Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hillshire Brands Co | d488900d8k.htm |

CAGNY

2013 Exhibit 99 |

Forward Looking

Statements This presentation contains forward-looking statements regarding HSH’s

business prospects and future financial results

and

metrics.

These

statements

are

typically

preceded

by

terms

such

as

“will,”

“anticipates,”

“intends,”

“expects,”

“likely”

or “believes”

and other similar terms. These forward-looking statements are based on currently

available competitive, financial and economic data and management’s views and assumptions

regarding future events and are inherently uncertain. Investors must recognize that

actual results may differ from those expressed or implied

in

the

forward-looking

statements,

and

the

company

wishes

to

caution

you

not

to

place

undue

reliance

on

any

forward-looking

statements.

We

have

provided

cautionary

language

in

our

most

recent

Annual

Report

on

Form

10-K and other filings with the SEC identifying factors that could cause actual results to

differ materially from those expressed or implied by our forward-looking statements.

All forward-looking statements included in this presentation are qualified in their

entirety by such cautionary statements. HSH undertakes no obligation to publicly update

any forward-looking statements, whether as a result of new information, future events or otherwise, except

as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not

substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial

measures to GAAP financial measures are provided in the Appendix at the end of the

presentation. Investors are urged to consider carefully the comparable GAAP

measures

and

the

reconciliations

to

those

measures

provided

in

the

Appendix,

or

on

our

website

at

www.hillshirebrands.com.

2 |

What We Want You

to Take Away From Today Terrific portfolio of leading, iconic brands that respond to

investment

Growth and cost agendas gaining traction

Confident we will deliver on financial targets

3 |

An Amazing

Year… Launched new company

Built new management team

Relocated headquarters to Chicago

Energized new culture

4 |

Past 12 Months

Have Validated Our Core Investment Thesis Compete in attractive and profitable

categories Key to success is disciplined investment in brand building and

innovation

Cost efficiencies exist to fund growth agenda

Potential to deliver significant shareholder return

5 |

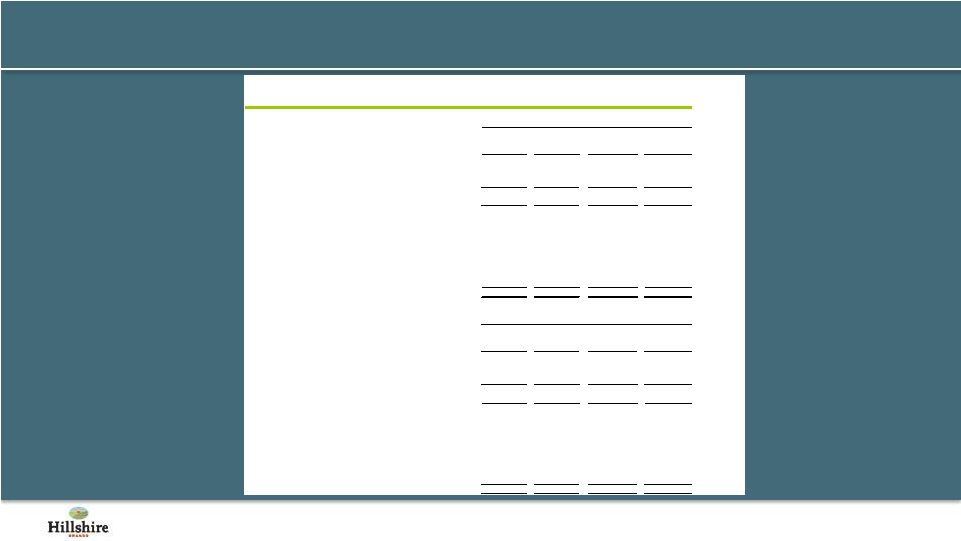

Early Days But

Turnaround Starting to Take Hold 6

Percent Change in Total Volume Sales

Product

FY12

FY13 YTD

Ball Park Hot Dogs

(4.7)%

+5.2%

Jimmy Dean Frozen Breakfast

(3.6)%

+7.9%

Hillshire Farm Lunchmeat

(7.5)%

+1.0%

State Fair Corn Dogs

(1.5)%

+1.7%

Gallo Salame

(6.4)%

+3.2%

Sara Lee Pre Sliced Deli

(17.2)%

+0.1%

Sara Lee Sweet Goods

(8.8)%

(2.8)%

Source: Symphony IRI Group Total US Multi-outlet data, 52 weeks ended 7/1/12

and Fiscal YTD through 2/3/13 |

What We Will

Cover Today Background on Hillshire Brands

Review of our four core strategies for growth

Financial outlook

7 |

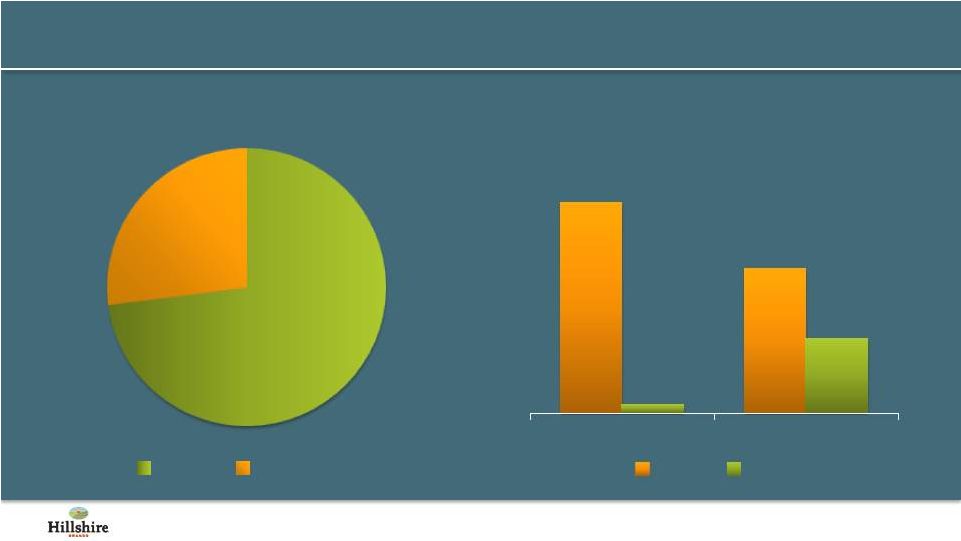

A $4B North

American Meat-Centric Food Company 8

Source: FY12 Company Financial Statement information; Based on reported net sales

73%

27%

Retail

Foodservice

Retail vs. Foodservice

96%

65%

4%

35%

Retail

Foodservice

Meat

Bakery

Meat vs. Bakery |

88% of Sales Are

Branded; Two $1B Brands 9

Source: Company Financial Statement information

88%

12%

Branded

Unbranded |

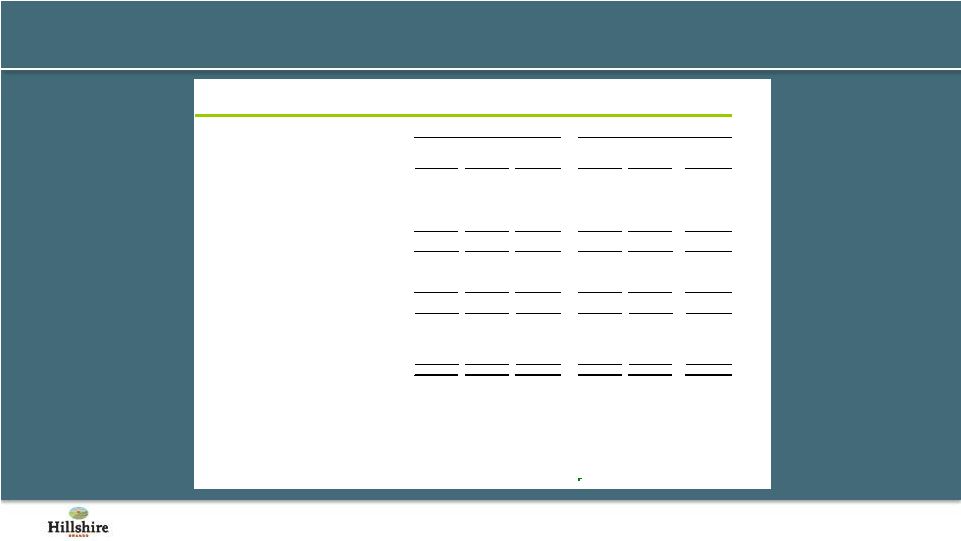

Leading Share

Positions in Core Categories 10

Source: IRI Multi-Outlet 52 weeks Ending 2/3/2013

Brand

Category

HSH Share

Position

Relative Market

Share

Breakfast Sausage

#1

2.8x

Frozen Protein Breakfast

#1

7.4x

Lunchmeat

#3

0.3x

Smoked Sausage

#1

2.8x

Hot Dogs

#1

1.1x

Corn Dogs

#1

1.7x

Super Premium Sausage

#1

1.6x

Specialty Lunchmeat

#3

0.3x |

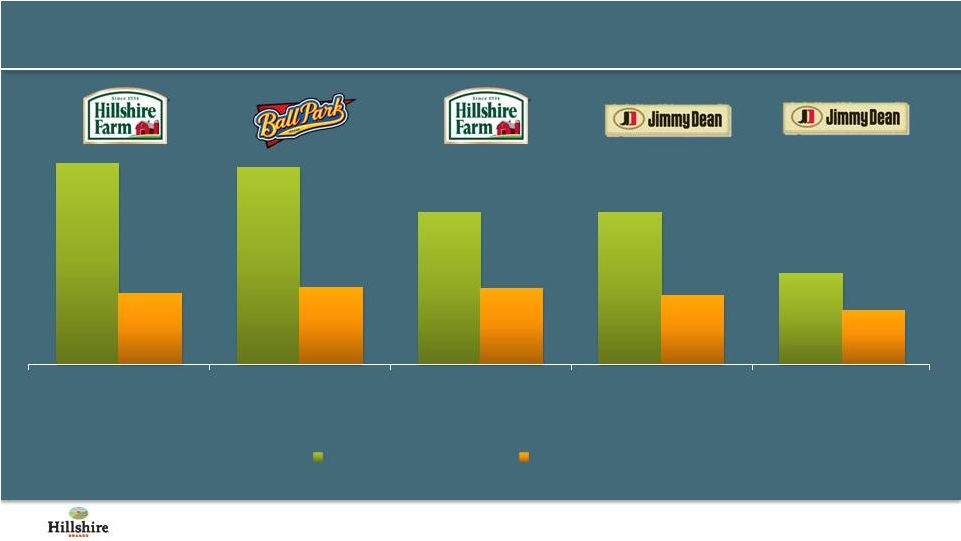

Multiple Areas

for Growth in Large Categories 11

Size of

Category

$5.1B

$2.7B

$1.8B

$1.8B

$1.5B

Source: Symphony IRI Group, National Consumer Panel, Total US–All Outlets, 52 weeks

ending 12/30/12. 80%

79%

60%

61%

36%

28%

31%

30%

28%

21%

Lunchmeat

Hot Dogs

Smoked Sausage

Breakfast Sausage

Frozen Protein Breakfast

Category HH Penetration

Brand HH Penetration |

Core Categories

Have Limited Private Label Penetration 12

Source: Symphony IRI Group Total US Multioutlet data, 52 weeks ending. 2/3/13

Category

Private Label Share

Frozen Protein Breakfast

7%

Hot Dogs

4%

Corn Dogs

4%

Smoked Sausage

6%

Cocktail Links

5%

Fresh Breakfast Sausage

9%

Mainstream Lunchmeat

14%

Food and Beverage Industry

18% |

Vision

Become THE

Most Innovative Meat-Centric

Food Company in the US

13 |

Four Strategies

Will Deliver Long-Term Value Creation 14

FY 2015 Targets

Volume Growth

Net Sales Growth

MAP % of Total Revenue

Operating Margin

2-3%

4-5%

5%

10%

Core Strategies

Strengthen the core

Extend into adjacencies

Fuel growth through efficiency

Acquire on-trend brands |

Two Core Growth

Strategies 15

Improve Business Fundamentals

Leverage Equities to

Win in New Categories

Near-term growth comes from strengthening the core

Strengthen

the Core

Extend into

Adjacencies |

Six Brands Will

Drive Our Growth 16

Mainstream Brands

Artisanal Brands |

Brand Building

and Innovation Key to Growth Agenda 17

Brand positioning

World-class advertising

Category management

Brand Building

Innovation

Upgrade existing quality

and packaging

New line extensions

Adjacent innovations |

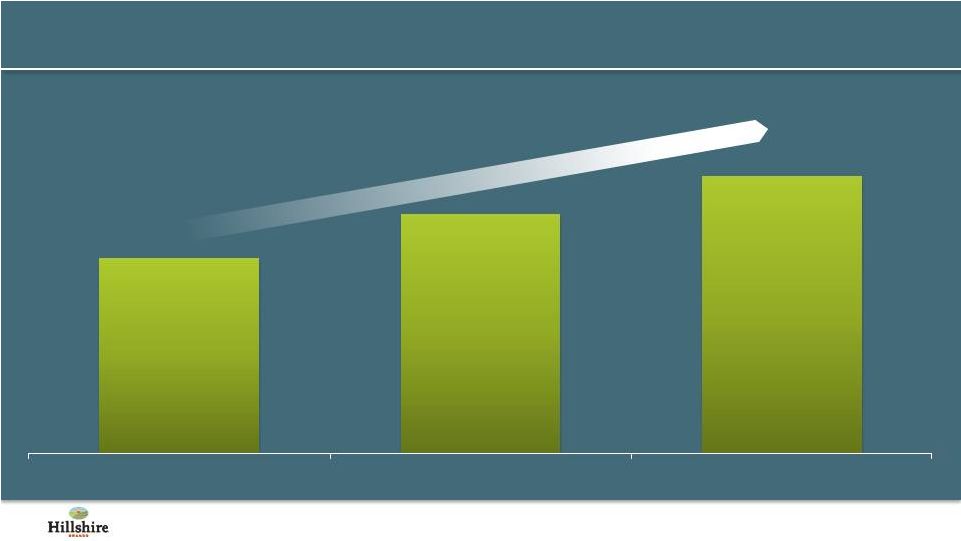

Increasing

Investment in MAP Behind Our Core Brands 18

3.5%

4.3%

5%

Historic Average

FY13 YTD

FY15E

MAP Spending as % of Sales |

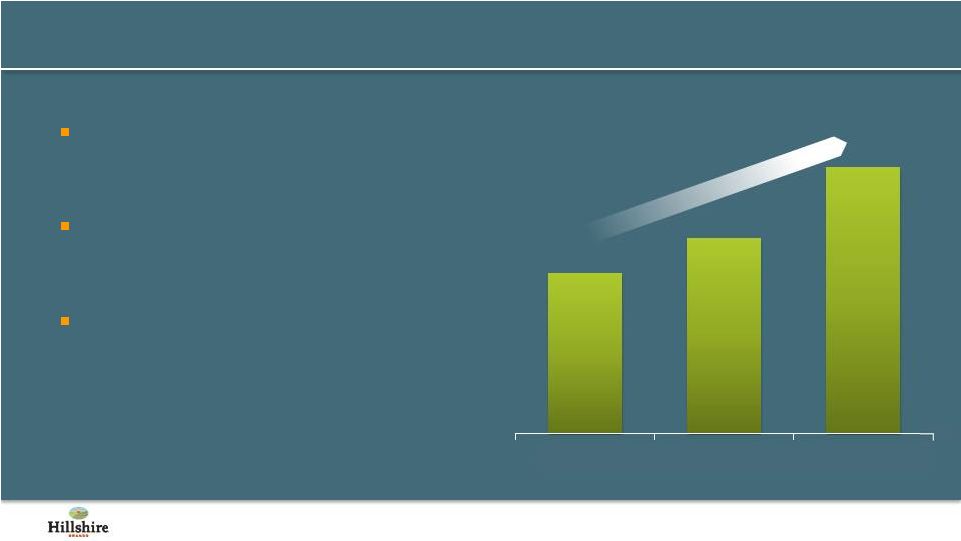

Building a

Culture Of Innovation Creating a sustainable pipeline by

shifting focus to growth platforms

Streamlining processes to reduce

time to market

Improving in-market success by

focusing on consumer insights

19

9%

11%

13%

15%

Past 4 Years

FY13 YTD

FY15E

-

Revenue from New Innovations*

*Percent annual revenue from past three years’ rolling innovations, Retail segment only

|

New Marketing

Leadership and Communications Partners New Marketing

Leadership

New Communications

Partner

20 |

Sharpened Brand

Positioning 21

“Farm House

Quality Meats”

“Hearty

Comfort Food”

“Better Guy Food for

Better Guy Times”

“Smart & Sensible

Family Choices”

“Authentic Ingredients,

Exceptional Tastes”

“Artisanal

Italian Meats” |

22

|

Focused on

Making MAP More Effective 23

1) Purchase Interest sourced from Nielsen In-Market Study (among ad aware)

2) Emotive Power sourced from Pre-Advertising Study (OTX)

Post-Market Analytics

Pre-Market Testing

Consumption Trends

Improved

ROI

TBD

Purchase Interest

1

+25 pct. pts.

Emotive Power

2

+57 pts. |

Strengthening

Our Customer Relationships 24

Gaining additional category captaincies

Increasing shelf space in key retailers

Improving shelf mix to higher velocity

and margin products |

Brand Building

and Innovation Key to Growth Agenda 25

Brand positioning

World-class advertising

Category management

Brand Building

Innovation

Upgrade existing quality

and packaging

New line extensions

Adjacent innovations |

Hillshire Farm

Improving Lunchmeat Packaging 26

Launch: Q3 FY13

New “fresh”

callout

Transparent window

UPGRADES BASED ON CONSUMER INSIGHTS |

Hillshire Farm

Improving Lunchmeat Quality 27

Better Taste

Better flavor

Optimized seasoning

Better Appearance

More natural look

Better texture

Launch: Q3 FY13 |

Hillshire Farm

Launching New Lunchmeat Flavors 28

Launch: Q4 FY13 |

Sara Lee Deli:

Improved Quality, Improved Packaging 29

Launch: H2 FY13

American Heart

Association

Heart-Check Mark

No gluten

No MSG

No fillers

No artificial flavors

No added hormones

0 grams of trans fat |

Hillshire Black

Label: Testing A New, Superior-Quality Approach To The Deli

30

Whole muscle meat

Seasoned in own juices

No added preservatives

No MSG

No fillers

Launch: Q1 FY14 |

Hillshire Farm

Upgrading Smoked Sausage Quality 31

3 new varieties

No artificial colors, flavors

No MSG

Gluten free

60/40 taste win vs. competition

Launch: Q3 FY13 |

Jimmy Dean

Adding Additional Comfort Foods 32

Launch: Q3 FY13 |

Ball Park

Bringing New, On-Trend Benefits to Hot Dogs 33

Launch: Q3 FY13 |

State Fair

Introducing New Packaging and Varieties 34

Launch: FY14 |

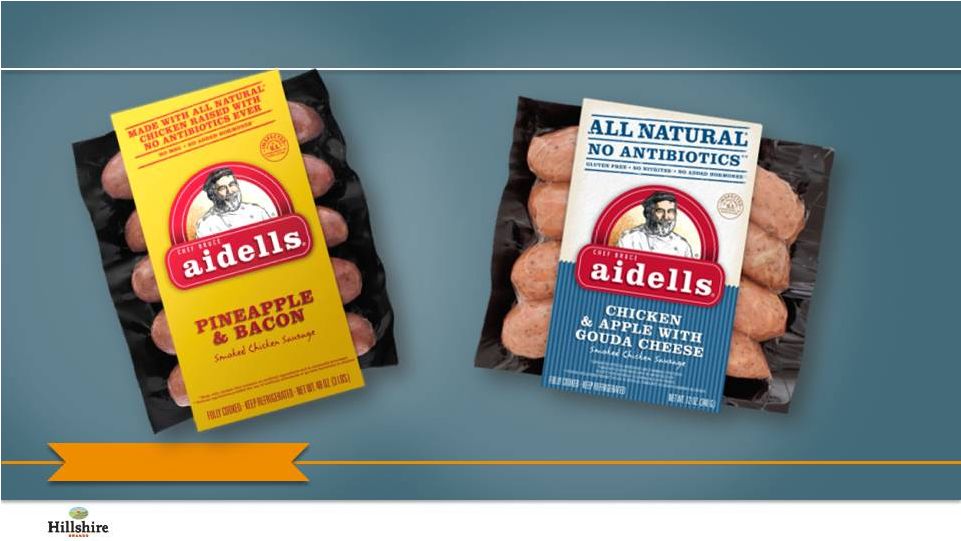

Aidells

Continues its Tradition of Flavor Experiences 35

Launch: FY13 -

FY14 |

Gallo Adding

Higher-Quality Salame 36

Launch: Q4 FY13 |

Second Growth

Opportunity Is To Extend Into Adjacencies 37

Protein

breakfast

Meat-centric

meal starters

Meat-centric

snacks

Meat-centric

entrees

Heat & eat

mini-meals

Heritage

categories |

Track Record of

Moving From Core to Adjacencies 38 |

Jimmy Dean

Frozen Adjacency Extended To “Better For You” 39

Launch: Q3 FY13 |

Ball Park

Extended Into Pre-cooked Burgers 40

Launch: FY12 |

State Fair

Entering Hot Dog Category 41

Launch: Q4 FY13

Bilingual packaging |

Aidells

Extending Beyond Smoked Sausage 42

Launch: FY13 –

FY14 |

Recent Record of

Managing Costs Saved $90 million via cost reductions in FY11 and FY12

Right-sized workforce for speed and empowerment

•

More than 600 positions eliminated in last 24 months

Closed two plants in FY12

43 |

We Will Remain

Relentless on Cost Efficiency Committed to $100 million of

cost savings

Opportunities for additional

efficiency

•

Supply chain

•

Trade spend

•

Productivity through culture

change

44

Expected savings by year

$ in millions

FY13

FY14/

FY15

Total

Supply chain

10

SG&A / Corp.

30

Total

40

60

100 |

Building Brands

to Build Value Outstanding portfolio of brands with clear potential

Emerging culture of innovation and agility

Demonstrating success –

products, processes and performance

Committed to growth and profitability through brand-building

Focus on cost efficiency as fuel for growth

45

Building Value in our Brands and for our Shareholders |

Capital

Allocation Priorities 46

Invest in Business

Dividends

Acquisitions

Share Repurchases

Pay Down Debt

Top priority

Expect to increase over time

Strategic and opportunistic

Opportunistic

Not a near-term priority |

Assets &

Capabilities We Can Leverage With Acquisitions Consumer insights

Protein / Breakfast / Meals

expertise

Category captaincies in key

product areas

Robust R&D and innovation

focus

History of success integrating

acquired businesses

Efficient supply chain and

production

Fully-integrated SAP enterprise

system

Extensive distribution

infrastructure

Powerful brand equities with

proven ability to penetrate new

segments

Capabilities

Assets

47 |

Criteria For

Acquisitions Value-added categories / consistent with consumer trends

Strong brands with attractive competitive positioning

Complementary / additive to HSH capabilities

Scale with suppliers and customers

Attractive top-line growth trends

Accretive to margin structure

EPS contribution and returns

Alignment with

Strategic Vision

Shareholder

Value Creation

48 |

Remain Committed

to Our FY15 Targets 49

Volume Growth

2-3%

Net Sales Growth

4-5%

MAP % of Total Revenue

5%

Operating Margin

10%

FY 2015 Targets |

FY13 Results on

Track 50

Strong 2013 First Half Results

Fiscal 2013 Full-Year Guidance

vs. H1 FY12

Adjusted Net Sales

+2.3%

Adjusted Operating Income

+44%

Adjusted Diluted EPS

+49%

Adjusted Net Sales

Slightly up vs. FY12

Adjusted Diluted EPS

$1.60 -

$1.70

“Adjusted” terms are non-GAAP financial measures. See our reconciliation to the

most directly comparable GAAP measure at the end of this presentation. |

Healthy

Financial Position 51

($ in millions)

As of Dec. 31, 2012

Adjusted YTD Cash Flow

$ 114

Adjusted YTD EBITDA

$ 301

Cash

$ 299

Debt

$ 946

Net Debt

$ 647

“Adjusted” terms are non-GAAP financial measures. See our reconciliation to the

most directly comparable GAAP measure at the end of this presentation. |

Key

Takeaways Terrific portfolio of leading, iconic brands that respond to

investment

Growth and cost agendas gaining traction

Confident we will deliver on financial targets

52 |

Q&A

|

Appendix

|

Impact of

As

Significant

Reported

Items

Dispositions

Adjusted (1)

2,034

$

-

$

-

$

2,034

$

1,408

4

-

1,404

626

(4)

-

630

88

-

-

88

349

35

-

314

Net charges for exit activities, asset and business dispositions

6

6

-

-

Impairment charges

-

-

-

-

183

$

(45)

$

-

$

228

$

Impact of

As

Significant

Reported

Items

Dispositions

Adjusted (1)

Net Sales

2,040

$

-

$

52

$

1,988

$

1,469

11

37

1,421

571

(11)

15

567

77

-

1

76

367

27

7

333

Net charges for exit activities, asset and business dispositions

66

66

-

-

Impairment charges

14

14

-

-

47

$

(118)

$

7

$

158

$

Cost of Sales

SG&A (excluding MAP)

Cost of Sales

Gross Profit

Six Months ended Dec. 29, 2012 and Dec. 31, 2011 (in millions, except

per share data - unaudited) Six Months ended Dec. 29, 2012

Operating income

MAP Expense

Operating Income Reconciliation - Reported to Adjusted

Net Sales

Six Months ended Dec. 31, 2011

Gross Profit

MAP Expense

SG&A (excluding MAP)

Operating income

(1) Represents a non-GAAP financial measure. See detailed explanation of these and other

non-GAAP measures in the release dated January 31, 2013 55

|

56

Impact of

Impact of

As

Significant

As

Significant

Reported

Items

Adjusted (1)

Reported

Items

Adjusted (1)

$

164

(45)

$

209

$

4

$

(118)

$

122

$

57

(16)

73

(11)

(46)

35

107

(29)

136

15

(72)

87

9

4

5

(223)

(440)

217

2

2

-

460

460

-

11

6

5

237

20

217

118

(23)

141

252

(52)

304

-

-

-

3

-

3

$

118

(23)

$

141

$

249

$

(52)

$

301

$

$

107

(29)

$

136

$

15

$

(72)

$

87

$

11

6

5

234

20

214

Earnings per share of common stock:

$

0.87

(0.23)

$

1.10

$

0.13

$

(0.61)

$

0.74

$

$

0.96

(0.19)

$

1.15

$

2.10

$

(0.44)

$

2.54

$

34.8%

35.2%

(277.4)%

28.8%

Net income from continuing operations

Amounts attributable to Hillshire Brands:

Diluted

Income from continuing operations

Net income

Effective tax rate - continuing operations

Discontinued operations:

Net income (loss) from discontinued operations

Net income (loss) from discontinued operations

Net income (loss)

Less: Income from noncontrolling interests, net of tax

Continuing operations:

Net income (loss) attributable to Hillshire Brands

before income taxes

Income tax expense (benefit)

Income from continuing operations

Income from continuing operations

Income from discontinued operations, net of tax

Gain (loss) on sale of discontinued operations, net of tax

Discontinued operations

Six Months ended Dec. 29, 2012 and Dec. 31, 2011 (in millions, except

per share data - unaudited) Six Months ended Dec. 29, 2012

Six Months ended Dec. 31, 2011

EPS Reconciliation - Reported to Adjusted

(1) Represents a non-GAAP financial measure. See detailed explanation of these and other

non-GAAP measures in the release dated January 31, 2013 |

57

Cash Flow Reconciliation - Reported to Adjusted

Six Months ended Dec. 31, 2012 (in millions, except per share data - unaudited)

Six Months ended Dec. 29, 2012

As

Reported

Impact of

Significant

Items

Adjusted (1)

Cash Flow

$70

$44

$114

(1) Represents a non-GAAP financial measure. See detailed explanation of these and other

non-GAAP measures in the release dated January 31, 2013 |

58

(1) Represents a non-GAAP financial measure. See detailed explanation of these and other

non-GAAP measures in the release dated January 31, 2013 EBITDA

Reconciliation - Reported to Adjusted

Six

Months

ended

Dec.

31,

2012

(in

millions,

except

per

share

data

-

unaudited)

Reported Net Income

118

Income

tax

expense

-

continuing

operations

57

Income

tax

benefit

-

discontinued

operations

(2)

Income

tax

expense

-

gain

on

sale

of

discontinued

operations

1

Interest (net)

19

Depreciation & Amortization

86

Reported EBITDA

279

Significant Items, excluding accelerated depreciation

22

Adjusted EBITDA (1)

301 |