Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Excel Trust, Inc. | d493518d8k.htm |

| EX-99.1 - EX-99.1 - Excel Trust, Inc. | d493518dex991.htm |

Exhibit 99.2

Supplemental Operating and Financial Data

For the Period Ended December 31, 2012

Table of Contents

| Page | ||||

| Company Overview |

3 | |||

| Property Locations |

4 | |||

| Analyst Coverage |

5 | |||

| Summary Financial and Portfolio Data |

6 | |||

| Financial Summary |

||||

| Consolidated Balance Sheets |

7 | |||

| Consolidated Statements of Operations |

8 | |||

| Reconciliation of Net Income to EBITDA |

9 | |||

| Reconciliation of Net Income to FFO and AFFO |

10 | |||

| Debt Summary |

11 | |||

| Common and Preferred Stock Data |

12 | |||

| Portfolio Summary |

||||

| Acquisitions & Developments |

13 | |||

| Portfolio Summary |

14 | |||

| Summary of Retail Leasing Activity |

15 | |||

| Same Property Analysis |

16 | |||

| Major Tenants |

17 | |||

| Expiration Schedule |

18 | |||

| Unconsolidated Investments |

19 | |||

| Definitions |

20 | |||

| * | Note: Financial and portfolio information reflects the consolidated operations of the company and excludes unconsolidated entities unless otherwise noted. |

Company Overview

Excel Trust, Inc. (“Excel Trust”) is a retail focused REIT that primarily targets community and power centers, grocery anchored neighborhood centers and freestanding retail properties. Excel Trust has elected to be treated as a REIT, for U.S. federal income tax purposes. Excel Trust trades publicly on the NYSE under the symbol “EXL” .

| Corporate Headquarters | Other Offices | |||

| Excel Trust, Inc. | Atlanta, GA | Salt Lake City, UT | ||

| 17140 Bernardo Center Dr., Ste 300 | Dallas, TX | Scottsdale, AZ | ||

| San Diego, CA 92128 | Orlando, FL | Stockton, CA | ||

| Tel: 858-613-1800 | Richmond, VA | |||

| Email: info@exceltrust.com | ||||

| Website: www.exceltrust.com | ||||

| Executives & Senior Management | ||||

| Gary B. Sabin - Chairman & CEO | Spencer G. Plumb - President & COO | |||

| James Y. Nakagawa - CFO | Mark T. Burton - CIO & SVP, Acquisitions | |||

| S. Eric Ottesen - SVP, General Counsel | William J. Stone - SVP, Asset Management/Development | |||

| Matthew S. Romney - SVP, Capital Markets | John P. Still - SVP, Leasing | |||

| Board of Directors | ||||

| Gary B. Sabin (Chairman) | Spencer G. Plumb | |||

| Mark T. Burton | Bruce G. Blakley | |||

| Burland B. East III | Robert E. Parsons, Jr. | |||

| Warren R. Staley | ||||

| Transfer Agent and Registrar | Corporate Counsel | |||

| Continental Stock Transfer & Trust Company | Latham & Watkins | |||

| 17 Battery Place, 8th Floor | 12636 High Bluff Drive, Suite 400 | |||

| New York, New York 10004 | San Diego, CA 92130 | |||

| Tel: 212-509-4000 | Tel: 858-523-5400 | |||

| Email: cstmail@continentalstock.com | ||||

| Website: www.continentalstock.com | ||||

Reported results and other information herein are preliminary and not final until the filing of Excel Trust’s report on Form 10-Q or Form 10-K with the Securities and Exchange Commission and, therefore, remain subject to adjustment.

Forward-Looking Statements

This document contains forward-looking statements that are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks include, without limitation: adverse economic or real estate developments in the retail industry or the markets in which Excel Trust operates; defaults on or non-renewal of leases by tenants; increased interest rates and operating costs; decreased rental rates or increased vacancy rates; Excel Trust’s failure to obtain necessary outside financing on favorable terms or at all; changes in the availability of additional acquisition opportunities; Excel Trust’s inability to successfully complete real estate acquisitions or successfully operate acquired properties and Excel Trust’s failure to qualify or maintain its status as a REIT. For a further list and description of such risks and uncertainties that could impact Excel Trust’s future results, performance or transactions, see the reports filed by Excel Trust with the Securities and Exchange Commission, including its final prospectus relating to its initial public offering, quarterly reports on Form 10-Q and annual report on Form 10-K. Excel Trust disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Page 3

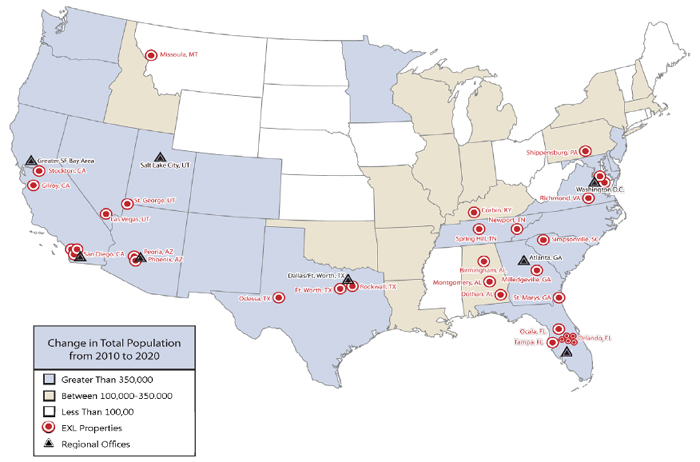

Property Locations

4

Analyst Coverage

| Company | Analyst | Contact | ||

| Barclays Capital |

Ross Smotrich | (212) 526-2306 | ||

| Bank of America Merrill Lynch |

Craig Schmidt | (646) 855-3640 | ||

| Katharine Hutchins | (646) 855-1681 | |||

| Cantor Fitzgerald |

David Toti | (212) 915-1219 | ||

| Evan Smith | (212) 915-1220 | |||

| KeyBanc |

Jordan Sadler | (917) 368-2280 | ||

| Todd Thomas | (917) 368-2286 | |||

| Morgan Stanley |

Paul Morgan | (415) 576-2627 | ||

| Stephen Bakke | (415) 576-2696 | |||

| Raymond James |

Paul D. Puryear | (727) 567-2253 | ||

| R.J. Milligan | (727) 567-2660 | |||

| Sandler O’Neill + Partners |

Alexander Goldfarb | (212) 466-7937 | ||

| Andrew Schaffer | (212) 466-8062 | |||

| Stifel, Nicolaus |

Nathan Isbee | (443) 224-1346 | ||

| Jennifer Hummert | (443) 224-1288 | |||

| UBS |

Ross Nussbaum | (212) 713-2484 | ||

| Christy McElroy | (203) 719-7831 | |||

| Wells Fargo |

Jeff Donnelly | (617) 603-4262 | ||

| Tamara Fique | (443) 263-6568 | |||

Page 5

Summary Financial and Portfolio Data (Consolidated)

For the Period Ended December 31, 2012

(Dollars and share data in thousands, except per share data)

| Portfolio Summary |

||||

| Total Gross Leasable Square Feet (GLA)-Operating Portfolio (1) |

5,466,199 | |||

| Percent Leased-Operating Portfolio |

92.8 | % | ||

| Percent Occupied-Operating Portfolio |

91.4 | % | ||

| Annualized Base Rent (2) |

$ | 77,051 | ||

| Total no. leases signed or renewed |

23 | |||

| Total sq. ft. leases signed or renewed |

53,501 | |||

| Financial Results |

||||

| Net loss attributable to the common stockholders |

$ | (2,188 | ) | |

| Net loss per diluted share |

$ | (0.06 | ) | |

| Funds from operations (FFO) |

$ | 8,570 | ||

| FFO per diluted share |

$ | 0.20 | ||

| Adjusted funds from operations (AFFO) |

$ | 8,503 | ||

| AFFO per diluted share |

$ | 0.20 | ||

| EBITDA |

$ | 15,871 | ||

| Assets |

||||

| Gross undepreciated real estate |

$ | 981,128 | ||

| Gross undepreciated assets |

$ | 1,116,019 | ||

| Total liabilities to gross undepreciated assets |

42.2 | % | ||

| Debt to gross undepreciated assets |

36.6 | % | ||

| Capitalization |

||||

| Common shares outstanding |

44,906 | |||

| OP units outstanding |

1,245 | |||

|

|

|

|||

| Total common shares and OP units |

46,151 | |||

| Closing price at quarter end |

$ | 12.67 | ||

| Equity capitalization |

$ | 584,733 | ||

| Series A convertible preferred shares (at liquidation preference of $25.00 per share) |

50,000 | |||

| Series B preferred shares (at liquidation preference of $25.00 per share) |

92,000 | |||

| Total debt (3) |

408,310 | |||

|

|

|

|||

| Total capitalization |

$ | 1,135,043 | ||

|

|

|

|||

| Debt/total capitalization |

36.0 | % | ||

| Debt/EBITDA |

6.4 | |||

| Common Stock Data |

||||

| Range of closing prices for the quarter |

$ | 11.38-12.91 | ||

| Weighted average common shares outstanding - diluted (EPS) |

40,830 | |||

| Weighted average common shares outstanding - diluted (FFO and AFFO) |

42,376 | |||

| Shares of common stock outstanding |

44,906 | |||

| (1) | Includes retail and office gross leasable area, but excludes gross leasable area from developments under construction and any planned development. |

| (2) | Annualized Base Rent excludes rental revenue from non-stabilized development properties. |

| (3) | Excludes debt discount or premium. |

Page 6

Balance Sheets

EXCEL TRUST, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

| December 31, 2012 | September 30, 2012 | June 30, 2012 | March 31, 2012 | December 31, 2011 | ||||||||||||||||

| ASSETS: |

||||||||||||||||||||

| Property: |

||||||||||||||||||||

| Land |

$ | 320,289 | $ | 262,960 | $ | 263,988 | $ | 253,999 | $ | 236,941 | ||||||||||

| Buildings |

564,352 | 395,338 | 398,441 | 372,622 | 287,226 | |||||||||||||||

| Site improvements |

51,875 | 43,283 | 41,826 | 39,649 | 28,257 | |||||||||||||||

| Tenant improvements |

42,903 | 35,003 | 33,617 | 32,214 | 28,517 | |||||||||||||||

| Construction in progress |

1,709 | 262 | 115 | 11 | 21,312 | |||||||||||||||

| Less accumulated depreciation |

(36,765 | ) | (31,074 | ) | (26,804 | ) | (22,287 | ) | (18,294 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Property, net |

944,363 | 705,772 | 711,183 | 676,208 | 583,959 | |||||||||||||||

| Cash and cash equivalents |

5,596 | 16,037 | 7,179 | 9,225 | 5,292 | |||||||||||||||

| Restricted cash |

5,657 | 5,265 | 4,925 | 4,165 | 3,680 | |||||||||||||||

| Tenant receivables, net |

5,376 | 4,270 | 2,995 | 3,588 | 4,174 | |||||||||||||||

| Lease intangibles, net |

85,646 | 68,946 | 72,666 | 71,088 | 68,556 | |||||||||||||||

| Mortgage loan receivable |

— | — | — | 2,000 | 2,000 | |||||||||||||||

| Deferred rent receivable |

5,983 | 4,920 | 4,343 | 3,722 | 2,997 | |||||||||||||||

| Other assets |

17,618 | 20,676 | 17,253 | 18,162 | 17,013 | |||||||||||||||

| Investment in unconsolidated entities |

9,015 | 1,348 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 1,079,254 | $ | 827,234 | $ | 820,544 | $ | 788,158 | $ | 687,671 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND EQUITY: |

||||||||||||||||||||

| Liabilities: |

||||||||||||||||||||

| Mortgages payable, net |

$ | 333,935 | $ | 285,069 | $ | 286,114 | $ | 243,906 | $ | 244,961 | ||||||||||

| Notes payable |

75,000 | — | — | — | 21,000 | |||||||||||||||

| Accounts payable and other liabilities |

25,319 | 18,798 | 15,847 | 17,784 | 21,080 | |||||||||||||||

| Lease intangibles, net |

26,455 | 16,122 | 16,444 | 16,759 | 13,843 | |||||||||||||||

| Dividends/distributions payable |

9,773 | 8,125 | 8,405 | 7,650 | 5,801 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

470,482 | 328,114 | 326,810 | 286,099 | 306,685 | |||||||||||||||

| Equity: |

||||||||||||||||||||

| Stockholders’ equity |

||||||||||||||||||||

| Preferred stock |

136,423 | 136,423 | 136,423 | 136,413 | 47,703 | |||||||||||||||

| Common stock |

448 | 348 | 336 | 335 | 302 | |||||||||||||||

| Additional paid-in capital |

459,151 | 352,282 | 346,385 | 353,061 | 319,875 | |||||||||||||||

| Cumulative deficit |

(1,414 | ) | (1,970 | ) | (2,471 | ) | (2,839 | ) | (3,277 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 594,608 | 487,083 | 480,673 | 486,970 | 364,603 | ||||||||||||||||

| Accumulated other comprehensive loss |

(572 | ) | (567 | ) | (608 | ) | (807 | ) | (811 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ equity |

594,036 | 486,516 | 480,065 | 486,163 | 363,792 | |||||||||||||||

| Non-controlling interests |

14,736 | 12,604 | 13,669 | 15,896 | 17,194 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total equity |

608,772 | 499,120 | 493,734 | 502,059 | 380,986 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

$ | 1,079,254 | $ | 827,234 | $ | 820,544 | $ | 788,158 | $ | 687,671 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The notes in the Form 10-Q or 10-K are an integral part of these condensed consolidated financial statements.

Page 7

Statements of Operations

EXCEL TRUST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data and dividends per share)

| Three Months Ended December 31, 2012 |

Three Months Ended December 31, 2011 |

Year Ended December 31, 2012 |

Year Ended December 31, 2011 |

|||||||||||||

| Revenues: |

||||||||||||||||

| Rental revenue |

$ | 20,971 | $ | 12,783 | $ | 71,522 | $ | 44,265 | ||||||||

| Tenant recoveries |

3,654 | 3,480 | 14,190 | 10,300 | ||||||||||||

| Other income |

457 | 313 | 1,432 | 662 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

25,082 | 16,576 | 87,144 | 55,227 | ||||||||||||

| Expenses: |

||||||||||||||||

| Maintenance and repairs |

1,578 | 1,441 | 5,688 | 3,792 | ||||||||||||

| Real estate taxes |

2,817 | 2,136 | 9,921 | 6,373 | ||||||||||||

| Management fees |

329 | 172 | 914 | 576 | ||||||||||||

| Other operating expenses |

1,313 | 762 | 4,085 | 3,106 | ||||||||||||

| Changes in fair value of contingent consideration |

(160 | ) | (106 | ) | (281 | ) | (434 | ) | ||||||||

| General and administrative |

3,642 | 3,846 | 13,778 | 12,773 | ||||||||||||

| Depreciation and amortization |

10,588 | 6,354 | 36,021 | 23,290 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

20,107 | 14,605 | 70,126 | 49,476 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net operating income |

4,975 | 1,971 | 17,018 | 5,751 | ||||||||||||

| Interest expense |

(4,727 | ) | (3,552 | ) | (16,556 | ) | (13,181 | ) | ||||||||

| Interest income |

48 | 70 | 173 | 297 | ||||||||||||

| Loss from equity in unconsolidated entities |

(162 | ) | — | (320 | ) | — | ||||||||||

| Gain on acquisition of real estate and sale of land parcel |

— | 542 | — | 1,479 | ||||||||||||

| Changes in fair value of financial instruments and gain on OP unit redemption |

418 | 1,238 | 1,530 | 1,154 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) from continuing operations |

552 | 269 | 1,845 | (4,500 | ) | |||||||||||

| Income from discontinued operations before gain on sale of real estate assets |

— | — | — | 1,023 | ||||||||||||

| Gain on sale of real estate assets |

— | — | — | 3,976 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from discontinued operations |

— | — | — | 4,999 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

552 | 269 | 1,845 | 499 | ||||||||||||

| Net (income) loss attributable to non-controlling interests |

4 | 9 | 18 | (51 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to Excel Trust, Inc. |

556 | 278 | 1,863 | 448 | ||||||||||||

| Preferred stock dividends |

(2,744 | ) | (875 | ) | (10,353 | ) | (3,228 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to the common stockholders |

$ | (2,188 | ) | $ | (597 | ) | $ | (8,490 | ) | $ | (2,780 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted net loss per share |

$ | (0.06 | ) | $ | (0.03 | ) | $ | (0.26 | ) | $ | (0.15 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares outstanding - basic and diluted |

40,830 | 29,272 | 34,681 | 22,465 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Dividends declared per common share |

$ | 0.1625 | $ | 0.16 | $ | 0.650 | $ | 0.605 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The notes in the Form 10-Q or 10-K are an integral part of these condensed consolidated financial statements.

Page 8

Reconciliation of Net Income to EBITDA

(Earnings before Interest, Taxes, Depreciation & Amortization)

(Dollars in thousands)

Excel Trust, Inc.’s EBITDA and a reconciliation to net income (loss) for the periods presented is as follows:

| Three Months Ended December 31, 2012 |

Three Months Ended September 30, 2012 |

Three Months Ended June 30, 2012 |

Three Months Ended March 31, 2012 |

Three Months Ended December 31, 2011 |

||||||||||||||||

| Net income (loss) attributable to Excel Trust, Inc. (1) |

$ | 556 | $ | 501 | $ | 368 | $ | 438 | $ | 278 | ||||||||||

| Add: |

||||||||||||||||||||

| Interest expense |

4,727 | 4,169 | 3,986 | 3,674 | 3,552 | |||||||||||||||

| Depreciation and amortization (2) |

10,588 | 8,602 | 8,552 | 8,279 | 6,354 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 15,871 | $ | 13,272 | $ | 12,906 | $ | 12,391 | $ | 10,184 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | The Company recently adjusted its calculation of EBITDA to exclude the impact of preferred dividends and has adjusted prior quarters accordingly. |

| (2) | Total consolidated depreciation and amortization, a portion of which is included in discontinued operations on the statements of operations. |

Page 9

Reconciliation of Net Income to FFO and AFFO

For the Periods Ended December 31, 2012

(In thousands, except per share data)

Excel Trust, Inc.’s FFO and AFFO available to common stockholders and operating partnership unitholders and a reconciliation to net income(loss) for the three months and year-ended December 31, 2012 is as follows:

| Three Months Ended December 31, 2012 |

Three Months Ended December 31, 2011 |

Year Ended December 31, 2012 |

Year Ended December 31, 2011 |

|||||||||||||

| Net loss attributable to the common stockholders |

$ | (2,188 | ) | $ | (597 | ) | $ | (8,490 | ) | $ | (2,780 | ) | ||||

| Add: |

||||||||||||||||

| Non-controlling interests in operating partnership |

(67 | ) | (28 | ) | (297 | ) | (53 | ) | ||||||||

| Preferred stock dividends |

— | — | ||||||||||||||

| Depreciation and amortization (1) |

10,588 | 6,354 | 36,021 | 23,705 | ||||||||||||

| Deduct: |

||||||||||||||||

| Depreciation and amortization related to joint venture(2) |

237 | (64 | ) | 72 | (199 | ) | ||||||||||

| Gain on acquisition of real estate and sale of land parcel |

— | (542 | ) | — | (1,479 | ) | ||||||||||

| Gain on sale of real estate assets |

— | — | — | (3,976 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds from operations (3) |

$ | 8,570 | $ | 5,123 | $ | 27,306 | $ | 15,218 | ||||||||

| Adjustments: |

||||||||||||||||

| Transaction costs |

387 | 231 | 1,572 | 753 | ||||||||||||

| Deferred financing costs |

457 | 412 | 1,867 | 1,367 | ||||||||||||

| Stock-based and other non-cash compensation expense |

817 | 1,371 | 3,223 | 4,497 | ||||||||||||

| Changes in fair value of contingent consideration |

(160 | ) | (106 | ) | (281 | ) | (434 | ) | ||||||||

| Changes in fair value of financial instruments |

(418 | ) | (1,238 | ) | (1,530 | ) | (1,154 | ) | ||||||||

| Straight-line effects of lease revenue |

(1,130 | ) | (392 | ) | (3,139 | ) | (1,968 | ) | ||||||||

| Amortization of above and below market leases |

77 | 79 | 65 | 153 | ||||||||||||

| Non-incremental capital expenditures |

(97 | ) | (58 | ) | (469 | ) | (123 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted funds from operations (3) |

$ | 8,503 | $ | 5,422 | $ | 28,614 | $ | 18,309 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding |

40,830 | 29,272 | 34,681 | 22,465 | ||||||||||||

| Add (4): |

||||||||||||||||

| OP units |

1,272 | 1,405 | 1,231 | 1,261 | ||||||||||||

| Restricted stock |

254 | 402 | 306 | 369 | ||||||||||||

| Contingent consideration related to business combinations |

20 | 127 | 73 | 206 | ||||||||||||

| LTIP restricted stock |

— | — | — | — | ||||||||||||

| Common stock issuable upon conversion of preferred stock |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding - diluted (FFO and AFFO) |

42,376 | 31,206 | 36,291 | 24,301 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds from operations per share (diluted)(5) |

$ | 0.20 | $ | 0.16 | $ | 0.74 | $ | 0.61 | ||||||||

| Adjusted funds from operations per share (diluted)(5) |

$ | 0.20 | $ | 0.17 | $ | 0.78 | $ | 0.74 | ||||||||

| Other Information (6): |

||||||||||||||||

| Leasing commissions paid |

$ | 550 | $ | 333 | $ | 1,018 | $ | 755 | ||||||||

| Tenant improvements paid |

$ | 820 | $ | 1,830 | $ | 2,625 | $ | 3,270 | ||||||||

| (1) | Total consolidated depreciation and amortization, a portion of which is included in discontinued operations on the statements of operations (for the year ended December 31, 2011). |

| (2) | Includes a reduction for the portion of consolidated depreciation and amortization expense that would be allocable to non-controlling interests in the operating partnership and an increase for the the Company’s portion of depreciation and amortization expense related to its investment in the unconsolidated La Costa Town Center property. |

| (3) | FFO and AFFO are described on the Definitions page. |

| (4) | The three months ended December 31, 2012 and 2011 include 1,546,000 and 1,610,000 additional shares of common stock, respectively, related to OP units, shares of restricted stock and shares contingently issuable related to business combinations, which are considered antidilutive for purposes of calculating diluted earnings per share. The year ended December 31, 2012 and 2011 include 1,934,000 and 1,836,000 additional shares of common stock, respectively, related to OP units, shares of restricted stock and shares contingently issuable related to business combinations, which are considered antidilutive for purposes of calculating diluted earnings per share. The three months and years ended December 31, 2012 and 2011 excludes 3,333,400 shares of common stock potentially issuable pursuant to the conversion feature of the preferred stock based on the “if converted” method. |

| (5) | The calculation of funds from operations per share (diluted) and adjusted funds from operations per share (diluted) for the three months and year ended December 31, 2012 includes a reduction of $114,000 and $456,000, respectively, for dividends paid to shares of restricted common stock in excess of earnings. The calculation of funds from operations per share (diluted) and adjusted funds from operations per share (diluted) for the three months and year ended December 31, 2011 includes a reduction of $163,000 and $628,000, respectively, for dividends paid to shares of restricted common stock in excess of earnings. |

| (6) | Excludes development properties. |

Page 10

Debt Summary (Consolidated)

For the Period Ended December 31, 2012

(Dollars in thousands)

| % Total Debt | ||||||||

| Fixed Rate Debt(1) |

$ | 257,510 | 63 | % | ||||

| Variable Rate Debt(2) |

150,800 | 37 | % | |||||

|

|

|

|

|

|||||

| Total Debt(1) |

$ | 408,310 | 100 | % | ||||

|

Debt(1)/Gross Undepreciated Assets |

36.6 | % | ||||||

| % Total Debt | ||||||||

| Secured Debt(1)(2) |

$ | 333,310 | 82 | % | ||||

| Unsecured Debt |

75,000 | 18 | % | |||||

|

|

|

|

|

|||||

| Total Debt |

$ | 408,310 | 100 | % | ||||

| Maturities by Year-Secured(3) |

Amount | % Total Debt | Maturities by Year-Unsecured(3) |

Amount | % Total Debt | |||||||||||||

|

2013(4) |

$ | 144,190 | 35.3 | % | 2013 |

$ | — | 0.0 | % | |||||||||

| 2014 |

76,749 | 18.8 | % | 2014 |

— | 0.0 | % | |||||||||||

| 2015 |

47,381 | 11.6 | % | 2015 |

— | 0.0 | % | |||||||||||

| 2016 |

1,341 | 0.3 | % | 2016(5) |

75,000 | 18.4 | % | |||||||||||

| 2017 |

39,990 | 9.8 | % | 2017 |

— | 0.0 | % | |||||||||||

| 2018 |

708 | 0.2 | % | 2018 |

— | 0.0 | % | |||||||||||

| 2019 |

544 | 0.1 | % | 2019 |

— | 0.0 | % | |||||||||||

| 2020 |

585 | 0.1 | % | 2020 |

— | 0.0 | % | |||||||||||

| 2021 |

628 | 0.2 | % | 2021 |

— | 0.0 | % | |||||||||||

| 2022 |

675 | 0.2 | % | 2022 |

— | 0.0 | % | |||||||||||

| Beyond 2022 |

20,519 | 5.0 | % | Beyond 2022 |

— | 0.0 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 333,310 | 81.6 | % | Total |

$ | 75,000 | 18.4 | % | |||||||||

| Mortgage Notes |

Amount | Contractual Interest Rate |

Maturity | |||||||||

| Red Rock Commons (2) |

$ | 13,800 | 2.5 | % | 2013 | |||||||

| West Broad Village |

50,000 | 2.8 | % | 2013 | ||||||||

| Five Forks Place |

4,882 | 5.5 | % | 2013 | ||||||||

| Grant Creek Town Center |

15,342 | 5.8 | % | 2013 | ||||||||

| Park West Place(6) |

55,800 | 3.7 | % | 2013 | ||||||||

| Excel Centre |

12,284 | 6.1 | % | 2014 | ||||||||

| Merchant Central |

4,468 | 5.9 | % | 2014 | ||||||||

| Edwards Theatre |

11,859 | 6.7 | % | 2014 | ||||||||

| Gilroy Crossing |

46,646 | 5.0 | % | 2014 | ||||||||

| The Promenade |

49,703 | 4.8 | % | 2015 | ||||||||

| 5000 South Hulen |

13,655 | 5.6 | % | 2017 | ||||||||

| Lake Pleasant Pavilion |

28,176 | 6.1 | % | 2017 | ||||||||

| Rite Aid-Vestavia Hills |

1,184 | 7.3 | % | 2018 | ||||||||

| Lowe’s |

13,511 | 7.2 | % | 2031 | ||||||||

| Northside Plaza(2) |

12,000 | 0.1 | % | 2035 | ||||||||

|

|

|

|

|

|||||||||

| Total |

333,310 | 4.5 | % | |||||||||

| Debt (discount) or premium |

625 | |||||||||||

|

|

|

|||||||||||

| Mortgage notes, net |

$ | 333,935 | ||||||||||

| (1) | Includes a mortgage note at our Park West Place property, which bears interest at LIBOR plus 2.25%. However, the Company has executed two interest rate swaps equal to the principal balance, which effectively fix the interest rate at 3.66% for the duration of the term. Amount excludes debt discount or premium. |

| (2) | Includes the Northside Plaza redevelopment revenue bonds to be used for the redevelopment of this property and a construction loan at our Red Rock Commons property. The revenue bonds are priced off the SIFMA index and reset weekly (the rate as of December 31, 2012 was 0.14%). The revenue bonds are secured by a $12.1 million letter of credit issued by the Company from the Company’s credit facility. The interest rate on the construction loan bears interest at LIBOR plus 2.25%. The rate as of December 31, 2012 was 2.45%. |

| (3) | Includes monthly payments on outstanding principal as well as principal due at maturity. |

| (4) | The Park West Place mortgage note matures on December 15, 2013, but may be extended for an additional year at the Company’s election, through December 15, 2014, after satisfying certain conditions and payment of an extension fee. Also includes a construction loan of $13.8 million, secured by Red Rock Commons, which matures on March 1, 2013. The construction loan may be extended for an additional two one-year periods at the Company’s election after satisfying certain conditions and payment of an extension fee. |

| (5) | Reflects the amount outstanding on the unsecured credit facility at quarter end. |

| (6) | Includes effect of interest rate swaps. |

| * | On July 20, 2012, Excel Trust amended its unsecured credit facility, increasing the borrowing capacity from $200 million to $250 million and lowering its interest rate. The facility now bears interest at a rate per annum equal to LIBOR plus 165 to 225 basis points (down from 220 to 300 basis points), depending on the company’s leverage ratio. If the Company is given an investment-grade credit rating by S&P or Moody’s in the future, the interest rate per annum will improve to LIBOR plus 100 basis points to 185 basis points. The facility includes an accordion feature that allows for an increase up to $450 million under specified circumstances. The maturity date of the credit facility is July 19, 2016 and can be extended for one year at the Company’s election. |

Page 11

Common and Preferred Stock Data

For the Period Ended December 31, 2012

(In thousands, except per share data)

| Three Months Ended December 31, 2012 |

Three Months Ended September 30, 2012 |

Three Months Ended June 30, 2012 |

Three Months Ended March 31, 2012 |

|||||||||||||

| Earning per share - share data |

||||||||||||||||

| Weighted average common shares outstanding - diluted |

40,830 | 33,294 | 32,785 | 31,761 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted common shares - EPS |

40,830 | 33,294 | 32,785 | 31,761 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Funds from operations - share data |

||||||||||||||||

| Weighted average common shares outstanding |

40,830 | 33,294 | 32,785 | 31,761 | ||||||||||||

| Weighted average OP units outstanding |

1,272 | 1,057 | 1,205 | 1,393 | ||||||||||||

| Weighted average restricted stock outstanding |

254 | 286 | 314 | 370 | ||||||||||||

| Dilutive effect of contingent consideration related to business combinations |

20 | 90 | 79 | 102 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total potential dilutive common shares |

42,376 | 34,727 | 34,383 | 33,626 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total common shares (including restricted stock) outstanding |

44,906 | 34,891 | 33,732 | 33,642 | ||||||||||||

| Total OP units outstanding |

1,245 | 1,040 | 1,105 | 1,284 | ||||||||||||

| Total Series A convertible preferred shares outstanding |

2,000 | 2,000 | 2,000 | 2,000 | ||||||||||||

| Total Series B preferred shares outstanding |

3,680 | 3,680 | 3,680 | 3,680 | ||||||||||||

| Common share data |

||||||||||||||||

| High closing share price |

$ | 12.91 | $ | 12.58 | $ | 12.37 | $ | 13.12 | ||||||||

| Low closing share price |

$ | 11.38 | $ | 11.39 | $ | 10.94 | $ | 11.58 | ||||||||

| Average closing share price |

$ | 12.15 | $ | 11.88 | $ | 11.63 | $ | 12.31 | ||||||||

| Closing price at end of period |

$ | 12.67 | $ | 11.42 | $ | 11.96 | $ | 12.08 | ||||||||

| Dividends per share - annualized |

$ | 0.65 | $ | 0.65 | $ | 0.65 | $ | 0.65 | ||||||||

| Dividend yield (based on closing share price at end of period) |

5.1 | % | 5.7 | % | 5.4 | % | 5.4 | % | ||||||||

| Dividends per share |

||||||||||||||||

| Common stock (EXL) |

$ | 0.1625 | $ | 0.1625 | $ | 0.1625 | $ | 0.1625 | ||||||||

| Series A Convertible Perpetual Preferred stock |

$ | 0.4375 | $ | 0.4375 | $ | 0.4375 | $ | 0.4375 | ||||||||

| Series B Preferred stock |

$ | 0.5078 | $ | 0.5078 | $ | 0.5078 | $ | 0.4232 | ||||||||

Page 12

Acquisitions & Developments

For Fiscal Year 2012

(Dollars in thousands, except price per square foot)

| Acquisition Property Name |

City | State | Year Built (1) |

Total GLA (2) |

Acquisition Date |

Price Sq. Ft. |

Initial Cost Basis (3) |

Major Tenants | ||||||||||||||

| Promenade Corporate Center |

Scottsdale | AZ | 2004 | 256,176 | 1/23/2012 | $ | 207 | $ | 53,000 | Fitch, Healthcare Trust of America, Regus, Meridian Bank | ||||||||||||

| EastChase Market Center |

Montgomery | AL | 2008 | 181,431 | 2/17/2012 | 136 | 24,700 | Dick’s, Jo-Ann, Bed Bath & Beyond, Michaels, Old Navy, Costco (non-owned) | ||||||||||||||

| La Costa Town Center(4) |

Carlsbad | CA | 1980 | 121,429 | 2/29/2012 | 194 | 23,500 | Vons (Safeway) | ||||||||||||||

| Lake Pleasant Pavilion |

Phoenix (Peoria) |

AZ | 2007 | 178,376 | 5/16/2012 | 234 | 41,800 | Target (non-owned), Marshalls, Bed Bath & Beyond, BevMo!, Tilly’s, Kirkland’s, The Dress Barn | ||||||||||||||

| Chimney Rock |

Odessa | TX | 2012 | 151,339 | 8/30/2012 | 157 | 23,800 | Academy Sports, Best Buy, Marshalls, Kirkland’s, Ulta | ||||||||||||||

| Pavilion Crossing |

Brandon | FL | 2012 | 68,400 | 10/1/2012 | 192 | 13,100 | Publix | ||||||||||||||

| West Broad Village(9) |

Richmond | VA | 2009 | 386,047 | 10/19/2012 | 265 | 170,200 | Whole Foods, REI, HomeGoods, Dave & Buster’s, South University | ||||||||||||||

| Dellagio |

Orlando | FL | 2009 | 123,198 | 10/19/2012 | 325 | 40,100 | Flemings, Fifth Third Bank | ||||||||||||||

| Meadow Ridge Plaza |

Orlando | FL | 2007 | 45,199 | 10/19/2012 | 215 | 9,700 | Fifth Third Bank | ||||||||||||||

| Shoppes of Belmere |

Orlando | FL | 2008 | 26,502 | 10/19/2012 | 366 | 9,700 | CVS | ||||||||||||||

| Lake Burden Shoppes |

Orlando | FL | 2008 | 20,598 | 10/19/2012 | 413 | 8,500 | Walgreens | ||||||||||||||

| The Fountains at Bay Hill(5) |

Orlando | FL | 2001 | 103,767 | 10/19/2012 | 191 | 19,800 | CVS, Ruth’s Chris | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

1,662,462 | $ | 263 | $ | 437,900 | |||||||||||||||||

| Developments Under |

City | State | Estimated Opening Date(6) |

GLA to be Constructed |

Land | Improvements | Total

Carrying Amount(7) |

Remaining Estimated Cost to Complete |

% GLA Leased / Committed(8) |

Major Tenants | ||||||||||||||||||||||

| Chimney Rock - Phase II |

Odessa | TX | TBD | 149,517 | $ | 2,030 | $ | 379 | $ | 2,409 | $ | 13,121 | 16 | % | Jo-Ann | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

149,517 | $ | 2,030 | $ | 379 | $ | 2,409 | $ | 13,121 | |||||||||||||||||||||||

| Future Developments / Land |

City | State | Estimated GLA to be Constructed / Land |

Estimated Start Date |

Estimated Project Cost |

Projected Use | ||||||||

| Plaza at Rockwall - Phase III |

Rockwall | TX | 22,700 | Q4 2013 | $ | 2,248 | Additional shop space | |||||||

| Red Rock Commons - Phase II |

St. George | UT | 15,541 | Q3 2013 | $ | 1,858 | Additional shop space | |||||||

| Park West Place |

Stockton | CA | 15,200 | TBD | NA | Additional shop space | ||||||||

| Shops at Foxwood |

Ocala | FL | 1.0 acres | TBD | NA | Additional land to be sold or developed | ||||||||

| Chimney Rock |

Odessa | TX | 4.2 acres | TBD | NA | Additional land to be sold or developed | ||||||||

| West Broad Village |

Richmond | VA | 1.4 acres | TBD | NA | Additional land to be sold or developed | ||||||||

| (1) | Year built represents the year in which construction was completed. |

| (2) | Total GLA represents total gross leasable area owned by the Company at the property (includes GLA of buildings on ground lease). |

| (3) | The initial cost basis is subject to change based on the final property valuation and may differ from amounts reported in prior periods. |

| (4) | Property was contributed to a joint-venture partnership on September 7, 2012. |

| (5) | The Fountains at Bay Hill property was purchased on October 19, 2012 as a part of the larger portfolio acquisition in which the Company purchased a 50% tenant-in-common interest in the property. As the Company does not control the operations of the property, the property is reflected as an investment in unconsolidated entities in the consolidated balance sheets and the Company’s interest in the property’s operations is recorded under the equity method of accounting. |

| (6) | Opening Date represents the date at which the Company estimates that the majority of the gross leasable area will be open for business. A property is reclassified from development to the operating portfolio at the earlier of (i) 85.0% occupancy or (ii) one year from completion and delivery of the space. |

| (7) | Total Carrying Amount includes land value, whereas Construction In Progress (CIP) values for development properties as listed in the Company’s SEC filings excludes land values. |

| (8) | Includes square footage of buildings leased to tenants (including square footage of buildings on outparcels owned by the Company and ground leased to tenants) as well as signed non-binding letters of intent as of February 2013. |

| (9) | The West Broad Village property is a mixed use shopping center that includes retail, office and 339 apartment units on the upper levels of the shopping center. However, the property’s total GLA listed herein excludes square footage of the apartments. As such, the approximate initial cost basis of the apartments of $68 million has been deducted from the price per square foot calculation. |

Page 13

Portfolio Summary (Consolidated)

For the Period Ended December 31, 2012

(Dollars in thousands, except price per square foot)

| Property Name |

City | State | Year Built(1) |

Total GLA(2) |

Acquisition Date |

Price Sq. Ft. |

Initial Cost Basis |

Percent Leased 12/31/2012 |

Percent Leased 9/30/2012 |

Major Tenants | ||||||||||||||||||||||

| Operating Portfolio | ||||||||||||||||||||||||||||||||

| West Broad Village (6) | Richmond | VA | 2009 | 386,047 | 10/19/2012 | $ | 265 | $ | 170,200 | 75.7 | % | n/a | Whole Foods, REI, HomeGoods, Dave & Buster’s, South University | |||||||||||||||||||

| The Promenade | Scottsdale | AZ | 1999 | 433,538 | 7/11/2011 | $ | 254 | $ | 110,000 | 100.0 | % | 100.0 | % | Nordstrom Rack, Trader Joe’s, OfficeMax, PetSmart, Old Navy, Michael’s, Stein Mart, Cost Plus, Lowe’s (non-owned) | ||||||||||||||||||

| Park West Place | Stockton | CA | 2005 | 598,152 | 12/14/2010 | $ | 155 | $ | 92,500 | 100.0 | % | 100.0 | % | Lowe’s, Kohl’s, Sports Authority, Jo-Ann, Ross, PetSmart, Office Depot, Target (non-owned) | ||||||||||||||||||

| Gilroy Crossing | Gilroy | CA | 2004 | 325,431 | 4/5/2011 | $ | 210 | $ | 68,400 | 98.4 | % | 98.4 | % | Kohl’s, Ross, Michaels, Bed Bath & Beyond, Target (non-owned) | ||||||||||||||||||

| Promenade Corporate Center | Scottsdale | AZ | 2004 | 256,176 | 1/23/2012 | $ | 207 | $ | 53,000 | 82.4 | % | 88.1 | % | Fitch, Healthcare Trust of America, Regus, Meridian Bank | ||||||||||||||||||

| Plaza at Rockwall | Rockwall | TX | 2007/2012 | 430,277 | 6/29/2010 | $ | 118 | $ | 50,800 | 96.8 | % | 96.5 | % | Best Buy, Dick’s, Staples, Ulta, JC Penney, Belk, HomeGoods, Jo-Ann | ||||||||||||||||||

| Brandywine Crossing | Washington Metro (Brandywine) |

MD | 2009 | 198,384 | 10/1/2010 | $ | 224 | $ | 44,500 | 97.6 | % | 97.6 | % | Safeway, Marshalls, Jo-Ann, Target (non-owned), Costco (non-owned) | ||||||||||||||||||

| Lake Pleasant Pavilion | Phoenix (Peoria) |

AZ | 2007 | 178,376 | 5/16/2012 | $ | 234 | $ | 41,800 | 86.4 | % | 97.6 | % | Target (non-owned), Marshalls, Bed Bath & Beyond, BevMo!, Tilly’s, Kirkland’s, The Dress Barn | ||||||||||||||||||

| Dellagio | Orlando | FL | 2009 | 123,198 | 10/19/2012 | $ | 325 | $ | 40,100 | 95.9 | % | n/a | Flemings, Fifth Third Bank | |||||||||||||||||||

| Vestavia Hills City Center | Birmingham (Vestavia Hills) |

AL | 2002 | 390,659 | 8/30/2010 | $ | 89 | $ | 34,900 | 80.7 | % | 82.0 | % | Publix, Dollar Tree, Stein Mart, Rave Motion Pictures | ||||||||||||||||||

| The Crossings of Spring Hill | Nashville (Spring Hill) |

TN | 2008 | 219,842 | 12/19/2011 | $ | 141 | $ | 31,000 | 96.9 | % | 97.7 | % | SuperTarget (non-owned), Kohl’s (non-owned), PetSmart, Ross, Bed Bath & Beyond | ||||||||||||||||||

| Red Rock Commons | St. George | UT | 2012 | 118,509 | ** | $ | 242 | $ | 28,700 | 94.1 | % | 93.3 | % | Dick’s, PetSmart, Old Navy, Gap Outlet, Ulta | ||||||||||||||||||

| Edwards Theatres | San Diego (San Marcos) |

CA | 1999 | 100,551 | 3/11/2011 | $ | 261 | $ | 26,200 | 100.0 | % | 100.0 | % | Edwards Theatres (a subsidiary of Regal Cinemas) | ||||||||||||||||||

| Rosewick Crossing | Washington Metro (La Plata) |

MD | 2008 | 115,972 | 10/1/2010 | $ | 215 | $ | 24,900 | 82.8 | % | 82.8 | % | Giant Food, Lowe’s (non-owned) | ||||||||||||||||||

| EastChase Market Center | Montgomery | AL | 2008 | 181,431 | 2/17/2012 | $ | 136 | $ | 24,700 | 98.9 | % | 98.9 | % | Dick’s, Jo-Ann, Bed Bath & Beyond, Michaels, Old Navy, Costco (non-owned) | ||||||||||||||||||

| Chimney Rock | Odessa | TX | 2012 | 151,339 | 8/30/2012 | $ | 157 | $ | 23,800 | 97.8 | % | 97.8 | % | Academy Sports, Best Buy, Marshalls, Kirkland’s, Ulta | ||||||||||||||||||

| Excel Centre | San Diego | CA | 1999 | 82,157 | ** | $ | 288 | $ | 23,700 | 83.6 | % | 82.5 | % | Kaiser Permanente, Excel Trust, UBS | ||||||||||||||||||

| 5000 South Hulen | Fort Worth | TX | 2005 | 86,833 | 5/12/2010 | $ | 252 | $ | 21,900 | 94.9 | % | 94.9 | % | Barnes & Noble, Old Navy | ||||||||||||||||||

| Grant Creek Town Center | Missoula | MT | 1998 | 163,291 | 8/27/2010 | $ | 130 | $ | 21,300 | 93.1 | % | 94.9 | % | Ross, TJ Maxx, REI | ||||||||||||||||||

| Lowe’s | Shippensburg | PA | 2008 | 171,069 | 6/22/2010 | $ | 103 | $ | 17,600 | 100.0 | % | 100.0 | % | Lowe’s | ||||||||||||||||||

| Anthem Highlands | Las Vegas (Henderson) |

NV | 2006 | 118,763 | 12/1/2011 | $ | 147 | $ | 17,500 | 82.2 | % | 82.2 | % | Albertsons, CVS, Wells Fargo, Bank of America | ||||||||||||||||||

| Pavilion Crossing | Brandon | FL | 2012 | 68,400 | 10/1/2012 | $ | 192 | $ | 13,100 | 96.5 | % | n/a | Publix | |||||||||||||||||||

| Shops at Foxwood | Ocala | FL | 2010 | 78,660 | 10/19/2010 | $ | 160 | $ | 12,600 | 90.8 | % | 89.3 | % | Publix, McDonald’s (non-owned) | ||||||||||||||||||

| Northside Plaza | Dothan | AL | 2010 | 171,670 | 11/15/2010 | $ | 70 | $ | 12,400 | 94.8 | % | 94.8 | % | Publix, Hobby Lobby, Books A Million | ||||||||||||||||||

| Meadow Ridge Plaza | Orlando | FL | 2007 | 45,199 | 10/19/2012 | $ | 215 | $ | 9,700 | 88.9 | % | n/a | Fifth Third Bank | |||||||||||||||||||

| Shoppes of Belmere | Orlando | FL | 2008 | 26,502 | 10/19/2012 | $ | 366 | $ | 9,700 | 100.0 | % | n/a | CVS | |||||||||||||||||||

| Lake Burden Shoppes | Orlando | FL | 2008 | 20,598 | 10/19/2012 | $ | 413 | $ | 8,500 | 100.0 | % | n/a | Walgreens | |||||||||||||||||||

| Five Forks Place | Simpsonville | SC | 2002 | 61,191 | ** | $ | 127 | $ | 7,800 | 98.0 | % | 98.0 | % | Publix | ||||||||||||||||||

| Mariner’s Point | St. Marys | GA | 2001 | 45,215 | 7/20/2010 | $ | 146 | $ | 6,600 | 95.6 | % | 95.6 | % | Shoe Show, Super Wal-Mart (non-owned) | ||||||||||||||||||

| Newport Towne Center | Newport | TN | 2006 | 60,100 | ** | $ | 108 | $ | 6,500 | 91.3 | % | 91.3 | % | Stage Stores (DBA Goody’s), Dollar Tree, Super Wal-Mart (non-owned) | ||||||||||||||||||

| Merchant Central | Milledgeville | GA | 2004 | 45,013 | 6/30/2010 | $ | 136 | $ | 6,100 | 83.9 | % | 87.6 | % | Dollar Tree, Super Wal-Mart (non-owned) | ||||||||||||||||||

| Walgreens | Corbin (North) | KY | 2009 | 13,650 | 5/24/2010 | $ | 256 | $ | 3,500 | 100.0 | % | 100.0 | % | Walgreens | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total Operating |

Total | 5,466,193 | $ | 182 | $ | 1,064,000 | 92.8 | % | 94.8 | % | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Developments

Under |

City | State | Estimated Opening Date(3) |

GLA to be Constructed |

Land Value |

Improvements | Total Carrying Amount (4) |

% GLA Leased / Committed (5) |

% GLA Leased / Committed |

Major Tenants | ||||||||||||||||||||||

| Chimney Rock - Phase II | Odessa | TX | TBD | 149,517 | 2,030 | 379 | 2,409 | 16 | % | 11 | % | Jo-Ann | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total | 149,517 | 2,030 | 379 | $ | 2,409 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total Portfolio (7) | 5,615,710 | $ | 1,066,409 | |||||||||||||||||||||||||||||

| ** | Acquired from Predecessor as part of the Company’s formation transactions. |

| (1) | Year built represents the year in which construction was completed. |

| (2) | Total GLA represents total gross leasable area owned by the Company at the property (includes GLA of buildings on ground lease). |

| (3) | Opening Date represents the date at which the Company estimates that the majority of the gross leasable area will be open for business. A property is reclassified from development to the operating portfolio at the earlier of (i) 85.0% occupancy or (ii) one year from completion and delivery of the space. |

| (4) | Total Carrying Amount includes land value, whereas Construction In Progress (CIP) values for development properties as listed in the Company’s SEC filings excludes land values. |

| (5) | Includes square footage of buildings leased to tenants (including square footage of buildings on outparcels owned by the Company and ground leased to tenants) as well as signed non-binding letters of intent as of February 2013. |

| (6) | The West Broad Village property is a mixed use shopping center that includes retail, office and 339 apartment units on the upper levels of the shopping center. However, the property’s total GLA listed herein excludes square footage of the apartments. As such, the approximate initial cost basis of the apartments of $68 million has been deducted from the price per square foot calculation. |

Page 14

Summary of Retail Leasing Activity (Consolidated)

For the Period Ended December 31, 2012

| Number

of Leases(1) |

GLA | Weighted Average- New Lease Rate(2) |

Weighted Average- Prior Lease Rate(2) |

Percentage Increase or (Decrease) |

Tenant Improvement Allowance per Sq. Ft. |

|||||||||||||||||||

| Comparable Leases |

||||||||||||||||||||||||

| New leases(3) |

2 | 4,149 | $ | 27.62 | $ | 24.28 | 13.8 | % | $ | 19.89 | ||||||||||||||

| Renewals/Options |

16 | 43,059 | 19.79 | 19.88 | -0.5 | % | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total: Comparable Leases |

18 | 47,208 | $ | 20.48 | $ | 20.27 | 1.0 | % | $ | 1.75 | ||||||||||||||

| Non-Comparable Leases |

||||||||||||||||||||||||

| Operating portfolio |

5 | 6,293 | $ | 18.74 | n/a | n/a | $ | 16.55 | ||||||||||||||||

| Development |

— | — | — | n/a | n/a | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total: Non-Comparable Leases |

5 | 6,293 | $ | 18.74 | n/a | n/a | $ | 16.55 | ||||||||||||||||

| Total Leasing Activity |

23 | 53,501 | $ | 20.27 | n/a | n/a | $ | 3.49 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| (1) | Excludes month-to-month leases and leases involving office GLA. |

| (2) | Lease rate represents final cash rent from the previous lease and the initial cash rent from the new lease and excludes the impact of changes in lease rates during the term. |

| (3) | Represents leases signed on spaces for which there was a tenant within the last 12 months. Excludes leases signed at development properties. |

Page 15

Same Property Analysis

For the Period Ended December 31, 2012

(In thousands, except per share amounts)

| Three Months Ended December 31, 2012 |

Three Months Ended December 31, 2011 |

Percentage Change |

||||||||||

| Same Property Portfolio (1) |

||||||||||||

| Number of properties |

19 | 19 | ||||||||||

| Rentable square feet |

3,571,813 | 3,571,813 | ||||||||||

| Percent leased |

95.0 | % | 93.4 | % | 1.7 | % | ||||||

| Percentage of total operating portfolio |

65.3 | % | 93.8 | % | ||||||||

| Total revenues |

$ | 15,652 | $ | 16,184 | -3.3 | % | ||||||

| Total expenses |

3,947 | 4,782 | -17.5 | % | ||||||||

|

|

|

|

|

|||||||||

| Same property - net operating income (GAAP basis) |

$ | 11,705 | $ | 11,402 | 2.7 | % | ||||||

|

|

|

|

|

|||||||||

| Less: straight line rents, fair-value lease revenue, lease incentive revenue |

(406 | ) | (299 | ) | 35.8 | % | ||||||

| Same property - net operating income (cash basis) |

$ | 11,299 | $ | 11,103 | 1.8 | % | ||||||

|

|

|

|

|

|||||||||

| (1) | Includes all properties purchased prior to September 30, 2011, including the Plaza at Rockwall property (a portion of which was under development through Q2 2012). |

16

Major Tenants By GLA (Consolidated)

For the Period Ended December 31, 2012

(Dollars in thousands, except rent per square foot)

| Total GLA-Operating Portfolio(1) |

5,466,199 | |||||||||||||

|

|

|

|||||||||||||

| Tenants |

# Stores | Square Feet | % of Total GLA | |||||||||||

| 1 | Lowe’s |

2 | 325,863 | 6.0 | % | |||||||||

| 2 | Publix |

5 | 244,151 | 4.5 | % | |||||||||

| 3 | Kohl’s |

2 | 176,656 | 3.2 | % | |||||||||

| 4 | Dick’s Sporting Goods |

3 | 140,018 | 2.6 | % | |||||||||

| 5 | TJX Companies |

5 | 137,907 | 2.5 | % | |||||||||

| 6 | Bed Bath & Beyond |

5 | 131,864 | 2.4 | % | |||||||||

| 7 | Ross Dress For Less |

4 | 115,259 | 2.1 | % | |||||||||

| 8 | Jo-Ann |

4 | 105,955 | 1.9 | % | |||||||||

| 9 | JC Penny |

1 | 103,639 | 1.9 | % | |||||||||

| 10 | Edwards Theatres (Regal Cinemas) |

1 | 100,551 | 1.8 | % | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total Top 10 GLA |

32 | 1,581,863 | 28.9 | % | ||||||||||

Major Tenants By ABR (Consolidated)

| Annualized Base Rent-Operating Portfolio (2) |

|

$ | 77,051 | |||||||||||||||||||

|

|

|

|||||||||||||||||||||

| Tenants |

# Stores | Square Feet | Rent Per Sq. Ft. | ABR | % ABR | |||||||||||||||||

| 1 | Publix |

5 | 244,151 | $ | 11.07 | $ | 2,702 | 3.5 | % | |||||||||||||

| 2 | Lowe’s |

2 | 325,863 | 6.74 | 2,195 | 2.8 | % | |||||||||||||||

| 3 | Edwards Theatres (Regal Cinemas) |

1 | 100,551 | 21.72 | 2,184 | 2.8 | % | |||||||||||||||

| 4 | Dick’s Sporting Goods |

3 | 140,018 | 12.33 | 1,726 | 2.2 | % | |||||||||||||||

| 5 | Kaiser Permanente |

1 | 38,432 | 41.58 | 1,598 | 2.1 | % | |||||||||||||||

| 6 | Bed Bath & Beyond |

5 | 131,864 | 10.93 | 1,441 | 1.9 | % | |||||||||||||||

| 7 | PetSmart |

5 | 91,246 | 15.16 | 1,383 | 1.8 | % | |||||||||||||||

| 8 | Kohl’s |

2 | 176,656 | 7.63 | 1,347 | 1.7 | % | |||||||||||||||

| 9 | Ross Dress For Less |

4 | 115,259 | 11.41 | 1,316 | 1.7 | % | |||||||||||||||

| 10 | TJX Companies |

5 | 137,907 | 9.08 | 1,252 | 1.6 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Top 10 Annualized Rent |

33 | 1,501,947 | $ | 11.41 | $ | 17,144 | 22.3 | % | ||||||||||||||

| (1) | Includes gross leasable area associated with buildings on ground lease. |

| (2) | Annualized Base Rent does not include rental revenue from multi-family properties and is further described on the Definitions page. |

Page 17

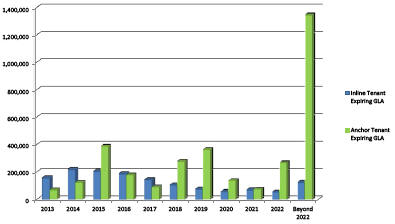

Expiration Schedule (Consolidated)

For the Period Ended December 31, 2012

(Dollars in thousands, except rent per square foot)

| 12/31/2012 | 9/30/2012(1) | |||||||

| Total GLA - Operating Portfolio |

5,466,199 | 4,797,124 | ||||||

| Total GLA Occupied - Operating Portfolio |

4,993,581 | 4,509,773 | ||||||

|

|

|

|

|

|||||

| % Occupied |

91.4 | % | 94.0 | % | ||||

| Total GLA - Operating Portfolio |

5,466,199 | 4,797,124 | ||||||

| Total GLA Leased - Operating Portfolio |

5,070,662 | 4,548,859 | ||||||

|

|

|

|

|

|||||

| % Leased |

92.8 | % | 94.8 | % | ||||

| Retail GLA - Operating Portfolio(2) |

5,127,860 | 4,458,791 | ||||||

| Retail GLA Occupied - Operating Portfolio |

4,736,205 | 4,232,765 | ||||||

|

|

|

|

|

|||||

| % Occupied |

92.4 | % | 94.9 | % | ||||

| Retail GLA - Operating Portfolio(2) |

5,127,860 | 4,458,791 | ||||||

| Retail GLA Leased - Operating Portfolio |

4,790,822 | 4,255,533 | ||||||

|

|

|

|

|

|||||

| % Leased |

93.4 | % | 95.4 | % | ||||

| Total Retail Anchor GLA % Leased - Operating Portfolio |

97.8 | % | 99.3 | % | ||||

| Total Retail Inline GLA % Leased - Operating Portfolio |

84.8 | % | 87.0 | % | ||||

| Same Property GLA % Leased (Sequential) - Operating Portfolio(3) |

94.0 | % | 95.0 | % | ||||

| % of Occupied Retail GLA |

Total Occupied Retail ABR |

% of Total Occupied Retail ABR |

||||||||||||||

| Occupied Retail Anchor GLA(4) |

3,330,956 | 70.3 | % | $ | 38,097 | 54.3 | % | |||||||||

| Occupied Retail Inline GLA(4) |

1,405,248 | 29.7 | % | 32,066 | 45.7 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Occupied Retail GLA |

4,736,204 | 100.0 | % | $ | 70,163 | 100.0 | % | |||||||||

| Year | Anchor GLA Expiring |

% of Total Retail GLA |

Anchor Rent Per Sq. Ft. |

Inline GLA Expiring |

% of Total Retail GLA |

Inline Rent Per Sq. Ft. |

Total Occupied Retail GLA Expiring |

% of Total Retail GLA |

Total Occupied Retail ABR Expiring |

% of Total Retail ABR |

Average Rent Per Sq. Ft. |

|||||||||||||||||||||||||||||||||

| 2013(5) | 70,624 | 1.5 | % | $ | 11.18 | 157,976 | 3.3 | % | $ | 19.65 | 228,600 | 4.8 | % | $ | 3,894 | 5.5 | % | $ | 17.03 | |||||||||||||||||||||||||

| 2014 | 125,398 | 2.6 | % | 14.27 | 219,826 | 4.6 | % | 21.86 | 345,224 | 7.3 | % | 6,594 | 9.4 | % | 19.10 | |||||||||||||||||||||||||||||

| 2015 | 388,714 | 8.2 | % | 13.99 | 205,026 | 4.3 | % | 22.46 | 593,740 | 12.5 | % | 10,042 | 14.3 | % | 16.91 | |||||||||||||||||||||||||||||

| 2016 | 179,807 | 3.8 | % | 9.31 | 187,620 | 4.0 | % | 23.66 | 367,427 | 7.8 | % | 6,113 | 8.7 | % | 16.64 | |||||||||||||||||||||||||||||

| 2017 | 91,759 | 1.9 | % | 13.87 | 143,701 | 3.0 | % | 21.69 | 235,460 | 5.0 | % | 4,390 | 6.3 | % | 18.64 | |||||||||||||||||||||||||||||

| 2018 | 279,227 | 5.9 | % | 14.30 | 106,095 | 2.2 | % | 21.89 | 385,322 | 8.1 | % | 6,315 | 9.0 | % | 16.39 | |||||||||||||||||||||||||||||

| 2019 | 364,623 | 7.7 | % | 14.84 | 76,636 | 1.6 | % | 26.63 | 441,259 | 9.3 | % | 7,452 | 10.6 | % | 16.89 | |||||||||||||||||||||||||||||

| 2020 | 138,618 | 2.9 | % | 17.71 | 57,951 | 1.2 | % | 28.57 | 196,569 | 4.2 | % | 4,111 | 5.9 | % | 20.91 | |||||||||||||||||||||||||||||

| 2021 | 75,356 | 1.6 | % | 5.97 | 70,459 | 1.5 | % | 17.01 | 145,815 | 3.1 | % | 1,649 | 2.4 | % | 11.31 | |||||||||||||||||||||||||||||

| 2022 | 268,603 | 5.7 | % | 10.58 | 55,046 | 1.2 | % | 15.59 | 323,649 | 6.8 | % | 3,699 | 5.3 | % | 11.43 | |||||||||||||||||||||||||||||

| Beyond 2022 | 1,348,227 | 28.5 | % | 8.89 | 124,912 | 2.6 | % | 31.39 | 1,473,139 | 31.1 | % | 15,904 | 22.7 | % | 10.80 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total | 3,330,956 | 70.3 | % | $ | 11.44 | 1,405,248 | 29.7 | % | $ | 22.82 | 4,736,204 | 100.0 | % | $ | 70,163 | 100.0 | % | $ | 14.81 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| (1) | Includes the La Costa Town Center which was contributed to a joint-venture partnership on September 7, 2012. |

| (2) | Retail figures exclude the Excel Centre and Promenade Corporate Center office properties. |

| (3) | Same property GLA % leased (sequential) excludes any properties that were reclassified to the operating portfolio, acquired or disposed of during the current quarter. |

| (4) | Anchor Tenants and Inline Tenants are described on the Definitions page. |

| (5) | Includes month-to-month leases and ground leases, but excludes percentage rent. |

Page 18

Unconsolidated Investments

For the Period Ended December 31, 2012

(Dollars in thousands)

| Financial Information | Leasing Information | |||||||||||||||||||||||||||||||

| Investment |

Formation/Acquisition Date | Property |

City | State | Total GLA(1) |

Total Assets |

Total Debt |

Ownership Interest |

Percent Leased |

ABR | ||||||||||||||||||||||

| GEM |

September 7, 2012 | La Costa Town Center | Carlsbad | CA | 121,429 | $ | 26,347 | $ | 14,100 | 20 | % | 40.6 | % | $ | 1,265 | |||||||||||||||||

| MDC |

October 19, 2012 | The Fountains at Bay Hill | Orlando | FL | 103,767 | $ | 41,789 | $ | 23,862 | 50 | % | 94.6 | % | $ | 2,929 | |||||||||||||||||

| (1) | Total GLA represents total gross leasable area owned by the Company at the property (includes GLA of buildings on ground lease). |

| Summary Financial Information: |

||||||||||||||||||

| Balance Sheet |

December 31, 2012 | Company Pro Rata | September 30, 2012 | Company Pro Rata | ||||||||||||||

| Assets: |

||||||||||||||||||

| Investments in Real Estate |

$ | 61,156 | $ | 23,553 | $ | 23,575 | $ | 4,715 | ||||||||||

| Cash & cash equivalents |

224 | 111 | 1,052 | 210 | ||||||||||||||

| Other assets |

6,756 | 2,500 | 435 | 87 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 68,136 | $ | 26,164 | $ | 25,062 | $ | 5,012 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities and members’ equity: |

||||||||||||||||||

| Mortgage notes payable and secured loan |

$ | 37,962 | $ | 14,751 | $ | 14,100 | $ | 2,820 | ||||||||||

| Other liabilities |

12,300 | 5,566 | 252 | 50 | ||||||||||||||

| Members’ equity |

17,874 | 5,847 | 10,710 | 2,142 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

$ | 68,136 | $ | 26,164 | $ | 25,062 | $ | 5,012 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Company’s investment in unconsolidated entities |

$ | 9,015 | $ | 1,348 | ||||||||||||||

|

|

|

|

|

|||||||||||||||

| Income Statement(2) |

Three months ended December 31, 2012 |

Company Pro Rata | Year ended December 31, 2012 |

Company Pro Rata | ||||||||||||||

| Total revenues |

$ | 1,341 | $ | 473 | $ | 1,506 | $ | 506 | ||||||||||

| Expenses: |

||||||||||||||||||

| Property operating expenses |

351 | 117 | 399 | 126 | ||||||||||||||

| General and administrative |

216 | 60 | 933 | 203 | ||||||||||||||

| Depreciation and amortization |

922 | 299 | 1,030 | 321 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

1,489 | 476 | 2,362 | 650 | ||||||||||||||

| Interest expense |

(484 | ) | (159 | ) | (567 | ) | (176 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (632 | ) | $ | (162 | ) | $ | (1,423 | ) | $ | (320 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Company’s loss from equity in unconsolidated entities |

$ | (162 | ) | $ | (320 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||||

| (2) Represents results since the formation of the La Costa joint-venture partnership on September 7, 2012 and the purchase of the Fountains at Bay Hill property on October 19, 2012. |

| |||||||||||||||||

| Unconsolidated Debt: |

||||||||||||||||||

| La Costa Town Center |

December 31, 2012 | |||||||||||||||||

| Proportionate share of debt: |

$ | 2,820 | ||||||||||||||||

| Maturity date: |

October 1, 2014 | |||||||||||||||||

| Current interest rate: |

6.0 | % | ||||||||||||||||

| Fountains at Bay Hill: |

December 31, 2012 | |||||||||||||||||

| Proportionate share of debt: |

$ | 11,931 | ||||||||||||||||

| Maturity date: |

April 2, 2015 | |||||||||||||||||

| Current interest rate: |

3.5 | % | ||||||||||||||||

Page 19

Definitions

Adjusted Funds From Operations (AFFO): Adjusted Funds From Operations (AFFO) is a non-GAAP financial measure we believe is a useful supplemental measure of our performance. We compute AFFO by adding to FFO the non-cash compensation expense, amortization of prepaid financing costs and non-recurring transaction costs, and other one-time items, then subtracting straight-line rents, amortization of above and below market leases and non-incremental capital expenditures. Our computation may differ from the methodology for calculating AFFO utilized by other equity REITs and, accordingly, may not be comparable to such other REITs. AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of Excel Trust’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of Excel Trust’s liquidity, nor is it indicative of funds available to fund Excel Trust’s cash needs, including Excel Trust’s ability to pay dividends or make distributions.

Anchor Tenant: A tenant who occupies 10,000 square feet or more.

Annualized Base Rent: Annualized Base Rent is obtained by annualizing the cash rental rate (excluding reimbursements and percentage rent) for the final month of a reporting period. Annualized Base Rent does not include rental revenue from multi-family properties.

EBITDA: Earnings (excluding preferred stock dividends) before interest, taxes, depreciation and amortization.

Funds From Operations (FFO): Excel Trust considers FFO an important supplemental measure of its operating performance and believe it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization unique to real estate, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year-over-year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income.

Excel Trust computes FFO in accordance with standards established by the National Association of Real Estate Investment Trusts, or NAREIT. As defined by NAREIT, FFO represents net income (loss) (computed in accordance with generally accepted accounting principles, or GAAP), excluding real estate-related depreciation and amortization, impairment charges and net gains (losses) on the disposition of real estate assets and after adjustments for unconsolidated partnerships and joint ventures. Excel Trust’s computation may differ from the methodology for calculating FFO utilized by other equity REITs and, accordingly, may not be comparable to such other REITs. Further, FFO does not represent amounts available for management’s discretionary use because of needed capital service obligations, or other commitments and uncertainties. FFO should not be considered as an alternative to net income (loss) replacement or expansion, debt (computed in accordance with GAAP) as an indicator of Excel Trust’s financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of Excel Trust’s liquidity, nor is it indicative of funds available to fund Excel Trust’s cash needs, including Excel Trust’s ability to pay dividends or make distributions.

Inline Tenant: Any tenant who does not qualify as an anchor tenant.

Leased: A space is considered leased when both Excel Trust and the tenant have executed the lease agreement.

Occupied: A space is considered occupied when the tenant has access to the space and revenue recognition has commenced (includes month-to-month tenants). If a tenant has vacated a space and Excel Trust has agreed to terminate the lease, the space is considered unoccupied as of the date of execution of the amended lease agreement.

Page 20