Attached files

| file | filename |

|---|---|

| EX-3.2 - EXHIBIT 3.2 - Trio Resources, Inc. | v335508_ex3-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 14, 2012

TRIO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 333-178472 | 99-0369568 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 100 King Street West, Suite 5600 | ||

| Toronto, Ontario | M5X 1C9 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (416) 409-2802

Allied Technologies Group, Inc. 28A Horbow-Kolonia, Zalesie, Poland 21-512

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K (this “Report”) contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Such statements may include, but are not limited to, information related to: anticipated operating results; relationships with our merchants and subscribers; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in accounting treatment; cost of sales; selling, general and administrative expenses; interest expense; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue our operations and take advantage of opportunities; legal proceedings and claims. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this Report. You should read this Report and the documents that we reference and file or furnish as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

CAUTIONARY NOTES TO U.S. INVESTORS CONCERNING ESTIMATES

We operate as an exploration company in the province of Ontario, Canada. Our activities have been limited to acquiring our initial land holdings and mineral claims, and our initial equipment and fixed assets, with a view to implementing our plans to begin small-scale processing and monetization of our existing above-ground mineralized material. The property that we have acquired is without known reserves, we currently undertake no mining operations and our proposed program is exploratory in nature. We have not obtained a “final” or “bankable” feasibility study (as defined under the SEC’s Industry Guide 7 (“Guide 7”)) nor a technical report under Canada’s National Instrument 43-101 (“NI 43-101”). Under Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three year history average price must be used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority. We report on quantities and qualities of certain mineralized materials and concentrates. These are not terms defined or recognized under United States standards, including Guide 7, or NI 43-101. These terms have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors are cautioned not to assume that all or any part of the Company’s mineralized materials will ever be upgraded to a higher or recognized category. The information contained in this report containing descriptions of our mineralized materials may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of Allied Technologies Group, Inc. and its consolidated subsidiaries.

In addition, unless the context otherwise requires and for the purposes of this Report only:

· | “Closing Date” means December 14, 2012; |

· | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

· | “Trio” refers to TrioResources AG Inc., an Ontario corporation; |

· | “Allied” refers to Trio Resources, Inc, formerly Allied Technologies Group, Inc., a Nevada corporation; |

· | “SEC” or the “Commission” refers to the Securities and Exchange Commission; and |

· | “Securities Act” refers to the Securities Act of 1933, as amended. |

| 2 |

INTRODUCTION

On December 14, 2012, we entered into a transaction (the “Share Exchange”), pursuant to which we acquired 100% of the issued and outstanding equity securities of Trio, in exchange for the issuance of 2,130,000 shares of common stock, par value $0.001 per share, of Allied (the “Common Stock”), to be issued to the shareholders of Trio (the “Trio Shareholders”). Under the terms of the Share Exchange, all 1,500,000 shares of Allied Common Stock owned by Ihar Yaravenka, the former sole director, officer, and principal shareholder of Allied (the “Principal Shareholder”), which constituted 57.9% of the issued and outstanding shares of Common Stock of Allied prior to the Share Exchange were cancelled.

As a result of the Share Exchange, Trio became the wholly owned subsidiary of Allied and the Trio Shareholders became the controlling shareholders of Allied, owning an aggregate of 66.15% of the issued and outstanding shares of Common Stock. In connection with the Share Exchange, the Principal Shareholder submitted a resignation letter resigning from his positions as the sole director and officer of Allied, effective upon the closing of the Share Exchange, and the directors of Trio were appointed to the Board of Directors of Allied, and the officers of Trio were appointed as the officers of Allied.

The Share Exchange was accounted for as a reverse takeover/recapitalization effected by a share exchange, wherein Trio is considered the acquirer for accounting and financial reporting purposes. For more information about the acquisition of Trio, see “Item 1.01—Share Exchange” and “Item 2.01—Description of Business—Our Corporate History and Background” of this Report.

Allied filed a Certificate of Amendment of its Articles of Incorporation (the “Charter Amendment”) with the Secretary of State of Nevada to (1) change its name from Allied Technologies Group, Inc. to Trio Resources, Inc. (the “Name Change”) and (2) increase its total authorized shares of Common Stock, from 75,000,000 shares to 400,000,000 shares (the “Authorized Share Increase”). Additionally, as a condition to close the Share Exchange, our Board of Directors approved and authorized us to take the necessary steps to effect a forward stock split of the issued and outstanding shares of Common Stock, such that each issued and outstanding share of Common Stock shall be automatically changed and converted into one hundred (100) shares of Common Stock, effective as of December 31, 2012 with a record date of December 27, 2012 (the “Forward Stock Split”).

As a result of the Share Exchange, the Company is now a holding company operating through Trio, a Canadian junior exploration and milling company.

Pursuant to the Share Exchange, Allied is considered to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act). To the extent that we are deemed to be a shell company, and in accordance with the requirements of Item 2.01(f) of Form 8-K, this Report sets forth information that would be required if Allied was required to file a general form for registration of securities on Form 10 under the Exchange Act with respect to the Common Stock (which is the only class of Allied’s securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Share Exchange).

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, all of which are incorporated herein by reference.

| 3 |

This Current Report responds to the following items on Form 8-K:

Item 1.01 Entry into a Material Definitive Agreement

Item 2.01 Completion of Acquisition or Disposition of Assets

Item 3.02 Unregistered Sales of Equity Securities

Item 4.01 Changes in Registrant’s Certifying Accountant

Item 5.01 Changes in Control of Registrant

| Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers |

Item 5.03 Amendments to Articles Of Incorporation or Bylaws; Change in Fiscal Year.

Item 5.06 Change in Shell Company Status

Item 9.01 Financial Statements and Exhibits

| 4 |

TABLE OF CONTENTS

| ITEM | DESCRIPTION | PAGE |

| 1.01 | Entry into a Material Definitive Agreement | 6 |

| Acquisition of Trio and Related Transactions | 6 | |

| 2.01 | Completion of Acquisition or Disposition of Assets | 6 |

| Form 10 Disclosure | 6 | |

| Description of Business | 7 | |

| Risk Factors | 15 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 | |

| Description of Property | 29 | |

| Security Ownership of Certain Beneficial Owners and Management | 30 | |

| Directors and Executive Officers | 30 | |

| Executive Compensation | 33 | |

| Certain Relationships and Related Transactions, and Director Independence | 34 | |

| Legal Proceedings | 35 | |

| Market Price and Dividends on our Common Equity and Related Stockholder Matters | 35 | |

| Recent Sales of Unregistered Securities | 36 | |

| Description of Securities | 36 | |

| Indemnification of Directors and Officers | 38 | |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 39 | |

| Item 3.02 | Unregistered Sales of Equity Securities | 39 |

| Item 4.01 | Changes in Registrant’s Certifying Accountant | 40 |

| Item 5.01 | Changes in Control of Registrant | 41 |

| Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers | 41 |

| Item 5.03 | Amendments to Articles Of Incorporation or Bylaws; Change in Fiscal Year. | 41 |

| Item 5.06 | Change in Shell Company Status | 42 |

| Item 9.01 | Financial Statements and Exhibits | 42 |

| Signatures | 44 | |

| Audited Financial Statements for the period ended September 30, 2012 for TrioResources AG Inc. | F-1 |

| 5 |

Item 1.01 Entry into a Material Definitive Agreement.

Acquisition of Trio

On the Closing Date, Allied entered into a Share Exchange Agreement (the “Exchange Agreement”) with (i) Trio and (ii) the former shareholders of Trio (the “Trio Shareholders”), and (iii) Ihar Yaravenka, the former sole director, officer, and principal shareholder of Allied (the “Principal Shareholder”), pursuant to which Allied acquired all of the outstanding capital stock of Trio from the Trio Shareholders in exchange for the issuance of 2,130,000 shares of Common Stock to the Trio Shareholders (the “Share Exchange”). The shares issued to the Trio Shareholders in the Share Exchange constituted approximately 66.15% of our issued and outstanding shares of Common Stock as of and immediately after the consummation of the Share Exchange and cancellation of the 1,500,000 shares of Ihar Yaravenka, as contemplated in the Exchange Agreement.

In connection with the Share Exchange, the Principal Shareholder submitted a resignation letter resigning from his positions as the sole director and officer of Allied, effective upon the closing of the Share Exchange, and the directors of Trio were appointed to the Board of Directors of Allied, and the officers of Trio were appointed as the officers of Allied.

The foregoing description of the Exchange Agreement is qualified in its entirety by reference to the provisions of the Exchange Agreement filed as Exhibit 2.1 to this Report, which is incorporated by reference herein.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosure in Item 1.01 of this Report regarding the Share Exchange is incorporated herein by reference in its entirety.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Report, we acquired Trio on the Closing Date pursuant to the Share Exchange, which was accounted for as a recapitalization effected by a share exchange. Item 2.01(f) of Form 8-K provides that if the Company was a shell company, other than a business combination related shell company (as those terms are defined in Rule 12b-2 under the Exchange Act) immediately before the Share Exchange, then the Company must disclose the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Exchange Act reflecting all classes of the Company’s securities subject to the reporting requirements of Section 13 of the Exchange Act upon consummation of the Share Exchange.

To the extent that the Company might have been considered to be a shell company immediately before the Share Exchange, we are providing below the information that would be required to disclose on Form 10 under the Exchange Act if we were to file such form. Please note that the information provided below relates to the combined Company after the acquisition of Trio, except that information relating to periods prior to the date of the Share Exchange relate only to Trio unless otherwise specifically indicated.

| 6 |

DESCRIPTION OF BUSINESS

TrioResources AG Inc. (“Trio”) is a wholly-owned Canadian exploration and small-scale processing company which plans to focus on the exploration and milling of precious metals located in historically prolific regions. Trio is organized to hold assets in the mining industry, targeting older mining camps with residual value. Trio’s intention is to conduct an extensive exploration program, in conjunction with milling initiatives to monetize the existing above-ground mineralized material on-site, with the purpose of being cash-flow positive primarily through milling and marketing mineralized material and concentrate to refiners, as well as producing precious metals and other valuable minerals. Trio’s business plan is currently focused on monetizing existing assets and beginning exploration on its existing property. Specifically, Trio plans to monetize its existing above-ground assets by way of: (i) selling our bulk concentrate to refiners as-is (without requiring further processing on the part of the Company); (ii) further processing our concentrate via gravitational separation in order to yield a higher concentrate material which we would market (as ready for smelting) to a broader range of refiners than with option (i); and (iii) millings our additional mineralized material to be marketable via options (i) or (ii). To date, we have commenced marketing our bulk-concentrate material via option (i), through selling it to a refiner, as-is. Subject to financial and/or revenues generated through our processing, we plan to commence an exploration program in May 2013.

Corporate History & Background

Allied was founded in the State of Nevada on September 22, 2011. It was a Poland-based company formed with the intention of operating a consulting business in small boat building and maintenance, which would include consulting in boat building, boat repairs and maintenance, refurbishing, winterizing, custom refinishing and modifications, interior customization, appraisals and major renovations in Poland and later, assuming available funds, in Europe and North America. We were unable to secure adequate financing nor able to implement our business plan. Therefore, we decided to enter into the Share Exchange with TrioResources AG Inc. and change our business model.

On the Closing Date, Allied entered into the Exchange Agreement with Trio, the Trio Shareholders, and the Principal Shareholder, resulting in Trio becoming the wholly owned subsidiary of Allied and the Trio Shareholders became the controlling shareholders of Allied. In connection with the Share Exchange, our sole officer and director, Ihar Yaravenka, resigned from his positions and the directors of Trio became the Board of Directors of Allied, and the officers of Trio became the officers of Allied. Allied ceased any and all of its original operations in connection with small boat building and maintenance and became a holding company with Trio as its sole asset and

subsidiary.

Trio was founded on May 16, 2012 by Jeffrey Duncan Reid, the current chief executive officer and chairman of the board of directors of the Company. Since its inception, Trio completed a limited exploration initiative of its main property which consisted of a small drilling program of 5 AQ size drill holes. The deepest drill hole was 187 feet and the shallowest was 122 feet. The targeted area was determined based on historic magnetic resonance data acquired from the previous owner of the property. The various cores were assayed by independent third parties, and demonstrated a best result of 240 oz of silver per ton at a depth of 124 feet, based on an assay performed by Activation Laboratories Ltd., an independent specialist analytical firm whose laboratories involved are accredited for ISO/IEC17025:2005 (including and ISO 9001) by Standards Council of Canada, on September 5, 2012. We only assayed core samples which demonstrated mineralization, and had the assays performed by Activation Laboratories Ltd. In addition to this exploration initiative, and as described further below, in September, 2012, Trio commenced a small milling operation to process the above-ground mineralized material already on the property. Subject to financing, Trio plans to acquire additional historical mining properties which were previously known to be rich in mineralized material, and which have development potential.

On May 17, 2012, TrioResources AG Inc. entered into a Consultant Services Agreement with Seagel Investment Corp. for certain consulting services in connection with a public listing for TrioResources AG. The consulting services provided by Seagel Investment Corp. to Trio included assistance in the incorporation of Trio, investor relations with the investment community, assistance in identifying public relations and other consulting firms, assistance in corporate marketing, assistance in preparing press releases and other corporate communications and other services as may be required by Trio. As consideration for these consulting services TrioResources AG agreed to pay Seagel Investment Corp. a fee equal to $20,000 per month and common stock equal to 5% of the total number of shares outstanding after the closing of the ‘going public’ transaction. For the purposes of the Seagel Investment Corp. agreement ‘going public’ shall mean any method or transaction whereby the business of Trio becomes public by way of stock exchange listing of its common shares or reverse merger. A copy of the Consultant Services Agreement is attached hereto as Exhibit 10.2.

On May 17, 2012, Trio purchased its mining claims and equipment from 2023682 Ontario Inc. DBA Canamet Resources, an entity which is controlled by Mr. Reid.

| 7 |

Business Model and Milling Operations

Above-Ground Mineralized Materials

The Company is a development-stage junior exploration and small processing company and has not generated revenue or cash flow from its assets. The Company’s operations are subject to all risks inherent in the establishment of a new business enterprise. The Company cash flow has primarily been generated from the sale of equity securities.

The ability of the Company to begin processing its mineralized material is a point of difference from typical junior mining and exploration companies, who do not conduct processing on site. This classifies Trio as a small processor, and separates us from almost all other junior mining companies, who lack the capability to process on site.

Part of the assets that were acquired by Trio were several groups of mineralized material including 4,000 tons of concentrate, (“Concentrate”), 16,000 tons of crushed material (“Crushed Material A”), an additional 16,000 tons of crushed material (“Crushed Material B”), 16,000 tons of trench material (“Trench Material”), a 910,000 ton muck pile (“Muck Pile”), and a tailings pond (“Tailings Pond”) with 347,870 tons of material. All of these volumes of material are either management estimates or have been estimates acquired from previous owners (who are not geologists) of the material. The volumes have not been verified by a qualified geologist. The property that we have acquired is without known reserves, we currently undertake no mining operations and our proposed program is exploratory in nature. Trio intends to mill the existing above ground material on its property with the near-term objective of selling our mineralized material (the Concentrate), and future milled material to refiners to generate income and with the objective of becoming a cash flow positive business in the near future.

The various estimated volumes of the mineralized material are based on the following: 1) each time the 4,000 tons of Concentrate had been moved, it was weighed by Trio on a digital scale attached to the loader, in addition to which the material was weighed after processing prior to bagging, 2) the respective 16,000 tons of both Crushed Material A and Crushed Material B was weighed by the previous owner as part of the crushing process as the hopper had a scale, 3) the 16,000 tons of Trench Material was estimated by the previous owner of the property, 4) the 910,000 ton Muck Pile was estimated by the previous owners and was based on the physical measurements of the Muck Pile, numerous measurements of samples each of which was eight cubic feet and which was measured to be equal to 1 ton and then discounted 50% for an estimate of air in the Muck Pile, and 5) the Tailings Pond of 347, 870 tons is based on historic reports, “Cobalt Mining Camp Tailings Inventory, Cobalt, Ontario, 1993” acquired from a previous owner.

Each of the various bodies of above-ground mineralized material has been assayed to determine its composition as follows: 1) Concentrate contains an average of 40 oz of silver per ton and 2% cobalt by weight, “Activation Laboratories Ltd, June 19, 2012”, 2) Crushed Material A contains an average of 38 oz of silver per ton and 1% cobalt by weight, estimates provided by previous owners which represents the most current information, 3) Crushed Material B contains an average of 25 oz of silver per ton, estimates provided by previous owners which represents the most recent information, 4) Trench Material consists of an average of 25 oz. of silver per ton and 2% cobalt by weight, based on information from the previous owners which represents the most current information, 5) Muck Pile contains an average of 10 oz of silver per ton, estimates provided by previous owners which represents the most current information, and 6) the Tailings Pond has a historic estimate of 0.7oz per ton of silver, “ Cobalt Mining Camp Tailings Inventory, Cobalt, Ontario, 1993”, which represents the most recent data.

Insofar as we are an early stage company, we are still in the process of finalizing our QA/QC protocols and procedures. Currently, we collect grab samples of our product, which we then proceed to crush, and send off to Activation Laboratories, Ltd. for sampling. Many of our estimates rely of information and assays provided by the previous owner, some of which has not been back-tested against internal estimates and MRI data. Accordingly, the previous owner’s estimates may not have been verified and may be unreliable.

| 8 |

Mill and Milling Operations

In addition to the mineralized material, we acquired parts for a small milling operation which we have retrofitted and augmented to make operational. The mill was inaugurated in July 2012, and we aim to completed our inaugural shipment of material in early 2013. It is our intention to continue using this small mill to process the various groups of our mineralized material, until which time it becomes financially feasible to upgrade the milling facility. The Company currently estimates that the remaining capital cost required to achieve full capacity at the mill is $2,000,000.

Trio began processing its above-ground material in 2012, and hopes to continue to generate revenue from sales of milled material throughout 2013. Processing has been taking place at a capacity of 1 ton per day in the small milling facility, and is currently anticipated to reach a capacity of 300 tons per day by June 2013, upon completion of upgrading the facility. Trio is currently processing the 4,000 tons of Concentrate which management believes contains an average of 40 oz of silver per ton, based on recent assays conducted by Activation Laboratories Ltd. and historical assays provided by the property’s previous owner. Crushed Material A will be processed after Concentrate has been fully processed. The current plan is to process the mineralized material in sequential order starting from the highest concentration of silver. The milling of the mineralized material has commenced without the Company having completed or obtained a technical report or a feasibility study. Currently, the small milling facility consists of a small capacity ball mill and a gravitational separation table, which is utilized to separate the value metals and minerals from waste material. It is our intention to implement further crushing, screening, and separation equipment upon the upgrade of the milling facility. Based on management’s estimates of the value of the mineralized material that is currently above ground and available for processing, they believe that initiating processing operations is warranted. Having commenced its processing and milling, Trio has effectively become a small processor.

There are currently four employees at the property who have been involved in retrofitting the equipment and its housing facility in order to make both fit for operations, and who will be operating the mill. Shipments would be expected to be processed periodically, based on a minimum of one ton of milled or bulk-feed material having been accumulated. Once shipments and agreements with refiners have demonstrated consistency, the management of Trio believes that shipments would be made weekly. The Company is currently in negotiations with refiners who would be willing to purchase our concentrate material, as-is, or to refine and smelt our milled material upon our in-house processing. As of December 14, 2012, the Company has not completed any shipments of its materials to a refiner or off-taker.

Trio has plans to expand the processing capacity once it has secured additional capital, and has completed multiple shipments with at least one refiner. Trio is exploring the opportunity to run more than one shift per day to increase the revenue opportunities of the business. The costs associated with the construction of a larger mill are currently anticipated to be approximately $1,000,000 plus cost of installation, and will take approximately 4 months lead time. In addition, implementing the larger mill will require upgrading our electrical system from 200amps to 600amps, upgrading our piping systems, coordinating anchoring the mill to the bedrock underneath the main building, as well as additional minor retrofits and adjustments to accommodate the mill’s function needs. Accordingly, the cost of installation, including all associated engineering and permitting costs, are anticipated to be approximately $1,000,000. There can be no assurance that such cost estimates will prove to be accurate. Actual costs may vary from the estimates depending on a variety of factors, many of which are not within the Company’s control. The Company would require external funding for any such expansion. There can be no assurance that the Company will secure such financing on acceptable terms or at all.

The implementation of a larger mill would significantly increase both our output and efficiency, while only marginally increasing our relative operating expenses. The capacity of the larger mill will enable us to increase the frequency and size of shipments to refiners, thereby generating higher revenues. Our aim is that the positive revenues generated through our milling operations will enable us to fund our exploration program, and continue to pursue viable targets.

In addition to milling, and subject to financing, Trio plans to continue its business model of exploration on its existing property and, in the future, acquiring historic mining properties with the potential to be explored and developed and provide additional mineralized material for Trio to process at its mill. In this regard, subject to additional financing, we intend to conduct further exploration initiatives on the existing property in order to identify additional high-concentration regions that may be profitable to develop.

| 9 |

When the management of Trio wants geological results from any of its mineralized material, it takes several samples and sends them to an independent lab for analysis. For the cores from a drilling program Trio logs the details, including time of day, location, length of core, and takes one-half of each core and sends them to an independent lab for analysis. The one half of the core kept by Trio is stored in a secure room in the manufacturing plant located on the property. The cores are kept in core boxes clearly identified and stored on racks in numerical order. Trio is currently using Activation Laboratories Ltd. an independent company which provides qualified assay results. Where geological make-up of the various mineralized material is required, the sample is recorded in a log book including location of the sample, size of sample, and one-half of the sample is sent for assay. The half of the sample retained by Trio is stored in a secure location in the manufacturing building clearly identified for easy reference. Prior to shipping any product, the management of Trio assays each shipment as a check against the results provided by the refiner. These samples will also be recorded in a log book with all of the relevant details and stored as outlined above. These assays will also be sent to an independent lab. At the present time Trio does not employ any geologist and does not have the necessary equipment to perform its own analysis.

Mineralized Material Inventory and Tailings

Concentrate material has been assayed at an average of 40 oz of silver per ton and 2% cobalt by weight, based on recent assays by Activation Laboratories Ltd. and historical assays provided by the property’s previous owner. This material has been crushed down to a 100 mesh screen, and commenced processing this material across its gravitational separation tables in September 2012.

Crushed Material A has gone through primary crushing only, and has been assayed, based on historical data provided by the property’s previous owner (who are not geologists), at average of 38 oz of silver per ton and 2% cobalt by weight. This material may need to go through additional crushing and milling depending on the requirements of the refiner.

Trio has two additional assets , Crushed Material B and Trench Material each totalling 16,000 tons of abvoe-ground mineralized material, and each having an estimated 25 oz of silver per ton. These results were acquired from the previous owner. This material is available to supplement our cash flow while primary exploration continues via our drilling program. Moreover, we have a Muck Pile with 910,000 tons of mineralized material and a Tailings Pond with 347,870 tons of mineralized material. The Muck Pile has been assayed at an average of 10 oz of silver per ton based on results acquired from the previous owner, and the Tailings Pond has nominal silver content based on a report acquired from a previous owner. These mineralized materials will be processed behind the initial 20,000 tons comprised of Concentrate and Crushed Material A, which will enable us to continue generating revenue in order to pursue more expansive exploration and development programs, including exploring for more prolific and valuable targets.

On May 17, 2012, TrioResources AG Inc. entered into a Purchase Agreement with 2023682 Ontario Inc. DBA Canamet Resources and Jeffrey Duncan. Reid for the purchase of certain milling equipment and property to be investigated for mining. As consideration for the assets, TrioResources AG Inc. agreed to pay CDN $100,000 in cash and to issue the seller a convertible promissory note in the amount of CDN $500,000 that can be converted into common stock at the seller’s election and at a conversion price equal to the prior 5 day average bid price. A copy of the Purchase Agreement is attached hereto as Exhibit 10.1.

| 10 |

2012 Drilling Program (Operating Plan for the next 12 months)—Monetization of Existing Assets

In May of 2012, Trio purchased property in the Cobalt Mining Camp located in Northern Ontario, Canada, including two patented claims covering the property.

At the present time the Company does not have the financial resources to begin an exploration program. Subject to financing, a work program is scheduled to commence in May, 2013. Trio intends to complete a digital GIS compilation of the Duncan Kerr Property. This will help to identify targets that will be further evaluated by a work program consisting of a combination of geological mapping, prospecting, mechanized trenching, and approximately 3,500m of diamond drilling.

Trio has planned a 3,500 meter drill campaign on the most prospective zones as indicated by preliminary geological and magnetic resonance data acquired from the previous owner(s). In the summer of 2012, Trio drilled 5 holes over shallow depths, ranging from 122 feet to 187 feet, based on targets identified from the magnetic and geologic data. The results of the assays were positive, and management will continue the drilling program in the spring and summer of 2013. The intent is to gather sufficient drilling results that will allow for the creation of a “final” or “bankable” feasibility study (as defined under the SEC’s Industry Guide 7 (“Guide 7”)) or a technical report under Canada’s National Instrument 43-101(“ NI 43-101”) which would identify the reserves on the property. In addition to the above, in the summer of 2012 Trio initiated a bulk sample project in a target zone based on historic geological and magnetic resonance data, which has resulted in approximately 16,000 tons of Trench Material with an average content of 25 oz per ton of silver. The volume of material and the estimate of silver content was provided by the third party engineering company that performed the drilling and blasting operation. For the fiscal year which ended September 30, 2012 Trio has expensed $165,811 on exploration and development activities and for the quarter ending December 31,2012 Trio has expensed $66,217 on exploration and development.

In the spring/summer of 2012, Trio completed a limited exploration initiative of its main property which consisted of a small drilling program of five (5) AQ size drill holes. The deepest drill hole was 187 feet and the shallowest was 122 feet. The targeted area was determined based on historic magnetic resonance data acquired from the previous owner of the property. We believe that magnetic resonance data is a useful tool for these sampling and estimation purposes. All drill cores from the exploration initiative were logged, split and stored by Company employees (who are not geologists) in a secure facility on-site at the Company’s property. The drill core was washed and logged prior to sampling. Core logging and sampling was carried out by Company employees, who are not geologists. One-half of selected samples were sent to a laboratory, Activation Laboratories Ltd., an independent specialist analytical firm whose laboratories involved are accredited for ISO/IEC17025:2005 (including and ISO 9001) by Standards Council of Canada. The samples were not verified by a secondary laboratory. The various cores assayed yielded up to a best result of 240 oz of silver per ton at a depth of 124 feet, based on an assay performed by Activation Laboratories Ltd. on September 5, 2012. Management is reviewing the results to determine its next steps. There are currently no known reserves on the Company’s Property.

In August of 2012, Trio produced drill results including a hole (DK4) that struck 3 meters of silver grading 240 oz of silver per ton based on an assay of the drill cores. Management is using current technological methods of geological assessment and drilling techniques which were not available when the properties in the Cobalt district were first mined in 1904. Many of the properties in the Cobalt area have not been active since the mid-1980’s.

The Duncan-Kerr Project

As part of the assets included in the Purchase Agreement, Trio acquired 94 acres of land, including two contiguous mining claims, located approximately 3 kilometers from the town of Cobalt, Ontario. The Company’s two contiguous mining patents provide mineral rights which cover the 94 acre area (38 hectares). As patented claims, the mining patents convey surface and mineral exploitation rights of our property indefinitely. This location is surrounded by existing infrastructure (i.e., railway spurs, hydro lines, roadways, close access to water, etc.) which will help to address some of the challenges that are common to new exploration, milling and small processing companies. The property where the Duncan Kerr Project is located, has previously produced positive drill results, including 240 oz of silver per ton at a depth of 124 feet, over a 150 meter drilled target. The property has been visited and physically examined by an independent professional geologist. The purpose of the visit by the professional geologist was to perform a review of the property as part of due diligence for potential investors. The geologist reviewed management information as it related to the various mineralized materials on-site, and performed an independent assay of the concentrate. This assessment was not, and was not intended to be, a “final” or “bankable” feasibililty study, and the results of the assessment were not furnished to the Company. A detailed assessment of the property was not performed during this visit as it was not feasible during the winter months.

Competition

Trio’s business model is based upon acquiring historically prolific properties (See “Properties” section below) which have only recently become economically viable to develop due to increases in commodity prices. Having acquired this property, we identify our targets through utilizing updated technologies including geological and magnetic reasonance to identify potential sites for drilling. If the results indicate an economically viable target, further steps would be explored to extract the mineralized material and make it available for processing in Trio’s mill. We are currently assessing next steps with respect to exploration of the property and the limited sample results collected in 2012. There are currently no known reserves on the property and our activities are exploratory in nature.

The mining industry is highly competitive in all its phases. The Company competes with a number of Canadian and foreign companies which are more mature or in later stages of production. These companies may possess substantially greater financial resources, more significant investments in capital equipment and mining infrastructure for the ongoing development, exploration and acquisition of mineral interests, as well as for the recruitment and retention of qualified employees and mining contractors. There can be no assurance that our acquisition, exploration and development efforts will succeed in the future.

In addition, given that Trio is a small processor with an existing ability to process its own mineralized material, Trio also competes against small processors with mineral resource properties, such as Barigus Gold Corp. This company has mineral resource properties, as defined by Canada’s NI 43-101, in Ontario and Saskatchewan, and it has its own milling operation.

| 11 |

Properties

As outlined in the Purchase Agreement, Trio owns the Duncan Kerr Property (the “Property), and has full rights and claims to the Property, which is comprised of the following parcels of land (and all structures and equipment on or associated with such parcels):

Property Parcel 1:

PT E. 1/2 OF N 1/2, LOT 3, CON 4, Coleman Township, District of Temiskaming, Ontario, Canada.

Patented Claim #1831NND

Property Parcel 2:

SW 1/4 OF N 1/2, LOT 3, CON 4, Coleman Township, District of Temiskaming, Ontario, Canada.

Patented Claim #3694NND

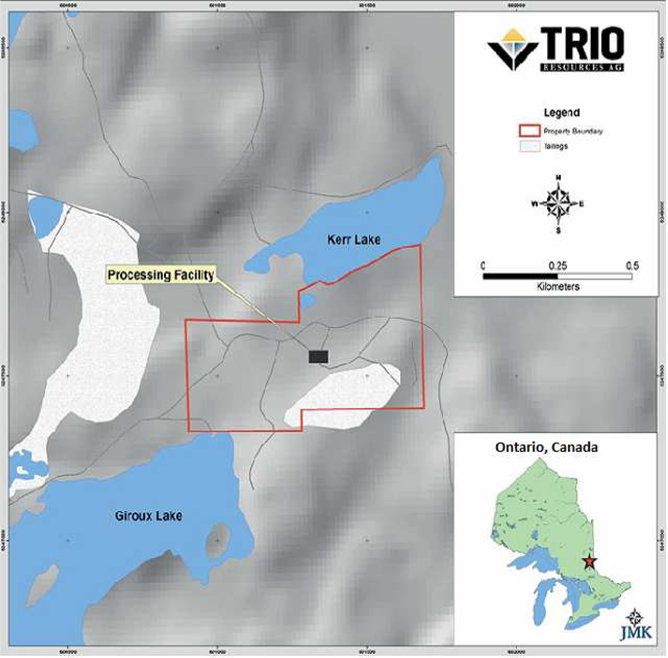

The following is a map showing the location of Trio’s property, which was drawn on January 23, 2013

| 12 |

The Property is located approximately 3 km southeast of the town of Cobalt, Ontario in Coleman Township. A well maintained municipal road and power line service the Property. The Property is bounded by UTM NAD83 Z17T coordinates 365720E to 381170E and 5081510N to 5095375N. The Property consists of 2 contiguous mining patents totaling 38 ha (94 acres) in area. Trio holds both the surface and mineral rights to both of these claims.

The Duncan Kerr Property is located within the Cobalt Embayment in the Southern Province of the Canadian Shield. The oldest rocks on the Property are Archean mafic volcanics that have been intruded by several lamprophyre dykes. These rocks have been unconformably overlain by Proterozoic age Huronian sediments. A large south-southeast dipping Nipissing diabase sill intrudes the Archean mafic volcanics and Huronian sediments. This sill is part of a domed Nipissing diabase sheet that is also exposed to the north of the property and dips towards the north. Most of the silver deposits in the Cobalt Camp (>450Moz Ag) are located proximal to the Huronian-Archean unconformity and are spatially associated with the Nipissing diabase sills. Most of the historical production has been within 200m of the contacts of the diabase, making the geology on the Duncan Kerr Property a favorable setting for silver mineralization. This is supported by the historical production on the Property by the Kerr Lake and Lawson Mines that have combined produced estimates >30,000,000 oz of silver (Ag). (“Sabina, Ann P., 2000. Rocks and Minerals for the Collector: Cobalt-Belleterre-Timmins, Ontario and Quebec, GSC. Miscellaneous Report 57, 266 p.”; “Ontario Dept. of Mines, 1968, MRC No.10, Silver Cobalt Calcite Vein Deposits of Ontario, by A.O.Sergiades”, “http://www.mindat.org/article.php/1398/Exploring+Cobalt+The+Historic+Silver+Capital+of+Canada”)

| 13 |

In 2012, Trio had completed five (5) diamond drill holes to depths up to 187 feet. Also, several trenches, totalling 200m2 in area, were completed using an excavator. Further, one trench was also blasted to expose mineralization that was outcropping at surface. All of the exploration work completed by Trio was exploratory in nature. At present, no known reserves are present on the Property.

The properties that we acquired have been previously mined intermittently from 1904 to the mid-1980’s. The last company to mine the property was Agnico Eagle Ltd. There remain open cuts on the property, which have been fenced, and there remain both the Muck Pile Tailings Pond which are also a result of the previous mining activity on the property. Agnico Eagle Ltd. has filed a Mine Closure Plan with the Province of Ontario. If Trio proceeds with mining activity it will be responsible for filing an updated Mine Closure Plan and for the costs associated with such Closure Plan, which may be significant. Trio’s plans for remediation of the site would coincide with the initiation of mining operations on our property. The remediation would is currently anticipated to include ensuring all access to open cuts is disabled through being fenced off; rehabilitating the Tailings Pond, which will include lining the bed of the pond with permanent non-penetrable material; as well as replacing existing piping to allow excess water to safely move to the polishing ponds. Trio is committed to ensuring that it complies with all regulations, and will work with the Ministry of Northern Development and Mines to ensure compliance in our remediation efforts. There is currently no plan to mine our property and not work, budgets or cost estimates have been prepared with respect to any remediation requirements.

Intellectual Property

Since its inception, Trio has retained ownership of all its intellectual property. This includes, but is not limited to, all geological and magnetic resonance data acquired from the predecessor companies, the application and interpretation of all findings , the drilling techniques used in our drilling initiatives, as well as the content in all marketing collateral, both print and electronic. We do not have nor have applied for any patents or trademarks in any jurisdictions.

Government Regulation

Our operations are subject to various types of Canadian and Ontario regulations. Such regulation includes: (i) requiring permits for drilling; (ii) implementing environmental impact practices; (iii) submitting notification and receiving permits relating to the presence, use and release of certain materials incidental to exploration and processing operations; and (iv) regulating the location of exploration, the method of exploration, the use, transportation, storage and disposal of fluids and materials used in connection with exploration and processing activities, surface usage and the restoration of properties upon which exploration and processing occur and the transporting of processed material.

Our operations are also subject to various conservation matters, including the regulation of the location, size and production rate mining interests. The effect of these regulations may limit the rate at which natural resources may be extracted from certain properties and the areas which we may access at one time.

Operations on properties in which we have or may acquire an interest are subject to extensive Canadian and Ontario environmental laws that regulate the discharge or disposal of materials or substances into the environment, restoration of properties and otherwise are intended to protect the environment. Numerous governmental agencies issue rules and regulations to implement and enforce such laws, which are often difficult and costly to comply with and which carry substantial administrative, civil and criminal penalties and in some cases injunctive relief for failure to comply.

Some laws, rules and regulations relating to the protection of the environment may, in certain circumstances, impose “strict liability” for environmental contamination. These laws render a person or company liable for environmental and natural resource damages, cleanup costs and restoration costs. Other laws, rules and regulations may require the rate of precious metal production to be below the economically optimal rate or may even prohibit exploration or production activities in environmentally sensitive areas. In addition, provincial and state laws often require some form of remedial action, such as closure of inactive pits and restorative measures.

The current regulations that have a direct impact on the operations of Trio are the MMER (“Metal Mining Effluent Regulations”) and EPA Ontario Regulation 560/94 (“Effluent Monitoring and Effluent Limits–Metal Mining Sector”). The application of these regulations are triggered by mines that (a) exceed an effluent flow rate of 50 m3 per day, based on effluent deposited from all final discharge points of the mine; and (b) deposit a deleterious substance in any water or place referred to in the respective Act. At the present time due to the low level of production at the mill, Trio is well below 50 m3 per day and is therefore below the reporting threshold required under these Regulations. As Trio increases its production capacity in the future, it will incur additional costs associated with ensuring compliance with these regulations. The management of Trio is currently researching and evaluating the cost of compliance associated with various regulations. It is expected that the cost of annual compliance, once required, will be in excess of $100,000 per quarter.

| 14 |

In addition, we are subject to Nevada corporate law as Allied, our parent company, is organized in the state of Nevada, as well as U.S. federal securities laws. We are also subject to both U.S. and Canadian tax laws.

Employees

As of December 14, 2012, we have 4 full-time employees at the mine/mill site, in addition to three full-time executive officers. Additionally, we have two consultants. None of these employees are covered by a collective bargaining agreement. We also engage consultants on an as-needed basis to supplement existing staff. The CEO Mr. Jeffrey Duncan Reid is certified as an above ground miner, is certified to operate various earth moving equipment used on the site, and has been managing an exploration company for over 10 years; our plant manager/foreman is a certified underground and above ground miner, and is certified on all of the equipment owned by Trio, and is a certified trainer on the equipment Trio uses; and we have one employee who is a qualified exploration driller, is certified for above ground mining, and is certified on the equipment we use. Both the CEO and the CFO have public company board experience. Notwithstanding the certification of certain employees, Trio does not currently employ a professional geologist or a mining engineer; rather, we engage qualified third parties to provide their services, when required.

The CEO regularly visits the property in Cobalt and spends an average of between 2-10 days per visit depending on the purpose of the visit.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Reports filed with the SEC pursuant to the Exchange Act, including annual and quarterly reports, and other reports we file, can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Investors may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. Investors can request copies of these documents upon payment of a duplicating fee by writing to the SEC. The reports we file with the SEC are also available on the SEC’s website (http://www.sec.gov). In addition, all of our periodic reports filed with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, through our website, www.trioresources.com, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports. These reports and amendments are available through our website as soon as reasonably practicable after we electronically file or furnish such material to the SEC.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline and you may lose all or part of your investment. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report.

Risks Related to Our Business

Our properties contain no known reserves and we have not obtained a pre-feasibility study, feasibility study or other technical report. There can be no assurance that our properties contain any reserves or that we will ever commence mining operations, in which case our business, prospects and financial condition could be materially adversely affected.

We operate as an exploration and small-scale processing company in the province of Ontario, Canada. The properties that we have acquired are without known reserves. We currently undertake no mining operations and our proposed program is exploratory in nature. We have not obtained a “final” or “bankable” feasibility study or other technical report in respect of our properties. In this respect, we are not basing our production decisions on a pre-feasibility or feasibility study of mineral reserves which demonstrates our economic and technical viability. Moreover, there is a great amount of uncertainty as to the economic feasibility and viability of the estimated mineralized materials on our properties. Accordingly, there is increased uncertainty with regard to the specific economic and technical risks of failure associated with our production decisions. There can be no assurance that our properties contain any reserves, that we will ever commence mining operations, or that the mineralized materials on our property will be economically viable, in which case our business, prospects and financial condition could be materially adversely affected. The SEC does not permit companies in their filings with the SEC to disclose estimates other than mineral reserves. See the discussion above under the heading “Cautionary Note to U.S. Investors Concerning Estimates”.

| 15 |

We have limited operating history and there can be no assurance that we will be successful in our business plan and exploration.

We are a small processor and exploration company with limited operating history in the mineral exploration field. This factor makes it impossible to reliably predict future growth and operating results. Accordingly, we are subject to all the risks and uncertainties which are characteristic of a relatively new business enterprise, including the substantial problems, expenses and other difficulties typically encountered in the course of its business, in addition to normal business risks. We were organized in 2012, have not earned any revenues as of December 14, 2012 and have had only losses since our inception related to our drilling, milling, and exploration operations. We face a high risk of business failure because we have commenced extremely limited business operations and as of December 14, 2012 have no revenues and no contracts with refiners or other off-takers. Moreover, we commenced our milling operations and without a feasibility study or other technical report in respect of our properties, and in this respect, our production decisions are not based on a study or report which demonstrates our economic and technical viability. There is no history upon which to base any assumption as to the likelihood that our business will be successful, and there can be no assurance that we will be able to raise sufficient capital to continue operations, that we will generate significant operating revenues in the future or that we will ever be able to achieve profitable operations in the future. We face all of the risks commonly encountered by other businesses that lack an established operating history, including, but not limited to, the need for additional capital and personnel, and competition.

Our operations depend on our acquisition of certain equipment which has yet to be finalized.

In order to ramp-up to full capacity at our mill, we will require additional products, equipment and materials, and will continue to require such assets in the course of our operations. Our working capital is currently limited, and there can be no assurance that we will obtain sufficient financing or cash flow from operations to acquire such assets. In addition, competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies and certain equipment, such as bulldozers, excavators and parts for the milling operation that we might need to conduct our operations. If we are unable to obtain the products, equipment and materials we need, we will have to suspend or limit our operations, which may adversely affect our business, prospects, operations, results of operations and financial condition.

Failure to generate sufficient cash flow from operations to fund our capital expenditure plans may result in a delay or indefinite postponement of exploration, development or production at our properties.

We require cash flow from operations or external financing to continue our operations and our exploration plans. The availability of financing capital is subject to general economic conditions and investor interest in the Company and its plans. The construction of an expanded mill, as well as continued exploration and, if viable, mining facilities, will require substantial capital expenditures. In addition, a portion of the Company’s future plans is directed to the search for, and the development of, new mineral deposits. The Company may be required to seek additional financing to maintain its expenditures at planned levels. The Company will also have additional capital requirements to the extent that it decides to expand its present milling operations and continue its exploration activities, and/or take advantage of other business opportunities that may arise. Financing may not be available when needed or, if available, may not be available on terms acceptable to the Company. Failure to obtain any financing necessary for the Company’s capital expenditure plans may result in a delay or indefinite postponement of exploration, development or production by the Company.

Our potential earnings are directly related to the market prices for various minerals.

Revenues from future sales, if any, of our mineralized materials and concentrates will depend on the market prices for various commodities, including silver, cobalt, and other materials which we may discover in our assets. The markets for each of these materials is highly volatile and is subject to various factors including political stability, general economic conditions and levels of demand, speculative trading, production costs in various producing regions and worldwide production levels. The aggregate effect of these factors is impossible to predict with accuracy. Fluctuations in the prices of these materials may materially adversely affect the Company’s prospects, financial condition and results of operations, and our development plans may be rendered uneconomic, delayed or suspended.

| 16 |

We currently have a single property. We will be required to replace materials depleted by production to maintain production levels over the long term.

We currently have a single property. We will be required to replace materials depleted by production to maintain production levels over the long term. Our exploration plans and future property acquisition plans are intended to address this replacement. Exploration is highly speculative in nature. Our exploration plans involve many risks and may be unsuccessful. Even if a site with mineralization is discovered and acquired, it may take several years, and substantial expenditures, from the initial phases of drilling until production is possible, during which time the economic feasibility of production may change. As a result, there is no assurance that current or future exploration programs will be successful. There is a risk that depletion of materials will not be offset by discoveries or acquisitions.

Exploration is highly speculative and risky and there can be no certainty of our successful development of profitable commercial mining operations.

The exploration and development of mineral properties involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. Exploration is highly speculative and often unsuccessful. Substantial expenditures are required to develop mineral reserves, develop metallurgical processes, and construct mining and processing facilities at a particular site. There can be no assurance that our current or future exploration will be successful or profitable. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; metals prices which are highly cyclical; drilling and other related costs that appear to be rising; and government regulations, including those related to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may have a material adverse effect on our business, prospects and financial condition.

We have relied and will continue to rely on independent analysis to evaluate our mineral claims and carry out our planned exploration activities.

We do not currently employ any geologists or engineers. We have relied and will continue to rely on independent geologists to engage in field work on our claim, to analyze our prospects, plan and carry out our exploration program, including an exploratory drilling program, and to prepare resource reports. While these geologists rely on standards established by various licensing bodies, there can be no assurance that their estimates or results will be accurate. Analyzing drilling results and estimating reserves or targeted drilling sites is not a certainty. Miscalculations and unanticipated drilling results may cause the geologists to alter their estimates. If this should happen, we may have devoted resources to areas where resources could have been better allocated, and as a result, our business could suffer.

It should further be stated that we are not basing our production decision on a pre-feasibility or feasibility study of mineral reserves, which demonstrate our economic and technical viability. Accordingly, there is increased uncertainty with regard to specific economic and technical risks of failure associated with our properties and production decisions.

Our auditors have expressed a going concern opinion.

We have no established source of revenues as of December 31, 2012, have incurred losses since inception, have a working capital deficit and are in need of capital to grow our operations so that we can become profitable. Accordingly, the opinion of our auditors for the period ended September 30, 2012 is qualified and subject to uncertainty as to whether we will be able to continue as a going concern. This may negatively impact our ability to obtain additional funding that we may require or to do so on terms attractive to us and may negatively impact the market price of our stock.

| 17 |

A part of our proposed business plan involves the acquisition of additional mineral claims, for which we do not currently have the resources.

We currently do not have resources to fund acquisitions of additional mineral claims. We will need to monetize our existing claims or obtain additional financing to, among other things, fund any future exploration, mining and drilling projects that we attempt to undertake and for general working capital purposes. Any additional equity financing may be dilutive to our shareholders and any such additional equity securities may have rights, preferences or privileges that are senior to those of the common stock. Debt financing, if available, will require payment of interest and may involve restrictive covenants that could impose limitations on our operating flexibility. We cannot assure you that additional funds will be available when and if needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. Our ability to obtain needed financing may be impaired by such factors as the condition of the capital markets, our capital structure, the lack of a market for our shares of common stock, and our lack of revenues and profitability, all of which could impact the availability or cost of future financings. If we are unable to raise capital or sufficient capital to meet our needs on acceptable terms or at all, we could forfeit our mineral property interests and/or reduce or terminate operations. In addition, and as is also disclosed in our financial statements, these matters raise substantial doubt about our ability to continue as a going concern.

Because our business involves numerous operating hazards, we may be subject to claims of a significant size, which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations.

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs, which would adversely affect our business. In addition, milling operations are subject to various hazards, including, without limitation, equipment failure and failure of retaining dams around tailings disposal areas, which may result in environmental pollution and legal liability.

Damage to the environment could also result from our operations. If our business is involved in one or more of these hazards, we may be subject to claims of a significant size that could force us to cease our operations.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to health and safety. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences; (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities; (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas; (iv) require remedial measures to mitigate pollution from former operations; and (v) impose substantial liabilities for pollution resulting from our proposed operations.

The exploration and development of mineral reserves are subject to all of the usual hazards and risks associated with such activities, which could result in damage to life or property, environmental damage, and possible legal liability for any or all damages. Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and there is no assurance that we will obtain such insurance in the future. There are also risks against which we may be unable, or may elect not to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our financial position, future earnings, and/or competitive position.

| 18 |

We may not be able to compete with current and potential mining exploration and development companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. Our business plan includes plans to acquire additional mineral claims in the future after we have raised sufficient additional financing and/or generated capital by monetizing our current interests and assets. However, we may be unable to obtain additional financing or monetize our current interests and assets, and, even if we are able to do so, we may be unable to compete successfully with our existing competitors or with any new competitors in acquiring additional assets. We will be competing with many exploration and development companies that have significantly greater personnel, financial, managerial and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

We are heavily dependent on our management and a loss of any member of our management, particularly J. Duncan Reid, our chief executive officer and chairman of the board, would be severely detrimental to our prospects.

We have a very limited management and number of employees. We are highly dependent on all members of our management, in particular Jeffrey Duncan Reid, our chief executive officer and chairman of the board of directors. Our future performance will be substantially dependent on the continued services of our management and the ability to retain and motivate them. The loss of the services of any of our officers or directors, particularly those of Mr. Reid, would materially and adversely affect our business and operations. If he were to resign, there can be no assurance that we could replace him with qualified individuals in a timely or economic manner, if at all. At the present time, we do not maintain any “key-man” life insurance policies. Our inability to attract and retain capable leaders and key management and professional personnel could have a material adverse effect on our business, financial condition and/or results of operations.

Defective title to our assets could have a material adverse effect on our exploration and exploitation activities.

There are uncertainties as to title matters in the mining industry. We believe we have good title to our assets; however, any defects in such titles that cause us to lose our rights in these mineral properties would seriously jeopardize our planned business operations. We have investigated our rights to explore, exploit and develop our assets in manners consistent with industry practice and, to the best of our knowledge, those rights are in good standing. However, we cannot guarantee that the title to or our rights to explore, exploit and develop our assets will not be challenged by third parties or governmental agencies. In addition, there can be no assurance that our assets are not subject to prior unregistered agreements, transfers or claims. Our title may be affected by undetected defects. A successful challenge to our title to our properties could result in our being unable to operate on our property as anticipated or being unable to enforce our rights with respect to our property which could have a material adverse effect on the Company.

| 19 |

At the present time we are unable to pay any dividends.

We have not paid any cash dividends and do not anticipate paying any cash dividends on our common stock in the foreseeable future. We anticipate that earnings, if any, which may be generated from operations will be used to finance our continued operations. Investors who anticipate the immediate need of cash dividends from their investment should refrain from purchasing any of our securities.

Risks Related to our Industry

The exploration and mining industry is highly competitive.

Competition in the mining industry is extremely intense in all aspects, including but not limited to raising investment capital for exploration and obtaining qualified managerial and technical employees. We are an insignificant participant in the mining industry due to our limited financial and personnel resources. Our competition includes large established mining companies, with substantial capabilities and with greater financial and technical resources than we have, as well as the myriad of other exploration stage companies. As a result of this competition, we may be unable to attract the necessary funding or qualified personnel. If we are unable to successfully compete for funding or for qualified personnel, our activities may be slowed, suspended or terminated, any of which would have a material adverse effect on our ability to continue operations.

The prices of natural resources are highly volatile and a decrease in metal prices can have a material adverse effect on our business.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals market from the time exploration for a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a minerals property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metal prices have decreased. Adverse fluctuations of metals market prices may force us to curtail or cease our business operations.

The speculative price of natural resources may adversely impact commercialization efforts.