eastern Massachusetts • Loans: $4.5 B • Deposits: $4.5 B • $AUA: $2.2 B • Market Cap: $0.7 B • NASDAQ: INDB Who We Are 2

• Strong fundamentals driving solid performance • Robust growth from new and existing customers • Expanding footprint into attractive markets • Rockland Trust brand gaining increased traction • Investing for growth in high priority businesses • Disciplined risk management culture • Strong capital position Key Messages 3

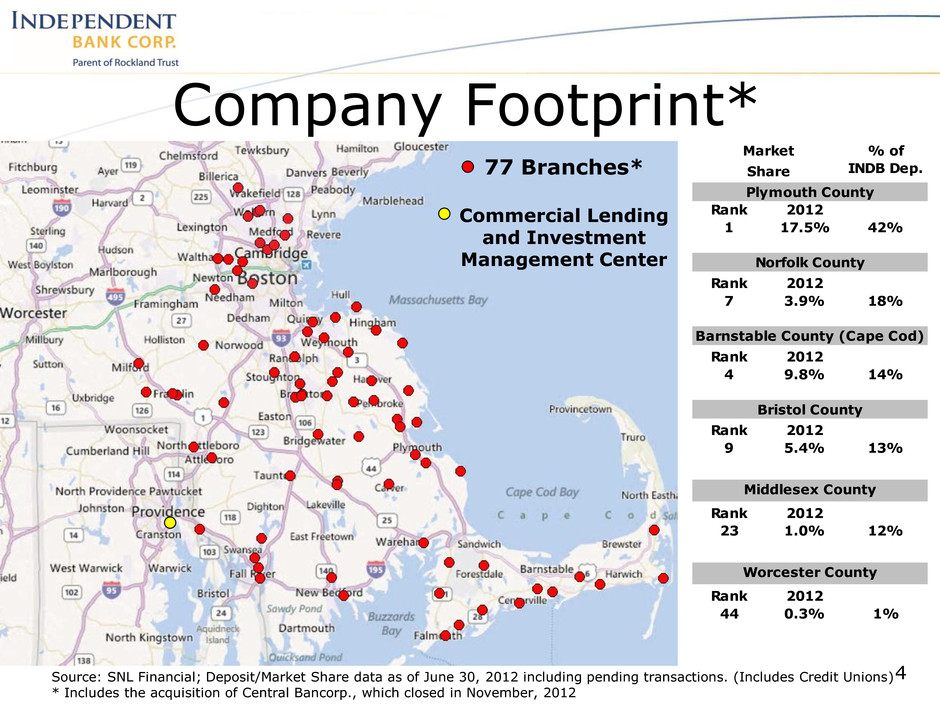

Company Footprint* 4 Rank 2012 1 17.5% 42% Rank 2012 7 3.9% 18% Rank 2012 4 9.8% 14% Rank 2012 9 5.4% 13% Rank 2012 23 1.0% 12% Rank 2012 44 0.3% 1% Worcester County Middlesex County Norfolk County % of INDB Dep.Share Barnstable County (Cape Cod) Market Plymouth County Bristol County Source: SNL Financial; Deposit/Market Share data as of June 30, 2012 including pending transactions. (Includes Credit Unions) * Includes the acquisition of Central Bancorp., which closed in November, 2012 77 Branches* Commercial Lending and Investment Management Center

• Excellent organic loan and core deposit growth • Capitalized on commercial banking expansion • Very successful customer acquisition campaigns • Double digit growth in core fee income • Grew franchise value via Central Bank acquisition • TBV continued to rise – up 5% in ‘12 • New Market Tax Credits Award (4th time) 2012 Accomplishments 5

Rockland Trust is the #1 ranked New England bank in Customer Satisfaction! 6 2012 Accomplishments

Strong Fundamentals Driving Performance 7 28.0 40.3 45.5 47.1 2009 2010 2011 2012 Operating Earnings ($ Mil.) Diluted EPS $1.43 $1.90 $2.12 $2.16 +13% +44% +4% • Excellent loan growth • Core dep. at 83% • Growing wealth mgmt. • Solid asset quality vs. peers • Strong capital • Core ROA of 1% (4Q’12) • E.P.S. growth of 8% in ‘12 excl. cust. loan fraud

Robust Core Business Generation ($ Mil.) 8 401 617 897 2008 2011 2012 Comm’l Loan Originations 428 587 668 2008 2011 2012 Consumer Loan Originations (Resi’s & Home Eq.) +22% CAGR +12% CAGR 12/12 vs. 12/11 12/12 vs. 9/12 #12% #13% annualized #14% Flat Comm’l Loan $ Bal. Home Equity $ Organic Growth

Strong Commercial and Industrial Loan Growth ($ Bal.-mil.) 9 271 374 503 576 688 2008 2009 2010 2011 2012 +26.2% CAGR (24.3% ex acquisitions) Adding High Quality Corporate Customers Yr. end

Attractive Balance Sheet Profile (4Q’12) Sec./ST Inv. 12% Resi Mtges 12% Home Eq 15% Other 1% Comm'l Loans 60% EARNING ASSETS $5.2 B Very Focused On Containing Deposit Costs Shift Towards Higher Yielding Assets Demand Deposits 27% Money Market 19% Savings/Now 37% CD's 17% TOTAL DEPOSITS $4.5 B AVG. COST: 0.25%

Net Interest Margin Fairly steady over various rate cycles Current low rate environment adding pressure 11 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 4Q05 4Q06 4Q07 4Q08 4Q09 4Q10 4Q11 4Q12 Fed Funds NIM (FTE) 5 yr SWAP

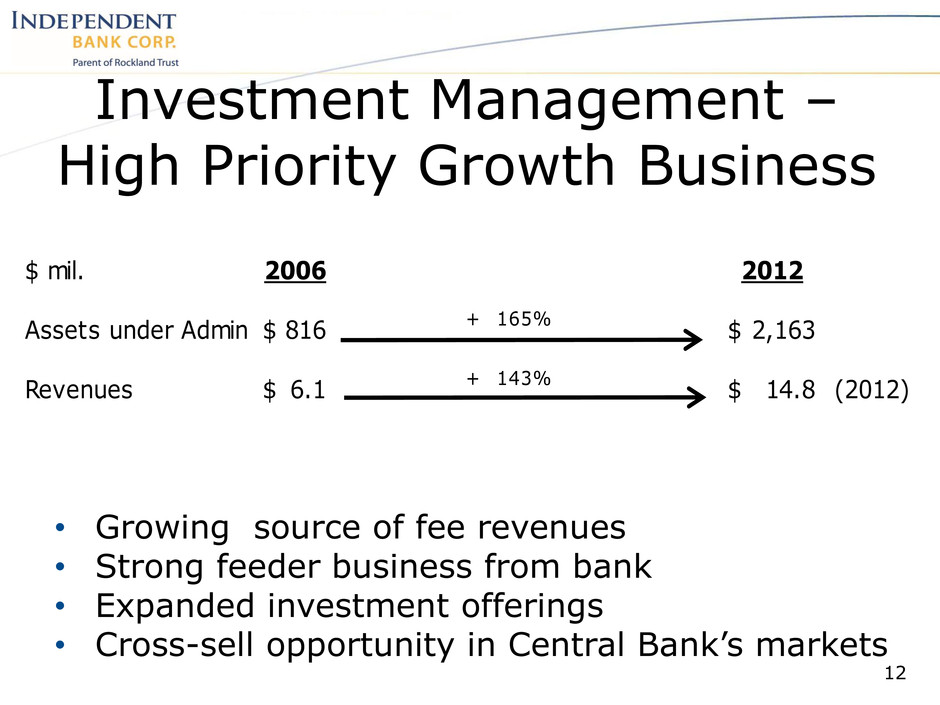

Investment Management – High Priority Growth Business 12 • Growing source of fee revenues • Strong feeder business from bank • Expanded investment offerings • Cross-sell opportunity in Central Bank’s markets $ mil. 2006 2012 Assets under Admin. 816$ + 165% 2,163$ Revenues 6.1$ + 143% 14.8$ (2012)

Asset Quality – Well Managed 36.2 23.1 29.0 28.8 2009 2010 2011 2012 NPL’s ($ Mil.) 12.0 14.8 9.5 4.8 customer fraud 9.7 2009 2010 2011 2012 Net Chargeoffs ($ Mil.) NPL/Loan % 1.07% 0.65% 0.76% 0.64% Peers 2.86%* Loss Rate 38bp 43bp 26bp 36bp Peers 64bp* Yr. end * Source: FFIEC Peer Group 2; $3-10 Billion in Assets, September 30, 2012 Incl. 90 days + overdue 14.5

Strong Loan Loss Reserves 14 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% Reserves/Loans Net Chargeoffs/Avg. Loans (annualized) Reserves a Healthy Multiple of Loss Rate Reflects loans acquired at FV Reflects customer fraud

Strong Capital 15 7.9% 8.2% 8.6% 8.7% 2009 2010 2011 2012 Tier 1 Leverage % 6.7% 6.9% 7.2% 6.9% 2009 2010 2011 2012 Tangible Common %(1) (1)Includes tax deductibility of certain goodwill (2)Estimated at 12/31/12 • Strong internal capital generation • No external capital raising • No dividend cuts $13.85 $14.86 $16.21 $17.00 2009 2010 2011 2012 Tangible Book Value(1) (Period end) (2)

Attentive to Shareholder Returns 16 $0.68 $0.72 $0.72 $0.72 $0.76 $0.84 2007 2008 2009 2010 2011 2012 Cash Dividends Per Share

Business Opportunities • Expanded Commercial Presence (Providence, Waltham) • Asset-Based Lending • Investment Management • Mobile Banking • Image ATMs Investing for Future Growth 17

Sustaining Business Momentum 18 Business Line Focal Points •Expand Market Presence •Grow C&I Client Base •Expand Specialty Products, e.g. ABL Commercial •Continue to Drive Household Growth •Expand Electronic Banking Platform •Optimize Branch Network Retail Delivery •Capitalize on Strong Market Demographics •Target COI Opportunity •Continue Strong Branch/Commercial Referrals Investment Management •Scalable Resi Mortgage Origination Platform •Continue Aggressive H.E. Marketing Consumer Lending

• Closed November, 2012 • Attractive financial return – Highly accretive to earnings: +7% in 2013 – IRR of 15.4% – Modest dilution to TBV and TCE/TA with short earn-back period • Significantly increases footprint in eastern Middlesex County, a natural market extension with attractive demographics – Part of the Boston MSA – the 10th largest MSA by population in the U.S.1 – Largest population of any county in New England (~1.5 million) and third highest median household income (~$78K)1 • Introduction of INDB operating model will provide: – Significant opportunity for improved efficiencies – Attractive platform for broader INDB product lines Central Bancorp. (CEBK) Acquisition Strategic Rationale 19 1 Source: SNL Financial; U.S. Bureau of Economic Analysis

Investment Management Commercial Banking Retail/ Consumer • $2 Bil. AUA • Wealth/Institutional • Sophisticated Products • Expanded presence • Knowledgeable bankers Central Bancorp. Customer Base Capitalizing on Rockland Trust Brand • Top-rated customer satisfaction • Electronic banking • Home equity INDB Winning Businesses – Major Opportunities 20

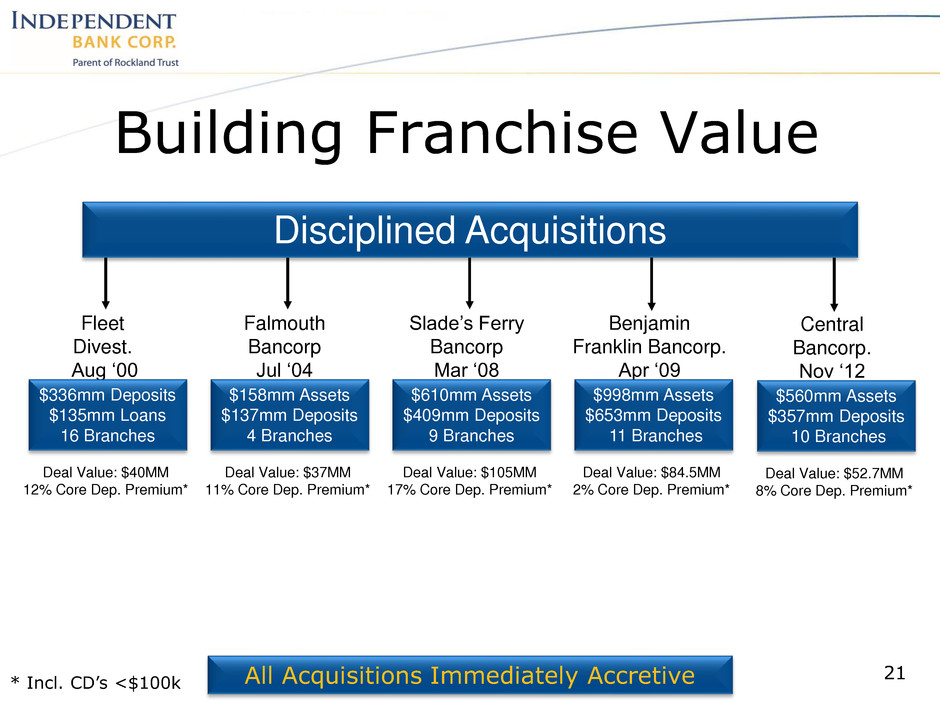

Building Franchise Value 21 All Acquisitions Immediately Accretive Deal Value: $40MM 12% Core Dep. Premium* Fleet Divest. Aug ‘00 $336mm Deposits $135mm Loans 16 Branches Deal Value: $37MM 11% Core Dep. Premium* Falmouth Bancorp Jul ‘04 $158mm Assets $137mm Deposits 4 Branches Deal Value: $105MM 17% Core Dep. Premium* Slade’s Ferry Bancorp Mar ‘08 $610mm Assets $409mm Deposits 9 Branches Deal Value: $84.5MM 2% Core Dep. Premium* Benjamin Franklin Bancorp. Apr ‘09 $998mm Assets $653mm Deposits 11 Branches Deal Value: $52.7MM 8% Core Dep. Premium* Central Bancorp. Nov ‘12 $560mm Assets $357mm Deposits 10 Branches Disciplined Acquisitions * Incl. CD’s <$100k

2013 Outlook Key Expectations 22 Loan Growth +4 – 5% Led by commercial segment Deposits +3 – 4% Continued core deposit growth Net Chargeoffs $10 – 14 MM Provision $12 – 16 MM Net Int. Margin FY: Mid 3.50s% ≈ 3.6% beg. of yr. ≈ 3.5% towards yr. end Non-Interest Inc. +6 – 8% Growth from multiple sources NIE +7 – 9% Includes full year of Central Bank ≈ 2% organic growth Tax Rate ≈ 25% vs. 26% in 2012

• High quality franchise in attractive markets • Strong on-the-ground business volumes • Operating platform that can be leveraged further • Investing for growth in competitive strengths • Balance sheet equipped to deal with uncertainty • Diligent stewards of shareholder capital • Grounded management team • Positioned to grow, build, and acquire to drive long-term value creation INDB – Investment Merits 23

NASDAQ Ticker: INDB www.rocklandtrust.com Denis Sheahan - CFO Shareholder Relations: Jennifer Kingston (781) 878-6100 Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time.

Appendix

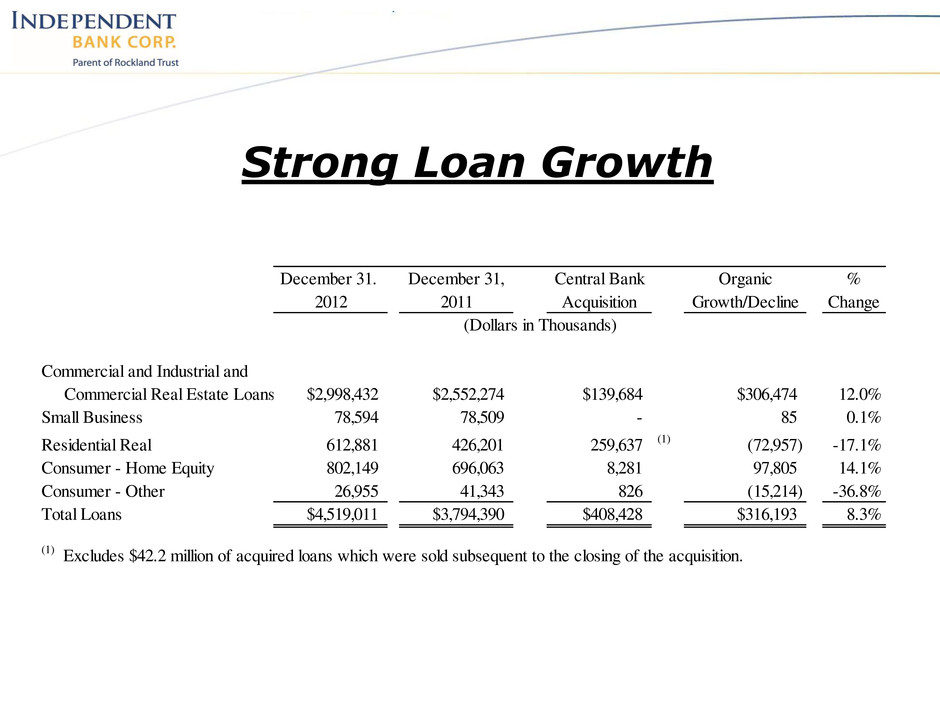

Strong Loan Growth December 31. December 31, Central Bank Organic % 2012 2011 Acquisition Growth/Decline Change (Dollars in Thousands) Commercial and Industrial and Commercial Real Estate Loans $2,998,432 $2,552,274 $139,684 $306,474 12.0% Small Business 78,594 78,509 - 85 0.1% Residential Real 612,881 426,201 259,637 (1) (72,957) -17.1% Consumer - Home Equity 802,149 696,063 8,281 97,805 14.1% Consumer - Other 26,955 41,343 826 (15,214) -36.8% Total Loans $4,519,011 $3,794,390 $408,428 $316,193 8.3% (1) Excludes $42.2 million of acquired loans which were sold subsequent to the closing of the acquisition.

Strong Core Deposit Growth December 31. December 31, Central Bank Organic % 2012 2011 Acquisition Growth/Decline Change (Dollars in Thousands) Demand Deposits $1,248,394 $992,418 $75,438 $180,538 18.2% Savings and Interest Checking Accounts 1,691,187 1,473,812 65,110 152,265 10.3% Money Market 853,971 780,437 72,849 685 0.1% Time Certificates of Deposit 753,125 630,162 144,037 (21,074) -3.3% Total Deposits $4,546,677 $3,876,829 $357,434 $312,414 8.1%