Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTHERN TRUST CORP | d485010d8k.htm |

P R I N

C I P L E S T H A T E N D U R E Northern Trust

Corporation Michael G. O’Grady

Executive Vice President &

Chief Financial Officer

Credit Suisse Financial Services Forum

February 13, 2013

EXHIBIT 99.1

©

2013 Northern Trust Corporation

Service

Expertise

Integrity

northerntrust.com |

2

Credit Suisse Financial Services Forum

Forward Looking Statement

This presentation may include forward-looking statements such as statements

that relate to Northern Trust’s financial goals, capital adequacy,

dividend policy, expansion and business development plans, risk management

policies, anticipated expense levels and projected profit improvements,

business prospects and positioning with respect to market, demographic and

pricing trends, strategic initiatives, re-engineering and outsourcing activities,

new business results and outlook, changes in securities market prices, credit

quality including allowance levels, planned capital expenditures and

technology spending, anticipated tax benefits and expenses, and the effects

of any extraordinary events and various other matters (including

developments with respect to litigation, other contingent liabilities and obligations,

and regulation involving Northern Trust and changes in accounting policies,

standards and interpretations) on Northern Trust’s business and

results. These statements speak of Northern Trust’s plans, goals,

targets, strategies, beliefs, and expectations, and refer to estimates or

use similar terms. Actual results could differ materially from those indicated by

these statements because the realization of those results is subject to many risks

and uncertainties.

Our 2011 annual report and periodic reports to the SEC contain information about

specific factors that could cause actual results to differ, and you are

urged to read them. Northern Trust disclaims any continuing accuracy of the

information provided in this presentation after today.

|

3

Credit Suisse Financial Services Forum

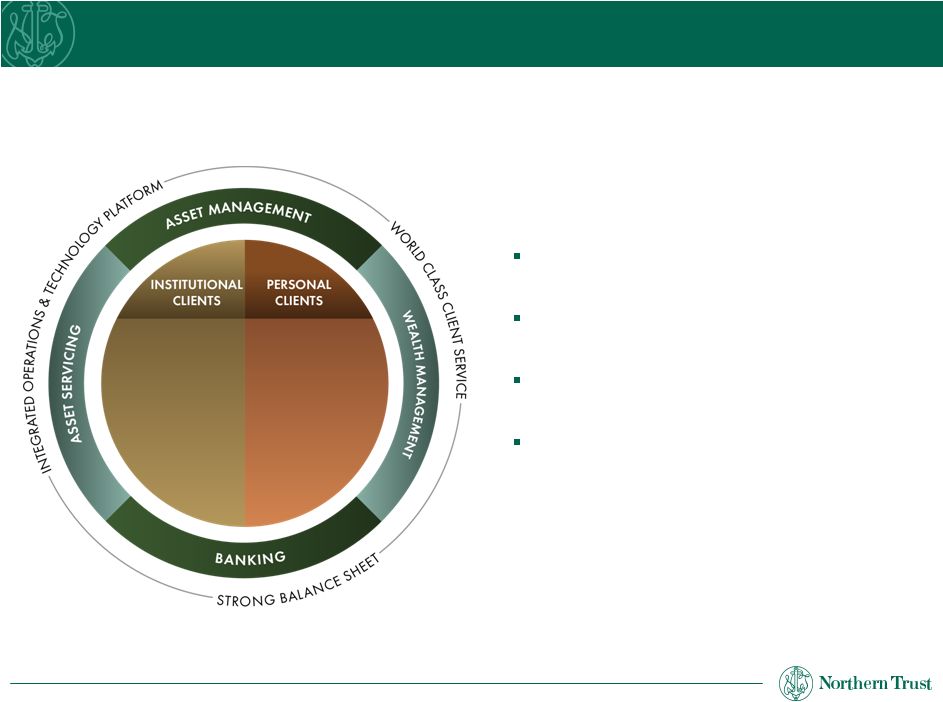

A Highly Focused Business Model

Northern Trust Corporation is a global leader in asset servicing, asset management,

wealth management and banking for personal and institutional clients.

Pension funds

Fund managers

Insurance

Foundations

Endowments

Sovereign

wealth funds

Individuals

Families

Family offices

Family foundations

& endowments

Privately held

businesses

Market Leader in Focused Businesses

Strong History of Organic Growth

Focused on Driving Performance

Distinctive Financial Strength

3

Credit Suisse Financial Services Forum |

4

Credit Suisse Financial Services Forum

High-touch trust,

investment management

and banking solutions.

Global Family

Office

Wealth Advisory

Private Client

$1 MM

$20 MM

$200 MM

Comprehensive,

advice-driven financial

solutions

through an integrated

team of specialists.

Personal Clients

Delivering Advice-based Solutions to our Target Markets

Teams of specialists are structured to serve three key segments.

Sophisticated asset

servicing solutions for

families

with

3

rd

party

investment

consultants.

4

Credit Suisse Financial Services Forum

Complexity |

5

Credit Suisse Financial Services Forum

Custom asset

allocation

Comprehensive

investment

capabilities

Broad menu of

outside managers

Brokerage

services

Deposit services

Custom

financing

Stock option

lending

Personal Clients

Comprehensive Capabilities Few Firms Can Match

Customized

investment

objectives

and strategic

asset allocation

Manager

selection and

oversight

Asset servicing

and

administration

Family education

and governance

Family business

Non-financial

asset

management

Cash flow

analysis

Debt

management

Tax planning

Retirement

planning

Wealth transfer

planning

Trust and estate

services

Philanthropic

advisory

services

Securities

custody

Services are tailored to client needs and goals.

Financial

Planning

Investment

Management

Private and

Business

Banking

Trust & Estate

Services

Advisory

Services

Foundation and

Institutional

Advisors |

6

Credit Suisse Financial Services Forum

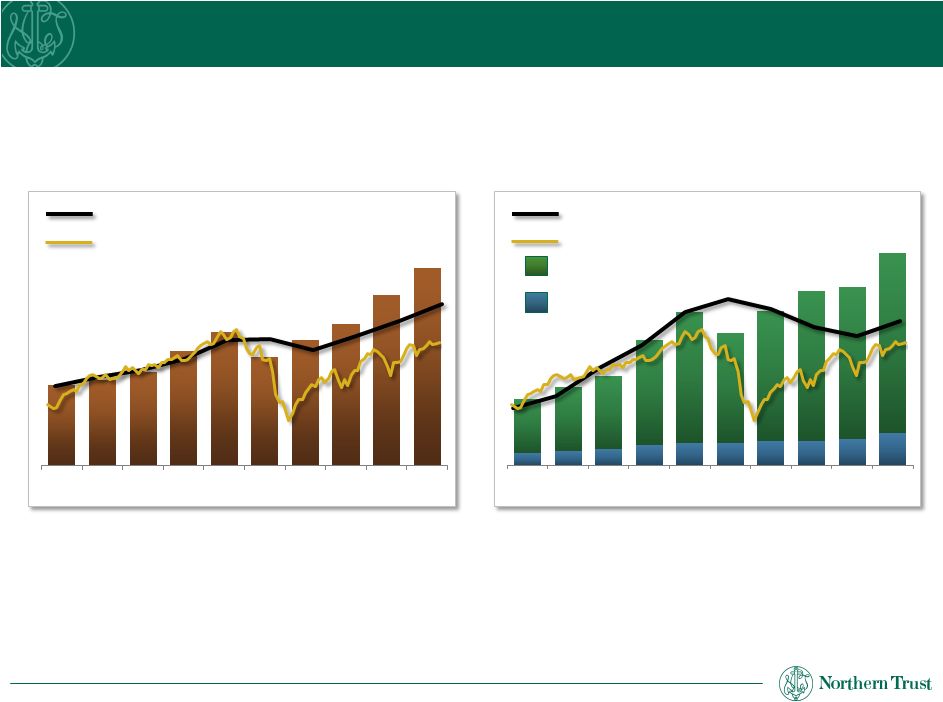

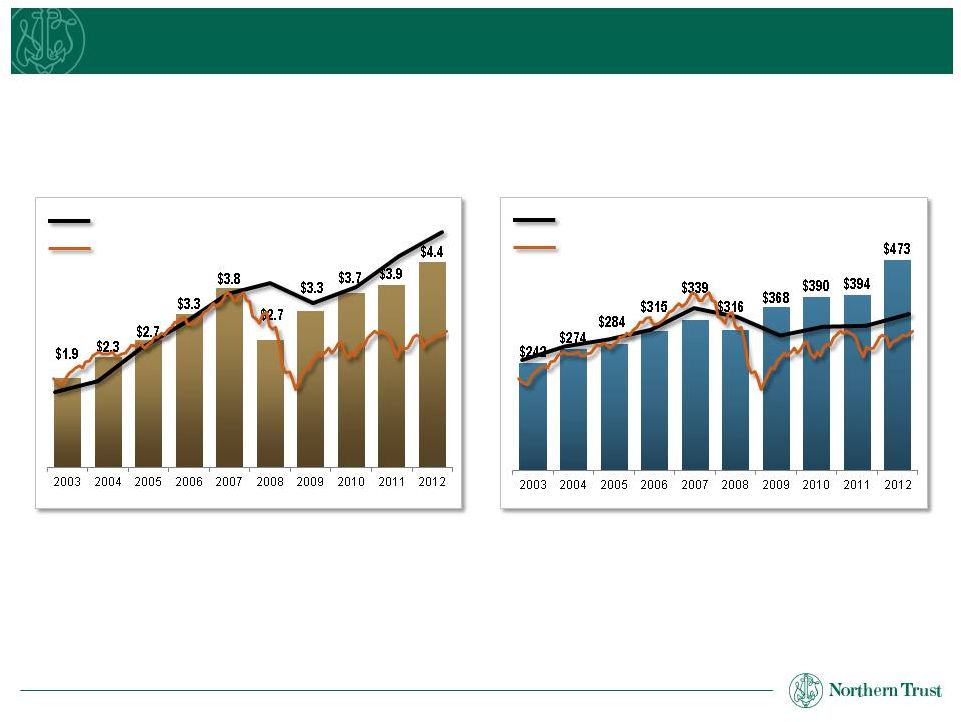

Personal Clients

Strong Growth Across Segments

Private Client & Wealth Advisory

Assets Under Management

($ Billions)

S&P 500

Private Client & Wealth Advisory Fees

Global Family Office

Assets Under Custody

($ Billions)

S&P 500

Global Family Office Fees

Non-managed

Managed

6

Credit Suisse Financial Services Forum

$87

$91

$95

$107

$118

$103

$114

$123

$140

$156

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

$85

$101

$114

$160

$195

$168

$196

$222

$227

$270

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

7

Credit Suisse Financial Services Forum

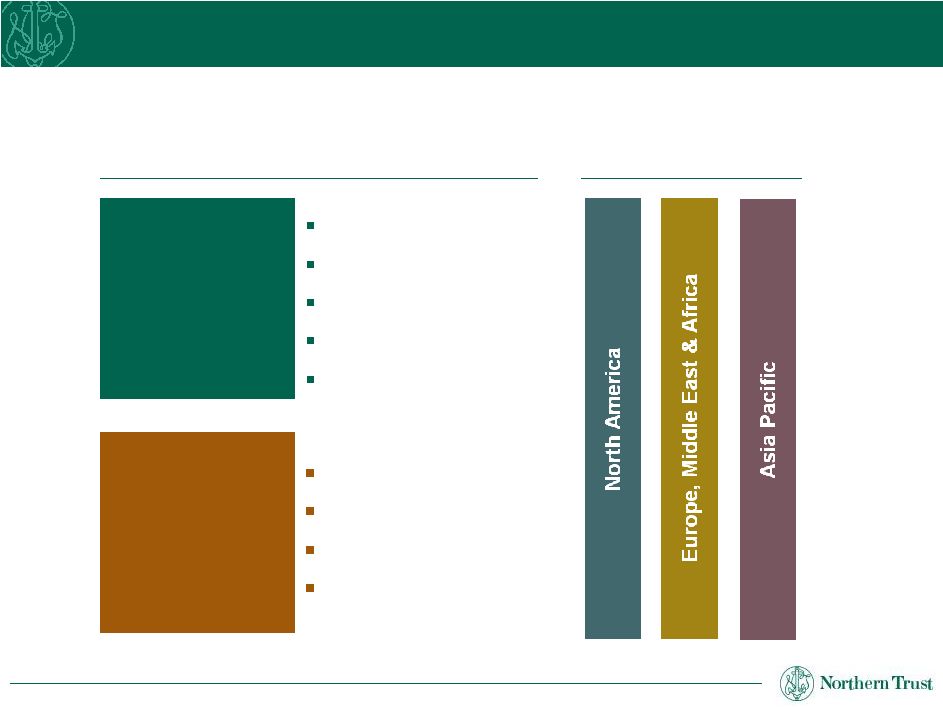

Providing solutions to asset owners and asset managers around the world.

Institutional

Investor Group

(IIG)

Global

Fund Services

(GFS)

Pension plans

Insurance

Sovereign wealth funds

Foundations

Endowments

Traditional funds

Hedge funds

Fund of funds

Exchange Traded Funds

Institutional Clients

Serving Select Institutional Segments

Segments

Regions |

8

Credit Suisse Financial Services Forum

Institutional Clients

A Broad Range of Solutions

Asset

Administration

Fund accounting

Transfer agency

Corporate

secretarial/trustee

Valuations

Investment

operations

outsourcing

Investment

Management

Short duration

Global index

Active

Investment

outsourcing

Liability driven

investing

Multi-manager

Transition

management

Asset

Processing

Custody

Safekeeping

Settlement

Derivatives and

collateral

processing

Income collection

Corporate actions

Tax reclamation

White label

reporting

Valuation analytics

Performance

analytics

Risk monitoring

and reporting

Trade execution

analysis

Asset

Reporting

Asset

Enhancement

Cross-border

pooling

Trade execution

Cash management

Securities lending

Foreign exchange

Offering an array of asset servicing and asset management services.

|

9

Credit Suisse Financial Services Forum

Institutional Clients

A Distinctive Record of Global Growth

Corporate & Institutional Services

Assets

Under

Custody

($

Trillions)

MSCI World Index

Custody & Fund Admin Fees

Corporate & Institutional Services

Assets Under Management

($ Billions)

Institutional Asset Mgmt Fees

1

Excludes Securities Lending collateral

MSCI World Index

1 |

10

Credit Suisse Financial Services Forum

Trends Impacting our Businesses

Global wealth creation

Globalization/cross-border investing

Expanding use of alternative assets

Shift from active to passive management

Increased regulation

Focus on risk management

Demand for transparency

Back and middle office outsourcing

Historically low interest rates

Low foreign exchange volatility

Low securities lending demand

Equity markets reflecting increased risk

appetite

Secular Trends

Cyclical Trends |

11

Credit Suisse Financial Services Forum

Revenue

Enhancements

Process

Optimization

Technology

Efficiency

Corporate-wide

Initiatives

Driving Performance

Improving Profitability and Returns

Surpassed 2012 goal of more than half of

$250 million target

2012 benefits were split roughly 40%/60%

between revenue and expense

Improved 2012 pre-tax margin by

approximately 375 basis points and return

on equity by approximately 150 basis points

On target to achieve $250 million of pre-tax

benefit in 2013 |

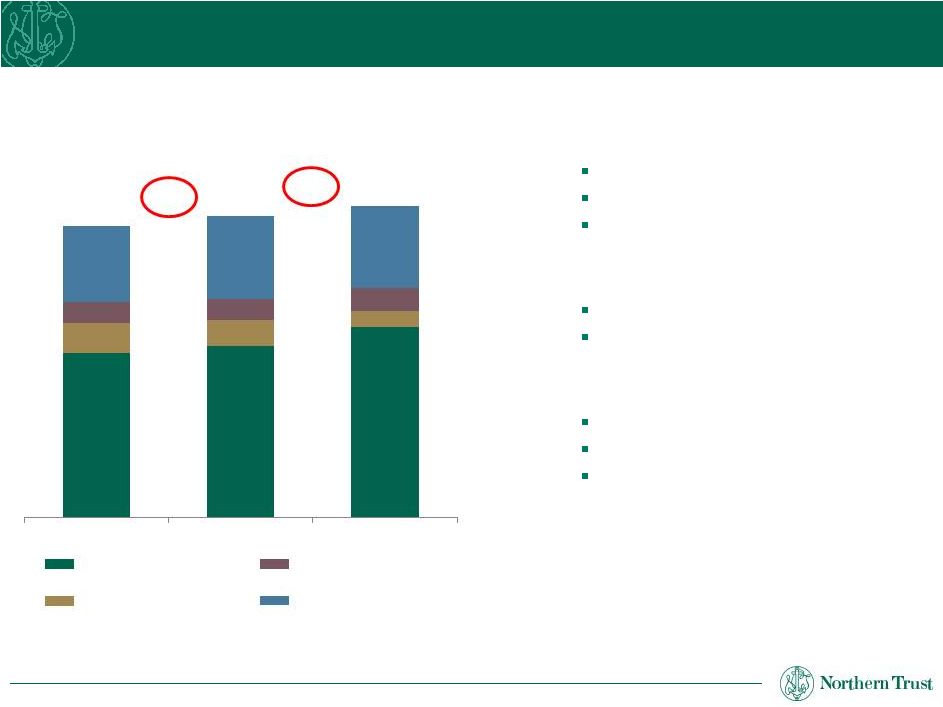

12

Credit Suisse Financial Services Forum

Revenue Trends and Drivers

Total Revenue (FTE

1

)

$ in millions

-2%

+10%

-36%

+11%

+10%

+1%

-15%

+4%

Trust, Investment and

Other Servicing Fees

Other Noninterest

Income

Net Interest Income

Trust Fees

FX Trading Income

Net Interest Income

+3%

+3%

$2,082

$2,170

$2,406

$382

$325

$206

$265

$267

$294

$958

$1,049

$1,031

$3,687

$3,810

$3,937

2010

2011

2012

FX Trading Income

New business

Market values

Activity levels

Currency volatility

Volume

Client deposit levels

Earning asset mix

Interest rates

(FTE

1

)

1

Net interest income and total revenue stated on an FTE basis are non-GAAP financial measures. A

reconciliation of these measures to reported results prepared in accordance with

U.S. GAAP is included in the Appendix on page 17.

|

13

Credit Suisse Financial Services Forum

Expense Trends and Drivers

$ in millions

Total Noninterest Expense

+2%

-4%

+12%

-4%

0%

+16%

+13%

+8%

+14%

+20%

+13%

+3%

Outside Services

Compensation & Benefits

Equipment & Software

Occupancy

Other

Compensation & Benefits

Outside Services

Equipment & Software

Other

$1,346

$1,525

$1,526

$460

$553

$529

$287

$328

$367

$168

$181

$174

$237

$244

$283

$2,498

$2,831

$2,879

2010

2011

2012

New business

Productivity

Global operating model

New business

Market levels

Regulatory environment

New business

Ongoing investment

Includes business promotion, staff-related

costs, and account servicing charges |

14

Credit Suisse Financial Services Forum

Primary Financial Levers

Maximize other revenue in context of

macroeconomic environment

Grow trust fees through new business

Improve productivity by managing expenses

relative to trust fees

Utilize capital efficiently

Focused on driving growth and higher returns.

Return on

Equity |

15

Credit Suisse Financial Services Forum

Strategically Positioned for Growth

Market Leader in Focused Businesses

Strong History of Organic Growth

Focused on Driving Performance

Distinctive Financial Strength |

Appendix

northerntrust.com

©

2013 Northern Trust Corporation

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

|

17

Credit Suisse Financial Services Forum

Reconciliation of Non-GAAP Financial Measures

The

following

table

presents

a

reconciliation

of

interest

income

and

net

interest

income

prepared

in accordance with GAAP to interest income and net interest income on a fully

taxable equivalent (FTE) basis, a non-GAAP financial measure.

Management believes this presentation provides a clearer indication of net

interest margins for comparative purposes. ($ In Millions)

Reported

FTE Adj.

FTE

Reported

FTE Adj.

FTE

Reported

FTE Adj.

FTE

Interest Income

$1,287.7

$40.8

$1,328.5

$1,408.6

$40.2

$1,448.8

$1,296.7

$39.1

$1,335.8

Interest Expense

297.4

–

297.4

399.5

–

399.5

378.0

–

378.0

Net Interest Income

990.3

$40.8

$1,031.1

1,009.1

$40.2

$1,049.3

918.7

$39.1

957.8

Net Interest Margin

1.18%

1.22%

1.22%

1.27%

1.35%

1.41%

Total Revenue

$3,896.1

$40.8

$3,936.9

$3,769.9

$40.2

$3,810.1

$3,647.7

$39.1

$3,686.8

Twelve Months Ended

December 31, 2012

December 31, 2010

December 31, 2011

$

$

$

$ |