Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EVANS BANCORP INC | d485174d8k.htm |

Sterne

Agee Financial Institutions Investor Conference

February 12-13, 2013

NYSE MKT: EVBN

Gary A. Kajtoch

Executive Vice President & CFO

David J. Nasca

President & CEO

©

2013 by Evans Bancorp

Exhibit 99 |

©

2013 by Evans Bancorp

Safe Harbor Statement

Safe Harbor Statement

2

This presentation includes "forward looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements concerning future business, revenue and

earnings. These statements are not historical facts or guarantees of future

performance, events or results. There are risks, uncertainties and other

factors that could cause the actual results of the Company to differ materially

from the results expressed or implied by such forward-looking statements.

Information on factors that could affect the Company's business and results is

discussed in the Company's periodic reports filed with the Securities and

Exchange Commission. Forward looking statements speak only as of the date

they are made. The Company undertakes no obligation to publicly update or

revise forward looking information, whether as a result of new, updated

information, future events or otherwise. |

©

2013 by Evans Bancorp

Recent Price

$17.15

52 week range

$12.90-18.70

Market

Capitalization

Total Shares Outstanding

4.17 million

Ownership

–

Insider

5.9%

Institutional

32.2%

3

Dividend Yield

2.8%

Total Assets

$809.7 million

Total

Gross

Loans

(excluding

Leases)

$581.3 million

Total Deposits

$679.0 million

Total Common Equity

$ 74.8 million

Tangible Book Value

$15.92

Evans Bancorp, Inc.

Evans Bancorp, Inc. (NYSE MKT: EVBN)

Market data as of February 06, 2013 (Source: Bloomberg); Financial data as of

December 31, 2013; Ownership as of most recent filing

$71.3

million

Community-based financial services company

Provides banking, insurance and investment services in WNY

Relationship-focused organization; serves as a trusted advisor

Easy to interact with; an excellent work environment for top talent

|

©

2013 by Evans Bancorp

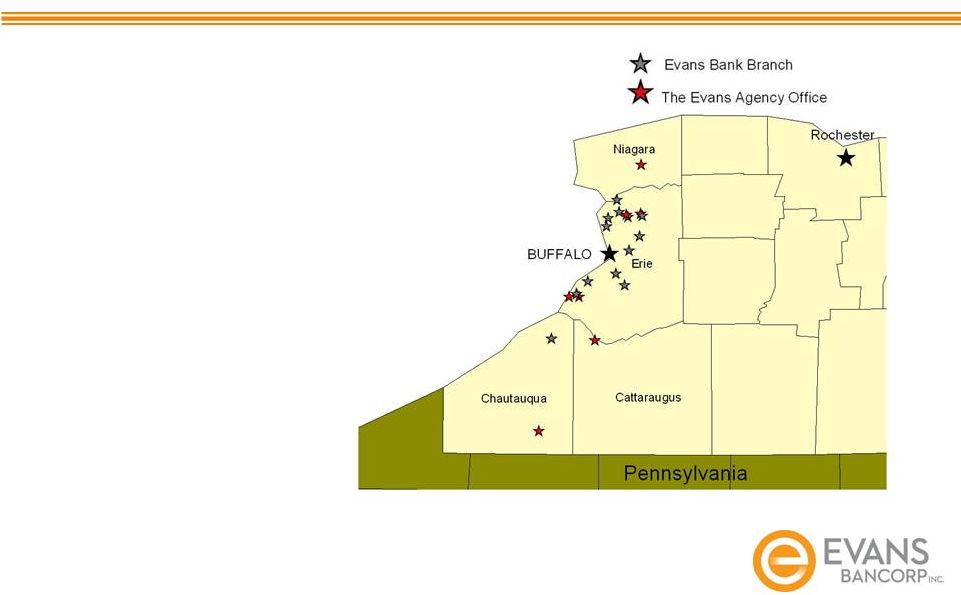

Geographic Reach

Geographic Reach

As of December 31, 2012

Evans Established: 1920

Bank Branches: 13

Insurance Agency Locations: 7

|

©

2013 by Evans Bancorp

Diversified Financial Services Company

Diversified Financial Services Company

5

Diversified Revenue Sources

2012: $40.6 million

Approximately 32% of

revenue from non-interest

sensitive relationships

Significant insurance agency

presence in WNY

Focus on commercial

lending and portfolio

diversification

68%

17%

15%

Net Interest Income

Insurance & Investment Services Fee Income

Other Non-interest Income |

Organic

Growth

Scalable

Organization

Capital

Sufficiency

Commercial

Portfolio

Branding

Talent

Management

Non-Interest

Income Focus

Foundation for Growth

Foundation for Growth

6

©

2013 by Evans Bancorp |

©

2013 by Evans Bancorp

Market Strategies

Market Strategies

Laser-focused upon WNY market

Proactive customer acquisition and sales efforts

Loan portfolio diversification leads the way

Alternative channels: Strong web presence, mobile banking and first to

market with remote deposit capture

Incent value-added and solution-based cross-sales and referrals

Optimize fee-based solutions to deepen customer profitability and loyalty

Significant presence, involvement and visibility as a community partner

Operational Excellence:

Ease of access and doing business = outstanding customer experience

Opportunistic Acquisitions

7 |

©

2013 by Evans Bancorp

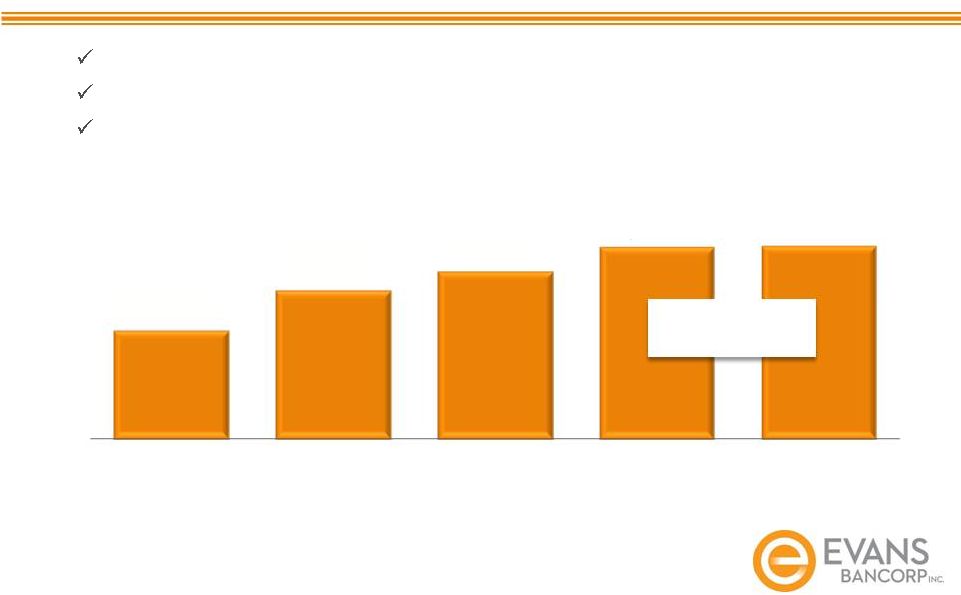

8

Successful Performance

Successful Performance

($ in millions)

Expanded asset base through organic loan growth and acquisition

Increased future earnings power potential

Assets expanded 83% since restructuring balance sheet in 2007

11.2% CAGR

(2008 –

2012)

Asset growth of 53%

$529.0

$619.4

$671.5

$740.9

$809.7

2008

2009

2010

2011

2012 |

©

2013 by Evans Bancorp

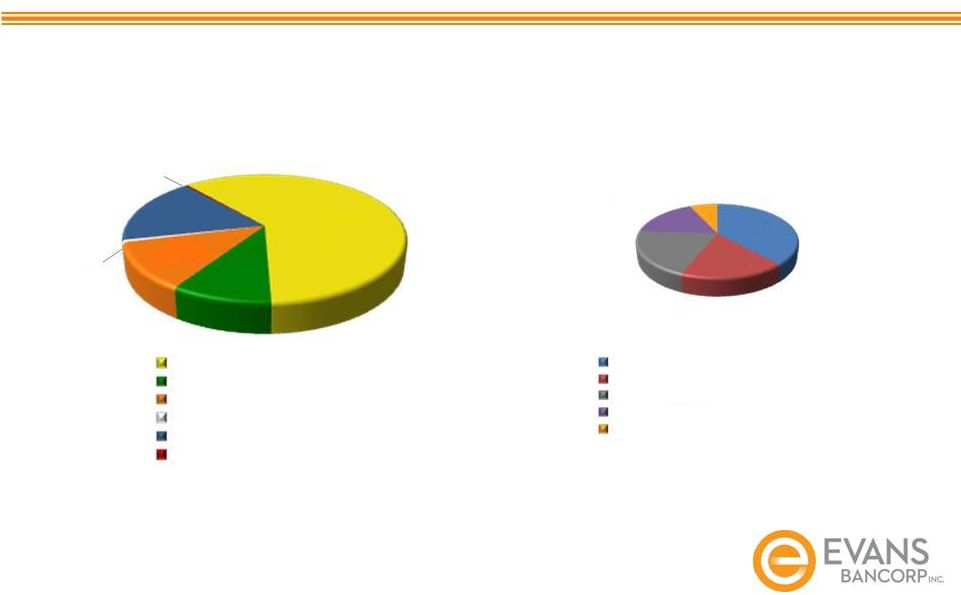

Source: FDIC, as of June

30, 2011 and 2012

Opportunity for Expansion

Opportunity for Expansion

9

Market Share by Deposits

$26.2B Total Deposits

HSBC

19.6%

M&T

39.0%

Key

Bank

9.6%

First

Niagara

15.8%

Evans

2.1%

Citizens

5.3%

Bank of

America

4.43%

All

Others

4.3%

2012

$32.3B Total Deposits

HSBC

8.8%

M&T

42.7%

Key

Bank

8.3%

First

Niagara

26.2%

Evans

1.9%

Citizens

4.6%

Bank of

America

3.8%

All

Others

3.7%

2011

1.1%

1.5%

1.7%

2.1%

1.9%

2008

2009

2010

2011

2012 |

Financial Highlights

and Results

©

2013 by Evans Bancorp |

©

2013 by Evans Bancorp

Core Banking: Loan Growth

Core Banking: Loan Growth

11

High quality in-market commercial loans

Capturing strong credits from larger banks

Supports core business strategy

($ in millions)

$349.1

$458.1

$512.5

$577.4

$581.3

2008

2009

2010

2011

2012

13.6% CAGR

(2008 –

2012) |

©

2013 by Evans Bancorp

As of December 31, 2012

Diverse Loan and Lease Portfolio

Diverse Loan and Lease Portfolio

* Includes construction loans

Commercial Loans

Total Loans and Lease Portfolio:

$582.9 million

12

60.5%

9.7%

11.8%

0.6%

17.1%

0.3%

Commercial Mortgages*

Home Equities

Residential Mortgages*

Consumer

Commercial & Industrial

Leases

38.4%

17.6%

20.2%

17.0%

6.8%

Non-owner occupied CRE

Owner occupied CRE

C&I

Multi-family

Construction / Land Development |

©

2013 by Evans Bancorp

13

NPAs to Total Loan + OREO

* Peer data per SNL

Booking high quality

assets

Solid underwriting

discipline

Strong customer

relationships

EVBN

(GAAP) Banks > $500 Million and < $1 Billion in Assets*

0.89%

2.65%

2.64%

2.60%

1.41%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2008

2009

2010

2011

2012

1.11%

EVBN without

ENL & WVB

Asset Quality

Asset Quality

- Evans National Leasing

ENL

-

Waterford Village Bank (FDIC assisted acquisition) WVB |

©

2013 by Evans Bancorp

14

Conservative Credit Quality

Conservative Credit Quality

Allowance for Loan Loss / Non-Accruals

Q4 2012

* Peer data per SNL

Allowance to

Loan Ratio

(as of 12/31/2012)

1.67%

** Allowance for ENL: $47 thousand; Allowance for WVB: $119 thousand

118.3%

154.1%

96.1%

EVBN (GAAP)

EVBN with ENL & WVB**

Banks <$1B*

-

Evans National Leasing

ENL

-

Waterford Village Bank (FDIC assisted acquisition) WVB |

©

2013 by Evans Bancorp

Q4 2012 Non-Performing Loans by Portfolio

($ in millions)

15

Asset Quality

Asset Quality

NPL Ratios by Portfolio

$1.4

$4.3

$0.7

$0.6

$0.9

$0.04

Residential Mortgage (2.12%)

Commercial & Multi-Family (1.33%)

Construction (2.45%)

Home Equity (1.10%)

Commercial Loans (0.91%)

Consumer (1.36%) |

©

2013 by Evans Bancorp

16

Low Cost Core Deposits

Low Cost Core Deposits

($ in millions)

13.9% CAGR

(2008 –

2012)

13.4% increase since December 31, 2011 in regular savings, demand deposits

and NOW deposits

Deposit Composition:

$679.0 million

$404.0

$499.5

$544.5

$616.2

$679.0

2008

2009

2010

2011

2012

56.1%

16.0%

27.9%

Savings & Money Market

Time Deposits

Demand & NOW |

©

2013 by Evans Bancorp

* Excludes $0.7 million gain on bargain purchase

17

Strong Margins and Revenue Growth

Strong Margins and Revenue Growth

Net Interest Margin

Comparison

Q4 2012

Revenue

* Peer data per SNL

**Q4 Net Interest Margin includes loan prepayment fees.

Q4 2012 NIM excluding these fees equals 3.69%.

($ in millions)

$30.9

$36.0

$37.1

$38.4

$40.6

2008

2009*

2010

2011

2012

7.1% CAGR

(2008

–

2012)

3.78%

3.66%

Banks <$1B*

EVBN** |

©

2013 by Evans Bancorp

18

Fee income less rate sensitive

Capitalize on relationship management

Insurance 54% of 2012 non-interest income

Focusing on growing commercial lines

2.3% CAGR

(2008 –

2012)

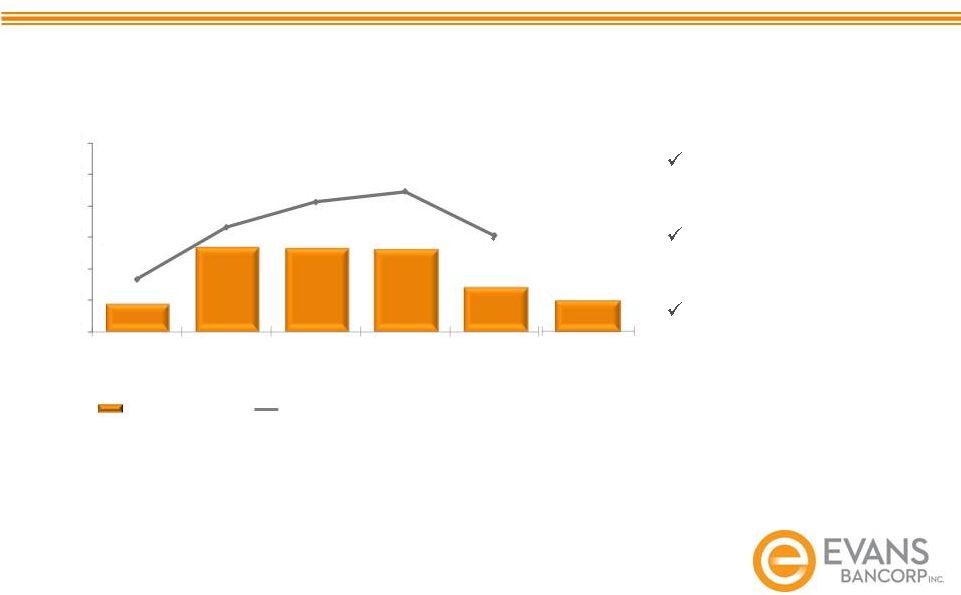

Non-Interest Income

Non-Interest Income

* Excludes $0.7 million gain on bargain purchase.

($ in millions)

$11.7

$13.4

$12.6

$12.4

$12.8

2008

2009*

2010

2011

2012 |

©

2013 by Evans Bancorp

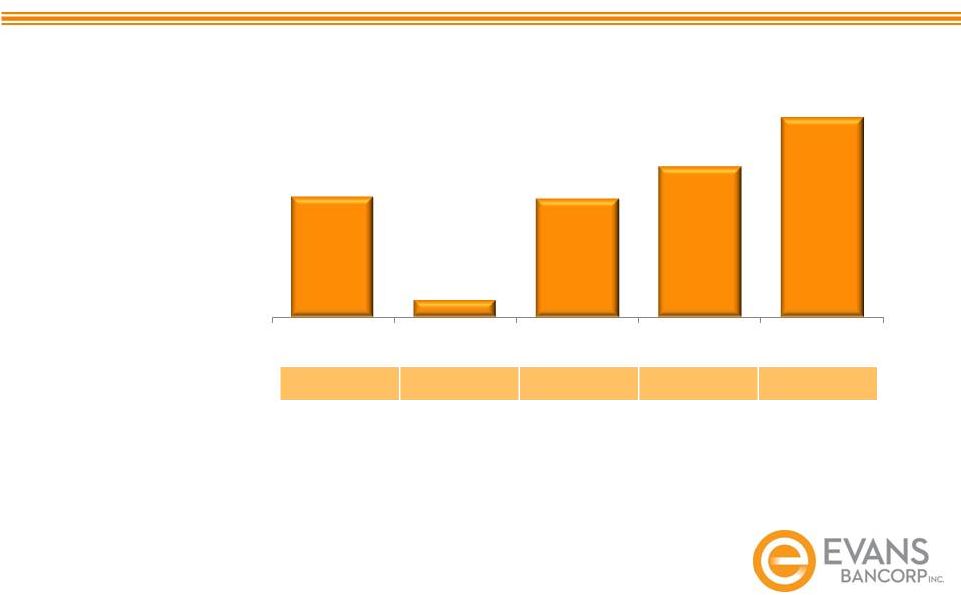

Bottom-line Results

Bottom-line Results

($ in millions)

Net Income

$ 1.78

$ 0.25

$ 1.34

$ 1.49

$ 1.95

Earnings Per Share

*

(diluted)

* 2009 and 2010 EPS include leasing losses of $(1.35) and $(0.09),

respectively 19

$4.9

$0.7

$4.8

$6.1

$8.1

2008

2009*

2010*

2011

2012 |

©

2013 by Evans Bancorp

Fourth

Fourth

Quarter

Quarter

2012

2012

–

–

Core Business Strength

Core Business Strength

($ in millions, except per share data; % y-o-y)

Net Interest Income

Non-Interest Income

Non-Interest Expense

Net Income

Earnings Per Share

(diluted)

20

Increased

3.0%

Increased

14.7%

Increased

1.9%

Increased

58.6%

Increased

56.1%

$7.1

$3.3

$7.2

Q4 2012

Q4 2012

Q4 2012

$2.1

Q4 2012

$0.51

Q4 2012 |

©

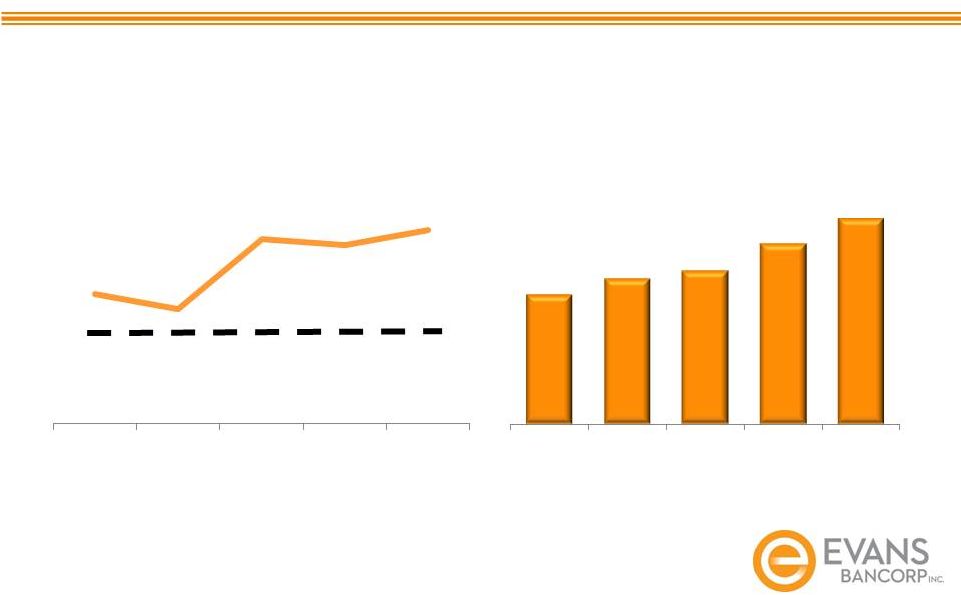

2013 by Evans Bancorp

10% Regulatory guideline

Tangible Book Value

Building Return on Capital

Building Return on Capital

21

11.8%

11.2%

14.3%

14.0%

14.7%

2008

2009

2010

2011

2012

$11.90

$12.72

$13.18

$14.60

$15.92

2008

2009

2010

2011

2012

Total Risk Based Capital |

Driving Growth

Managing Risk

©

2013 by Evans Bancorp |

23

©

2013 by Evans Bancorp

Why Growth is Important

Why Growth is Important

Competitive Pressures

Margin Compression

Regulatory Burden Expansion

Requirements for Increased Capital |

©

2013 by Evans Bancorp

Opportunity: Organic and Human Capital

24

Market Disruption Created Opportunity

Market Disruption Created Opportunity |

©

2013 by Evans Bancorp

EVBN outperformed

Local Banks & High

Performing Peer

groups since 1/1/12

Stock Market Performance

Stock Market Performance

25

44%

EVBN

(through 2/6/2013)

EVBN

SNL Bank

High Performing Peers

Local

-3%

2%

7%

12%

17%

22%

27%

32%

37%

42%

47%

Dec-11

Feb-12

Apr-12

Jun-12

Aug-12

Oct-12

Dec-12 |

©

2013 by Evans Bancorp

Investment Highlights

Investment Highlights

26

Diverse revenue mix, strong operating fundamentals

Strong and growing franchise in WNY

Sophisticated / experienced management team

Solid capital base

Quality core deposit growth

Low risk balance sheet

Shareholder return orientation

Historically reasonable valuation |

NYSE

MKT: EVBN Sterne Agee Financial Institutions

Investor Conference

February 12-13, 2013

©

2013 by Evans Bancorp |

Supplemental Information

©

2013 by Evans Bancorp |

©

2013 by Evans Bancorp

Executive Compensation

Base Salary :

–

Benchmarked against peer group

–

Scope and complexity of position

–

Market value of job

–

Level of expertise

–

Performance in position

–

Company performance factors

Short-Term Cash Incentives:

–

Performance compared to financial, operational and strategic goals

–

Based on net income threshold

–

Individual performance and attainment of assigned goals

Long-Term Equity Incentives:

–

Aligns interests of participants and shareholders

–

Focuses on Company performance over a longer period of time

–

Stock options and restricted stock

29 |