Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST MIDWEST BANCORP INC | feb268k.htm |

Title date FMBI Investor Relations Conference and Marketing Presentation Materials First Quarter 2013

Company Overview Performance Positioned to Grow 2013 Priorities Why Invest in FMBI? *

$8.1 Billion of Assets $6.7 Billion of Deposits Strong, Low Cost Core Deposits 79% Transactional $5.4 Billion of Loans IL’s Largest Ag Lender $5.7 Billion of Trust Assets IL’s 4th Largest Bank Asset Manager Full Retail and Commercial Product Line Organized Around Clients and Markets 240,000 Retail and 26,000 Commercial Relationships Information as of 12/31/12 A Premier Community Bank * ¹Includes construction.

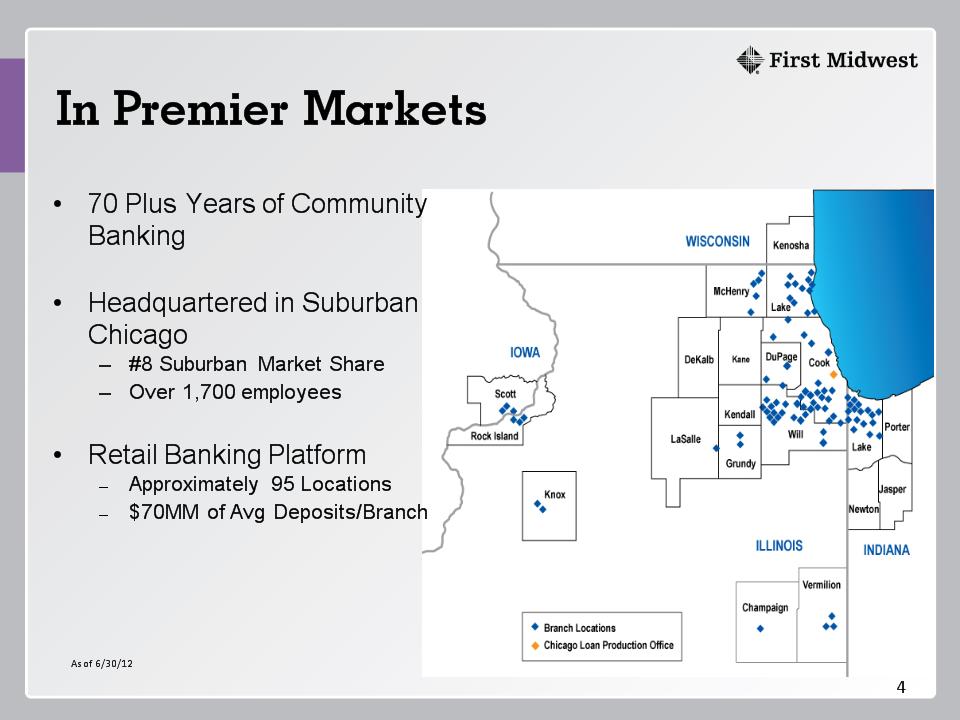

In Premier Markets As of 6/30/12 70 Plus Years of Community Banking Headquartered in Suburban Chicago #8 Suburban Market Share Over 1,700 employees Retail Banking Platform Approximately 95 Locations $70MM of Avg Deposits/Branch *

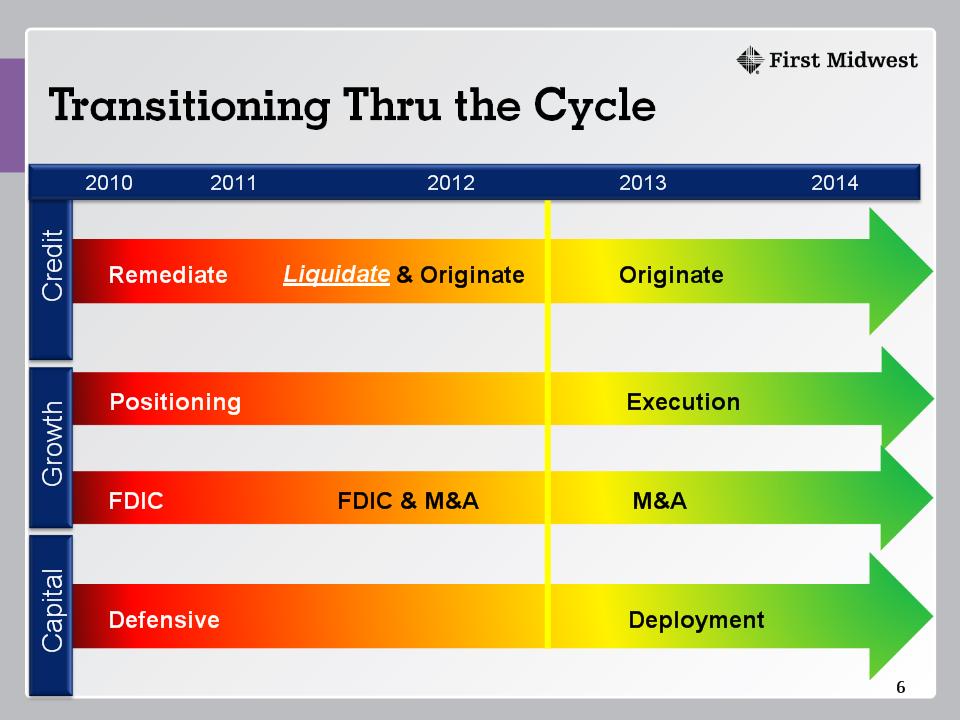

Remediate Liquidate & Originate Originate Positioning Execution FDIC FDIC & M&A M&A Defensive Deployment Credit Growth Capital 2010 2011 2012 2013 2014 *

Significantly Improved Risk Profile NPAs / Loans + OREO NPAs / Tangible Common Equity + Allowance for Credit Losses * Non-Performing Assets ($’s in millions) Note: Excludes covered loans.

Leadership Team Strengthened Internet, ATM and Mobile Cost Control Performance Management Wealth Management Mortgage Platform Treasury Management Strengthening Our Business Focusing on Our Core Delivering the Basics on Multiple Fronts 1. Asset Formation 3. Efficiency 2. Fee Income/Deposits 4. Investment Focused and Enhanced Lending Asset-Based and Other Niches *

Building Business Momentum Expanded Sales and Footprint: Strengthened Teams Mortgage Platform $50MM in 2012 Chicago Loop, Expanding in Western Suburbs Asset Based and Other Niches $60MM *

Loan Portfolio Shifting Portfolio Mix $5,388 $5,472 * $5,349 2010 2011 2012 Non-accruing and adverse, performing $’s in millions $777 $591 $304 19% 44% 6% 31% 32% 35% 45% 46% 5% 3% 17% 17% Diversifying Portfolio C&I Growing Niche Lending Reduced Construction 46% Owner Occupied NPLs Down Dramatically

Fee-Based Revenues $87 $94 $97 * $’s in millions 2010 2011 2012 16% 17% 15% 2% 21% 21% 22% 22% 21% 23% 41% 41% 38% Core is Strong Wealth Management Growing Mortgage Opportunity Card is Increasing

Factors Impacting Efficiency: Environmental Lower Margin Credit Transition Acquisition Integration Expense Business Investment Leadership and Sales Team Compliance and Control Internet and Mobile Banking Targeted Reductions Retail Platform Organizational Alignment Normalization Core Non-Core Focus on Expense Management Continuing As We Go Forward * Efficiency Ratio Remediation

Opportunities to Leverage Ability to Leverage Infrastructure to Grow Environment will Create Opportunities: Traditional and Non-traditional Other Disciplined Approach Well Positioned To Benefit Infrastructure Solid Reputation Strong Capital *

Market Opportunities Expect Consolidation Across First Midwest’s Footprint 25 Banks < $500 Million 15 Banks $500 Million to $1 Billion 12 Banks $1 Billion to $3 Billion Fewer FDIC, Shifting to Healthier: Disciplined Approach Well Positioned To Benefit Solid Reputation and Culture Experienced Acquiror Strong Capital *

Date Deposits Core Loans First DuPage 4Q09 $ 232 26% $ 212 Peotone Bank And Trust 2Q10 84 73% 53 Palos Bank And Trust 3Q10 462 47% 297 Integra/ONB 4Q11 107 65% - Waukegan Savings 3Q12 74 56% 63 Total $ 959 $ 625 Successful Acquisition Growth 1 Follows a Focus on Strategic and Financial Accretive Approach Experienced Acquirer with 22 Distinct Acquisitions 1 Information as of acquisition date *

Capital Management Priority Requirements Normalized Uses Stronger Earnings Regulatory Clarity Sustain Credit Profile Dividends Organic Growth Acquisitions Repurchase Shares *

Enter 2013 Stronger, Building Momentum with Long Term Focus 2013 Priorities Strengthening Business Asset Formation Revenue Growth Focused on Efficiency Manage Capital Stabilize Earnings Normalize Capital Align with Growth Opportunities Proactive Credit Continued Credit Risk Profile Improvement Lower Credit Costs * Shareholder Value

* Forward Looking Statements This presentation may contain, and during this presentation our management may make, statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events or outcomes, many of which, by their nature, are inherently uncertain and outside our control. Forward-looking statements include, among other things, statements regarding our future anticipated financial performance, business prospects, future growth and operating strategies, objectives and results. Actual results, performance or developments could differ materially from those expressed or implied by these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, among others, those discussed in our Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission, copies of which will be made available upon request. With the exception of fiscal year end information previously included in our Annual Report on Form 10-K, the information contained herein is unaudited. Except as required by law, we undertake no duty to update the contents of this presentation after the date of this presentation. Non-GAAP Disclaimer This presentation contains GAAP financial measures and, where management believes it to be helpful in understanding the Company’s results of operations or financial position, non-GAAP financial measures. Where non-GAAP financial measures are used, the most directly comparable GAAP financial measure, as well as the reconciliation to the most directly comparable GAAP financial measure can be found in the Company’s current quarter earnings release or Quarterly Report on Form 10-Q which can be found on the Company’s website at www.firstmidwest.com/secfilings. Non-GAAP financial measures in this presentation include core operating earnings and pre-tax, pre-provision return on risk weighted average assets. Both of these measures are useful in understanding the performance and trends of the Company’s core franchise over time without respect to investment securities gains/losses, taxes, provisions expense and OREO losses, each of which can significantly vary from quarter to quarter, and therefore may distort the Company’s underlying performance.

Certain Terms Used in this Presentation Chicago Peers – Means collectively the companies with the ticker symbol MBFI, WTFC, PVTB, and TAYC. Core Deposit – Includes demand, savings and NOW accounts. Core Operating Earnings – Means the Company’s pre-tax pre-provision operating earnings for the stated period, which reflect the Company’s operating performance before the effects of credit-related charges and other unusual, infrequent, or non-recurring revenues and expenses. This is a non-GAAP financial measure. Covered Loans or Covered Assets – Means loans or assets which the Company acquired through an FDIC-assisted transaction with loss share agreements. National Peers – Means collectively the companies with the ticker symbol SRCE, CHFC, CRBC, FCF, FMER, MBFI, ONB, PNFP, PVTB, PFS, STSA, SUSQ, UMBF, UMPQ, VLY, TAYC, TCBI, TRMK, WSBC, WTFC. Net Interest Income – Means the difference between interest income and fees earned on interest-earning assets and interest expense incurred on interest-bearing liabilities, presented on a tax-equivalent basis, assuming a federal income tax rate of 35%. Non-Core Expenses – Means OREO operating expenses, severance-related costs, integration costs on acquisitions, bulk loan sale expenses, and accelerated amortization of the FDIC indemnification asset. Non-Performing Assets – Means non-accrual loans, loans 90 days or more past due and still accruing interest, troubled debt restructurings still accruing interest, and OREO. Commercial Real Estate (“CRE”) – Means the combination of office, retail, and industrial loans, multi-family loans, and other commercial real estate loans, unless otherwise noted. SNL Midwestern Banks – Means 74 Midwest based banks. Tier 1 Common Capital – Means tier 1 capital, less trust preferred securities, divided by risk based assets. Note: Unless otherwise indicated, all dollar amounts used in this presentation are in millions except per share information. Unless otherwise indicated, all loan information includes Covered Loans. Peer information source for this presentation from SNL. *