Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HEALTHPEAK PROPERTIES, INC. | a13-4832_18k.htm |

| EX-99.1 - EX-99.1 - HEALTHPEAK PROPERTIES, INC. | a13-4832_1ex99d1.htm |

Exhibit 99.2

Supplemental Information

December 31, 2012

(Unaudited)

Table of Contents

|

Company Information |

1 |

|

Summary |

2 |

|

Funds From Operations |

3 |

|

Funds Available for Distribution |

4 |

|

Capitalization |

5 |

|

Credit Profile |

6-7 |

|

Indebtedness and Ratios |

8 |

|

Investments and Dispositions |

9 |

|

Development |

10 |

|

Owned Portfolio |

|

|

Portfolio summary |

12 |

|

Portfolio concentrations |

13 |

|

Same property portfolio |

14 |

|

Lease expirations and debt investment maturities |

15 |

|

Owned Senior Housing Portfolio |

|

|

Investments and operator concentration |

16 |

|

Trends |

17 |

|

Owned Post-Acute/Skilled Nursing Portfolio |

|

|

Investments and operator concentration |

18 |

|

Trends and HCR ManorCare information |

19 |

|

Owned Life Science Portfolio |

|

|

Investments, tenant concentration and trends |

20 |

|

Selected lease expirations and leasing activity |

21 |

|

Owned Medical Office Portfolio |

|

|

Investments and trends |

22 |

|

Leasing activity |

23 |

|

Owned Hospital Portfolio |

|

|

Investments and operator concentration |

24 |

|

Trends |

25 |

|

Investment Management Platform |

26 |

|

Reporting Definitions and Reconciliations of Non-GAAP Measures |

27-32 |

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: The statements contained in this supplemental information which are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include among other things the Company’s estimate of (i) completion dates, stabilization dates, rentable square feet and total investment for development projects in progress, and (ii) rentable square feet for land held for development. These statements are made as of the date hereof, are not guarantees of future performance and are subject to known and unknown risks, uncertainties, assumptions and other factors—many of which are out of the Company and its management’s control and difficult to forecast—that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements. These risks and uncertainties include but are not limited to: national and local economic conditions; continued volatility in the capital markets, including changes in interest rates and the availability and cost of capital, which changes and volatility affect opportunities for profitable investments; the Company’s ability to access external sources of capital when desired and on reasonable terms; the Company’s ability to manage its indebtedness levels; changes in the terms of the Company’s indebtedness; the Company’s ability to maintain its credit ratings; the potential impact of existing and future litigation matters, including the possibility of larger than expected litigation costs and related developments; the Company’s ability to successfully integrate the operations of acquired companies; risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision-making authority and its reliance on its joint venture partners’ financial condition and continued cooperation; competition for lessees and mortgagors (including new leases and mortgages and the renewal or rollover of existing leases); the Company’s ability to reposition its properties on the same or better terms if existing leases are not renewed or the Company exercises its right to replace an existing operator or tenant upon default; continuing reimbursement uncertainty in the post-acute/skilled nursing segment; competition in the senior housing segment specifically and in the healthcare industry in general; the ability of the Company’s operators and tenants from its senior housing segment to maintain or increase their occupancy levels and revenues; the ability of the Company’s lessees and mortgagors to maintain the financial strength and liquidity necessary to satisfy their respective obligations to the Company and other third parties; the bankruptcy, insolvency or financial deterioration of the Company’s operators, lessees, borrowers or other obligors; changes in healthcare laws and regulations, including the impact of future or pending healthcare reform, and other changes in the healthcare industry which affect the operations of the Company’s lessees or obligors, including changes in the federal budget resulting in the reduction or nonpayment of Medicare or Medicaid reimbursement rates; the Company’s ability to recruit and retain key management personnel; costs of compliance with regulations and environmental laws affecting the Company’s properties; changes in tax laws and regulations; changes in the financial position or business strategies of HCR ManorCare; the Company’s ability and willingness to maintain its qualification as a REIT due to economic, market, legal, tax or other considerations; changes in rules governing financial reporting, including new accounting pronouncements; and other risks described from time to time in the Company’s Securities and Exchange Commission filings. The Company assumes no, and hereby disclaims any, obligation to update any of the foregoing or any other forward-looking statements as a result of new information or new or future developments, except as otherwise required by law.

![]()

Company Information(1)

|

Board of Directors | |

|

|

|

|

James F. Flaherty III |

Michael D. McKee |

|

Chairman and Chief Executive Officer |

Chief Executive Officer |

|

HCP, Inc. |

Bentall Kennedy U.S., L.P. |

|

|

|

|

Christine N. Garvey |

Peter L. Rhein |

|

Former Global Head of Corporate |

Partner, Sarlot & Rhein |

|

Real Estate Services, Deutsche Bank AG |

|

|

|

|

|

David B. Henry |

Kenneth B. Roath |

|

Vice Chairman, President and Chief |

Chairman Emeritus, HCP, Inc. |

|

Executive Officer, Kimco Realty Corporation |

|

|

|

|

|

Lauralee E. Martin |

Joseph P. Sullivan |

|

Chief Executive Officer, Americas and Chief Financial Officer |

Chairman Emeritus of the Board of Advisors |

|

Jones Lang LaSalle Incorporated |

RAND Health |

|

|

|

|

|

|

|

Senior Management | |

|

|

|

|

James F. Flaherty III |

Thomas M. Klaritch |

|

Chairman and |

Executive Vice President |

|

Chief Executive Officer |

Medical Office Properties |

|

|

|

|

Jonathan M. Bergschneider |

James W. Mercer |

|

Executive Vice President |

Executive Vice President, General Counsel |

|

Life Science Estates |

and Corporate Secretary |

|

|

|

|

Paul F. Gallagher |

Timothy M. Schoen |

|

Executive Vice President and |

Executive Vice President and |

|

Chief Investment Officer |

Chief Financial Officer |

|

|

|

|

Edward J. Henning |

Susan M. Tate |

|

Executive Vice President |

Executive Vice President |

|

|

Post-Acute and Hospitals |

|

Thomas D. Kirby |

|

|

Executive Vice President |

Kendall K. Young |

|

Acquisitions and Valuations |

Executive Vice President |

|

|

Senior Housing |

|

|

|

|

Other Information | |

|

|

|

|

Corporate Headquarters |

San Francisco Office |

|

3760 Kilroy Airport Way, Suite 300 |

400 Oyster Point Boulevard, Suite 409 |

|

Long Beach, CA 90806-2473 |

South San Francisco, CA 94080-1920 |

|

(562) 733-5100 |

|

|

|

|

|

Nashville Office |

|

|

3000 Meridian Boulevard, Suite 200 |

|

|

Franklin, TN 37067-6388 |

|

The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with the Securities and Exchange Commission (“SEC”). The Reporting Definitions and Reconciliations of Non-GAAP Measures are an integral part of the information presented herein.

On the Company’s internet website, www.hcpi.com, you can access, free of charge, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information contained on its website is not incorporated by reference into, and should not be considered a part of, this supplemental information package. In addition, the SEC maintains an internet website that contains reports, proxy and information statements, and other information regarding issuers, including HCP, that file electronically with the SEC at www.sec.gov.

For more information, contact Timothy M. Schoen, Executive Vice President and Chief Financial Officer at (562) 733-5309.

(1) As of February 8, 2013.

|

|

|

Summary

Dollars in thousands, except per share data

|

|

|

Three Months Ended |

|

Year Ended |

| ||||||||

|

|

|

2012 |

|

2011 |

|

2012 |

|

2011 |

| ||||

|

Revenues |

|

$ |

508,487 |

|

$ |

458,281 |

|

$ |

1,900,722 |

|

$ |

1,712,096 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

NOI |

|

421,871 |

|

388,093 |

|

1,590,293 |

|

1,390,008 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted (Cash) NOI |

|

384,609 |

|

347,138 |

|

1,447,360 |

|

1,248,506 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

YoY SPP Adjusted (Cash) NOI % Growth |

|

4.3% |

|

2.2% |

|

4.2% |

|

4.0% |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted EBITDA |

|

$ |

431,690 |

|

386,599 |

|

$ |

1,627,374 |

|

$ |

1,473,258 |

| |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted FFO per common share |

|

0.71 |

|

0.37 |

|

2.72 |

|

2.19 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted FFO as adjusted per common share |

|

0.72 |

|

0.67 |

|

2.78 |

|

2.69 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted FAD per common share |

|

0.57 |

|

0.50 |

|

2.22 |

|

2.14 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted EPS |

|

0.53 |

|

0.15 |

|

1.90 |

|

1.29 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Dividends per common share |

|

$ |

0.50 |

|

$ |

0.48 |

|

$ |

2.00 |

|

$ |

1.92 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

FFO as adjusted payout ratio |

|

69% |

|

72% |

|

72% |

|

71% |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

FAD payout ratio |

|

88% |

|

96% |

|

90% |

|

90% |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Financial leverage |

|

40% |

|

41% |

|

40% |

|

41% |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjusted fixed charge coverage |

|

3.8x |

|

3.4x |

|

3.6x |

|

3.1x |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

December 31, |

|

December 31, |

|

|

|

|

| ||||

|

Total properties: |

|

2012 |

|

2011 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Senior housing |

|

441 |

|

314 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Post-acute/skilled nursing |

|

312 |

|

313 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Life science |

|

113 |

|

108 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Medical office |

|

273 |

|

254 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Hospital |

|

21 |

|

21 |

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Total |

|

1,160 |

|

1,010 |

|

|

|

|

| ||||

|

Portfolio Income from Assets Under Management(1) |

|

Assets Under Management: $21.3 billion(2) |

|

|

|

|

|

|

|

|

(1) Represents adjusted NOI from real estate owned by HCP, interest income from debt investments and HCP’s pro rata share of adjusted NOI from real estate owned by the Company’s Investment Management Platform, excluding assets under development and land held for development, for the year ended December 31, 2012.

(2) Represents the historical cost of real estate owned by HCP, the carrying amount of debt investments and 100% of the cost of real estate owned by the Company’s Investment Management Platform, excluding assets held for sale and under development and land held for development, at December 31, 2012.

See Reporting Definitions and Reconciliations of Non-GAAP Measures

Funds From Operations

Dollars and shares in thousands, except per share data

|

|

|

Three Months Ended |

|

Year Ended |

| ||||||||

|

|

|

2012 |

|

2011 |

|

2012 |

|

2011 |

| ||||

|

Net income applicable to common shares |

|

$ |

239,881 |

|

$ |

61,996 |

|

$ |

812,289 |

|

$ |

515,302 |

|

|

Depreciation and amortization of real estate, in-place lease and other intangibles: |

|

|

|

|

|

|

|

|

| ||||

|

Continuing operations |

|

99,373 |

|

84,348 |

|

358,245 |

|

349,922 |

| ||||

|

Discontinued operations |

|

800 |

|

3,019 |

|

8,267 |

|

7,473 |

| ||||

|

DFL depreciation |

|

3,330 |

|

2,961 |

|

12,756 |

|

8,840 |

| ||||

|

Gain on sales of real estate |

|

(28,598 |

) |

(3,107 |

) |

(31,454 |

) |

(3,107 |

) | ||||

|

Gain upon consolidation of joint venture |

|

— |

|

— |

|

— |

|

(7,769 |

) | ||||

|

Equity income from unconsolidated joint ventures |

|

(11,652 |

) |

(13,952 |

) |

(54,455 |

) |

(46,750 |

) | ||||

|

FFO from unconsolidated joint ventures |

|

14,438 |

|

16,479 |

|

64,933 |

|

56,887 |

| ||||

|

Noncontrolling interests’ and participating securities’ share in earnings |

|

6,379 |

|

3,509 |

|

17,547 |

|

18,062 |

| ||||

|

Noncontrolling interests’ and participating securities’ share in FFO |

|

(6,112 |

) |

(4,675 |

) |

(21,620 |

) |

(20,953 |

) | ||||

|

FFO applicable to common shares |

|

$ |

317,839 |

|

$ |

150,578 |

|

$ |

1,166,508 |

|

$ |

877,907 |

|

|

Distributions on dilutive convertible units |

|

3,631 |

|

— |

|

13,028 |

|

6,916 |

| ||||

|

Diluted FFO applicable to common shares |

|

$ |

321,470 |

|

$ |

150,578 |

|

$ |

1,179,536 |

|

$ |

884,823 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted average shares used to calculate diluted FFO per share |

|

454,992 |

|

409,730 |

|

434,328 |

|

403,864 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted FFO per common share |

|

$ |

0.71 |

|

$ |

0.37 |

|

$ |

2.72 |

|

$ |

2.19 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Dividends per common share |

|

$ |

0.50 |

|

$ |

0.48 |

|

$ |

2.00 |

|

$ |

1.92 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

FFO payout ratio |

|

70.4% |

|

129.7% |

|

73.5% |

|

87.7% |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Impact of adjustments to FFO: |

|

|

|

|

|

|

|

|

| ||||

|

Preferred stock redemption charge(1) |

|

$ |

— |

|

$ |

— |

|

$ |

10,432 |

|

$ |

— |

|

|

Litigation settlement charge(2) |

|

— |

|

125,000 |

|

— |

|

125,000 |

| ||||

|

Merger-related items(3) |

|

5,642 |

|

— |

|

5,642 |

|

26,596 |

| ||||

|

Impairments(4) |

|

— |

|

— |

|

7,878 |

|

15,400 |

| ||||

|

|

|

$ |

5,642 |

|

$ |

125,000 |

|

$ |

23,952 |

|

$ |

166,996 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

FFO as adjusted applicable to common shares |

|

$ |

323,481 |

|

$ |

275,578 |

|

$ |

1,190,460 |

|

$ |

1,044,903 |

|

|

Distributions on dilutive convertible units and other |

|

3,613 |

|

2,858 |

|

12,957 |

|

11,646 |

| ||||

|

Diluted FFO as adjusted applicable to common shares |

|

$ |

327,094 |

|

$ |

278,436 |

|

$ |

1,203,417 |

|

$ |

1,056,549 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted average shares used to calculate diluted FFO as adjusted per share |

|

452,122 |

|

415,624 |

|

433,607 |

|

393,237 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted FFO as adjusted per common share |

|

$ |

0.72 |

|

$ |

0.67 |

|

$ |

2.78 |

|

$ |

2.69 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

FFO as adjusted payout ratio |

|

69.4% |

|

71.6% |

|

71.9% |

|

71.4% |

| ||||

(1) In connection with the redemption of the Company’s preferred stock, during the year ended December 31, 2012, the Company incurred a one-time, non-cash redemption charge of $10.4 million, or $0.02 per share, related to the original issuance costs.

(2) The litigation settlement charge during the quarter and year ended December 31, 2011 relates to the settlement with Ventas, Inc.

(3) The 2012 merger-related items attributable to the $1.7 billion Senior Housing Portfolio acquisition include direct transaction costs and the impact of the negative carry of prefunding the transaction with the $1.0 billion, or 22 million shares, common stock offering completed on October 19, 2012 on the calculation of weighted average shares. The 2011 merger-related items of $0.15 per share attributable to the HCR ManorCare Acquisition, which closed on April 7, 2011.

(4) The 2012 impairment charge of $7.9 million, or $0.02 per share, relates to the sale of a land parcel in the life science segment. The impairment charge of $15.4 million, or $0.04 per share, relates to the Company’s senior secured loan to Delphis Operations, L.P. (“Delphis”).

|

See Reporting Definitions and Reconciliations of Non-GAAP Measures |

Funds Available for Distribution

Dollars and shares in thousands, except per share data

|

|

|

Three Months Ended |

|

Year Ended |

| ||||||||

|

|

|

2012 |

|

2011 |

|

2012 |

|

2011 |

| ||||

|

FFO as adjusted applicable to common shares |

|

$ |

323,481 |

|

$ |

275,578 |

|

$ |

1,190,460 |

|

$ |

1,044,903 |

|

|

Amortization of above and below market lease intangibles, net(1) |

|

(377 |

) |

(1,239 |

) |

(2,232 |

) |

(4,510 |

) | ||||

|

Amortization of deferred compensation |

|

6,330 |

|

4,748 |

|

23,277 |

|

20,034 |

| ||||

|

Amortization of deferred financing costs, net |

|

4,086 |

|

3,651 |

|

16,501 |

|

13,716 |

| ||||

|

Straight-line rents |

|

(13,703 |

) |

(12,237 |

) |

(47,311 |

) |

(59,173 |

) | ||||

|

DFL accretion(2) |

|

(23,168 |

) |

(25,499 |

) |

(94,240 |

) |

(74,007 |

) | ||||

|

DFL depreciation |

|

(3,330 |

) |

(2,961 |

) |

(12,756 |

) |

(8,840 |

) | ||||

|

Deferred revenues – tenant improvement related |

|

(313 |

) |

(237 |

) |

(1,570 |

) |

(2,371 |

) | ||||

|

Deferred revenues – additional rents (SAB 104) |

|

(2,443 |

) |

(798 |

) |

(85 |

) |

52 |

| ||||

|

Leasing costs and tenant and capital improvements |

|

(18,623 |

) |

(21,131 |

) |

(61,440 |

) |

(52,903 |

) | ||||

|

Joint venture and other FAD adjustments(2) |

|

(18,099 |

) |

(16,985 |

) |

(61,298 |

) |

(46,250 |

) | ||||

|

FAD applicable to common shares |

|

$ |

253,841 |

|

$ |

202,890 |

|

$ |

949,306 |

|

$ |

830,651 |

|

|

Distributions on dilutive convertible units |

|

2,310 |

|

1,758 |

|

7,714 |

|

6,916 |

| ||||

|

Diluted FAD applicable to common shares |

|

$ |

256,151 |

|

$ |

204,648 |

|

$ |

957,020 |

|

$ |

837,567 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted average shares used to calculate diluted FAD per share |

|

450,207 |

|

413,338 |

|

431,429 |

|

390,944 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Diluted FAD per common share |

|

$ |

0.57 |

|

$ |

0.50 |

|

$ |

2.22 |

|

$ |

2.14 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Dividends per common share |

|

$ |

0.50 |

|

$ |

0.48 |

|

$ |

2.00 |

|

$ |

1.92 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

FAD payout ratio |

|

87.7% |

|

96.0% |

|

90.1% |

|

89.7% |

| ||||

(1) Excludes $11.3 million related to the write-off of unamortized loan fees for the Company’s expired bridge loan commitment and $0.8 million related to the amortization of deferred issuance costs of the senior notes, which costs are included in merger-related items for the year ended December 31, 2011.

(2) For the quarter and year ended December 31, 2012, DFL accretion reflects an elimination of $15.0 million and $59.4 million, respectively. For the quarter and year ended December 31, 2011, DFL accretion reflects an elimination of $14.5 million and $42.2 million, respectively. The Company’s ownership interest in HCR ManorCare OpCo is accounted for using the equity method, which requires an ongoing elimination of DFL income that is proportional to its ownership in HCR ManorCare OpCo. Further, the Company’s share of earnings from HCR ManorCare OpCo (equity income) increases for the corresponding elimination of related lease expense recognized at the HCR ManorCare OpCo level, which the Company presents as a non-cash joint venture FAD adjustment.

See Reporting Definitions and Reconciliations of Non-GAAP Measures

Capitalization

Dollars and shares in thousands, except price data

|

Total Debt | ||||||||

|

|

|

|

|

December 31, |

|

December 31, | ||

|

Bank line of credit |

|

|

|

$ |

— |

|

$ |

454,000 |

|

Term loan(1) |

|

|

|

222,694 |

|

— | ||

|

Senior unsecured notes |

|

|

|

6,712,624 |

|

5,416,063 | ||

|

Mortgage debt |

|

|

|

1,676,544 |

|

1,715,039 | ||

|

Mortgage debt on assets held for sale |

|

|

|

— |

|

49,532 | ||

|

Other debt |

|

|

|

81,958 |

|

87,985 | ||

|

Consolidated debt |

|

|

|

8,693,820 |

|

7,722,619 | ||

|

HCP’s share of unconsolidated debt(2) |

|

|

|

140,705 |

|

143,196 | ||

|

Total debt |

|

|

|

$ |

8,834,525 |

|

$ |

7,865,815 |

|

|

|

|

|

|

|

| ||

|

Total Market Capitalization | ||||||||

|

|

|

December 31, 2012 | ||||||

|

|

|

Shares |

|

Value |

|

Total Value | ||

|

Common stock (NYSE: HCP) |

|

453,191 |

|

$ |

45.16 |

|

$ |

20,466,106 |

|

|

|

|

|

|

|

| ||

|

Convertible partnerships (DownREITs)(3) |

|

6,089 |

|

|

|

274,979 | ||

|

|

|

|

|

|

|

| ||

|

Total market equity |

|

|

|

|

|

$ |

20,741,085 | |

|

|

|

|

|

|

|

| ||

|

Consolidated debt |

|

|

|

|

|

8,693,820 | ||

|

|

|

|

|

|

|

| ||

|

Total market equity and consolidated debt |

|

|

|

|

|

$ |

29,434,905 | |

|

|

|

|

|

|

|

| ||

|

HCP’s share of unconsolidated debt(2) |

|

|

|

|

|

140,705 | ||

|

|

|

|

|

|

|

| ||

|

Total market capitalization |

|

|

|

|

|

$ |

29,575,610 | |

|

Common Stock and Equivalents | ||||||||||

|

|

|

|

|

Weighted Average Shares | ||||||

|

|

|

Shares |

|

Three Months Ended December 31, 2012 | ||||||

|

|

|

Outstanding |

|

Diluted |

|

Diluted |

|

Diluted FFO |

|

Diluted |

|

|

|

December 31, 2012 |

|

EPS |

|

FFO |

|

As Adjusted |

|

FAD |

|

Common stock |

|

453,191 |

|

447,889 |

|

447,889 |

|

445,019 |

|

445,019 |

|

Common equivalent securities: |

|

|

|

|

|

|

|

|

|

|

|

Restricted stock and units |

|

1,364 |

|

213 |

|

213 |

|

213 |

|

213 |

|

Dilutive impact of options |

|

801 |

|

801 |

|

801 |

|

801 |

|

801 |

|

Convertible partnership units |

|

6,089 |

|

— |

|

6,089 |

|

6,089 |

|

4,174 |

|

Total common and equivalents |

|

461,445 |

|

448,903 |

|

454,992 |

|

452,122 |

|

450,207 |

|

|

|

|

|

| ||||||

|

|

|

|

|

Weighted Average Shares | ||||||

|

|

|

|

|

Year Ended December 31, 2012 | ||||||

|

|

|

|

|

Diluted |

|

Diluted |

|

Diluted FFO |

|

Diluted |

|

|

|

|

|

EPS |

|

FFO |

|

As Adjusted |

|

FAD |

|

Common stock |

|

|

|

427,047 |

|

427,047 |

|

426,326 |

|

426,326 |

|

Common equivalent securities: |

|

|

|

|

|

|

|

|

|

|

|

Restricted stock and units |

|

|

|

262 |

|

262 |

|

262 |

|

262 |

|

Dilutive impact of options |

|

|

|

1,007 |

|

1,007 |

|

1,007 |

|

1,007 |

|

Convertible partnership units |

|

|

|

— |

|

6,012 |

|

6,012 |

|

3,834 |

|

Total common and equivalents |

|

|

|

428,316 |

|

434,328 |

|

433,607 |

|

431,429 |

(1) Represents £137 million translated into U.S. dollars as of December 31, 2012.

(2) Reflects the Company’s pro rata share of amounts in the Investment Management Platform and HCR ManorCare OpCo.

(3) Convertible partnership (DownREIT) units are exchangeable for an amount of cash equivalent to the then-current market value of shares of the Company’s common stock at the time of conversion or, at the Company’s election, shares of the Company’s common stock.

Credit Profile

Financial Leverage

Secured Debt Ratio

Adjusted Fixed Charge Coverage

Net Debt to Adjusted EBITDA

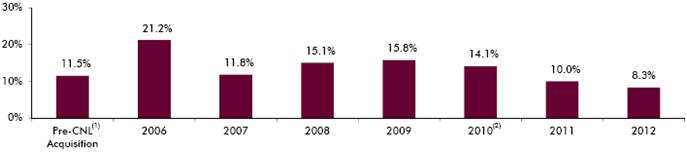

(1) As of and for the six months ended June 30, 2006 (12 months for adjusted fixed charge coverage). The Company completed the mergers with CNL Retirement Properties, Inc. and CNL Retirement Corp (“CNL”) on October 5, 2006, with significant prefunding activities occurring in the quarter ended June 30, 2006; therefore, the Company refers to the period ended June 30, 2006 as “Pre-CNL Acquisition.”

(2) Financial leverage, secured debt ratio and net debt to adjusted EBITDA are pro forma to exclude the temporary benefit resulting from prefunding the HCR ManorCare acquisition in December 2010.

See Reporting Definitions and Reconciliations of Non-GAAP Measures

Credit Profile

Same Property NOI Growth

FFO as Adjusted Payout Ratio

Total Gross Assets

(In billions)

Liquidity(5)

(In billions)

Credit Ratings (Senior Unsecured Debt)

|

|

|

Pre-CNL(3) |

|

2006 |

|

2007 |

|

2008 |

|

2009 |

|

2010 |

|

2011 |

|

2012 |

|

Moody’s |

|

Baa2 |

|

Baa3 |

|

Baa3 |

|

Baa3 |

|

Baa3 |

|

Baa3 |

|

Baa2 |

|

Baa1 (Stable) |

|

Standard & Poor’s |

|

BBB+ |

|

BBB |

|

BBB |

|

BBB |

|

BBB |

|

BBB |

|

BBB |

|

BBB+ (Stable) |

|

Fitch |

|

BBB+ |

|

BBB |

|

BBB |

|

BBB |

|

BBB |

|

BBB |

|

BBB+ |

|

BBB+ (Stable) |

(1) HCP information is presented as originally reported and represents annual SPP cash NOI growth.

(2) Major Property Sectors information was compiled by Green Street Advisors and is available in their Commercial Property Outlook report dated November 16, 2012 (the “Green Street Report”); this information represents the average annual same property NOI growth equally weighted for each of five major property sectors: apartment, industrial, mall, office, and strip center. The Company’s definitions of SPP and NOI may not be comparable to the measures compiled in the Green Street Report, as different methodologies may be used to define or calculate inputs to the growth rates presented.

(3) As of and for the six months ended June 30, 2006. The Company completed the mergers with CNL Retirement Properties, Inc. and CNL Retirement Corp (“CNL”) on October 5, 2006, with significant prefunding activities occurring in the quarter ended June 30, 2006; therefore, the Company refers to the period ended June 30, 2006 as “Pre-CNL Acquisition.”

(4) Total gross assets and liquidity are pro forma to exclude the temporary benefit resulting from prefunding the HCR ManorCare acquisition in December 2010.

(5) Represents the availability under the Company’s bank line of credit and cash and cash equivalents (unrestricted cash).

See Reporting Definitions and Reconciliations of Non-GAAP Measures

Indebtedness and Ratios

Dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Debt Maturities and Scheduled Principal Repayments (Amortization) |

| ||||||||||||||||||||||||||||||||||||

|

December 31, 2012 |

| ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

Senior |

|

|

|

|

|

|

|

|

|

HCP’s Share of |

|

|

|

|

| ||||||||||||||||

|

|

|

Bank Line |

|

|

|

Unsecured |

|

|

|

Mortgage |

|

|

|

Consolidated |

|

Unconsolidated |

|

|

|

|

| ||||||||||||||||

|

|

|

of Credit |

|

Term Loan(1) |

|

Notes |

|

Rates(2) |

|

Debt(3) |

|

Rates(2) |

|

Debt |

|

Debt(4) |

|

Rates(2) |

|

Total Debt |

| ||||||||||||||||

|

2013 |

|

$ |

— |

|

$ |

— |

|

$ |

550,000 |

|

5.80 |

% |

$ |

291,747 |

|

6.15 |

% |

$ |

841,747 |

|

$ |

3,271 |

|

6.86 |

% |

$ |

845,018 |

| |||||||||

|

2014 |

|

— |

|

— |

|

487,000 |

|

3.15 |

|

179,695 |

|

5.78 |

|

666,695 |

|

849 |

|

7.25 |

|

667,544 |

| ||||||||||||||||

|

2015 |

|

— |

|

— |

|

400,000 |

|

6.64 |

|

308,048 |

|

6.03 |

|

708,048 |

|

11,347 |

|

5.82 |

|

719,395 |

| ||||||||||||||||

|

2016 |

|

— |

|

222,694 |

|

900,000 |

|

5.07 |

|

291,338 |

|

6.88 |

|

1,414,032 |

|

47,057 |

|

6.05 |

|

1,461,089 |

| ||||||||||||||||

|

2017 |

|

— |

|

— |

|

750,000 |

|

6.04 |

|

550,052 |

|

6.04 |

|

1,300,052 |

|

41,376 |

|

5.86 |

|

1,341,428 |

| ||||||||||||||||

|

2018 |

|

— |

|

— |

|

600,000 |

|

6.83 |

|

6,129 |

|

5.90 |

|

606,129 |

|

36,942 |

|

5.00 |

|

643,071 |

| ||||||||||||||||

|

2019 |

|

— |

|

— |

|

450,000 |

|

3.96 |

|

1,587 |

|

N/A |

|

451,587 |

|

— |

|

— |

|

451,587 |

| ||||||||||||||||

|

2020 |

|

— |

|

— |

|

800,000 |

|

2.79 |

|

1,561 |

|

5.07 |

|

801,561 |

|

— |

|

— |

|

801,561 |

| ||||||||||||||||

|

2021 |

|

— |

|

— |

|

1,200,000 |

|

5.53 |

|

8,832 |

|

5.37 |

|

1,208,832 |

|

— |

|

— |

|

1,208,832 |

| ||||||||||||||||

|

2022 |

|

— |

|

— |

|

300,000 |

|

3.39 |

|

312 |

|

N/A |

|

300,312 |

|

— |

|

— |

|

300,312 |

| ||||||||||||||||

|

Thereafter |

|

— |

|

— |

|

300,000 |

|

6.89 |

|

47,465 |

|

5.17 |

|

347,465 |

|

— |

|

— |

|

347,465 |

| ||||||||||||||||

|

Subtotal |

|

— |

|

222,694 |

|

6,737,000 |

|

|

|

1,686,766 |

|

|

|

8,646,460 |

|

140,842 |

|

|

|

8,787,302 |

| ||||||||||||||||

|

Other debt(5) |

|

— |

|

— |

|

— |

|

|

|

— |

|

|

|

81,958 |

|

— |

|

|

|

81,958 |

| ||||||||||||||||

|

(Discounts) and premiums, net |

|

— |

|

— |

|

(24,376 |

) |

|

|

(10,222 |

) |

|

|

(34,598 |

) |

(137 |

) |

|

|

(34,735 |

) | ||||||||||||||||

|

Total debt |

|

$ |

— |

|

$ |

222,694 |

|

$ |

6,712,624 |

|

|

|

$ |

1,676,544 |

|

|

|

$ |

8,693,820 |

|

$ |

140,705 |

|

|

|

$ |

8,834,525 |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

Weighted average interest rate |

|

N/A |

|

2.00% |

|

5.10% |

|

|

|

6.13% |

|

|

|

5.22% |

|

5.84% |

|

|

|

5.23% |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

Weighted average maturity in years |

|

3.19 |

|

3.58 |

|

6.00 |

|

|

|

3.65 |

|

|

|

5.48 |

|

4.13 |

|

|

|

5.46 |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

Ratios |

|

Covenants |

| ||||||||||||||||||||||||||||||||||

|

|

|

December 31, |

|

December 31, |

|

The following is a summary of the financial covenants under the revolving line of credit facility at December 31, 2012. |

| ||||||||||||||||||||||||||||||

|

|

|

2012 |

|

2011 |

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

Consolidated Debt/Consolidated Gross Assets |

|

40.1% |

|

41.0% |

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

Financial Leverage (Total Debt/Total Gross Assets) |

|

40.2% |

|

41.0% |

|

|

|

Bank Line of Credit |

| ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

Financial Covenants(6) |

|

Requirement |

|

Actual Compliance |

| ||||||||||||||||||||||||||

|

Consolidated Secured Debt/Consolidated Gross Assets |

|

7.7% |

|

9.4% |

|

Leverage Ratio |

|

No greater than 60% |

|

40% |

| ||||||||||||||||||||||||||

|

Secured Debt Ratio (Total Secured Debt/Total Gross Assets) |

|

8.3% |

|

10.0% |

|

Secured Debt Ratio |

|

No greater than 30% |

|

9% |

| ||||||||||||||||||||||||||

|

|

|

|

|

|

|

Unsecured Leverage Ratio |

|

No greater than 60% |

|

39% |

| ||||||||||||||||||||||||||

|

Fixed and variable rate ratios(7): |

|

|

|

|

|

Fixed Charge Coverage Ratio (12 months) |

|

No less than 1.50x |

|

3.3x |

| ||||||||||||||||||||||||||

|

Fixed rate Total Debt |

|

99.1% |

|

93.1% |

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

Variable rate Total Debt |

|

0.9% |

|

6.9% |

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

|

|

100.0% |

|

100.0% |

|

|

|

|

|

|

| ||||||||||||||||||||||||||

(1) Represents £137 million translated into U.S. dollars as of December 31, 2012.

(2) Senior unsecured notes and mortgage debt weighted average effective rates relate to maturing amounts.

(3) Mortgage debt attributable to non-controlling interests at December 31, 2012 was $65 million.

(4) Includes pro-rata share of mortgage and other debt in the Company’s Investment Management Platform and HCR ManorCare OpCo. At December 31, 2012, 100% of the Company’s Investment Management Platform’s mortgage debt accrues interest at fixed rates. HCR ManorCare OpCo’s debt accrues interest at LIBOR (subject to a floor of 150bps) plus 350bps.

(5) Represents non-interest bearing life care bonds and occupancy fee deposits at certain of the Company’s senior housing facilities that have no scheduled maturities.

(6) Financial covenants for the revolving line of credit facility are calculated based on the definitions contained within the agreement and may be different than similar terms in the Company’s Consolidated Financial Statements as provided in its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Compliance with certain of these financial covenants requires the inclusion of the Company’s consolidated amounts and its proportionate share of unconsolidated investees.

(7) $86 million of variable-rate mortgages and £137 million term loan are presented as fixed-rate debt as the interest payments under such debt have been swapped (pay fixed and receive float).

See Reporting Definitions and Reconciliations of Non-GAAP Measures

|

|

|

|

|

|

Investments and Dispositions

Dollars and square feet in thousands

|

Investments |

| ||||||

|

|

|

December 31, 2012 |

| ||||

|

Description |

|

Three Months |

|

Year |

| ||

|

|

|

|

|

|

| ||

|

Senior Housing Portfolio Acquisition |

|

$ |

1,701,412 |

|

$ |

1,701,412 |

|

|

Acquisitions of other real estate and land |

|

61,722 |

|

296,653 |

| ||

|

Secured financing |

|

52,000 |

|

52,000 |

| ||

|

Purchase of marketable debt securities(1) |

|

— |

|

214,859 |

| ||

|

Mezzanine loan funding(2) |

|

— |

|

100,000 |

| ||

|

Total fundings for development, tenant and capital improvements(3) |

|

57,893 |

|

183,468 |

| ||

|

Construction loan commitment fundings |

|

21,382 |

|

58,498 |

| ||

|

Total investments |

|

$ |

1,894,409 |

|

$ |

2,606,890 |

|

|

Acquisitions of real estate and land for the year ended December 31, 2012 |

| |||||||||||

|

Location |

|

Date |

|

Capacity |

|

Property |

|

Segment |

|

Investment |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Senior Housing Portfolio Acquisition |

|

|

|

|

|

|

|

|

|

|

| |

|

Various |

|

October 31, 2012 |

|

9,842 units |

|

127 |

|

Senior housing |

|

$ |

1,677,462 |

|

|

Various |

|

December 4, 2012 |

|

235 units |

|

2 |

|

Senior housing |

|

23,950 |

| |

|

|

|

|

|

|

|

|

|

|

|

1,701,412 |

| |

|

Acquisitions of other real estate and land |

|

|

|

|

|

|

|

|

|

|

| |

|

Durham, NC |

|

May 15, 2012 |

|

115 sq. ft. |

|

1 |

|

Life science |

|

8,050 |

| |

|

Slidell, LA |

|

May 30, 2012 |

|

12.6 acres |

|

N/A |

|

Hospital |

|

3,000 |

| |

|

Kokomo, IN |

|

July 1, 2012 |

|

22 units |

|

— |

|

Senior housing |

|

3,860 |

| |

|

N. Richland Hills, TX |

|

July 30, 2012 |

|

80 sq. ft. |

|

1 |

|

Medical office |

|

13,500 |

| |

|

Various |

|

July 31, 2012 |

|

327 sq. ft. |

|

6 |

|

Medical office |

|

77,646 |

(4) | |

|

Scottsdale, AZ |

|

August 7, 2012 |

|

395 sq. ft. |

|

8 |

|

Medical office |

|

79,754 |

| |

|

Various |

|

August 15, 2012 |

|

199 sq. ft. |

|

4 |

|

Medical office |

|

49,121 |

(4) | |

|

Various |

|

October 19, 2012 |

|

232 sq. ft. |

|

2 |

|

Medical office |

|

61,722 |

(4) | |

|

|

|

|

|

|

|

|

|

|

|

296,653 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

$ |

1,998,065 |

|

|

Dispositions for the year ended December 31, 2012 |

| |||||||||||

|

Location |

|

Date |

|

Capacity |

|

Property |

|

Segment |

|

Sales Price, |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

St. Louis, MO |

|

February 29, 2012 |

|

44 sq. ft. |

|

1 |

|

Medical office |

|

$ |

6,982 |

|

|

Poway, CA |

|

November 30, 2012 |

|

18.6 acres |

|

N/A |

|

Life science |

|

18,177 |

| |

|

Huntsville/Birmingham, AL |

|

December 28, 2012 |

|

538 units |

|

2 |

|

Senior housing |

|

110,820 |

| |

|

Vista, CA |

|

December 28, 2012 |

|

187 beds |

|

1 |

|

Skilled nursing |

|

14,500 |

| |

|

|

|

|

|

|

|

|

|

|

|

$ |

150,479 |

|

(1) Senior unsecured notes of Four Seasons Health Care with an aggregate par value of £138.5 million, purchased at a discount for £136.8 million, and translated into U.S. dollars as of the acquisition date.

(2) On July 31, 2012, the Company closed a mezzanine loan facility to lend up to $205 million to Tandem Health Care, an affiliate of Formation Capital, as part of the recapitalization of a post-acute/skilled nursing portfolio. The Company funded $100 million at closing and has a commitment to fund an additional $105 million between March 2013 and August 2013.

(3) The three months ended December 31, 2012, includes the following: (i) $20.8 million of development, (ii) $21.8 million of first generation tenant and capital improvements, and (iii) $15.3 million of second generation tenant and capital improvements (excludes $3.3 million of leasing costs). The year ended December 31, 2012, includes the following: (i) $88.1 million of development, (ii) $48.2 million of first generation tenant and capital improvements, and (iii) $47.2 million of second generation tenant and capital improvements (excludes $14.2 million of leasing costs).

(4) Represents the Boyer Company MOB portfolio that closed in three tranches.

See Reporting Definitions and Reconciliations of Non-GAAP Measures

|

|

|

|

|

|

Development

As of December 31, 2012, dollars and square feet in thousands

|

Development Projects in Process |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

Estimated/ |

|

Estimated |

|

|

|

|

| ||

|

|

|

|

|

|

|

Actual |

|

Rentable |

|

|

|

Estimated |

| ||

|

|

|

|

|

|

|

Completion |

|

Square |

|

Investment |

|

Total |

| ||

|

Name of Project |

|

Location |

|

Segment |

|

Date |

|

Feet |

|

to Date(1)(3) |

|

Investment |

| ||

|

Development |

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

2019 Stierlin Ct. |

|

Mountain View, CA |

|

Life science |

|

1Q 2013 |

|

70 |

|

$ |

17,860 |

|

$ |

21,298 |

|

|

Ridgeview |

|

Poway, CA |

|

Life science |

|

2Q 2014 |

|

115 |

|

11,430 |

|

22,937 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Redevelopment |

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Durham Research Lab |

|

Durham, NC |

|

Life science |

|

3Q 2013 |

|

53 |

|

13,068 |

|

25,851 |

| ||

|

Carmichael(4) |

|

Durham, NC |

|

Life science |

|

3Q 2013 |

|

38 |

|

3,737 |

|

16,397 |

| ||

|

1030 Massachusetts Avenue |

|

Cambridge, MA |

|

Life science |

|

2Q 2014 |

|

75 |

|

35,833 |

|

39,992 |

| ||

|

Westpark Plaza |

|

Plano, TX |

|

Medical office |

|

2Q 2013 |

|

50 |

|

10,537 |

|

13,585 |

| ||

|

Innovation Drive |

|

San Diego, CA |

|

Medical office |

|

4Q 2013 |

|

84 |

|

29,327 |

|

33,689 |

| ||

|

Alaska |

|

Anchorage, AK |

|

Medical office |

|

4Q 2013 |

|

49 |

|

8,553 |

|

11,763 |

| ||

|

Folsom |

|

Sacramento, CA |

|

Medical office |

|

2Q 2014 |

|

92 |

|

33,360 |

|

39,251 |

| ||

|

Fresno(5) |

|

Fresno, CA |

|

Hospital |

|

1Q 2013 |

|

N/A |

|

14,708 |

|

21,324 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

Total |

|

|

|

|

|

|

|

$ |

178,413 |

|

$ |

246,087 |

|

|

Land Held for Development |

|

|

|

|

|

|

|

|

Estimated |

| |

|

|

|

|

|

Gross |

|

Rentable |

| |

|

|

|

|

|

Site |

|

Square |

| |

|

Location |

|

Segment |

|

Acreage |

|

Feet |

| |

|

So. San Francisco, CA |

|

Life science |

|

50 |

|

1,666 |

| |

|

Carlsbad, CA |

|

Life science |

|

41 |

|

690 |

| |

|

Poway, CA |

|

Life science |

|

46 |

|

765 |

| |

|

Various |

|

Various |

|

19 |

|

93 |

| |

|

|

|

|

|

156 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Investment-to-date(2)(3) |

|

|

|

$ |

361,549 |

|

|

|

|

Projects Placed in Service |

|

|

|

|

|

|

|

|

Date |

|

Rentable |

|

|

|

|

| |

|

|

|

|

|

|

|

Placed in |

|

Square |

|

|

|

Percentage |

| |

|

Name of Project |

|

Location |

|

Segment |

|

Service |

|

Feet |

|

Investment(6) |

|

Leased |

| |

|

Modular Labs IV |

|

So. San Francisco, CA |

|

Life science |

|

1Q 2012 |

|

97 |

|

$ |

56,179 |

|

75 |

|

|

Soledad |

|

San Diego, CA |

|

Life science |

|

1Q 2012 |

|

28 |

|

13,208 |

|

100 |

| |

|

Conroe |

|

Conroe, TX |

|

Medical office |

|

2Q – 4Q 2012 |

|

70 |

|

9,869 |

|

80 |

| |

|

Knoxville |

|

Knoxville, TN |

|

Medical office |

|

2Q – 3Q 2012 |

|

35 |

|

8,684 |

|

69 |

| |

|

Alaska(7) |

|

Anchorage, AK |

|

Medical office |

|

3Q 2012 |

|

43 |

|

7,854 |

|

100 |

| |

|

Westpark(7) |

|

Plano, TX |

|

Medical office |

|

4Q 2012 |

|

20 |

|

3,574 |

|

100 |

| |

|

|

|

|

|

|

|

|

|

293 |

|

$ |

99,368 |

|

|

|

(1) Investment-to-date of $178 million includes the following: (i) $81 million in development costs and construction in progress, (ii) $71 million of buildings and (iii) $26 million of land.

(2) Investment-to-date of $362 million includes the following: (i) $260 million in land (ii) $102 million in development costs and construction in progress.

(3) Development costs and construction in progress of $237 million presented on the Company’s consolidated balance sheet at December 31, 2012, include the following: (i) $81 million of costs for development projects in process; (ii) $102 million of costs for land held for development; and (iii) $54 million for tenant and other facility related improvement projects in process.

(4) Represents approximately 33% of the Carmichael facility in redevelopment. The balance of the facility remains in operations.

(5) Represents approximately 25% of the Fresno hospital placed in redevelopment in March 2011. The balance of the hospital remains in operations.

(6) Represents the investment as of the date the respective property was placed in service.

(7) Represents approximately 50% and 30% of the Alaska and Westpark facilities, respectively.

See Reporting Definitions and Reconciliations of Non-GAAP Measures

|

|

|

|

|

|

Portfolio Information

December 31, 2012

(Unaudited)

Owned Portfolio Summary

As of and for the year ended December 31, 2012, dollars and square feet in thousands

Portfolio Summary by Investment Product

|

Leased |

|

Property |

|

|

|

|

|

Age |

|

|

|

Occupancy |

|

EBITDAR(1) |

|

EBITDARM(1) | |||||||||

|

Properties |

|

Count |

|

Investment |

|

NOI |

|

(Years) |

|

Capacity |

|

% |

|

Amount |

|

CFC |

|

Amount |

|

CFC | |||||

|

Senior housing |

|

420 |

|

$ |

6,784,141 |

|

$ |

479,767 |

|

15 |

|

40,661 |

Units |

|

85.6 |

|

$ |

387,817 |

|

1.11 x |

|

$ |

466,355 |

|

1.33 x |

|

Post-acute/skilled |

|

312 |

|

5,669,469 |

|

538,856 |

|

33 |

|

41,538 |

Beds |

|

85.6 |

|

52,701 |

|

1.45 x |

|

71,822 |

|

1.97 x | ||||

|

Life science |

|

109 |

|

3,362,298 |

|

236,491 |

|

19 |

|

7,002 |

Sq. Ft. |

|

91.3 |

|

N/A |

|

N/A |

|

N/A |

|

N/A | ||||

|

Medical office |

|

207 |

|

2,613,254 |

|

202,547 |

|

20 |

|

14,274 |

Sq. Ft. |

|

92.0 |

|

N/A |

|

N/A |

|

N/A |

|

N/A | ||||

|

Hospital |

|

17 |

|

650,937 |

|

80,980 |

|

26 |

|

2,410 |

Beds |

|

53.9 |

|

398,373 |

|

4.94 x |

|

434,570 |

|

5.39 x | ||||

|

|

|

1,065 |

|

$ |

19,080,099 |

|

$ |

1,538,641 |

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Operating |

|

Property |

|

Investment |

|

NOI |

|

Age |

|

Capacity |

|

Occupancy |

|

|

|

|

|

|

|

| |||||

|

Senior housing(2) |

|

21 |

|

$ |

759,022 |

|

$ |

51,652 |

|

22 |

|

5,008 |

Units |

|

86.0 |

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Debt |

|

|

|

Investment |

|

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Senior housing |

|

|

|

$ |

123,642 |

|

$ |

3,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Post-acute/skilled(3) |

|

|

|

328,905 |

|

19,993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Hospital(4) |

|

|

|

46,292 |

|

1,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

$ |

498,839 |

|

$ |

24,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Total |

|

1,086 |

|

$ |

20,337,960 |

|

$ |

1,614,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Portfolio NOI, Adjusted NOI and Interest Income

|

|

|

Three Months Ended December 31, 2012 |

| ||||||||||||||||

|

|

|

Rental and |

|

|

|

|

|

|

|

|

|

Adjusted NOI |

| ||||||

|

|

|

RIDEA |

|

Operating |

|

|

|

Adjusted |

|

Interest |

|

and Interest |

| ||||||

|

Segment |

|

Revenues |

|

Expenses |

|

NOI(5) |

|

NOI |

|

Income |

|

Income |

| ||||||

|

Senior housing(2) |

|

$ |

176,321 |

|

$ |

24,736 |

|

$ |

151,585 |

|

$ |

138,504 |

|

$ |

1,817 |

|

$ |

140,321 |

|

|

Post-acute/skilled |

|

136,033 |

|

(134 |

) |

136,167 |

|

116,991 |

|

10,151 |

|

127,142 |

| ||||||

|

Life science |

|

74,095 |

|

14,943 |

|

59,152 |

|

55,818 |

|

— |

|

55,818 |

| ||||||

|

Medical office |

|

88,150 |

|

33,633 |

|

54,517 |

|

53,297 |

|

— |

|

53,297 |

| ||||||

|

Hospital |

|

21,193 |

|

743 |

|

20,450 |

|

19,999 |

|

255 |

|

20,254 |

| ||||||

|

|

|

$ |

495,792 |

|

$ |

73,921 |

|

$ |

421,871 |

|

$ |

384,609 |

|

$ |

12,223 |

|

$ |

396,832 |

|

|

|

|

Year Ended December 31, 2012 |

| ||||||||||||||||

|

|

|

Rental and |

|

|

|

|

|

|

|

|

|

Adjusted NOI |

| ||||||

|

|

|

RIDEA |

|

Operating |

|

|

|

Adjusted |

|

Interest |

|

and Interest |

| ||||||

|

Segment |

|

Revenues |

|

Expenses |

|

NOI(5) |

|

NOI |

|

Income |

|

Income |

| ||||||

|

Senior housing(2) |

|

$ |

626,081 |

|

$ |

94,662 |

|

$ |

531,419 |

|

$ |

480,872 |

|

$ |

3,503 |

|

$ |

484,375 |

|

|

Post-acute/skilled |

|

539,242 |

|

386 |

|

538,856 |

|

462,927 |

|

19,993 |

|

482,920 |

| ||||||

|

Life science |

|

289,664 |

|

53,173 |

|

236,491 |

|

226,997 |

|

— |

|

226,997 |

| ||||||

|

Medical office |

|

334,811 |

|

132,264 |

|

202,547 |

|

197,569 |

|

— |

|

197,569 |

| ||||||

|

Hospital |

|

84,493 |

|

3,513 |

|

80,980 |

|

78,995 |

|

1,040 |

|

80,035 |

| ||||||

|

|

|

$ |

1,874,291 |

|

$ |

283,998 |

|

$ |

1,590,293 |

|

$ |

1,447,360 |

|

$ |

24,536 |

|

$ |

1,471,896 |

|

(1) EBITDAR, EBITDARM and their respective CFC are not presented for the disaggregated HCR ManorCare senior housing and post-acute/skilled nursing portfolios as the combined portfolio is cross-collateralized under a single master lease. See HCR ManorCare Leased Portfolio Summary on page 19 of this report.

(2) Brookdale Senior Living manages 21 assets on behalf of the Company under a RIDEA structure. For the three months ended December 31, 2012, revenues and operating expenses were $35.9 million and $23.5 million, respectively. For the year ended December 31, 2012, revenues and operating expenses were $142.7 million and $91.0 million, respectively.

(3) Includes senior unsecured notes of Four Seasons Health Care with an aggregate par value of £138.5 million, purchased at a discount for £136.8 million with a carrying value translated into U.S. dollars of $222.8 million as of December 31, 2012.

(4) Includes a senior secured loan to Delphis that was placed on non-accrual status effective January 1, 2011 with a carrying value of $30.7 million at December 31, 2012. For additional information regarding the senior secured loan to Delphis see Note 7 to the Consolidated Financial Statements for the year ended December 31, 2012 included in the Company’s Annual Report on Form 10-K filed with the SEC.

(5) NOI attributable to non-controlling interests for the quarter and year ended December 31, 2012 was $9.2 million and $2.3 million, respectively.

See Reporting Definitions and Reconciliations of Non-GAAP Measures

Owned Portfolio Concentrations

As of and for the year ended December 31, 2012, dollars in thousands

Geographic Diversification of Properties

|

|

|

Total |

|

Senior |

|

Post-Acute/ |

|

Life |

|

Medical |

|

|

|

|

|

% of |

| ||||||

|

Investment by State |

|

Properties |

|

Housing |

|

Skilled |

|

Science |

|

Office |

|

Hospital |

|

Total |

|

Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

CA |

|

159 |

|

$ |

729,423 |

|

$ |

264,076 |

|

$ |

3,235,984 |

|

$ |

216,158 |

|

$ |

128,545 |

|

$ |

4,574,186 |

|

23 |

|

|

TX |

|

108 |

|

873,500 |

|

104,534 |

|

— |

|

722,057 |

|

229,793 |

|

1,929,884 |

|

10 |

| ||||||

|

FL |

|

95 |

|

834,849 |

|

544,406 |

|

— |

|

157,375 |

|

62,450 |

|

1,599,080 |

|

8 |

| ||||||

|

PA |

|

55 |

|

274,312 |

|

1,206,920 |

|

— |

|

— |

|

— |

|

1,481,232 |

|

7 |

| ||||||

|

IL |

|

51 |

|

507,279 |

|

700,148 |

|

— |

|

13,490 |

|

— |

|

1,220,917 |

|

6 |

| ||||||

|

OH |

|

72 |

|

215,890 |

|

682,408 |

|

— |

|

9,421 |

|

— |

|

907,719 |

|

5 |

| ||||||

|

MI |

|

38 |

|

176,747 |

|

577,342 |

|

— |

|

— |

|

— |

|

754,089 |

|

4 |

| ||||||

|

MD |

|

34 |

|

302,122 |

|

231,029 |

|

— |

|

30,073 |

|

— |

|

563,224 |

|

3 |

| ||||||

|

WA |

|

30 |

|

256,918 |

|

125,913 |

|

— |

|

177,886 |

|

— |

|

560,717 |

|

3 |

| ||||||

|

VA |

|

30 |

|

338,790 |

|

175,492 |

|

— |

|

43,050 |

|

— |

|

557,332 |

|

3 |

| ||||||

|

Other |

|

414 |

|

3,033,333 |

|

1,057,201 |

|

126,314 |

|

1,243,744 |

|

230,149 |

|

5,690,741 |

|

28 |

| ||||||

|

Total |

|

1,086 |

|

$ |

7,543,163 |

|

$ |

5,669,469 |

|

$ |

3,362,298 |

|

$ |

2,613,254 |

|

$ |

650,937 |

|

$ |

19,839,121 |

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|