Attached files

| file | filename |

|---|---|

| EX-31.1 - American Magna Corp | form10ka1043012ex31-1.htm |

| EX-32.1 - American Magna Corp | form10ka1043012ex32-1.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment #1

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2012

Commission file number: 000-53630

DAKOTA GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

20-5859893

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

701 N. Green Valley Parkway, Suite 200

Henderson, Nevada, 89074

(Address of principal executive offices)

(702) 990-3256

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

(Do not check if a smaller reporting company)

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of October 31, 2011 was approximately $445,500.

The number of shares of the issuer’s common stock issued and outstanding as of July 20, 2012 was 2,345,998 shares.

Documents Incorporated By Reference: None

1

EXPLANATORY NOTE:

Dakota Gold Corp., (the “Company”) is filing this Amendment No. 1 on Form 10-K (the “Amendment”) to the Company’s annual report on Form 10-K for the period ended April 30, 2012 (the “Form 10-K”), filed with the Securities and Exchange Commission on July 23, 2012 (the “Original Filing Date”) to provide additional disclosure on the company’s geological exploration program and rectify erroneous references to the Company’s state as a ‘development stage’ company.

No other changes have been made to the Form 10-K. This Amendment speaks as of the Original Filing Date, does not reflect events that may have occurred subsequent to the Original Filing Date, and does not modify or update in any way disclosures made in the Form 10-K.

TABLE OF CONTENTS

|

Page

|

||

|

Glossary of Mining Terms

|

3 | |

|

PART I

|

6 | |

|

Item 1

|

Business

|

6 |

|

Item 1A

|

Risk Factors

|

10 |

|

Item 1B

|

Unresolved Staff Comments

|

19 |

|

Item 2

|

Property

|

19 |

|

Item 3

|

Legal Proceedings

|

25 |

|

Item 4

|

Mine Safety Disclosures

|

25 |

|

PART II

|

26 | |

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

26 |

|

Item 6

|

Selected Financial Data

|

27 |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

27 |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk.

|

33 |

|

Item 8

|

Financial Statements and Supplementary Data.

|

33 |

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

47 |

|

Item 9A

|

Controls and Procedures

|

47 |

|

Item 9B

|

Other Information

|

48 |

|

PART III

|

||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

49 |

|

Item 11

|

Executive Compensation

|

51 |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

53 |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

53 |

|

Item 14

|

Principal Accountant Fees and Services

|

54 |

|

PART IV

|

||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

54 |

|

SIGNATURES

|

55 | |

2

Glossary of Mining Terms

Adit(s), Historic working driven horizontally, or nearly so into a hillside to explore for and exploit ore.

Adularia. A potassium-rich alteration mineral – a form of orthoclase.

Ag. Elemental symbol for silver.

Air track holes. Drill hole constructed with a small portable drill rig using an air-driven hammer.

Au. Elemental symbol for gold.

Core holes. A hole in the ground that is left after the process where a hollow drill bit with diamond chip teeth is used to drill into the ground. The center of the hollow drill fills with the core of the rock that is being drilled into, and when the drill is extracted, a hole is left in the ground.

Felsic Tertiary Volcanic Rocks. Quartz-rich rocks derived from volcanoes and deposited between two and sixty-five million years ago.

Geochemical sampling. Sample of soil, rock, silt, water or vegetation analyzed to detect the presence of valuable metals or other metals which may accompany them. For example, arsenic may indicate the presence of gold.

Geologic mapping. Producing a plan and sectional map of the rock types, structure and alteration of a property.

Geophysical survey. Electrical, magnetic, gravity and other means used to detect features, which may be associated with mineral deposits

Leaching. Leaching is a cost effective process where ore is subjected to a chemical liquid that dissolves the mineral component from ore, and then the liquid is collected and the metals extracted from it.

Level(s), Main underground passage driven along a level course to afford access to stopes or workings and provide ventilation and a haulageway for removal of ore.

Magnetic lows. An occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver.

Plug. A vertical pipe-like body of magma representing a volcanic vent similar to a dome.

Quartz Monzonite. A medium to coarse crystalline rock composed primarily of the minerals quartz, plagioclase and orthoclase.

Quartz Stockworks. A multi-directional system of quartz veinlets.

3

RC holes. Short form for Reverse Circulation Drill holes. These are holes left after the process of Reverse Circulation Drilling.

Resource. An estimate of the total tons and grade of a mineral deposit defined by surface sampling, drilling and occasionally underground sampling of historic diggings when available.

Reverse circulation drilling. A less expensive form of drilling than coring that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not give as much information about the underlying rocks.

Scoping Study. A detailed study of the various possible methods to mine a deposit.

Sedimentation. The process of deposition of a solid material from a state of suspension or solution in a fluid (usually air or water).

Silicic dome. A convex landform created by extruding quartz-rich volcanic rocks.

Stope(s). An excavation from which ore has been removed from sub-vertical openings above or below levels.

Tertiary. That portion of geologic time that includes abundant volcanism in the western U.S.

Trenching. A cost effective way of examining the structure and nature of mineral ores beneath gravel cover. It involves digging long usually shallow trenches in carefully selected areas to expose unweathered rock and allow sampling.

Tuffaceous. Pertaining to sediments which contain up to 50% tuff.

Volcanic center. Origin of major volcanic activity.

Volcanoclastic. Coarse, unsorted sedimentary rock formed from erosion of volcanic debris.

4

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Dakota Gold Corp. (the “Company”, “Dakota”, or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

5

PART I

Item 1. Description of Business

We are engaged in natural resource exploration and anticipate acquiring, exploring, and if warranted and feasible, developing natural resource properties. Currently we are in the exploration stage and are undertaking one exploration program in Nevada.

History

Dakota Gold Corp. is an exploration stage company. We were incorporated under the laws of the State of Florida on October 27, 2006 under the name Coastline Corporate Services, Inc. The Company was initially established to provide services to public companies requiring guidance and assistance in converting and filing their documents with the Securities and Exchange Commission.

On July 8, 2010 the Company’s principal shareholder entered into a Stock Purchase Agreement which provided for the sale of 600,000 shares of common stock of the Company to Daulat Nijjar. In addition, Mr. Nijjar acquired a total of 47,500 shares of common stock from three other shareholders resulting in Mr. Nijjar owning a total of 647,500 shares of common stock, or at that time, 81.7% of the issued and outstanding shares of common stock of the Company. Effective as of July 8, 2010, in connection with the share acquisition, Mr. Nijjar was appointed President, Chief Executive Officer, Chief Financial Officer, Treasurer, Director, and Chairman of the Company.

On August 16, 2010, Mr. Nijjar returned 450,000 shares of common stock to the Company for cancellation in order to reduce the number of shares issued and outstanding. Subsequent to the cancellation, the Company had 342,998 shares issued and outstanding; a number that Mr. Niijar, who was also a director of the Company at that time, considered more in line with the Company’s business plans. Following the share cancellation, Mr. Nijjar owned 197,500 shares of common stock, or 57.6%, of the remaining 342,998 issued and outstanding shares of common stock of the Company at that time.

On August 18, 2010, Mr. Nijjar, as the holder of 197,500, or 57.6%, of the issued and outstanding shares of the Company’s common stock at that time, provided the Company with written consent in lieu of a meeting of stockholders authorizing the Company to amend the Company’s Articles of Incorporation for the purpose of changing the name of the Company from Coastline Corporate Services, Inc. to “Dakota Gold Corp.” In connection with the change of the Company’s name to Dakota Gold Corp. the Company intended to change its business to mineral resource exploration and move its domicile to Nevada. In order to undertake the name and domicile change, the Company incorporated a wholly-owned subsidiary in Nevada named Dakota Gold Corp. and merged Coastline Corporate Services, Inc. with the new subsidiary. The name and domicile change became effective on November 26, 2010 and the Company is now a Nevada corporation.

6

On September 10, 2010, the Company executed a property option agreement (the “Property Option Agreement”) with Zsolt Rosta, Jennifer Oliver, and Genesis Gold Corporation (the “Property Owners”) granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by the Property Owners. The property known as the Caldera Property is located in Nye County, Nevada and currently consists of 32 unpatented claims (the “Property”). Upon execution of the Agreement, the Company paid the Property Owners $5,000. The Agreement requires the Company to make a total of $1,975,000 in additional property option payments and incur $200,000 in exploration expenditures on the Property.

On December 2, 2010 the Company’s Board of Directors adopted a resolution to split the Company’s stock. The common stock of the Company was forward split on a 100:1 basis on the record date of December 16, 2010 and a payment date of December 17, 2010.

On March 25, 2011, the Company received a joint written consent in lieu of a meeting (the “Joint Written Consent”) from the members of the Board of Directors (the “Board”) and the holder of 197,500 (representing 57.1%) of the issued and outstanding shares of our common stock (the “Majority Stockholder”). The Joint Written Consent adopted resolutions which authorized the Company to act on a proposal to effect a reverse stock split on the issued and outstanding shares of common stock of the Company at a ratio of 1 new post reverse split common stock for each 100 outstanding pre reverse split common stock of the Company. On June 16, 2011 the reverse split was completed.

Effective as of August 31, 2011 the Board of Directors of the Company elected Mr. Bobby Nijjar President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer, Secretary, and Director of the Company. Also effective as of August 31, 2011 Mr. Daulat Nijjar resigned as President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer, Secretary, and Director of the Company. Mr. Bobby Nijjar is the son of Mr. Daulat Nijjar.

Business Operations

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, developing natural resource properties. Our primary focus in the natural resource sector is gold. We are an exploration stage company. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

7

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term. Therefore, we anticipate selling or partnering any ore bodies that we may discover to a major mining company. Many major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. We believe selling or partnering a deposit found by us to these major mining companies, would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and would also provide future capital for the Company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have optioned in Nevada contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the selling or partnering of our property, the purchase of small interests in producing properties, the purchase of properties where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date we have one property under option. We have not yet conducted any significant exploration on the property but we have initiated an exploration program that will include mapping, sampling, surveying and drilling on the property. There has been no indication as yet that any commercially viable mineral deposits exist on this property, and there is no assurance that a commercially viable mineral deposit exists on our property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Competition

The mineral exploration industry, in general, is intensively competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. We compete with many junior exploration companies many of which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to develop, maintain or expand our business.

8

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Government Regulation

The federal government and various state and local governments have adopted laws and regulations regarding the protection of natural resources, human health and the environment. We will be required to conduct all exploration activities in accordance with all applicable laws and regulations. These may include requiring working permits for any exploration work that results in physical disturbances to the land and locating claims, posting claims and reporting work performed on the mineral claims. The laws and regulations may tell us how and where we can explore for natural resources, as well as environmental matters relating to exploration and development. Because these laws and regulations change frequently, the costs of compliance with existing and future environmental regulations cannot be predicted with certainty.

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The cost of complying with environmental concerns under any of these acts varies on a case-by-case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

Other than the normal bonding requirements, there are no costs to us at the present time in connection with compliance with environmental laws. However, since we anticipate engaging in natural resource projects, these costs could occur at any time. Costs could extend into the millions of dollars for which we could be liable. In the event of liability, we would be entitled to contribution from other owners so that our percentage share of a particular project would be the percentage share of our liability on that project. However, other owners may not be willing or able to share in the cost of the liability. Even if liability is limited to our percentage share, any significant liability would wipe out our assets and resources.

Employees

We have commenced only limited operations. Therefore, we have no full time employees. Our officers and directors provide planning and organizational services for us on a part-time basis.

9

Item 1A. Risk Factors

Factors that May Affect Future Results

1. Our independent auditor has issued a going concern opinion after auditing our financial statements. Our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

We will be required to expend substantial amounts of working capital in order to explore and develop our Caldera Property. Upon changing our business to mineral exploration we entered the exploration stage on August 1, 2010. Our operations have been funded entirely from capital raised from our private offerings of securities from March 2011 through September 2011 and from a bridge loan received in August 2010. We will continue to require additional financing to execute our business strategy. We are totally dependent on external sources of financing for the foreseeable future, of which we have no commitments. Our failure to raise additional funds in the future will adversely affect our business operations, and may require us to suspend our operations, which in turn may result in a loss to the purchasers of our common stock. We are entirely dependent on our ability to attract and receive additional funding from either the sale of securities or outside sources such as private investment or a strategic partner. We currently have no firm agreements or arrangements with respect to any such financing and there can be no assurance that any needed funds will be available to us on acceptable terms or at all. The inability to obtain sufficient funding of our operations in the future could restrict our ability to grow and reduce our ability to continue to conduct business operations. As of April 30, 2012, we have incurred a net loss of $168,046 from inception of the exploration stage and used cash in operations from inception of the exploration stage of $123,109. After auditing our financial statements, our independent auditor issued a going concern opinion and our ability to continue is dependent on our ability to raise additional capital. If we are unable to obtain necessary financing, we will be required to curtail our exploration plans which could cause us to become dormant and our shareholders to lose their investment in our company. In addition, any additional equity financing may involve substantial dilution to our then existing stockholders.

2. We are an exploration stage company, have generated no revenues to date and have a limited operating history upon which we may be evaluated.

We were incorporated on October 26, 2006 in the State of Florida under the name Coastline Corporate Services, Inc. In 2010 we completed a name and jurisdiction change and on August 1, 2010 we became an exploration stage company. We have optioned an early stage mineral property but the property does not have any known resources or reserves. Our only other meaningful asset is approximately $37,000 in available cash at April 30, 2012. Our limited operating history makes it difficult to evaluate our business on the basis of historical operations. We have no known commercially viable deposits, or “resources”, or "reserves" on our Property. Therefore, determination of the existence of a resource or reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If we fail to find a commercially viable deposit on our Property our financial condition and results of operations will suffer. If we cannot generate income from the Property we will have to cease operations which will result in the loss of your investment.

10

We face all of the risks inherent in a new business and those risks specifically inherent in the exploration stage company, with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject. We cannot assure you that we will be able to generate revenues or profits from the operation of our business or that we will be able to generate or sustain profitability in the future.

3. We expect losses in the future because we have no revenue to offset losses.

As reflected in our financial statements we are in the exploration stage. Since entering the exploration stage on August 1, 2010, we have incurred a net loss of $168,046 and used cash in operations of $123,109. As we have no current revenue, we are expecting losses over the next 12 months because we do not have any revenues to offset the expenses associated with the development and implementation of our business plan. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

4. Our business model is unproven and our success is dependent on our ability to explore and develop our mineral property.

Our business model is to generate revenues from the sale of minerals from our optioned exploration property located in Nye County, Nevada. We cannot guarantee that we will ever be successful in effectuating our business plan or in generating revenues in the future. The Property is at a very early stage, and our ability to generate revenue is unproven. Therefore, it is not possible for us to predict the future level of production, if any, or if we will be able to effectuate our business plan. If we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

5. Because we anticipate our operating expenses will increase prior to our earning revenues, if any, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues due to the significant amount of expenditures required to bring a property to the point where it is producing revenue. Therefore, we expect to incur significant losses into the foreseeable future. If we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations.

6. The failure to hire qualified employees or consultants would damage our business.

Due to the highly technical nature of our business, we will depend greatly on attracting and retaining experienced management and highly qualified and trained personnel. We will compete with other companies intensely for qualified and well trained professionals in our industry. If we cannot hire or retain, and effectively integrate, a sufficient number of qualified and experienced professionals, this will have a material adverse effect on our capacity to sustain and grow our business.

11

7. Because our key exploration consultant is also a consultant to other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire properties to explore and to run our business.

Our key exploration consultant is also a consultant to other natural resource or mining-related companies, and may be involved in related pursuits that could present conflicts of interest with our company. Our key exploration consultant owns and operates his own mineral exploration consulting business. This association may give rise to inherent conflicts of interest from time to time. For example, we may be presented with an opportunity in which our key exploration consultant would have to decide if the opportunity would be more appropriate for us or another company.

8. If we do not make the required option payments and property expenditure requirements mandated in the Agreement with the Caldera Property owners we will lose our interest in our Property and our business may fail.

If we do not make all of the property payments or incur the required expenditures in accordance with the property option agreement on the Caldera Property we will lose our option to acquire the Property and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Since our payment obligations are non-refundable, if we do not make any payments, we will lose any payments previously made and all our rights to the Property.

9. Because of the speculative nature of exploration of natural resources, there is a substantial risk that our business will fail.

The search for valuable natural resources on our Property is extremely risky as the exploration for natural resources is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing mines. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. Because the probability of an individual prospect ever having reserves is extremely remote, in all probability the Property does not contain any reserves, and any funds we spent on exploration will probably be lost. In such a case, we would be unable to complete our business plan.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. The risks associated with mineral exploration include:

|

·

|

the identification of potential mineralization based on superficial analysis;

|

|

·

|

the quality of our management and our geological and technical expertise; and

|

|

·

|

the capital available for exploration.

|

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities.

12

10. We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors such as other junior exploration companies or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

11. We may not have the funds to purchase all of the supplies, manpower and materials we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, manpower and certain equipment such as drill rigs, bulldozers and excavators that we might need to conduct exploration. If there is a shortage or scarcity, we cannot compete with larger companies in the exploration industry for supplies, manpower and equipment. In the event that the prices for such resources rise above our affordability levels, we may have to delay or suspend operations. In the event we are forced to limit our exploration activities, we may not find any minerals, even though our Property may contain mineralized material. Without any minerals we cannot generate revenues and shareholders may lose their investment in our company.

12. The prices of metals are highly volatile and a decrease in metals prices could result in us incurring losses.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals markets from the time development of a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a mineral property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metals prices have decreased. Adverse fluctuations of metals market price may force us to curtail or cease our business operations.

13. Because our business involves numerous operating hazards, we may be subject to claims of a significant size which would be costly to rectify.

Our proposed business is subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure, and craterings. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of equipment, injury or death to personnel resulting in substantial liability to us. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs and could force us to cease our operations, which will cause you a loss of your investment.

13

Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. We do not currently carry insurance to protect against these risks and we may not obtain such insurance in the future. Even if we do obtain insurance, the nature of these risks is such that liabilities could exceed policy limits or be excluded from coverage. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, thereby hurting our financial position, potential future earnings, and competitive positions and the cessation of our operations.

14. Failure to comply with regulations or damage to the environment from our operations may subject us to significant claims.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry since the rules and regulations frequently are amended or interpreted. We cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the cost of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and property are subject to extensive federal, state, and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released into the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations. Non-compliance with laws, including environmental laws could result in significant costs and liabilities that would adversely affect our finances and force us to cease operations.

14

15. Because access to our mineral claims is limited during inclement weather conditions delays in our exploration could occur.

The business of mining for gold and other metals is generally subject to a number of risks and hazards including natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. Access to our mineral Property is restricted during these weather conditions. Furthermore, during the winter months exploration cannot be done on the Property. As a result, any attempt to test or explore the Property is largely limited to the times when weather conditions permits such activities. These limitations may result in significant delays in exploration efforts. Such delays may have a significant negative effect on our results of operations.

16. Our principal stockholder, who is also our President and CEO and director, owns a controlling interest in our voting stock and is able to influence all matters requiring shareholder approval and approval of significant corporate transactions.

Our principal shareholder beneficially owns approximately 85.3% of our outstanding common stock. As a result, this shareholder will have the ability to control substantially all matters submitted to our stockholders for approval including:

|

•

|

election of our board of directors;

|

|

•

|

removal of any of our directors;

|

|

•

|

amendment of our Articles of Incorporation or bylaws; and

|

|

•

|

adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

17. Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

As a result of his duties and responsibilities with the other businesses Mr. Nijjar can only provide his management services to us on a part-time basis. Because we are in the early stages of our business, Mr. Nijjar will not be spending all of his time working for the Company. Mr. Nijjar will expend enough time to oversee the work program that has been approved by the Company. Later, if the demands of our business require additional time from Mr. Nijjar, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Nijjar to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Nijjar’s other interests increase. Competing demands on Mr. Nijjar’s time may lead to a divergence between his interests and the interests of our shareholders.

15

RISK FACTORS RELATING TO OUR COMMON STOCK

18. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 100,000,000 shares of common stock, par value $.001 per share, of which 2,345,998 shares are currently issued and outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

19. Our President and CEO who is also a director owns a controlling interest in our voting stock and may take actions that are contrary to your interests, including selling their stock.

Our President and CEO, who is also a director, beneficially owns approximately 85.3% of our outstanding common stock. If and when he is able to sell his shares in the market, such sales within a short period of time could adversely affect the market price of our common stock if the marketplace does not orderly adjust to the increase in the number of shares in the market. This will result in a decrease in the value of your investment in the Company. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

20. Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

16

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

21. Since our shares are quoted on the OTC Bulletin Board, sales of our shares relying upon rule 144 may depress prices in that market by a material amount.

The majority of the outstanding shares of our common stock held by present shareholders are "restricted securities" within the meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. On November 15, 2007, the Securities and Exchange Commission adopted changes to Rule 144, which, would shorten the holding period for sales by non-affiliates to six months (subject to extension under certain circumstances) and remove the volume limitations for such persons. The changes became effective in February 2008. Rule 144 provides in essence that an affiliate who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1% of a company's outstanding common stock. The alternative average weekly trading volume during the four calendar weeks prior to the sale is not available to our shareholders being that the (“OTCBB”) is not an "automated quotation system" and, accordingly, market based volume limitations are not available for securities quoted only over the OTCBB. As a result of the revisions to Rule 144 discussed above, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of six months, if the Company has filed its required reports. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of common stock of present stockholders, may have a depressive effect upon the price of the common stock in any market that may develop.

17

22. We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

We are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate ongoing changes to our internal control systems, processes and information systems. Currently, we have no employees, other than our sole officer and director. As we engage in the exploration of our mineral claim, hire employees and consultants, our current design for internal control over financial reporting will not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses.

In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital.

23. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

18

Because none of our directors are independent, we do not currently have independent audit or compensation committees. As a result, the directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

24. Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

Item 2. Description of Property

We do not own any real property. We currently maintain our corporate office space on a shared basis at 701 N. Green Valley Parkway, Suite 200, Henderson, Nevada, 89074 pursuant to a one-year lease for $249 per month that expires in August 2012. Management believes that our office space is suitable for our current needs.

In the following discussion relating to our interests in real property, there are references to “patented” mining claims and “unpatented” mining claims. A patented mining claim is one for which the U.S. government has passed its title to the claimant, giving that person title to the land as well as the minerals and other resources above and below the surface. The patented claim is then treated like any other private land and is subject to local property taxes. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If one purchases an unpatented mining claim that is later declared invalid by the U.S. government, one could be evicted.

19

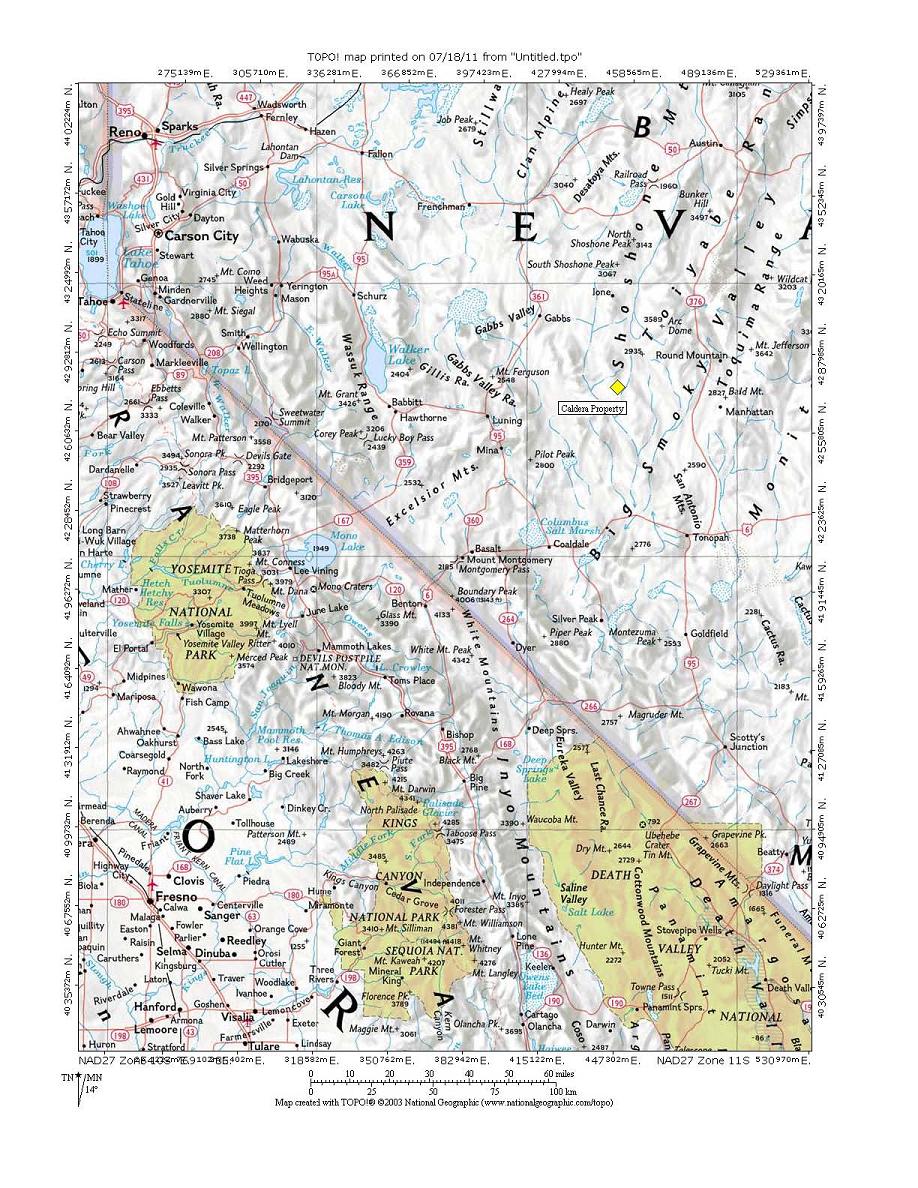

Map of our Caldera Property located in Nevada.

20

Caldera Property

Acquisition of Interest

On September 10, 2010, the Company executed the Property Option Agreement with the Property Owners granting the Company the right to acquire 100% of the mining interests of the Caldera Property, located in Nye County, Nevada and currently consists of 32 unpatented claims.. Upon execution of the Agreement, the Company paid the Property Owners $5,000. On January 1, 2011 the Company made an additional option payment of $20,000, and on September 1, 2011 the Company made a $25,000 option payment under the Agreement.

The remaining annual option payments and minimum annual exploration expenditures under Agreement are as noted below:

|

Property

|

Work

|

|||||||

|

Payments

|

Expenditures

|

|||||||

|

By September 1, 2012

|

35,000 | - | ||||||

|

By September 1, 2013

|

50,000 | 50,000 | ||||||

|

By September 1, 2014

|

100,000 | 50,000 | ||||||

|

By September 1, 2015

|

100,000 | 50,000 | ||||||

|

By September 1, 2016

|

100,000 | 50,000 | ||||||

|

By September 1, 2017

|

100,000 | - | ||||||

|

By September 1, 2018

|

165,000 | - | ||||||

|

By September 1, 2019

|

200,000 | - | ||||||

|

By September 1, 2020

|

200,000 | - | ||||||

|

By September 1, 2021

|

200,000 | - | ||||||

|

By September 1, 2022

|

200,000 | - | ||||||

|

By September 1, 2023

|

200,000 | - | ||||||

|

By September 1, 2024

|

300,000 | - | ||||||

| $ | 1,950,000 | $ | 200,000 | |||||

Since our payment obligations are non-refundable, if we do not make any payments under the Agreement we will lose any payments made and all our rights to the Property. If all said payments under the Agreement are made, then we will acquire all mining interests in the Property, subject to a royalty payable to the Property Owners. If the Company fails to make any payment when due the Agreement gives the Company a 60-day period to pay the amount of the deficiency.

The Property Owners retained a royalty of the aggregate proceeds received by the Company from any smelter or other purchaser of any ores, concentrates, metals or other material of commercial value produced from the Property, minus the cost of transportation of the ores, concentrates or metals, including related insurance, and smelting and refining charges, including penalties as follows:

|

US$ per ounce

|

Net Smelter Return

|

|

Below $1200

|

1.50%

|

|

$ 1200.01 and above

|

3.00%

|

The price of gold used to determine the royalty is based on the average monthly afternoon London gold fix price.

21

Both the Company and the Property Owners have the right to assign, sell, mortgage or pledge their rights in the Agreement or on the Property. In addition, any mineral interests staked, located, granted or acquired by either the Company or the Property Owners which are located within a 1 mile radius of the Property will be included in the option granted to the Company.

Description and Location of the Caldera Property

The property known as the Caldera Property is located in Nye County, Nevada and currently consists of 32 unpatented claims. The property is located in northwestern Nye County in west-central Nevada, approximately 130 miles (210 kilometers) southeast of Carson City and approximately 41 airline miles (66 kilometers) north-northwest of the Nye County seat at Tonopah, Nevada.

The easiest access to the property is from Tonopah, traveling northwest via U.S. Highway 6 and the county "Pole Line" road for a distance of 32 miles (51 kilometers), then north 4 miles (6.4 kilometers) via a BLM-marked gravel road to the Cloverdale Ranch. From there a gravel road trends north and west along the foothills of the Shoshone Range for about 6 miles (10 kilometers). At this point, a dirt road goes mainly east for about 3 miles (5 kilometers) to the center of the property.

Exploration History of the Caldera Property

Modern exploration in the area was prompted by the increased gold prices of the early 1980's. During the last 25 years, various portions of the project area have been held in unpatented mining claims by numerous individuals and companies. The Bureau of Land Management records indicate that the following groups held claims in the district: Amselco (1984 to 1985), Exxon (1985 to 1986), Battle Mountain Gold (1987 to 1988), Great Basin Exploration (1984 to 1995), Noranda (1986 to 1989), Western Mining (1992), Homestake (1995 to 1997), and Glamis Gold/Rayrock (1997 to 2001). Amselco, Exxon, Battle Mountain Gold, Glamis Gold, and Western Mining Company explored on the western portion of the project. Homestake has worked both the western and eastern portion of the project area, but that data is not available.

Palladon Ventures Ltd. (“Palladon”) entered into an option agreement May 7, 2004 with Genesis Gold, which included assuming an underlying agreement between Genesis Gold and the Rosta claims holders. Palladon performed work consisting of geological mapping, geochemical sampling and a drilling program consisting of approximately 24 shallow holes (CD series) on the Caldera Property. The claims reverted back to Genesis Gold in 2009.

Battle Mountain Gold held an area of about 40 claims covering the western part of the project area up to the crest of the Shoshone Range. Battle Mountain conducted detailed geologic mapping, rock and soil geochemical sampling, and a drilling program of 17 mostly shallow reverse circulation drill holes (GKL series). Western Mining Company concentrated their exploration in an area southeast of the Golden King Mine. In this area of northwest-trending veins, dikes, and replacements, Western Mining drilled 4 shallow angle reverse circulation holes (CLV series). Glamis Gold completed general mapping of the majority of the project area with detailed mapping in three areas. Glamis also conducted rock sampling, soil sapling in two grids on the west side of the property, and completed 21 drill holes (GW series).

22

Geology of the Caldera Property

Regionally, Northern Nye County, is that part of the county north of 38° N. latitude, and covers an area of nearly 11,000 square miles (28,490 square kilometers) in central Nevada, a region characterized by alternate north-trending bedrock ranges and alluvial valleys. Pre-Tertiary rocks of diverse lithologies crop out across the region. Paleozoic marine sediment predominate in the east and central parts of northern Nye County, and late Paleozoic and Mesozoic marine sedimentary strata interbedded with metavolcanic rocks occur in the far western part of the region. Most of the Paleozoic rocks change in facies from east to west, grading from a mainly carbonate platform assemblage westward to a mixed carbonate-shale transitional assemblage. A volcanic-detrital assemblage with near-shore elements dominates the late Paleozoic and Mesozoic sections in the extreme western part of northern Nye County, and is possibly of island-arc or back-arc basin origin.

Basin and Range normal faults, which generally strike north to northeast, represent the latest stage of significant structural development in the region and formed the present topography. These normal faults were likely initiated in the Middle Miocene, had major movement in the Pliocene, and have been recurrently active to the present. Uplift of the ranges during this tectonic event may have locally generated gravity slides and low-angle faults that put pre-Tertiary bedrock on Tertiary and Quaternary deposits.

The Caldera Property is located in the southern Shoshone Range, a north-south trending range located in west-central Nevada in the southwest portion of the Great Basin. The southern Shoshone Range is comprised mainly of Tertiary volcanic units extruded from several different volcanic centers and calderas in the vicinity. The property lies near the inferred margin of one of these calderas, the Peavine caldera.

Geologic structure in the Cloverdale district can only be determined primarily from the Tertiary onward because pre-Tertiary exposures are very limited. Presumably, the concealed pre-Tertiary structure is somewhat similar to that observed in the Jett and Twin River districts on the other (east) side of the Toiyabe Range, 16 and 28 miles (26 and 45 kilometers) to the east and northeast of the Cloverdale district. The relation of Tertiary rhyolite dikes to the pre-Tertiary strata are notable. However, the dikes cutting the Pablo Formation generally trend west, whereas the few dikes mapped in the Dunlap Formation are more irregular in trend and shape. The differences may reflect different stress fields caused by the Sonoma and Nevadan Orogenies.

Generally, the Tertiary rocks are gently tilted westward or are nearly flat lying. Very steep dips are localized and commonly associated with Basin and Range-type faults. The axis of a north-trending open synclinal fold affecting the Toiyabe Quartz Latite is approximately coincident with Indian Valley. There may be a causative relationship between this fold axis, the coincident form of Indian Valley, and the young basalt flows, remnants of which rest on a tilted and uplifted erosion surface according

23

The Caldera property area represents a window through younger post-mineral volcanics that exposes various mid-Tertiary felsic welded tuffs, subvolcanic intrusives, and minor units of volcano-clastic sediments. The general dip of the volcanic units in the project area is to the west.

Mapping has provided the most detail on local project geology and has distinguished three major igneous units, two pre-mineral and one post-mineral.

Gold mineralization on the Caldera property is related to stockwork quartz-adulana veining and diffuse dissemination as irregular replacements of silica. Mineralization and alteration, including silicification, argillization, and bleaching, cover about a 3.5-square mile (9-square kilometer) area. Open space filling by late crystalline and drussy quartz, as well as abundant jarositic staining, are common at most mineralized sites and prospects. Specific controls of gold mineralization are indistinct and not well understood at the present time.

Although no coherent bodies of gold mineralization have yet been defined in the project area, based on rock chip sampling from previous exploration companies and Genesis Gold, local areas of the Property have been shown to contain mineralization. The style of gold mineralization on the Caldera Property is that typical of an epithermal volcanic-hosted precious metal system. Gold and silver are dominant in this type of system and generally occur in narrow veins and diffuse replacements in silicified zones. We believe that potential mineral deposits at Caldera would most likely be similar to other epithermal deposits in the vicinity.

Current State of Exploration

The Caldera claims presently do not have any mineral resources or reserves. The property that is the subject of our mineral claims is undeveloped and does not contain any open-pits. No reported historic production is noted for the Property. There is no mining plant or equipment located on the Property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claims. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found. Although drill holes are present within the property boundary, there is no drilled resource on our claims.

Geological Exploration Program

The Company has initiated an exploration program under a budget approved by the Company in August, 2011. The budget will include a drill program. However, the Company does not have any specific plans with respect to its planned program. The Company is currently in the process of taking the steps necessary to prepare and submit the drill permit application but has not yet determined the details of its plans. In the next twelve months the Company currently expects to complete mapping, sampling, in-fill geology and geochemistry in order to select drill targets. Once that portion of the work is completed the Company will prepare a Plan of Operations for submission to the US Forest Service (the “USFS”) for approval. The Caldera Property is located on land managed by the USFS and as a result the Company must receive USFS approval prior to undertaking any work on the Property. The process of selecting drill targets is expected to take at least a year so any future drilling will not take place until the summer of 2013.

24

The company has relied on previous sampling and drilling efforts completed by several companies over a 10 year period. The previous drilling campaigns were conducted by reputable companies such as Homestake and Glamis.. Sampling procedures and Quality Assurance/Quality Control (QA/QC) practices are not well documented in historical reports from the Caldera Property. As a result, the exact procedures followed by previous operators are not well known. However, it is likely that their respective QA/QC methodologies would at least have met industry standards at the time of the work.

The exploration to be undertaken by the Company will be a phased program. After the first drill program is completed the next steps will dependon the success of the drill program. A second phase of drilling would be contemplated. At this point, drilling would likely infill and expand on any mineralized intervals. Assuming further positive results, additional drilling will be carried out in phases including the use of both RC and Core drilling methods. Metallurgical tests will be carried out on mineralized intervals after the first phase in order to determine the potential for recovery of the gold. Geophysical surveys would be carried out before the third phase of drilling to better identify drill targets based on areas of known mineralization. Eventual preliminary economic analysis (PEA) would be conducted on the project if sufficient mineralization is found. Assuming a positive PEA, further drilling would be conducted and an eventual feasibility study would be implemented. If all of this work concluded that the project was viable at the current commodity prices, a decision would be made to put the project into production. However, the follow up phases are dependent on the success of the first phase of drilling. The Company has not yet submitted its plan to governmental authorities and has not yet determined the details of its exploration plan.

Item 3. Legal Proceedings

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

Item 4. Mine Safety Disclosures

The Company currently has no mining operations.

25

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market Information

Our common stock is traded on the Over The Counter Bulletin Board (“OTCBB”) under the symbol “DAKO.” The following table sets forth the quarterly high and low closing bid prices of the common stock as reported on http://finance.yahoo.com during the years ending April 30, 2012 and April 30, 2011:

|

Financial Quarter

|

Bid Price Information*

|

||

|

Year

|

Quarter

|

High Bid Price

|

Low Bid Price

|

|

2012

|

Fourth Quarter

|

$0.05

|

$0.03

|

|

Third Quarter

|

$0.05

|

$0.03

|

|

|

Second Quarter

|

$0.05

|

$0.03

|

|

|

First Quarter

|

$0.11

|

$0.06

|

|

|

2011

|

Fourth Quarter

|

$0.25

|

$0.20

|

|

Third Quarter

|

$0.25

|

$0.03

|

|

|

Second Quarter

|

$0.003

|

$0.003

|

|

|

First Quarter

|

$0.003

|

$0.003

|

|

*The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Holders

On July 19, 2012, there were approximately thirty-four holders of record of the Company’s common stock.

Dividends

The Company has not declared or paid any cash dividends on its common stock nor does it anticipate paying any in the foreseeable future. Furthermore, the Company expects to retain any future earnings to finance its operations and expansion. The payment of cash dividends in the future will be at the discretion of its Board of Directors and will depend upon its earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

There were no sales of unregistered securities that were not previously reported.

26

Purchases of Equity Securities by the Company and Affiliated Purchasers

None.

Item 6. Selected Financial Data

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 7. Management’s Discussion and Analysis or Plan of Operation

Overview

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, exploiting natural resource properties. Our primary focus in the natural resource sector is gold. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term indeed. We therefore anticipate optioning or selling any ore bodies that we may discover to a major mining company. Most major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. By optioning or selling a deposit found by us to these major mining companies, it would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and it would also provide future capital for the company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have in Nevada contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

27

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the purchase or option of early stage property. To date we have one property under option. We have not yet conducted significant exploration on the property but we have initiated an exploration program that will include mapping, sampling, surveying and drilling on the property. There has been no indication as yet that any mineral deposits exist on the property, and there is no assurance that a commercially viable mineral deposit exists on our property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

In the following discussion, there are references to “unpatented” mining claims. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If you purchase an unpatented mining claim that is later declared invalid by the U.S. government, you could be evicted.

Plan of Operation