Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 15, 2013

|

|

SWINGPLANE VENTURES, INC.

|

|

Exact name of registrant as specified in its charter

|

|

Nevada

|

000-54571

|

27-2919616

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

Alcantara 200, piso 6, Las Condes, Santiago, Chile

|

7550159

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(800) 373-0537

|

|

Registrant’s telephone number, including area code

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Cautionary Notice Regarding Forward-Looking Statements

This Current Report on Form 8-K (“Form 8-K”) and other reports filed by the Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the Registrant or the Registrant’s management identify forward-looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward-looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s financial statements and pro forma financial statements and the related notes filed with this Form 8-K.

Unless otherwise indicated, in this Form 8-K, references to “we,” “our,” “us,” “SWVI,” the “Company” or the “Registrant” refer to Swingplane Ventures, Inc., a Nevada corporation and its wholly owned subsidiary, Mid Americas Corp., a corporation incorporated under the laws of the country of Belize.

2

SECTION 2 – FINANCIAL INFORMATION

Item 2.01 Completion of Acquisition or Disposition of Assets

On February 22, 2013 (the “Closing Date”), Swingplane Ventures, Inc., a Nevada corporation, closed a voluntary share exchange transaction pursuant to a Share Exchange Agreement agreed to between the parties on February 15, 2013 (the “Exchange Agreement”) by and among the Company, Mid Americas Corp., a corporation incorporated under the laws of the country of Belize (“Mid Americas”), and the stockholders of Mid Americas Corp. (the “Selling Stockholders”).

In accordance with the terms of the Exchange Agreement, on the Closing Date, we issued a total of 100,000,000 shares of common stock of the Company and 5,000,000 shares of preferred stock of the Company to the Selling Stockholders in exchange for 100% of the issued and outstanding capital stock of Mid Americas (the “Transaction”). As a result of the Transaction, the Selling Stockholders acquired 42.5% of our issued and outstanding common stock and 100% of our issued and outstanding preferred stock, Mid Americas became our wholly-owned subsidiary, and we acquired the business and operations of Mid Americas.

Mid Americas is a natural resource exploration stage company. Mid Americas’ sole asset is an option agreement to acquire 75% of certain mining concessions in Chile.

Prior to the Transaction, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”). Accordingly, pursuant to the requirements of Item 2.01(f) of Form 8-K, set forth below is the information that would be required if the Registrant were filing a general form for registration of securities on Form 10 under the Exchange Act, for the Registrant’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Transaction.

The following description of the terms and conditions of the Exchange Agreement and the transactions contemplated thereunder that are material to the Registrant does not purport to be complete and is qualified in its entirety by reference to the full text of the Exchange Agreement, Option Agreement, as amended and the Assignment Agreement, copies of which are filed with this Current Report on Form 8-K and incorporated by reference into this Item 2.01.

From and after the Closing Date, our primary operations consist of the business and operations of Mid Americas. In the Transaction, or reverse acquisition, the Registrant is the accounting acquiree and Mid Americas is the accounting acquirer. The financial statements subsequent to the date of the Transaction are presented as a continuation of Mid Americas. Accordingly, we are presenting the financial statements of Mid Americas as set forth in Exhibit 99.1 and certain pro forma financial information as set forth in Exhibit 99.2 of this Current Report on Form 8-K. Further, we disclose information about the business, financial condition, and management of Mid Americas in this Current Report on Form 8-K.

3

DESCRIPTION OF BUSINESS

Overview

Background

The Company was incorporated in the State of Nevada on June 24th, 2010. The Company’s initial principal business objective was to sell men's and women's golf apparel. On March 29, 2012, the Company amended its Articles of Incorporation to increase its authorized shares of common stock from 70,000,000 to 550,000,000. On May 11, 2012, the Company effected a forward split of 35:1 of its issued and outstanding common stock. Both the foregoing amendment to the Company’s Articles of Incorporation and the forward stock split were approved by shareholders holding 74% of our issued and outstanding common stock. On August 22, 2012, the Company went through a change in control and management subsequently determined not to pursue the then current business of the Company and began to seek other potential acquisitions.

Summary

On October 15, 2012, the Company entered into an Assignment Agreement with Mid Americas (the “Assignment Agreement”). Under the terms of the Assignment Agreement the Company was assigned all of the rights under an option agreement between Mid Americas and Gunter Stromber and Elsa Dorila Durate Horta (the “Optionors”) whereby Mid Americas has the rights to acquire 75% of certain mining concessions in Chile (the “Option Agreement”). On January 21, 2013, the Company renegotiated the Assignment Agreement with Mid Americas to a share exchange agreement and on February 15, 2013, the Company, Mid Americas and the Selling Stockholders executed the Exchange Agreement, which closed on February 20, 2013.

Through the transactions described below, the Company acquired all of the issued and outstanding capital stock of Mid Americas, which is now the Company’s wholly owned subsidiary. The Company is currently focused exclusively on the acquisition and development of mineral resource properties. We are considered to be an exploration stage company, as we have not generated any revenues from operations. Our current project is to undertake exploration and development of certain mineral concessions located in Chile.

Mid Americas was incorporated in the country of Belize on April 23, 2012. On January 31, 2013, Mid Americas effected a 100 for 1 forward stock split effectively increasing the issued and authorized share capital from 5,000 to 5,000,000 shares, and reducing the par value per share from $10 to $0.001 per share. Mid Americas is a natural resource exploration stage company and anticipates acquiring, exploring, and if warranted and feasible, developing natural resource assets. To date, Mid Americas’ activities have been limited to the formation, the raising of equity capital, the development of a plan to develop and monetize the Algarrobo property, which plan has included the preparation of a title opinion by Chilean legal counsel and two due diligence site visits by our consulting geologist during 2012 where representative grab samples were recovered for the purposes of property evaluations. Many of the samples were recovered from visually sorted piles of high grade mineralized material prepared for shipping as direct shipping mineralized material to the government-owned ENAMI facility at Copiapo. Currently, limited mining operations are being conducted on the Algarrobo property by the Optionors, however no ore is being shipped currently. The Company will not receive any funds from any ore shipped until such time as the Company has commenced operations on the Property. The Company is developing a program to undertake additional exploration, development and increase production on the Property in 2013. The Property currently has limited, preliminary production from a total of six developed drifts comprising approximately 145 ha of the 6,161 ha available.

4

The Company, based on reports from consulting geologists, believes considerable opportunity exists to identify, and subsequently develop, additional well mineralized, high grade copper veins on, and throughout, the Property. Therefore, the Company proposes to undertake both exploration and further development on the Property, ideally culminating in increased production.

The Company has established offices at Regus Santiago, Alcantara 200, piso 6, Las Condes, Santiago, Chile 7550159 and its telephone number is (800) 373-0537. Our common stock is traded over-the-counter on the OTCBB under the ticker symbol “SWVI.”

Background on Assignment Agreement, Option Agreement and Transaction

On October 15, 2012, the Company entered into the Assignment Agreement. Under the terms of the Assignment Agreement the Company was to acquire all of the rights under an Option Agreement and two amendments to the Option whereby Mid Americas has the rights to acquire 75% of certain mining concessions in Chile (the “Option”).

Specifically, on April 23, 2012, Mid Americas entered into the Option Agreement with Gunter Stromberger and Elsa Dorila Durate Horta in respect to a property known as the Algarrobo. Under the terms of the Option Agreement, Mid Americas has the rights to acquire 75% of certain mining concessions in Chile from the Vendors in consideration for cash payments. On July 27, 2012, Mid Americas entered into Amendment Number 1 to the Option Agreement, and on September 27, 2012, Mid Americas entered into Amendment Number 2 to the Option Agreement.

The Option Agreement, as amended, required the following actions to be taken to finalize closing:

|

-

|

the Company was required to assume the December 1, 2012 payment obligation of $250,000 and all other payments thereafter, which were due under the Option Agreement;

|

|

-

|

cause the cancellation of a total of 337,500,000 of its common stock currently held by Michel Voyer, an officer and director of the Company;

|

|

-

|

file a registration statement with the requisite regulatory authorities to raise up to $10,000,000 by way of the sale of up to 40,000,000 shares of the common stock of the Company, of which no less than seventy-five percent of the funds raised under such registration statement was used to fund the required payments under the Option Agreement;

|

|

-

|

issue a total of 300,000,000 shares of its common stock to Mid Americas or its directed assignees, of which a total of 10,000,000 shares of common stock to be issued to Mid Americas were to be included for registration in the registration statement.

|

The Company issued 300,000,000 shares of common stock to Mid Americas which was held in trust subject to final documentation and the Company’s controlling shareholder, Michel Voyer, returned a total of 337,500,000 shares to treasury. It is management’s understanding that Mr. Voyer, who was the control person of the Company, wished to acquire a project into the Company and retain a minor equity position in the Company so that he could perhaps share in the growth of the Company. When Mid Americas and management of the Company agreed to the assignment of the Option to the Company, part of that agreement was that Mr. Voyer would retain a small minority equity position and would continue as an officer and director of the Company to assist with the growth of the Company as it pursued the exploration and development of the mining concessions.

5

As required under the Assignment Agreement, the Company undertook, during the period of closing, the payment of certain property taxes to maintain the property and funded $125,000 of the $250,000 required option payment due on December 1, 2012. The Company was in default on the remaining $125,000 payment due on December 1, 2012 under the Assignment Agreement. Pending completion of the registration statement required for closing, the Company commissioned the preparation of a 43-101 property report on the mining concessions. The Company determined during this process that it was in the best interests of the Company to renegotiate the acquisition of the Assignment Agreement to acquire Mid Americas directly thus giving the Company direct ownership of the Option Agreement through a wholly owned subsidiary. On January 21, 2013, the Company announced the renegotiation of the Assignment Agreement, whereby the Company would enter into a Share Exchange Agreement with Mid Americas.

Under the terms of the newly negotiated Exchange Agreement, the Company has acquired all of the issued and outstanding shares of Mid Americas in exchange for the issuance of a total of 100,000,000 shares of common stock of the Company and 5,000,000 shares of preferred stock of the Company. The preferred stock is convertible into shares of common stock of the Company on the basis of 50 shares of common stock for each 1 share of preferred stock. Further, the preferred stock carries voting rights of 100 shares per each share of preferred stock. All other terms of the original acquisition agreement are included in this acquisition agreement. The only terms that have been amended are the acquisition of Mid Americas rather than the assignment of the Option Agreement, the issuance of shares as defined above and the requirement to register 10,000,000 shares of stock for Mid Americas is eliminated. Further, the Company is not required to file the registration statement for the 40,000,000 shares to raise $10,000,000.

Concurrent with closing of the Exchange Agreement, the 300,000,000 shares issued to Mid Americas in trust were returned to treasury and the Company issued a total of 100,000,000 shares of common stock and 5,000,000 shares of preferred stock to the Selling Stockholders in exchange for all of the issued and outstanding capital stock of Mid Americas.

Terms of Option Agreement

Under the Option Agreement and certain amendments thereto, Mid Americas is required to pay the following payments:

1. Cash Consideration to the Vendors:

|

(i)

|

$950,000 cash payments through to October 15, 2012

|

|

(ii)

|

$250,000 cash payment on December 1, 2012

|

|

(iii)

|

$750,000 cash payment on or before June 30, 2013

|

|

(iv)

|

$750,000 cash payment on or before June 30, 2014

|

|

(v)

|

$5,000,000 cash payment to be made from net proceeds of Production.

|

2. Property Expenditures:

Further, the agreement calls for Mid Americas to incur expenditures in an aggregate amount of $20,000,000 over a period of three (3) years from the Effective Date as follows:

|

(i)

|

$10,000,000 to be placed in trust with the Optionee for expenditure on the Property within 180 days October 1st (the “Effective Date”) to be fully expended within eighteen (18) months of the Effective Date;

|

6

|

(ii)

|

$10,000,000 to be expended on or before three years from the Effective Date;

|

|

|

(iii)

|

until the Option is earned retain the services of Gunter Stromberger at a fee of $25,000 per month, which fee shall commence with the commencement of operations on the mining concessions by Mid Americas.

|

Under the Option Agreement and the Amendments thereto, the funds paid to the Optionors under Cash Consideration shall be understood to be Expenditures under Property Expenditures therefore shall be expressly considered as part of the Property Expenditures which the Optionee must incur pursuant to said Property Expenditures in order to maintain in force and exercise, the Option Agreement. A total of $1,200,000 has been paid pursuant to the Option Agreement to date, of which amount $950,000 was remitted by Mid Americas, and $250,000 by the Company. The Option Agreement as of the date of this filing is in good standing with the next requirement to be $10,000,000 to be place in trust by April 1st, 2013.

The formula used to determine the amount of consideration given to Mid Americas was based on negotiations between the Company and Mid Americas. In entering into the Assignment Agreement and after taking into consideration that the costs to Mr. Voyer for his shares was $35,000 for 350,000,000 shares of the Company and that Mid Americas had expended a total of $950,000 on the Option and the illiquidity of the Company’s stock at the time of the initial negotiations, the Company deemed the value of the issuance of the shares to be $0.003 per share and Mid Americas accepted the terms offered. The Company determined in renegotiating the transaction that they were in default under the Option Agreement as they had not paid a payment as it came due, the merits of the Property based on the 43-101 report commissioned by the Company, and the restructure of the stock issuance whereby the Company would issue a lesser number of shares of common stock, thus making financing more attractive to potential funders.

Immediately prior to the closing of the transactions pursuant to the Assignment Agreement, the Company had 550,000,000 authorized shares of common stock, $0.001 par value, of which 435,000,000 were issued and outstanding of which 300,000,000 had been issued in trust to Mid Americas. At closing there were a total of 235,000,000 shares of common stock issued and outstanding and 5,000,000 shares of preferred stock issued and outstanding which if fully converted would bring the issued and outstanding to 485,000,000 shares of common stock.

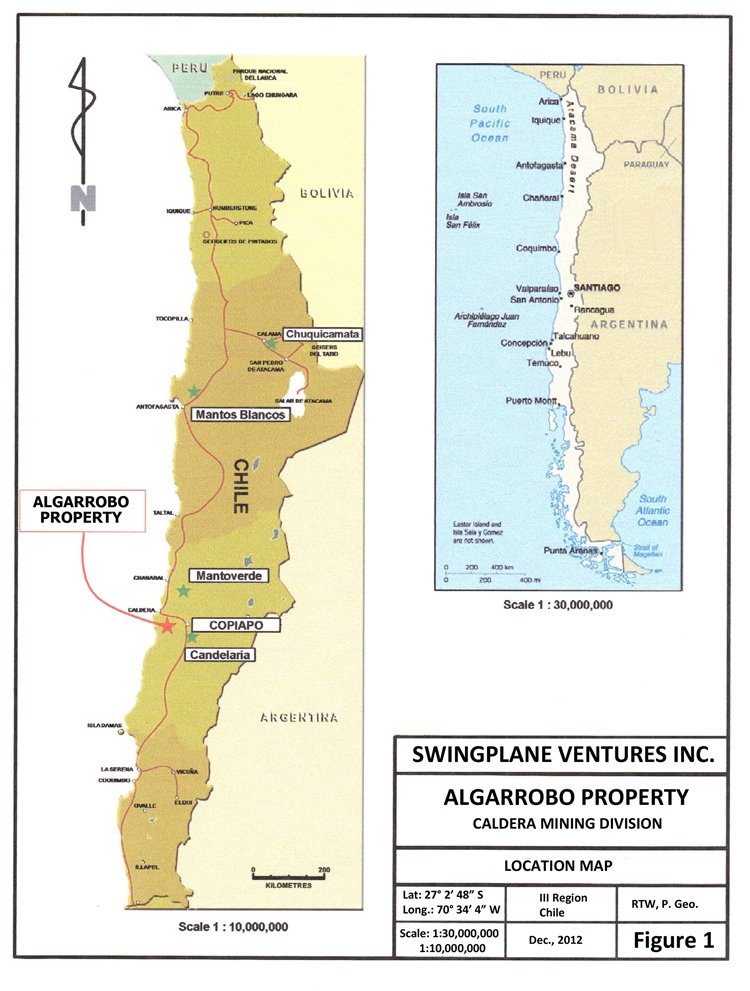

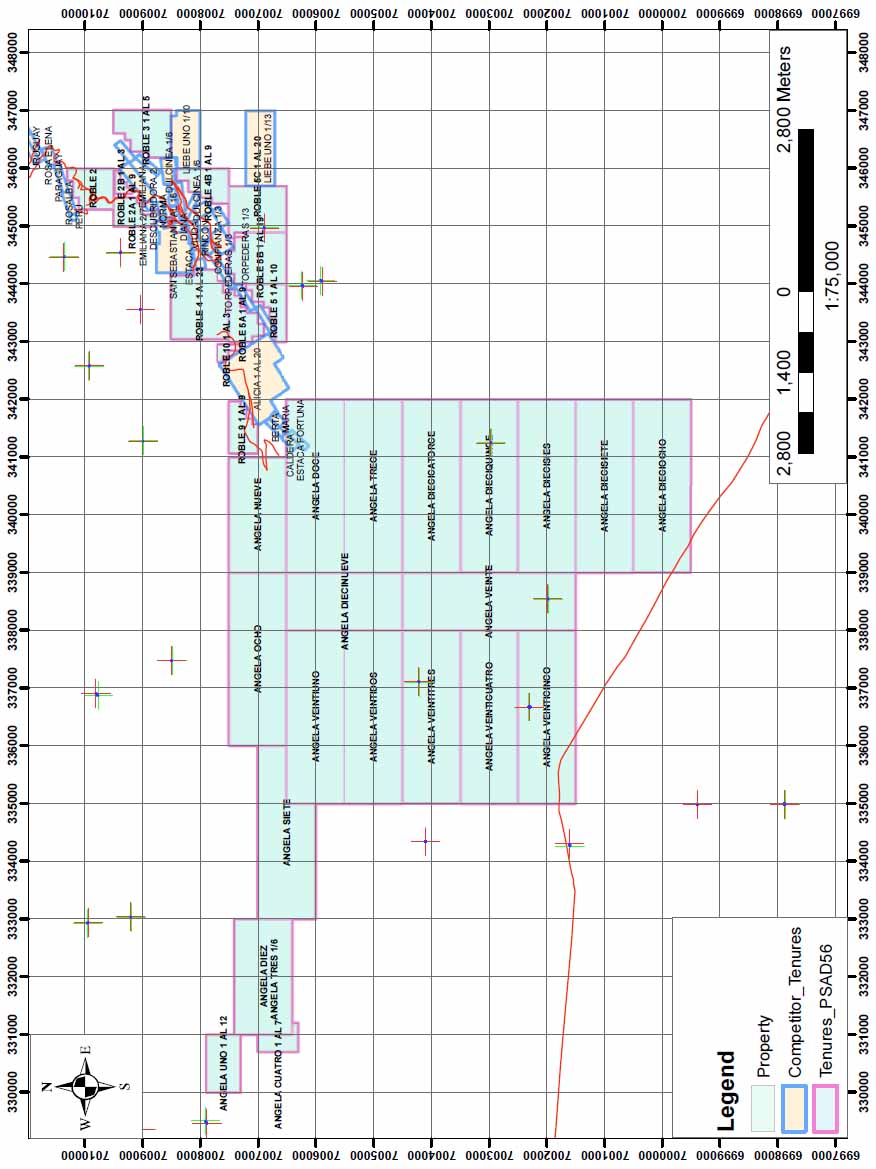

Current Operations on the Property

The Company’s Algarrobo Property (the “Property”) is an Iron Oxide - Copper - Gold (IOCG) property located approximately 850 km north of Santiago, in the III Region, Province of Copiopo, Chile. The city of Copiopo is located approximately 43 km to the southeast of the Property, with the small port city of Caldera 25 km to the east. The Property consists of 32 tenures, comprising a total of 6,161 ha (15,224 acres). As of the date of this Current Report on Form 8-K, all of the initial payments in the total amount of $1,200,000 have been made as required under the assigned Option Agreement with the Company making the last payment of $125,000 to bring the Option into full compliance. The Company and Mid Americas have completed payments of $1,200,000 with the Company making the last two payments, totaling $250,000. The next payment of $750,000 is due on or before June 30, 2013.

Subsequent to the Option Agreement, an application has been made to ENAMI for the purposes of shipping ore from the Property to the state run La Empresa Nacional de Minería (“ENAMI”) facility in Copiapo. Once the certificate has been received, which the Company expects at any time, then shipment of Direct Shipping Ore (having a minimum of 9% Cu content) currently being stockpiled on the Property can commence.

7

In addition, we are completing reconstruction of a camp on the Property capable of accommodating 30 people. The camp has been built in the immediate vicinity of current, active drift development, with accommodation for the underground crew, field personnel and management. The camp will be utilized to support exploration of the Property, together with current and future development activity on the Property.

During 2012, the camp was constructed, but there was a fire at the site and the camp had to be reconstructed, which reconstruction has just been completed. Completion of the camp is timely with respect to anticipated receipt of the license required to sell stockpiled material to ENAMI in Copiapo and a concurrent increase in development for the purposes of initial, limited production from the existing drifts. However, we must commence operations on the Property in order to receive the revenue from any products shipped to ENAMI.

Multiple shipments of low grade, copper mineralized vein material have been delivered to the ENAMI facility over the past two months. The ENAMI facility at Copiapo (45 km south of the Property) is a government owned smelter and processing facility, primarily for copper ore. The material shipped to date is low grade, copper mineral for leaching, having documented grades, as determined and reported by ENAMI, ranging between 1.88% and 8.8%.

These initial, test shipments comprise a reported total of approximately 500 tons of low grade, copper mineralized vein material produced, and stockpiled, from three of the drifts developed over the past year. Certificates received by the Company to date document delivery of approximately 94 tons from the Veta Gruesa Centre (7 shipments grading between 1.88 and 2.64% Cu), 58 tons from the Exploration Drift (3 shipments grading between 3.24 and 4.28% Cu) and 36 tons from the Descubridora Drift (three shipments grading between 7.75 and 8.8% Cu).

Total value received to date for the shipments totals approximately $30,845, however, this total does not include payment for 5 of the shipments, comprising approximately 58 tons of mineralized material. We believe all five shipments are expected to provide a higher rate of return due to the higher grade material delivered. As a result of these high grades, all of the ore stockpiled from the Descubridora Drift will be shipped in the future as “Direct Shipping” ore.

In addition, a single delivery of “Direct Shipping” ore was made on January 21, 2013, for which the corresponding ENAMI certificate documents a grade of 11.42% copper. Payment for this shipment has not yet been made. As noted above, shipment of “Direct Shipping” ore will commence once the required ENAMI license has been received. Sale of high grade mineralized material to ENAMI requires a license, following a thorough review of the application for license and a review of the Property and workings for which the license is being sought.

A full description of our mining concessions located in Chile, including the Property, can be found below under “Description of Property” within this Current Report on Form 8-K.

Under the terms of our Option Agreement, all proceeds from the sale of any ore shipped and processed will be paid to the Optionors, until such time as the Company commences operations on the Property, which it hopes to undertake prior to April 1, 2013, which is the date when the Company must have $10,000,000 in trust for operations.

8

Overview of the Mining Industry in Chile:

According to the Engineering and Mining Journal published in March 2012, “The economy of Chile is one of South America’s most stable and prosperous, with the highest nominal GDP per capita in Latin America. The Global Competitiveness Report by the World Economic Forum for 2011-2012 ranks Chile 31st, topping all Latin American countries, well above Brazil (53rd), Mexico (58th), Peru (67th) and Argentina (85th). The Ease of Doing Business Index of the World Bank for 2012 lists Chile as being the 29th most competitive country in the world and the first in Latin America. The mining sector is one of the pillars of the Chilean economy. The Chilean government strongly supports foreign investment in the sector and has modified its mining industry laws and regulations to create a favorable investing environment for foreigners. Thanks to large copper resources, progressive legislation and a healthy investment environment, Chile has become the copper-mining capital of the world, producing over a third of global output. In recent decades, mining activity has led Chile’s economic growth. Mining projects are not seen as isolated enclaves but as active promoters of regional development and generating new sources of employment. Increased investment in exploration and mining stocks, greater output and exports of mineral products and their derivatives have been key factors that have contributed to the development of communities. In the words of the President of Chile, Sebastián Piñera, at the annual meeting of the Mining Council (Consejo Minero) held in November 2011, “The mining industry represents a little more than 20% of Chile’s GDP, equal to more than US$40 billion and generates direct employment for approximately 110,000, and indirect more than 500,000 people.” “Mining is Chile’s engine,” said Hernán de Solminihac, Chilean Minister of Mining, when talking about the overall mining investment portfolio by 2020, which is estimated to equate to US$66.8 billion. This continual growth is based not just on the industry expanding, but also on it becoming more sophisticated and diverse. Traditionally, Chile’s mining strength has been based on a single commodity: copper. In the past two decades, Chile has consolidated its position as world leader in copper production, raising its global market share from 17.7% in 1990 to 34.2% in 2011. Mine copper output in 2011 reached 5.69 million metric tons (mt) of refined copper, a 267,000 mt or a 5.0% annual increase on the previous year. According to AndrésMac-Lean, executive vice president of The Chilean Copper Commission (Cochilco), “The trend should stand over the short term, with production in 2013 expected to reach a record 6.12 million mt”. Chile has been the leading global producer of copper since the 1990s when the process of liberalization opened the Chilean market to the arrival of large international mining companies, whose investments led to a tripling of the country’s copper production so that in 1999 Chile produced roughly 35% of the copper mined in the world.”

Despite this traditional and continued focus on copper, which accounts for more than 60% of the total mining Chilean exports, other minerals are also receiving increased attention. In 2011, Chile ranked first globally in copper, lithium and rhenium, third in molybdenum, fifth in silver and 15th in gold. Chile was also one of the world’s significant producers and exporters of potassium nitrate and sodium nitrate and ranked second after Japan in world production of iodine. Over the next four years, we believe there will be a substantial increase in silver, copper and, especially, gold output. Moreover, Chile is one of the most significant producers of arsenic, boron, refined selenium, pumicite, sulfur, salt and diatomite. However, the Chilean mining industry needs to face certain challenges including access to water, energy and the lack of qualified personnel. Nevertheless, the stable political and economic situation and the mining regulation framework support confidence and foresight for investments in the country; we believe the production potential of Chile is huge and long-term projections are positive.

Investment Regime applicable to foreign company involvement in mining projects in Chile

Capital and loans for any kind of projects can be brought into Chile as FDI under either Decree Law 600 or Chapter XIV of the Foreign Exchange Regulations of the Central Bank of Chile. As a general rule, foreign exchange transactions must be reported to the Central Bank of Chile.

9

There are two regulatory frameworks to bring investment capital into Chile: (i) Chapter XIV: The capital that may be registered under this regulation must exceed US$10,000 or its equivalent in other currencies. After the funds enter the country through the Formal Exchange Market (commercial banks and authorized exchange houses), they can be either converted into local currency or delivered to the beneficiary in foreign currency. Under Chapter XIV there are no restrictions on repatriations of profits or capital. Likewise there are no specific rights or benefits when capital is brought through these means; and, (ii) Decree Law 600: The minimum amount that may be registered under DL 600 is US$5,000,000 or its equivalent in other currencies; likewise working capital can be brought by these means and registered as a foreign investment. Under DL 600, the foreign investor enters into a contract with the Country of Chile, which governs all the rights and obligations related to the investment. Amendment to these contracts require consent from both parties. Thus, the Country of Chile cannot unilaterally alter these contractual arrangements. Among other guarantees, DL 600 guarantees free access to foreign exchange for the remittance of capital and profits. When the foreign investment is entered through Decree Law 600 the foreign investor has the right to tax stability during the term of the foreign contract.

The Company has not yet established the regime under which it will bring working capital into Chile, however, it has been working with legal counsel and an accounting firm in Chile to determine the best taxation structure under which it will bring the $10,000,000 of required exploration and development funding into Chile to maximize its return on investment and keep taxation to a minimal and allow the Company to repatriate profits.

International Investment Treaties applicable to Mining projects undertaken or sponsored by foreign companies.

We believe that Chile is very rich in natural resources, and the most active industries are mineral and energy resources, fisheries, forestry, agriculture, manufacturing and service industries. We believe that Chile is one of the preferred investment destinations in Latin America due to its open and stable economy, with one of the most extended free trade agreements and investment protection treaties networks worldwide (more than 20 commercial agreements that cover 90 per cent of Chilean trade).

Moreover, Chile has an expanding tax treaty network, which includes effective double taxation treaties with Argentina, Brazil, Canada, Croatia, Denmark, Ecuador, France, Ireland, South Korea, Malaysia, Mexico, New Zealand, Norway, Paraguay, Peru, Poland, Portugal, Spain, Sweden and the United Kingdom. Furthermore, there is tax treaty negotiation activity with several other countries. While the United States has tax treaties with a number of foreign countries, and they drafted a treaty document with Chile in 2010, they do not currently have a tax treaty with Chile. .The Company is going to review the taxation implications on profits derived from operations but has not yet finalized any taxation advice in regard to the U.S. taxation issues of doing business in Chilean. Currently we have been focused on the structure of the Chilean operations to minimize tax under the Chilean tax regime which is the primary jurisdiction in which our operations will take place. We do intend to get taxation advice in regard to the impact on shareholders in the U.S.

Duties, royalties, and taxes in Chile conditional on obtaining or continuing mining concessions.

A mining concession requires the payment of an annual fee during the month of March of each year, which is calculated based on the surface of the concession and the amount varies according to the nature of the concession (exploration, exploitation and non-metallic). If the owner fails to pay the mining fee within the corresponding annual period, a judicial procedure to publicly auction the concessions is commenced; this auction may be suspended if the owner makes double payment of the amount due before to the auction.

Water Rights, Availability of Water, Shared Water Resources

Water rights in Chile are generally granted by means of a resolution issued by the Chilean Water Agency. The water right is a concession, by which the right to exercise an exclusive possession over a public good is created in favor of the concessionaire. Its holder has ownership over the granted or acquired water right, which is constitutionally protected and may be freely transferred or mortgaged. Water rights have an independent legal standing, and therefore, they do not follow mining concessions or land ownership. However, current legislation contemplates “water right of the miner,” which enables the holder of mining concession to use the water that has been discovered – within the limits of its mining concession- when performing mining operations. As such, the “water right of the miner” follows the mining concession, thus expiring jointly with the mining concession.

10

Once granted, water rights are not limited in terms of time. However, they may be subject to a non-use fee if the Water Agency determines that the water rights are not being used. If such fee is not paid, then, under the direction of the Water Agency, the State Treasury of Chile will initiate a judicial process to auction the water rights.

Mining facilities are mainly located in the north of Chile where there is little availability for both surface and ground water. In order to overcome difficulties in obtaining water resources for their activities, mining companies have started to investment in desalination plants.

Surface Rights, Use and Occupation of Surface, access routes, pipeline and electric line routes, roadways or railways for product transport.

Under Chilean law, a mining concession is a right different and separate from ownership of the surface land, even if the land and the mining concession are owned by the same person. Easements are granted in favor of the mining concession with different purposes, such as rights of way, occupation, water supply, and power supply. These mining easements can either be established upon mutual agreements between the parties or by a court resolution, which will estimate the corresponding compensation for the damages derived from the easement.

Availability of Power

In Chile, private companies are responsible for electric power generation, transmission and distribution, while the Chilean government plays a subsidiary role as regulator and supervisor.

Mining facilities may generate their own power or acquire energy from one of four interconnected grid systems. Due to their geographical location, most mining projects are connected to the Interconnected System of the North (SING) or to the Interconnected Central System (SIC). The owner of a mining concession may be granted with an easement right to facilitate power supply.

Grounds for termination of rights under a mining concession, water or surface rights

The primary reason for lawful termination of a mining concession is the failure to timely pay mining fees. Surface rights granted to develop a mining project (easement) may be cancelled in case of no fulfillment of the obligations contained in the agreement or in the judicial resolution that granted the easement.

Chile has recently passed a law on mine closure, which includes technical, environmental and financial considerations for abandonment of mine operations, although such closing shall not terminate the mining concession.

Infrastructure

Chilean law generally provides clear legal and regulatory framework to develop (in some cases as public-private partnership) essential infrastructure for the mining industry such as port facilities, overland transportation, electric power, airports and sanitary infrastructure. This infrastructure may be subject to a prior environmental assessment according to the environmental regulations.

Collateral Security Arrangements in Chile

The most common securities used for transactions regarding mining projects are a mortgage over the mining concessions, surface land and water rights, as well as pledges over the machinery used for the exploration and exploitation of mining concessions. It is also common to grant pledges over the shares of the companies that own the mining concessions.

11

Notwithstanding prohibitions granted in favor of a third party, such as a bank, there are no limitations to transfer and assign the rights associated to a mining project, including any environmental licenses.

Insurance in Chile

Domestic insurance companies in Chile cover all kinds of risk. In addition, insurance and reinsurance policies can be purchased from insurance companies abroad, and can cover almost all kind of risks. Payments from insurance policies can be claimed abroad, and as any other legal title, the creditor of an insurance policy can endorse it to permit claims, either in Chile or abroad. The authority in this matter is the Chilean Securities and Insurance Supervisor.

Requirements in Chile related to domestic and foreign labor, suppliers and contractors

According to the Chilean labor legal framework, there is a 15% maximum of foreign workers that may be hired by a company in Chile. All foreign workers need a working visa that allows them to perform remunerated activities, exclusively for the employer with which the labor contract was subscribed. The foregoing 15% limitation only applies to the general workforce. Professional and specialized technical positions as required and used in by the mining industry, are not commonly affected by the 15% rule and companies are permitted to have foreigners on their pay-rolls.

In Chile, employees cannot have salaries under the net minimum salary fixed by law (currently approx. US $385 per month for 2012, with the 2013 minimum wage yet to be published), and the employer has also to pay an employee’s social security, which includes pension funds, health insurance, labor accident insurance and unemployment insurance.

Extension of liabilities beyond the Company

Generally a company is only liable to the extent of its assets for any claims arising within Chile. However, in some cases such as labor accidents and fraud (corruption, money laundering and financing of terrorism), a company’s responsibility and liability may be extended to the owners, directors and mangers.

Financing of Mining Projects in Chile

Due to the political and economic stability offered by Chile, mining projects are commonly financed throughout traditional ways (shareholder contributions, loans, project financing, and bond issuance).

The main challenge in terms of mining financing is how to strengthen the participation of mining companies in the stock exchange and to attract more investment for exploration activities. For this purpose, Chile has taken some measures such as the implementation of a qualified persons system and the public funding of mining exploration through Corporacion del Fomento de la Produccion (“CORFO”), the organization responsible for economic development in Chile. CORFO will foster the “Phoenix Fund”, a mixture of public and private investment, to fund up to 50 different projects over the next ten years. The government contribution is just under US$100 million, while six investment funds have contributed the remainder of the financing for the project (total amount estimated in US$150 million). The Company is currently seeking information from its Chilean lawyers and accountants as to whether the Phoenix Fund may have funds available that the Company can source for the exploration and development of its property.

Government Royalties

In 2006, Chile passed a law approving the Specific Mining Tax (royalty) to be paid by mining companies depending on their production and based on operating margins (sales less direct costs and expenses). At that time, companies that entered into a foreign investment agreement (DL 600) accepted an amendment to their tax invariability, subject to certain guarantees related to the maximum royalty rate of 4 per cent (instead of 5 per cent) and accelerated asset depreciation, and a 12-year or 15-year invariability for these new foreign investment contracts, depending on their execution dates.

12

In 2010, in support of Chile’s reconstruction of damage caused by a major earthquake that occurred in Chile in February 2010, the Chilean government approved a temporary increase in the income tax rate from 17 per cent to 20 per cent. Likewise, jointly with a new maximum for the royalty, it implemented a rate calculation formula in order to associate such tax payment with the mining industry’s cycle.

Therefore, companies with annual sales ranging between 12,000 and 50,000 metric tones of fine copper (exempted below 12,000) will be charged with a marginal rate ranging from 0.5 per cent to 4.5 per cent over the taxable operational mining income; and those with annual sales over 50,000 metric tones of fine copper are subject to an effective tax burden ranging from 5 per cent to 14 per cent over the taxable operational mining income.

Information sources

The website of the Chilean Copper Commission contains important legal and regulatory pieces related to the mining industry such as the Political Constitution, the Organic Constitutional Law on Mining Concessions, the Mining Law, the Environmental Law and the Safety Regulations. Moreover, it has several reports and studies conducted by the Commission with valuable information about mining in Chile. Its website is www.cochilco.cl.

For an overview of taxation in Chile, including the Specific Mining Tax, the website of the Chilean Internal Revenue Service is www.sli.cl/portales/inversionistas/imp_chile/imp-chile-ing.htm.

Other relevant authorities for the mining industry in Chile are the National Mining and Geologic Service, the Central Bank of Chile, the Water Agency and the Chilean Securities and Insurance Supervisor. Website for the foregoing authorities are noted below.

|

·

|

www.sernageomin.cl

|

|

·

|

www.dga.cl

|

|

·

|

www.bcentral.cl/eng/

|

|

·

|

www.svs.cl

|

Market, Customers and Distribution Methods

We believe that large and well capitalized markets are readily available for all metals and precious metals throughout the world. A futures market for the pricing and delivery of future production of metals and precious metals also exists. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities, production in the industry, and new and or reduced uses for subject metals.

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

13

Competition

The mineral exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of resource legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions and overall levels of supply and demand for mineral exploration. In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable mining properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

|

|

●

|

keeping our costs low;

|

|

●

|

relying on the strength of our management’s contacts; and

|

|

●

|

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

|

Intellectual Property

The Company has no intellectual property.

14

Research and Development

We did not incur any research and development expenses during the period from June 24, 2010 (inception) to the period ended December 31, 2012.

Available Information

We are subject to the reporting and other requirements of the Exchange Act and we are required to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K in order to meet our timely and continuous disclosure requirements. We make available on our internet website our filings with the Securities and Exchange Commission which can be found at www.swingplaneventuresinc.com.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Any operations at our mineral properties will be subject to various state laws and regulations in Chile which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. As in most jurisdictions, the state has absolute, exclusive, inalienable and non-lapsable ownership of all minerals. According to the legal framework, mining concessions, both for exploration and exploitation, are granted by a judicial resolution from the civil courts in a voluntary and non-contentious judicial proceeding. The main consideration behind this judicial nature of the concession is the non-intervention of any other authority (lack of administrative interference) with the technical support provided by the National Mining and Geologic Service. The procedure to incorporate a mining concession is based on the godfathering principle that grants preference to obtain it to the first petitioner before the local ordinary court.

The mining framework is based on three legal pieces: (i) The Constitution (1980); (ii) The Organic Constitutional Law on Mining Concessions (1982); and, (iii) The Chilean Mining Code (1983). These essential rules are complemented with other key laws and regulations related to safety, environmental protection, water and energy, among others.

We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders or directions relating to us or our properties with respect to the foregoing laws and regulations. Notwithstanding that the Country of Chile is the owner of all mineral resources, the Constitution allows exploration and exploitation work conducted by private companies or individuals, either local or foreigners, through mining concessions. The exception is the exploitation of lithium, and liquid and gaseous hydrocarbons which are limited only for the Country of Chile that may exploit them directly or through administrative concessions or special contracts with private parties. All mining concessions shall always be granted by a judicial resolution, and the ownership of the mining concession is protected by the Constitutional guarantee of the right of property. Once a mining concession is granted, its owner will be entitled to explore or exploit all the mines located within the area of its concessions and to become the owner of all mineral substances that are able to be removed. Certain of the mining concessions held under the Option Agreement have been granted to the Optionors and certain of the mining concessions are under application.

15

The exploration concession is granted for two years (renewable for another 2 years under certain conditions) and the exploitation concession is granted indefinitely, in both cases only subject to the payment of the corresponding mining fees. There is no obligation to conduct works or make certain investments to keep the concession. Certain exploration concessions have been granted to the Optionors, while other exploration concessions are in the final process of being issued, according to the title option prepared by our Chilean legal counsel.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Regarding the environmental license and the associated permits, the project may require an environmental impact assessment (study or declaration) depending on the area it is located. Also, the associated permits would vary according to the phase of the mining project (prospection, exploration, development, construction, operation and closure). The public agency in charge of overseeing safety matters is the National Mining and Geologic Service.

Foreign Currency Exchange Rate

We expect that international revenues will account for a majority of our total revenues. Our international operations in Chile expose the Company to foreign currency fluctuations. Revenues and related expenses generated from our international operations will generally be denominated in the functional currencies of the local countries. For example, revenues derived from Chile will be denominated in pesos. Generally, any person can enter freely into foreign exchange transactions pursuant to the Central Bank Act of Chile. However, the Central Bank of Chile can, for a period of up to one year (which can be indefinitely renewed for further one-year periods): (i) require that certain foreign exchange transactions be effected exclusively in the formal foreign exchange market; and (ii) restrict, and impose conditions on, foreign exchange transactions. Within this framework, the Central Bank currently requires that certain foreign exchange transactions (such as bringing foreign currency into Chile) be reported to the Central Bank and effected exclusively in the formal foreign exchange market.

Our statements of income of our international operations are translated into United States dollars at the average exchange rates in each applicable period. To the extent the United States dollar strengthens against foreign currencies, the translation of foreign currency denominated transactions will result in reduced revenues, operating expenses and net income for our business. Similarly, our revenues, operating expenses and net income will increase if the United States dollar weakens against foreign currencies.

We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiary and our investments in equity interests into United States dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiary financial statements into United States dollars will lead to a translation gain or loss which is recorded as a component of accumulated other comprehensive income which is part of stockholders’ equity. In addition, we may have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss.

16

Capital Equipment and Expenditures

During the year ended June 30, 2012 and through the period ended December 31, 2012, our efforts were primarily focused on exploring potential mining opportunities; therefore, no material capital equipment was acquired by us.

Investment Policies

We do not have an investment policy at this time. Any excess funds the Company has on hand will be deposited in interest bearing notes such as term deposits or short term money instruments. There are no restrictions on what the directors are able to invest or additional funds held by our Company. Presently we do not have any excess funds to invest.

Employees

As of December 31, 2012 we did not have any employees. Michel Voyer, our sole officer and a director of the Company works full time on our operations on a consulting basis and has a consulting contract for $10,000.00 per month. We currently contract with outside consultants as required. We will be required to hire employees as we commence production of our mining concessions. We cannot at this time determine how many employees will be required however we expect all employees will be hired in a subsidiary to be established in Chile.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Form 8-K before making an investment decision with regard to our securities. The statements contained in or incorporated into this Form 8-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to our Business and Associated with Mining

We currently have no source of operating cash flow and we have a history of operating losses.

We have no revenues from operations, our mineral property interests are in the exploration stage and we have a history of operating losses. We will not receive revenues from operations at any time in the near future, and we have no prior year’s history of earnings or cash flow. We have incurred losses. There can be no assurance that our operations will ever generate sufficient revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or sustain profitability in any future period.

We are currently a mining exploration stage company. See “Item 2 Properties” of this Report for more information regarding our mining concessions.

According to SEC definitions, our mining concessions do not have any proven or probable reserves. A “reserve,” as defined by the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to our mining concessions. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on our mining concessions.

17

Mineral exploration is highly speculative in nature and there can be no certainty of our successful development of profitable commercial mining operations.

The exploration and development of mineral properties involve significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few explored properties develop into producing mines. Substantial expenses may be incurred to locate and establish mineral reserves, develop metallurgical processes, and construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; metals prices which are highly cyclical; drilling and other related costs that appear to be rising; and government regulations, including those related to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by us towards the exploration and evaluation of mineral deposits will result in discoveries of commercial quantities of ore.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our exploration activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed beyond the first few months of our exploration program. We will also require additional financing for the fees we must pay to maintain our status in relation to the rights to our properties and to pay the fees and expenses necessary to become and operate as a public company. We will also need more funds if the costs of the exploration of our existing projects are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

We may be unable to obtain the funds necessary to finalize our property option agreement.

Under the terms of the Option Agreement, for our mining concessions, we are required to expend the following payments:

(i) $750,000 cash payment on or before June 30, 2013

(ii) $750,000 cash payment on or before June 30, 2014

(iii) $5,000,000 cash payment to be made from net proceeds of Production.

Further, the agreement calls for us to incur expenditures in an aggregate amount of $20,000,000 over a period of three (3) years from the Effective Date (as defined below) as follows:

(i) $10,000,000 to be placed in trust with the Optionee for expenditure on the Property within 180 days of October 1st, 2012, which is the effective date of the assigned option agreement (the “Effective Date”) or April 1, 2013 to be fully expended within eighteen (18) months of the October 1, 2012.

18

(ii) $10,000,000 to be expended on or before three years from October 1, 2012;

(iii) until the Option is earned retain the services of Gunter Stromberger at a fee of $25,000 per month, which fee shall commence with the commencement of operations on the mining concessions.

Currently we do not have sufficient funds to expend the ongoing exploration funds and property payments required under the Option Agreement. As an exploration company it is often difficult to obtain adequate financing when required, and it is not necessarily the case that the terms of such financings will be favorable. If we fail to obtain additional financing on a timely basis, we could forfeit our rights to the mining concessions and/or reduce or terminate operations.

Because our business involves numerous operating hazards, we may be subject to claims of a significant size, which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations.

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs, which would adversely affect our business.

Damage to the environment could also result from our operations. If our business is involved in one or more of these hazards, we may be subject to claims of a significant size that could force us to cease our operations.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to health and safety. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences; (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities; (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas; (iv) require remedial measures to mitigate pollution from former operations; and (v) impose substantial liabilities for pollution resulting from our proposed operations.

19

The exploration of mineral reserves are subject to all of the usual hazards and risks associated with mineral exploration, which could result in damage to life or property, environmental damage, and possible legal liability for any or all damages. Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and there is no assurance that we will obtain such insurance in the future. There are also risks against that we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our financial position, future earnings, and/or competitive positions.

The prices of metals are highly volatile and a decrease in metal prices can have a material adverse effect on our business.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals market from the time exploration for a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a minerals property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metal prices have decreased. Adverse fluctuations of metals market prices may force us to curtail or cease our business operations.

Mining operations generally involve a high degree of risk.

Mining operations are subject to all the hazards and risks normally encountered in the exploration, development and production of base or precious metals, including unusual and unexpected geological formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining operations could also experience periodic interruptions due to bad or hazardous weather conditions and other acts of God. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailing disposal areas, which may result in environmental pollution and consequent liability.

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may: (i) increase the cost of exploration to a point where it is no longer economically feasible to continue operations; (ii) require us to write down the carrying value of one or more mines or a property; (iii) cause delays or a stoppage in the exploration of minerals; (iv) result in damage to or destruction of mineral properties or processing facilities; and (v) result in personal injury, death or legal liability. Any or all of these adverse consequences may have a material adverse effect on our financial condition, results of operations, and future cash flows.

We may not be able to compete with current and potential exploration and production companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We will be competing with many exploration and production companies that have significantly greater personnel, financial, managerial and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

We may not have access to all of the supplies and materials we need to begin exploration or production, which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies and certain equipment such as bulldozers and excavators that we might need to conduct exploration and production activities. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials prior to undertaking exploration or production programs. If we cannot find the products, equipment and materials we need, we will have to suspend our exploration or production plans until we do find the products, equipment and materials.

20

Mineralized material is based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralized material presented in our filings with securities regulatory authorities, including the SEC, press releases, and other public statements that may be made from time to time are based upon estimates made by our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered at production scale. The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades, and operating costs that may prove inaccurate. Extended declines in market prices for metals may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

An adequate supply of water may not be available to undertake mining and production at our properties.

The amount of water that we are entitled to use from wells or other sources must be determined by the appropriate regulatory authorities. A determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing a property to a point where it can commence commercial production of precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at our properties.

We are an exploration stage company, and there is no assurance that a commercially viable deposit or “reserve” exists in the property over which we have concessions.

We are an exploration stage company and cannot assure you that a commercially viable deposit, or “reserve,” exists on our mineral properties. Therefore, determination of the existence of a reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic and environmental factors. If we fail to find commercially viable deposits, our financial condition and results of operations will be materially adversely affected.

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We plan to conduct mineral exploration on certain mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on these properties will establish that commercially exploitable reserves of minerals exist on these properties. Additional potential problems that may prevent us from discovering any reserves of minerals on these property include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on these properties, our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

Our operating costs could be adversely affected by inflationary pressures especially to labor, equipment, and fuel costs.

The global economy is currently experiencing a period of high commodity prices and as a result the mining industry is attempting to increase production at new and existing projects, while also seeking to discover, explore and develop new projects. This has caused significant upward price pressures in the costs of mineral exploration companies, especially in the areas of skilled labor and drilling equipment, both of which are in tight supply and whose costs are increasing. Continued upward price pressures in our exploration costs may have an adverse impact to our business.

21

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.