Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONSUMERS ENERGY CO | d490589d8k.htm |

Exhibit 99.1

[GRAPHIC]

DSEDATA:[ECR][99999][rrdSource][3][08][STYLEFILE,0c0750000a6a622d-b00750000a6a622e,99,d00750000a6a621c-d00750000a6a621c,54]

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward-l

ooking statements are subject to risks and uncertainties. They should be read i n conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss im portant factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements.

CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circu

mstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial

performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is

included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance,

unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or othe r items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2013. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.

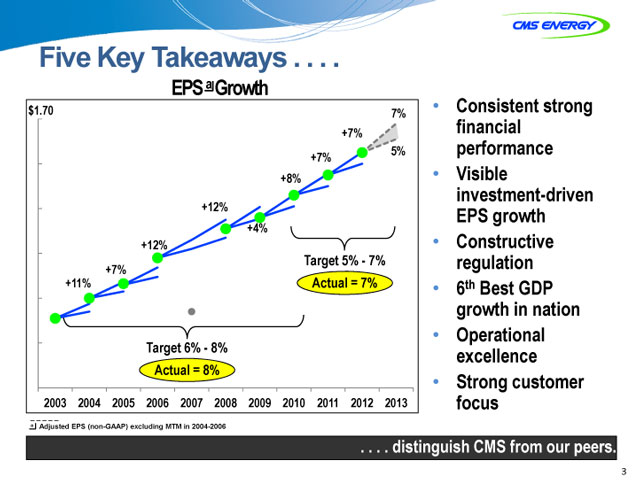

Five Key Takeaways . . . .

EPS a Growth

Consistent strong financial performance

Visible investment-driven EPS growth

Constructive regulation

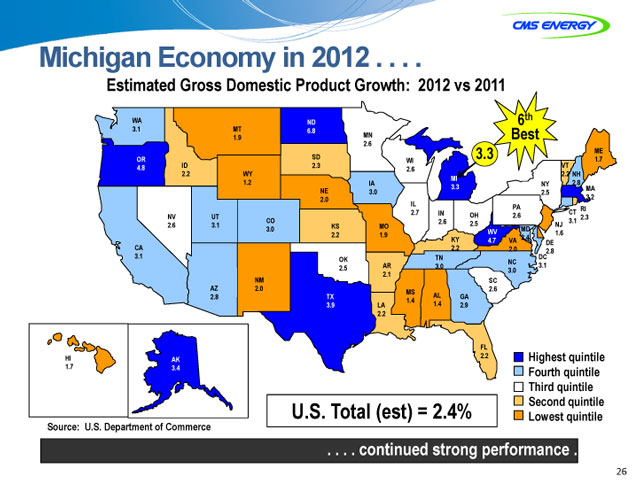

6th Best GDP growth in nation

Operational excellence

Strong customer focus

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

. . . . distinguishistinguish CMS from our peers.

2012 Results . . . .

Safety – First Quartile (20% improvement)

2012 Adjusted EPS (non-GAAP)

– $1.55

– Up 7%

Raised annual dividend 6%

– $1.02 per share

– 62% payout (comparable to peers)

Gross operating cash flow (non-GAAP) $1.7 billion

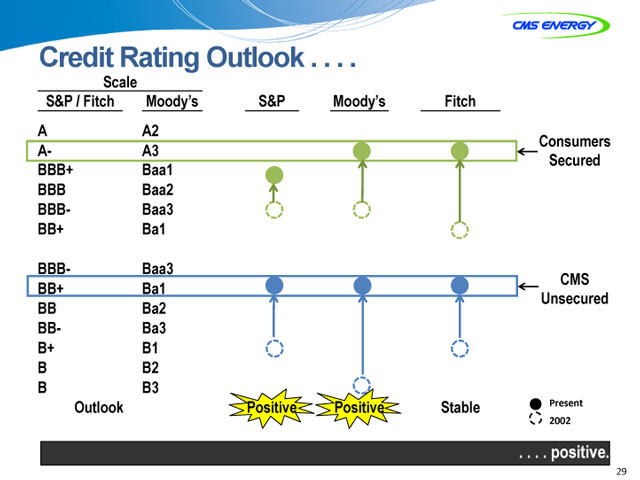

Credit ratings outlook positive

Tenth consecutive year of consistent financial performance

. . . . anothernother year of strong performance.

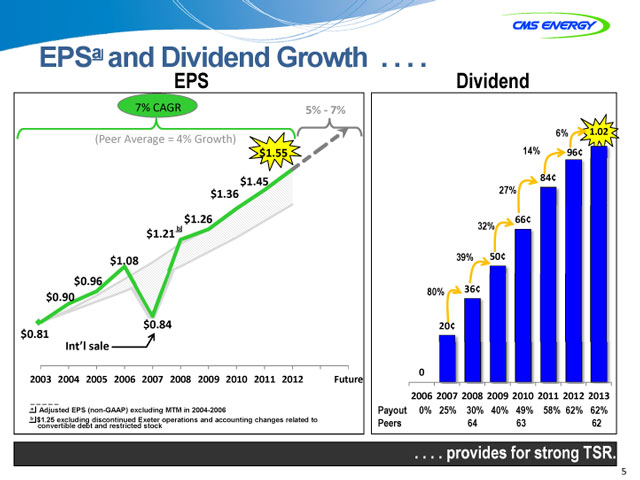

EPSa and Dividend Growth . . . .

EPS Dividend

(Peer Average = 4% Growth)

$1.55

$1.45

$1.36

$1.26

b

$1.21

$1.08

$0.96

$0.90

$0.81 $0.84 Int’l sale

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Future

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

6% 1.02

14% 96¢

84¢

27%

66¢

32% 39% 50¢ 80% 36¢ 20¢

0

2006 2007 2008 2009 2010 2011 2012 2013

Payout 0% 25% 30% 40% 49% 58% 62% 62% Peers 64 63 62

. . . . provides for strong TSR.

5

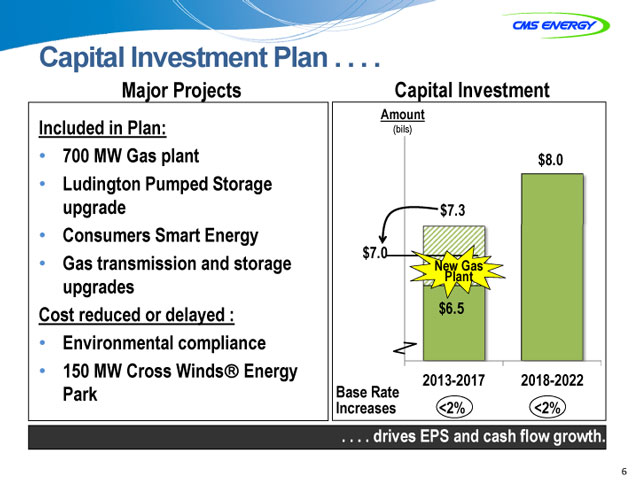

Capital Investment Plan . . . .

Major Projects Capital Investment

Included in Plan:

700 MW Gas plant

Ludington Pumped Storage upgrade

Consumers Smart Energy

Gas transmission and storage upgrades Cost reduced or delayed :

Environmental compliance

150 MW Cross Winds®Energy Park

Amount

(bils)

$8.0

$7.3

$7.0

New Gas Plant

$6.5

2013-2017 2018-2022 Base Rate Increases <2% <2%

. . . . drivesrives EPS and cash flow growth.

6

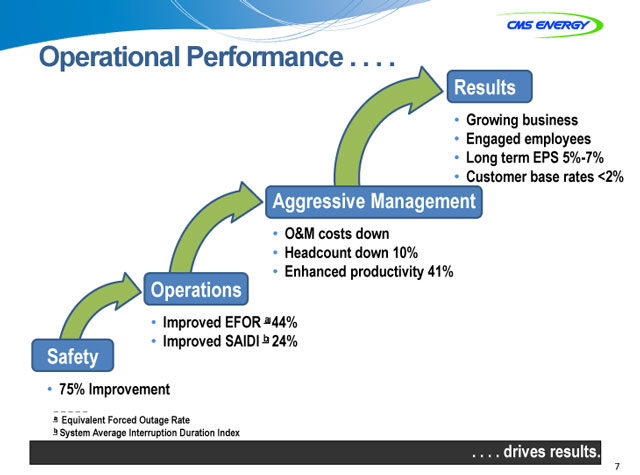

Operational Performance . . . .

Results

Growing business

Engaged employees

Long term EPS 5%-7%

Customer base rates <2%

Aggressive Management

O&M costs down

Headcount down 10%

Enhanced productivity 41%

Enhanced

Operations

Improved EFOR a 44%

Improved SAIDI b 24%

11 Safety

75% Improvement

a Equivalent Forced Outage Rate b System Average Interruption Duration Index

. . . . drivesrives results.

7

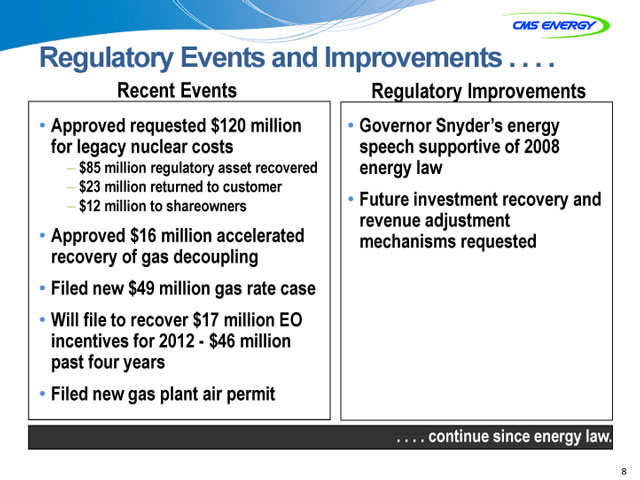

Regulatory Events and Improvementst

Recent Events Regulatory Improvements

Approved requested $120 million Governor Snyder’s energy

for legacy nuclear costs speech supportive of 2008

– $85 million regulatory asset recovered energy law

– $23 million returned to customer

$12 million to shareowners Future investment recovery and

revenue adjustment

Approved $16 million accelerated mechanisms requested

recovery of gas decoupling

Filed new $49 million gas rate case

Will file to recover $17 million EO

incentives for 2012 - $46 million

past four years

Filed new gas plant air permit

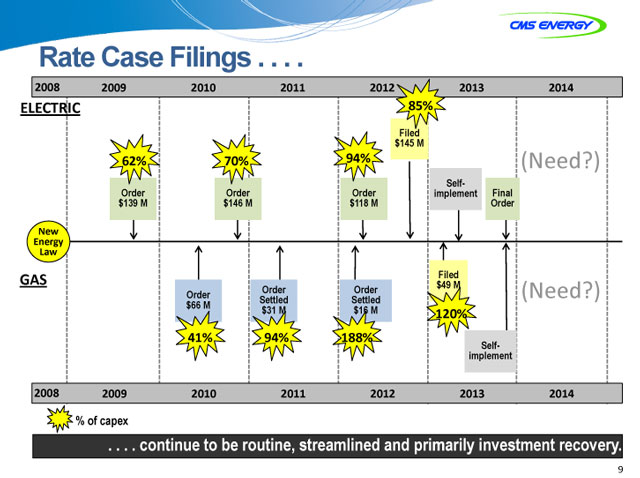

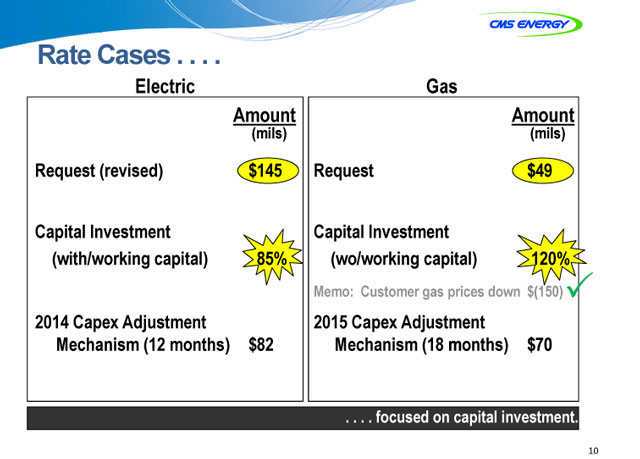

Rate Case Filings . . . .

2008 2009 2010 2011 2012 2013 2014

ELECTRIC 85%

$Filed 145 M

62% 70% 94% (Need?)

Order Order Order implement Self- Final $139 M $146 M $118 M Order

New Energy Law

GAS $ Filed 49 M

Order Order (Need?) Order Settled Settled

$66 M

$31 M $16 M 120%

41% 94% 188%

implement Self-

2008 2009 2010 2011 2012 2013 2014

% of capex

Rate Cases

Electric asGas

Amount Amount

(mils) (mils)

Request (revised) $ 145 Request $49

Capital Investment Capital Investment

(with/working capital) 85% (wo/working capital) 120%

Memo: Customer gas prices down $(150)

2014 Capex Adjustment 2015 Capex Adjustment

Mechanism (12 months) $ 82 Mechanism (18 months) $70

. . . focusedocused on capital investment.

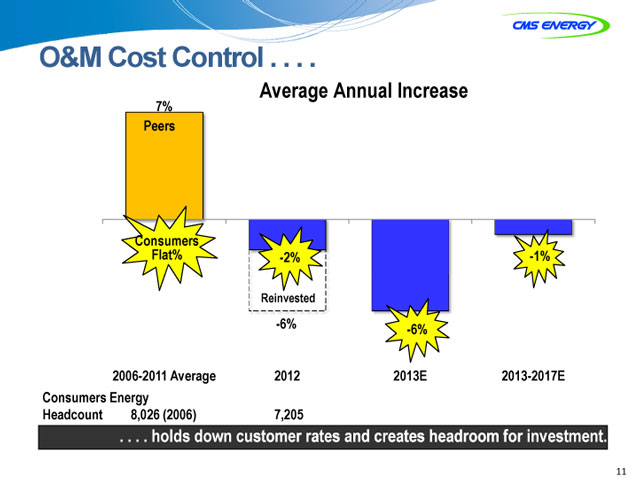

O&M Cost Control . . . .

7% Average Annual Increase

2006-2011 Average 2012 2013E 2013-2017E Consumers Energy Headcount 8,026 (2006) 7,205

. . . . holdsolds down customer rates and creates headroom for investment.

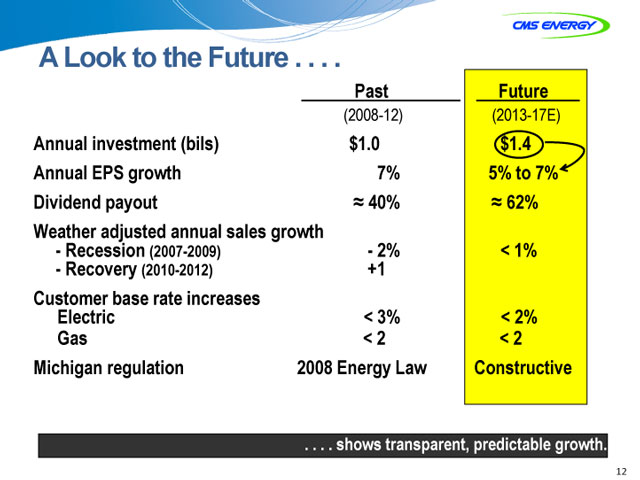

A Look to the Future

Past Future

(2008-12) (2013-17E)

Annual investment (bils) $1.0 $1.4

Annual EPS growth 7% 5% to 7%

Dividend payout ~ 40% ~ 62%

Weather adjusted annual sales growth

- Recession (2007-2009) - 2% < 1%

- Recovery (2010-2012) +1

Customer base rate increases

Electric < 3% < 2%

Gas < 2 < 2

Michigan regulation 2008 Energy Law Constructive

. . . . shows transparent, predictable growth.

12

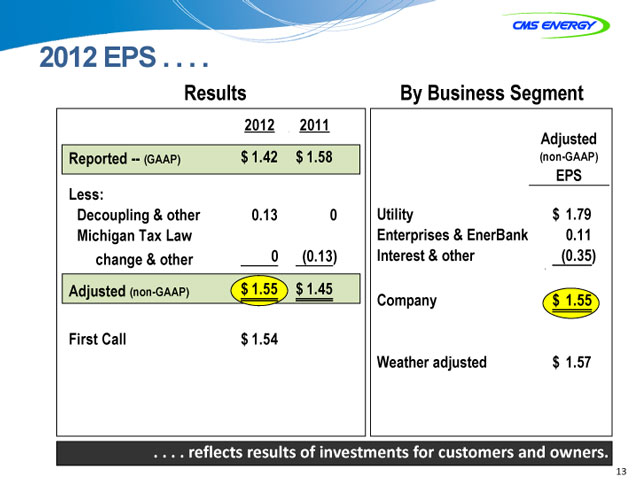

2012 EPS

Results By Business Segment

2012 2011

Adjusted

Reported -- (GAAP) $ 1.42 $ 1.58 (non-GAAP)

EPS

Less:

Decoupling & other 0.13 0 Utility $ 1.79

Michigan Tax Law Enterprises & EnerBank 0.11

change & other 0 (0.13) Interest & other (0.35)

Adjusted (non-GAAP) $ 1.55 $ 1.45 Company $ 1.55

First Call $ 1.54

Weather adjusted $ 1.57

. . . . reflects results of investments for customers and owners.

13

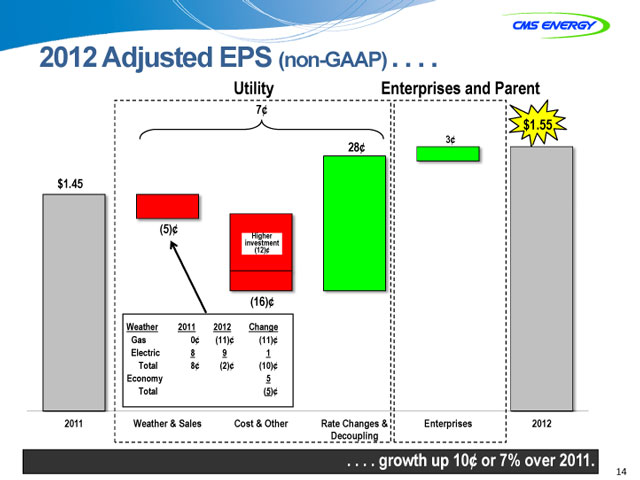

2012 Adjusted EPS (non-GAAP) . . . .

Utility Enterprises and Parent

7¢

$1.55

3¢

28¢

$1.45

(5)¢

investment Higher (12)¢

(16)¢

Weather 2011 2012 Change Gas 0¢ (11)¢ (11)¢ Electric 8 9 1 Total 8¢ (2)¢ (10)¢ Economy 5 Total (5)¢

2011 Weather & Sales Cost & Other Rate Changes & Enterprises 2012 Decoupling

. . . . growthrowth up 10¢ or 7% over 2011.

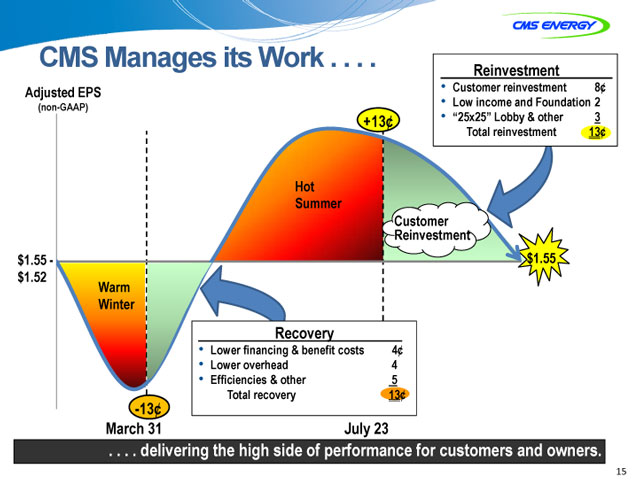

CMS Manages its Work . . . .

Reinvestment

Adjusted EPS Customer reinvestment 8¢ (non-GAAP) Low income and Foundation 2 +13¢ “25x25” Lobby & other 3 Total reinvestment 13¢

Hot Summer

Customer Reinvestment $1.55 - $1.55 $1.52 Warm Winter

Recovery

Lower financing & benefit costs 4¢

Lower overhead 4

Efficiencies & other 5 Total recovery 13¢

-13¢

March 31 July 23

. . . . deliveringelivering the high side of performance for customers and owners.

Our Top Priorities for 2013 . . . .

Safety

Operational excellence

Execute investment plan

Gas Plant Certificate of Need

Constructive electric and gas rate case outcomes

Achieve 11th year of consistent financial performance

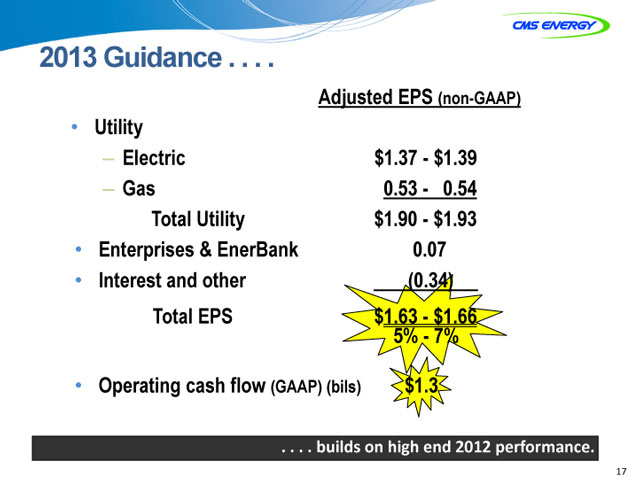

2013 Guidance . . . .

Adjusted EPS (non-GAAP)

Utility

– Electric $1.37 - $1.39

– Gas 0.53 - 0.54 Total Utility $1.90 - $1.93

Enterprises & EnerBank 0.07

Interest and other (0.34) Total EPS $1.63 5% - - $ 7% 1.66

Operating cash flow (GAAP) (bils) $1.3

. . . . buildsuilds on high end 2012 performance.

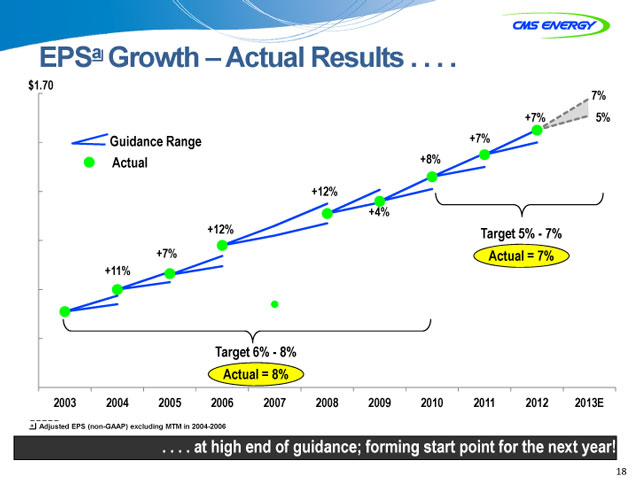

EPSa Growth – Actual Results . . . .

$1.70

7%

+7% 5%

Guidance Range +7%

Actual +8%

+12%

+4%

+12% Target 5% - 7%

+7% Actual = 7%

+11%

Target 6% - 8%

Actual = 8%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013E

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

. . . . at high end of guidance; forming start point for the next year!

18

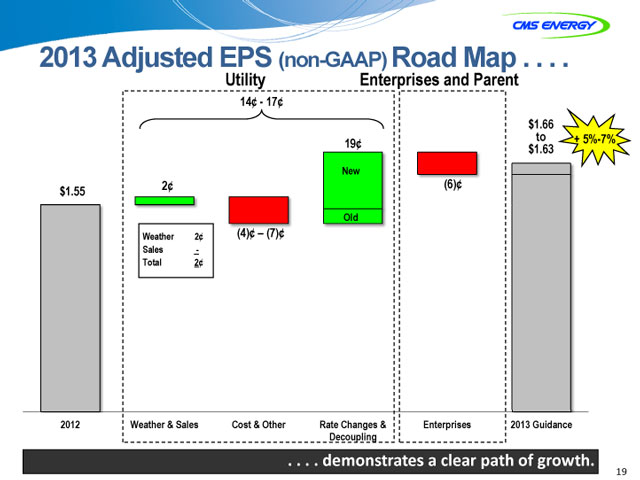

2013 Adjusted EPS (non-GAAP) Road Map . . . .

Utility Enterprises and Parent

14¢ - 17¢ $1.66 to + 5%-7%

19¢ $1.63

New

2¢ (6)¢ $1.55

Old

Weather 2¢ (4)¢ – (7)¢

Sales -Total 2¢

2012 Weather & Sales Cost & Other Rate Changes & Enterprises 2013 Guidance Decoupling

. . . . demonstr emonstrates es a clear path of growth.

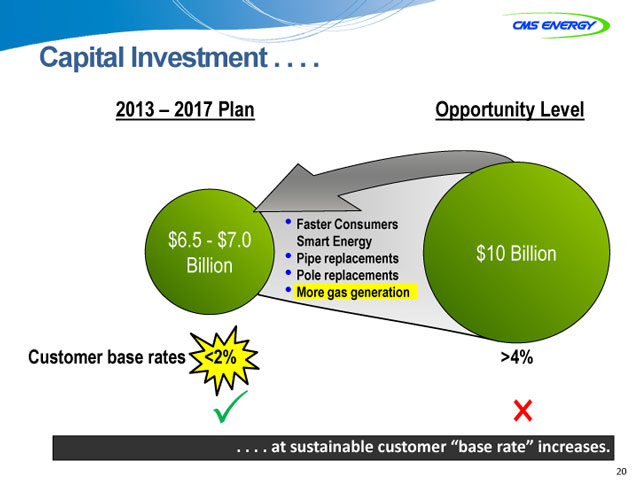

Capital Investment . . . .

2013 – 2017 Plan Opportunity Level

Faster Consumers $6.5 - $7.0 Smart Energy

Pipe replacements $10 Billion

Billion

More gas generation

Customer base rates <2%2% >4%4%

3 ×

. . . . at sustainable customer “base rate” increases.

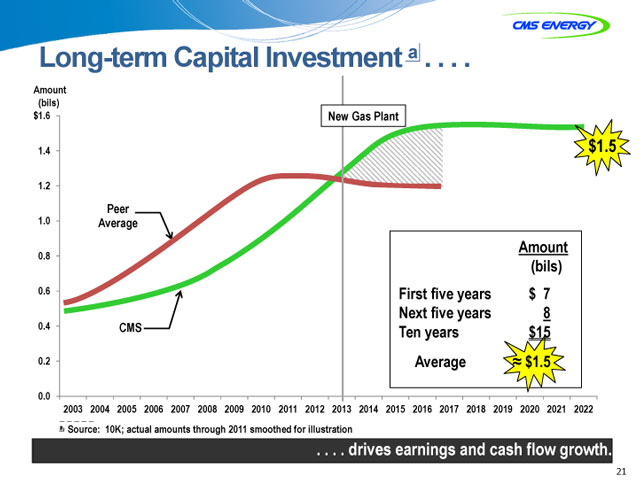

Long-term Capital Investment a . . . .

Amount (bils) $1.6 New Gas Plant

1.4 $1.5

1.2

Peer 1.0 Average

Amount

0.8

(bils) 0.6 First five years $ 7 Next five years 8 0.4 CMS Ten years $15 0.2 Average ~ $1.5

0.0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

a Source: 10K; actual amounts through 2011 smoothed for illustration

. . . . drives earnings and cash flow growth.

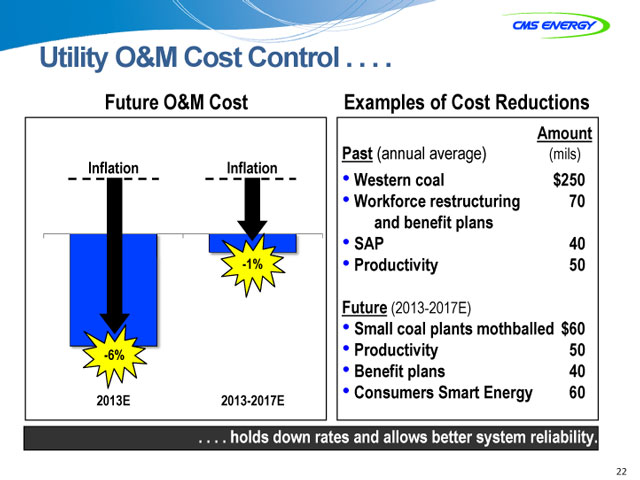

| Utility |

|

O&M Cost Control . . . . |

Future O&M Cost Examples of Cost Reductions

Amount

Past (annual average) (mils)

Inflation Inflation

Western coal $250

Workforce restructuring 70

and benefit plans

SAP 40

-1% Productivity 50

Future (2013-2017E)

Small coal plants mothballed $60

-6% Productivity 50

Benefit plans 40

Consumers Smart Energy 60

2013E 2013-2017E

. . . . holds down rates and allows better system reliability.

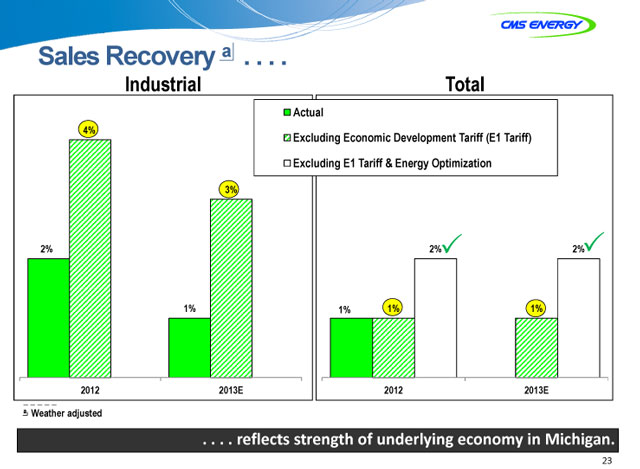

Sales Recovery a . . . .

Industrial Total otal

Actual

Excluding Economic Development Tariff (E1 Tariff) Excluding E1 Tariff & Energy Optimization

a Weather adjusted

. . . . reeflects strength of underlying economy in Michigan.

23

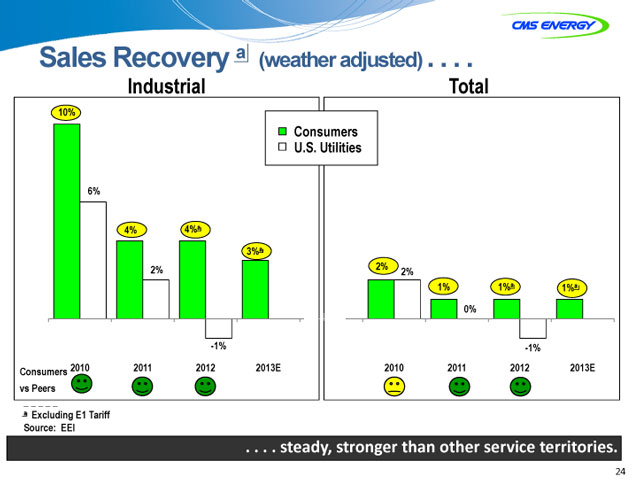

Sales Recovery a (weather adjusted) . . . .

Industrial Total otal

10%

Consumers U.S. Utilities

-1% -1%

Consumers 2010 2011 2012 2013E 2010 2011 2012 2013E vs Peers

a Excluding E1 Tariff Source: EEI

. . . . steady, stronger than other service territories.

24

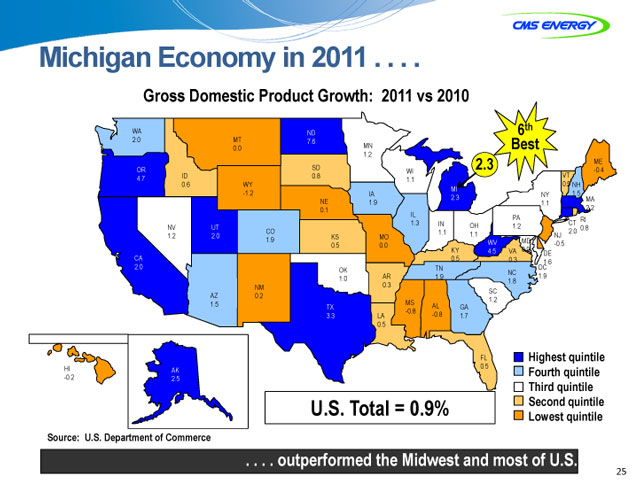

Michigan Economy in 2011 . . . .

Gross Domestic Product Growth: 2011 vs 2010

WA 6th 2.0 MT ND

7.6

0.0 MN Best 1.2

SD 2.3 ME OR WI -0.4 4.7 ID 0.8 VT

1.1

0.6 WY 0.5 NH MI

-1.2 IA NY 1.5 2.3 MA

NE 1.9 1.1

0.1 IL 2.2 PA RI

1.3 IN OH CT NV UT 1.2 0.8 CO 1.1 1.1 2.0 1.2 2.0 KS MO NJ

1.9 WV MD

0.5 0.0 -0.5 KY 4.5 VA 0.9 DE

CA 0.5 0.3

1.6 2.0 TN DC

OK NC

1.0 AR 1.9 1.9 1.8 NM 0.3 SC

AZ 0.2

MS 1.2 1.5 TX -0.8 AL GA

3.3 LA -0.8 1.7 0.5

FL Highest quintile

HI 0.5

AK Fourth quintile -0.2 2.5 Third quintile

U.S. Total = 0.9% Second quintile

Lowest quintile

Source: U.S. Department of Commerce

. . . . outperformed the Midwest and most of U.S.

25

Michigan Economy in 2012 . . . .

Estimated Gross Domestic Product Growth: 2012 vs 2011

WA th

3.1 MT ND 6

6.8

19. MN Best

2.6

SD 3.3 ME

OR WI 1.7

4.8 ID 2.3 VT

2.6

2.2 WY 2.2 NH

MI

1.2 IA NY 2.8

3.3 MA

NE 3.0 2.5

2.0 IL 3.2

PA RI

2.7 IN OH CT

NV UT 2.6 2.3

CO 2.6 2.5 3.1

2.6 3.1 KS MO NJ

3.0 WV MD

2.2 1.9 1.6

KY 4.7 VA 2.4

DE

CA 2.2 2.0

2.8

3.1 TN DC

OK NC

2.5 AR 3.0 3.1

3.0

212.1

NM SC

AZ 2.0 2.6

MS AL

2.8 TX GA

1.4 1.4

3.9 LA 2.9

2.2

FL

HI 2.2 Highest quintile

AK

1.7 3.4 Fourth quintile

Third quintile

U.S. Total (est) = 2.4% Second quintile

Source: U.S. Department of Commerce Lowest quintile

. . . . continued strong

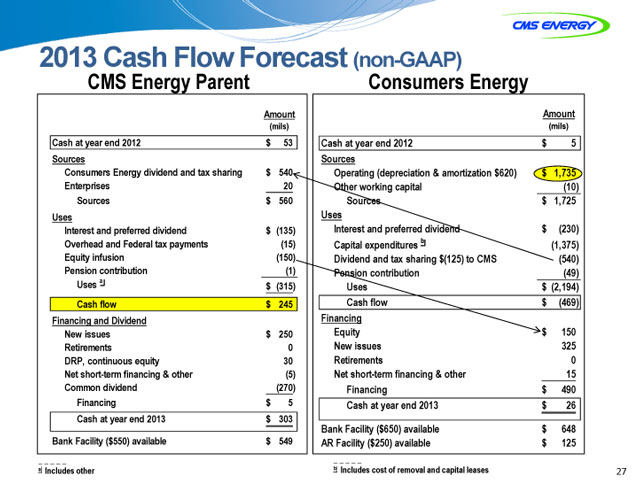

2013 Cash Flow Forecast (non-GAAP)

CMS Energy Parent Consumers Energy

Amount Amount

(mils) (mils)

Cash at year end 2012 $ 53 Cash at year end 2012 $ 5

Sources Sources

Consumers Energy dividend and tax sharing $ 540 Operating (depreciation & amortization $620) $ 1,735

Enterprises 20 Other working capital (10)

Sources $ 560 Sources $ 1,725

Uses Uses

Interest and preferred dividend $ (135) Interest and preferred dividend $ (230)

Overhead and Federal tax payments (15) Capital expenditures b (1,375)

Equity infusion (150) Dividend and tax sharing $(125) to CMS (540)

Pension contribution (1) Pension contribution (49)

Uses a $ (315) Uses $ (2,194)

Cash flow $ 245 Cash flow $ (469)

Financing and Dividend Financing

New issues $ 250 Equity $ 150

Retirements 0 New issues 325

DRP, continuous equity 30 Retirements 0

Net short-term financing & other (5) Net short-term financing & other 15

Common dividend (270) Financing $ 490

Financing $ 5 Cash at year end 2013 $ 26

Cash at year end 2013 $ 303

Bank Facility ($650) available $ 648

Bank _ Facility ($550) available $ 549 AR _ Facility _ _ _ _ ($250) available $ 125

a Includes other b Includes cost of removal and capital leases 27

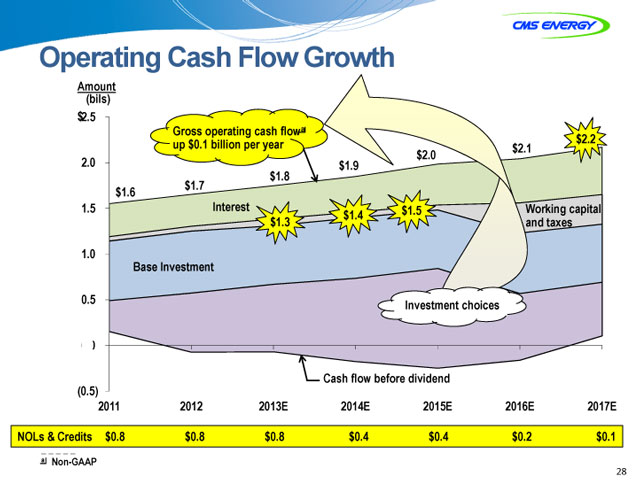

Operating Cash Flow Growth

Amount

(bils)

$2.5

Gross operating cash flowa $2.2

up $0.1 billion per year

2.0

$1.8

$1.7

$1.6

1.5 Interest $1.5 king capital

$1.4

$1.3 taxes

1.0

Base Investment

0.5 Investment choices

0

Cash flow before dividend

(0.5)

2011 2012 2013E 2014E 2015E 2016E 2017E

Credit Rating Outlook . . . .

Scale

S&P / Fitch Moody’s S&P Moody’s Fitch A A2

Consumers A- A3 Secured BBB+ Baa1 BBB Baa2 BBB- Baa3 BB+ Ba1

BBB- Baa3

CMS BB+ Ba1 Unsecured BB Ba2 BB- Ba3 B+ B1 B B2 B B3 Outlook Positive Positive Stable Present

2002

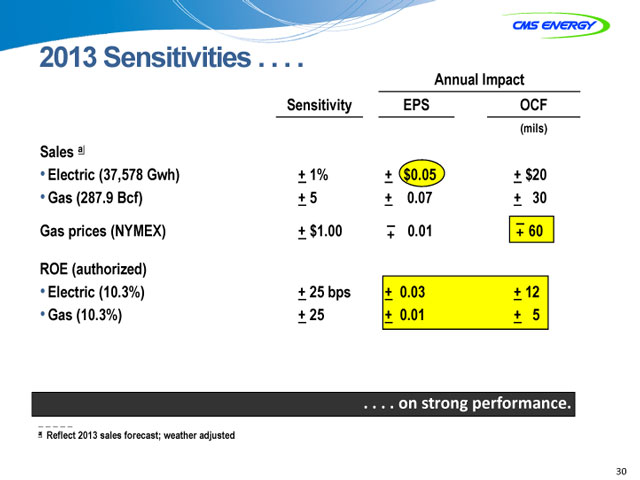

2013 Sensitivities

Annual Impact

Sensitivity EPS OCF

(mils)

Sales a

Electric (37,578 Gwh) + 1% + $0.05 + $20

Gas (287.9 Bcf) + 5 + 0.07 + 30

Gas prices (NYMEX) + $1.00 –+ 0.01 –+ 60

ROE (authorized)

Electric (10.3%) + 25 bps + 0.03 + 12

Gas (10.3%) + 25 + 0.01 + 5

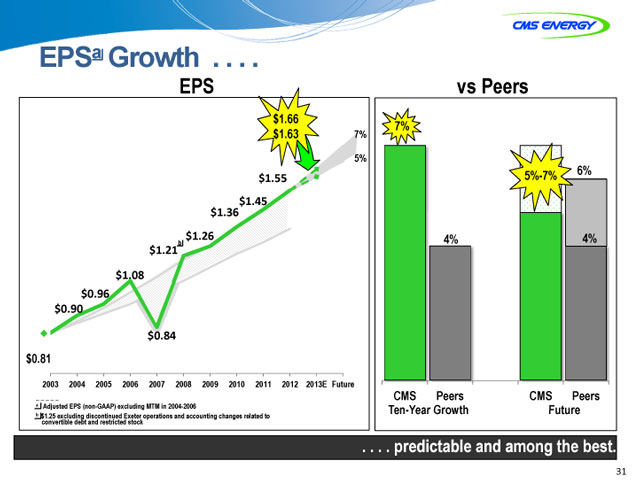

EPSa Growth . . . .

EPS vs Peers

$1.66

7%

$1.63 7%

5%

5%-7% 6%

$1.55 5%

$1.45

$1.36

$1.26 4% 4%

b

$1.21

$1.08

$0.96

$0.90

$0.84

$0.81

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013E Future

CMS Peers CMS Peers

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 Ten-Year Growth Future

b $1.25 excluding discontinued Exeter operations and accounting changes related to

convertible debt and restricted stock

. . . . predictableredictable and among the best.

31

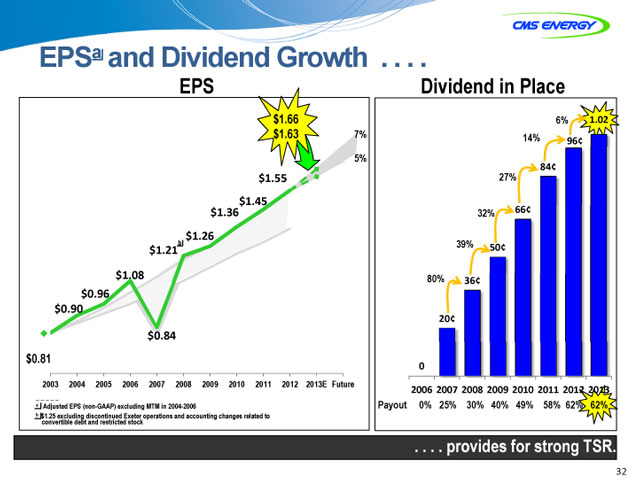

EPSa and Dividend Growth . . . .

EPS Dividend in Place

$1.66 6% 1.02 $1.63 7% 14%

96¢

5% 84¢

$1.55 27%

$1.45 66¢

$1.36 32%

$1.26 b 39%

$1.21 50¢

$1.08 80%

36¢

$0.96

$0.90

20¢

$0.84

.81

0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013E Future

2006 2007 2008 2009 2010 2011 2012 2013

Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 Payout 0% 25% 30% 40% 49% 58% 62% 62%

$1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

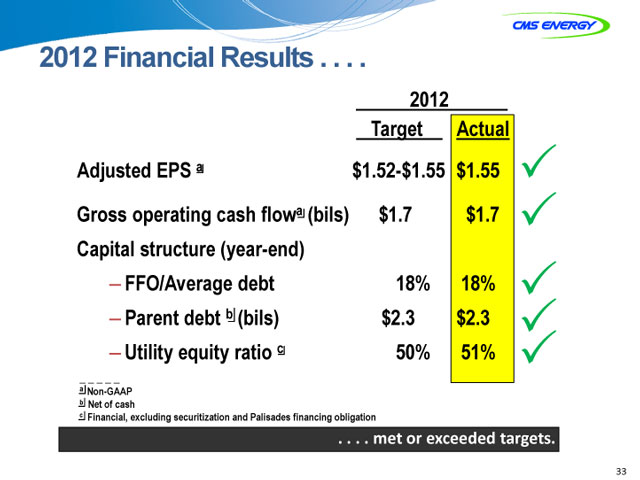

2012 Financial Results

2012

Target Actual

Adjusted EPS a $1.52-$1.55 $1.55 3

Gross operating cash flowa (bils) $1.7 $1.7 3

Capital structure (year-end)

– FFO/Average debt 18% 18%

– Parent debt b (bils) $2.3 $2.3 33

– Utility equity ratio c 50% 51% 3

a Non-GAAP

b Net of cash

c Financial, excluding securitization and Palisades financing obligation

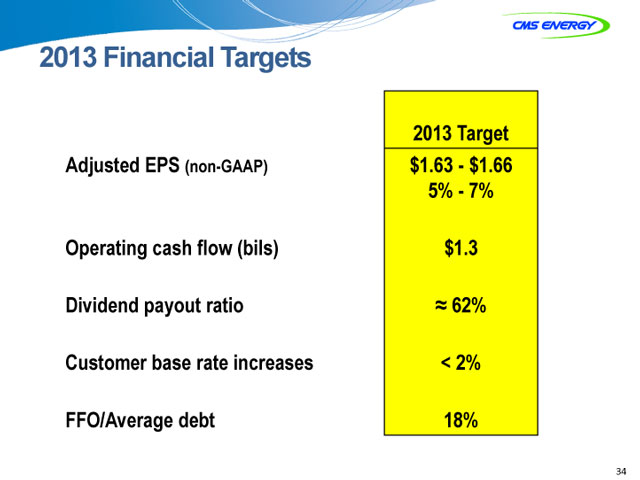

2013 Financial Targets

2013 Target

Adjusted EPS (non-GAAP) $1.63 - $1.66

5% - 7%

Operating cash flow (bils) $1.3

Dividend payout ratio ~ 62%

Customer base rate increases < 2%

FFO/Average debt 18%

Appendix

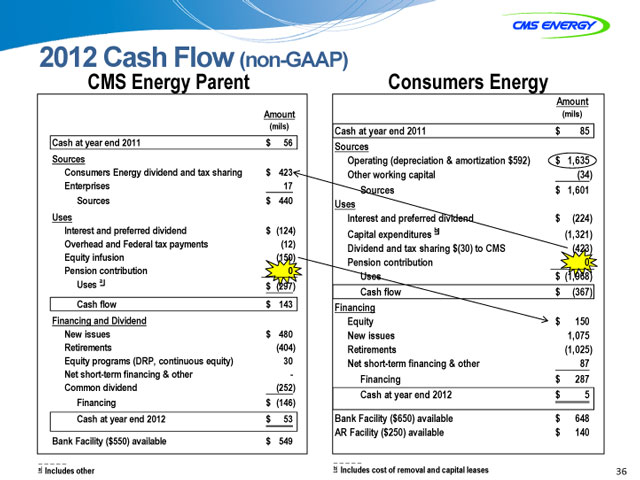

2012 Cash Flow (non-GAAP)

CMS Energy Parent Consumers Energy

Amount

Amount (mils)

(mils) Cash at year end 2011 $ 85

Cash at year end 2011 $ 56 Sources

Sources Operating (depreciation & amortization $592) $ 1,635

Consumers Energy dividend and tax sharing $ 423 Other working capital (34)

Enterprises 17 Sources $ 1,601

Sources $ 440 Uses

Uses Interest and preferred dividend $ (224)

Interest and preferred dividend $ (124) Capital expenditures b (1,321)

Overhead and Federal tax payments (12) Dividend and tax sharing $(30) to CMS (423)

Equity infusion (150) Pension contribution 0

Pension contribution 0 Uses $ (1,968)

Uses a $ (297) Cash flow $ (367)

Cash flow $ 143 Financing

Financing and Dividend Equity $ 150

New issues $ 480 New issues 1,075

Retirements (404) Retirements (1,025)

Equity programs (DRP, continuous equity) 30 Net short-term financing & other 87

Net short-term financing & other - Financing $ 287

Common dividend (252) Cash at year end 2012 $ 5

Financing $ (146)

Cash at year end 2012 $ 53 Bank Facility ($650) available $ 648

AR Facility ($250) available $ 140

Bank _ Facility ($550) available $ 549 _ _ _ _ _

a Includes other b Includes cost of removal and capital leases

GAAP Reconciliation

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||||||||||||||

| Reported earnings (loss) per share—GAAP |

$ | (0.30 | ) | $ | 0.64 | $ | (0.44 | ) | $ | (0.41 | ) | $ | (1.02 | ) | $ | 1.20 | $ | 0.91 | $ | 1.28 | $ | 1.58 | $ | 1.42 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| After-tax items: |

||||||||||||||||||||||||||||||||||||||||

| Electric and gas utility |

0.21 | (0.39 | ) | — | — | (0.07 | ) | 0.05 | 0.33 | 0.03 | 0.00 | 0.17 | ||||||||||||||||||||||||||||

| Enterprises |

0.74 | 0.62 | 0.04 | (0.02 | ) | 1.25 | (0.02 | ) | 0.09 | (0.03 | ) | (0.11 | ) | (0.01 | ) | |||||||||||||||||||||||||

| Corporate interest and other |

0.16 | (0.03 | ) | 0.04 | 0.27 | (0.32 | ) | (0.02 | ) | 0.01 | * | (0.01 | ) | * | ||||||||||||||||||||||||||

| Discontinued operations (income) loss |

(0.16 | ) | 0.02 | (0.07 | ) | (0.03 | ) | 0.40 | ( | *) | (0.08 | ) | 0.08 | (0.01 | ) | (0.03 | ) | |||||||||||||||||||||||

| Asset impairment charges, net |

— | — | 1.82 | 0.76 | 0.60 | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Cumulative accounting changes |

0.16 | 0.01 | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted earnings per share, including MTM—non-GAAP |

$ | 0.81 | $ | 0.87 | $ | 1.39 | $ | 0.57 | $ | 0.84 | $ | 1.21 | (a) | $ | 1.26 | $ | 1.36 | $ | 1.45 | $ | 1.55 | |||||||||||||||||||

| Mark-to-market impacts |

0.03 | (0.43 | ) | 0.51 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted earnings per share, excluding MTM—non-GAAP |

NA | $ | 0.90 | $ | 0.96 | $ | 1.08 | NA | NA | NA | NA | NA | NA | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| * | Less than $500 thousand or $0.01 per share. |

| (a) | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-12 EPS

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation

(Unaudited)

| 2011 | ||||||||||||||||||||

| (In millions, except per share amounts) |

1Q | 2Q | 3Q | 4Q | YTD Dec | |||||||||||||||

| Reported net income—GAAP |

$ | 135 | $ | 100 | $ | 139 | $ | 41 | $ | 415 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| After-tax items: |

||||||||||||||||||||

| Electric and gas utility |

— | — | — | — | — | |||||||||||||||

| Enterprises |

* | (28 | ) | * | 1 | (27 | ) | |||||||||||||

| Corporate interest and other |

— | (4 | ) | — | * | (4 | ) | |||||||||||||

| Discontinued operations income |

(2 | ) | * | * | ( | *) | (2 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted income—non-GAAP |

$ | 133 | $ | 68 | $ | 139 | $ | 42 | $ | 382 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average shares outstanding, basic |

250.0 | 250.3 | 251.3 | 251.7 | 250.8 | |||||||||||||||

| Average shares outstanding, diluted |

261.7 | 261.9 | 263.9 | 265.5 | 263.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reported earnings per share—GAAP |

$ | 0.52 | $ | 0.38 | $ | 0.53 | $ | 0.15 | $ | 1.58 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| After-tax items: |

||||||||||||||||||||

| Electric and gas utility |

— | — | — | — | — | |||||||||||||||

| Enterprises |

* | (0.11 | ) | * | * | (0.11 | ) | |||||||||||||

| Corporate interest and other |

— | (0.01 | ) | — | * | (0.01 | ) | |||||||||||||

| Discontinued operations income |

(0.01 | ) | * | * | ( | *) | (0.01 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted earnings per share—non-GAAP |

$ | 0.51 | $ | 0.26 | $ | 0.53 | $ | 0.15 | $ | 1.45 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2012 | ||||||||||||||||||||

| (In millions, except per share amounts) |

1Q | 2Q | 3Q | 4Q | YTD Dec | |||||||||||||||

| Reported net income—GAAP |

$ | 67 | $ | 100 | $ | 148 | $ | 67 | $ | 382 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| After-tax items: |

||||||||||||||||||||

| Electric and gas utility |

36 | 7 | * | ( | *) | 43 | ||||||||||||||

| Enterprises |

1 | 1 | (3 | ) | ( | *) | (1 | ) | ||||||||||||

| Corporate interest and other |

— | — | — | * | * | |||||||||||||||

| Discontinued operations income |

(7 | ) | * | * | * | (7 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted income—non-GAAP |

$ | 97 | $ | 108 | $ | 145 | $ | 67 | $ | 417 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average shares outstanding, basic |

255.6 | 261.2 | 262.9 | 263.0 | 260.7 | |||||||||||||||

| Average shares outstanding, diluted |

266.9 | 268.2 | 269.0 | 269.5 | 268.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reported earnings per share—GAAP |

$ | 0.25 | $ | 0.37 | $ | 0.55 | $ | 0.25 | $ | 1.42 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| After-tax items: |

||||||||||||||||||||

| Electric and gas utility |

0.14 | 0.03 | * | ( | *) | 0.17 | ||||||||||||||

| Enterprises |

0.01 | * | (0.01 | ) | ( | *) | (0.01 | ) | ||||||||||||

| Corporate interest and other |

— | — | — | * | * | |||||||||||||||

| Discontinued operations income |

(0.03 | ) | * | * | * | (0.03 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted earnings per share—non-GAAP |

$ | 0.37 | $ | 0.40 | $ | 0.54 | $ | 0.25 | $ | 1.55 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Note: Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences.

| * | Less than $500 thousand or $0.01 per share. |

2012 A-1

CMS Energy Corporation

Earnings Segment Results GAAP Reconciliation

(Unaudited)

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| December 31 |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Electric Utility |

||||||||||||||||

| Reported |

$ | 0.10 | $ | 0.09 | $ | 1.21 | $ | 1.27 | ||||||||

| Electric Decoupling Court Order |

— | — | 0.14 | — | ||||||||||||

| Downsizing Program |

( | *) | — | 0.02 | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted |

$ | 0.10 | $ | 0.09 | $ | 1.37 | $ | 1.27 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gas Utility |

||||||||||||||||

| Reported |

$ | 0.18 | $ | 0.16 | $ | 0.41 | $ | 0.49 | ||||||||

| Downsizing Program |

( | *) | — | 0.01 | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted |

$ | 0.18 | $ | 0.16 | $ | 0.42 | $ | 0.49 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Enterprises |

||||||||||||||||

| Reported |

$ | 0.03 | $ | (0.01 | ) | $ | 0.06 | $ | 0.13 | |||||||

| Downsizing Program |

— | — | * | — | ||||||||||||

| Tax Changes |

— | — | — | (0.11 | ) | |||||||||||

| Restructuring Costs and Other |

( | *) | * | (0.01 | ) | * | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted |

$ | 0.03 | $ | (0.01 | ) | $ | 0.05 | $ | 0.02 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Corporate Interest and Other |

||||||||||||||||

| Reported |

$ | (0.06 | ) | $ | (0.09 | ) | $ | (0.29 | ) | $ | (0.32 | ) | ||||

| Tax Changes |

— | — | — | (0.01 | ) | |||||||||||

| Restructuring Costs and Other |

* | * | * | * | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted |

$ | (0.06 | ) | $ | (0.09 | ) | $ | (0.29 | ) | $ | (0.33 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Discontinued Operations |

||||||||||||||||

| Reported |

$ | (*) | $ | * | $ | 0.03 | $ | 0.01 | ||||||||

| Discontinued Operations Income |

* | ( | *) | (0.03 | ) | (0.01 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Totals |

||||||||||||||||

| Reported |

$ | 0.25 | $ | 0.15 | $ | 1.42 | $ | 1.58 | ||||||||

| Discontinued Operations Income |

* | ( | *) | (0.03 | ) | (0.01 | ) | |||||||||

| Electric Decoupling Court Order |

— | — | 0.14 | — | ||||||||||||

| Downsizing Program |

( | *) | — | 0.03 | — | |||||||||||

| Tax Changes |

— | — | — | (0.12 | ) | |||||||||||

| Restructuring Costs and Other |

( | *) | * | (0.01 | ) | * | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted |

$ | 0.25 | $ | 0.15 | $ | 1.55 | $ | 1.45 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Average Common Shares Outstanding—Diluted (in millions) |

269.5 | 265.5 | 268.6 | 263.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | Less than $0.01 per share. |

2012 A-2

Consumers Energy

2012 Cash Flow GAAP Reconciliation (in millions) (unaudited)

| Reclassifications From Sources and Uses to Statement of Cash Flows | ||||||||||||||||||||||||||||||||||||||||||

| Presentation Sources and Uses |

Tax Sharing Operating |

Interest Payments as Operating |

Premium on Early Debt Retirement As Operating |

Other Working Capital as Investing |

Capital Lease Pymts as Financing |

Securitization Debt Pymts as Financing |

Preferred Dividends as Financing |

Common Dividends as Financing |

Consolidated Statements of Cash Flows | |||||||||||||||||||||||||||||||||

| Description |

non-GAAP Amount |

GAAP Amount |

Description | |||||||||||||||||||||||||||||||||||||||

| Cash at year end 2011 |

$ | 85 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 85 | Cash at year end 2011 | |||||||||||||||||||||

| Sources |

||||||||||||||||||||||||||||||||||||||||||

| Operating |

$ | 1,635 | ||||||||||||||||||||||||||||||||||||||||

| Other working capital |

(34 | ) | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Sources |

$ | 1,601 | $ | (30 | ) | $ | (222 | ) | $ | (15 | ) | $ | (42 | ) | $ | 22 | $ | 39 | $ | — | $ | — | $ | 1,353 | Net cash provided by operating | |||||||||||||||||

| Uses |

||||||||||||||||||||||||||||||||||||||||||

| Interest and preferred dividends |

$ | (224 | ) | |||||||||||||||||||||||||||||||||||||||

| Capital |

(1,321 | ) | ||||||||||||||||||||||||||||||||||||||||

| Dividends/ |

(423 | ) | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Uses |

$ | (1,968 | ) | $ | 30 | $ | 222 | $ | — | $ | 42 | $ | — | $ | — | $ | 2 | $ | 393 | $ | (1,279 | ) | Net cash provided by investing | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Cash flow |

$ | (367 | ) | $ | — | $ | — | $ | (15 | ) | $ | — | $ | 22 | $ | 39 | $ | 2 | $ | 393 | $ | 74 | Cash flow from operating and investing activities | |||||||||||||||||||

| Financing |

||||||||||||||||||||||||||||||||||||||||||

| Equity |

$ | 150 | ||||||||||||||||||||||||||||||||||||||||

| New Issues |

1,075 | |||||||||||||||||||||||||||||||||||||||||

| Retirements |

(1,025 | ) | ||||||||||||||||||||||||||||||||||||||||

| Net short-term financing & other |

87 | 15 | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Financing |

$ | 287 | $ | — | $ | — | $ | 15 | $ | — | $ | (22 | ) | $ | (39 | ) | $ | (2 | ) | $ | (393 | ) | $ | (154 | ) | Net cash provided by financing | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Net change |

$ | (80 | ) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (80 | ) | Net change in cash | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Cash at year |

$ | 5 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 5 | Cash at year end 2012 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| a | Includes cost of removal and capital leases |

2012 A-3

CMS Energy Parent

2012 Cash Flow GAAP Reconciliation (in millions) (unaudited)

| Reclassifications From Sources and Uses to Statement of Cash Flows |

||||||||||||||||||||||||||||||

| Presentation Sources and Uses |

Interest Payments as Operating |

Overheads & Tax Payments as Operating |

Other Uses (a) as Operating |

Financing as Operating |

Cash

From Consolidated Companies |

Consolidated Statements of Cash Flows | ||||||||||||||||||||||||

| Description |

non-GAAP Amount |

GAAP Amount |

Description | |||||||||||||||||||||||||||

| Cash at year end 2011 |

$ | 56 | $ | — | $ | — | $ | — | $ | — | $ | 20 | $ | 76 | Cash at year end 2011 | |||||||||||||||

| Sources |

||||||||||||||||||||||||||||||

| Consumers Energy dividends/tax sharing |

$ | 423 | ||||||||||||||||||||||||||||

| Enterprises |

17 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Sources |

$ | 440 | $ | (124 | ) | $ | (12 | ) | $ | 5 | $ | (35 | ) | $ | 9 | $ | 283 | Net cash provided by operating activities | ||||||||||||

| Uses |

||||||||||||||||||||||||||||||

| Interest and preferred dividends |

$ | (124 | ) | |||||||||||||||||||||||||||

| Overhead and Federal tax payments |

(12 | ) | ||||||||||||||||||||||||||||

| Equity infusions |

(150 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Uses (a) |

$ | (297 | ) | $ | 124 | $ | 12 | $ | (5) | $ | — | $ | (55 | ) | $ | (221 | ) | Net cash provided by investing activities | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Cash flow |

$ | 143 | $ | — | $ | — | $ | — | $ | (35 | ) | $ | (46 | ) | $ | 62 | Cash flow from operating and | |||||||||||||

| Financing and dividends |

||||||||||||||||||||||||||||||

| New Issues |

$ | 480 | ||||||||||||||||||||||||||||

| Retirements |

(404 | ) | ||||||||||||||||||||||||||||

| Equity programs (DRP, continuous equity) |

30 | |||||||||||||||||||||||||||||

| Net short-term financing & other |

— | |||||||||||||||||||||||||||||

| Common dividend |

(252 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Financing |

$ | (146 | ) | $ | — | $ | — | $ | — | $ | 35 | $ | 61 | $ | (50 | ) | Net cash provided by financing activities | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net change in cash |

$ | (3 | ) | $ | — | $ | — | $ | — | $ | — | $ | 15 | $ | 12 | Net change in cash | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Cash at year end 2012 |

$ | 53 | $ | — | $ | — | $ | — | $ | — | $ | 35 | $ | 88 | Cash at year end 2012 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (a) | Includes other |

2012 A-4

Consolidated CMS Energy

2012 Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

| Eliminations/Reclassifications to Arrive at the Consolidated Statement of Cash Flows |

||||||||||||||||||||||||||

| Statements of Cash Flows |

Consumers Common Dividend as Financing |

Consumers Preferred Dividend as Operating |

Equity Infusions to Consumers |

|||||||||||||||||||||||

| Consumers | CMS Parent | Consolidated Statements of Cash Flows | ||||||||||||||||||||||||

| Description |

Amount | Amount | Amount | Description | ||||||||||||||||||||||

| Cash at year end 2011 |

$ | 85 | $ | 76 | $ | — | $ | — | $ | — | $ | 161 | Cash at year end 2011 | |||||||||||||

| Net cash provided by operating activities |

$ | 1,353 | $ | 283 | $ | (393 | ) | $ | (2 | ) | $ | — | $ | 1,241 | Net cash provided by operating activities | |||||||||||

| Net cash provided by investing activities |

(1,279 | ) | (221 | ) | — | — | 150 | (1,350 | ) | Net cash provided by investing activities | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash flow from operating and investing activities |

$ | 74 | $ | 62 | $ | (393 | ) | $ | (2 | ) | $ | 150 | $ | (109 | ) | Cash flow from operating and investing activities | ||||||||||

| Net cash provided by financing activities |

$ | (154 | ) | $ | (50 | ) | $ | 393 | $ | 2 | $ | (150 | ) | $ | 41 | Net cash provided by financing activities | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net change in cash |

$ | (80 | ) | $ | 12 | $ | — | $ | — | $ | — | $ | (68 | ) | Net change in cash | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash at year end 2012 |

$ | 5 | $ | 88 | $ | — | $ | — | $ | — | $ | 93 | Cash at year end 2012 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2012 A-5

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | ||||||||||||||||||||||

| Consumers Operating Income + Depreciation & Amortization |

$ | 1,527 | $ | 1,635 | $ | 1,735 | $ | 1,821 | $ | 1,948 | $ | 2,011 | $ | 2,113 | ||||||||||||||

| Enterprises Project Cash Flows |

24 | 17 | 20 | 29 | 37 | 44 | 56 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross Operating Cash Flow |

$ | 1,551 | $ | 1,652 | $ | 1,755 | $ | 1,850 | $ | 1,985 | $ | 2,055 | $ | 2,169 | ||||||||||||||

| Other operating activities including taxes, interest payments and working capital |

(382 | ) | (411 | ) | (405 | ) | (400 | ) | (435 | ) | (805 | ) | (819 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net cash provided by operating activities |

$ | 1,169 | $ | 1,241 | $ | 1,350 | $ | 1,450 | $ | 1,550 | $ | 1,250 | $ | 1,350 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2011-17 OCF

CMS Energy

2012 Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| 2012 | ||||

| Consumers Operating Income + Depreciation & Amortization |

$ | 1,635 | (a) | |

| Enterprises Project Cash Flows |

17 | |||

|

|

|

|||

| Gross Operating Cash Flow |

$ | 1,652 | ||

| Other operating activities including taxes, interest payments and working capital |

(411 | ) | ||

|

|

|

|||

| Net cash provided by operating activities |

$ | 1,241 | ||

|

|

|

|||

| (a) | Excludes impact of $59 million electric decoupling write off |

2012 OCF

Consumers Energy

2013 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| Reclassifications From Sources and Uses to Statement of Cash Flows | ||||||||||||||||||||||||||||||||||||||

| Presentation Sources and Uses |

Tax Sharing Operating |

Interest Payments as Operating |

Other Working Capital as Investing |

Capital Lease Pymts as Financing |

Securitization Debt Pymts as Financing |

Preferred Dividends as Financing |

Common Dividends as Financing |

Consolidated Statements of Cash Flows | ||||||||||||||||||||||||||||||

| non-GAAP Amount |

GAAP Amount |

|||||||||||||||||||||||||||||||||||||

| Description |

Description | |||||||||||||||||||||||||||||||||||||

| Cash at year end 2012 |

$ | 5 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 5 | Cash at year end 2012 | |||||||||||||||||||

| Sources |

||||||||||||||||||||||||||||||||||||||

| Operating (dep & amort $620) |

$ | 1,735 | ||||||||||||||||||||||||||||||||||||

| Other working capital |

(10 | ) | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Sources |

$ | 1,725 | $ | (125 | ) | $ | (228 | ) | $ | (101 | ) | $ | 28 | $ | 41 | $ | — | $ | — | $ | 1,340 | Net cash provided by operating activities | ||||||||||||||||

| Uses |

||||||||||||||||||||||||||||||||||||||

| Interest and preferred dividends |

$ | (230 | ) | |||||||||||||||||||||||||||||||||||

| Pension Contribution |

(49 | ) | ||||||||||||||||||||||||||||||||||||

| Capital expenditures a |

(1,375 | ) | ||||||||||||||||||||||||||||||||||||

| Dividends/tax sharing to CMS |

(540 | ) | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Uses |

$ | (2,194 | ) | $ | 125 | $ | 228 | $ | 101 | $ | — | $ | — | $ | 2 | $ | 415 | $ | (1,323 | ) | Net cash provided by investing activities | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Cash flow |

$ | (469 | ) | $ | — | $ | — | $ | — | $ | 28 | $ | 41 | $ | 2 | $ | 415 | $ | 17 | Cash flow from operating and investing activities | ||||||||||||||||||

| Financing |

||||||||||||||||||||||||||||||||||||||

| Equity |

$ | 150 | ||||||||||||||||||||||||||||||||||||

| New Issues |

325 | |||||||||||||||||||||||||||||||||||||

| Retirements |

— | |||||||||||||||||||||||||||||||||||||

| Net short-term financing & other |

15 | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Financing |

$ | 490 | $ | — | $ | — | $ | — | $ | (28 | ) | $ | (41 | ) | $ | (2 | ) | $ | (415 | ) | $ | 4 | Net cash provided by financing activities | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net change in cash |

$ | 21 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 21 | Net change in cash | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Cash at year end 2013 |

$ | 26 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 26 | Cash at year end 2013 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| a | Includes cost of removal and capital leases |

2013 B-1

CMS Energy Parent

2013 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| Reclassifications From Sources and Uses to Statement of Cash Flows | ||||||||||||||||||||||||||

| Presentation Sources and Uses |

Interest Payments as Operating |

Overheads & Tax Payments as Operating |

Other Uses (a) as Operating |

Cash From Consolidated Companies |

Consolidated Statements of Cash Flows | |||||||||||||||||||||

| non-GAAP | GAAP | |||||||||||||||||||||||||

| Description |

Amount | Amount | Description | |||||||||||||||||||||||

| Cash at year end 2012 |

$ | 53 | $ | — | $ | — | $ | — | $ | 35 | $ | 88 | Cash at year end 2012 | |||||||||||||

| Sources |

||||||||||||||||||||||||||

| Consumers Energy dividends/tax sharing |

$ | 540 | ||||||||||||||||||||||||

| Enterprises |

20 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Sources |

$ | 560 | $ | (135 | ) | $ | (15 | ) | $ | (6) | $ | 23 | $ | 427 | Net cash provided by operating activities | |||||||||||

| Uses |

||||||||||||||||||||||||||

| Interest and preferred dividends |

$ | (135 | ) | |||||||||||||||||||||||

| Overhead and Federal tax payments |

(15 | ) | ||||||||||||||||||||||||

| Equity infusions |

(150 | ) | ||||||||||||||||||||||||

| Pension Contribution |

(1 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Uses (a) |

$ | (315 | ) | $ | 135 | $ | 15 | $ | 6 | $ | (86 | ) | $ | (245 | ) | Net cash provided by investing activities | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash flow |

$ | 245 | $ | — | $ | — | $ | — | $ | (63 | ) | $ | 182 | Cash flow from operating and investing activities | ||||||||||||

| Financing and dividends |

||||||||||||||||||||||||||

| New Issues |

$ | 250 | ||||||||||||||||||||||||

| Retirements |

— | |||||||||||||||||||||||||

| Equity programs (DRP, continuous equity) |

30 | |||||||||||||||||||||||||

| Net short-term financing & other |

(5 | ) | ||||||||||||||||||||||||

| Common dividend |

(270 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Financing |

$ | 5 | $ | — | $ | — | $ | — | $ | 72 | $ | 77 | Net cash provided by financing activities | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net change in cash |

$ | 250 | $ | — | $ | — | $ | — | $ | 9 | $ | 259 | Net change in cash | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash at year end 2013 |

$ | 303 | $ | — | $ | — | $ | — | $ | 44 | $ | 347 | Cash at year end 2013 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (a) | Includes other |

2013 B-2

Consolidated CMS Energy

2013 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

| Eliminations/Reclassifications to Arrive at the Consolidated Statement of Cash Flows |

||||||||||||||||||||||||||

| Statements of Cash Flows |

Consumers Common Dividend as Financing |

Consumers Preferred Dividend as Operating |

Equity Infusions to Consumers |

|||||||||||||||||||||||

| Consumers Amount |

CMS Parent Amount |

Consolidated Statements of Cash Flows | ||||||||||||||||||||||||

| Description |

Amount | Description | ||||||||||||||||||||||||

| Cash at year end 2012 |

$ | 5 | $ | 88 | $ | — | $ | — | $ | — | $ | 93 | Cash at year end 2012 | |||||||||||||

| Net cash provided by operating activities |

$ | 1,340 | $ | 427 | $ | (415 | ) | $ | (2 | ) | $ | — | $ | 1,350 | Net cash provided by operating activities | |||||||||||

| Net cash provided by investing activities |

(1,323 | ) | (245 | ) | — | — | 150 | (1,418 | ) | Net cash provided by investing activities | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash flow from operating and investing activities |

$ | 17 | $ | 182 | $ | (415 | ) | $ | (2 | ) | $ | 150 | $ | (68 | ) | Cash flow from operating and investing activities | ||||||||||

| Net cash provided by financing activities |

$ | 4 | $ | 77 | $ | 415 | $ | 2 | $ | (150 | ) | $ | 348 | Net cash provided by financing activities | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net change in cash |

$ | 21 | $ | 259 | $ | — | $ | — | $ | — | $ | 280 | Net change in cash | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash at year end 2013 |

$ | 26 | $ | 347 | $ | — | $ | — | $ | — | $ | 373 | Cash at year end 2013 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2013 B-3