Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - METLIFE INC | d486796d8k.htm |

Steven A. Kandarian

Chairman, President &

Chief Executive Officer

February 14, 2013

Bank of America Merrill Lynch

2013 Insurance Conference

Exhibit 99.1 |

This presentation may contain or incorporate by reference forward-looking

statements. Forward-looking statements give expectations or forecasts of future events and

use words such as “anticipate,”

“estimate,”

“expect,”

“project”

and other terms of similar meaning. Any or all

forward-looking statements may turn out to be wrong, and

actual results could differ materially from those expressed or implied in the forward-looking statements.

Predictions of future performance are

inherently

difficult

and

are

subject

to

numerous

risks

and

uncertainties,

including

those

identified

in

the

“Risk

Factors”

section

of

MetLife,

Inc.’s

filings

with the U.S. Securities and Exchange Commission. The company does not

undertake any obligation to publicly correct or update any forward-looking statement if it

later becomes aware that such statement is not likely to be achieved.

Additional discussion of forward-looking statements may be included in other slides in this

presentation; if so, please refer to those slides for more information.

The presentation may also contain measures that are not calculated based on

accounting principles generally accepted in the United States of America, also known as

GAAP. Additional discussion of non-GAAP financial information may be

included in other slides in this presentation, on the Investor Relations portion of MetLife's

website

(www.metlife.com),

or elsewhere on that website; if so, please refer to those slides or the website

for more information. Cautionary Statement on Forward Looking Statements and

Non-GAAP Financial Information

2 |

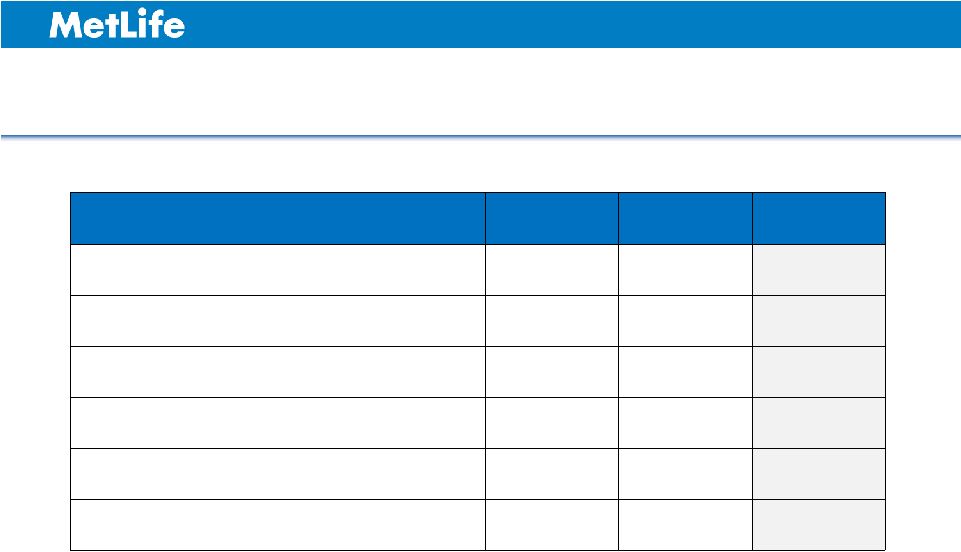

A

Strong Year in a Challenging Environment See Appendix for non-GAAP

financial information, definitions and/or reconciliations. ($ in millions,

except per share data) 2011

2012

Variance

Operating Earnings

$4,677

$5,686

22%

Operating Earnings Per Share

$4.38

$5.28

21%

Premiums, Fees & Other Revenues

$45,449

$47,879

5%

Operating Expense Ratio

24.4%

23.8%

(60) bps

Book Value per Share, excluding AOCI

$46.69

$46.73

-

Operating ROE

10.1%

11.3%

120 bps

3 |

Strategy to Become a World-Class Company

Drive Toward

Customer Centricity

and a Global Brand

Grow

Emerging Markets

Build Global

Employee Benefits

Business

Refocus the U.S.

Business

GLOBAL

*

WORLD-CLASS

*

SCALE

4 |

Refocus

the

U.S.

business

–

VA

strategy

Grow

emerging

markets

–

Provida

acquisition

Creating

shareholder

value

–

Increase

operating

ROE,

lower

cost

of

equity capital (COEC)

Executing on our Strategy

5

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

Managing for Another Material Drop in VA Sales

6

1

Statutory premiums, direct and assumed, excluding company sponsored internal

exchanges. 2

Represents midpoint of the guidance range of $10 to $11 billion.

($ in Billions)

MetLife U.S. Variable Annuity Sales¹

2

$15.3

$13.9

$15.4

$18.3

$28.4

$17.7

$10.5

2007

2008

2009

2010

2011

2012

2013P |

Introduced new guaranteed minimum income benefit (GMIB) variable

annuity effective February 4, 2013

–

Reduced roll-up rate from 5.0% to 4.0%

–

Reduced withdrawal rate from range of 4.5%-5.0% to 4.0%

Products under consideration would further improve annuity risk profile

Competitive landscape has changed for VAs

Further Actions to Improve Annuity Risk/Return Profile

7 |

More

Favorable Return on Investment for New VA Product 1

GMIB

MAX

IV

(5%

Rollup)

launched

on

Aug.

20,

2012

and

GMIB

Max

V

(4%

Rollup)

launched

on

Feb.

4,

2013.

The

pricing

results

were

based

on

market

conditions

as of December 31, 2012. Incidences of ROIs reflected in the chart above are the results of roughly 1,000 stochastic scenarios observed.

8

61%

75%

GMIB Max IV (5% Rollup)

GMIB Max V (4% Rollup)

>15%

12% to 15%

10% to 12%

8% to 10%

0% to 8%

<0%

Distribution

of

Potential

Return

Scenarios

1 |

Refocus

the

U.S.

business

–

VA

strategy

Grow

emerging

markets

–

Provida

acquisition

Creating

shareholder

value

–

Increase

operating

ROE,

lower

cost

of

equity capital (COEC)

Executing on our Strategy

9

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

Acquiring AFP Provida for approximately $2 billion in cash, funded with

on balance sheet resources

Price is approximately 10x forward earnings expectation, expect

operating

EPS

accretion

of

approximately

$0.05

in

2013,

$0.15

in

2014

Acquisition creates value assuming 75% equity, 25% debt funding mix

Free cash flow generation for acquired business expected to be

roughly 70% of operating earnings

Provida Acquisition a Positive for Shareholder Value

10

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

Provida: A Growth Opportunity in an Attractive Market

Highest

rated

country

in

region

1

,

government

surplus

position

5-year

projected

GDP

growth

rate

of

4.7%

2

Provida

ranked

#1

(29%

market

share)

in

concentrated

market

3

Employees required to contribute fixed percentage of salaries

Chile

Economics of the

Pension Business

AFP Market

11

1

Sovereign debt ratings of A+/A+/Aa3 (S&P/Moody’s/Fitch).

2

Economic

Intelligence

Unit

for

the

period

2013

–

2017.

3

Company filings and FactSet. Note: Local currency figures converted at spot rate of

$471.1 CLP/USD as of January 22, 2013. Figure denotes rank and market share by

mandatory AUM.

Fees charged as a percentage of contributions, not AUM

Strong and predictable free cash flows |

Provida Deal Aligns with Strategic Goals

1

Based

on

5-year

projected

average

PGAAP

ROE

assuming

75%

equity

/

25%

debt

capital

structure.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. Pre-Tax Expense Savings

12

Grow Emerging Markets to 20%+ of

Operating Earnings

Shift from Market Sensitive to Protection

Products

Operating ROE Expansion

~15%

(1)

Levered

Operating ROE

Fees Based on

Contributions

14% 17% |

Refocus

the

U.S.

business

–

VA

strategy

Grow

emerging

markets

–

Provida

acquisition

Creating

shareholder

value

–

Increase

operating

ROE,

lower

cost

of

equity capital (COEC)

Executing on our Strategy

13

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

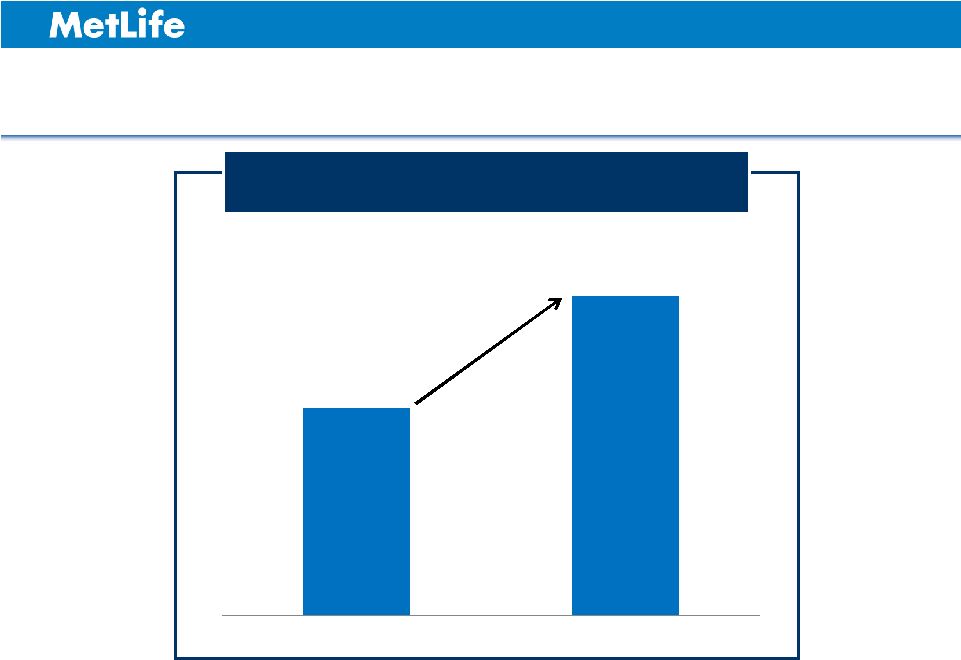

Goal is to Expand Operating ROE

Expect to Achieve 12% Operating ROE by 2016

Even if Interest Rates Remain Low

1

14

1

The bars represent mid-points of ranges.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. 12.0% -

14.0%

10.2% -

10.9%

2013P

2016 Target |

MetLife Operating ROE Spread to Cost of Equity Capital

15

Sources: BofA Merrill Lynch and Professor Aswath Damodaran, Stern School of

Business (NYU). See Appendix for non-GAAP financial information,

definitions and/or reconciliations. -12%

-10%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

Working on Both Sides of Value Creation

Valuation is a function of both return on equity and cost of equity

capital

We are committed to increase operating ROE and decrease COEC

over time

We believe our VA strategy and the Provida acquisition lower COEC

and increase operating ROE

16

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

Key

Takeaways Strong financial performance in 2012

Continue to execute on strategic initiatives despite macro and

regulatory uncertainty

Improving operating ROE and lowering cost of equity capital should

drive shareholder value over time

17

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

|

Appendix

2 0 1 3

INSURANCE CONFERENCE |

Safe Harbor Statement

20

These materials may contain or incorporate by reference information that includes or is based upon

forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to

historical or current facts. They use words such as “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in connection

with a discussion of future operating or financial performance. In particular, these include

statements relating to future actions, prospective services or products, future performance or

results of current and anticipated services or products, sales efforts, expenses, the outcome of

contingencies such as legal proceedings, trends in operations and financial results.

Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate

assumptions or by known or unknown risks and uncertainties. Many such factors will be important

in determining the actual future results of MetLife, Inc., its subsidiaries and affiliates. These statements are based on current expectations and the current economic

environment. They involve a number of risks and uncertainties that are difficult to predict. These

statements are not guarantees of future performance. Actual results could differ materially

from those expressed or implied in the forward-looking statements. Risks, uncertainties, and other factors that might cause such differences include the risks, uncertainties

and other factors identified in MetLife, Inc.’s filings with the U.S. Securities and Exchange

Commission (the “SEC”). These factors include: (1) difficult conditions in the global capital

markets; (2) concerns over U.S. fiscal policy and the “fiscal cliff” in the U.S., as well as

rating agency downgrades of U.S. Treasury securities; (3) uncertainty about the effectiveness of

governmental and regulatory actions to stabilize the financial system, the imposition of fees relating

thereto, or the promulgation of additional regulations; (4) increased volatility and disruption

of the capital and credit markets, which may affect our ability to seek financing or access our credit facilities; (5) impact of comprehensive financial services regulation reform

on us; (6) economic, political, legal, currency and other risks relating to our international

operations, including with respect to fluctuations of exchange rates; (7) exposure to financial

and capital market risk, including as a result of the disruption in Europe and possible withdrawal of

one or more countries from the Euro zone; (8) changes in general economic conditions, including

the performance of financial markets and interest rates, which may affect our ability to raise capital, generate fee income and market-related revenue and finance

statutory reserve requirements and may require us to pledge collateral or make payments related to

declines in value of specified assets; (9) potential liquidity and other risks resulting from

our participation in a securities lending program and other transactions; (10) investment losses and defaults, and changes to investment valuations; (11) impairments of goodwill

and realized losses or market value impairments to illiquid assets; (12) defaults on our mortgage

loans; (13) the defaults or deteriorating credit of other financial institutions that could

adversely affect us; (14) our ability to address unforeseen liabilities, asset impairments, or rating

actions arising from acquisitions or dispositions, including our acquisition of American Life

Insurance Company and Delaware American Life Insurance Company (collectively, “ALICO”) and to successfully integrate and manage the growth of acquired businesses with

minimal disruption; (15) uncertainty with respect to the outcome of the closing agreement entered into

with the United States Internal Revenue Service in connection with the acquisition of ALICO;

(16) the dilutive impact on our stockholders resulting from the settlement of common equity units issued in connection with the acquisition of ALICO or otherwise;

(17) regulatory and other restrictions affecting MetLife, Inc.’s ability to pay dividends and

repurchase common stock; (18) MetLife, Inc.’s primary reliance, as a holding company, on

dividends from its subsidiaries to meet debt payment obligations and the applicable regulatory

restrictions on the ability of the subsidiaries to pay such dividends; (19) downgrades in our

claims paying ability, financial strength or credit ratings; (20) ineffectiveness of risk management policies and procedures; (21) availability and effectiveness of reinsurance or

indemnification arrangements, as well as default or failure of counterparties to perform; (22)

discrepancies between actual claims experience and assumptions used in setting prices for our

products and establishing the liabilities for our obligations for future policy benefits and claims; (23) catastrophe losses; (24) heightened competition, including with respect to

pricing, entry of new competitors, consolidation of distributors, the development of new products by

new and existing competitors, distribution of amounts available under U.S. government programs,

and for personnel; (25) unanticipated changes in industry trends; (26) changes in assumptions related to investment valuations, deferred policy acquisition

costs, deferred sales inducements, value of business acquired or goodwill; (27) changes in accounting

standards, practices and/or policies; (28) increased expenses relating to pension and

postretirement benefit plans, as well as health care and other employee benefits; (29) exposure to losses related to variable annuity guarantee benefits, |

Safe Harbor Statement (Continued)

21

including from significant and sustained downturns or extreme volatility in equity markets, reduced

interest rates, unanticipated policyholder behavior, mortality or longevity, and the adjustment

for nonperformance risk; (30) deterioration in the experience of the “closed block” established in connection with the

reorganization of Metropolitan Life Insurance Company; (31) adverse results or other consequences from

litigation, arbitration or regulatory investigations; (32) inability to protect our

intellectual property rights or claims of infringement of the intellectual property rights of others; (33) discrepancies between actual

experience and assumptions used in establishing liabilities related to other contingencies or

obligations; (34) regulatory, legislative or tax changes relating to our insurance, banking,

international, or other operations that may affect the cost of, or demand for, our products or services, or increase the cost or

administrative burdens of providing benefits to employees; (35) the effects of business disruption or

economic contraction due to disasters such as terrorist attacks, cyberattacks, other

hostilities, or natural catastrophes, including any related impact on our disaster recovery systems, cyber- or other information

security systems and management continuity planning; (36) the effectiveness of our programs and

practices in avoiding giving our associates incentives to take excessive risks; and (37) other

risks and uncertainties described from time to time in MetLife, Inc.’s filings with the SEC.

MetLife, Inc. does not undertake any obligation to publicly correct or update any forward-looking

statement if MetLife, Inc. later becomes aware that such statement is not likely to be

achieved. Please consult any further disclosures MetLife, Inc. makes on related subjects in reports to the SEC.

|

Explanatory Note on Non-GAAP Financial Information

Any references in this presentation (except in this Explanatory Note on

Non-GAAP Financial Information slide and the Appendix) to net income

(loss), net income (loss) per share, operating earnings, operating earnings per

share, book value per common share, premiums, fees and other revenues and

operating return on equity, should be read as net income (loss) available to MetLife, Inc.'s common shareholders, net income

(loss) available to MetLife, Inc.'s common shareholders per diluted common share,

operating earnings available to common shareholders, operating

earnings

available

to

common

shareholders

per

diluted

common

share,

book

value

per

common

share,

excluding

accumulated

other

comprehensive income (loss) ("AOCI"), premiums, fees and other revenues

(operating) and operating return on MetLife, Inc.’s common equity,

excluding AOCI, respectively.

Operating

earnings

is

the

measure

of

segment

profit

or

loss

that

MetLife

uses

to

evaluate

segment

performance

and

allocate

resources.

Consistent with accounting principles generally accepted in the United States of

America ("GAAP") accounting guidance for segment reporting,

operating

earnings

is

MetLife's

measure

of

segment

performance.

Operating

earnings

is

also

a

measure

by

which

MetLife

senior

management's and many other employees' performance is evaluated for the purposes of

determining their compensation under applicable compensation plans.

Operating earnings is defined as operating revenues less operating expenses, both

net of income tax. Operating earnings available to common shareholders

is defined as operating earnings less preferred stock dividends.

Operating

revenues

and

operating

expenses

exclude

results

of

discontinued

operations

and

other

businesses

that

have

been

or

will

be

sold

or

exited by MetLife, Inc. (“Divested Businesses”). Operating revenues

also excludes net investment gains (losses) (“NIGL”) and net derivative

gains (losses) (“NDGL”). Operating expenses also excludes goodwill

impairments. The following additional adjustments are made to GAAP revenues,

in the line items indicated, in calculating operating revenues: •

Universal life and investment-type product policy fees excludes the

amortization of unearned revenue related to NIGL and NDGL and certain

variable annuity guaranteed minimum income benefits ("GMIB") fees

("GMIB Fees"); •

Net investment income: (i) includes amounts for scheduled periodic settlement

payments and amortization of premium on derivatives that are hedges of

investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations,

(iii) excludes post-tax operating earnings adjustments relating to insurance

joint ventures accounted for under the equity method, (iv) excludes certain

amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to

securitization entities that are variable interest entities ("VIEs")

consolidated under GAAP; and •

Other revenues are adjusted for settlements of foreign currency earnings hedges.

22 |

Explanatory Note on Non-GAAP Financial Information

(Continued)

23

The following additional adjustments are made to GAAP expenses, in the line items indicated, in

calculating operating expenses:

•

Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder

dividend obligation related to NIGL and NDGL, (ii) inflation-indexed benefit adjustments

associated with contracts backed by inflation-indexed investments and amounts associated

with periodic crediting rate adjustments based on the total return of a contractually referenced pool

of assets, (iii) benefits and hedging costs related to GMIBs ("GMIB Costs"), and (iv)

market value adjustments associated with surrenders or terminations of contracts ("Market Value

Adjustments");

•

Interest credited to policyholder account balances includes adjustments for scheduled periodic

settlement payments and amortization of premium on derivatives that are hedges of policyholder

account balances but do not qualify for hedge accounting treatment and excludes amounts related

to net investment income earned on contractholder-directed unit-linked investments;

•

Amortization of deferred policy acquisition costs (“DAC”) and value of business acquired

("VOBA") excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB Fees and GMIB Costs,

and (iii) Market Value Adjustments;

•

Amortization of negative VOBA excludes amounts related to Market Value Adjustments; •

Interest expense on debt excludes certain amounts related to securitization entities that are VIEs

consolidated under GAAP; and

•

Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new

insurance regulatory requirements, and (iii) acquisition and integration costs. Operating return on MetLife, Inc.'s common equity is defined as operating earnings available to common

shareholders divided by average GAAP common equity. Operating expense

ratio is calculated by dividing operating expenses (other expenses net of capitalization of DAC) by premiums, fees and other

revenues (operating).

MetLife believes the presentation of operating earnings and operating earnings available

to common shareholders as MetLife measures it for management purposes enhances the

understanding of the company's performance by highlighting the results of operations and the underlying

profitability drivers of the business. Operating revenues, operating expenses, operating

earnings, operating earnings available to common shareholders, operating earnings available to

common shareholders per diluted common share, book value per common share, excluding AOCI, book

value per diluted common share, excluding AOCI, operating return on MetLife, Inc.’s common equity, operating return on MetLife, Inc.’s

common equity, excluding AOCI, investment portfolio gains (losses) and derivative gains (losses)

should not be viewed as substitutes for the following financial measures calculated in

accordance with GAAP: GAAP revenues, GAAP expenses, GAAP income (loss) from continuing

operations, net of income tax, GAAP net income (loss) available to MetLife, Inc.'s common

shareholders, GAAP net income (loss) available to MetLife, Inc.'s common shareholders per

diluted common share, book value per common share, book value per diluted common share, return on

MetLife, Inc.’s common equity, return on MetLife, Inc.’s common equity, excluding AOCI, net

investment gains (losses) and net derivative gains (losses), respectively. |

Explanatory Note on Non-GAAP Financial Information

(Continued)

24

For the historical periods presented, reconciliations of non-GAAP measures used in this

presentation to the most directly comparable GAAP measures may be included in an Appendix to

the presentation materials and/or are on the Investor Relations portion of our Internet website.

Additional information about our historical results is also available on our Internet website in our

Quarterly Financial Supplements for the corresponding periods. Managed Assets (as

defined below) is a financial measure based on methodologies other than GAAP. MetLife utilizes “Managed Assets” to

describe assets in its investment portfolio which are actively managed and reflected at estimated fair

value. MetLife believes the use of Managed Assets enhances the understanding and

comparability of its investment portfolio by excluding assets such as policy loans, other invested assets,

mortgage loans held-for-sale, and mortgage loans held by consolidated securitization entities,

as substantially all of those assets are not actively managed in MetLife’s investment

portfolio. Trading and other securities are also excluded as this amount is primarily comprised of contractholder-

directed unit-linked investments, where the contractholder, and not the company, directs the

investment of these funds. Mortgage loans and certain real estate investments have also been

adjusted from carrying value to estimated fair value.

The non-GAAP measures used in this presentation should not be viewed as substitutes for the most

directly comparable GAAP measures.

In this presentation, we may refer to sales activity for various products. These sales statistics do

not correspond to revenues under GAAP, but are used as relevant measures of business

activity.

The impact of changes in foreign currency exchange rates is calculated using the average foreign

currency exchange rates for the current period and is applied to the prior period. In this

presentation, we may provide guidance on our future earnings, premiums, fees and other revenues, earnings per diluted common share,

book value per common share and return on common equity on an operating or non-GAAP

basis. A reconciliation of the non-GAAP measures to the most directly comparable GAAP

measures is not accessible on a forward-looking basis because we believe it is not possible to provide other

than a range of net investment gains and losses and net derivative gains and losses, which can

fluctuate significantly within or without the range and from period to period and may have a

significant impact on GAAP net income. |

Reconciliations

2 0 1 3

INSURANCE CONFERENCE |

Reconciliation of Operating Earnings Available to Common Shareholders to

Income (Loss) from Continuing Operations, Net of Income Tax

26

(In millions, except per share data)

Operating earnings available to common shareholders

5,686

$

$ 5.28

4,677

$

$ 4.38

Add: Preferred stock dividends

122

0.11

122

0.11

Operating earnings

$ 5,808

$ 5.39

$ 4,799

$ 4.49

Adjustments from operating earnings to income (loss) from continuing operations,

net of income tax: Add: Net investment gains (losses)

(352)

(0.33)

(867)

(0.81)

Add: Net derivative gains (losses)

(1,919)

(1.78)

4,824

4.52

Add: Goodwill impairment

(1,868)

(1.73)

-

-

Add: Other adjustments to continuing operations

(2,550)

(2.37)

(1,451)

(1.36)

Add: Provision for income tax (expense) benefit

2,195

2.04

(914)

(0.86)

Income (loss) from continuing operations, net of income tax

1,314

$

1.22

$

6,391

$

5.98

$

Weighted average

common

shares

outstanding

-

diluted

1,076.8

1,068.1

2012

2011 |

Reconciliation

of

Premiums,

Fees

&

Other

Revenues

(Operating)

to

Premiums,

Fees

&

Other Revenues (GAAP)

(In millions)

2012

2011

Premiums, fees & other revenues (operating)

47,879

$

45,449

$

Adjustments from premiums, fees & other revenues (operating) to

premiums, fees & other revenues (GAAP):

Add: Premiums

64

92

Add: Universal life and investment-type product policy fees

344

278

Add: Other revenues

150

880

Premiums, fees & other revenues (GAAP)

48,437

$

46,699

$

27 |

Reconciliation of Return on Common Equity

2012

2011

Return on MetLife, Inc.'s Common Equity

Operating return on MetLife, Inc.'s common equity, excluding AOCI (1)

11.3%

10.1%

Operating return on MetLife, Inc.'s common equity (1)

9.6%

9.3%

Return on MetLife, Inc.'s common equity, excluding AOCI (2)

2.4%

13.2%

Return on MetLife, Inc.'s common equity (2)

2.0%

12.2%

Book Value Per Common Share (3)

Book value per common share, excluding accumulated other comprehensive

income (loss) - (actual common shares outstanding)

46.73

$

46.69

$

10.44

5.74

Book value per common share - (actual common shares outstanding)

57.17

$

52.43

$

Common shares outstanding, end of period (in millions)

1,091.7

1,058.0

(1) Operating return on MetLife, Inc.'s common equity is defined as operating earnings available

to common shareholders divided by average GAAP common equity. (2) Return on MetLife, Inc.'s

common equity is defined as net income available to common shareholders divided by average GAAP common equity.

(3) Book value per common share, book value per common share, excluding accumulated other

comprehensive income (loss) and MetLife, Inc.'s common equity exclude $2,043 million of equity.

Add: Accumulated other comprehensive income (loss) per common share

28 |

|