Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIAA FSB Holdings, Inc. | form8-kforeverbankinvestor.htm |

1 EverBank Financial Corp February 2013 Investor Meetings

2 Disclaimer THIS PRESENTATION HAS BEEN PREPARED BY EVERBANK FINANCIAL CORP ("EVERBANK" OR THE “COMPANY”) SOLELY FOR INFORMATIONAL PURPOSES BASED ON ITS OWN INFORMATION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF EVERBANK AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF EVERBANK AND THE DATA SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF EVERBANK. EXCEPT AS OTHERWISE INDICATED, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE WILL BE NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF. CERTAIN OF THE INFORMATION CONTAINED HEREIN MAY BE DERIVED FROM INFORMATION PROVIDED BY INDUSTRY SOURCES. EVERBANK BELIEVES THAT SUCH INFORMATION IS ACCURATE AND THAT THE SOURCES FROM WHICH IT HAS BEEN OBTAINED ARE RELIABLE. EVERBANK CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION, HOWEVER, AND HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION. THIS PRESENTATION MAY CONTAIN CERTAIN FORWARD-LOOKING STATEMENTS AS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, AND SUCH STATEMENTS ARE INTENDED TO BE COVERED BY THE SAFE HARBOR PROVIDED BY THE SAME. WORDS SUCH AS “OUTLOOK,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “MAY,” “WILL,” “COULD,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES” OR THE NEGATIVE VERSION OF THOSE WORDS OR OTHER COMPARABLE WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY’S INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT. ALTHOUGH THE COMPANY BELIEVES THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE AS OF THE DATE MADE, EXPECTATIONS MAY PROVE TO HAVE BEEN MATERIALLY DIFFERENT FROM THE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. UNLESS OTHERWISE REQUIRED BY LAW, EVERBANK ALSO DISCLAIMS ANY OBLIGATION TO UPDATE ITS VIEW OF ANY SUCH RISKS OR UNCERTAINTIES OR TO ANNOUNCE PUBLICLY THE RESULT OF ANY REVISIONS TO THE FORWARD-LOOKING STATEMENTS MADE IN THIS PRESENTATION. INTERESTED PARTIES SHOULD NOT PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENT AND SHOULD CONSIDER THE UNCERTAINTIES AND RISKS DISCUSSED UNDER THE HEADINGS “RISK FACTORS” AND “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” IN EVERBANK’S QUARTERLY REPORTS ON FORM 10-Q AND IN, AMONG OTHER FACTORS, OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION.

3 Company Overview

4 EverBank Overview Strong Returns High Growth Low Risk Acquired in 1994 and headquartered in Jacksonville, FL $18.2bn in assets, $13.1bn in deposits & $1.5bn shareholders’ equity as of December 31, 2012 Initial public offering on May 3, 2012 $1.8bn market capitalization(1) Nationwide banking franchise Unique, diversified business model Robust asset generation capabilities Scalable, low cost deposit platform Disciplined risk management Cohesive, long tenured management team (1) Market capitalization as of 2.8.2013 close

5 $ 1.7 $ 2.1 $ 3.1 $ 3.7 $ 4.2 $ 5.5 $ 7.0 $ 8.1 $ 12.0 $ 13.0 $ 18.2 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 $b n Assets Deposits Acquired MetLife Bank’s warehouse finance business (April 1) Completion of Initial Public Offering (May 2) Acquired GE Capital’s Business Property Lending (Oct 1) Preferred equity offering (Nov 5) Acquired online deposit franchise 2000 - 2003 Mortgage Lending and Servicing 2004 - 2007 Expansion of Deposit Strategy 2008 - 2012 Addition of Diversified Asset Generation Evolution and Growth Adopted EverBank name Acquired NetBank mortgage assets Growth capital infusion Acquired Tygris FDIC-Assisted Acquisition of Bank of Florida

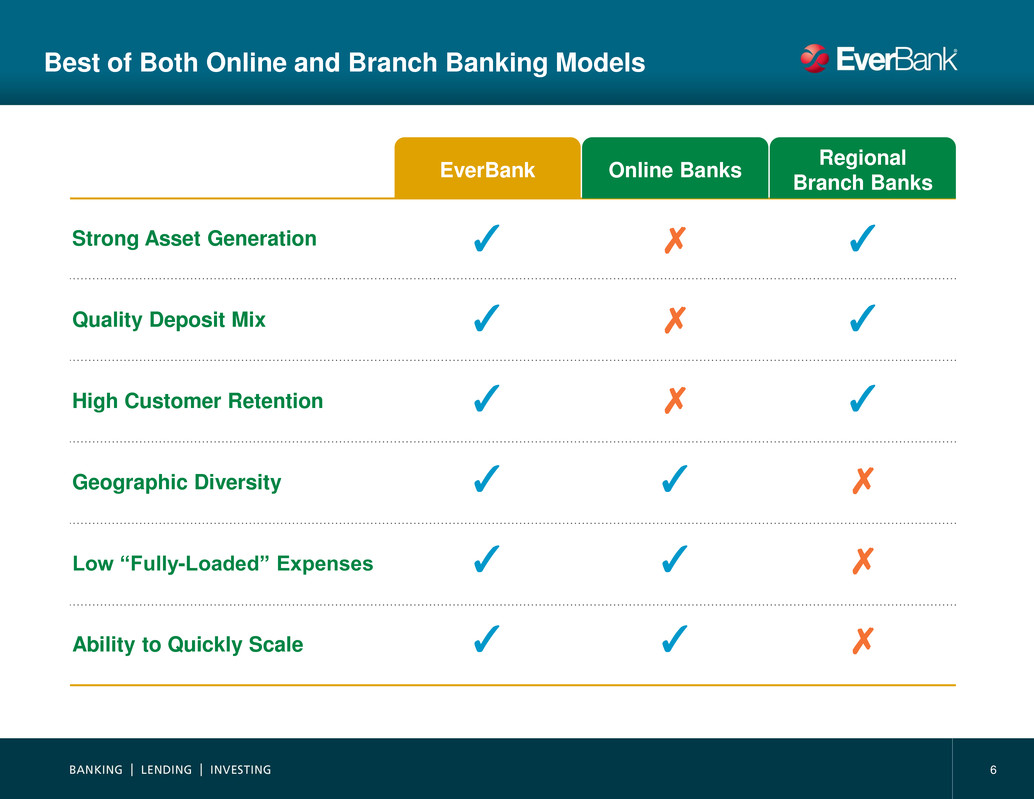

6 Best of Both Online and Branch Banking Models Strong Asset Generation Quality Deposit Mix High Customer Retention Geographic Diversity Low “Fully-Loaded” Expenses Ability to Quickly Scale EverBank Online Banks Regional Branch Banks ✗ ✗ ✗ ✓ ✓ ✓ ✓ ✓ ✓ ✗ ✗ ✗ ✓ ✓ ✓ ✓ ✓ ✓

7 Deliver high value products and services to self-directed customers nationwide through a variety of channels Target Vanguard retail and small business clients in key wealth markets nationwide Continue integrating core product offering Jumbo Lending Commercial Finance Commercial Lending Deposits Expansion of retail lending channel Addition of ~440 professionals in 2012 Positioning the business to increase market share via an eventual return in purchase driven origination activity Broaden fee base businesses Wealth Management EverBank’s Business Strategy Incorporate LPOs Strategic Plan Deposits and Lending by County / Business Locations Los Angeles Area Houston, TX Denver Area Dallas, TX Atlanta, GA St Louis, MO Direct Bank Chicago, IL Branch Presence Jacksonville, FL Redmond, WA BPL FTE Presence Business Headquarters Corporate Headquarters BPL Presence San Francisco Area Minneapolis, MN Boston Area Austin, TX Miami Area EVER Deposits EVER Lending EVER Deposits & Lending Bethesda, MD Northern VA Parsippany, NJ ECF

8 2011 2012 Key Highlights – 2012 v 2011 Record Revenues Adjusted EPS Growth Robust Organic Asset Generation 2011 20122011 2012 $1.27 $6,803 $685 $884 $1.11 $11,788 Note: $ in millions, except per share amounts. A reconciliation of non-GAAP financial measures can be found in the appendix

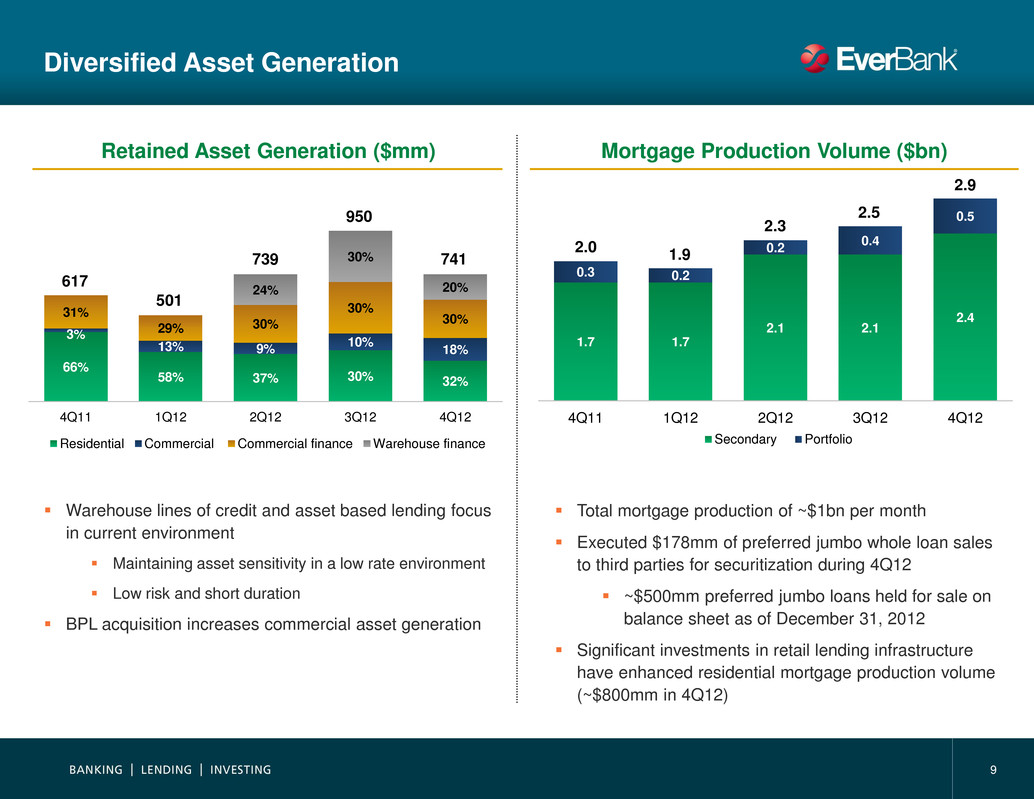

9 1.7 1.7 2.1 2.1 2.4 0.3 0.2 0.2 0.4 0.5 4Q11 1Q12 2Q12 3Q12 4Q12 Secondary Portfolio 66% 58% 37% 30% 32% 3% 13% 9% 10% 18% 31% 29% 30% 30% 30% 24% 30% 20% 4Q 1 1Q12 2Q12 3Q12 4Q12 Residential Commercial Commercial finance Warehouse finance Diversified Asset Generation Retained Asset Generation ($mm) Mortgage Production Volume ($bn) 741 617 501 739 950 2.9 2.0 1.9 2.3 2.5 Warehouse lines of credit and asset based lending focus in current environment Maintaining asset sensitivity in a low rate environment Low risk and short duration BPL acquisition increases commercial asset generation Total mortgage production of ~$1bn per month Executed $178mm of preferred jumbo whole loan sales to third parties for securitization during 4Q12 ~$500mm preferred jumbo loans held for sale on balance sheet as of December 31, 2012 Significant investments in retail lending infrastructure have enhanced residential mortgage production volume (~$800mm in 4Q12)

10 65% 61% 63% 56% 54% 35% 39% 37% 44% 46% 4Q11 1Q12 2Q12 3Q12 4Q12 Net Interest Income Non-interest Income Total Revenue Total Revenue Contribution ($mm) Total revenue of $272.2mm up $48.7mm, or 22%, LQ and $96.4mm, or 55%, YoY Net interest income up $20.8mm, or 16%, LQ and $32.2mm, or 28%, YoY Non-interest income up $27.9mm, or 29%, LQ and $64.2mm, or 105%, YoY Quarter Highlights 272 175 189 199 223

11 Noninterest Income and Expense Quarter Highlights Adjusted noninterest income up $9.6mm, or 8%, LQ and $45.4mm, or 57%, YoY Loan production and gain on sale income up $6.2mm, or 7%, LQ on lending volume of $2.9bn Loan servicing fee income up $2.5mm, or 6%, LQ No addition to MSR valuation allowance Noninterest Income ($mm) 4Q11 3Q12 4Q12 Loan servicing fee income 45$ 42$ 45$ MSR amortization and valuation allowance (47) (55) (38) Loan production and gain o sale income 41 96 103 Deposit, lease and other income 21 13 15 Noninterest income 61$ 97$ 125$ Increase in MSR valuation allowance 19 18 - Adjusted noninterest income 80$ 116$ 125$

12 8 15 8 3 5 1 9 5 6 4Q11 3Q12 4Q12 Noninterest Expense Breakdown Commentary Credit-related Expenses ($mm) 20 25 15 Other credit-related expenses increased $1.0mm, or 20%, LQ and decreased $2.1mm, or 25%, YoY Foreclosure and OREO expenses decreased $3.7mm, or 80%, LQ and $1.9mm, or 66%, YoY GNMA Buyout expenses decreased $7.1mm, or 47%, LQ and $0.6mm, or 7%, YoY GNMA buyout expenses Foreclosure and OREO Other credit-related Noninterest Expense Quarter Highlights Adjusted pre-credit noninterest expense increased $29.2mm, or 19%, LQ and $62.1mm, or 51%, YoY Salaries, commissions and other employee benefits rose $18.1mm, or 21%, LQ Increased retail lending staffing Commissions and incentives increased due to strong loan origination activity General and administrative expense increase due to increased professional fees and consent order expenses We expect third party costs of ~$3.0-4.5mm per quarter after tax to continue through 2Q13 Credit-related expenses down $9.8mm, or 36%, LQ ($mm) 4Q11 3Q12 4Q12 Salaries, commissions and other employee benefits expense 61$ 85$ 103$ Equipment expense 14 18 20 Occupancy expense 5 7 8 General and administrative expense 67 74 85 Total noninterest expense 148$ 184$ 217$ Transaction and regulatory related 7 4 17 Credit-related 20 25 15 Adjusted pre-credit noninterest expense 121$ 155$ 185$

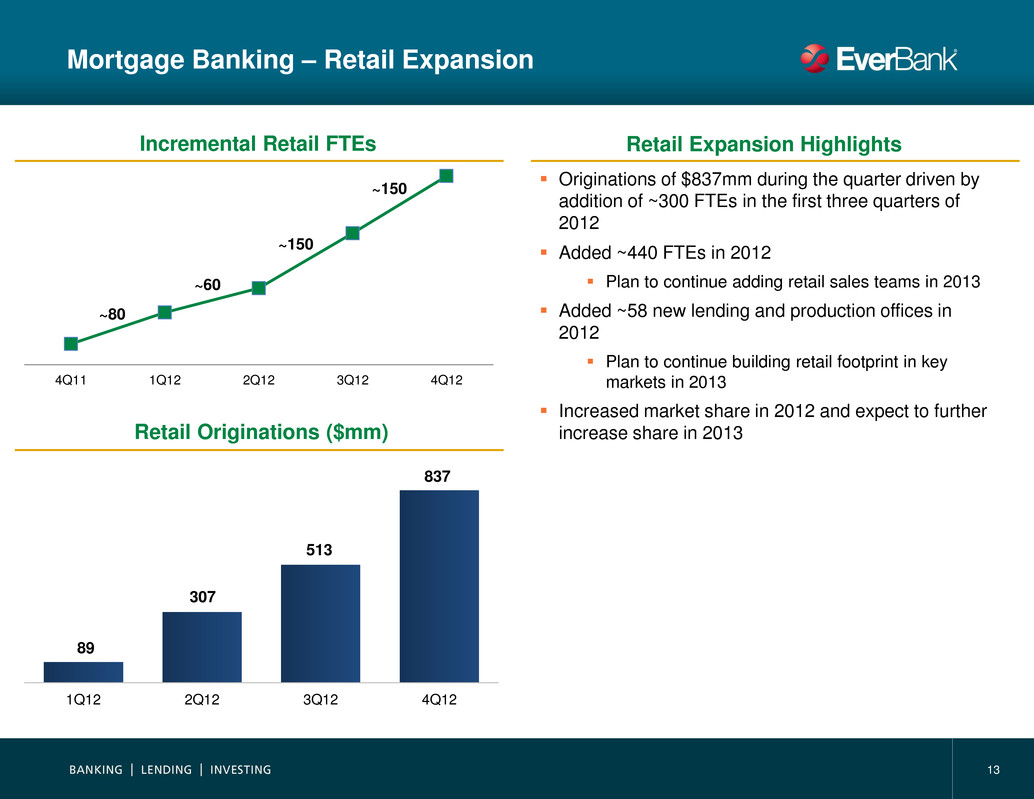

13 1Q12 2Q12 3Q12 4Q12 4Q11 1Q12 2Q12 3Q12 4Q12 Mortgage Banking – Retail Expansion Originations of $837mm during the quarter driven by addition of ~300 FTEs in the first three quarters of 2012 Added ~440 FTEs in 2012 Plan to continue adding retail sales teams in 2013 Added ~58 new lending and production offices in 2012 Plan to continue building retail footprint in key markets in 2013 Increased market share in 2012 and expect to further increase share in 2013 Incremental Retail FTEs Retail Expansion Highlights Retail Originations ($mm) ~150 ~80 ~60 ~150 837 89 307 513

14 Source: AlixPartners study (1) Percentage of U.S. households who used branch banking channel within the last year Online and Mobile Banking Trends Online banking channel market share has grown to 43% vs. a decline to 62% for branch banking Bank Channel Usage as a % of U.S. Households 91% 19% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Branch banking Online banking Mobile banking Branch Banking (1) Online Banking Mobile Banking

15 Value Proposition Yields Attractive Customer Base One stop, integrated financial portal Internal and external account aggregation Analysis and reporting across financial life: investing, spending, budgeting, tracking alerts Bill pay and electronic transfers Convenient access: 24 x 365 Mobile, Online, 24 Hour Phone Support, No Fee ATM, Imaging / Remote Deposit, Direct Deposit, Select Financial Centers, Mail ATM fee rebates 474,000 ATMs 4Q12 Deposit Composition Noninterest-bearing Interest Checking MMDA & Savings Global Market Time Deposits Attractive Nationwide Customer Base 119,782 households, 245,553 accounts Average deposits per household: $85,039 50% household income > $75,000 40% household net worth(1) > $250,000 (1) Based on reported household net worth; excludes 17% of households that do not report household net worth 11% 20% 9% 34% 26%

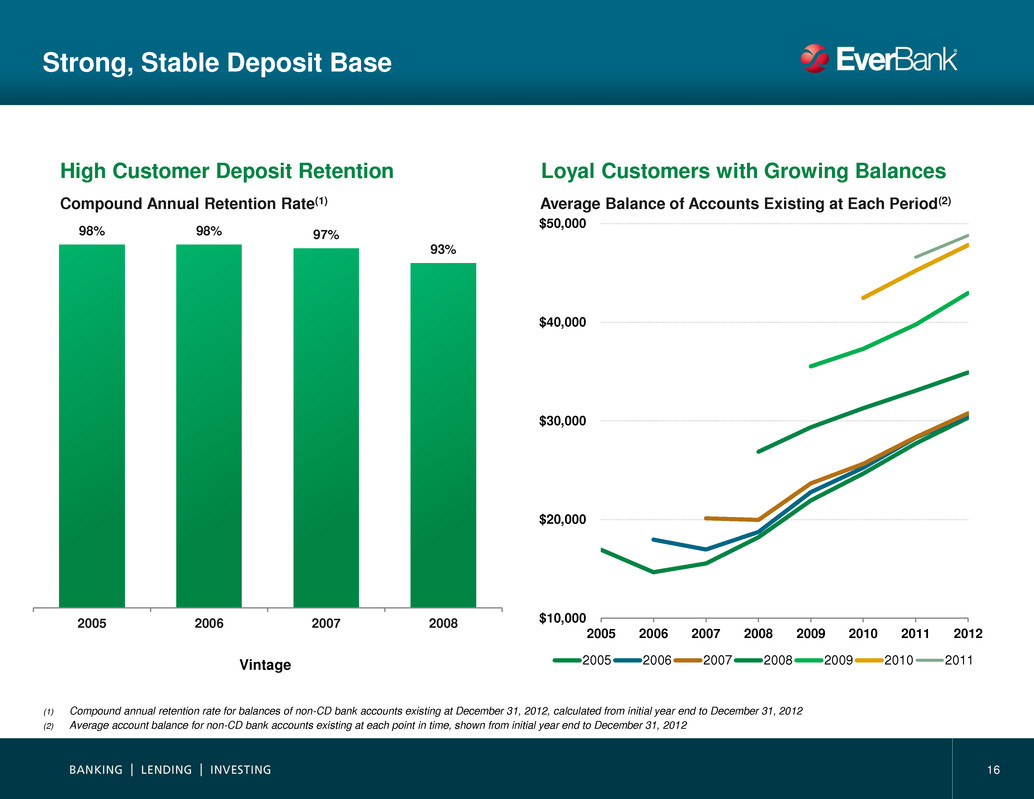

16 Strong, Stable Deposit Base (1) Compound annual retention rate for balances of non-CD bank accounts existing at December 31, 2012, calculated from initial year end to December 31, 2012 (2) Average account balance for non-CD bank accounts existing at each point in time, shown from initial year end to December 31, 2012 Loyal Customers with Growing Balances High Customer Deposit Retention Compound Annual Retention Rate(1) Average Balance of Accounts Existing at Each Period(2) Vintage 98% 98% 97% 93% 2005 2006 2007 2008 $10,000 $20,000 $30,000 $40,000 $50,000 2005 2006 2007 2008 2009 2010 2011 2012 2005 2006 2007 2008 2009 2010 2011

17 14.3% 15.4% 16.3% 16.5% 13.1% 7.4% 11.5% 14.0% 10.7% 12.4% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 EverBank Banks $5-25bn in Assets Adjusted Earnings Per Share(1) Financial Highlights (1) Represents adjusted diluted earnings per common share from continuing operations for 2007-YTD; 2003-2006 represents adjusted basic earnings per common share from continuing operations Calculated using adjusted net income attributable to the Company from continuing operations; 2012 adjusted EPS calculation includes $4.5mm and $1.1mm cash dividends paid to Series A and Series B Preferred shareholders in Q1 and Q2, respectively; a reconciliation of non-GAAP financial measures can be found in the appendix (2) Basel III information on a fully phased-in basis and based on proposed guidance through December 31, 2012 Adjusted Return on Average Equity 4Q12 Capital Ratios(2) Tangible Book Value Per Share $0.42 $0.53 $0.63 $0.74 $0.66 $0.41 $0.78 $1.28 $1.11 $1.27 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 $3.10 $3.60 $4.08 $4.81 $5.39 $6.96 $8.54 $10.65 $10.12 $10.30 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 8.5% - 9.0% 8.0% 13.5% Estimated Basel III (Fully-Phased) Tier 1 Leverage (Bank) Total Risk-Based Capital (Bank)

18 2011 1Q12 2Q12 3Q12 4Q122011 1Q12 2Q12 3Q12 4Q12 Adjusted NPA / Total Assets Note: A reconciliation of Non-GAAP financial measures can be found in the appendix (1) Acquired credit-impaired loans and leases accounted for under ASC 310-30 or by analogy Asset Quality Adjusted NPA ratio excludes loans and leases with enhanced credit protection (1) Adjusted NPA / Total Assets Build Highlights NCO / Average Loans HFI Adjusted non-performing assets to total assets declined 21 bps LQ resulting from a $16.1mm, or 8%, decrease in non-performing assets Net charge-offs to average loans HFI decreased 9 bps LQ to 0.16% Allowance for loan and lease losses increased $5.6mm, or 7%, LQ on provisions of $10.5mm and net charge-offs of $4.9mm Increase in provision related to TDR policy changes 0.16% 1.02% 0.65% 0.34% 1.29% 1.08% 1.86% 1.63% 1.46% 0.25% 11.09% 1.08% (9.48)% (0.53)% Regulatory NPAs / Assets Impact Ex. Govt Insured Loans Impact Ex. ACI Loans Adjusted NPAs / Assets

19 Appendix

20 Annual Targets 9% - 12% 23%(1) 9% - 12% 33% / 14%(3)(4) 10% - 13% 12%(3) 12% - 14% 14.6% ROE Net Income / EPS Growth(2) Total Risk-Based Capital Ratio Asset Growth Intermediate Financial Targets 2-Year Average Historical Annual Performance (1) Represents CAGR from 2010 - 2012 (2) EPS on a diluted basis (3) Adjusted earnings and return metrics for continuing operations; a reconciliation of non-GAAP financial measures can be found in the appendix (4) Represents year over year growth from 2011 - 2012

21 1.67% 2.36% 3.29% 3.87% 3.18% 1.83% 1.20% 0.97% 0.78% 2.17% 4.02% 5.29% 5.02% 3.20% 1.57% 0.93% 0.86% 1.01% 0.00 % 1.50% 3.00% 4.50% 6.00% 2004 2005 2006 2007 2008 2009 2010 2011 2012 EverBank interest cost of deposits Avg. one-year LIBOR 200 bps Deposit Pricing Lags in Rising Rate Environment (1) Calculated as annual deposit interest expense divided by average balance of deposits; includes non-interest bearing deposits; YTD (1)

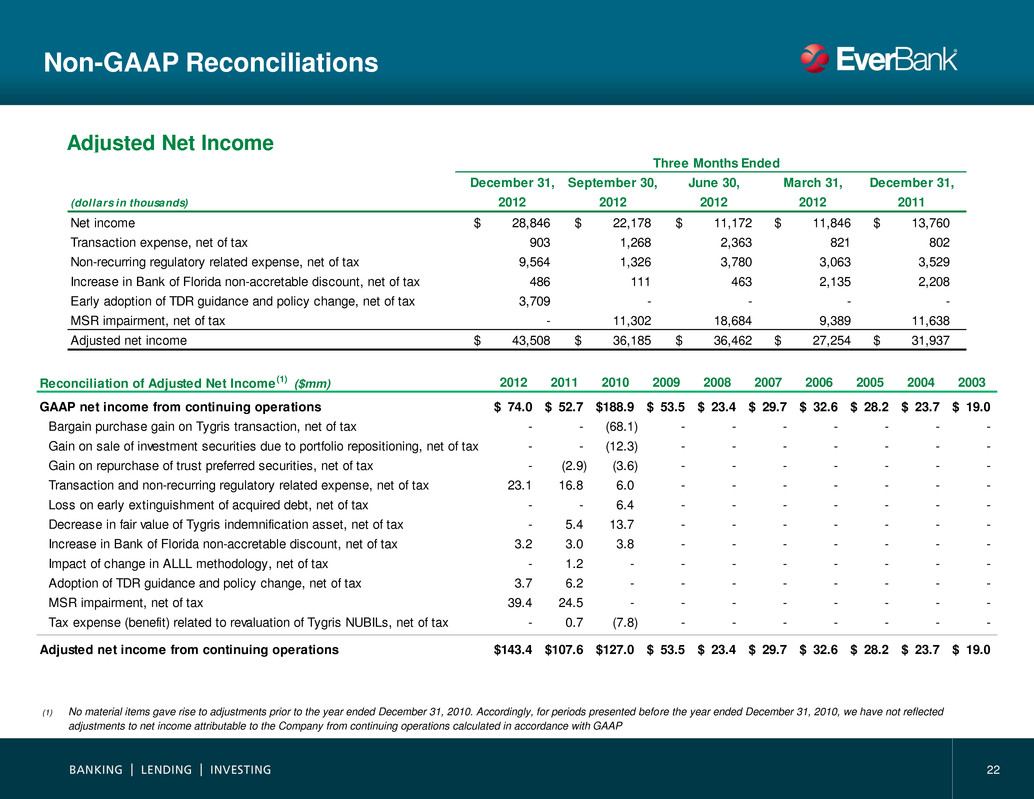

22 Non-GAAP Reconciliations Adjusted Net Income (1) No material items gave rise to adjustments prior to the year ended December 31, 2010. Accordingly, for periods presented before the year ended December 31, 2010, we have not reflected adjustments to net income attributable to the Company from continuing operations calculated in accordance with GAAP Three Months Ended December 31, September 30, June 30, March 31, December 31, (dollars in thousands) 2012 2012 2012 2012 2011 Net income 28,846$ 22,178$ 11,172$ 11,846$ 13,760$ Transaction expense, net of tax 903 1,268 2,363 821 802 Non-recurring regulatory related expense, net of tax 9,564 1,326 3,780 3,063 3,529 Increase in Bank of Florida non-accretable discount, net of tax 486 111 463 2,135 2,208 Early adoption of TDR guidance and policy change, net of tax 3,709 - - - - MSR impairment, net of tax - 11,302 18,684 9,389 11,638 Adjusted net income 43,508$ 36,185$ 36,462$ 27,254$ 31,937$ Reconciliation of Adjusted Net Income (1) 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 GAAP net income from continuing operations 74.0$ 52.7$ 188.9$ 53.5$ 23.4$ 29.7$ 32.6$ 28.2$ 23.7$ 19.0$ Bargain purchase gain on Tygris transaction, net of tax - - (68.1) - - - - - - - Gain on sale of investment securities due to portfolio repositioning, net of tax - - (12.3) - - - - - - - Ga n repurchase of trust preferred securities, net of tax - (2.9) (3.6) - - - - - - - Transaction and non-recurring regulatory related expense, net of tax 23.1 6.8 6.0 - - - - - - - Loss on early extinguishment of acquired debt, net of t - - 6.4 - - - - - - - Decrease in fair value of Tygris indemnific tion asset, net of tax - 5.4 13.7 - - - - - - - Increase in Bank of Florida non-accretable discount, net of tax 3.2 .0 3.8 - - - - - - - Impact of change in ALLL methodology, net of tax - 1.2 - - - - - - - - Adoption of TDR guidance and policy change, net of tax 3.7 6.2 - - - - - - - - MSR impairment, net of tax 39.4 24.5 - - - - - - - - Tax expense (benefit) related to revaluation of Tygris NUBILs, net of tax - 0.7 (7.8) - - - - - - - Adjusted net income from continuing operations 143.4$ 107.6$ 127.0$ 53.5$ 23.4$ 29.7$ 32.6$ 28.2$ 23.7$ 19.0$ ($mm)

23 Non-GAAP Reconciliations Non-performing Assets (NPA) (1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property acquired in the Bank of Florida acquisition accounted for under ASC 310-30 because as of December 31, 2012, we expected to fully collect the carrying value of such loans and foreclosed property. December 31, September 30, June 30, March 31, December 31, December 31, (dollars in thousands) 2012 2012 2012 2012 2011 2010 Total non-accrual loans and leases 156,629$ 167,650$ 168,962$ 170,589$ 193,478$ 213,838$ Accruing loans 90 days or more past due - 1,973 1,800 5,119 6,673 1,754 Total non-performing loans (NPL) 156,629 169,623 170,762 175,708 200,151 215,592 Other real estate owned (OREO) 40,492 43,612 49,248 49,304 42,664 37,450 Total non-performing assets (NPA) 197,121 213,235 220,010 225,012 242,815 253,042 Troubled debt restructurings (TDR) less than 90 days past due 90,094 82,030 93,184 92,954 92,628 70,173 Total NPA and TDR (1) 287,215$ 295,265$ 313,194$ 317,966$ 335,443$ 323,215$ Total NPA and TDR 287,215$ 295,265$ 313,194$ 317,966$ 335,443$ 323,215$ Government-insured 90 days or more past due still accruing 1,729,877 1,684,550 1,647,567 1,530,665 1,570,787 553,341 Loans accounted for under ASC 310-30: 90 days or more past due 79,984 117,506 140,797 146,379 149,743 195,425 OREO 16,528 18,557 20,379 22,852 19,456 19,166 Total regulatory NPA and TDR 2,113,604$ 2,115,878$ 2,121,937$ 2,017,862$ 2,075,429$ 1,091,147$ Adjusted credit quality ratios excluding government-insured loans and loans accounted for under ASC 310-30: (1) NPA to total assets 1.08% 1.29% 1.46% 1.63% 1.86% 2.11% Credit quality ratios including government-insured loans and loans accounted for under ASC 310-30: NPA to total assets 11.09% 12.32% 13.49% 13.97% 15.20% 8.50%

24 Non-GAAP Reconciliations Regulatory Capital (bank level) Tangible Equity December 31, September 30, June 30, March 31, December 31, (dollars in thousands) 2012 2012 2012 2012 2011 Shareholders' equity 1,518,934$ 1,339,669$ 1,263,687$ 1,099,404$ 1,070,887$ Less: Goodwill and other intangibles (54,780) (16,586) (16,938) (17,290) (17,642) Disallowed servicing asset (32,378) (33,366) (36,650) (40,783) (38,925) Disallowed deferred tax asset (67,296) (69,412) (70,357) (71,302) (71,803) dd: Accumulated losses on securities and cash flow hedges 83,477 103,238 110,101 86,981 105,682 Tier 1 capital 1,447,957 1,323,543 1,249,843 1,057,010 1,048,199 Less: Low-level recourse and residual interests - - - (20,424) (21,587) Add: Allowance for loan and lease losses 82,102 76,469 77,393 78,254 77,765 Total regulatory capital 1,530,059$ 1,400,012$ 1,327,236$ 1,114,840$ 1,104,377$ Adjusted total assets 18,141,856$ 16,488,067$ 15,022,729$ 13,731,482$ 13,081,401$ Risk-weighted assets 11,339,412 8,701,164 8,424,290 7,311,556 7,043,371 Reconciliation of Adjusted Tangible Shareholders Equity 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 GAAP shareholders equity 1,451$ 968$ 1, 13$ 554$ 411$ 239$ 213$ 185$ 165$ 144$ Less: Goo will 4 10 10 0 0 2 0 0 0 0 Less: Other intangible assets 8 7 9 - 1 2 3 4 6 7 Tangible equity 1,396$ 950$ 994$ 554$ 410$ 235$ 209$ 180$ 159$ 137$ Less: Perpetual preferred stock 150 - - - - - - - - - Tangible common equity 1,246$ 950$ 994$ 554$ 410$ 235$ 209$ 180$ 159$ 137$ Less: Accu ulated other comprehensive income (loss) (87) (108) (5) 20 1 (2) 3 3 4 3 Adjusted tangible common equity 1,333$ 1,058$ 999$ 534$ 409$ 237$ 206$ 178$ 155$ 134$

25 Non-GAAP Reconciliations Tangible Equity, Adjusted Tangible Equity and Tangible Assets December 31, (dollars in thousands) 2012 Shareholders' equity 1,451,176$ Less: Goodwill 46,859 Intangible assets 7,921 Tangible equity 1,396,396$ Less: Perpetual preferred stock 150,000$ Tangible common equity 1,246,396$ Less: Accumulated other comprehensive loss (86,784) Adjusted tangible common equity 1,333,180$ Total assets 18,242,878$ Less: Goodwill 46,859 Intangible assets 7,921 Tangible assets 18,188,098$