Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RENASANT CORP | d483127d8k.htm |

Sterne Agee & Leach

Financial Institutions Investor

Conference

February 11-13, 2013

Exhibit 99.1 |

2

Forward Looking Statement

This presentation contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of

1995. Congress passed the Private Securities Litigation Act of 1995 in an effort to encourage corporations to provide

information about companies’ anticipated future financial

performance. This act provides a safe harbor for such disclosure,

which protects the companies from unwarranted litigation if

actual results are different from management expectations. This

release contains forward looking statements within the meaning of the

Private Securities Litigation Reform Act, and reflects

management’s current views and estimates of future economic

circumstances, industry conditions, company performance, and

financial results. These forward looking statements are subject

to a number of factors and uncertainties which could cause

Renasant’s, M&F’s or the combined company’s actual

results and experience to differ from the anticipated results and

expectations expressed in such forward looking statements.

Forward looking statements speak only as of the date they are made

and neither Renasant nor M&F assumes any duty to update forward

looking statements. In addition to factors previously

disclosed in Renasant’s and M&F’s reports filed with the

SEC and those identified elsewhere in presentation, these forward-

looking statements include, but are not limited to, statements about

(i) the expected benefits of the transaction between Renasant and

M&F and between Renasant Bank and Merchants and Farmers Bank, including future financial and operating results, cost

savings, enhanced revenues and the expected market position of the

combined company that may be realized from the transaction, and

(ii) Renasant and M&F’s plans, objectives, expectations and intentions and other statements contained in this

presentation that are not historical facts. Other statements

identified by words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,”

“estimates,” “targets,” “projects” or words of similar meaning generally are intended to identify

forward-looking statements. These statements are based upon

the current beliefs and expectations of Renasant’s and M&F’s

management and are inherently subject to significant business, economic

and competitive risks and uncertainties, many of which are

beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change. Actual results may differ materially from those indicated

or implied in the forward-looking statements. |

Capitalize on Opportunities

Leverage Existing Markets

FDIC Assisted Acquisitions

Seek New Markets

Enhance Lines of Business

Build Capital Ratios

Selective Balance Sheet Growth

Maintain Dividend

Non-TARP Participant

3

Enhance Profitability

Noninterest Expense Control

Execution of

Execution of

Strategic

Strategic

Initiatives

Aggressively Manage Problem Credits

Quarantine Troubled Assets

“Good Bank/Bad Bank”

Structure

Managed Asset Growth

Loan Growth

Core Deposit Growth

Net Int Margin Expansion/Int Rate Risk |

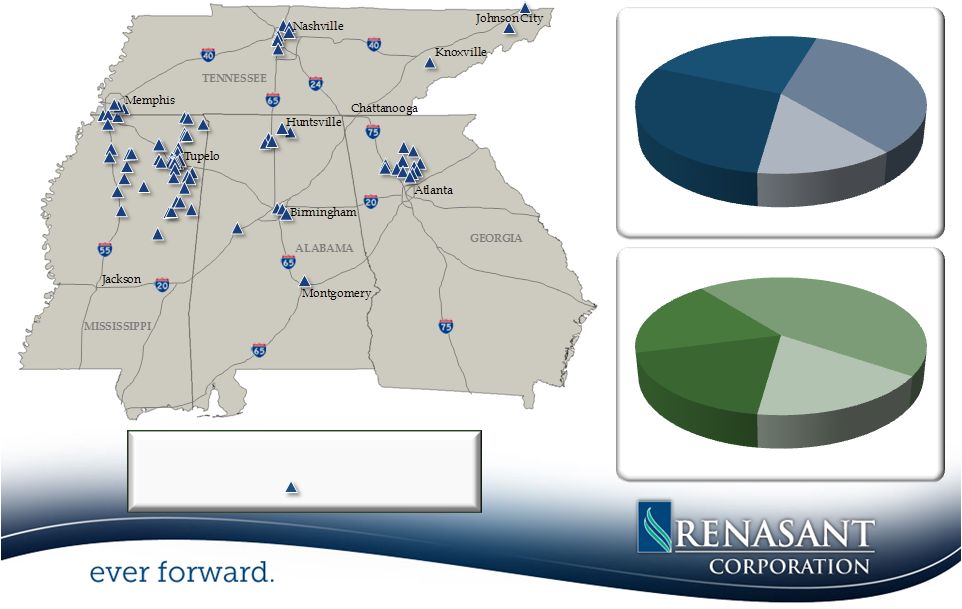

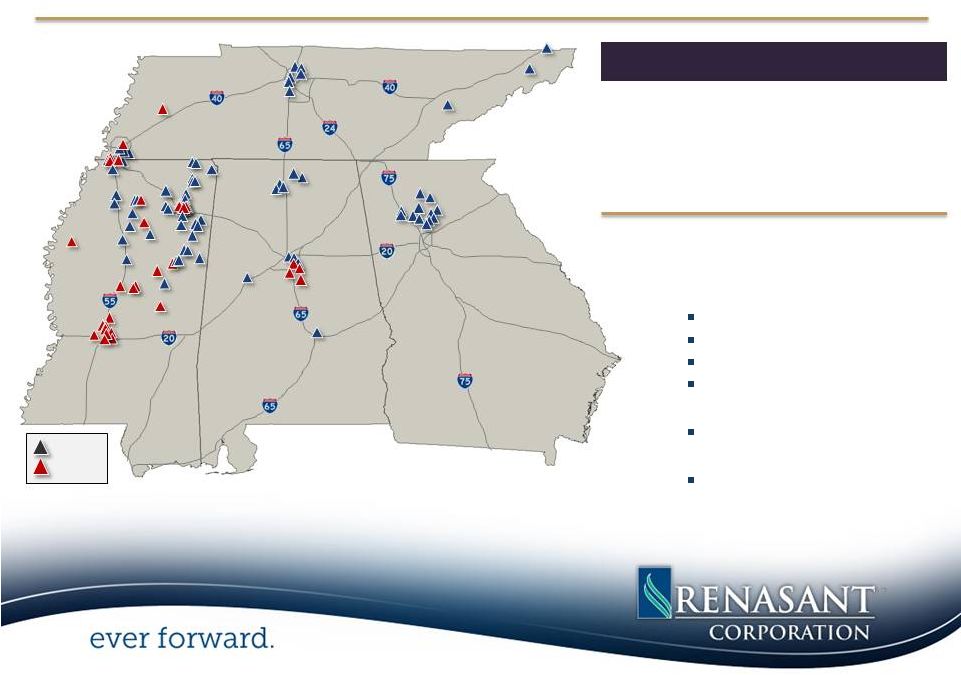

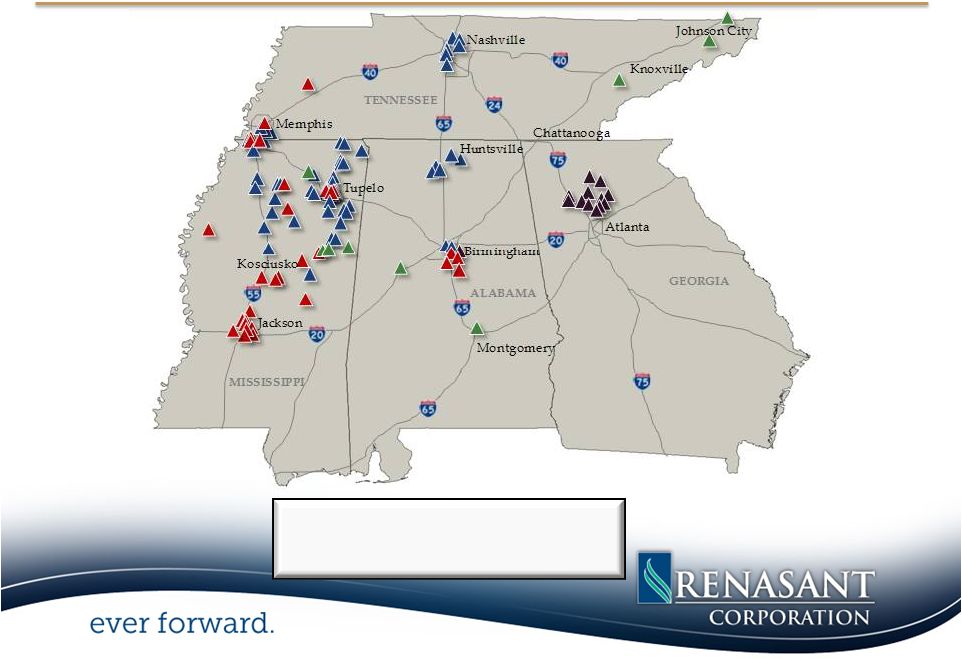

Over 75 banking, lending, financial services and insurance offices

Portfolio Loans: $2.81B

Total Deposits: $3.46B

4

TN

19%

AL

18%

MS

45%

GA

18%

Existing Footprint

RNST

TN

30%

AL

23%

MS

34%

GA

13%

Targeted Market Expansion |

5

*Source: Dunn & Bradstreet

Small businesses defined as businesses with annual sales less than $5 million

ATLANTA

Roswell

Alpharetta

Cartersville

Canton

Cumming

Jasper

Dalton

Rome

Lafayette

Georgia

Entered the North GA market through two FDIC loss

share

transactions

12 full-service locations

Footprint located in attractive markets with

long-term

growth potential

Expanded our mortgage and wealth management personnel

Over 36K small businesses* in our GA footprint, of which many

are being under-served due to the lack of strong community

banks Carrollton

Woodstock

Lawrenceville

Median home sales prices increased 25.3%

Pending sales are up an average of 16.5%

Positive economic developments in Georgia markets

Recent announcement of a $600M mixed-use project in

the

Alpharetta area, to be located on the GA 400

corridor with construction to begin in

early 2013 According to a recent study conducted by Georgetown

University, Georgia is one of

the

top two states that will add health-care related jobs between

2010 and 2020 Housing inventories have declined 36% to a 4.8

month’s supply year-over-year Loans total $372M at

December 2012 Recently established an asset based lending

division Growth

in

non-covered

loans

continue

to

offset

the

decline

in

covered

loans

on

a

Y-T-D

basis

64% of the loans outstanding are covered under FDIC loss share

agreements |

6

Huntsville/

Decatur

Montgomery

Tuscaloosa

Birmingham

Acquisition

De Novo

•

Entered the Montgomery and Tuscaloosa markets during late

3Q11 with the hiring of an experienced management team well

entrenched in the respective markets

•

Acquired RBC Bank USA’s Birmingham, AL Trust unit

on

Sept 1, 2011 with assets under management of $680M

•

Birmingham leads the state in the health care

industry with an annual payroll of approximately

$2.9B, followed by Huntsville with $998M

•

With an unemployment rate of 5.8% in December

Metro Birmingham is ranked number 8 out of top

50 MSA’s

•

All three auto makers (Honda, Hyundai, Mercedes-

Benz) are adding employees to keep pace with

demand

•

Net loan growth was 18.5% for the year, with loan

growth occurring in 11 out of the last 12 quarters

•

Proposed merger with First M&F will provide

$113.9 million loans, $184.4 million deposits and

4 branch locations

Account retention exceeded 95%

Alabama

|

7

Tupelo

New Albany

De Novo

Toyota Plant

Columbus

Starkville

West Point

Mississippi

Entered the Columbus, MS market in November 2010 and opened an

office in

Starkville,

home

of

Mississippi

State

University,

during

late

3Q11

Columbus is home of the Columbus Air Force Base which trains one-third

of the nation’s pilots, and has a $250M economic impact

The Tupelo/Lee County market is showing positive signs of improvement

North MS Medical Center is constructing a $55M West Wing Tower

Toyota recently announced the completion of its 100,000

th

Corolla as

downstream suppliers are beginning to add new jobs

Tupelo recently approved the construction of an $11M aquatic center and

completed a $4M expansion of the Elvis Presley Birthplace and

Museum Hosts one of the largest furniture markets in the U.S., with

the Fall 2012

market attendance up 100% over markets held in the previous 5 years

Oxford, Tupelo and Columbus were noted by American Express as three of

the best small towns in America for business

Oxford has recently announced the construction of a $250M hospital

American Express also noted Desoto County for placing 7

th

nationally for

job creation in late 2011

Net loans grew 8.5% during 2012

Proposed

merger

with

First

M&F

will

add

$732.6

million

in

loans,

$1.2

billion in deposits and 30 branches |

Opened the Knoxville/Maryville MSA location in late 2Q12 employing a 13

member management team to

be further utilized in the planned expansions in to Johnson

City/Bristol Tennessee ranked 7

th

best state to do business according to Area Development magazine

In the Nashville market, Hospital Corporation of American has announced an

expansion that will create 2,000 jobs over the next five years

The Memphis MSA market ranked #1 for Logistics Leaders both nationally and

globally Net loans grew by 8.8% during 2012

Proposed merger with First M&F will provide $19.9 million in loans,

$36.0 million in deposits and 2 branches 8

Tennessee

Memphis and Nashville

Driven

by

VW,

Nissan

and

GM,

Tennessee

was

named

as

the

#1

state

in

the

nation

for

automotive

manufacturing

strength

for

a

3

rd

consecutive

year

according

to

Business

Facilities

Magazine

The unemployment rate continues to improve for the state with the rate

declining to 7.6% down from 9.1% on a year over year basis

The Nashville housing market continues sustainability as sales increased

23.4% year-over-year The median home price increased

approximately 6% on a year-over-year, with average price/sq ft increasing

49.3%

Bass Pro Shops announced their intention to build a $70M hotel in

conjunction with their Pyramid flagship store

Electrolux has begun the hiring of some 1,200 workers from its expansion

announcement in 2010 The

housing

market

continues

to

improve

in

the

Memphis

market

as

home

sales

increased

on

a

year-over-year basis by approximately 16% with median sales prices

up slightly |

9

Capitalize

on

Opportunities

Leverage Existing Markets

FDIC Assisted Acquisitions

Seek New Markets

Enhance Lines of Business

Enhance Profitability

Managed Asset Growth

Loan Growth

Core Deposit Growth

Net Int Margin Expansion/Int Rate Risk

Noninterest Expense Control

Build

Capital

Ratios

Selective Balance Sheet Growth

Maintain Dividend

Non-TARP Participant

Aggressively

Manage

Problem

Credits

Quarantine Troubled Assets

“Good Bank/Bad Bank”

Structure

Execution of

Execution of

Strategic

Strategic

Initiatives |

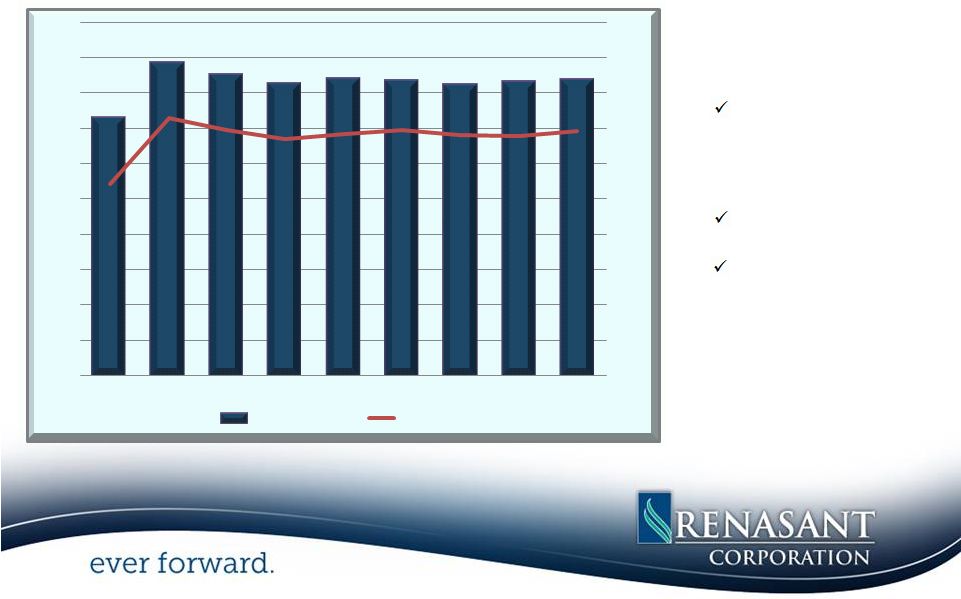

10

•

Asset levels have been managed

on a declining basis over the prior

quarters

Managed deposit mix by

emphasizing core deposit

growth while allowing

higher-priced, non-core

deposits to erode

Significantly paid down

high-costing borrowings

Restructured asset mix by

redeploying excess cash

levels into higher yielding

investments and loans

•

Loan demand will drive

deposit/funding growth going

forward

(in millions)

Total

Assets

3,642

4,422

4,259

4,136

4,202

4,176

4,112

4,164

4,182

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

1Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Total Assets

Deposits |

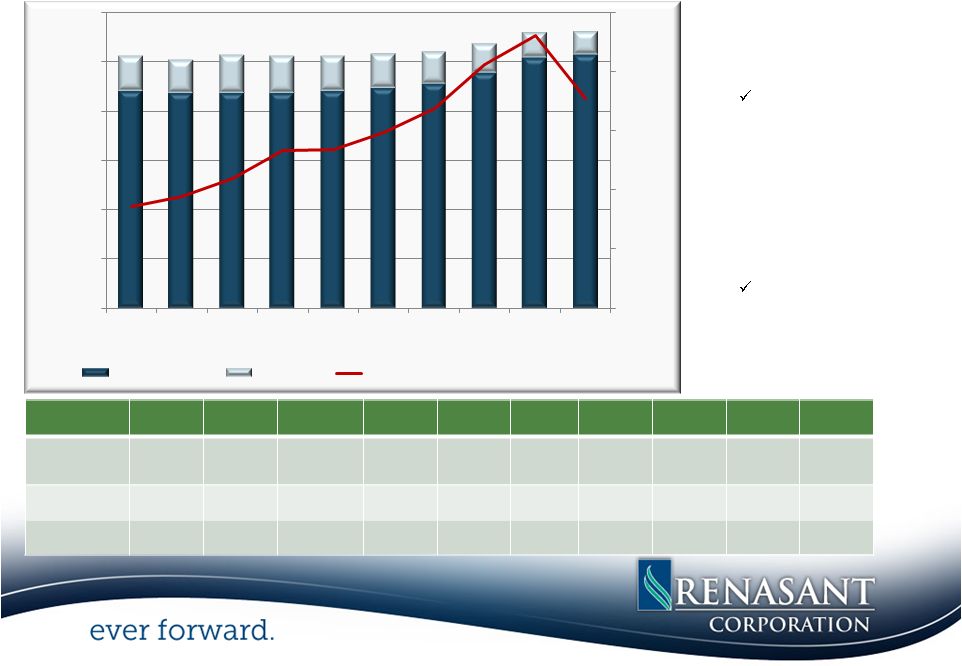

11

*Covered loans stated at fair value

•

Non-covered loans have

increased $331M or 15% on

a Y-O-Y basis

Approximately 46% of

2012 loan growth

originated from de novos

•

Covered loans declined $103M

during 2012

•

Consistent increases in

quarterly production

over

past 2 years

New loan production

totaled $177M for 4Q12

and $783M for the year,

outpacing 2011 by 49%

Total

Portfolio

Loans

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

$3,000,000

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Non-Covered

Covered

Quarterly New Production (Right Axis)

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Non-

Covered

$2,205

$2,191

$2,190

$2,186

$2,205

$2,242

$2,282

$2,392

$2,540

$2,573

Covered*

$360

$334

$387

$377

$360

$339

$318

$290

$260

$237

Total Loans

$2,565

$2,525

$2,577

$2,563

$2,565

$2,581

$2,600

$2,682

$2,800

$2,810 |

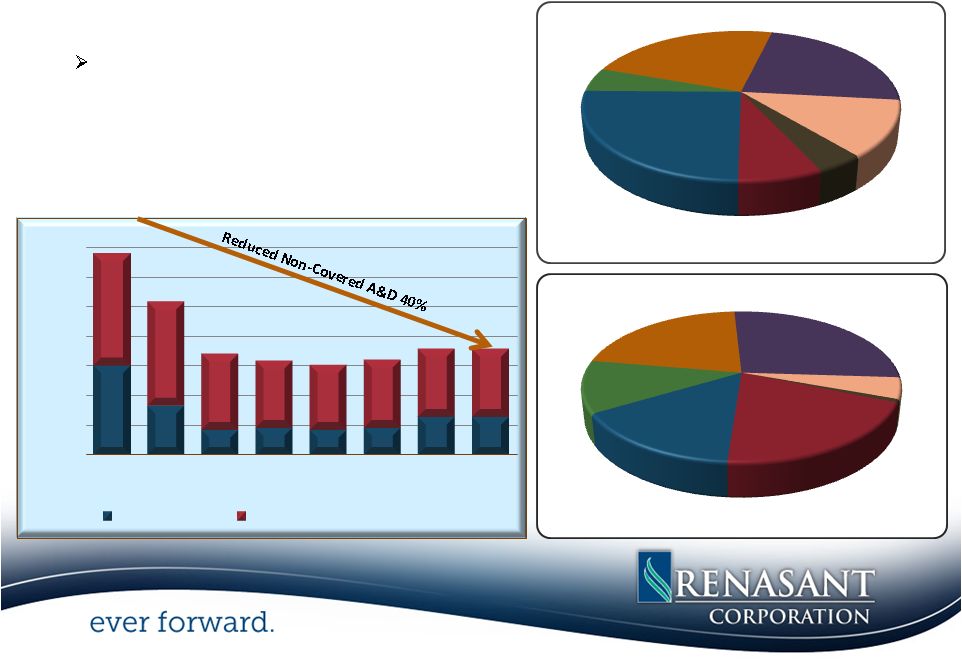

•

Loans totaled $2.80B

8.4% of portfolio covered by FDIC through an

80% loss share agreement

•

Owner occupied/C&I loans comprise 35% of the non

covered loan portfolio

•

Reduced non-covered A&D loans by 40% from 2008

12

* Covered loans stated at fair value

Diversified Loan Portfolio

241,818

133,299

66,798

74,159

67,223

73,109

103,522

104,058

302,409

281,521

205,981

179,549

176,201

184,649

181,876

181,439

$0

$80,000

$160,000

$240,000

$320,000

$400,000

$480,000

$560,000

2008

2009

2010

2011

1Q12

2Q12

3Q12

4Q12

Construction

Land Development (A&D)

Const

4%

Land Dev

7%

1-4 Family

25%

1-4 Family

Rental

5%

Non Owner

Occupied

24%

Owner

Occupied

23%

C&I

12%

Non Covered Loans $2.57B

Const

1%

Land Dev

20%

1-4 Family

15%

1-4 Family

Rental

11%

Non Owner

Occupied

21%

Owner

Occupied

27%

C&I

5%

Covered Loans $237M* |

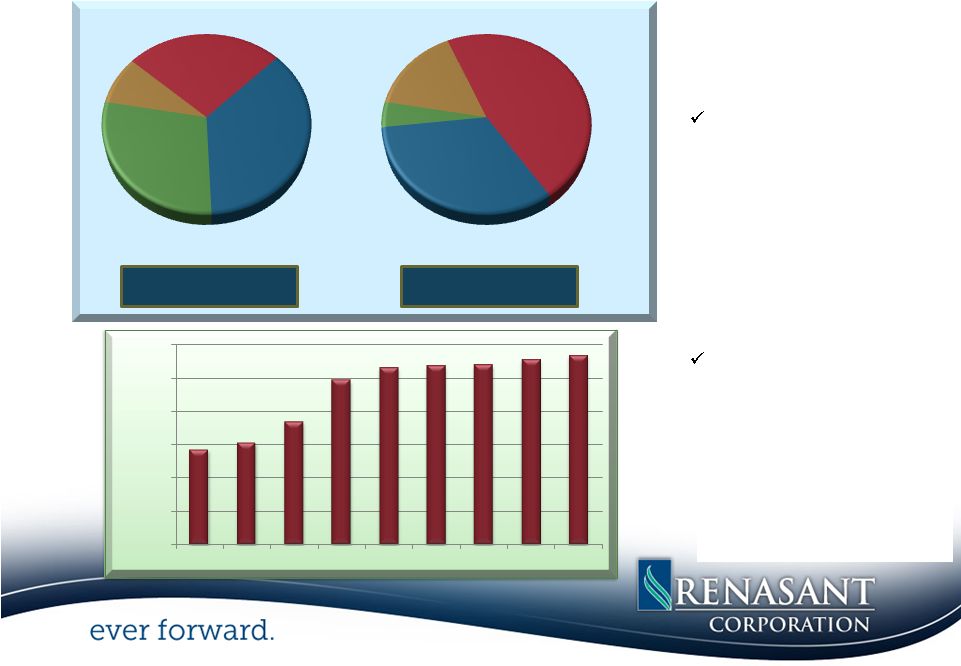

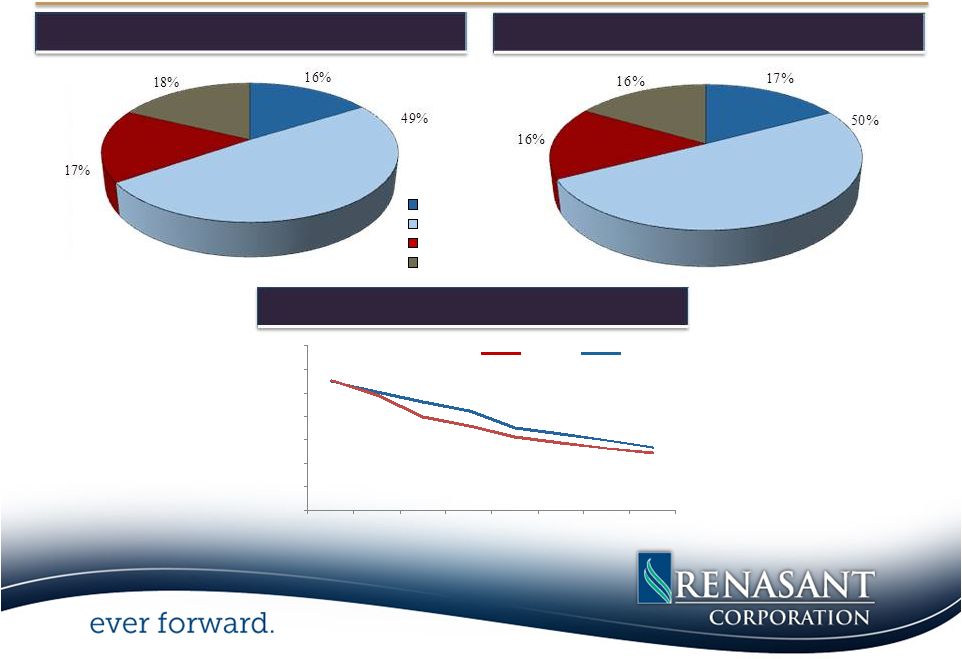

13

$3.28B

$3.62B

•

Non-interest bearing deposits

represent 16% of deposits, up

from 12% at year end 2008

DDA grew 7% on a Y-O-Y

basis

•

Time deposits totaling $207M

at WAR of 83 bps will be

maturing during 1Q13 with the

current repricing rate between

60-65 bps

•

Less reliance on borrowed

funds

Borrowed funds as a percentage

of funding sources declined

from 15% at year end 2008 to

5% at the end of 2012

Transition To Core Funding Cost of Funds

2.81%

Cost of Funds

.72%

DDA

10%

Other Int

Bearing

Accts

36%

Time

Deposits

39%

Borrowed

Funds

15%

2008

DDA

16%

Other Int

Bearing

Accts

47%

Time

Deposits

33%

Borrowed

Funds

5%

2012

-

100,000

200,000

300,000

400,000

500,000

600,000

2008

2009

2010

3Q11

2011

1Q12

2Q12

3Q12

4Q12

Non Interest Bearing Demand Deposits |

14

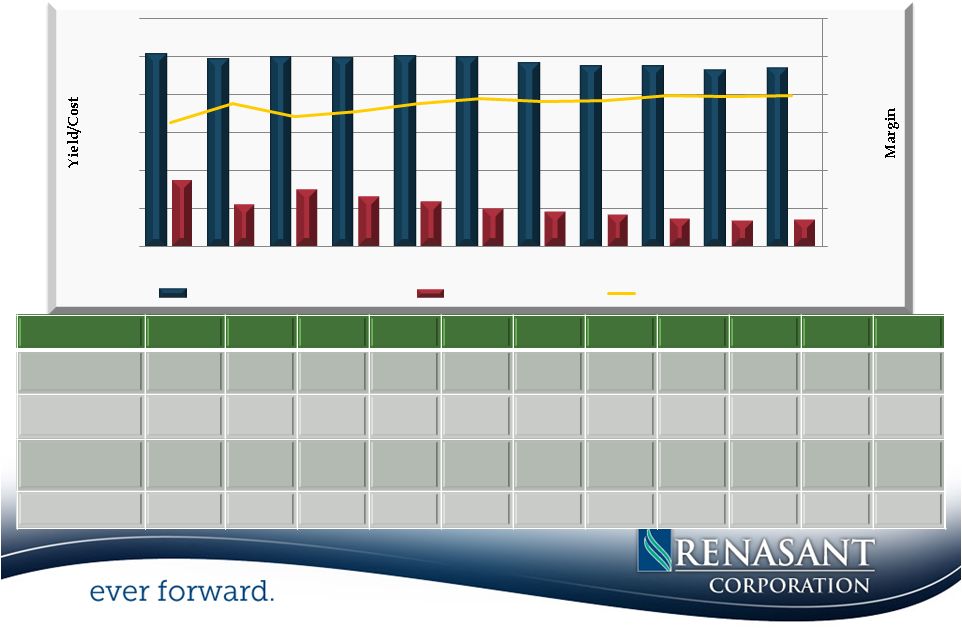

Net Interest Income and Net Interest Margin Remained at

one of the Highest Since 3Q06 0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2010

2011

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Yield on Earning Assets

Cost of Funds

Margin

2010

2011

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Net

Interest

Income

105,062

129,077

29,855

31,096

32,622

32,864

32,495

32,843

33,410

33,132

33,954

Net Interest

Margin

3.26%

3.77%

3.43%

3.55%

3.75%

3.90%

3.82%

3.85%

3.98%

3.94%

3.97%

Yield on

Earning Assets

5.04%

4.92%

4.97%

4.93%

4.99%

4.94%

4.79%

4.71%

4.73%

4.63%

4.67%

Cost of Funds

1.74%

1.11%

1.49%

1.31%

1.18%

1.00%

0.93%

0.84%

0.74%

0.68%

0.72% |

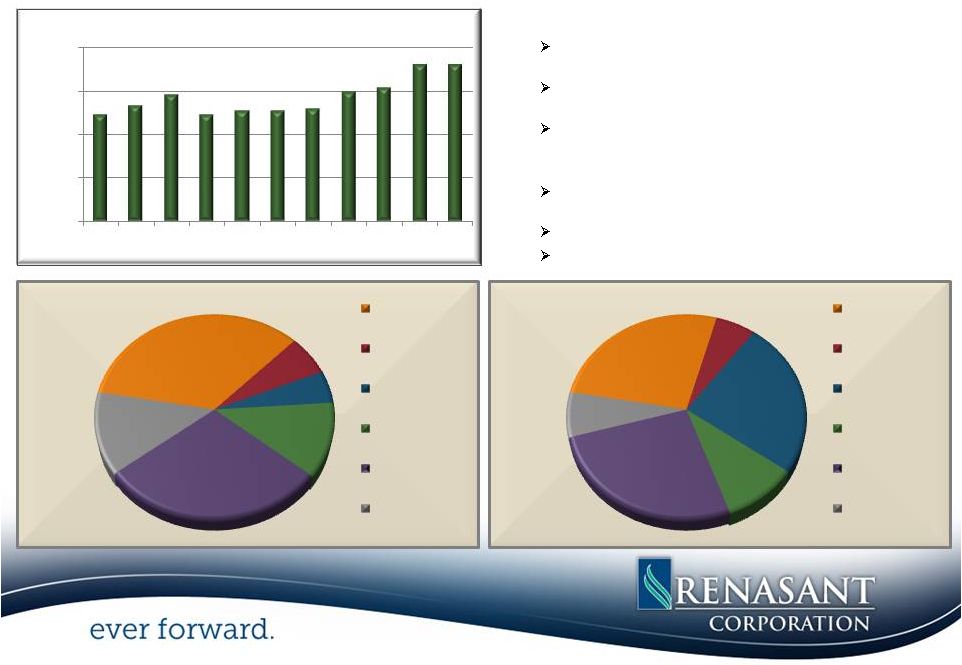

•

Non Interest Income for 4Q, excluding securities gains and gain

from acquisitions, increased 39% on a Y-O-Y basis

Fees associated with increased production in secondary market

mortgage loans

Expansion from our wealth management division with the

acquisition of RBC Trust in Birmingham

Fees derived from higher penetration and usage of debit cards and

deposit charges

•

Opportunities for growing Non Interest Income

Expansion of Trust Division Wealth Management Services into

larger, metropolitan markets

Expansions within our de novo operations

Expansion of the Mortgage Division within new markets

*Non interest income excludes gains from securities transactions, gain from

the acquisition of the RBC Trust unit and insurance settlements on

real property 15

-

5,000

10,000

15,000

20,000

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Non Interest Income*

35%

6%

5%

12%

29%

13%

27%

6%

25%

10%

26%

7%

4Q11

$12.8M

Svc

Chgs

Insurance

Mtg

Gains

Wealth

Mgmt

Fees

&

Comm

Other

4Q12

$18.1M

Svc

Chgs

Insurance

Mtg

Gains

Wealth

Mgmt

Fees

&

Comm

Other

Sources of Non Interest Income*

|

•

Continued focus on managing

Noninterest Expense

•

Provided resources for

nine de novo

expansions Approximately 56% of the

increase in Noninterest

Expense Y-O-Y is related to

de novo expansions and

acquisition of the RBC Trust

Division

•

Increased mortgage loan expense

driven by higher production

•

Incurred elevated costs related to

OREO and loan collection fees

•

Incurred merger related expenses

during 2010 & 2011

*Adjusted NIE is equal to total non interest expense less expenses related

to OREO, merger expense and FHLB prepayment penalty 16

Total Annualized NIE

to Avg. Assets

Adjusted Annualized NIE

to Avg. Assets

DeNovo Impact

on Total Annualized NIE

DeNovo Impact on

Adjusted Annualized NIE

2.40%

2.60%

2.80%

3.00%

3.20%

3.40%

3.60%

3.80%

4.00%

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Noninterest Expense

|

•

OREO totaled $44.7M at 4Q12, a decline of $25.3M from 4Q11 and

$13.7M from 2Q12

•

Sold XX properties totaling $4.7M during 4Q12

•

Purchased X properties totaling $2.5M

•

44% of Y-T-D sales were from residential lots and land

development •

Geographic segmentation

•

West TN

$13.4M

•

MS (Excluding DeSoto)

8.0M

•

DeSoto

8.0M

•

Mid TN

4.5M

•

AL

10.4M

•

GA

.4M

Total

$

44.7M

•

$4.9M under purchase agreements to close by the end of 1Q13

Changes in OREO

Non-

Covered

4Q12

Non-Covered

2011

Y-T-D

Non-Covered

2012

Y-T-D

**Covered

2012

Y-T-D

Beginning

Balance

$48,568

$71,833

$70,079

$43,156

Additions

2,522

35,623

9,683

38,977

Improvements

0

37

492

0

Impairments

-1,637

-7,895

-5,326

-9,738

Dispositions

-4,736

-29,087

-30,410

-26,797

Other

0

-432

199

-64

Ending

Balance

$44,717

$70,079

$44,717

$45,534

17

•

Amounts based on OREO not covered through the FDIC loss share agreement

** Amounts based on OREO covered through the FDIC loss share agreement

18.4%

50.3%

17.4%

13.9%

4Q12

$44.7M

Residential

Properties

Residential

Land

Dev

Commercial

Properties

Commercial

Land

Dev

Other

21.9%

51.5%

16.4%

10.2%

4Q11

$70.1M

Residential

Properties

Residential

Land

Dev

Commercial

Properties

Commercial

Land

Dev

Other

Other Real Estate*

|

18

Capitalize

on

Opportunities

Leverage Existing Markets

FDIC Assisted Acquisitions

Seek New Markets

Enhance Lines of Business

Enhance Profitability

Managed Asset Growth

Loan Growth

Core Deposit Growth

Net Int Margin Expansion/Int Rate Risk

Noninterest Expense Control

Aggressively

Manage

Problem

Credits

Quarantine Troubled Assets

“Good Bank/Bad Bank”

Structure

Build

Capital

Ratios

Selective Balance Sheet Growth

Maintain Dividend

Non-TARP Participant

Execution of

Execution of

Strategic

Strategic

Initiatives |

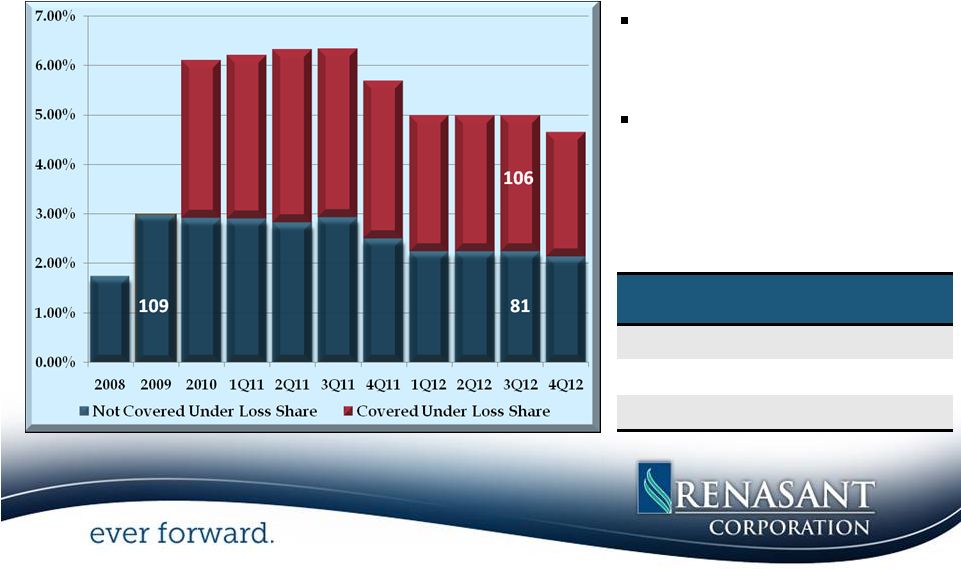

57% of total NPAs are

covered under FDIC loss

share

NPAs not covered through

an FDIC loss share declined

29% on a Y-O-Y basis

129

126

120

122

105

65

19

115

141

149

146

137

95

132

Non-

Covered

Covered

NPL’s

$30.19M

$53.19M

ORE

$44.72M

$45.53M

Total NPA’s

$74.91M

$98.72M

104

88

As a percentage of total assets

75

99

Non Performing Assets Continue

to Decline Both

on a Linked Quarter and Y-O-Y Basis

|

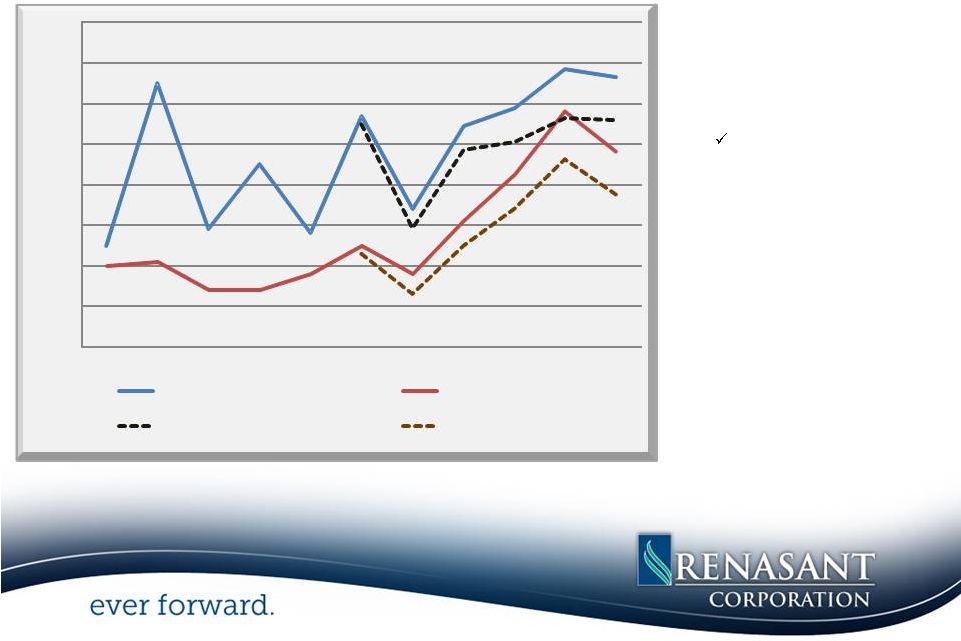

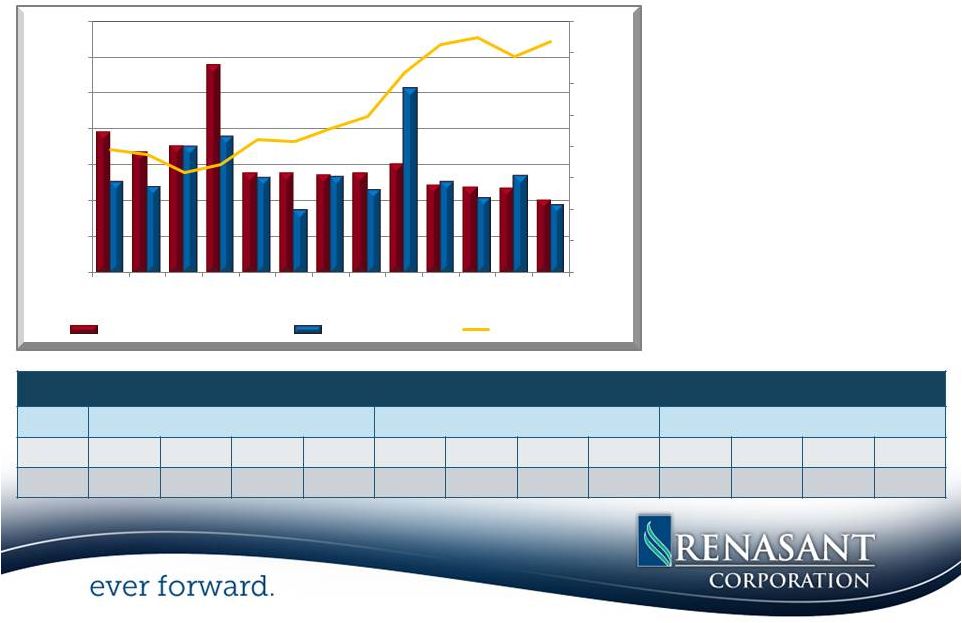

*Amounts based on loans not covered through the FDIC loss share

agreement 20

•

Net charge-offs totaled $3.7M for

4Q12 and $18.1M for 2012

compared to $23.4M for 2011

•

Provision for loan losses totaled

$4.0M and $18.1M for 4Q and

Y-T-D respectively, down $4.23M

on a Y-O-Y basis

•

The allowance for loan losses to

non-covered loans was 1.72%

•

Consistent improvement in the

coverage ratio

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

140.00%

160.00%

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

($)Provision for Loan Losses

($)Net Charge Offs

Coverage Ratio*

Proactive in Providing Reserves for

Problem Credit Resolution

2009

2010

2011

2012

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

1.67%

1.78%

1.82%

2.02%

2.07%

2.17%

2.18%

2.20%

1.98%

1.94%

1.87%

1.74%

1.72%

Allowance for Loan Losses as % of Non-Covered Loans*

|

Continued Improvement

NPLs and Early Stage Delinquencies

(30-89 Days Past Due Loans)

*

*Amounts based on loans not covered through the FDIC loss share

agreement 21

(In millions)

•

NPL’s declined $1.8M during 4Q and $4.7M Y-T-D

TDRs declined to $29.4M, down $6.9M from 4Q11

•

Loans 30-89 days past due declined $7.8M Y-T-D

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

2008

2009

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

39.9

50.0

54.6

64.7

65.6

53.4

57.2

51.9

49.0

34.9

30.4

29.9

32.0

30.2

48.5

24.1

35.6

18.9

17.5

15.8

13.4

14.5

14.1

8.0

NPLs

30-89

Days

41.6

23.5

21.5

16.6 |

Capitalize on Opportunities

Leverage Existing Markets

FDIC Assisted Acquisitions

Seek New Markets

Enhance Lines of Business

Build Capital Ratios

Selective Balance Sheet Growth

Maintain Dividend

Non-TARP Participant

22

Enhance Profitability

Aggressively Manage Problem Credits

Quarantine Troubled Assets

“Good Bank/Bad Bank”

Structure

Execution of

Execution of

Strategic

Strategic

Initiatives

Loan Growth

Core Deposit Growth

Net Int Margin Expansion/Int Rate

Risk Noninterest Expense

Control |

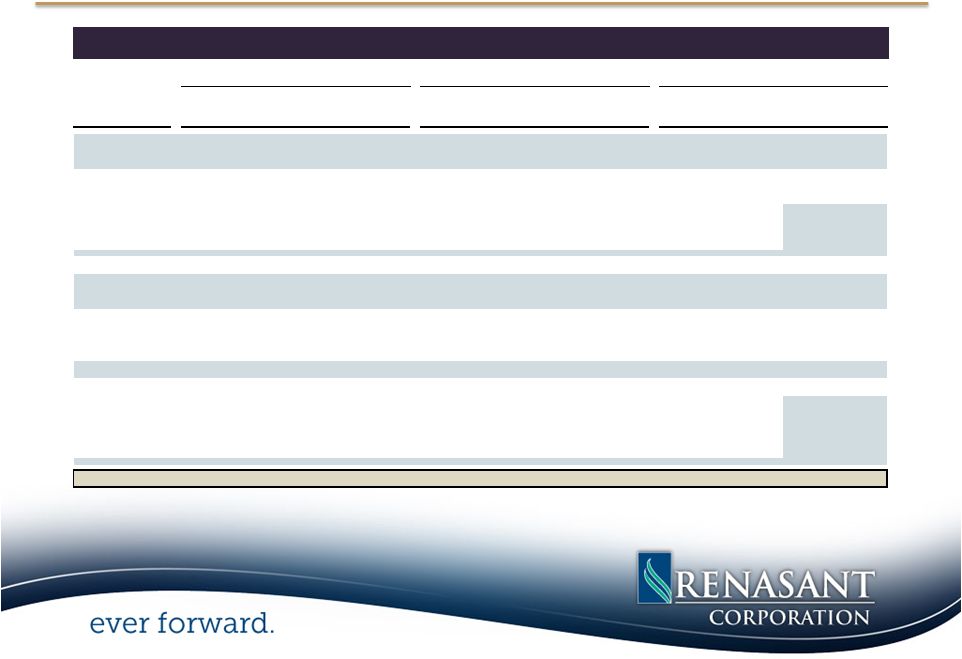

*1Q11 decline in leverage is primarily due to ATB transaction

23

Capital

2008

2009

2010

1Q11*

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Tangible

Common Equity

5.87%

6.34%

6.76%

6.66%

7.11%

7.47%

7.35%

7.47%

7.65%

7.69%

7.62%

Leverage

8.34%

8.68%

8.97%

8.77%

9.10%

9.48%

9.44%

9.38%

9.68%

9.90%

9.86%

Tier 1 Risk Based

10.85%

11.12%

13.58%

13.59%

13.58%

13.63%

13.32%

13.32%

13.14%

12.73%

12.85%

Total Risk Based

12.10%

12.37%

14.83%

14.84%

14.83%

14.89%

14.58%

14.58%

14.39%

14.00%

14.13%

•

Continue to grow common equity which is

at highest level since 2Q07

•

Regulatory capital ratios are above the

minimum for well-capitalized classification

Expected to remain “well capitalized”

on a pro forma basis under the

proposed Basel III NPR

•

Capital level positions the Company for

future growth and geographic expansion

•

Maintained dividend throughout economic

downturn

•

Did not participate in the TARP program

Tangible Common Equity Ratio

4.50%

5.00%

5.50%

6.00%

6.50%

7.00%

7.50%

8.00%

8.50%

2007

2008

2009

2010

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Renasant

All US Banks

Strong Capital Position

Source: SNL Financial “All US Banks” : Includes all Major Exchange (NYSE,

NYSE Amex, NASDAQ) Banks in SNL's coverage universe. |

24

$4.2B

franchise

well

positioned

in

attractive

markets

in

the

Southeast

with

comprehensive

line of product offerings

Strategic focus on expanding footprint

Established a 12 branch network in North GA through 2 FDIC assisted

acquisitions Entered 5 new markets with the hiring of management

teams Acquired the AL Trust Division of RBC Trust in 3Q11, enhancing

fee income opportunities

Improved risk profile

Aggressive identification and prudent disposition of problem assets

Significantly reduced concentration in land development loans

Continued decline of early stage delinquencies

Net loan growth Y-O-Y was 15%*

Strong

base

for

continued

core

deposit

growth

Continued focus on revenue growth

Strong capital position affording future opportunities to enhance

shareholder value Consistent

dividend

history

*Amounts based on loans not covered through the FDIC loss share

agreement Poised for Growth with Added Shareholder Value

|

Merger of Renasant Corporation and First M&F Corporation

|

26

Strategically advantageous

•

Acquisition of 120+ year old bank with quality core customer

base –

Combination of two 100+ year old institutions

•

In-market transaction consistent with our acquisition

philosophy •

Creates

the

4

th

largest

bank

by

pro

forma

deposit

market

share

in

Mississippi

–

Strengthens position throughout existing footprint and provides

entrance into new markets •

Enhances fee revenue businesses of insurance, mortgage, and wealth

management •

Complementary cultures and strong ties to community

•

Strong, stable deposits and earnings generation complement de novo and

out-of-state market expansion activities

Financially attractive

•

Immediately accretive to EPS, double-digit EPS accretion projected

in 2014 •

Tangible book value earn back in approximately 2.5 years

•

IRR approximately 20%

•

Realization

of

significant

expense

synergies

(25%

of

noninterest

expense)

•

Pro

forma

capital

ratios

above

“well

capitalized”

guidelines

Transaction Rationale |

27

27

Source: SNL Financial

(1)

Pro forma branches as of 1/31/2013

(2)

Pro forma figures as of 12/31/2012, excluding purchase accounting

adjustments •

Provides further expansion in

current states of operation

–

Mississippi

Jackson MSA

DeSoto County

Oxford

Starkville

–

Alabama

Birmingham MSA

–

Tennessee

Greater Memphis

•

7 of 36 FMFC branches are located

within 1 mile of a RNST branch

Branches

(1)

117

Assets

(2)

$5.8 billion

Gross Loans

(2)

$3.8 billion

Deposits

(2)

$4.9 billion

Pro Forma Highlights

Tupelo

Nashville

Atlanta

Birmingham

Huntsville

Montgomery

Jackson

Memphis

Kosciusko

Chattanooga

Johnson City

Knoxville

GEORGIA

ALABAMA

MISSISSIPPI

TENNESSEE

RNST

FMFC

Logical In-Market Transaction |

28

Consideration:

100% stock (tax-free exchange)

Fixed exchange ratio of 0.6425x

Implied Price Per Share:

$12.35

(1)

Aggregate Value:

$118.8 million

(1)(2)

CDCI Preferred Stock and TARP Preferred

Warrant Treatment:

$30.0 million CDCI to be redeemed in full prior to close

TARP warrants to be repurchased at close

Repurchase price to be negotiated with US Treasury

Board Seats:

Two current members from FMFC to be added to RNST’s board

of directors

Ownership:

FMFC pro forma ownership will be approximately 20%

Required Approvals:

Customary regulatory approval, RNST and FMFC shareholder

approval

Expected Closing:

Third quarter 2013

(1)

Based on RNST’s 10 day average closing price as of February 4, 2013

of $19.22 (2)

Does not include consideration to repurchase TARP warrants

Transaction Terms |

29

Implied Price Per Share:

$12.35

(1)

Price / Tangible Book Value Per Share:

119%

Price / 2012 EPS:

23.1x

Price / 2013 EPS

(2)

:

15.8x

Core Deposit Premium:

1.5%

(1)

Based on RNST’s 10 day average closing price as of February 4, 2013

of $19.22 and an exchange ratio of 0.6425x (2)

Based on analyst estimate

Transaction Multiples |

30

Extensive Credit Review

•

Two tiered review conducted by Renasant’s senior

credit officers and loan review team

•

Individually reviewed 84% of adversely classified

loans by volume, representing all relationships with

a balance greater than $100,000

•

Individually reviewed 100% of relationships with a

balance greater than $500,000

•

Conducted review of underwriting policy and

procedure for smaller balance portfolios

•

Reviewed 100% of OREO properties, including

physical inspection of over 80% of OREO by

volume

Cumulative Losses and Credit Mark

Cumulative

Losses

Since

12/31/07

(1)

:

$118.2mm

Estimated Credit Mark (Loans & OREO)

$62.5mm

Total Estimated Losses Through

Cycle: $180.7mm As

%

of

12/31/07

Gross

Loan

Balance

(2)

:

14.8%

(1)

Represents cumulative net charge-offs and OREO expenses through

12/31/12 (2)

12/31/07 gross loans held for investment of $1.2 billion

Credit Due Diligence |

31

Assumptions

•

Credit Mark

•

Gross of Reserves: $54.7mm or 5.4% of

loans

•

Net of Reserves: $37.5mm or 3.7% of loans

•

OREO Mark: 30%

•

Cost Savings: 25%, 40% realized in 2013 and

100% realized thereafter

•

No revenue enhancements assumed

•

Pre-Tax Merger Expenses: $12.0 million

•

100% realized in 2013

•

Core Deposit Intangible: 2.0%, amortized

sum-of-the-years digits over 10 years

•

Closing: Q3 2013

Attractive Returns

•

Immediately accretive to EPS; double-digit EPS

accretion projected in 2014

•

Tangible book value earn back in less than two and a

half years

•

IRR approximately 20%

Pro Forma Capital Ratios

Pro

“Well RNST

Forma

Capitalized”

TCE/TA

7.7%

6.5% N/A

Tier 1

Leverage 9.9% 8.3% 5.0%

Tier 1

Risk-Based 12.7% 11.0% 6.0%

Total

Risk-Based 14.0% 12.1% 10.0%

(1)

As of December 31, 2012

(2)

Estimated pro forma capital ratios at close, including the redemption of

the CDCI preferred stock (1)

(2)

Financial Impact of the Transaction |

32

32

Source: SNL Financial, Company documents

Expansions in 2010 –

2013

RNST

De Novo

FMFC

Acquisition

Market Expansion Experience Since 2010 |

33

Source:

SNL

Financial,

dates

are

those

on

which

each

transaction

was

announced

Market Expansion Experience Since 2010

FDIC-assisted transaction:

Crescent Bank and Trust Company headquartered

in Jasper, Georgia; assets ~ $1 billion

De novo expansion:

Columbus, Mississippi

FDIC-assisted transaction:

American Trust Bank headquartered in Roswell,

Georgia; assets ~ $145 million

Trust

acquisition:

RBC

(USA)

Trust

Unit

based

in

Birmingham,

Alabama;

AUM ~ $680 million

De novo expansion:

Montgomery, Alabama

De novo expansion:

Starkville, Mississippi

De

novo

expansion:

Tuscaloosa,

Alabama

De novo expansion:

Maryville, Tennessee

De novo expansion:

Jonesborough, Tennessee

De

novo

expansion:

Bristol,

Tennessee

Whole

Bank

transaction:

First

M&F

Corporation

headquartered

in

Kosciusko,

MS; assets ~$1.6 billion

July 23

September 8

February 4

June 29

July 1

July 26

August 23

May 2

December 6

January 17

February 7 |

34

Strategically advantageous

•

Acquisition of 120+ year old bank with quality core customer base

•

In-market transaction consistent with our acquisition

philosophy •

Creates the 4

th

largest bank by pro forma deposit market share in Mississippi

•

Enhances fee revenue businesses of insurance, mortgage, and wealth

management •

Complementary cultures and strong ties to community

•

Strong, stable deposits and earnings generation complement de novo and

out-of-state market expansion activities

Financially attractive

•

Immediately accretive to EPS, double-digit EPS accretion projected

in 2014 •

Tangible book value earn back in approximately 2.5 years

•

IRR approximately 20%

•

Realization

of

significant

expense

synergies

(25%

of

noninterest

expense)

•

Pro

forma

capital

ratios

above

“well

capitalized”

guidelines

•

Extensive due diligence process completed

•

Comprehensive review of loan and OREO portfolios

•

Conservative credit mark

Low

risk

opportunity

Summary

Highlights |

Appendix |

36

Source: SNL Financial

Company Profile

Bank Subsidiary

Merchants

and

Farmers Bank

Headquarters

Kosciusko,

Mississippi

Bank Established:

1890

Offices

36 branches

9 insurance

offices

Top 5 Markets by

Deposit Market Share:

Jackson, MS

Birmingham, AL

Tupelo,

MS

Starkville, MS

Memphis, TN

Financial

Highlights (Year Ended 12/31/12)

Total Assets:

Gross Loans:

Total Deposits:

$1.6 billion

$1.0 billion

$1.4 billion

NPAs/Assets:

Noninterest Income/Avg. Assets:

Q4’12 Cost of Deposits:

2.15%

1.41%

0.54%

First M&F Corporation Highlights |

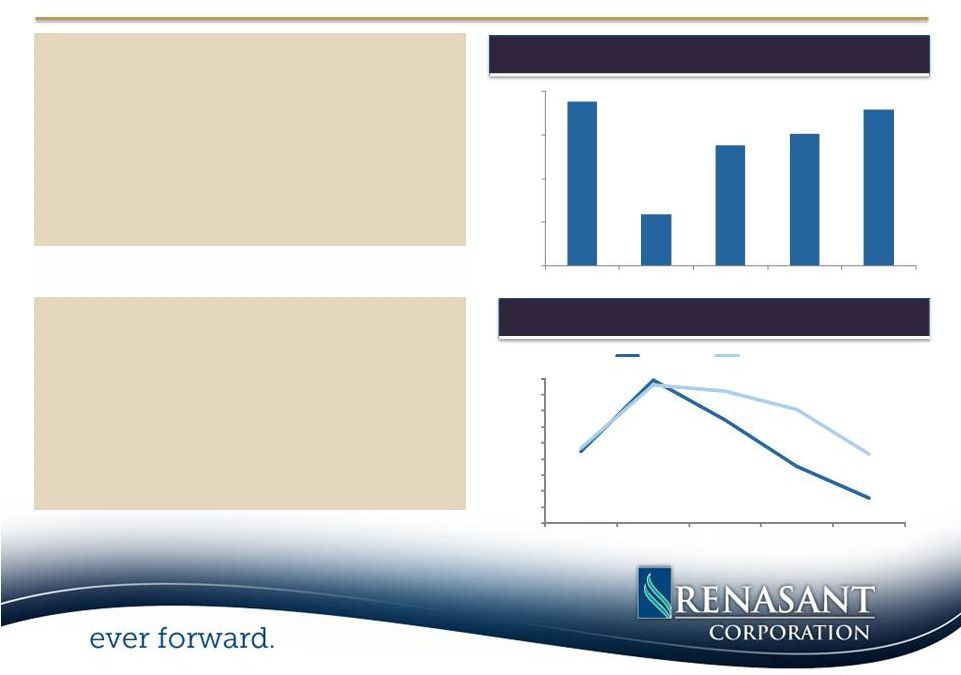

37

(1) In 2009, excludes $34.3 million goodwill impairment charge

(2) Nonperforming loans (NPLs) include loans 90 days past due and

nonaccrual loans. Nonperforming assets (NPAs) include NPLs

and other real estate owned Source: SNL Financial, data as of

12/31/2012 Credit Quality

(2)

Pre-Tax, Pre-Provision Revenue ($mm)

(1)

2.23%

0.80%

2.34%

2.15%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2008

2009

2010

2011

2012

NPLs / Loans

NPAs / Assets

$18.8

$6.0

$13.8

$15.1

$17.9

$0.0

$5.0

$10.0

$15.0

$20.0

2008

2009

2010

2011

2012

First M&F Corporation: Recent Improvements

•

Increased Profitability

–

Net income available to common

shareholders increased by 90% in 2012

•

Fee Income

–

–

Insurance revenues of $3.5 million

•

Considerable Improvement in Asset Quality

–

Nonperforming Loans/Loans at lowest

level since 2006 (0.80% of gross loans)

–

38% decrease in total nonperforming

assets in 2012 (to 2.15% of total assets)

Mortgage

banking

revenue

of

$5.3

million |

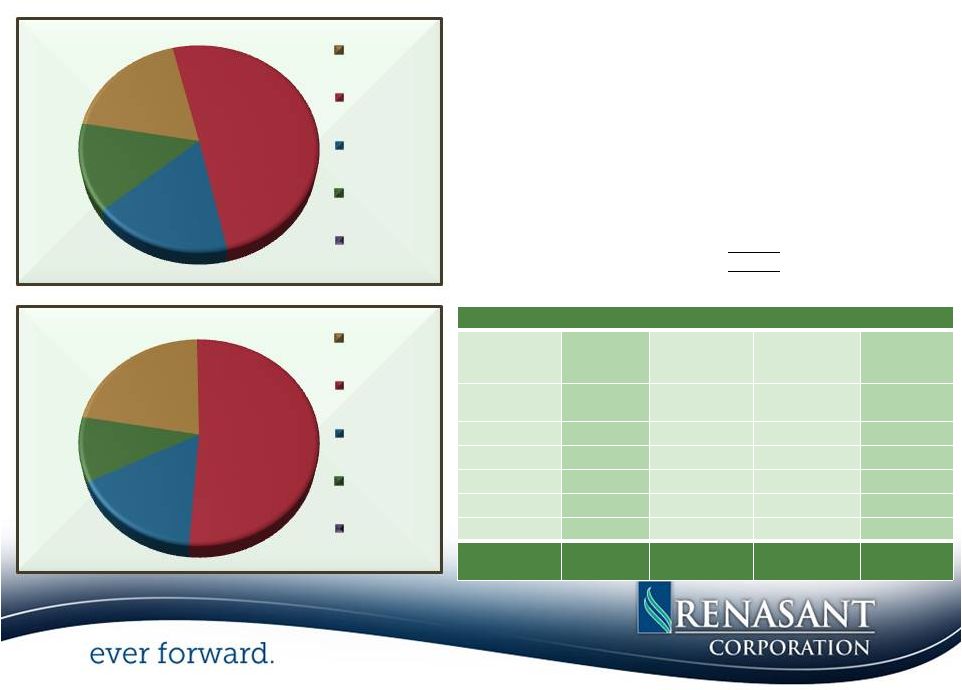

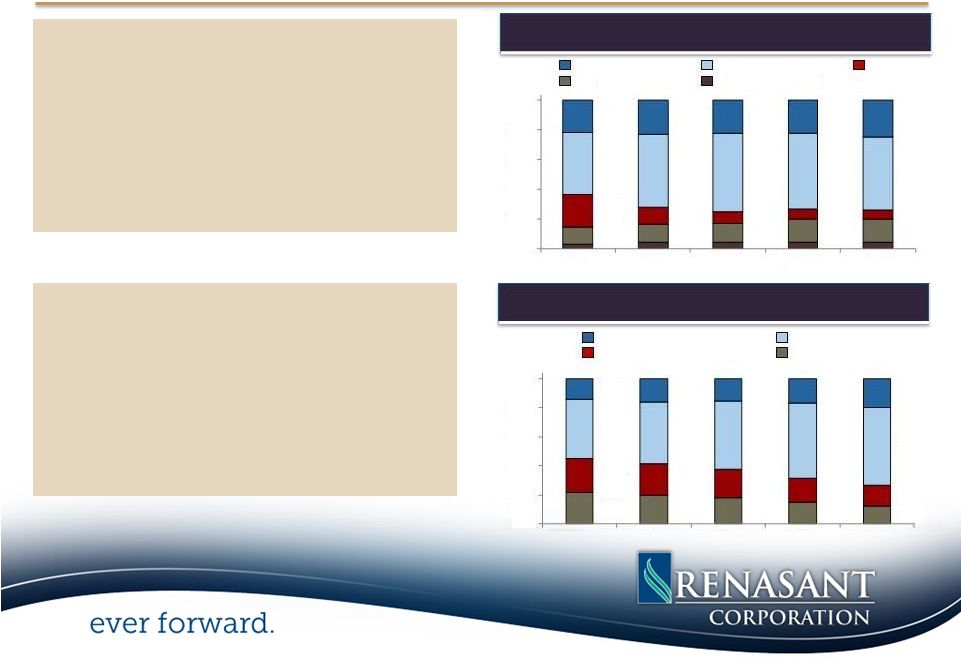

38

Non-Int. Bearing

Int. Bearing

Trans.

Time < $100K

Time > $100K

RE –

Residential

C&I

•

Significant Remixing of Loan Portfolio

–

C&D loans now represent 6% of the

portfolio, replaced by a greater

concentration of owner occupied CRE and

C&I loans

•

Shift in Deposit Mix

–

Noninterest bearing deposits represent

20% of total deposits

–

Decrease in time deposits to 27% of total

deposits

Loan Portfolio

Deposit Mix

First M&F Corporation: Recent Improvements

Consumer & Other

RE

–

Commercial

C&D

42%

50%

22%

6%

12%

16%

3%

4%

22%

24%

0%

20%

40%

60%

80%

100%

2008

2009

2010

2011

2012

41%

54%

14%

20%

23%

14%

22%

13%

0%

20%

40%

60%

80%

100%

2008

2009

2010

2011

2012 |

39

Source: SNL Financial, company earnings releases, data as of

12/31/2012 RNST

FMFC

Non-Int. Bearing

Int. Bearing Trans.

Time < $100K

Time > $100K

Renasant Corporation (12/31/12)

Pro Forma Company (12/31/12)

Historical Cost of Total Deposits

1.10%

1.01%

0.93%

0.85%

0.71%

0.65%

0.60%

0.54%

1.11%

0.99%

0.80%

0.72%

0.63%

0.58%

0.53%

0.49%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

Q1'11

Q2'11

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Q4'12

Pro Forma Deposit Composition |

40

Source: SNL Financial

Deposit data as of 6/30/2012

(1)Represents deposit market share for the state of Mississippi

(2)Represents deposit market share for counties with RNST presence

40

Mississippi

1

Alabama

2

Total

Market

# of

Deposits

Share

Rank

Institution

Branches

($mm)

(%)

1

Regions Financial Corp.

146

$6,851

14.8

2

Trustmark Corp.

137

6,577

14.2

3

BancorpSouth Inc.

102

5,047

10.9

--

Pro Forma

77

2,830

6.1

4

Hancock Holding Co.

46

2,642

5.7

5

Community Bancshares of MS

37

1,915

4.1

6

BancPlus Corp.

59

1,814

3.9

7

Renasant Corp.

47

1,658

3.6

8

First M&F Corp.

30

1,172

2.5

9

Citizens National Banc Corp.

27

956

2.1

10

BankFirst Capital Corp.

13

626

1.4

11

Wells Fargo & Co.

13

619

1.3

12

Planters Holding Co.

15

616

1.3

13

Citizens Holding Co.

22

593

1.3

14

First Bancshares Inc.

17

536

1.2

15

State Capital Corp.

22

493

1.1

16

Peoples Financial Corp.

17

482

1.0

17

Guaranty Capital Corp.

13

472

1.0

18

First Horizon National Corp.

7

454

1.0

19

PriorityOne Capital Corp.

11

449

1.0

20

Merchants & Marine Bancorp

11

449

1.0

Top 20 Institutions

792

$34,420

74.5

Total Market

1,199

46,221

100.0

Total

Market

# of

Deposits

Share

Rank

Institution

Branches

($mm)

(%)

1

Regions Financial Corp.

118

$14,394

33.2

2

Banco Bilbao Vizcaya Argentaria SA

48

7,320

16.9

3

Wells Fargo & Co.

62

5,087

11.7

4

Synovus Financial Corp.

27

2,645

6.1

5

BB&T Corp.

28

2,603

6.0

6

ServisFirst Bancshares Inc.

7

1,853

4.3

7

PNC Financial Services Group Inc.

33

1,556

3.6

8

Cadence Bancorp LLC

26

988

2.3

9

Bryant Bank

12

807

1.9

--

Pro Forma

14

719

1.7

10

Renasant Corp.

10

568

1.3

11

AloStar Bank of Commerce

1

466

1.1

12

IBERIABANK Corp.

13

452

1.0

13

USAmeriBancorp Inc.

9

433

1.0

14

Charles Investment Group LLC

4

376

0.9

15

Progress Bank and Trust

4

357

0.8

16

BancorpSouth Inc.

11

285

0.7

17

Capstone Bancshares Inc.

3

211

0.5

18

SouthPoint Bank

3

198

0.5

19

Trustmark Corp.

4

175

0.4

20

Oakworth Capital Bank

1

171

0.4

21

River Financial Corp.

2

162

0.4

22

Altrust Financial Services Inc.

9

155

0.4

23

First M&F Corp.

4

152

0.4

Top 20 Institutions

424

$40,944

94.4

Total Market

540

43,388

100.0

Pro Forma Deposit Market Share |

41

Counties with Top 5 Deposit Market Share

Source: SNL Financial, deposit data as of 6/30/2012

Includes counties with pro forma deposits greater than $100 million

Blue highlight denotes top 5 deposit market share

RNST Market Share Information

FMFC Market Share Information

Pro Forma Market Share Information

Deposits

Market

Deposits

Market

Deposits

Market

County

($mm)

Share

Branches

Rank

($mm)

Share

Branches

Rank

($mm)

Share

Branches

Rank

Lee, MS

$653.2

36.3

13

1

$133.6

7.4

3

4

$786.8

43.7

%

16

1

Morgan, AL

275.9

17.1

3

2

--

--

--

--

275.9

17.1

3

2

Shelby, TN

241.4

1.3

3

14

14.6

0.1

1

21

256.0

1.4

4

13

Davidson, TN

252.1

1.1

4

13

--

--

--

--

252.1

1.1

4

13

Madison, MS

--

--

--

--

250.4

10.6

5

4

250.4

10.6

5

4

Attala, MS

--

--

--

--

191.9

60.0

3

1

191.9

60.0

3

1

Shelby, AL

32.2

1.2

1

17

151.6

5.6

4

5

183.8

6.8

5

5

Cherokee, GA

173.2

7.6

3

6

--

--

--

--

173.2

7.6

3

6

Desoto, MS

84.1

4.2

4

8

64.3

3.2

3

9

148.3

7.4

7

5

Monroe, MS

138.9

23.5

4

2

--

--

--

--

138.9

23.5

4

2

Jefferson, AL

133.7

0.6

2

16

--

--

--

--

133.7

0.6

2

16

Forsyth, GA

126.5

4.8

2

9

--

--

--

--

126.5

4.8

2

9

Rankin, MS

--

--

--

--

121.9

5.4

4

7

121.9

5.4

4

7

Pickens, GA

116.3

15.8

2

3

--

--

--

--

116.3

15.8

2

3

Fulton, GA

112.1

0.2

3

21

--

--

--

--

112.1

0.2

3

21

Pontotoc, MS

106.1

27.8

2

2

--

--

--

--

106.1

27.8

2

2

Bartow, GA

103.5

8.9

2

5

--

--

--

--

103.5

8.9

2

5

Prentiss, MS

102.7

27.6

3

2

--

--

--

--

102.7

27.6

3

2

Lafayette, MS

25.0

2.9

2

8

76.2

8.9

2

5

101.2

11.8

4

4

Counties with top 5 market share

7

5

12

Deposit Market Share by County |

42

Renasant and M&F will be filing a joint proxy statement/prospectus,

and other relevant documents concerning the merger

with the Securities and Exchange

Commission (the “SEC”). This presentation does not constitute an offer to sell or the

solicitation

of

an

offer

to

buy

any

securities

or

a

solicitation

of

any

vote

or

approval.

INVESTORS

ARE

URGED

TO

READ

THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE

FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED

BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RENASANT, M&F

AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be mailed to shareholders

of

both

Renasant

and

M&F.

Investors

will

also

be

able

to

obtain

copies

of

the

joint

proxy

statement/prospectus

and

other

relevant documents (when they become available) free of charge at the

SEC’s Web site (www.sec.gov). In addition, documents

filed with the SEC by Renasant will be available free of charge from

Mitchell Waycaster, Director of Investor Relations, Renasant

Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, telephone: (662) 680-1215. Documents filed with the

SEC by M&F will be available free of charge from M&F by

contacting John G. Copeland, Chief Financial Officer, First M&F

Corporation, 134 West Washington Street, Kosciusko, Mississippi 39090,

telephone: (662) 289-8594.

Renasant,

M&F

and

certain

of

their

directors,

executive

officers

and

other

members

of

management

and

employees may be deemed to be participants in the solicitation of

proxies from the shareholders of Renasant and M&F in

connection with the proposed merger. Information about the

directors and executive officers of Renasant is included in the

proxy statement for its 2012 annual meeting of shareholders, which was

filed with the SEC on March 8, 2012. Information

about

the

directors

and

executive

officers

of

M&F

is

included

in

the

proxy

statement

for

its

2012

annual

meeting

of

shareholders, which was filed with the SEC on March 14, 2012.

Additional information regarding the interests of such

participants

and

other

persons

who

may

be

deemed

participants

in

the

transaction

will

be

included

in

the

joint

proxy

statement/prospectus

and

the

other

relevant

documents

filed

with

the

SEC

when

they

become

available.

Additional Information

|

43

E. Robinson McGraw

Chairman

President and Chief Executive Officer

Kevin D. Chapman

Senior Executive Vice President and

Chief Financial Officer

Investor Inquiries 209 TROY

STREET

TUPELO, MS 38804-4827 PHONE:

1-800-680-1601

FACSIMILE: 1-662-680-1234

WWW.RENASANT.COM

WWW.RENASANTBANK.COM

|