Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraft Foods Group, Inc. | d488553d8k.htm |

The New Kraft

Foods Group CAGNY Conference

February 19, 2013

Exhibit 99.1 |

Chris

Jakubik Vice President, Investor Relations |

3

Kraft Foods Group, Inc.

Forward-Looking Statements

This presentation contains a number of forward-looking statements. The words

“plan,” “drive,” “make,” “expect,” “will,”

“deliver,” “taking,” “moving,” “executing” and similar

expressions are intended to identify the forward-looking statements. Examples

of forward-looking statements include, but are not limited to, statements regarding Kraft’s growth, progress, cash and

cash management, mission and plans including its integrated and business planning and sales

incentive program, productivity, overheads, innovation, marketing and advertising,

post-employment benefit strategy, pension contributions and funding, dividends,

Restructuring Program costs, EPS and free cash flow. These forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, many of which are beyond Kraft’s

control, and important factors that could cause actual results to differ materially

from those indicated in the forward-looking statements include, but are not limited to,

increased competition; continued consumer weakness and weakness in economic conditions;

Kraft’s ability to differentiate its products from retailer and economy brands;

Kraft’s ability to maintain its reputation and brand image; continued volatility and

increases in commodity and other input costs; pricing actions; increased costs of sales;

regulatory or legal changes, restrictions or actions; unanticipated expenses and

business disruptions; product recalls and product liability claims; unexpected safety or

manufacturing issues; Kraft’s indebtedness and its ability to pay its indebtedness;

Kraft’s inability to protect its intellectual property rights; tax law changes;

Kraft’s ability to achieve the benefits it expects to achieve from the spin-off and to do so in a

timely and cost-effective manner; and its lack of operating history as an independent,

publicly traded company. For additional information on these and other factors

that could affect Kraft’s forward-looking statements, see Kraft’s risk factors, as they may

be amended from time to time, set forth in its filings with the SEC, including its

Registration Statement on Form 10. Kraft disclaims and does not undertake any

obligation to update or revise any forward-looking statement in this presentation, except

as required by applicable law or regulation. |

4

Kraft Foods Group, Inc.

The New Kraft Foods Group

•

Our Plan

•

Driving Profitable Growth Through Innovation

•

Making Cash King

•

Q&A |

Tony Vernon

Chief Executive Officer |

This is Kraft

Foods Group |

7

Kraft Foods Group, Inc.

We Have The Best Sandbox in Our Industry

•

$18 billion annual food and beverage sales, and growing

–

Focused on the most profitable market in the world

–

Household penetration 98% in U.S., 99% in Canada

•

The best portfolio of food and beverage brands

–

9 brands >$500MM = 70% of 2012 net revenue

–

29 brands >$100MM = 90% of 2012 net revenue

–

Average 2x the share of the nearest branded competitor

•

Tremendous opportunity to make each brand and franchise

more contemporary and the

lowest cost producer

Source: Kraft Foods Group, Nielsen |

8

Kraft Foods Group, Inc.

Our Mission

Superior

Dividend

Payout

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Make Kraft North American

Food & Beverage Company

Best Investment in the Industry |

9

Kraft Foods Group, Inc.

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Our Plan |

10

Kraft Foods Group, Inc.

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Making Progress

•

Actively recruiting top talent

•

Populating Kraft University curriculum

•

20/70/10 performance management in place for 2013

•

Expanding stock ownership across employee base

•

Early retirement program just announced |

11

Kraft Foods Group, Inc.

Making Progress

•

Rolling out Integrated Business Planning

–

Focusing Business Units, Sales, Supply Chain on ONE number

–

Piloted in U.S. Cheese in May 2012

–

Executing staged rollout to rest of business units this year

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Keys

to Success

Product

Management

Demand

Management

Supply

Management

©

Oliver Wight |

12

Kraft Foods Group, Inc.

Making Progress

•

Rolling out Integrated Business Planning

•

Changing sales incentive program

•

Increasing focus on cash KPI’s

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge |

13

Kraft Foods Group, Inc.

Making Progress

•

Driving industry-leading productivity

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Net Productivity as a % of COGS |

14

Kraft Foods Group, Inc.

Making Progress

Driving industry-leading productivity

Redefining lowest-cost overheads

North America

Overhead as a % of Net Revenue

12.3%

8.7%

~8%

2010 Kraft Foods

2012 Kraft Foods Group

Best-in-Class |

15

Kraft Foods Group, Inc.

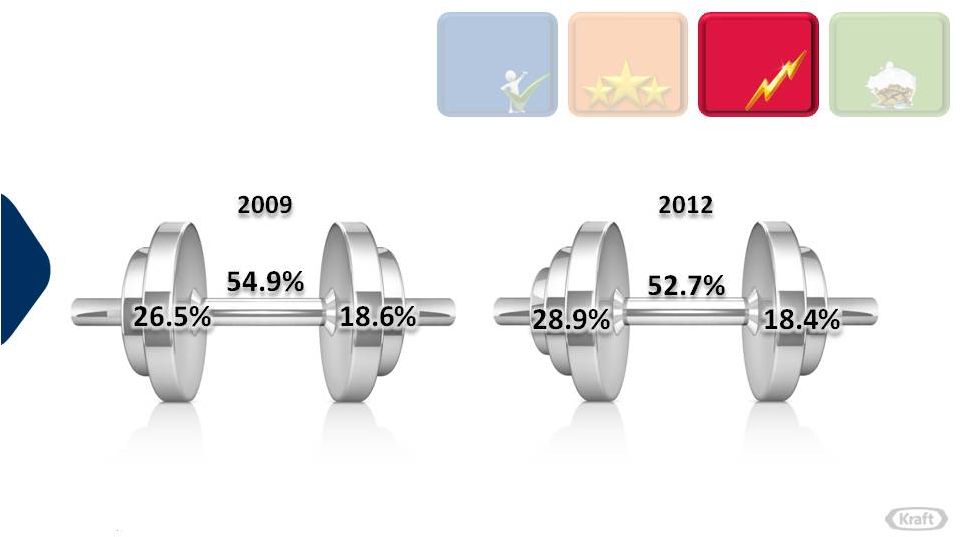

Making Progress

•

Never a greater need to contemporize and innovate

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Low

Income

Middle

Income

High

Income

Low

Income

Middle

Income

High

Income

Source: Kraft Foods Group, Nielsen Homescan Panel, 2009 & 2012

|

16

Kraft Foods Group, Inc.

Making Progress

•

Never a greater need to contemporize and innovate

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Consumer

Customer

Competition

•

Gravitating to value and

premium; the middle is

being squeezed

•

Prefer healthier

offerings

•

At home cooking and

bolder flavors growing

•

Latina and Boomers are

fastest growing segments

•

Traditional grocers hurt by

retailers targeting ends of

bar-belled consumer base

•

Looking to us to drive

category growth,

innovation, product

differentiation

•

Encouraging competition to

enter our categories

•

Several years of Retailer

Brand share increases due

to value differentiation and

quality improvements

•

Branded competition

aggressively entering our

higher-margin categories |

17

Kraft Foods Group, Inc.

Making Progress

Never a greater need to contemporize and innovate

Increasing share of voice behind world-class marketing

–

Advertising to net revenue 3.5% in 2012 vs 2.9% in 2011

Driving gains through bigger, better innovation

http://www.youtube.com/watch?v=hJvX_m0Xqls |

Barry

Calpino Vice President, Breakthrough Innovation

18 |

19

Kraft Foods Group, Inc.

Innovation at Kraft: The End in Mind

Consistent, sustained, best-in-class innovation—

year after year after year

A

source

of

true

competitive

advantage

and

differentiation

versus competition and industry peers

That

helps

deliver

consistent,

sustainable,

profitable

growth |

20

Kraft Foods Group, Inc. |

21

Kraft Foods Group, Inc.

We Were “Worst”

•

With customers

•

Versus competition

•

With analysts

•

Industry reputation

•

Every study, by any measure |

22

Kraft Foods Group, Inc.

2008 CPG Ranking –

Bottom Tier

Nestle

Hershey

General Mills

Unilever

Peer Average

Pepsi

Kraft

Heinz

Kellogg’s

ConAgra

Sara Lee

Campbell’s

Danone

Kraft Top 25

2008 3-Outlet Consumption Index From New Products

Source: ACN FDM 52 w.e. 12/27/08; All Food & Beverage categories. Excludes up or

down-sized items; includes new items over past two years 57

66

70

80

84

91

91

100

100

100

118

126

139

147 |

23

Kraft Foods Group, Inc.

17 of 19 Kraft New Product Launches in 2008

Were Considered Failures |

2009 CPG Ranking

– Bottom Tier Again

2009* 3-Outlet Consumption Index From New Products

Nestle

Hershey

General Mills

Unilever

Peer Average

Pepsi

Kraft

Heinz

Kellogg’s

ConAgra

Sara Lee

Campbell’s

Danone

Kraft Top 25

Source: ACN FDM 52 w.e. 12/26/09; All Food & Beverage categories. Excludes up or

down-sized items; includes new items over past two years 24

Kraft Foods Group, Inc.

64

66

66

69

75

82

88

98

100

105

108

128

134

184 |

Bad Habits Made

Us “Worst” Small

ideas

Poor execution

with customers—not leveraging our

incredible Sales advantage

Lack

of

focus,

rigor,

prioritization,

discipline

in

Stage

Gate

process

Very

low

investment

—or big ideas made small

—behind launches

25

Kraft Foods Group, Inc. |

26

Kraft Foods Group, Inc.

Only 3 of 16 2009 launches received more than

$10 million in A&C support...

…and these were the 3 most successful |

27

Kraft Foods Group, Inc.

Bad Habits Fostered a Bad Innovation Culture

•

Culture of “we don’t”, “we are bad at innovation”

•

Culture where innovators were 3rd class, “dead-end”

job

•

Culture of “innovation doesn’t really matter here”

|

28

Kraft Foods Group, Inc.

“Kraft is where good ideas…

“Kraft is where good ideas…

...go to die”

...go to die” |

29

Kraft Foods Group, Inc. |

30

Kraft Foods Group, Inc.

The Ingredients for a Comeback

•

Looking in the mirror, honestly

•

Top to bottom attention to innovation

•

Recognizing underutilized strengths and

gems

(R&D, Sales, Iconic Brands)

•

Spirit of “positive discontent”

•

…

and a new playbook |

31

Kraft Foods Group, Inc.

Essence of the Playbook

Good, proven principles, fundamentals, habits...

•

… that emphasize transparency, data, the right rigor,

KPI’s, simple processes

•

… that give the ball to the business unit teams to make

great things happen |

32

Kraft Foods Group, Inc.

Principles of the Playbook

•

Real

Fewer, Bigger, Better

•

Great consumer concepts, products, packaging

•

Great customer execution

•

Focused and disciplined financial criteria, KPI’s

incrementality, cash

•

Heavy A&C investment

for great marketing of new platforms

—actions, not words

—with the right lead times

—size, margin,

|

33

Kraft Foods Group, Inc.

Principles of the Playbook…Continued

•

Multi-year

platforms—

•

3-year pipelines of future multi-year platforms

•

“What gets measured gets done”

•

“Lessons learned”

“year 2” matters! |

34

Kraft Foods Group, Inc.

2011: Something’s Happening Here!

•

Focus shifted from dozens of “items”

to 13 “Big Bets”

•

A&C increased from ~$5 million per launch to ~$25 million

per Big Bet

•

New brand launched (MiO) with over $50 million in A&C

•

Sales step up to delivering best-in-class distribution and

merchandising on Big Bets—with KPI’s, incentives

•

Amped up measurement, tracking—to the right KPI’s |

35

Kraft Foods Group, Inc.

2011 Results

•

Over $600 million from Big Bets

•

Revenue from innovation over last 3 years jumps to 10%

•

Three $100 million platforms are born—MiO, Oscar Mayer

Selects, Velveeta Skillets

•

A real shift in distortion from small Tier

*

3 to big Tier 1 projects

•

Culture begins to shift

*Based on criteria for initiative size, investment, pipeline and margin |

36

Kraft Foods Group, Inc.

Others Begin to Notice

•

Walmart Innovator of the Year,

all departments

•

Walmart Innovation of the Year,

MiO

•

Edison Award: #1 Food and Beverage Innovation,

MiO

•

3 IRI Pacesetters,

top-selling new products |

37

Kraft Foods Group, Inc.

“I never thought I would think of Kraft as

an innovative company, but lately your

innovation has been so impressive.”

Dave Mirelez

DMM -

Perishables

Target |

38

Kraft Foods Group, Inc.

New $100MM Platforms |

39

Kraft Foods Group, Inc.

New $100MM Platforms |

40

Kraft Foods Group, Inc.

New $100MM Platforms |

41

Kraft Foods Group, Inc.

Good-Better-Best

Ready-to-

Drink

Beverages

Cold Cuts

Coffee

Sandwich

Cheese

Convenient

Meals

*per serving

*per serving

$1.79

$2.49

$2.99

$1.99

$2.99

$3.99

$0.04-$0.06

*

$0.09-$0.15

*

$0.60-$1.00

*

$1.99

$2.99

$3.99

$0.99

$1.99

$3.49 |

42

Kraft Foods Group, Inc.

Real Resource Distortion

Kraft Innovation Profile –

2010 to 2012

% NP Initiatives

% NP SKUs

2010

2011

2012

15%

19%

27%

26%

28%

31%

59%

54%

42%

Tier 3

Tier 2

Tier 1/Big Bet

5%

52%

43%

26%

55%

52%

23%

Tier 3

Tier 2

Tier 1/Big Bet

20%

25%

2

1

Source: Kraft Financial Shipment data, 3 year rolling average;

¹2012 Estimate: ²SKUs estimate based off of Walmart initiative list;

Tiers are based on criteria for initiative size,

investment,

pipeline and margin |

43

Kraft Foods Group, Inc.

Real Resource Distortion

Kraft Innovation Profile –

2010 to 2012

2010

2011

2012

% NP A&C Spending

% NP Revenue

Source: Kraft Financial Shipment data, 3 year rolling average; ¹ 2012 Estimate; Tiers are based on criteria for initiative size, investment, pipeline and margin

1 |

44

Kraft Foods Group, Inc.

2012 Results

•

“Year 2”

principle executed for Velveeta Skillets, MiO and a

blow-out of Oscar Mayer Selects platform

•

New Fresh Take, Gevalia, Capri Super V platforms launched

•

Canada implements Fewer, Bigger, Better, with even better results

•

Significant improvement in key aspects of customer execution—

samples, sales stories, customer collaboration, activation |

45

Kraft Foods Group, Inc.

Contribution from Innovation Sets a New High!

Net revenue from new product innovation over last 3 years

Range across

Business

Units: 8%-15%

0%

2%

4%

6%

8%

10%

12%

14%

2009

2010

2011

2012E*

6.5%

7.8%

10.4%

13.0%

Source: U.S. Nielsen Consumption - 3-Outlet (2009-2011) and All Outlet-xAOC

(2012), *2012 Estimate |

46

Kraft Foods Group, Inc. |

47

Kraft Foods Group, Inc.

2013 Platforms |

48

Kraft Foods Group, Inc.

In Innovation,

“First to Worst”

can happen as easily and as often as

“Worst to First”

This will not happen

at Kraft |

49

Kraft Foods Group, Inc.

Innovation at Kraft: The End in Mind

•

Consistent, sustained, best-in-class

innovation—year after

year after year

•

A source of true competitive advantage

and differentiation

versus competition and industry peers

•

That helps deliver consistent, sustainable, profitable growth

—year after

That helps deliver consistent, sustainable, profitable

growth |

50

Kraft Foods Group, Inc.

Today’s Honest Look in the Mirror

•

Process, best practices, decision-making

process upgrade

•

Channel ubiquity

•

Voice of the Hispanic

•

Talent and culture

•

Consistency

—end-to-end

—consistently in our innovation work —the

team with the best players wins

—especially in quality of hand-offs, launch execution

—Value, Club, Immediate Consumption

|

Today’s

Honest Look in the Mirror •

Process,

best

practices,

decision-making

process upgrade

•

Channel

ubiquity

•

Voice

of

the

Hispanic

•

Talent

and

culture

•

Consistency

51

Kraft Foods Group, Inc.

—end-to-end

—Value, Club, Immediate Consumption

—consistently in our innovation work

—the team with the best players wins

—especially in quality of hand-offs, launch execution |

52

Kraft Foods Group, Inc.

CREATION

CREATION

PHASE

PHASE

MANY MANY

MANY MANY

IDEAS

IDEAS

DEVELOPMENT

DEVELOPMENT

PHASE

PHASE

A SELECT FEW

A SELECT FEW

LAUNCH

LAUNCH

PHASE

PHASE

THE VERY FINEST

THE VERY FINEST

A Typical Innovation Mindset:

It All “Ends”

at Launch |

53

Kraft Foods Group, Inc.

Future State Mindset:

Launch The Beginning of a New Business!

Big Hand-off issues

Post-launch rigor drops off vs. pre-launch |

54

Kraft Foods Group, Inc.

“Be quick,

“Be quick,

but don’t hurry”

but don’t hurry”

John Wooden

UCLA Hall of Fame Coach |

55

Kraft Foods Group, Inc.

Innovation Can Be a Competitive Advantage at Kraft

•

Nobody

is really good at it—and it’s really hard

•

We have shown what’s possible—

•

We have a playbook that is timeless—

•

We have Top Leadership’s total commitment and key strengths

in our Brands, R&D, Sales and Marketing

We will make it happen

and we’ve only just begun and

built to last |

Tim

McLevish Chief Financial Officer

56 |

57

Kraft Foods Group, Inc.

Making Cash King at the New Kraft

•

Cash is now an objective—not an outcome

–

Pushing FCF and ROIC metrics to business unit and category

manager score cards

–

Embedding into compensation metrics in 2014 |

58

Kraft Foods Group, Inc.

Making Cash King at the New Kraft

•

Cash is now an objective—not an outcome

•

Changing our culture to focus decisions on true economics

–

Rolling out cash training across the company

Sales Force Focus

Category Management,

SKU rationalization

Trade spend

ROI

Optimized price-change timing

Highest margin products, events

Sales timing and phasing

Business Unit Focus

Productivity pipeline

Resource distortion on risk-adjusted

NPV basis

Supplier-owned inventory

Supply chain

restructuring

Shift capex

to the highest return initiatives |

59

Kraft Foods Group, Inc.

Making Cash King at the New Kraft

•

Cash is now an objective—not an outcome

•

Changing our culture to focus decisions on true economics

•

Inoculating earnings and cash flow streams against

potential volatility of post-employment benefits |

60

Kraft Foods Group, Inc.

We’re Off to a Strong Start

FYE 2012E

Cash and

Cash Equivalents

2013E Free

Cash Flow

(1)

Annual Dividends

@ $2.00/Share

FYE 2013E

Cash and

Cash Equivalents

~$1.0 B

~($1.2) B

~$1.1 B

(1)

Free Cash Flow = Cash Flow from Operations (~$1.4 billion) less Capital Expenditures (~$0.4

billion) Includes:

~$600MM Pension Funding

~$125MM Fifth Tax Payment

~$150MM Restructuring

$1.3 B |

61

Kraft Foods Group, Inc.

Priorities for Free Cash Flow

Fund a highly competitive dividend

Fund a highly competitive dividend

Reinvest in the

business

Acquisitions that quickly

achieve EPS accretion and

an IRR > risk-adjusted

hurdle rate

Share

repurchase |

62

Kraft Foods Group, Inc.

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Superior

Dividend

Payout

We are Well-Positioned to Deliver Predictable

Returns |

63

Kraft Foods Group, Inc.

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Our Plan |

64

Kraft Foods Group, Inc.

Our Mission

Superior

Dividend

Payout

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Make Kraft North American

Food & Beverage Company

Best Investment in the Industry |

|