Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FNB CORP/PA/ | d488478d8k.htm |

| EX-99.1 - EX-99.1 - FNB CORP/PA/ | d488478dex991.htm |

F.N.B. Corporation

Announces Agreement to Acquire

PVF Capital Corp.

February 19, 2013

Exhibit 99.2 |

Cautionary Statement Regarding Forward-Looking Information

and Non-GAAP Financial Information

2

This presentation contains "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act, relating to present or future trends or factors affecting the

banking industry and, specifically, the financial operations, markets and products of F.N.B. Corporation. Forward-looking statements are

typically identified by words such as “believe”, “plan”, “expect”,

“anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”, “project”, “goal”, and other

similar words and expressions. These forward-looking statements involve certain risks and

uncertainties. In addition to factors previously disclosed in F.N.B. Corporation’s reports

filed with the SEC and those identified elsewhere in this filing, the following factors among others, could cause actual results to differ

materially from forward-looking statements or historical performance: ability to obtain regulatory

approvals and meet other closing conditions to the Merger, including approval by PVF Capital

Corp. shareholders, on the expected terms and schedule; delay in closing the Merger; difficulties and delays in integrating the

FNB and PVF Capital Corp. businesses or fully realizing cost savings and other benefits; business

disruption following the Merger; changes in asset quality and credit risk; the inability to

sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of FNB products and

services; customer borrowing, repayment, investment and deposit practices; customer disintermediation;

the introduction, withdrawal, success and timing of business initiatives; competitive

conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated

with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of

technological changes, capital management activities, and other actions of the Federal Reserve

Board and legislative and regulatory actions and reforms. F.N.B. Corporation undertakes no obligation to revise these

forward-looking statements or to reflect events or circumstances after the date of this

presentation. F.N.B. Corporation and PVF Capital Corp. will file a proxy statement/prospectus

and other relevant documents with the SEC in connection with the merger. SHAREHOLDERS OF

PVF CAPITAL CORP. ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND

ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE

DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

The proxy statement/prospectus and other relevant materials (when they become available), and any

other documents F.N.B. Corporation and PVF Capital Corp. have filed with the SEC, may be

obtained free of charge at the SEC's website at www.sec.gov. In addition, investors and security holders may obtain

free copies of the documents F.N.B. Corporation has filed with the SEC by contacting James Orie, Chief

Legal Officer, F.N.B. Corporation, One F.N.B. Boulevard, Hermitage, PA 16148, telephone:

(724) 983-3317; and free copies of the documents PVF Capital Corp. has filed with the SEC by contacting

Jeffrey N. Male, Secretary, PVF Capital Corp., 30000 Aurora Road, Solon, OH 44139, telephone: (440)

248-7171. F.N.B. Corporation and PVF Capital Corp. and certain of their directors and

executive officers may be deemed to be participants in the solicitation of proxies from

shareholders of PVF Capital Corp. in connection with the proposed merger. Information concerning such participants' ownership of PVF Capital Corp.

common shares will be set forth in the proxy statement/prospectus relating to the merger when it

becomes available. This communication does not constitute an offer of any securities for sale.

ADDITIONAL INFORMATION ABOUT THE MERGER |

Transaction Rationale

•

Immediately accretive to EPS

•

Accretive to tangible book value

•

Strong internal rate of return

Strategic

Opportunity to

Add Scale

Financially

Attractive

Low Risk

•

Expands current presence in Cleveland Market

Accelerates current growth strategy

•

Market opportunity

Leverages FNB’s model in another major MSA

Significant commercial opportunities (over 50,000 businesses)

Attractive suburbs provide opportunity to expand retail, wealth & private

banking platforms •

Comprehensive due diligence process completed

•

Leverages FNB’s existing in-market management platform

•

Experienced acquiror

3 |

Transaction Overview

Fully Diluted Deal Value

Consideration

Implied Price Per Share

Required Approvals

Termination Fee

Key Assumptions

Capital Impact

Anticipated Closing

$106.4

million

(1)

100% stock; fixed 0.3405 exchange ratio

$3.98

(1)

Customary regulatory and PVFC shareholder

$4.0 million

Cost savings estimated at 31% of PVFC’s expense base

One-time transaction expenses of approximately $14.3 million,

pre-tax Accretive to tangible book value per share

Breakeven to TCE / TA

Minimal impact to regulatory capital ratios

Third quarter of 2013

(1) Based on FNB 20-day trailing stock price of $11.69 on 2/15/13

4 |

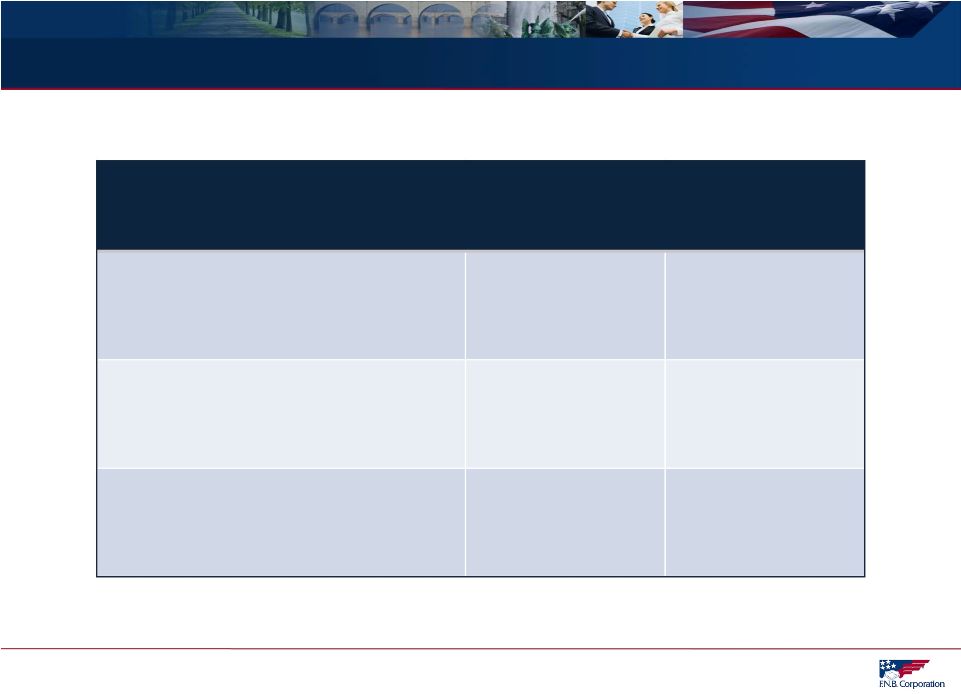

Transaction

Pricing Source: SNL Financial

Metrics based on FNB 20-day trailing stock price of $11.69 on 2/15/13 multiplied by the fixed

exchange ratio (1) Based on PVFC’s tangible book value per share of $2.90

as of 12/31/2012 (2) Based on PVFC’s closing price of $2.52 on

2/15/13 (3) Equal to deal value to common shareholders minus PVFC’s

tangible common equity as a percentage of core deposits; Core deposits defined as total deposits less jumbo time deposits (greater than $100,000)

(4) Includes bank & thrift transactions in the Mid-Atlantic and Midwest

announced after January 1, 2012 with deal values between $50 and $500 million 5

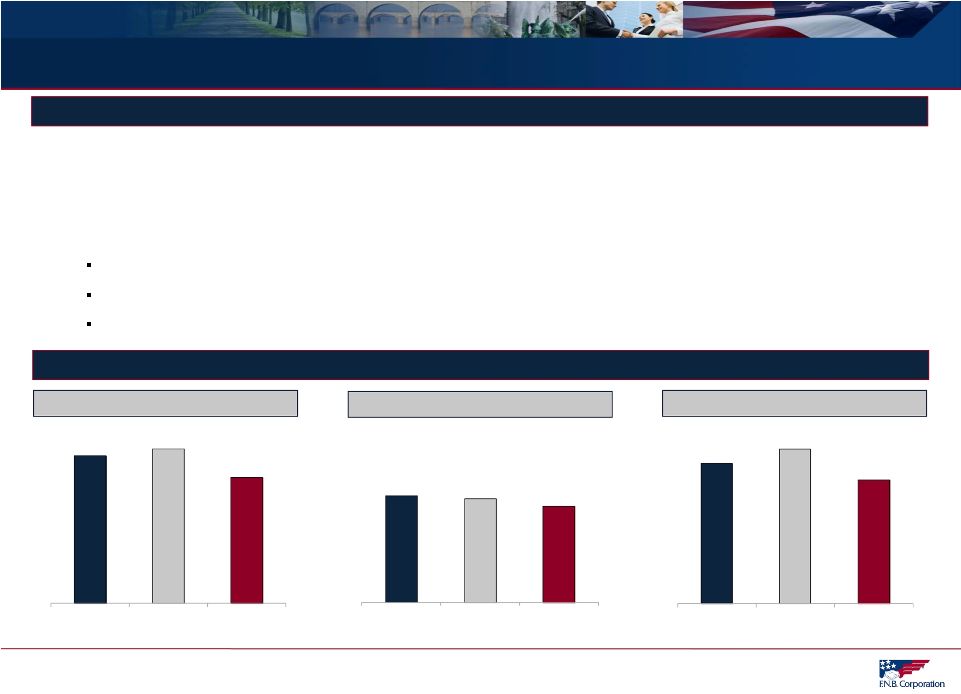

Transaction Multiples

FNB / PVFC

Transaction

1.37x

1.52x

57.9%

59.6%

5.6%

5.9%

Price

/

Tangible

Book

Value

(x)

(1)

Market

Premium

(%)

(2)

Core

Deposit

Premium

(%)

(3)

Recent Regional

Transactions

(4) |

Cleveland Market Opportunity

Total Households -

2011 (000)

Businesses

Unemployment Rate

6

Source: SNL Financial

(1) As of December 2012

(2) Per U.S. Census Bureau

•

Third consecutive acquisition in a major MSA

•

Cleveland,

Pittsburgh

and

Baltimore

have

an

aggregate

population

of

7.1

million,

significant

commercial

lending

opportunities

and

favorable demographics

•

The Cleveland market is conducive to FNB’s commercial banking model and strong

cross sell culture Opportunity to replicate FNB’s proven Pittsburgh

success in a market with similar characteristics Significantly enhances

number of commercial banking prospects within FNB footprint Retail locations

in attractive markets expected to benefit consumer banking, Wealth Management and Private Banking

Strong Opportunity

Expansion in Cleveland Market

1,001

1,043

852

Pittsburgh

MSA

Baltimore

MSA

Cleveland

MSA

7.2%

7.0%

6.5%

Pittsburgh

MSA

Baltimore

MSA

Cleveland

MSA

59,240

65,169

52,149

Pittsburgh

MSA

Baltimore

MSA

Cleveland

MSA

(2)

(1) |

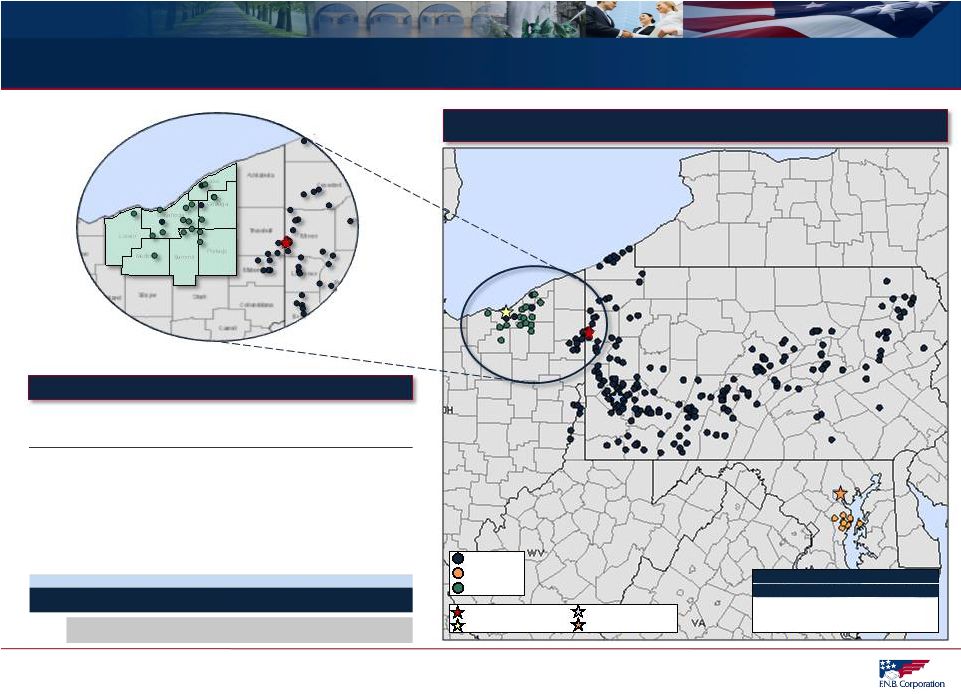

Pro

Forma Franchise Pro Forma Branch Franchise

Cleveland, OH MSA

Source: SNL Financial and Microsoft MapInfo

Deposit data as of 6/30/2012 and pro forma for pending and completed transactions

7

FNB (246)

ANNB (8)

PVFC (16)

FNB Headquarters

Pittsburgh MSA

Cleveland MSA

Baltimore MSA

Branch Overlap

Distance

Branches

% of Franchise

< 1 mi:

1

6.3%

< 5 mi:

3

18.8%

Rank

Institution (ST)

Number

of

Branches

Deposits in

Market

($mm)

Market

Share

(%)

1

KeyCorp (OH)

76

9,961

19.8

2

PNC Financial Services Group (PA)

81

5,758

11.5

3

TFS Financial Corp (MHC) (OH)

19

5,629

11.2

4

RBS

66

4,421

8.8

5

Huntington Bancshares Inc. (OH)

88

4,212

8.4

6

Fifth Third Bancorp (OH)

64

3,531

7.0

7

FirstMerit Corp. (OH)

67

3,350

6.7

8

JPMorgan Chase & Co. (NY)

42

2,739

5.4

9

U.S. Bancorp (MN)

66

1,979

3.9

10

Dollar Bank FSB (PA)

27

1,663

3.3

14

Pro Forma

15

624

1.2

14

PVF Capital Corp. (OH)

12

564

1.1

27

F.N.B. Corp. (PA)

3

60

0.1

Totals (1-10)

596

43,243

86.0

Totals (1-39)

723

50,255

100.0 |

•

Headquartered in Solon, Ohio

•

Founded in 1920 as an Ohio chartered savings and loan association called Park View

Federal Savings Bank •

Operates 16 branches in the Greater Cleveland area

•

Completed demutualization / IPO in 1992 (Ticker: PVFC)

•

Market Capitalization: $65 million

•

Balance sheet as of December 31, 2012

$782 million in assets

$585 million in net loans

$634 million in deposits

TCE / TA: 9.61%

•

Income statement for the quarter ended December 31, 2012

Net income of $2.67 million

Net interest margin of 3.16%

Noninterest expense / average assets of 3.4%

•

Does not have TARP

Completed $30 million capital raise in March 2010

Overview of PVF Capital Corp.

Source: SNL Financial and Microsoft MapInfo

Market data as of 2/15/2013

8 |

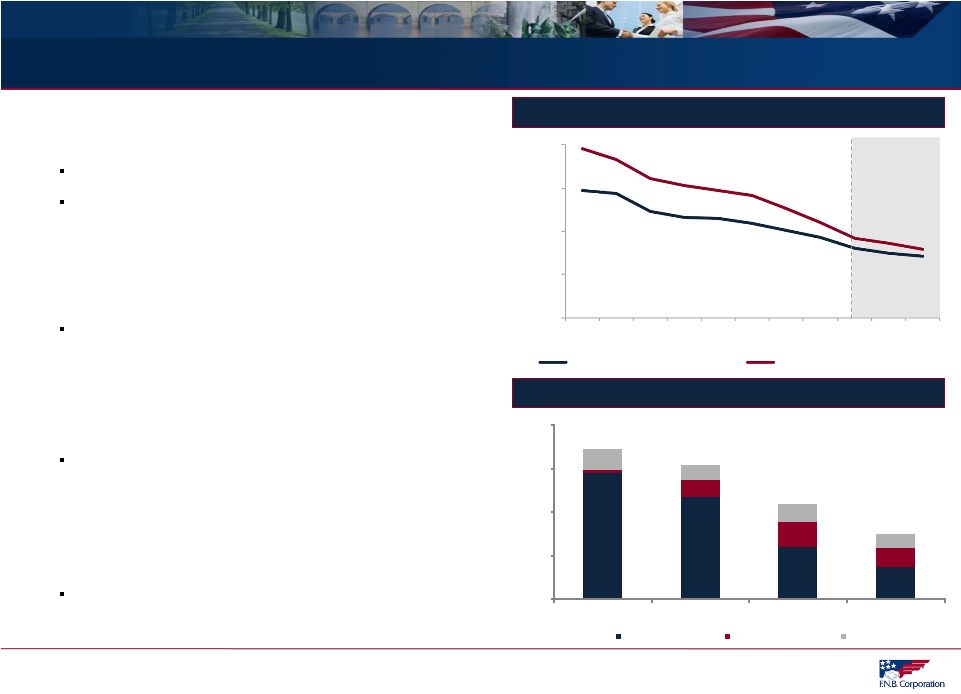

PVFC

Turnaround Nonperforming Assets ($mm)

$85.8

$77.1

$54.2

$37.0

Bank Order Ratios

In compliance

with order

•

Introduced new management team in 2009 to address

regulatory order and focus on credit quality issues

Bob King, CEO

Jim Nicholson, CFO

•

Successfully worked through and charged-off significant

portion of problem credits

$60 million cumulative net charge-offs since 12/31/08 or

approximately 8.2% of the loan portfolio

•

Steadily reduced nonperforming assets

NPAs down $50.4 million or 58% from peak in 2009

•

On August 27, 2012 the OCC lifted the formal regulatory

order issued to Park View Federal Savings Bank

As of 12/31/12 classified assets to core capital plus general

valuation allowance had been reduced to 42.4%

Source: SNL Financial and company documents

9

0.0%

30.0%

60.0%

90.0%

120.0%

2Q'10

3Q'10

4Q'10

1Q'11

2Q'11

3Q'11

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

Classified Assets / Core Cap. + LLR

Criticized Assets / Core Cap. + LLR

$72.0

$58.1

$29.6

$18.0

$1.7

$10.2

$14.6

$11.3

$12.1

$8.8

$10.0

$7.7

$0

$25

$50

$75

$100

2009

2010

2011

2012

Nonaccrual Loans

Restructured Loans

OREO |

Comprehensive Due Diligence

Due Diligence Review

Estimated Credit Mark

•

Independent third-party credit review on $1 billion

residential mortgage servicing portfolio

Put-back losses estimated to be $2.5 million

•

Aggregate credit mark of $46.2 million, or 8.0% of

total loans and OREO

Greater than 3x current reserve

•

Total cycle losses, including $60.3 million of charge-

offs taken since 12/31/08, equal to 14.5% of total

loans as of 12/31/08

10

Credit Mark Summary

($mm)

(%)

Gross Loan Credit Mark

$44.7

7.8%

OREO Mark

1.5

19.4%

Gross Credit Mark

$46.2

8.0%

Credit Review Summary

% of Total

Portfolio Type

Reviewed

Commercial

80%

Construction & Land

83%

1-4 Family & HELOC

27%

NPL & 90+ PD Greater than $50k

100%

OREO Properties

100%

Total Gross Loans HFI

~60% |

Conclusions

•

FNB has proven success gaining market share in major metropolitan markets

#3 market share in Pittsburgh is generating solid growth

Scale serves to attract talent

•

Significant commercial and retail opportunities enable FNB to continue to expand

share Ability to leverage deep product set in an attractive market

Access to an additional 50,000 commercial prospects

Attractively located retail locations provide strong cross sell opportunity

•

The strategic merits of the deal are matched by the financial returns

Immediately accretive to EPS

Accretive to tangible book value

Strong internal rate of return

11 |