Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PREMIERWEST BANCORP | d490215d8k.htm |

Exhibit 99.1

PREMIERWEST BANCORP ANNOUNCES APPROVAL OF ADJOURNMENT

PROPOSAL AND ADJOURNED SPECIAL MEETING OF SHAREHOLDERS

Special Meeting to be Reconvened on Wednesday, March 13, 2013;

PremierWest Stockholders Urged To Vote “FOR” the Proposed Merger

MEDFORD, OREGON—February 19, 2013: PremierWest Bancorp (Nasdaq: PRWT) (“PremierWest”), the parent company of PremierWest Bank, announced today at its Special Meeting of shareholders at the Rogue Valley Country Club, 2660 Hillcrest Road, Medford, Oregon, that shareholders approved adjournment of the Special Meeting and that the Special Meeting has been adjourned until 9:00 a.m. Pacific Time, on Wednesday, March 13, 2013 at the Rogue Valley Country Club, 2660 Hillcrest Road, Medford, Oregon.

The meeting is being adjourned to provide PremierWest with additional time to solicit proxies from its shareholders to approve the Agreement and Plan of Merger, dated October 29, 2012, among PremierWest, Starbuck Bancshares, Inc. and Pearl Merger Sub Corp., pursuant to which PremierWest will merge with and into Pearl Merger Sub Corp., with Pearl Merger Sub Corp. as the surviving entity. Approval of the merger agreement requires the affirmative vote of a majority of the outstanding shares entitled to vote at the Special Meeting. As of February 19, 2013, approximately 46.9% of the outstanding shares and approximately 63.9% of the total votes cast voted in favor of the merger proposal.

The Board of Directors of PremierWest has not withdrawn, modified or qualified its recommendation that PremierWest shareholders vote “FOR” the merger proposal.

Submission of proxies in respect of the adjourned meeting via Internet and telephone will resume at 8:00 am EST on Thursday, February 21, 2013 and will be available until 11:59 p.m. EDT on Tuesday, March 12, 2013.

Shareholders who have previously submitted their proxy or otherwise voted, and who do not want to change their vote, need not take any action. Shareholders who have questions about the merger proposal, need assistance in submitting their proxy or voting their shares (or changing a prior vote of their shares) should contact Georgeson, Inc., PremierWest’s proxy solicitor, toll-free at 1-877-278-9670.

PremierWest shareholders are urged to read the full definitive proxy statement filed by PremierWest with the U.S. Securities and Exchange Commission on January 4, 2013 and previously sent to shareholders for additional information regarding the proposed merger.

IMPORTANT ADDITIONAL INFORMATION

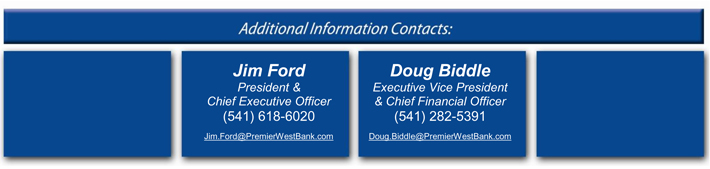

PremierWest filed a definitive proxy statement with the U.S. Securities and Exchange Commission on January 4, 2013, in connection with the proposed merger of PremierWest and an affiliate of AmericanWest Bank. Shareholders of PremierWest are urged to read the proxy statement, because it contains important information. Shareholders can obtain a free copy of the proxy statement, as well as other filings containing information about PremierWest and the merger, without charge, at the U.S. Securities and Exchange Commission’s Internet site (www.sec.gov). In addition, copies of the proxy statement and other filings containing information about PremierWest and the proposed merger can be obtained, without charge, by directing a request to PremierWest’s Internet site at www.premierwestbank.com under the heading “About Us” and then under the heading “Investor Relations.” Shareholders and customers may also contact: James M. Ford, PremierWest President & CEO at (541) 618-6020 or Jim.Ford@PremierWestBank.com or Doug Biddle, Executive Vice President & Chief Financial Officer at (541) 282-5391 or Doug.Biddle@PremierWestBank.com.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. We make forward-looking statements in this press release about the proposed merger with Pearl Merger Sub Corp., a wholly-owned subsidiary of Starbuck Bancshares, Inc. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to certain risk factors, including those set forth from time to time in PremierWest’s filings with the SEC. Such statements are subject to risks that we may be unable to procure the required shareholder approval. You should not place undue reliance on forward-looking statements and we undertake no obligation to update any such statements.

PROXY SOLICITATION

PremierWest and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from PremierWest shareholders in respect of the proposed merger. You can find information about PremierWest’s executive officers and directors in PremierWest’s definitive annual proxy statement filed with the U.S. Securities and Exchange Commission on April 9, 2012. You can obtain free copies of PremierWest’s annual proxy statement, and PremierWest’s proxy statement in connection with the merger by contacting PremierWest’s investor relations department.

ABOUT PREMIERWEST BANCORP

PremierWest Bancorp (NASDAQ: PRWT) is a bank holding company headquartered in Medford, Oregon, and operates primarily through its subsidiary, PremierWest Bank. PremierWest Bank offers expanded banking-related services through its subsidiary, PremierWest Investment Services, Inc.

PremierWest Bank was created following the merger of the Bank of Southern Oregon and Douglas National Bank in May 2000. In April 2001, PremierWest Bancorp acquired Timberline Bancshares, Inc. and its wholly-owned subsidiary, Timberline Community Bank, located in Siskiyou County in northern California. In January 2004, PremierWest acquired Mid Valley Bank located in the northern California counties of Shasta, Tehama and Butte. In January 2008, PremierWest acquired Stockmans Financial Group, and its wholly-owned subsidiary, Stockmans Bank, located in the Sacramento, California area. During the last several years, PremierWest expanded into Klamath Falls and the Central Oregon communities of Bend and Redmond, and into Nevada, Yolo and Butte counties in California.