Attached files

| file | filename |

|---|---|

| EX-14.1 - CODE OF ETHICS - METHES ENERGIES INTERNATIONAL LTD | meil_ex141.htm |

| EX-32.1 - CERTIFICATION - METHES ENERGIES INTERNATIONAL LTD | meil_ex321.htm |

| EX-32.2 - CERTIFICATION - METHES ENERGIES INTERNATIONAL LTD | meil_ex322.htm |

| EX-31.1 - CERTIFICATION - METHES ENERGIES INTERNATIONAL LTD | meil_ex311.htm |

| EX-31.2 - CERTIFICATION - METHES ENERGIES INTERNATIONAL LTD | meil_ex312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - METHES ENERGIES INTERNATIONAL LTD | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended November 30, 2012

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from_______to_______

Commission File Number: 001-35652

(Exact name of registrant as specified in its charter)

|

Nevada

|

71-1035154

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

3651 Lindell Road, Suite D-272, Las Vegas, Nevada

|

89103

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (702) 932-9964

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Name of each exchange on which registered:

|

|

|

Common Stock, Class A Warrants and Class B Warrants

(par value $0.001 per share)

|

The NASDAQ Stock Market

|

Securities registered pursuant to Section 12(g) of the Act:

None.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o Accelerated Filer o Non-accelerated Filer o Smaller Reporting Company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

On May 31, 2012, the last business day of the registrant’s most recently completed second fiscal quarter there was no trading market for the registrant’s common stock. The registrant’s common stock began trading on the NASDAQ Capital Market on November 26, 2012.

As of February 22, 2013, the registrant has 6,978,169 shares of Common Stock issued and outstanding.

Documents Incorporated By Reference

The information in response to Part III, Items 10, 11, 12, 13 and 14 of this Report are incorporated herein by reference to the Registrant’s Definitive Proxy Statement, to be filed on or before March 30, 2013, with respect to its Annual Meeting of Stockholders for the fiscal year ended November 30, 2012.

|

Page

|

|||||

| 4 | |||||

| 16 | |||||

| ITEM 1B. | Unresolved Staff Comments | 23 | |||

| 23 | |||||

| 24 | |||||

| 24 | |||||

| 24 | |||||

| 26 | |||||

| 26 | |||||

| 38 | |||||

| 38 | |||||

| 38 | |||||

| 38 | |||||

| 39 | |||||

| 39 | |||||

| 39 | |||||

| 40 | |||||

| 40 | |||||

| 40 | |||||

| 40 | |||||

| Signatures | 42 | ||||

Cautionary Statement Regarding Forward-Looking Information

This Form 10-K contains “forward looking information” within the meaning of applicable securities laws. Such statements include, but are not limited to, statements with respect to the Company’s beliefs, plans, strategies, objectives, goals and expectations, including expectations about the future financial or operating performance of the Company and its projects, capital expenditures, capital needs, government regulation of the industry, environmental risks, limitations of insurance coverage, and the timing and possible outcome of regulatory matters, including the granting of patents and permits. Words such as “expect,” “anticipate,” “intend,” “attempt,” “may,” “will,” “plan,” “believe,” “seek,” “estimate” and variations of such words and similar expressions are intended to identify such forward looking information. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict.

These statements are based on and were developed using a number of factors and assumptions including, but not limited to: stability in the U.S. and other foreign economies; stability in the availability and pricing of raw materials, energy and supplies; stability in the competitive environment; the continued ability of the Company to access cost effective capital when needed; and no unexpected or unforeseen events occurring that would materially alter the Company’s current plans. All of these assumptions have been derived from information currently available to the Company including information obtained by the Company from third party sources. Although management believes that these assumptions are reasonable, these assumptions may prove to be incorrect in whole or in part. As a result of these and other factors, actual results may differ materially from those expressed, implied or forecasted in such forward looking information, which reflect the Company’s expectations only as of the date hereof.

Factors that could cause actual results or outcomes to differ materially from the results expressed, implied or forecasted by the forward-looking information include risks associated with general business, economic, competitive, political and social uncertainties; risks associated with changes in project parameters as plans continue to be refined; risks associated with failure of plant, equipment or processes to operate as anticipated; risks associated with accidents or labour disputes; risks associated in delays in obtaining governmental approvals or financing, or in the completion of development or construction activities; risks associated with financial leverage and the availability of capital; risks associated with the price of commodities and the inability of the Company to control commodity prices; risks associated with the regulatory environment within which the Company operates; risks associated with litigation including the availability of insurance; and risks posed by competition. These and other factors that could cause actual results or outcomes to differ materially from the results expressed, implied or forecasted by the forward looking information are discussed in more detail in the section entitled “Risk Factors” in this document.

The Company does not intend to, and the Company disclaims any obligation to, update any forward-looking information (including any financial outlooks), whether written or oral, or whether as a result of new information, future events or otherwise, except as required by law.

All references in this Form 10-K to “Company,” “Methes,” “we,” “us,” or “our” refer to Methes Energies International Ltd. and its wholly owned subsidiaries Methes Energies Canada Inc. and Methes Energies USA Ltd. unless the context otherwise indicates.

We have rights to the trademarks Methes Energies and Design, Methes, The Biodiesel Company and Denami.

|

BUSINESS

|

Overview

We are a renewable energy company that offers an array of products and services to a network of biodiesel fuel producers. We also market and sell in the U.S. and Canada biodiesel fuel produced at our small-scale production and demonstration facility in Mississauga, Ontario, Canada, and have recently commissioned and are scaling-up biodiesel production at our new facility in Sombra, Ontario, Canada. In fiscal 2011 and 2012, our largest source of revenue was from the sale of biodiesel fuel produced by others.

Among other services, we sell feedstock to our network of biodiesel producers, sell their output in the U.S. and Canada, provide them with proprietary software used to operate and control their processors, remotely monitor the quality and characteristics of their output, upgrade and repair their processors, and advise them on adjusting their processes to use varying feedstock and improve their output. Through the accumulation of production data from our network, we are equipped to provide consulting services to network members and other producers for operating their facilities, maintaining optimum production and solving production problems. In addition, we provide assistance to network members and others in production site selection, site development, installation of equipment and commissioning of processors. For our network services and the license of our operating and communications software, we receive a royalty from network members based on gallons of biodiesel produced.

Network members currently produce biodiesel through use of Denami 600 processors purchased from us, which have a maximum rated capacity of 1.3 million gallons per year, or mgy, of biodiesel, and starting in 2013 may purchase one of our new Denami 3000 processors designed to produce up to 6.5 mgy of biodiesel. We market Denami processors designed to meet the needs of 2 to 20 mgy biodiesel producers. We believe that small and medium-scale producers will be the fastest growing segment of the biodiesel market. Our processors are flexible and can use a variety of virgin vegetable oils, used vegetable oil and rendered animal fat feedstock, allowing operators to take advantage of feedstock buying opportunities. Our Denami processors operate automatically in a continuous flow mode and can be rapidly fine-tuned to adjust to feedstock and production variables. In addition to low production and labor costs, our processors minimize electrical use and utilize water only in closed loop components. The absence of waste water discharge has facilitated obtaining environmental permits for our facilities and those of our customers.

We expect to achieve economies of scale for our network members by bulk purchasing feedstock, methanol, catalyst and other biodiesel related products and negotiating more favorable sales prices through the sale of larger quantities of biodiesel and glycerin for these members. Achieving our growth plan will enable us to spread fixed overhead costs over a larger revenue base.

In May 2012, we completed construction and installation of two of our new intermediate-scale Denami 3000 processors at our Sombra facility. Our Denami 3000 processors at the Sombra plant have been favorably tested during full-scale operation for a few days in July 2012 and received United States EPA approval on October 4, 2012. We began commercial operation and formal training of our employees at the Sombra, Ontario facility in November 2012.

Growth Plan

We plan to expand our business by (i) developing a computer-linked, North American network of small and medium-scale independent biodiesel producers, (ii) adding to our production capacity at our Sombra location, (iii) marketing and selling our Denami processors in Europe, Asia and South America, and (iv) expanding our consulting services. The network is intended to provide us not only with royalties but also with opportunities to offer additional services to network members, such as sales of feedstock and process monitoring services. Purchasers of our Denami processors benefit from the computer-linked, real-time monitoring services which improve the quality of processor output and processor efficiency. Other small and intermediate producers can take advantage of our upgrade, repair and service capabilities. We may also offer to purchase biodiesel from computer-linked network members and others. Specific steps contemplated by our growth plan include:

|

●

|

Expand our biodiesel production network. We believe that our existing small network can be expanded. We already consult with entrepreneurs, existing producers and other businesses seeking to enter into small and intermediate-scale biodiesel production. We expect most new members of our network will be purchasers of our Denami processors, but certain network services will be open to other small and intermediate producers.

|

|

|

●

|

Increase production capacity. We began commercial operation and formal training of our employees at the Sombra, Ontario facility in November 2012. Depending upon the availability of financing, we plan to further increase capacity at our Sombra facility by another 13 mgy by May 2014.

|

|

●

|

Increase marketing and sales of Denami processors. We plan to begin selling our new 6.5 mgy Denami 3000 processors to potential members of our North American network as well as to other purchasers outside the areas served by our network. We also plan to offer our processors in Europe, Asia and South America. We believe there is demand for small and intermediate biodiesel processors in these regions that we have been unable to exploit because of our small size, limited resources and small marketing staff. We intend to hire additional marketing and sales personnel upon completion of this offering in order to pursue our growth plan. We did not sell any Denami processors to third parties in fiscal 2011 and 2012.

|

|

|

●

|

Expand consulting services. We plan to offer consulting services to other biodiesel producers in North America, providing them with solutions to production process, quality, sourcing and marketing problems. We also expect to offer additional “turnkey” services to those considering entry into the biodiesel industry, including assistance in finding suitable production sites, setting up production facilities, obtaining required zoning approval and environmental permits, and installing production equipment. We believe that our strong research and development background and our experience in providing these services give us a clear advantage in offering these services.

|

Competitive Advantages

We believe we have a number of competitive advantages that will contribute to our ability to achieve our growth plans:

|

●

|

Experience in operating a biodiesel producers’ network. We have operated an interconnected computer-linked network of biodiesel producers since 2010 and have the background, knowledge and skills to assist network members in acquiring feedstock, marketing and selling their biodiesel output, refining and improving production processes and resolving any production difficulties. At present, our network consists of four production facilities, two of which are owned by us. Data collected from an expanded network of members will enhance our biodiesel trading and consulting services.

|

|

|

●

|

Multiple revenue streams. We derive revenue from sale of our biodiesel and biodiesel produced by others, feedstock sales, equipment sales, government incentives, royalties and miscellaneous other revenues. In fiscal 2011 and 2012, respectively, these revenue sources contributed the following percentages of our total revenue: internal biodiesel production 29.5% and 39.2%; biodiesel re-sales 53.1% and 49.3%; feedstock sales 7.1% and 6.0%; equipment sales 2.2% and (3.7%); government incentives 4.4% and 4.6%; royalties 0.9% and 1.0%; and other 1.7% and 2.8%. These diverse revenues sources and the synergies among the different parts of our business reduce the seasonality of our business and our dependence on any one market.

|

|

|

●

|

Sophisticated proprietary technology. Our processors are controlled by proprietary and encrypted software developed by us which provides real-time information to the operators and our Canadian operating headquarters, and permits remote monitoring and control of our members’ processors. The real-time information provided includes the quantities of oil, methanol, catalyst and other feedstock components consumed; the flow rate of material through the system; the temperatures at which each of the system components operate; and the output derived and elapsed time for each processing component.

|

|

|

●

|

Products designed for small and intermediate scale producers. Our Denami 600 and Denami 3000 processors are specifically designed to meet the needs of 2 to 20 mgy producers, and require a relatively small capital investment and less time to complete a production facility. Production is scalable as additional units can then be added with relative ease to increase capacity. Expanding production through individual units also provides more flexibility in processing different feedstocks, as the production process can be grouped by type of feedstocks or by feedstock from a particular source. | |

|

●

|

Superior quality assurance processes. We regularly receive samples of biodiesel output from network members so we can provide the highest level of quality assurance to our customers. In addition, we continuously monitor production processes for network members. These quality assurance processes enable us to assure compliance with applicable industry purity standards and offer consistent product quality. | |

|

●

|

Superior product design. Our Denami processors are engineered to offer the following advantages: | |

|

●

|

Adaptability to multiple feedstocks. Unlike most equipment now in production, our Denami processors can use a variety of feedstocks, including soy oil, canola oil, used vegetable oil, used cooking oil, pork lard and beef tallow, to produce high-quality biodiesel which enables us and our network members to purchase in the market whatever feedstock is then most economical. |

|

●

|

Modular component design. As the biodiesel industry matures, the regulatory standards will likely continue to evolve, which will require modifications to current production processes and upgrades to existing equipment. The modular design of the Denami 600 and Denami 3000 allows components to be removed, repaired or replaced without replacing the entire unit, thus permitting upgrades to components of the process to be made in a cost-effective manner. | |

|

●

|

Small footprint and short build time. Our Denami processors are compact and can be installed in a footprint as small as 11 feet wide by 16 feet long and 16 feet high, and can be manufactured in as little as 16 weeks unlike many other processors which require more than seven months to build. |

Biodiesel Industry Background

Biodiesel is an engine fuel produced from vegetable oils and animal fats that has favorable environmental and lubrication characteristics when used as a blend with or alternative for petroleum-based diesel fuels. Federal and state environmental requirements and incentives, particularly the Renewable Fuel Standard program and RFS2 there under, have encouraged the production and use of biodiesel in recent years. U.S. biodiesel production in 2012 was estimated at nearly 1.1 billion gallons. Canadian biodiesel production is still in its infancy with its first federally mandated use of 2% renewable in diesel and home heating oil which began on July 1, 2011. With only 13 biodiesel production facilities in Canada, mostly small were operating in 2012 with an estimated production of 54 million gallons per year.

Rudolph Diesel designed the diesel engine in 1894 to run on peanut oil. Until recently, however, vegetable oils (biodiesel) have not been a significant source of energy for the diesel engine. Instead, petroleum-based distillate fuels became the primary energy source for a variety of heating, diesel fuel and electric power generation uses. According to the Energy Information Administration, the United States consumed approximately 57.2 billion gallons of distillate fuel in 2011, an increase of 1.2 billion gallons over 2010. Diesel fuel makes up approximately two-thirds of the distillate fuel use and fuel oil approximately one-third. The major distillate market segments include “on-highway” with 65 percent of the market; “residential” with 7 percent; “farm” and “commercial” with 5 percent; and “railroad,” “industrial” and “off-highway” with approximately four percent each.

The biggest change in the diesel fuel market in the past decade has been the requirement to decrease regulated emissions, principally in the “on-highway” portion of the market. This has required diesel fuel refineries to produce fuel with lower sulfur content. Effective June 2006, all diesel fuel was required to have a sulfur content of less than 15 parts per million. A problem encountered with “ultra low sulfur diesel or “ULSD” is decreased lubricity of the fuel. All diesel fuel injection equipment depends on diesel fuel for lubrication of internal moving parts, which reduces equipment wear and premature breakdown. Accordingly, producers and distributors of ULSD are under pressure to find additives or other means to increase the lubricity of their diesel fuels.

The U.S. federal government began encouraging biodiesel production in 2000. The 2002 Energy Bill provided producers of biodiesel a tax credit of $0.80 per gallon, and mandated that all federal, state and local governments with diesel-powered vehicles and diesel-powered equipment use a mixture of 2 percent biodiesel (B2). As of late 2011, the National Biodiesel Board, a trade association, estimates that there is capacity to produce approximately 2 billion gallons of biodiesel in the United States annually.

The Canadian federal government began the ecoENERGY for Biofuels Program in 2008 to support the production of renewable alternatives to gasoline and diesel. Under this incentive program Canadian producers of biodiesel receive incentive payments per gallon of biodiesel produced in declining amounts through 2017 when the incentive program ends. In addition, the Canadian Government has adopted regulations requiring 2% renewable content in diesel and heating oil starting July 1, 2011, with an 18-month compliance period to meet that volume requirement.

Benefits of Biodiesel: Environmental and Lubricity

Biodiesel, which is produced from animal and vegetable oils, can be used as a fuel in its pure form or blended with petroleum distillate in any percentage to ensure proper performance in diesel engines. Fuel-grade biodiesel must be produced in compliance with ASTM D6751, a standard issued in December 2001 by ASTM International, formerly known as the American Society for Testing and Materials. Issuance of this specification has been crucial in standardizing fuel quality for biodiesel in the U.S. market and increasing the confidence of consumers and engine makers. Although Canada has yet to establish its own standards for biodiesel, The Canadian General Standards Board (CGSB) recognizes ASTM D6751 as part of a Canadian biodiesel specification.

According to the National Biodiesel Board, biodiesel is the only alternative fuel to have fully completed the health effects testing requirements of the 1990 Clean Air Act Amendments. Biodiesel that meets ASTM D6751 requirements is a legal motor fuel that may be sold and distributed in the United States. It has been registered as a fuel and fuel additive with the EPA and meets clean diesel standards established by the California Air Resources Board. According to the National Biodiesel Board, biodiesel, in pure form, has been designated as an alternative fuel by the U.S. Department of Energy and the U.S. Department of Transportation.

Based on a comprehensive technical report of biodiesel emissions data released by the EPA, the use of biodiesel (B100) can reduce emissions of particulate matter by up to 47 percent when compared to petroleum diesel in unmodified diesel engines. The report also verified a 67 percent reduction in unburned hydrocarbons and a 48 percent reduction in carbon monoxide with pure biodiesel. However, there was a 10 percent increase in NOx emissions compared with petroleum diesel fuel. Source: EPA, A Comprehensive Analysis of Biodiesel Impacts on Exhaust Emissions (Oct. 2002). Biodiesel is the only alternative automotive fuel to have successfully completed the Tier I and Tier II health effects testing requirements of the Clean Air Act Amendments of 1990. The results of the tests concluded that biodiesel is nontoxic and biodegradable, and posed no known threat to human health.

To assist in ensuring that biodiesel is produced and maintained at the ASTM D6751 industry standard, the National Biodiesel Board created the National Biodiesel Accreditation Commission (the “NBAC”) to certify producers and marketers of biodiesel that successfully meet the accreditation criteria as “Accredited BQ9000 Producers.” Accreditation is awarded following a successful formal review and audit of the capacity and commitment of the applicant to produce or market biodiesel fuel that meets the ASTM D6751 specification for Biodiesel Fuel (B100) Blend Stock for Distillate Fuels. The accreditation process is comprehensive and includes a detailed review of the applicant’s quality system documentation, followed by a formal audit of the applicant’s conformance to its system. The BQ9000 accreditation is voluntary and optional. Our Mississauga and Sombra facilities are not BQ-9000 accredited although we may seek such accreditation once our Sombra facility has begun full-scale production and completed the required review and audit procedures.

In addition to its lower emissions than petroleum-based diesel, the better lubricity characteristics of biodiesel have caused it to emerge as an attractive alternative fuel or blending resource. According to the National Biodiesel Board, bench-scale testing has shown that a one percent biodiesel blend can improve the lubricity of diesel fuel by up to 65 percent, depending on the base diesel fuel product. Subject to the adaptability of the engine or use, biodiesel can be blended or used in any ratio, ranging from one percent (B1) to 100 percent (B100).

Market Overview

Since biodiesel has been more expensive to produce than petroleum-based diesel fuel over the past few years, the biodiesel industry is dependent on government programs that support a market for biodiesel that might not otherwise exist. Stimulated largely by federal, state and provincial government environmental regulations and incentives, the biodiesel market has grown substantially in recent years. According to the website of the National Biodiesel Board, biodiesel production reached approximately 250 million gallons in 2006 and 1.1 billion gallons in 2011. In the United States and Canada, there were 204 biodiesel facilities as of May 2012 with the capacity to produce approximately 3.1 billion gallons of biodiesel annually.

The future demand for biodiesel will depend in part on whether federal and state government incentives and mandates are maintained and expanded and on the demand for diesel fuel in general, which is relatively large but growing slowly. We believe the demand for biodiesel may increase as automobiles and small trucks shift to using diesel to take advantage of the benefits of biodiesel and biodiesel blends.

Biodiesel is one of the fastest growing alternative fuels in the United States. In January 1999, there were only a few fleets buying and using biodiesel. According to information published on company websites, as of May 2012, several hundred major fleets have implemented biodiesel programs across the country, including federal fleets such as the U.S. Postal Service, the U.S. Air Force, the U.S. Army, the U.S. Department of Energy and NASA; state fleets in Ohio, Iowa, Virginia, Missouri, Delaware and New Jersey; city buses such as Cincinnati Metro in Cincinnati, Ohio and the Bi-State in St. Louis, Missouri; and major public utility fleets such as Commonwealth Edison, Florida Power and Light, Duke Energy, Georgia Power, Alabama Power and others. The Company believes that this growth is spurred in part by three principal factors: (1) standards established by the ASTM, (2) health effects testing criteria by the federal EPA, and (3) the necessity to comply with standards established under the Energy Policy Act of 1992.

The biodiesel market in Canada is expected to develop in a manner similar to the U.S. market. In order to meet the mandate of 2% biodiesel content in Canada, 158 mgy of biodiesel was required by the end of the first compliance period on December 31, 2012.

We believe, based on the number of small and intermediate size production facilities now existing or under development in the United States and Canada and the number of additional investors that may seek to enter into biodiesel production, that the market for the services we provide to members of our network and other biodiesel producers will be strong over the next several years. Our services facilitate the marketing of biodiesel by our network members, enable network members to achieve production efficiencies by purchasing feedstock through us which provides the highest yield at the lowest cost, provide potential new biodiesel producers with the benefit of our “turnkey” services and otherwise assist network members in efficiently running their production processes and remediating production problems.

Government Incentives

United States

The U.S. federal government and various state governments have created incentive programs to encourage biodiesel production in the United States The federal incentive programs include direct payments to eligible U.S. producers for increased biodiesel production. State incentive programs include tax exemptions and credits for U.S. producers. We compete with U.S. biodiesel producers that benefit from the programs described below, and as a result they may affect our ability to be competitive in the U.S. biodiesel market.

U.S. Biodiesel Tax Credits. The first biodiesel-specific tax incentives were adopted as part of the American Jobs Creation Act of 2004. Under these incentives, federal income and excise tax credits are available to certain distributors and blenders of biodiesel and agri-biodiesel. The incentives were designed to reduce the price of and increase the demand for biodiesel. The federal credits expired on December 31, 2011. However, certain states, such as Illinois, exempt biodiesel from sales or fuel excise taxes.

U.S. Energy Policy Act of 2005: The Energy Policy Act of 2005 established a renewable fuel standard or RFS, for automotive fuels. The RFS was expanded by the Energy Independence and Security Act of 2007. The RFS requires the use of renewable fuels (including ethanol and biodiesel) in transportation fuel. In 2013 the EPA is proposing a renewable fuel standard calling for 16.55 billion gallons of renewable fuel, compared to 2011 when fuel suppliers were required to include 13.95 billion gallons of renewable fuel in the national transportation fuel supply; this requirement increases annually to 36 billion gallons in 2022. The expanded RFS also specifically mandated the use of “advanced biofuels”- fuels produced from non-corn feedstocks and with 50% lower lifecycle greenhouse gas emissions than petroleum fuel-starting in 2009.

Of the 36 billion gallons required in 2022, at least 21 billion gallons must be advanced biofuel. There are also specific quotas for cellulosic biofuels and for biomass-based diesel fuel. On May 1, 2007, the EPA issued a final rule on the original RFS program detailing compliance standards for fuel suppliers, as well as a system to trade renewable fuel credits between suppliers. On March 26, 2010, the EPA issued final rules for the expanded RFS2 program, including lifecycle analysis methods necessary to categorize fuels as advanced biofuels, and new rules for credit verification and trading. While this program is not a direct subsidy for the construction of biofuels plants, the guaranteed market created by the renewable fuel standard is expected to stimulate growth of the biofuels industry and to raise prices above where they would have been in the absence of the mandate.

Under this act, a U.S. domestic producer or an importer of biodiesel produced by a foreign renewable fuel producer approved by the EPA generates 1.5 RIN units for each gallon of biodesel produced in or imported into the U.S., which units can be sold on an established market.

Canada

Canadian Federal ecoENERGY for Biofuels Program. The ecoENERGY for Biofuels Program is aimed at helping producers of renewable alternatives to gasoline or diesel by providing financial incentives. Financial incentives are provided for the number of liters produced in Canada and sold anywhere, based on fixed declining incentive rates established by the program and as agreed upon in each contribution agreement. The incentive for biodiesel (converted to U.S. dollars per gallon at the exchange rate in effect on November 30, 2012) was $0.74 per gallon for the April 1, 2010 through March 31, 2011 program year, and will decline in steps to $0.15 per gallon for the 2016-2017 program year, at the end of which the program is scheduled to end.

Canadian Provincial Road Tax Exemption for Biodiesel. Provincial jurisdictions have acted individually to implement biodiesel initiatives to stimulate biodiesel production and investment. British Columbia, Ontario and Manitoba are the only provinces that offer tax exemption. The province of Ontario exempts biodiesel from its road tax at CDN $0.143 per liter and British Columbia has introduced a tax exemption of CDN $0.15-$0.21 per liter for biodiesel when used in blends from 5-50% with petroleum diesel. The Manitoba government no longer collects road and provincial sales tax on pure biodiesel of CDN $0.115 per liter. In addition, Manitoba released a CDN $1.5 million support program for biodiesel production.

Other Canadian National and Provincial Requirements. Biodiesel demand in Canada is expected to grow significantly in 2012 and 2013 due to Canada’s renewable fuel policies. Those policies require a 2% renewable blend into Canadian petroleum-based diesel and heating oil beginning July 1, 2011 for an estimated 158 mgy by the end of the first compliance period on December 31, 2012. Additionally, several Canadian provinces maintain provincial blend requirements, including a 2% biodiesel blend requirement into diesel fuel in Manitoba as of November 2009, a 4% renewable fuel content in British Columbia that increased to a 5% renewable fuel content requirement in January 2012, and a 2% renewable fuel content requirement in Alberta as of April 2011. According to the Canadian Renewable Fuels Association, there is 54 mgy of operating production capacity in Canada. Therefore, we expect biodiesel production in Canada to increase significantly to satisfy higher demand levels pursuant to the recently enacted national blend requirements.

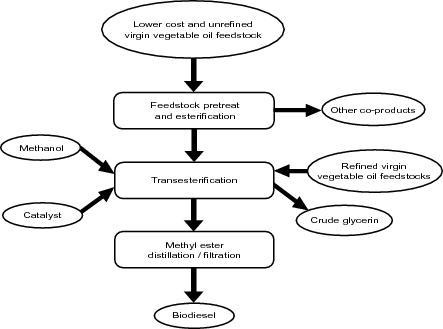

Our Biodiesel Production Process

The production of biodiesel, or methyl esters, is a well-known chemical process that has been used for decades in the soaps and detergents industry. There are three basic chemical routes to produce methyl esters from oils and fats: base-catalyzed transesterification of oil with methanol; direct acid catalyzed esterification of oil with methanol; and conversion of the oil to fatty acids, and then to methyl esters with acid catalysis. Each of these transesterification processes describe complex organic chemical reactions in which existing esters are transformed into methyl esters through the use of differing catalysts or reactants. Denami processors use only the base-catalyzed transesterification method. This is the most economical process technology, and most methyl esters are produced using it. The base-catalyzed transesterification method is a low-temperature (160–180° F) and low-pressure (15 to 30 psi) chemical process that yields high conversion (98 percent) with minimal side reactions when feedstocks low in free fatty acids are used. In our processors, for every 100 pounds of oil feedstock and 10 pounds of methanol in the presence of a base catalyst, we produce 100 pounds of biodiesel and 10 pounds of glycerin. To speed the conversion, we input added methanol which is recovered for reuse. Generally, we use sodium methylate as our base catalyst.

Our Denami processors produce ASTM biodiesel in an automated, remotely controlled, continuous flow process. The Denami 600 processor produces 600 liters per hour, and the Denami 3000 produces 3,000 liters per hour of grade B100 biodiesel fuel, which exceeds current ASTM biodiesel standards. We believe that our Denami 600 was the industry’s first compact, fully automated processor that offers the flexibility of using a wide variety of feedstock options. Although in fiscal 2011 our Mississauga plant used primarily yellow grease (used cooking oil) as its feedstock, it can use such common and widely available feedstocks as soy oil, canola oil, beef tallow or poultry fat.

Biodiesel Production Process

The Denami processor performs all critical processes needed to produce ASTM grade biodiesel, specifically:

|

●

|

The conversion process. The conversion process requires specific quantities of oil, methanol and catalyst in the heated and pressurized environment to successfully convert the oils to biodiesel that meet ASTM specifications. Parameters can be changed “on-the-fly” in order to cover a wide variety of feedstock options. After the conversion process, two products are produced: crude biodiesel and crude glycerin.

|

|

|

●

|

The separation process. The separation process uses a continuous gravity settling process. This is the most robust method of separation because it does not need to be configured for specific feedstocks.

|

|

|

●

|

The methanol recovery process. The crude biodiesel will have high methanol content. The methanol recovery process uses flash evaporation technology to recover the methanol and reuse it in the conversion process.

|

|

|

●

|

The polishing/refining process. The crude biodiesel is passed through a centrifuge to remove bulk impurities such as glycerin, soaps, salts and water. Then it is passed through a dry resin bed to remove the remaining trace amounts of impurities to produce ASTM-grade biodiesel.

|

|

|

●

|

The methanol removal process. The methanol removal process is designed to remove methanol from the polished biodiesel to meet either the ASTM D93 flashpoint test or EN14014 methanol content test.

|

|

|

●

|

The stabilization process. Biodiesel is naturally unstable and oxidizes when exposed to air. The stabilization process meters in the appropriate amount of antioxidants (stabilizers) to the biodiesel. After this process, the biodiesel is transferred to a storage tank and is ready to be sold.

|

We originally retained Turnkey Modular Systems Inc., or TKMS, to design our biodiesel processor. We purchased all of TKMS’s ownership rights to, and interest in, the intellectual property rights, including the design and specifications, for the Denami 600 biodiesel processor in March 2009. We developed the Denami 3000 in collaboration with TKMS and we now own all intellectual property rights to the Denami 600 and Denami 3000 processors. Since September 2007, we have retained TKMS as the exclusive manufacturer of our processors in the United States and Canada. We expect to continue to retain TKMS as the exclusive manufacturer of our processors until the expiration of the current term of our agreement in August 2015. Our decision to work with TKMS was based on quality, experience, industry track record, warranties, equipment capabilities, price and representations made by TKMS.

Research and Development

We regularly engage in research and development, primarily on the development, improvement and enhancement of the efficiency of our Denami processors and the software used to operate those processors. Generally, research and development activities are conducted at our Mississauga facility.

Denami Processor Sales

We offer our biodiesel processors for sale either alone or with a range of services up to a complete turn-key solution where we obtain the production facility site, manage the construction or renovation of the facility, obtain all necessary permits, and install the processor and related storage tanks, pipes, containment wall and truck-loading facility. If the customer desires, we will also manage and operate the facility in exchange for an additional fee.

After sale of a Denami processor, the customer is required to enter into a license agreement which grants the customer a non-exclusive, perpetual, royalty-bearing license to use our proprietary monitoring technology. Our licensed software allows the operation and maintenance of the Denami in an unmanned and remotely controlled environment. The license agreement requires the customer to pay us a royalty of CDN$0.11 per gallon, in perpetuity, for each gallon of biodiesel produced.

Maintenance and support services provided to purchasers of Denami processors include real-time monitoring of the customer’s processor(s) via our proprietary monitoring technology and in-process testing to ensure that the biodiesel produced meets quality standards. Furthermore, all Denami processors come with an extended warranty, pursuant to which we provide our customers, without charge and subject to the limits discussed below, labor and replacement parts for products that prove to be defective in material or workmanship and which result in the production of biodiesel that does not meet the applicable ASTM D6571 specifications. The warranty does not cover products or parts that are damaged due to accident, misuse, improper or insufficient maintenance, improper operation, and normal wear and tear. Warranty claims are not subject to any dollar limitation for the first year after commissioning, and are limited to CDN$25,000 per year for each year thereafter.

Our Facilities

Sombra Facility

Our Sombra facility utilizes two Denami 3000 processors capable of producing 13.2 mgy of biodiesel and 182 tons of glycerin per year. It is located on a 20.6-acre property near the St. Clair River in Sombra, Ontario. It is close to the border with the United States to which some of the biodiesel produced is expected to be shipped. Sombra is an excellent production location due to its proximity to oil refiners and extensive manufacturing infrastructure, including easy access by road, rail and water. We believe that due to its geographical location, the Sombra facility will play a key role in meeting the regional demand for biodiesel in the United States and Canada.

The Sombra facility site was formerly a refinery that produced oil, gas and chemical products. We purchased the facility from a third party in July 2008 for CDN$2,200,000. The property includes a production warehouse, rail access, storage tanks, loading area and office space. There are 3,600 feet of rail, four rail spurs, three switches, and a spill containment unit for unloading bulk liquid rail cars on the property. There are two pipelines that run from the site to the St. Clair River with a pump house to draw water and to discharge storm water. The electrical supply is 27,000 volts. The site currently has 27,163 square feet of buildings and 26 storage tanks with an aggregate capacity of 1,227,665 gallons.

The zoning of this property is regulated by the Planning Act of the Province of Ontario where this property is classified as M3-1 Industrial land. We have entered into several agreements with local authorities that restrict our use of the site, including agreements that we will not use the site for any purpose related to the manufacture or sale of choline chloride, specialty choline derivatives, monomethylamine, dimethylamine, trimethylamine, monomethylformamide or dimethylformamide, none of which are used in our production of biodiesel. We have not been notified of any environmental problems at the Sombra facility.

We have installed two Denami 3000 processors at the Sombra plant that were favorably tested during full operation for a few days in July 2012. We filed our application for EPA approval on July 21, 2012 and received approval on October 4, 2012. We began commercial operation and formal training of our employees at the Sombra, Ontario facility in November 2012. With further development, the site could accommodate two to four additional Denami 3000 processors.

Mississauga Facility

We operate a biodiesel production and demonstration facility in Mississauga, Ontario, Canada. The facility utilizes a single Denami 600 processor capable of producing 1.3 mgy of biodiesel. However, since this facility is also used as a demonstration site for sale of Denami 600 processors, as a test site for various animal and vegetable feedstocks, as well as for research and development, it does not generally operate at full capacity. The facility occupies 6,319 square feet, approximately 40 percent of which is corporate office space and the remaining 60 percent is used for the production of biodiesel. The facility contains six above-ground storage tanks. Five of these tanks have an aggregate capacity of 72,500 gallons of which two tanks are used for feedstocks, two tanks are used for biodiesel and one is used for glycerin. These tanks are located within a spill containment area that has been constructed as a dike-system using concrete block partial walls that are epoxy coated to be impervious to liquids. The last tank is for methanol and has a 11,138 gallon capacity. The methanol tank is separated from the feedstock and product storage within the containment area in a fire rated methanol room. The fire safety room complies with Provincial building and fire codes. We lease the Mississauga facility, but pursuant to the terms of the lease agreement, we own all of the equipment located at, and improvements to, the facility.

The plant is also used to demonstrate our production of biodiesel in an automated and remotely controlled environment and to test the different types of feedstock that could be used by us or our clients to produce biodiesel. A chemist is employed full-time on site to monitor the quality of the biodiesel produced at the Mississauga facility as well as to perform analysis of the raw materials used for the production of biodiesel.

Supplies

Feedstock

We currently process virgin animal fats, vegetable oil and used cooking oil at our facilities in Mississauga and Sombra. The Mississauga facility requires 5,000 tons of feedstock per year to run at full capacity, and we anticipate that the Sombra facility will require 50,000 tons per year to run at its full design capacity. We purchase animal fats, and used cooking and vegetable oils on the open market and have not previously entered into any definitive feedstock supply agreements to secure feedstock on favorable terms. All of the feedstock supplies utilized in our biodiesel production are readily available in the marketplace. We manage the risks associated with varying prices for our feedstock by utilizing the feedstock which will give us the highest effective yield based on the varying feedstock costs for different fats and oils and by purchasing feedstock that is available in the vicinity of our facility to minimize transportation costs.

Chemical Inputs

We purchase methanol, sodium methylate, acetic acid, sulfuric acid and caustic potash from various vendors and suppliers for use at our plants. All of these chemical inputs are readily available.

Transportation and Delivery

The Mississauga facility is accessible by road and the Sombra facility accessible by road and rail, and may in the future also be accessible seasonally by barge (the facility is approximately 3,000 feet from the St. Clair River). Feedstock is delivered to our production facility in Mississauga on a regular basis. We intend for the Sombra facility to be supplied by railcar as soon as full production begins, and have entered into an agreement with CSX Transportation with respect to the connection of our private tracks to CSX’s and CN’s rail lines. We currently have a leased fleet of 18 rail cars that we use to ship biodiesel and receive oil. At our Mississauga facility, the biodiesel is shipped by truck to Sombra to be transloaded into rail cars.

Whenever we are required to arrange for transportation of oil or biodiesel, we contract with local transport companies. To date, transportation has been readily available and priced competitively. We currently have no long-term agreement with a freight company.

Risk Management

The profitability of the biodiesel production business largely depends on the spread between prices for feedstock and for biodiesel fuel. We actively monitor changes in prices of these commodities and attempt to manage a portion of the risks associated with these price fluctuations. However, the extent to which we engage in risk management activities varies substantially from time to time, and from feedstock to feedstock, depending on market conditions and other factors. Adverse price movements for these commodities directly affect our operating results. In making risk management decisions, we may receive input from others with risk management expertise and could utilize research conducted by outside firms to provide additional market information.

Sales and Marketing

We market and sell two principal products to the biodiesel industry: Denami biodiesel processors and biodiesel (B100) fuel. We also sell glycerin as a by-product and offer services related to the production of biodiesel. We also purchase feedstock from various sources on the spot markets for our own use as well as for resale to certain customers.

Biodiesel

Sales and marketing of our biodiesel are handled by our in-house sales and marketing team. Our largest customer accounted for 83% of total revenue in 2011 and our three largest customers accounted for 39%, 26% and 21% of total revenue in 2012. The sales to these customers were made at spot market prices, and we have no binding off take agreements covering our production. There are additional potential customers for the biodiesel sold to these three largest customers, including potential customers already in our customer base, and we believe that the loss of one or more of these three customers would not have a material adverse effect on our business. We also sell our biodiesel directly to private fleet users and others who can blend our biodiesel with petroleum based diesel fuels. We expect our current customers or other wholesaler/marketers will sell most of our biodiesel to fuel users and retail locations in the United States and Canada. It is also our intention to approach private fleet users such as trucking companies to maximize market penetration and increase sales.

Our Mississauga facility currently sells almost all of its biodiesel into the United States market. Our Mississauga and Sombra facilities are registered with the EPA as Foreign Renewable Fuel Producers under RSF2 which allows for RINs to be generated when our biodiesel is imported into the United States.

Under the Canadian Federal ecoENERGY for Biofuels Program, we received incentives in program years 2011 and 2012 for production at our Mississauga plant in the amount of $518,872 and $299,540, respectively. In December 2011, we were approved for incentives under that program for biodiesel produced at our Sombra facility up to its full 13 mgy capacity. The following table outlines the incentive rate per gallon (converted to U.S dollars at the exchange rate in effect on November 30, 2012) for the years 2010 to 2017, when the program is scheduled to end, and the maximum incentive amounts in Canadian dollars that we may receive in the program years 2012-2013 through 2016-2017:

|

Program Year

|

2010 / 2011 | 2011 / 2012 | 2012 / 2013 | 2013 / 2014 | 2014 / 2015 | 2015 / 2016 | 2016 / 2017 | |||||||||||||||||||||

|

Incentive Rate Payable

|

$ | 0.74 | $ | 0.66 | $ | 0.53 | $ | 0.38 | $ | 0.30 | $ | 0.23 | $ | 0.15 | ||||||||||||||

|

Maximum Incentive Payable

|

$7.7 million

|

$5.5 million

|

$4.4 million

|

$3.1 million

|

$2.0 million

|

|||||||||||||||||||||||

Biodiesel Processors

Sales and marketing of Denami biodiesel processors are handled by our in-house sales and marketing team consisting of two employees headed by our Vice President of Sales and Marketing. Our sales and marketing team use traditional advertising methods to target potential buyers looking to enter the biodiesel production industry or existing producers seeking to expand their production capacity or upgrade their production equipment. We have from time to time advertised in Biodiesel Magazine , which is an online and offline magazine published by BBI International, Inc. The other method used by our sales and marketing team consists of promoting our product at the National Biodiesel Conference & Expo, held once each year in a different location in the United States. Members of our sales and marketing team are paid salaries and also receive commissions based on the sales they generate. Our target market segment is biodiesel production facilities in the 1.3 mgy to 20 mgy range, which is not addressed by the majority of our competitors, who focus on facilities over 20 mgy. This strategy allows our customers to open production facilities in places that would not support production capacities greater than 20 mgy.

Glycerin

We produce glycerin as a primary by-product of our biodiesel production process. Glycerin, equals approximately 11 percent of the amount of biodiesel produced. We do not expect to invest our resources in actively marketing or refining our glycerin production in the near term. Once our Sombra facility is operating at full capacity and, depending on the availability of capital and the current market for glycerin, we anticipate investing in additional infrastructure that will enable us to refine and market our glycerin. Until such time, we plan to sell our glycerin on the spot market as crude glycerin. Glycerin prices have declined significantly in recent years due to overcapacity in the glycerin market, caused in large part by expansion of the biodiesel industry. Since 2006, market prices for crude glycerin have been reported at between no value to $0.05 per pound.

Services

We market and sell our services through our in-house sales and marketing team consisting of two employees who use traditional advertising methods to target existing small and intermediate scale biodiesel producers and potential customers looking to enter the biodiesel production industry. We promote our service offering at the National Biodiesel Conference & Expo, held once each year in a different location in the United States. In the future we intend to expand our sales and marketing efforts through increased appearances at trade shows, additional advertising in trade publications and, possibly, additional sales personnel.

Employees

We currently have 33 full-time employees of which eight are executive officers, four are other officers, managers or professional employees, 16 are production employees, and five are office or clerical employees. Of our employees, 18 work at the Sombra facility and 13 at the Mississauga facility. As our production increases at Sombra, we plan to expand to two-shift and three-shift schedules to achieve maximum volume and our operations and then will require approximately five additional full-time employees. None of our employees is unionized. We believe we enjoy good relations with our employees.

Environmental and Other Regulatory Matters; Governmental Approvals

Our biofuel production facilities, like other fuel and chemical production facilities, are subject to environmental regulations. Although our biodiesel production processes generally do not discharge pollutants into the environment, we are subject to environmental regulation in preparation for unanticipated or unexpected releases of contaminants into the environment. Construction and operation of our plants required us to obtain a number of environmental permits from the Ontario Ministry of Environment (the “MOE”) and the Counties of Lambton and St. Clair, including an industrial storm water permit for our Sombra plant. We currently hold all required permits to operate our plants, with the exception of the storm water discharge permit at our Sombra plant for which we have applied and are awaiting issuance of a final permit. We have not received any notices of violation of any environmental regulations.

Permitting and environmental and other regulatory requirements may change in the future. Changes in permitting and regulatory requirements, including testing protocols, could make compliance more difficult and costly. If we are unable to obtain necessary permits or to comply with the requirements of such permits or any other environmental regulations, our business may be adversely affected and we may not be able to operate our plants.

Air Pollution Standards and Permits

There are a number of Canadian environmental standards that affect the operation of our plants, including those applicable to boilers, biodiesel processors, storage tanks and other equipment which may discharge a contaminant into any part of the natural environment other than water.

The air permits for our plants have terms and conditions that include strict emission limits and associated specific control technologies for each pollutant that must be maintained, and monitoring and record-keeping requirements that must be provided or made available to environmental officials. Any failure to comply with these requirements can result in a notice of violation and penalties that can include fines and even a requirement to cease facility operations until the violation is remedied. We have conducted an Emission Summary and Dispersion Modeling Report which was submitted as part of our approved Certificate of Air permit application for our Sombra plant.

Pollution Discharge Permits

We use water to cool and heat closed loop boiler and chiller systems in our plants. Since we use closed loop systems, water will not be discharged into the St. Clair River by our Sombra plant or Lake Ontario by our Mississauga plant.

Biodiesel Quality Testing Procedures

We are required to retain a certificate of analysis for each batch of B100 sold or delivered for at least one year. Natural Resource Canada may examine these records, perform on-site testing or obtain samples of biodiesel from us.

Competition

We compete directly with producers of biodiesel and other alternative fuel additives, with providers of biodiesel processing equipment, and indirectly with producers of petroleum-based diesel fuel. Many of these producers have significantly greater resources than we do. We also expect the number of direct biodiesel fuel competitors to increase in the future. The development of other biodiesel plants, particularly those in close proximity to our plants, will increase the supply of biodiesel and may result in lower local biodiesel prices and higher costs for feedstock locally.

Biodiesel Fuel

In our direct competition with biodiesel producers, many of which produce the same product that we do, we compete on the basis of price; ease, time and cost of delivery; and the quality and consistency of our products.

In February 2012, there were 12 other biodiesel producers in Canada with a total capacity of approximately 52.8 mgy. Additional plants are under construction in Canada which are expected to add approximately 75 mgy to capacity. We also compete with a large number of U.S-based biodiesel producers. In the future we will also compete with companies developing and using second-generation biofuels technologies, which may prove less costly to construct and operate and may produce superior biodiesel fuel, including biorefineries that will produce biodiesel from wood fiber. If the input and operational costs for second-generation biofuels technologies are lower or yields are higher, these companies could experience higher margins and it could be more difficult for us to compete with them because our biodiesel may be more expensive to produce.

In our indirect competition with producers of petroleum-based diesel fuel, the capital and operating costs of producing biodiesel make it prohibitive to compete on the basis of price. If the diesel fuel industry is able to produce diesel fuel with acceptable environmental characteristics, or if government regulations supporting or mandating the blending of biodiesel with petroleum based diesel are eliminated or weakened, biodiesel producers would find it extremely difficult to compete. Petroleum refiners are continually attempting to develop diesel fuels with low sulfur and other clean burning attributes, together with lubricity and other characteristics necessary for the diesel engines in the marketplace. It is not possible to predict what success the petroleum industry may experience in making diesel fuel more acceptable or the impact these efforts may have on the biodiesel industry. Accordingly, we are able to compete principally as a consequence of government environmental regulations and incentives, assisted by current high petroleum and diesel fuel prices.

Processors

In the sale of our processors, we compete with other biodiesel-technology companies from the United States and abroad, who focus on providing modular biodiesel processors to small and medium-sized producers. We are aware of at least five other companies who sell modular biodiesel processors, and there may be others. Our competitors rely on different proprietary technologies that may prove to be more efficient, less costly to operate, or produce a higher quality of biodiesel than ours do. While we believe we have a superior technology platform for our biodiesel processors, our competitors may have greater marketing resources or may achieve greater market acceptance for their processors.

Our strategy for generating revenues from sale of our processors to our target market segment also differs from our competitors’ strategies. The large biodiesel processor manufacturers are currently pursuing big projects, where a significant portion of revenues are earned from design, engineering, and construction services ($100 million and greater). Such projects generally take at least 2-3 years to complete. In contrast, we focus on small production facilities ranging in size from $1.6 million to $20 million, and our strategy is based not only on selling processors, but also on earning royalties from the use of our software controlling these processors and other revenues from the services provided to purchasers of our processors who become members of our network.

Intellectual Property

We hold Canadian trademark registrations for Methes Energies and Design and Methes, The Biodiesel Company. We have applied for U.S. registrations for Methes Energies The Biodiesel Company & Flame Design. We have also have applied for Canadian and United States registrations of our proprietary trademark Denami. The structure and design of our Denami processors is not protected by patent or other intellectual property laws. We protect the proprietary software that controls, operates and assesses the performance of our Denami processors by encrypting and preserving the confidentiality of the software. We believe that encrypting and preserving the confidentiality of the software that controls and operates our Denami processors and monitors their performance provides a meaningful measure of protection for our intellectual property and makes it more difficult for a competitor to produce similar processors. We do not believe the absence of patent protection for our processors adversely affects our business.

|

Risk Factors

|

Investors in our securities should carefully consider the risks described below before making an investment decision. For the reasons below and elsewhere in this document, investing in our units involves a high degree of risk. If any of the events described below actually occur, our business, financial condition or results of operation could be harmed, which could cause the value of our shares to decline and investors to lose all or part of their investment.

Risks Related to Our Operations and Market

Shortages of feedstock or increases in the cost of feedstock will reduce our profitability.

To produce biodiesel we must purchase significant amounts of feedstock. In the past, for our Mississauga plant, we have purchased this feedstock on the spot market and have not entered into fixed price or formula priced contracts with sources of supply. There is risk that adequate supplies of feedstock may not be available to us at affordable costs, particularly for the larger quantities that will be required at our Sombra plant. Increased demand for virgin vegetable oil, used vegetable oil or rendered animal fat either for feedstock or for other uses may increase spot market prices and reduce our ability to enter into supply contracts at prices which will allow us to remain competitive. The drought in the Midwestern United States has increased the cost of corn and soybeans and may increase the cost of certain biodiesel feedstocks in the future, including vegetable oil and animal fat. The impact of the drought on the prices of our feedstocks is uncertain, but the drought may increase the prices of some or all of our feedstocks as the market adjusts to higher corn and soybean prices. The availability and price of this feedstock will significantly affect our gross margins. A significant reduction in the quantity of available feedstock or an increase in the prices of feedstock could result in increased costs and adversely affect our cash flow and results of operations.

We have installed a larger version of our Denami processor at our Sombra plant, the performance of which has been assessed during only a few days of full-scale operation.

We have installed a larger version of our Denami processor, the Denami 3000, at the Sombra plant. Although the Denami 3000 is based on the same technology as the Denami 600, the Denami 3000 is much larger and operates at a faster flow rate. The larger Denami 3000 has been favorably tested during full scale operation for only a few days and we could still experience unexpected problems during sustained operations that might make it difficult to produce quality biodiesel. Potential problems with the Denami 3000 could increase costs and delay the start of full-scale production, and could adversely affect our ability to sell our Denami processors, and adversely affect our revenues and results of operations.

Our operating costs at our Sombra plant could be higher than we expect.

In addition to general market fluctuations and economic conditions, we could experience significant operating cost increases as a result of the failure of our Sombra plant to operate as efficiently as we expect. Other factors, many of which are beyond our control, which may also increase our costs include:

|

●

|

Higher feedstock prices because of an inadequate supply of or greater demand by others for feedstock;

|

|

|

●

|

Higher labor costs;

|

|

|

●

|

Higher costs for electricity and natural gas due to market conditions; and

|

|

|

●

|

Higher transportation costs because of greater demands on truck and rail transportation services.

|

Our management team has little or no experience in the operation of a biodiesel facility the size of our Sombra plant, which increases the risk that we will be unable to manage and operate it successfully.

We are highly dependent on our management team to operate our Sombra plant. Our management team has substantial business experience and four years’ experience operating our Mississauga plant, but has little or no experience in building and operating a biodiesel production plant of the size of our new Sombra facility. Although the construction of that facility is now complete, it may not have been properly designed or constructed. Although we expect to hire additional personnel and enter into agreements with contractors and consultants to assist us in our operations at Sombra, there is no assurance that we will be able to hire employees or enter into agreements satisfactory to us. If our management team is unable or finds it difficult to manage our Sombra operations successfully, our results of operations and our ability to succeed as a business will be adversely affected.

Compliance with existing or new environmental laws and rules could significantly increase our costs, or cause us to suspend or halt operations at our Sombra plant.

To operate our plants, we will need to comply with ongoing and new environmental and permitting requirements. Although we have received all permits required to operate our Mississauga and Sombra plants, the stormwater permit for Sombra is not yet finalized and must be confirmed by issuance of a final permit. Even final permits may be subject to changes in requirements and compliance reviews. Failure to receive a final stormwater permit or failure to maintain other necessary permits could subject us to demands by regulators that increase our costs of operations. Environmental issues, such as contamination and compliance with applicable environmental standards, could arise at any time. If this occurs, it could require us to spend significant resources to remedy the issues and may suspend or prevent operation of our plants. There can be no assurance that we will be able to comply with all permitting and environmental requirements to operate our plants efficiently on a continuing basis.

Defects in the construction or performance of the Sombra plant could result in a reduction in our revenues and profitability.

Although we have engaged experienced third-party companies to construct the Sombra plant, we have not received any warranties with respect to materials and workmanship or assurances that the project will operate at design capacity. Defects in the construction or performance of the plant could occur, and there is no assurance that we, our sub-contractors or anyone else that we contracted with to construct the project could correct these problems. If defects hinder the operations of the plant, our revenues, profitability and the value of your shares could be materially adversely affected. If defects require a lengthy or permanent discontinuance of production, your shares could have little or no value.

We have a history of losses which should be considered by investors in assessing the liklihood of our operating profitably in the future.

We have never earned a profit. For the years ended November 30, 2011 and 2012, we reported net losses of approximately $811,000 and $3.97 million, respectively. As of November 30, 2012, our accumulated deficit was approximately $10.2 million. Investors should consider this history of losses in assessing the likelihood of our operating profitably in the future.

As more biodiesel plants are built, biodiesel production will increase and, if demand does not sufficiently increase, this could result in lower prices for biodiesel, which will decrease the amount of revenue we may generate.

We expect that the number of biodiesel producers and the amount of biodiesel produced will likely continue to increase. In particular, we believe there is a significant effort in the United States and in Canada to develop and construct biodiesel plants and produce biodiesel products that would compete with us in the marketplace. We cannot assure you that the demand for biodiesel will continue to increase proportionally or at all. The demand for biodiesel is dependent on numerous factors, including governmental regulations, mandates, and incentives, as well as the development of other technologies or products that may compete with biodiesel. If the demand for biodiesel does not increase sufficiently, then increased biodiesel production may lead to lower biodiesel prices. Decreases in the price of biodiesel will result in decreases in our revenues.

We face intense competition within the biodiesel marketplace.

We operate in the intensely competitive alternative fuels business, and there can be no assurance that we will be able to compete effectively. Other companies presently in the market, or that could enter the market, could adversely affect prices for the biodiesel and glycerin we sell. There are numerous other entities considering or constructing biodiesel plants, some of which are near or in our potential trade territory and supply region. In Canada and the United States, the biodiesel industry is expected to become more competitive given the substantial initial construction of biodiesel facilities currently taking place. In addition, several regional biodiesel producers have been recently formed or are under consideration, which are or would be of a similar or greater size and have similar or greater resources than us. In light of such competition, there is no assurance that we will be able to complete or successfully operate our plants.

We have no long-term sale contracts and we may not be successful in profitably selling our biodiesel.

We have no long-term or fixed price agreements for the sale of our biodiesel and must compete with other producers of biodiesel. This competition could impair our ability to sell our biodiesel at profitable price points. Competition in the biodiesel industry is strong and growing more intense as more biodiesel production facilities are built and the industry expands. We are in direct competition with larger biodiesel producers, many of which have greater resources than we do. We compete with other facilities in Canada and the United States for customers in our regional market. We expect that additional biodiesel producers will enter the market if the regulatory environment remains favorable and the demand for biodiesel continues to increase.

Our business is only diversified within the biodiesel industry and is primarily dependent on the sale of biodiesel products and services. As a consequence, we may not be able to adapt to changing market conditions or endure any decline in the biodiesel industry.

Our success depends on the overall success of the biodiesel industry and on our ability to efficiently produce biodiesel and to provide the biodiesel industry with competitive equipment and services to produce biodiesel. With the exception of selling the glycerin that is produced as a byproduct of our biodiesel production, our revenues, including license fees from use of our software to run Denami processors, are all generated in the biodiesel industry. If we cannot efficiently produce biodiesel, if our Denami processors are not competitive with other biodiesel processors or if the demand for biodiesel declines, our business would be seriously harmed. Our plants do not have the ability to produce any other products. Our lack of diversification means that we may not be able to adapt to changing market conditions or any significant decline in the biodiesel industry.

The market price of biodiesel is influenced by the price of petroleum-based distillate fuels, such as ultra-low sulfur diesel, and decreases in the price of petroleum-based distillate fuels or RIN values would very likely decrease the price we can charge for our biodiesel, which could harm our revenues and profitability.

Historically, biodiesel prices have been strongly correlated to petroleum-based diesel prices and in particular ultra-low sulfur diesel, or ULSD, regardless of the cost of producing biodiesel itself. We market our biofuel as an alternative to petroleum-based fuels. Therefore, if the price of petroleum-based diesel falls, the price of biodiesel could decline, and we may be unable to produce products that are a commercially viable alternative to petroleum-based fuels. Petroleum prices are volatile due to global factors such wars, political uprisings, and other events, Organization of Petroleum Exporting Countries, or OPEC, production quotas, worldwide economic conditions, changes in refining capacity and natural disasters. Additionally, demand for liquid transportation fuels, including biodiesel, is affected by economic conditions. A reduction in petroleum-based fuel prices may have a material adverse effect on our revenues and profits if such price decreases reduce the price we are able to charge for our biodiesel. Increasing required volume obligations for biodiesel under Renewable Fuel Standard 2, or RFS2, has made the price of biodiesel more sensitive to changes in feedstock costs. Increased RIN values have, in part, offset the higher cost of biodiesel when compared to petroleum-based fuels. A reduction in RIN values may have a material adverse effect on our revenues and profits if such reduction reduces the price we are able to charge for our biodiesel.