Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d482426d8k.htm |

Fifth Third Bank | All Rights Reserved

Credit Suisse

Financial Services Forum

Kevin T. Kabat

Vice Chairman and Chief Executive Officer

February 13, 2013

Refer to earnings release dated January 17, 2013 for further information

Exhibit 99.1 |

2

Fifth Third Bank | All Rights Reserved

Well-positioned for success and leadership in new banking landscape

Key themes |

3

Fifth Third Bank | All Rights Reserved

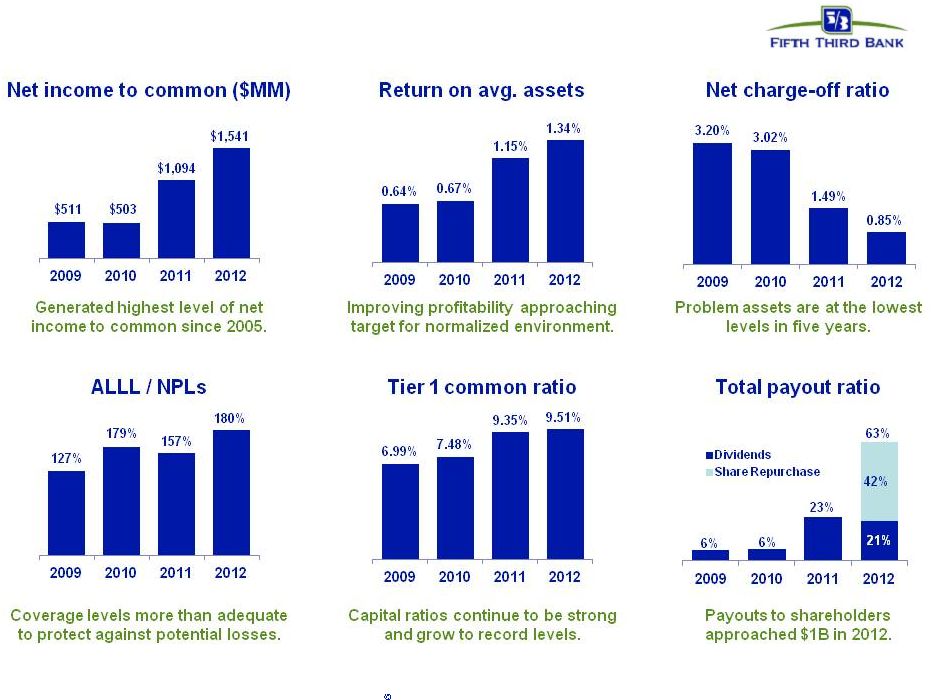

A strong franchise with strong momentum |

4

Fifth Third Bank | All Rights Reserved

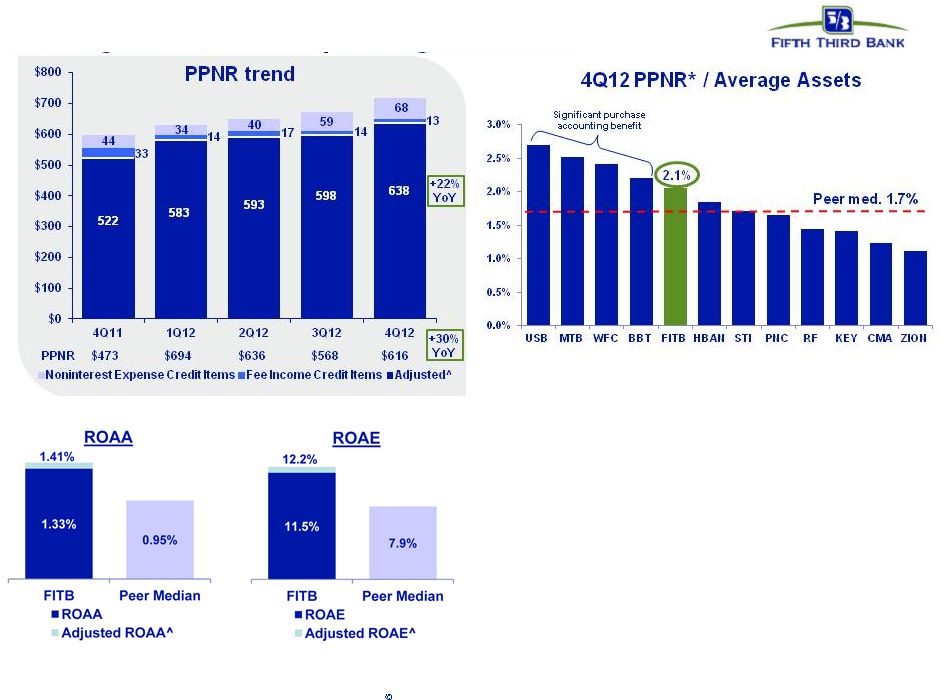

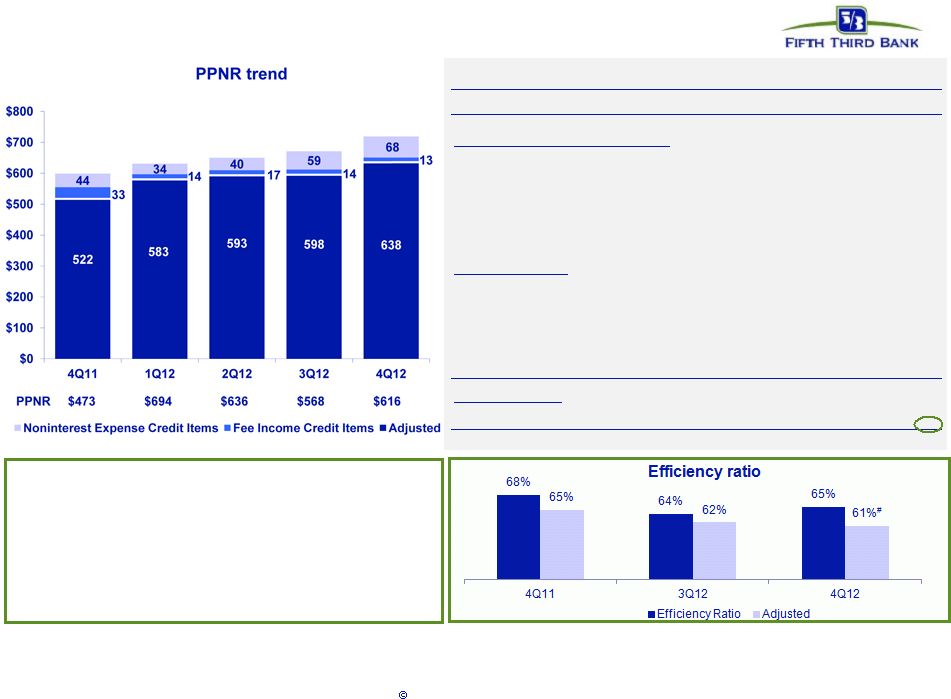

Strong revenue and profit generation

4Q12 returns strong relative to peers

•

Business mix provides higher than

average diversity among spread and fee

revenues (40+% of revenue)

•

Relatively strong margin and relatively

high fee income contribution drives

strong revenue and PPNR generation

profitability despite interest rate

environment

PPNR is a Non-GAAP measure. See Reg. G reconciliation in the Appendix to

the presentation. Source: SNL Financial and Company Reports. Peer median

includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC, and ZION *

Excludes securities gains / losses for FITB and peers. Also excludes goodwill impairment charge for peers as applicable.

^ See Page 18 in the Appendix for adjustments |

5

Fifth Third Bank | All Rights Reserved

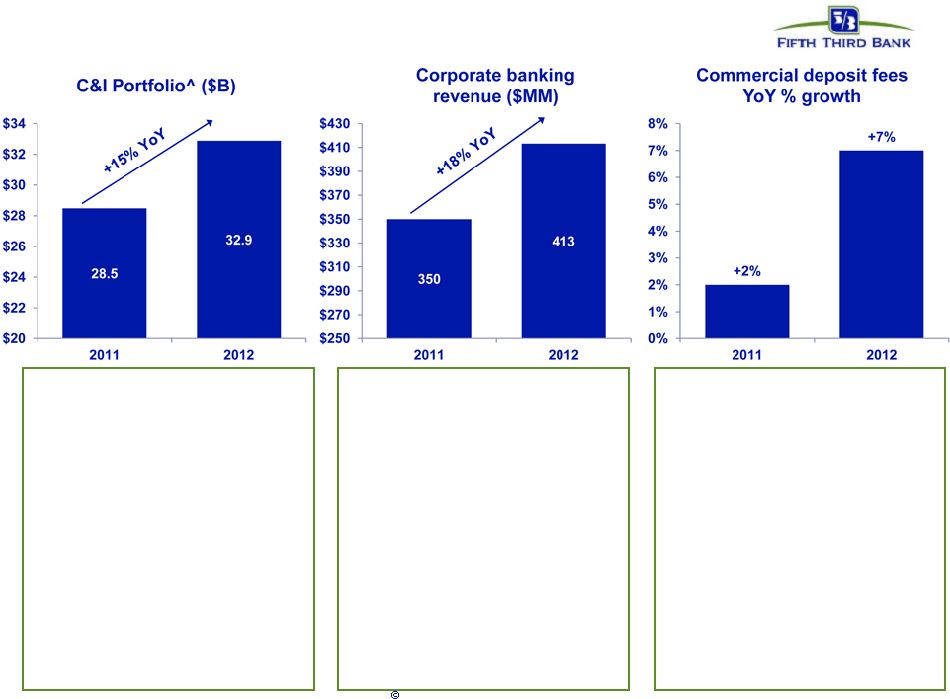

Corporate banking business generating growth

•

Reflects investments in mid-

corporate space (businesses

that generate $200MM to $2B

in revenue)

•

C&I production broad based

across industries and

sectors

–

Strength in

manufacturing and

healthcare industries

•

Launch of Energy Lending

concentration contributed to

4Q12 production and

expected to contribute to

future growth in C&I

^ Presented on an average basis; Excluding held-for-sale loans.

•

Growth in corporate banking

revenue driven by:

–

Investments in capital

markets capabilities

–

Increased syndication

and business lending

fees

•

Led or co-led ~80% of

syndications in 2012 versus

~60% in 2011

•

Broad product set and

capabilities to deliver

solutions that meet client

needs

•

Growth from investments in

treasury management

business

•

Remote Currency Manager

(RCM) contributed ~$13MM in

revenue in 2012

–

Remote cash management

solution that simplifies

cash handling and

improves cash flow

•

Specialized healthcare

industry products including

RevLink Solutions platform;

~20% increase in accounts

from a year ago |

6

Fifth Third Bank | All Rights Reserved

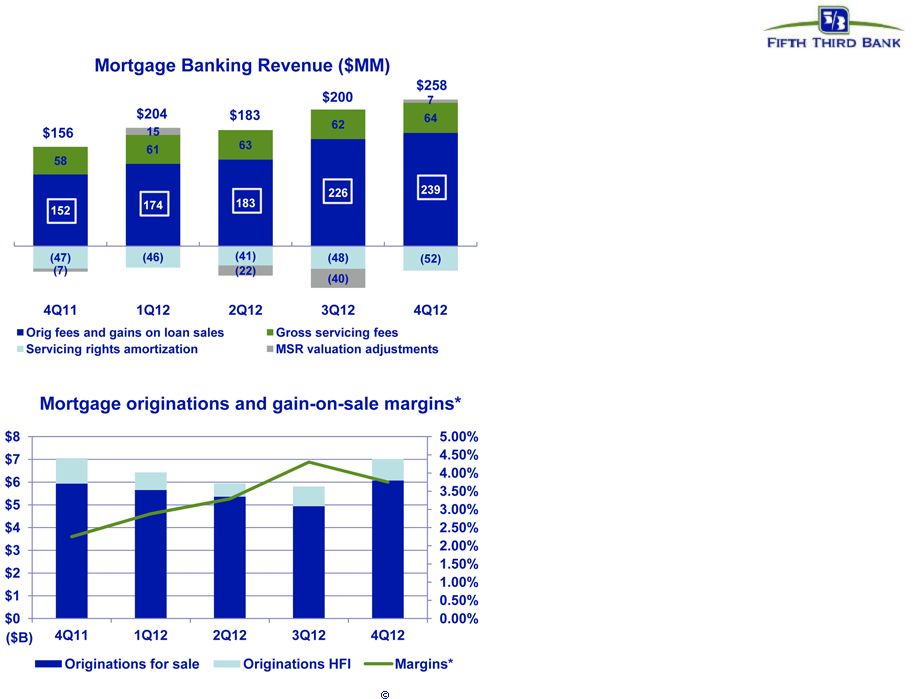

Strong mortgage banking results

•

Record origination fees and gain on

loan sales in FY12

–

Driven by record gain on sales

margin and origination volumes

–

2012 origination fees and gain on

loan sales increased 108% to

$822MM from 2011

–

Originations increased 35% to

$25.2B in 2012 versus $18.6B in

2011

Looking forward into 2013:

•

Expect solid mortgage revenue,

although lower than recent quarters

due to:

–

Pressure on margins (competitive

/ market)

–

Waning of refinance boom

–

Partially offset by better mortgage

servicing results

* Gain-on-sale margin represents margin on loans originated for sale.

•

Maintained mortgage market share

position in Top 20 |

7

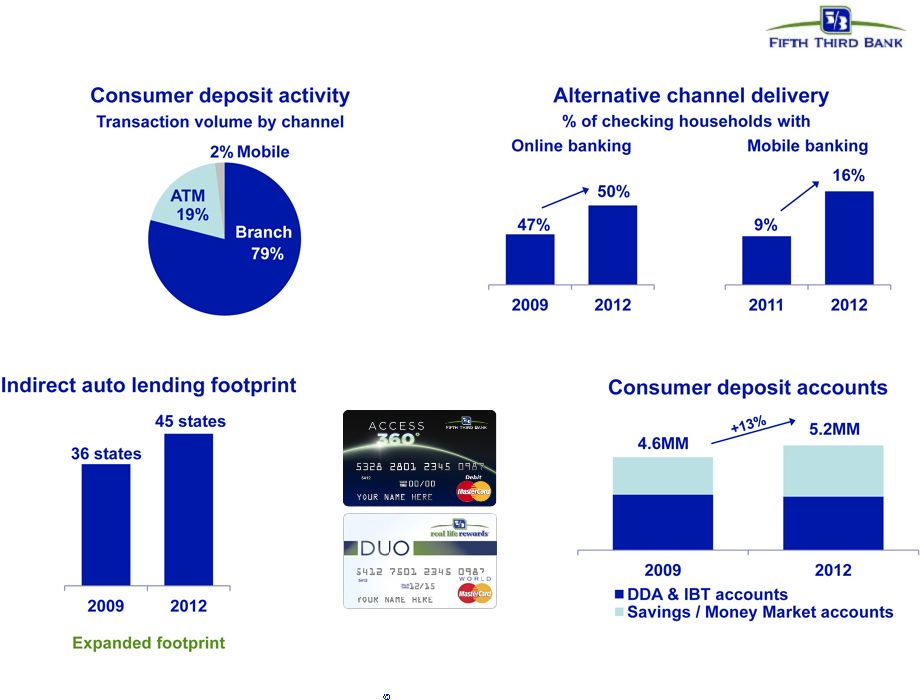

Fifth Third Bank | All Rights Reserved

Momentum building in consumer bank as a

result of investments and strategic changes

More distribution channels for customers to access our products and services

4Q12 consumer deposit account average balance

increased 16% compared with 4Q09

Card innovation

New products that fit the way

customers choose to bank |

8

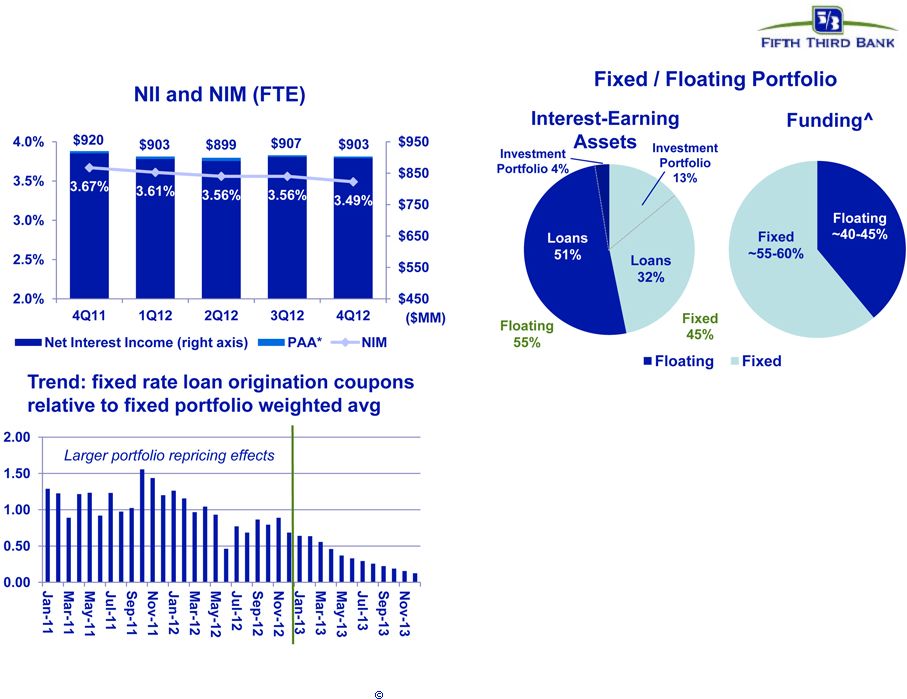

Fifth Third Bank | All Rights Reserved

NII results reflect continued moderate NIM

pressure offset by balance sheet growth

* Represents purchase accounting adjustments included in net interest income.

^ Estimate; funding (DDAs + interest-bearing liabilities); liabilities

attributed to fixed or floating using terms and expected beta •

Negative impact of lower rates on net interest

income generally offset by loan growth

•

Spreads on new originations of variable rate

assets consistent with historical spreads

•

Coupons on new fixed rate loan originations

converging with portfolio average coupons

–

Emphasis on variable rate C&I lending |

9

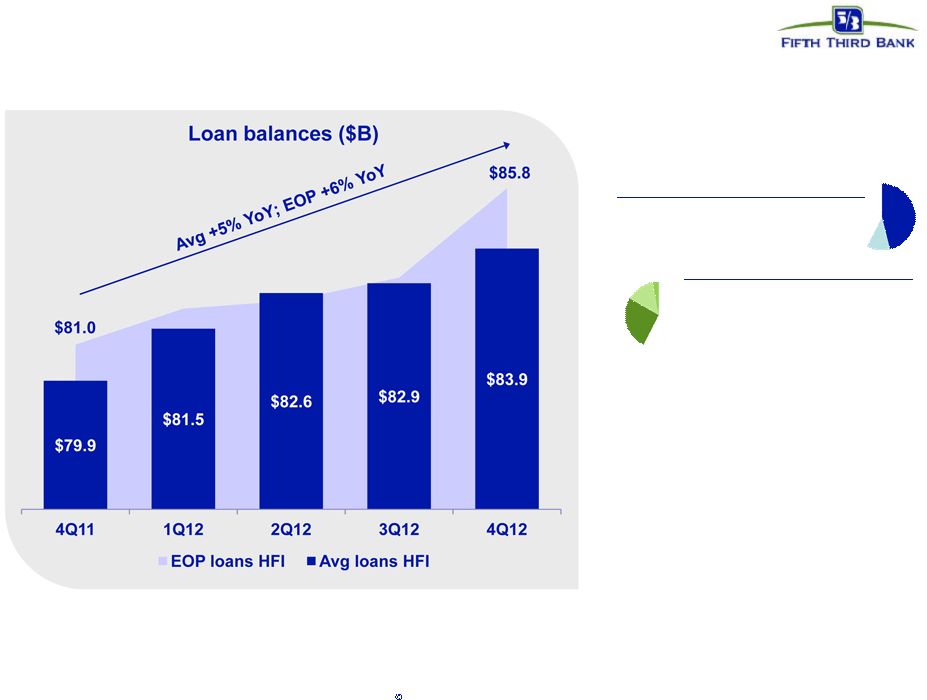

Fifth Third Bank | All Rights Reserved

Loan growth excelled in 2012,

ample opportunities for ongoing growth

Loan composition

46% C&I / lease

11% Commercial real estate

Commercial

26% Resi. mtg. / home equity

14% Auto

3% Card / other

Consumer

•

Solid loan growth with

disciplined lending standards

throughout 2012

•

C&I and residential mortgage

balance growth more than

offset run-off in both home

equity and commercial real

estate loans (CRE run-off

continues to slow) |

10

Fifth Third Bank | All Rights Reserved

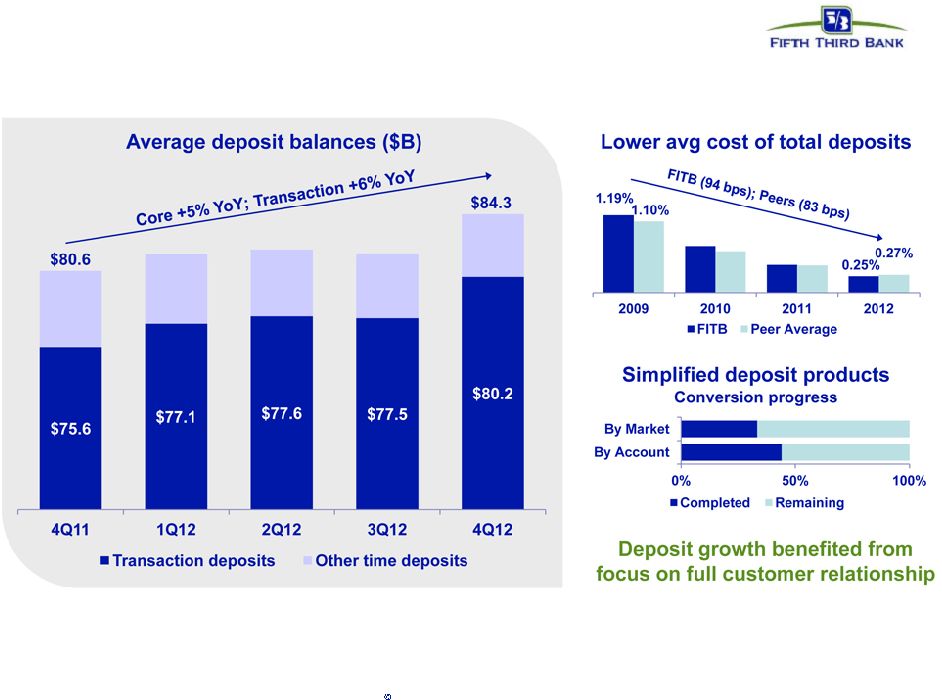

Strengthened deposit profile

and increased value proposition to customers

Source: SNL Financial. Peer average includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF,

STI, USB, WFC, ZION |

11

Fifth Third Bank | All Rights Reserved

Disciplined expense management

•

Long-term target for mid-50% efficiency

ratio in normalized environment (with

higher interest rate environment)

2012 expense trend ($MM)

* Non-recurring items described on page 18 in the appendix to this

presentation. Reported expense

Increasing expense

Non-recurring items*:

Adjusted expense

Decreasing expense

$973

$937

$1,006

$23

$18

$5

($29)

--

($55)

$967

$955

$956

Managing expenses carefully in response to revenue

environment; continuous process of expense evaluation

Efficiency ratio trend

--

($173)

$990

$1,163

–

Current

impact

of

credit

costs

on

revenue

and

expenses;

impact

of

regulatory

reforms

(e.g.,

debit

interchange)

not

fully

mitigated

–

Reflects

below-capacity

balance

sheet

and

lower

revenue

than

we

expect

and

can

support

longer

term

–

~60%

for

year

end

2013 |

12

Fifth Third Bank | All Rights Reserved

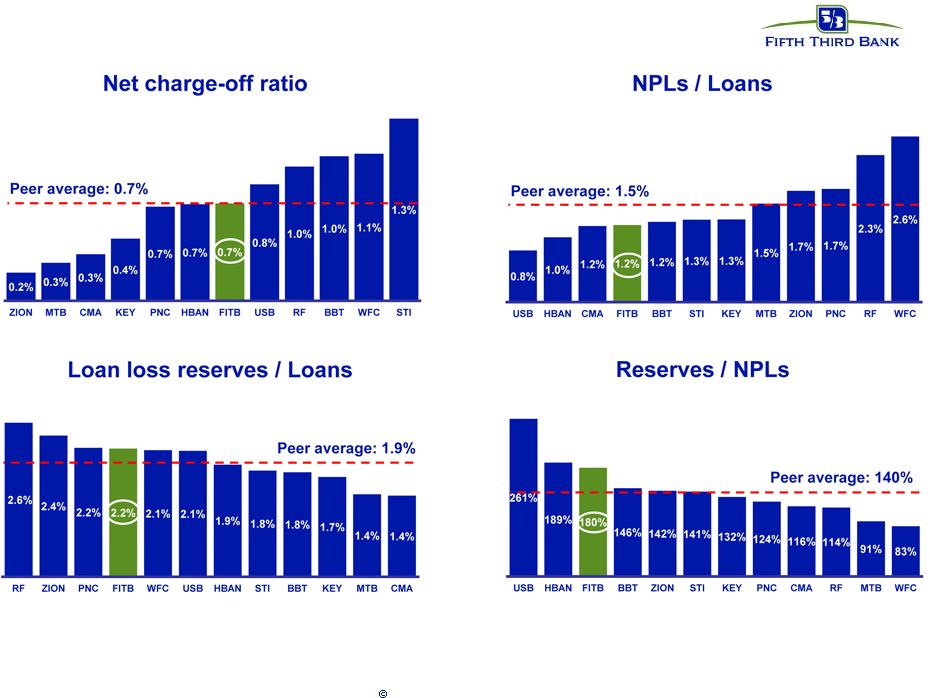

Credit trends continue to improve

with strong reserve coverage levels

Source: SNL Financial and Company Reports. Data as of 4Q12. HFI NPLs exclude loans

held-for-sale and also exclude covered assets for BBT, USB, and ZION

Continued decline in problem assets and corresponding decline in

charge-offs combined

with strong reserves on an absolute and relative basis

|

13

Fifth Third Bank | All Rights Reserved

Capital management philosophy

* Subject to Board of Directors and regulatory approval

Organic growth opportunities

•

Support growth of core banking franchise

•

Continued loan growth despite sluggish

economy

Strategic opportunities

*

•

Prudently evaluate franchise including

increasing density in core markets via

disciplined acquisitions or selective de

novos

•

Expect future acquisition opportunities

although activity remains muted in near-term

•

Attain top 3 market position in 65% of

markets or more longer term

Dividends*

•

Move towards levels more consistent with

Fed’s near-term payout ratio guidance of

30%

•

Strong levels of profitability would support

higher dividend than current level

•

Quarterly dividend increased to $0.10 in

3Q12

Repurchases / Redemptions

*

•

Common share repurchases to limit and

manage growth of excess capital levels

•

Redeemed $1.4bn in TruPS in 3Q12

Expect capital philosophy to remain consistent

pending evaluation of results in 2013 CCAR process

Capital Deployment

Capital Return

–

Manage capital in light of regulatory

environment, other alternatives,

maintenance of desired / required buffers,

stock price

–

2012 capital plan included $600MM of

repurchases over five quarters ended 1Q13

($125MM ASR entered into in January) |

14

Fifth Third Bank | All Rights Reserved

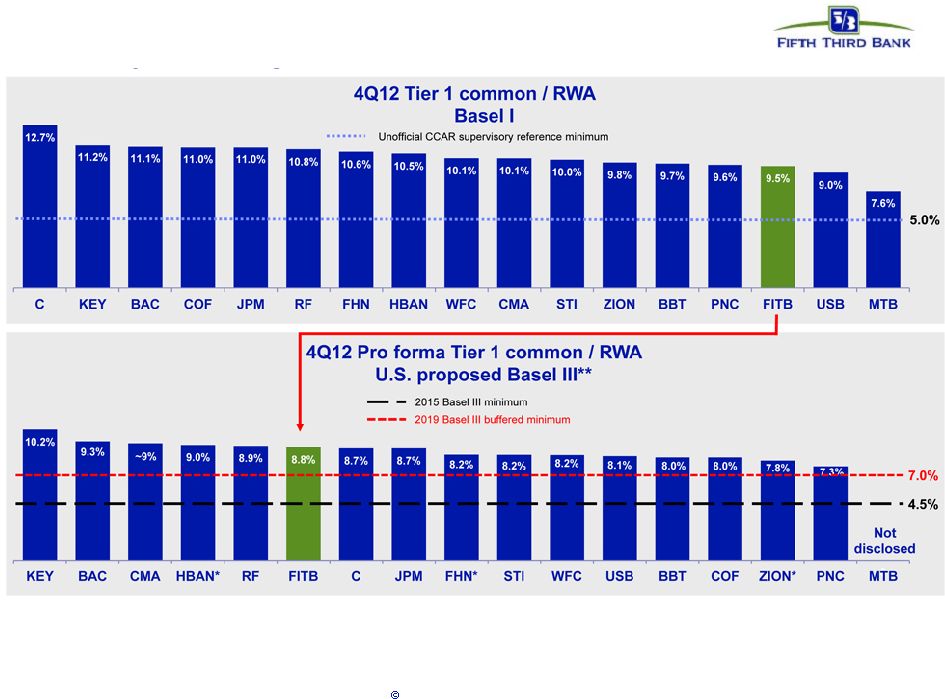

Fifth Third’s balance sheet and business model

relatively advantaged under new capital standards

Source: SNL Financial and company reports (financial data as of 4Q12).

*

In

2Q12,

HBAN

stated

Basel

III

Tier

1

common

ratio

would

be

negatively

impacted

by

approximately

150

basis

points.

In

2Q12,

ZION

stated

Tier

1

common

ratio

would

be

in

the

7.75%

area.

In

3Q12

FHN

stated

Basel

III

Tier

1

common

ratio

would

be

negatively

impacted

by

approximately

240

basis

points.

** Note: Fifth Third’s pro forma Tier I common equity ratio is

management’s estimate based upon its current interpretation of the three draft Federal Register notices proposing

enhancements to regulatory capital requirements published in June 2012. The actual

impact to the Bancorp’s Tier I common equity ratio may change significantly due to further clarification

of the agencies proposals or revisions to the agencies final rules, which remain

subject to public comment. Not adjusted for potential mitigation efforts. Fifth

Third’s capital position already well in excess of any established standards, likely standards, and most peers |

15

Fifth Third Bank | All Rights Reserved

FITB

“Trillionaire”

Banks

Regional

Banks

Community

Banks

Investment

Banks

Diverse businesses

Efficiencies

of scale

Local market focus

Multi-channel

delivery

Customer-centric

model

Moderate risk

profile

Strong profitability

and well-capitalized

Fifth Third: A differentiated business model

Competitively well-positioned in new landscape

|

16

Fifth Third Bank | All Rights Reserved

Cautionary statement

This

report

contains

statements

that

we

believe

are

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Rule

175

promulgated

thereunder,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

and

Rule

3b-6

promulgated

thereunder.

These

statements

relate

to

our

financial

condition,

results

of

operations,

plans,

objectives,

future

performance

or

business.

They

usually

can

be

identified

by

the

use

of

forward-looking

language

such

as

“will

likely

result,”

“may,”

“are

expected

to,”

“is

anticipated,”

“estimate,”

“forecast,”

“projected,”

“intends

to,”

or

may

include

other

similar

words

or

phrases

such

as

“believes,”

“plans,”

“trend,”

“objective,”

“continue,”

“remain,”

or

similar

expressions,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could,”

“might,”

“can,”

or

similar

verbs.

You

should

not

place

undue

reliance

on

these

statements,

as

they

are

subject

to

risks

and

uncertainties,

including

but

not

limited

to

the

risk

factors

set

forth

in

our

most

recent

Annual

Report

on

Form

10-K.

When

considering

these

forward-looking

statements,

you

should

keep

in

mind

these

risks

and

uncertainties,

as

well

as

any

cautionary

statements

we

may

make.

Moreover,

you

should

treat

these

statements

as

speaking

only

as

of

the

date

they

are

made

and

based

only

on

information

then

actually

known

to

us.

There

are

a

number

of

important

factors

that

could

cause

future

results

to

differ

materially

from

historical

performance

and

these

forward-

looking

statements.

Factors

that

might

cause

such

a

difference

include,

but

are

not

limited

to:

(1)

general

economic

conditions

and

weakening

in

the

economy,

specifically

the

real

estate

market,

either

nationally

or

in

the

states

in

which

Fifth

Third,

one

or

more

acquired

entities

and/or

the

combined

company

do

business,

are

less

favorable

than

expected;

(2)

deteriorating

credit

quality;

(3)

political

developments,

wars

or

other

hostilities

may

disrupt

or

increase

volatility

in

securities

markets

or

other

economic

conditions;

(4)

changes

in

the

interest

rate

environment

reduce

interest

margins;

(5)

prepayment

speeds,

loan

origination

and

sale

volumes,

charge-offs

and

loan

loss

provisions;

(6)

Fifth

Third’s

ability

to

maintain

required

capital

levels

and

adequate

sources

of

funding

and

liquidity;

(7)

maintaining

capital

requirements

may

limit

Fifth

Third’s

operations

and

potential

growth;

(8)

changes

and

trends

in

capital

markets;

(9)

problems

encountered

by

larger

or

similar

financial

institutions

may

adversely

affect

the

banking

industry

and/or

Fifth

Third;

(10)

competitive

pressures

among

depository

institutions

increase

significantly;

(11)

effects

of

critical

accounting

policies

and

judgments;

(12)

changes

in

accounting

policies

or

procedures

as

may

be

required

by

the

Financial

Accounting

Standards

Board

(FASB)

or

other

regulatory

agencies;

(13)

legislative

or

regulatory

changes

or

actions,

or

significant

litigation,

adversely

affect

Fifth

Third,

one

or

more

acquired

entities

and/or

the

combined

company

or

the

businesses

in

which

Fifth

Third,

one

or

more

acquired

entities

and/or

the

combined

company

are

engaged,

including

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act;

(14)

ability

to

maintain

favorable

ratings

from

rating

agencies;

(15)

fluctuation

of

Fifth

Third’s

stock

price;

(16)

ability

to

attract

and

retain

key

personnel;

(17)

ability

to

receive

dividends

from

its

subsidiaries;

(18)

potentially

dilutive

effect

of

future

acquisitions

on

current

shareholders’

ownership

of

Fifth

Third;

(19)

effects

of

accounting

or

financial

results

of

one

or

more

acquired

entities;

(20)

difficulties

from

the

separation

of

or

the

results

of

operations

of

Vantiv,

LLC

from

Fifth

Third;

(21)

loss

of

income

from

any

sale

or

potential

sale

of

businesses

that

could

have

an

adverse

effect

on

Fifth

Third’s

earnings

and

future

growth;

(22)

ability

to

secure

confidential

information

through

the

use

of

computer

systems

and

telecommunications

networks;

and

(23)

the

impact

of

reputational

risk

created

by

these

developments

on

such

matters

as

business

generation

and

retention,

funding

and

liquidity.

You

should

refer

to

our

periodic

and

current

reports

filed

with

the

Securities

and

Exchange

Commission,

or

“SEC,”

for

further

information

on

other

factors,

which

could

cause

actual

results

to

be

significantly

different

from

those

expressed

or

implied

by

these

forward-looking

statements. |

17

Fifth Third Bank | All Rights Reserved

Appendix |

18

Fifth Third Bank | All Rights Reserved

($ in millions)

4Q11

1Q12

2Q12

3Q12

4Q12

Income before income taxes (U.S. GAAP) (a)

$418

$603

$565

$503

$540

Add: Provision expense (U.S. GAAP) (b)

55

91

71

65

76

PPNR (a) + (b)

$473

$694

$636

$568

$616

Adjustments to remove (benefit) / detriment^:

In noninterest income:

Gain from Vantiv IPO (1Q12) and sale of shares (4Q12)

-

(115)

-

-

(157)

Vantiv debt refinancing

-

34

-

-

-

Valuation of 2009 Visa total return swap

54

19

11

1

15

Vantiv warrant & puts

(10)

(46)

(56)

16

19

Valuation of bank premises moved to HFS

-

-

17

-

-

Litigation reserve additions in revenue

-

-

6

-

-

Sale of certain Fifth Third funds

-

-

-

(13)

-

Securities (gains) / losses

(5)

(9)

(3)

(2)

(2)

In noninterest expense:

Debt extinguishment (gains) / losses

-

9

-

26

134

Non-income tax related assessment resolution

-

(23)

-

-

-

Sale of certain Fifth Third funds

-

-

-

2

-

Termination of certain borrowing & hedging transactions

-

-

-

-

-

Severance expense

-

6

-

-

-

FDIC insurance expense

-

-

(9)

-

-

Gain on sale of affordable housing

-

-

(8)

(5)

-

Litigation reserve additions in expense

10

14

(1)

5

13

Adjusted PPNR

$522

$583

$593

$598

$638

Credit-related items^^:

In noninterest income

33

14

17

14

13

In noninterest expense

44

34

40

59

68

Credit-adjusted PPNR**

$599

$631

$650

$671

$719

Pre-tax pre-provision earnings*

* Non-GAAP measure. See Reg. G reconciliation on pages 20 and 21.

**

There

are

limitations

on

the

usefulness

of

credit-adjusted

PPNR,

including

the

significant

degree

to

which

changes

in

credit

and

fair

value

are

integral,

recurring

components

of

the

Bancorp’s

core

operations

as

a

financial

institution.

This

measure

has

been

included

herein

to

facilitate

a

greater

understanding

of

the

Bancorp’s

financial

condition.

^ Prior quarters include similar adjustments.

^^ See Slide 19 for detailed breakout of credit-related items.

# 60% also excluding 4Q12 mortgage repurchase reserve build

•

PPNR of $616MM up 8% from 3Q12 levels and

30% from prior year

•

Adjusted PPNR of $638MM, up 7% sequentially and

22% year-over-year

—

Including 4Q12 mortgage repurchase reserve

build of $29MM in adjustments, related to new

Freddie Mac guidance, adjusted PPNR of

$667MM

PPNR reconciliation |

19

Fifth Third Bank | All Rights Reserved

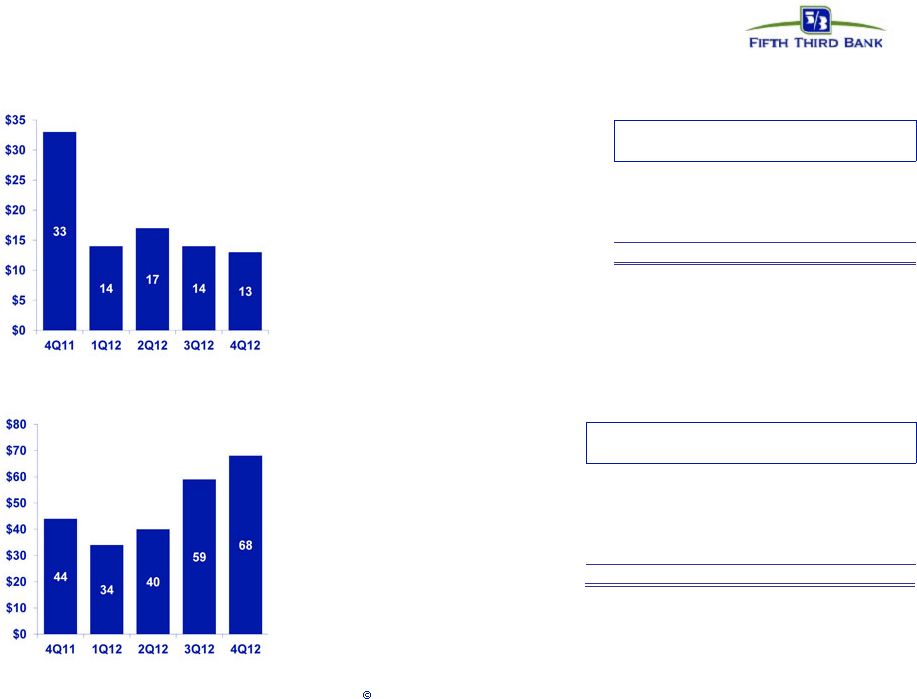

Credit-related costs

In noninterest income ($MM)

In noninterest expense ($MM)

Note: Numbers may not sum due to rounding

Actual

($ in millions)

4Q11

1Q12

2Q12

3Q12

4Q12

Gain / (loss) on sale of loans

$9

$5

$8

$2

$4

Commercial loans HFS FV adjustment

(18)

(1)

(5)

(3)

(3)

Gain / (loss) on sale of OREO properties

(22)

(17)

(19)

(11)

(10)

Mortgage repurchase costs

(1)

(2)

(2)

(2)

(3)

Total credit-related revenue impact

($33)

($14)

($17)

($14)

($13)

Actual

($ in millions)

4Q11

1Q12

2Q12

3Q12

4Q12

Mortgage repurchase expense

$18

$15

$18

$36

$44

Provision for unfunded commitments

(6)

(2)

(1)

(2)

3

Derivative valuation adjustments

(5)

(4)

(0)

(2)

(2)

OREO expense

8

5

5

6

5

Other problem asset related expenses

28

19

19

21

19

Total credit-related operating expenses

$44

$34

$40

$59

$68 |

20

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

December

September

June

March

December

2012

2012

2012

2012

2011

Income before income taxes (U.S. GAAP)

$540

$503

$565

$603

$418

Add:

Provision expense (U.S. GAAP)

76

65

71

91

55

Pre-provision net revenue (a)

616

568

636

694

473

Net income available to common shareholders (U.S. GAAP)

390

354

376

421

305

Add:

Intangible amortization, net of tax

2

2

2

3

3

Tangible net income available to common shareholders

392

356

378

424

308

Tangible net income available to common shareholders (annualized) (b)

1,559

1,416

1,520

1,705

1,222

Average Bancorp shareholders' equity (U.S. GAAP)

13,855

13,887

13,628

13,366

13,147

Less:

Average preferred stock

(398)

(398)

(398)

(398)

(398)

Average goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Average intangible assets

(28)

(31)

(34)

(38)

(42)

Average tangible common equity (c)

11,012

11,041

10,779

10,513

10,290

Total Bancorp shareholders' equity (U.S. GAAP)

13,716

13,718

13,773

13,560

13,201

Less:

Preferred stock

(398)

(398)

(398)

(398)

(398)

Goodwill

(2,416)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(27)

(30)

(33)

(36)

(40)

Tangible common equity, including unrealized gains / losses (d)

10,875

10,873

10,925

10,709

10,346

Less: Accumulated other comprehensive income / loss

(375)

(468)

(454)

(468)

(470)

Tangible common equity, excluding unrealized gains / losses (e)

10,500

10,405

10,471

10,241

9,876

Total assets (U.S. GAAP)

121,894

117,483

117,543

116,747

116,967

Less:

Goodwill

(2,416)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(27)

(30)

(33)

(36)

(40)

Tangible assets, including unrealized gains / losses (f)

119,451

115,036

115,093

114,294

114,510

Less: Accumulated other comprehensive income / loss, before tax

(577)

(720)

(698)

(720)

(723)

Tangible assets, excluding unrealized gains / losses (g)

118,874

114,316

114,395

113,574

113,787

Common shares outstanding (h)

882

897

919

920

920

Net charge-offs (i)

147

156

181

220

239

Ratios:

Return on average tangible common equity (b) / (c)

14.2%

12.8%

14.1%

16.2%

11.9%

Tangible

common

equity

(excluding

unrealized

gains/losses)

(e)

/

(g)

8.83%

9.10%

9.15%

9.02%

8.68%

Tangible

common

equity

(including

unrealized

gains/losses)

(d)

/

(f)

9.10%

9.45%

9.49%

9.37%

9.04%

Tangible book value per share (d) / (h)

12.33

12.12

11.89

11.64

11.25

Pre-provision net revenue / net charge-offs (a) / (i)

419%

364%

351%

315%

198%

For the Three Months Ended |

21

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

December

September

June

March

December

2012

2012

2012

2012

2011

Total Bancorp shareholders' equity (U.S. GAAP)

$13,716

$13,718

$13,773

$13,560

$13,201

Goodwill and certain other intangibles

(2,499)

(2,504)

(2,512)

(2,518)

(2,514)

Unrealized gains

(375)

(468)

(454)

(468)

(470)

Qualifying trust preferred securities

810

810

2,248

2,248

2,248

Other

33

38

38

38

38

Tier I capital

11,685

11,594

13,093

12,860

12,503

Less:

Preferred stock

(398)

(398)

(398)

(398)

(398)

Qualifying trust preferred securities

(810)

(810)

(2,248)

(2,248)

(2,248)

Qualifying noncontrolling interest in consolidated subsidiaries

(48)

(51)

(51)

(50)

(50)

Tier I common equity (a)

10,429

10,335

10,396

10,164

9,807

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (b)

109,699

106,858

106,398

105,412

104,945

Ratio:

Tier I common equity (a) / (b)

9.51%

9.67%

9.77%

9.64%

9.35%

Basel III -

Estimates (Amounts in billions)

December

September

June

2012

2012

2012

Tier 1 common equity (Basel I)

$10.4

$10.3

$10.4

Add:

Adjustment related to AOCI for AFS securities

0.5

0.5

0.5

All other adjustments

-

-

-

Estimated Tier 1 common equity under Basel III rules (a)

$10.9

$10.8

$10.9

Estimated risk-weighted assets under Basel III rules (b)

123.7

120.3

119.4

Estimated Tier 1 common equity ratio under Basel III rules

8.8%

9.0%

9.2%

(a)

(b)

Tier 1 common equity under Basel III includes the unrealized gains and losses for

AFS securities. Other adjustments include mortgage servicing rights and deferred tax assets subject to

threshold limitations and deferred tax liabilities related to intangible

assets. Key differences under Basel III in the calculation of

risk-weighted assets compared to Basel I include: (1) Risk weighting for commitments under 1 year; (2) Higher risk weighting for exposures

to residential

mortgage,

home

equity,

past

due

loans,

foreign

banks

and

certain

commercial

real

estate;

(3)

Higher

risk

weighting

for

mortgage

servicing

rights

and

deferred

tax

assets

that

are

under

certain

thres

holds

as

a

percent

of

Tier

1

capial;

(4)

Incremental

capital

requirements

for

stress

VaR;

and

(5)

Derivatives

are

differentiated

between

exchange

clearing

and

over-the-counter and the 50% risk-weight cap is removed.

For the Three Months Ended

For the Three Months Ended |