Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MAPLEBY HOLDINGS MERGER Corp | d489600d8k.htm |

Exhibit 99.1

|

|

Creating a Stronger, More Efficient Competitor Able to Meet Growing Challenges of a Rapidly Changing Industry February 20, 2013

|

|

2 OFFICE DEPOT SAFE HARBOR STATEMENT This document may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning Office Depot, the merger and other transactions contemplated by the merger agreement, Office Depot’s long-term credit rating and its revenues and operating earnings. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to Office Depot, based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward- looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside of Office Depot’s control. Therefore, investors and shareholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include adverse regulatory decisions; failure to satisfy other closing conditions with respect to the merger; the risks that the new businesses will not be integrated successfully or that Office Depot will not realize estimated cost savings and synergies; Office Depot’s ability to maintain its current long-term credit rating; unanticipated changes in the markets for its business segments; unanticipated downturns in business relationships with customers or their purchases from Office Depot; competitive pressures on Office Depot’s sales and pricing; increases in the cost of material, energy and other production costs, or unexpected costs that cannot be recouped in product pricing; the introduction of competing technologies; unexpected technical or marketing difficulties; unexpected claims, charges, litigation or dispute resolutions; new laws and governmental regulations. The foregoing list of factors is not exhaustive. Investors and shareholders should carefully consider the foregoing factors and the other risks and uncertainties that affect Office Depot’s business described in its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to time with the SEC. Office Depot does not assume any obligation to update these forward-looking statements. Discussion of Forward-Looking Statements

|

|

3 OFFICEMAX SAFE HARBOR STATEMENT Certain statements made in this document and other written or oral statements made by or on behalf of OfficeMax constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding OfficeMax’s future performance, as well as management’s expectations, beliefs, intentions, plans, estimates or projections relating to the future. OfficeMax cannot guarantee that the macroeconomy will perform within the assumptions underlying its projected outlook; that its initiatives will be successfully executed and produce the results underlying its expectations, due to the uncertainties inherent in new initiatives, including customer acceptance, unexpected expenses or challenges, or slower-than-expected results from initiatives; or that its actual results will be consistent with the forward-looking statements and you should not place undue reliance on them. In addition, forward-looking statements could be affected by the following additional factors, among others, related to the business combination: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement or the failure to satisfy closing conditions; the ability to obtain regulatory approvals or third-party approvals for the transaction and the timing and conditions for such approvals; the ability to obtain approval of the merger by the stockholders of OfficeMax and Office Depot; the risk that the synergies from the transaction may not be realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the ability to successfully integrate the businesses, unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; future regulatory or legislative actions that could adversely affect OfficeMax and Office Depot; and business plans of the customers and suppliers of OfficeMax and Office Depot. The forward-looking statements made herein are based on current expectations and speak only as of the date they are made. OfficeMax undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information or otherwise. Important factors regarding OfficeMax that may cause results to differ from expectations are included in OfficeMax’s Annual Report on Form 10-K for the year ended December 31, 2011, under 1A “Risk Factors”, and in OfficeMax’s other filings with the SEC. Discussion of Forward-Looking Statements

|

|

4 NO OFFER OR SOLICITATION This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction in connection with the transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC Office Depot will file with the SEC a registration statement on Form S-4 that will include the Joint Proxy Statement of Office Depot and OfficeMax that also constitutes a prospectus of Office Depot. Office Depot and OfficeMax plan to mail the Joint Proxy Statement/Prospectus to their respective shareholders in connection with the transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OFFICE DEPOT, OFFICEMAX, THE TRANSACTION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed with the SEC by Office Depot and OfficeMax through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed by Office Depot with the SEC by contacting Office Depot Investor Relations at 6600 North Military Trail, Boca Raton, FL 33496 or by calling 561-438-3657, and will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed by OfficeMax by contacting OfficeMax Investor Relations at 263 Shuman Blvd., Naperville, Illinois, 60563 or by calling 630-864- 6800. Additional Information

|

|

5 PARTICIPANTS IN THE SOLICITATION Office Depot and OfficeMax and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the respective shareholders of Office Depot and OfficeMax in respect of the transaction described the Joint Proxy Statement/Prospectus. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Office Depot and OfficeMax in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding Office Depot’s directors and executive officers is contained in Office Depot’s Annual Report on Form 10-K for the year ended December 29, 2012 and its Proxy Statement on Schedule 14A, dated March 15, 2012, which are filed with the SEC. Information regarding OfficeMax’s directors and executive officers is contained in OfficeMax’s Annual Report on Form 10-K for the year ended December 31, 2011 and its Proxy Statement on Schedule 14A, dated March 20, 2012, which are filed with the SEC. Additional Information

|

|

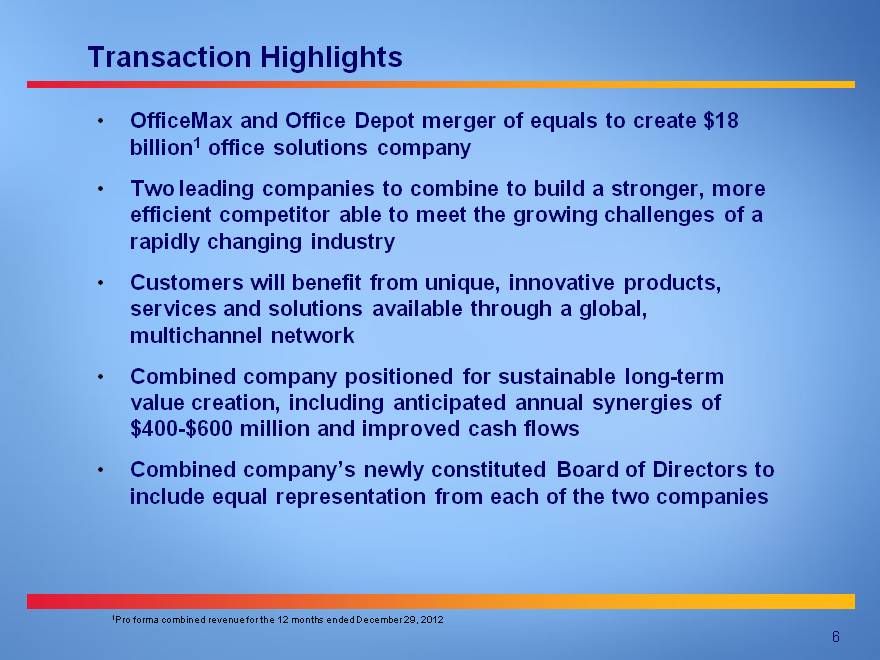

6 Transaction Highlights OfficeMax and Office Depot merger of equals to create $18 billion1 office solutions company Two leading companies to combine to build a stronger, more efficient competitor able to meet the growing challenges of a rapidly changing industry Customers will benefit from unique, innovative products, services and solutions available through a global, multichannel network Combined company positioned for sustainable long-term value creation, including anticipated annual synergies of $400-$600 million and improved cash flows Combined company’s newly constituted Board of Directors to include equal representation from each of the two companies 1Pro forma combined revenue for the 12 months ended December 29, 2012

|

|

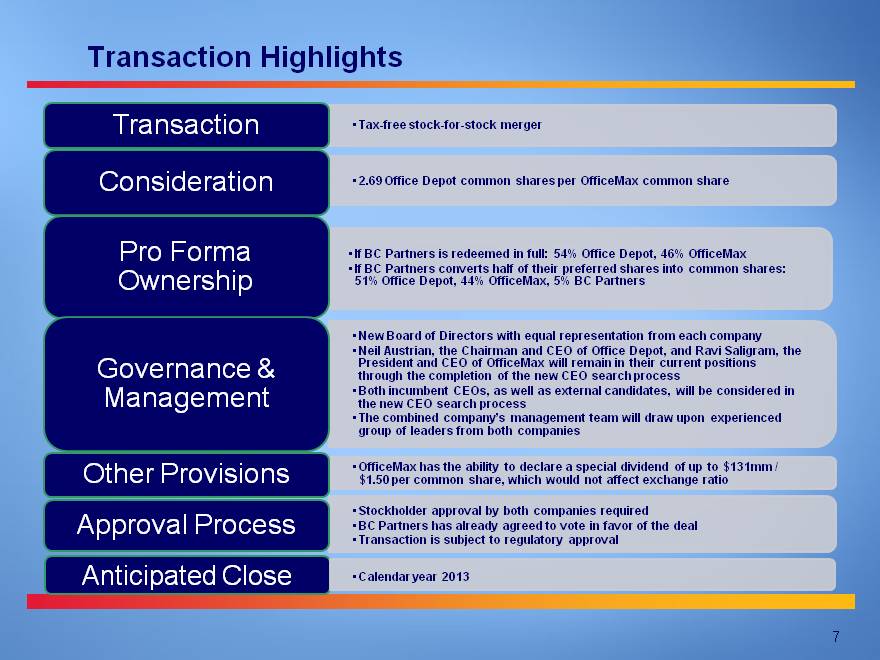

Transaction Highlights Transaction Highlights 7 Anticipated Close Calendar year 2013

|

|

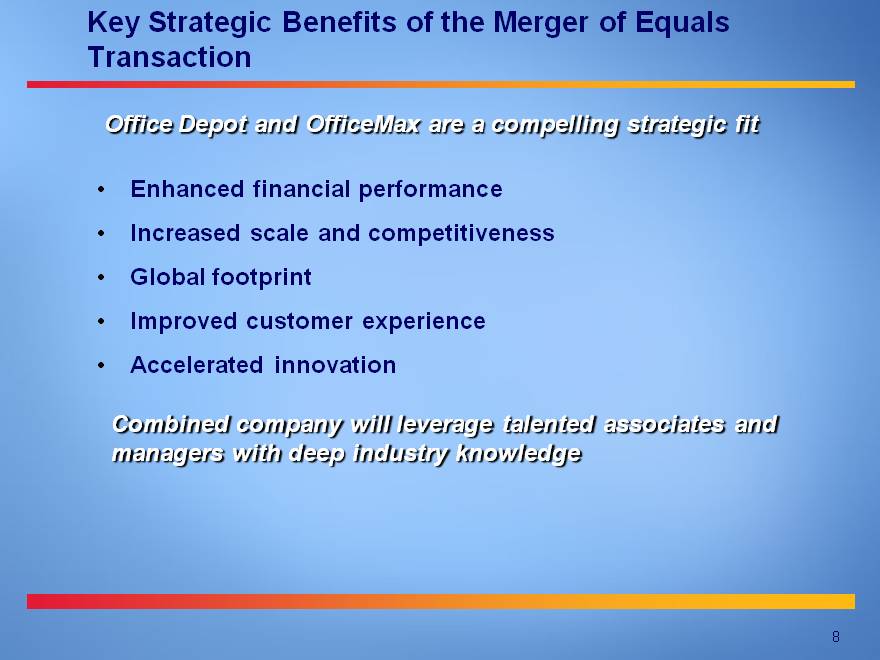

8 Key Strategic Benefits of the Merger of Equals Transaction Enhanced financial performance Increased scale and competitiveness Global footprint Improved customer experience Accelerated innovation Combined company will leverage talented associates and managers with deep industry knowledge Office Depot and OfficeMax are a compelling strategic fit

|

|

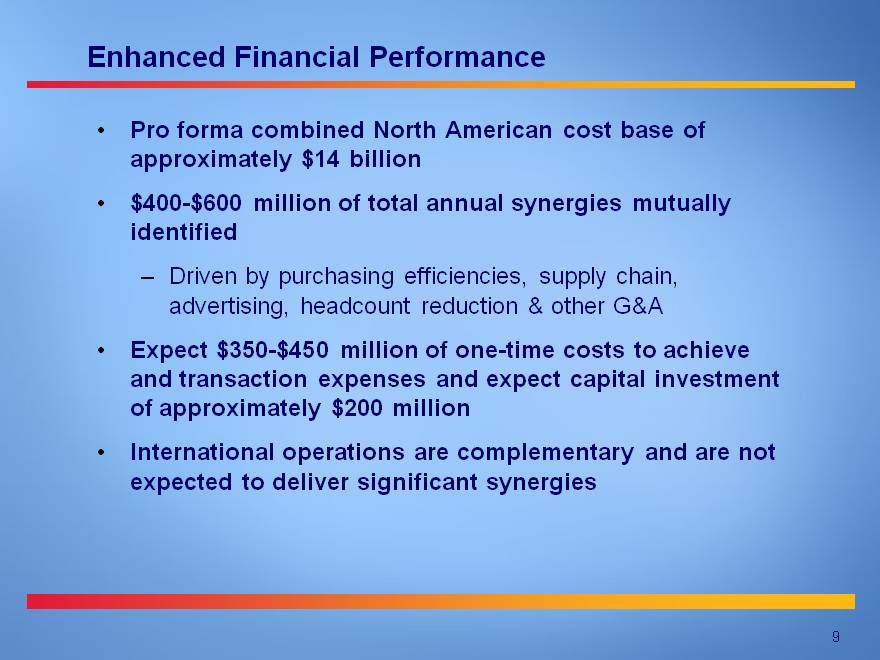

9 Enhanced Financial Performance Pro forma combined North American cost base of approximately $14 billion $400-$600 million of total annual synergies mutually identified Driven by purchasing efficiencies, supply chain, advertising, headcount reduction & other G&A Expect $350-$450 million of one-time costs to achieve and transaction expenses and expect capital investment of approximately $200 million International operations are complementary and are not expected to deliver significant synergies

|

|

Increased Scale and Competitiveness Well positioned to optimize shared multichannel sales platform and distribution network, primarily in North America Size and scale allow for expanded multichannel capabilities to better serve customers Combined company better able to compete against larger players (e.g., Wal-Mart, Amazon, Costco, Target) Better able to make the necessary investments to grow e-commerce platform and enhance systems to provide a seamless customer experience across channels Global reach strengthens portfolio of products, services and solutions to customers worldwide 10

|

|

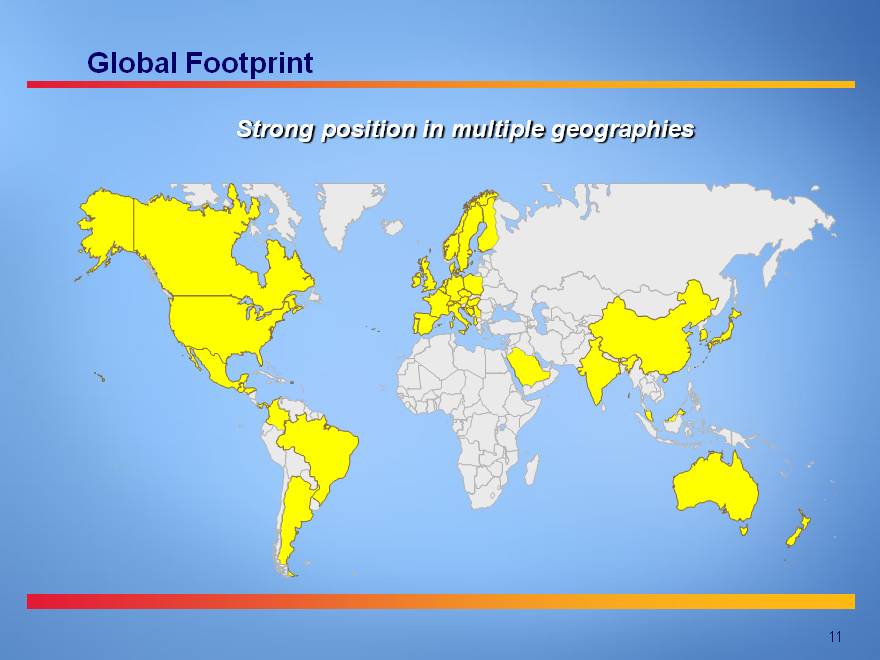

11 Global Footprint Strong position in multiple geographies

|

|

Improved Customer Experience Continued focus on a high level of service Improved omnichannel capabilities to better serve our valued customers Products, services and solutions that enable customers to work more efficiently and productively Accelerate change in the office solutions business, bringing to customers innovative solutions for today’s workplace Provide customers with a seamless experience across retail stores, direct sales, telesales and digital environments 12 Build lasting brand loyalty

|

|

Accelerated Innovation Sharing customer insights and learnings from innovative pilot programs underway to better identify and fulfill evolving customer needs Improved and expanded e-commerce offerings Complementary capabilities will provide customers with better solutions faster and more efficiently 13

|

|

14 Conclusion Two leading companies combine to build a stronger, more efficient competitor Customers to benefit from innovative products, services and solutions available through a global, multichannel network Long-term value creation, including anticipated annual synergies of $400-$600 million Significant cash generation and liquidity to fund internal and external opportunities Creates $18 billion1 global office solutions company to meet growing challenges of a rapidly changing industry 1Pro forma combined revenue for the 12 months ended December 29, 2012

|

|

15 Q & A

|

|

Creating a Stronger, More Efficient Competitor Able to Meet Growing Challenges of a Rapidly Changing Industry