Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - National Bank Holdings Corp | d483675d8k.htm |

Fourth Quarter 2012 Update

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation contains forward-looking statements. Any statements about our

expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical

facts and may be forward-looking. These statements are often, but not always, made through

the use of words or phrases such as “anticipate,” “believes,” “can,” “would,” “should,” “could,” “may,” “predicts,”

“potential,” “should,” “will,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. These statements are only predictions and involve estimates, known and

unknown risks, assumptions and uncertainties. Our actual results could differ materially from

those expressed in or contemplated by such forward-looking statements as a result of a variety of factors, some of

which are more fully described under the caption “Risk Factors” in the registration

statements and quarterly report we have filed with the Securities and Exchange Commission. Any or all of our forward-looking

statements in this presentation may turn out to be inaccurate. The inclusion of such

forward-looking statements should not be regarded as a representation by us, or any other person that the results expressed

in or contemplated by such forward-looking statements will be achieved. We have based

these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our financial condition, liquidity, results of operations,

business strategy and growth prospects. There are important factors that could cause our actual results, level of activity,

performance or achievements to differ materially from the results, level of activity,

performance or achievements expressed in or contemplated by the forward looking statements, including, but not limited to: (1)

ability to execute our business strategy; (2) changes in the regulatory environment,

including changes in regulation that affect the fees that we charge; (3) economic, market, operational, liquidity, credit and

interest rate risks associated with our business; (4) our ability to identify potential

candidates for, obtain regulatory approval of and consummate, acquisitions of banking franchises on attractive terms, or at all;

(5) our ability to integrate acquisitions and to achieve synergies, operating efficiencies

and/or other expected benefits within expected time-frames, or at all, or within expected cost projections, and to preserve

the goodwill of acquired banking franchises; (6) our ability to achieve organic loan and

deposit growth and the composition of such growth; (7) business and economic conditions generally and in the financial

services industry; (8) increased competition in the financial services industry, nationally,

regionally or locally, resulting in, among other things, lower risk-adjusted returns; (9) changes in the economy or supply-

demand imbalances affecting local real estate values; (10) volatility and direction of market

interest rates; (11) effects of any changes in trade and monetary and fiscal policies and laws, including the interest

rate policies of the Federal Reserve; (12) the ability in certain states to amend the state

constitution to impose restrictions on financial services by a simple majority of the people who actually vote; (13)

governmental legislation and regulation, including changes in accounting regulation or

standards; (14) failure of politicians to reach consensus on a bipartisan basis; (15) acts of war or terrorism, natural

disasters such as tornadoes, flooding, hail storms and damaging winds, earthquakes,

hurricanes or fires, or the effects of pandemic flu; (16) the timely development and acceptance of new products and

services and perceived overall value of these products and services by users; (17) changes in

the Company’s management personnel; (18) continued consolidation in the financial services industry; (19) ability

to maintain or increase market share; (20) ability to implement and/or improve operational

management and other internal risk controls and processes and our reporting system and procedures; (21) a

weakening of the economy which could materially impact credit quality trends and the ability

to generate quality loans; (22) the impact of current economic conditions on the Company’s performance, liquidity,

financial condition and prospects and on its ability to obtain attractive third-party

funding to meet its liquidity needs; (23) fluctuations in face value of investment securities due to market conditions; (24) changes

in fiscal, monetary and related policies of the U.S. federal government, its agencies and

government sponsored entities; (25) inability to receive dividends from our subsidiary bank, pay dividends to our common

stockholders and to service debt and satisfy obligations as they become due; (26) costs and

effects of legal and regulatory developments, including the resolution of legal proceedings or regulatory or other

governmental inquiries, and the results of regulatory examinations or reviews; (27) changes

in estimates of future loan reserve requirements based upon the periodic review thereof under relevant regulatory

and accounting requirements; (28) changes in capital classification; (29) impact of

reputational risk on such matters as business generation and retention; and (30) the Company’s success at managing the risks

involved in the foregoing items. All forward-looking statements are necessarily

only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the

particular forward-looking statement, and, therefore, you are cautioned not to place

undue reliance on such statements. Any forward-looking statement is qualified in its entirety by reference to the matters

discussed in this presentation. Further, any forward-looking statement speaks only as of

the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events

or circumstances after the date on which the statement is made or to reflect the occurrence

of unanticipated events or circumstances, except as required by applicable law.

No Offer or Solicitation; Further Information

We have filed registration statements and other documents with the SEC. Before you invest,

you should read the documents we have filed with the SEC for more complete information about us. You may get

these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

This presentation should be read together with “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes theret

included in our registration statements and quarterly report filed with the SEC.

Non-GAAP Measures

We consider the use of select non-GAAP financial measures and ratios to be useful for

financial and operational decision making and useful in evaluating period-to-period comparisons. Please see the

Appendix to this presentation and our registration statements and quarterly report for

a further description of our use of non-GAAP financial measures and a reconciliation of the differences from the most

directly comparable GAAP financial measures.

|

Company Overview |

A Foundation For

Growth 4

Stock Price / Market Cap

$18.52 / $1.0bn

Assets

$5.4bn

Deposits

$4.2bn

Loans

$1.8bn

NBH 4Q12 Snapshot

Raised $974 million in late 2009

Completed four acquisitions in 12 months

Created meaningful scale and market

share in attractive markets

Fully integrated acquired franchises into

scalable operating platform

Executing on both organic and M&A

strategy

Profitable since inception of banking

operations

Successfully completed IPO

Note: Market data as of 24-Jan-13, financial information as of

31-Dec-12. ¹

4Q12

TBV

/

share

+

net

present

value

(5%

discount

rate)

of

excess

A-T

accretable

yield

and

FDIC

indemnification

asset

yield

/

share.

Excess

A-T

accretable

yield

defined

as

total

accretable

yield

less 4.5% average loan yield on originations.

Company Overview

Full-Service Banking Centers

101

Capital Deployed

$650mm

TBV / Share

(Inception / Current / Current

with Excess Accretable Yield¹)

$18.82 / $19.17 / $19.67¹

Excess Capital

(10% T1L / 8% T1L)

$400mm / $475mm |

NBH Management

Team 5

Head

of

M&A

and

Corporate

Planning,

Head

of

Foreign

Exchange

and

Interest

Derivatives

business,

and

Mid-Atlantic

Chief

Financial Officer at Citizens Financial Group

Don Gaiter

Chief of Acquisitions and Strategy (23 years in banking)

Head of Business Services at Regions Financial, where he also led the transformation of

wholesale lines of business Senior management roles in small business, commercial

banking, private banking, corporate marketing and change management, and Management

Operating Committee member at Bank of America; also served as President, Bank of America, Florida

Tim Laney

Chief Executive Officer (30 years in banking)

Head of Business Services Credit at Regions Financial

Senior roles in risk management, credit, commercial banking, global bank debt and corporate

marketing at Bank of America Richard Newfield

Chief Risk Officer (27 years in banking)

Vice Chairman and Chief Financial Officer at F.N.B. Corporation

Corporate strategic planning, line-of-business and geographic Chief

Financial Officer at PNC Brian Lilly

Chief Financial Officer (32 years in banking) |

Accomplished

Board of Directors Title

Past

Experience

Name

Frank Cahouet

Chairman

Chairman, President, and Chief Executive Officer of Mellon Financial

President and Chief Operating Officer of Fannie Mae

Tim Laney

President / CEO

Senior EVP and Head of Business Services of Regions Financial

EVP and Management Operating Committee at Bank of America

Ralph Clermont

Director / Chairman of the Audit and

Risk Committee

Managing Partner of the St. Louis office of KPMG LLP

Robert Dean

Director / Chairman of the

Nominating and Corporate

Governance Committee

Senior Managing Director at Ernst & Young Corporate Finance LLC

Co-Chair of Gibson, Dunn & Crutcher LLP’s banking practice

Lawrence Fish

Director

Chairman and Chief Executive Officer of Citizens Financial Group

Director of the Federal Reserve Bank of Boston

Micho Spring

Director

Chair of Global Corporate Practice of Weber Shandwick

CEO of Boston Communications Company

Burney Warren

Director / Chairman of the

Compensation Committee

EVP and Director of Mergers and Acquisitions of BB&T

President and Chief Executive Officer of First Federal Savings Bank

6 |

7

Acquisition Growth

Organic

Growth

Attractive

Markets

Disciplined

Acquisitions

Client-Centered,

Relationship-Driven

Enhanced

Product

Offerings

Scalable

Operating

Platform

& Efficiencies

Leading Regional Bank Holding Company

Our Objectives |

Investment

Highlights 8

Disciplined Focus on Building Meaningful Scale and Market Share in Attractive

Markets Expertise in FDIC-assisted and Unassisted Bank

Transactions with Substantial Future Opportunities

Operating Platform Implemented with Full Conversion of All Acquisitions

Organic Growth Accelerating

Attractive Low-Risk Profile

Available Capital to Support Growth

Experienced and Respected Management Team and Board of Directors

|

Attractive Footprint

9

Bank Holding Company

OCC Charter (Single Charter)

Local Branded Divisional Banks

Source: SNL Financial.

Kirksville MSA

Maryville MSA

St. Joseph MSA

Kansas City

Kansas City MSA

Fort Collins MSA

Boulder MSA

Denver MSA

Greeley MSA

Denver

Colorado Springs MSA |

U.S.

Population (mm)

311.0

2.1

2.6

4.1

Pop. Projection CAGR

(‘11-’16)

0.7

%

0.9

%

1.2

%

1.2

%

2011 Median Household Inc.

$50.2K

$54.4K

$59.0K

$57.8K

# of Businesses (000s)

72.8

95.7

154.9

Unemployment Rate

(Dec-12)

7.8

%

6.4

%

7.4

%

7.4

%

Real GDP per Capita

$42.2K

$47.1K

$56.7K

$50.1K

Real GDP Growth (’05-’10)

0.70

%

0.90

%

1.70

%

1.70

%

HPI Change (’07-’11)

(19.2)%

(8.2)%

(5.6)%

(5.7)%

Branch Penetration

(per 100k people)

31.2

37.5

27.1

28.0

Deposits per Branch ($mm)

$

82

$

56

$

85

$

70

Top 3 Combined

Deposit Market Share

54%

36%

53%

52%

Front Range

Denver, CO

Kansas City, MO

Better Than U.S. Average

Source: SNL Financial, U.S. Census, U.S. Bureau of Economic Analysis.

Note:

All

data

as

of

2011

except

unemployment

rate

and

deposit

data.

“Front

Range”

statistics

include

populated

weighted

values

for

Denver,

Boulder,

Colorado

Springs,

Fort

Collins,

and

Greeley

MSAs.

Deposit data as of 30-Jun-12. Front Range unemployment based on a

weighted average of Nov-12 unemployment and YE 2011 population for each MSA.

¹

Based on U.S. Top 20 MSAs (determined by population).

10

Our Markets are Attractive

1

Key Statistics by MSA, 2011 |

Proven Acquirer

– FDIC Assisted and Unassisted Transactions

Kansas City MSA

Colorado

11

Jul-2011

Assets: $950mm

Deposits: $760mm

Full-Service Branches: 16

FDIC / No Loss Share

Bank Midwest Transaction –

Deposit Premium

FDIC-Assisted Transactions –

Asset Discount / FV Marks Net of Loss Coverage

4

1.4 x

1.7 x

1.1 x

1.4 x

1.4 x

Hillcrest Bank

Bank of

Choice

Community

Banks of

Colorado

Total Colorado

Total

2.2 %

4.0 %

4.8 %

Bank Midwest

Nationwide Branch

Deals ³

Midwest Branch

Deals ³

Jul-2010 / Dec-2010

Assets: $2.4bn

Deposits: $2.4bn

Full-Service Branches: 39

Unassisted transaction

Oct-2010

Assets: $1.4bn

Deposits: $1.2bn

Full Service Branches: 9

FDIC / Loss Share

Oct-2011

Assets: $1.2bn

Deposits: $1.2bn

Full-Service Branches: 40

FDIC / Loss Share

Bank Midwest

Hillcrest Bank

Bank of Choice

CBoC

Source: SNL Financial.

1

Defined as capital deployed divided by post mark-to-market adjusted fair value of net assets

(bargain purchase gain or goodwill) plus capital deployed. 2

Tax adjustments are calculated at a rate equal to the effective tax rate for the Company in 2011.

3

Includes branch transactions since 31-Dec-09 with greater than $250 million in deposits

acquired. 4

Multiples calculated as the asset discount divided by the total loan and OREO fair value marks

(including yield mark) net of the FDIC indemnification asset.

Balance Sheet

Full-Serv.

Transaction

Accounting Impact

Assets

Deposits

Banking

Capital

A-T Bar.

A-T Accr.

GW &

($mm)

Acquired

Assumed

Centers

Deployed

P / TBV¹

Purch. Gain²

Yield²

Intangibles

All Transactions

$

5,981

$

5,575

104

$

650

1.1

x

$

59

$

181

$

97

Implied |

MO

KS

CO

NE

SD

IA

WY

ND

MT

12

Large Number of Acquisition Opportunities with Limited Competition

Historical

Acquisition

Market

Share

4

Future Acquisition Opportunities

In Market

Market Extension ²

Total Markets

Troubled Institutions ¹

Number of Institutions

30

12

42

Total Assets ($bn)

$18.4

$4.7

$23.1

Other Institutions ($750mm-$10bn in Assets)

Number of Institutions

35

43

78

Total Assets ($bn)

$68.8

$89.2

$158.0

Total Institutions

Number of Institutions

65

55

120

Total Assets ($bn)

$87.2

$93.9

$181.1

Number of Active

Acquirers ³

6

2

6

% of

Deposits

Deposits

Acquired

Acquired

# of

Rank

Buyer

($mm)

($mm)

Deals

1

NBH Holdings Corp.

$5,575

24.7

%

4

2

First Citizens BancShares

2,324

10.3

2

3

National Australia Bank

2,261

10.0

1

4

LINCO Bancshares

1,028

4.6

1

5

Simmons First National

909

4.0

4

6

Strategic Growth Bank

820

3.6

1

7

Carlile Bancshares

624

2.8

2

8

Equity Bancshares

563

2.5

1

9

RCB Holding Company

561

2.5

1

10

Enterprise Financial Services

524

2.3

1

Other

7,376

32.7

112

Total for Institutions in Market

$22,565

100.0

%

130

1

2

3

4

Source: SNL Financial.

Includes banks with Texas Ratios >100% or <0%. Texas ratio defined as (Adj. NPAs + 90s) / (TCE

+ LLR). Market Extension includes IA, MT, ND, NE, SD, and WY.

“Active acquirers” are defined as all banks & thrifts with a presence in each market that

meet the following criteria: Total assets greater than $5bn, NPAs / Assets < 2.5%, Leverage Ratio > 8.0% and have

completed 1 or more acquisitions since 31-Dec-08. Totals and subtotals exclude

double-counting. Includes open bank and FDIC deals in CO, IA, KS, MO, MT, ND, NE, SD, and WY announced after

31-Mar-10 and before 31-Dec-12. |

Well

Positioned to Capture Fair Share of Market Market Opportunity

13

Source: SNL Financial, Hoovers D&B, and U.S. Bureau of Economic Analysis.

Progress to Date ($mm)

BMW & Hillcrest Conversion

KC New Talent Recruit / Sales Initiative

BoC & CBOC Conversion

CO New Talent Recruit /

Sales Initiative

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$ 25

$ 25

$ 35

$ 54

$ 82

$ 84

$ 128

$ 140

KC MSA

59.4

Colorado Front Range

155.1

Total

214.5

Number of Small Business (K)

KC MSA

$

43.6

Colorado Front Range

78.2

Total

$

121.8

KC MSA

$

10.5

Colorado Front Range

21.5

Total

$

32.0

Market Deposits ($bn)

Market Mortgage Outstandings ($bn)

KC MSA

1.1

Colorado Front Range

1.8

Total

2.9

Number of Mid & Large Businesses (K)

101 banking centers

58 commercial bankers |

New

Leadership Hires Treasurer

M&I /

Citibank

Richard Newfield

Chief Risk

Officer

Kathy

Hinderhofer

Chief of Integration,

Tech & Operations

Brian Lilly

Chief Financial

Officer

Lisa Monteleone

Chief Human

Resources Officer

Joseph Bonner

President,

Community Banks

of Colorado Division

Chief Accounting

Officer

Great Western Bank/

Commerce

Bancshares

Director of Mgmt

Reporting, Planning

& Analysis

Jeppesen

Sanderson,

a

Boeing

company

Director of Public

Reporting

Fifth Third Bank /

CrossFirst Holdings

EVP, Commercial

Banking

UMB Bank

EVP, Consumer

Banking

Bank of America

Chief Compliance

Officer

TD Bank / First Data

Director of

Enterprise

Technology

Commerce

Bancshares

HR Regional

Manager

Greater Kansas City

Chamber of

Commerce

EVP, Consumer

Banking

Commerce

Bancshares

Regional Manager

M&I /

Bank of America

Small Business

US Bank

SBA Program

Manager

Great Western Bank

Treasury

Management

Manager

Mutual Bk

of Omaha/

Guaranty Bank

Director of

Internal Audit

M&I

Director of Credit

Management

Bank of America

Senior Credit

Approval Officer

Bank of America

Director of Credit

Review

Commerce

Bancshares

Chief Appraiser

UMB Bank

Enterprise Risk

Manager

JP Morgan Chase

CRA

&

Fair

Lending

Officer

Commerce

Bancshares

Director of Loan

Operations

First Natl Bank of

Kansas

HR Benefits

Manager

Assurant Employee

Benefits / H&R Block

HR Program

Manager

JE Dunn

Construction

Donald Gaiter

Chief of Acquisitions

& Strategy

Thomas Metzger

President,

Bank Midwest /

Hillcrest Division

14

Light blue shading represents New Hire by NBH

Marketing Manager

Bank of America

17 New

Commercial

Bankers

12 New

Commercial

Bankers

General Counsel &

Secretary

Comerica / M&T

30 new leadership hires

58 commercial bankers, of

which 29 are new hires |

Accomplishments to Date

Completed four acquisitions

Established scalable, efficient operating platform to support growth

Fully integrated Kansas City and Colorado franchises

Successfully completed IPO

Divisional branding and marketing

Consolidated bank charters

Leadership and banker hires

30 new leadership hires

58 commercial bankers, of which 29 are new hires

$574mm cumulative new loan originations

$434mm in 2012

Initiated quarterly dividend of $0.05

Announced modest stock repurchase program ($25mm authorization)

15 |

Financial Overview |

Fourth

Quarter Earnings Summary 17

Reported 4Q12 net income of $3.0 million or $0.06 per share

Grew

organic

loan

production

for

the

eighth

consecutive

quarter,

resulting

in

growth

in

our

strategic

loan portfolio

Grew average non-interest bearing demand deposit balances 16.6% annualized,

leading to growth in average transaction balances

Lowered cost of deposits by 11 basis points to 0.48%

Added $8.9 million to accretable yield for the acquired loans accounted for under

ASC 310-30, while

only

taking

$1.6

million

in

impairments,

netting

to

a

$7.3

million

economic

improvement

in

the quarter and $68.9 million on a life-to-date basis

Tangible book value per share of $19.17 before consideration of the excess

accretable yield value of $0.50 per share; $19.67 including excess

accretable yield Net interest margin expanded to 4.09%, driven by higher

yields on loans accounted for under ASC 310-30

Approximately $400 million in excess strategic capital (above 10% Tier 1 Leverage),

which positions us for future growth opportunities

|

$ 19.29

$ 19.17

$18.82

$17.60

$17.68

$18.25

$19.50

$19.10

$19.16

$19.30

$19.67

$0.50

$ 1.3

$ 17.0

$ 15.7

$ 3.1

$ 4.1

$ 4.0

$ 4.3

0.09 %

0.39 %

0.33 %

0.25 %

0.34 %

0.34 %

0.38 %

FY2010

FY2011

FY2012

1Q12

2Q12

3Q12

4Q12

Adj. Net Income

Adj. ROATA

18

Off to a Great Start

Profitability & Adj. ROATA

TBV / Share

($ in millions, except per share data)

Source: SNL Financial.

Note: Please refer to the appendix for a reconciliation of non-GAAP financial

metrics. NBH metrics presented on an adjusted basis, which excludes stock-based compensation expense, gain or loss on sale

of securities, bargain purchase gains, related acquisition expenses, and IPO related

expenses. Financial metrics tax affected based on the effective tax rate for each period.

¹

Excluding $12mm of after-tax expenses related to NBH’s IPO, 3Q12 and FY2012

net income would have been $4mm and $16mm, respectively. ²

4Q12

TBV

/

share

+

net

present

value

(5%

discount

rate)

of

excess

A-T

accretable

yield

and

FDIC

indemnification

asset

yield/

share.

Excess

A-T

accretable

yield

defined

as

total

accretable

yield

less

4.5% average loan yield on originations.

Acquisition of Bank

Midwest & Hillcrest Bank

Acquisition of Bank

of Choice

Acquisition of Community

Banks of Colorado

Profitable since beginning of operating

history¹

TBV accretive even after four acquisitions

and start-up costs

Inception

FY 2010

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Reported

Excess Accretable Yield ²

2 |

19

69% of total assets are in cash, securities (low-risk, high-

quality agency residential MBS and CMOs), and covered

loans

98% of total liabilities composed of client deposits and repos

Capital is strictly composed of common equity

Loan Portfolio

Total Assets

Loans

Non 310-30

Loan Pools

$1,016mm

55%

310-30

Loan Pools

$831mm

45%

New

Originations

$539mm

Covered

$529mm

Covered

$80mm

Non-

Covered

$397mm

Low-Risk Balance Sheet

310-30 Loan Pools Accretable Yield

Reclassification Life-to-Date ($mm)

$ 93.0

$ 68.9

$(24.0)

Inc. in Accr. Yield

(Recog. Over Time)

Impairments

(Provision)

Net Increase in

Accretable Yield

Marked to

Market

38%

New

Originations

29%

Marked to

Market &

Covered

33%

FDIC

Indemnification

Asset

2%

Loans

34%

Investment

Securities

43%

Cash

14%

Other

Assets

7%

~71% of portfolio carry acquisition fair value marks

33% is covered by FDIC loss share

45% are in accounting loans pools that are revalued quarterly

Non-

Covered

$302mm |

$ 14

$ 10

$ 20

$ 11

$ 26

$ 31

$ 19

$ 7

$ 11

$ 21

$ 8

$ 22

$ 24

$ 29

$ 14

$ 17

$ 17

$ 36

$ 33

$ 40

$ 60

$ 53

$ 7

$ 6

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

Commercial

CRE

Agriculture

Resi.

Consumer

$ 25

$ 25

$ 35

$ 54

$ 82

$ 84

$ 128

$ 140

20

Loan Portfolio

Strategic Loan Composition (31-Dec-12)

($ in millions)

High Quality and Stable Strategic Loan Portfolio

Strategic

Loans

–

Non-performing

(31-Dec-12)

Strategic Portfolio: $1.1bn

Loan Originations

Q-o-Q Growth

40%

54%

52%

2%

52%

9%

Strategic Loans

Non-Strategic Loans

12/31/11

6/30/12

9/30/12

12/31/12

$ 1,085

$ 1,047

$ 1,086

$ 1,127

$ 719

12/31/11

6/30/12

9/30/12

12/31/12

$ 1,189

$ 937

$ 852

Comm.

14%

Agriculture

14%

CRE

25%

Resi

43%

Consumer

4%

28%

Performing

99.4%

Non-performing

0.6% |

1.41 %

1.28 %

1.12 %

0.94 %

0.84 %

0.79 %

0.69 %

0.59 %

0.48 %

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

21

Deposit Composition

Cost of

Deposits

Time Maturity

($ in millions)

Growing Low Cost Transaction Accounts

(13) bps

(16) bps

(18) bps

(10) bps

(5) bps

(10) bps

6/30/12

12/31/11

12/31/10

Rate

0.74%

0.67%

0.88%

1.77%

1.83%

1.64%

(10) bps

9/30/12

Transaction Deposits

Time Deposits

(11) bps

12/31/12

16 %

24 %

26 %

26 %

29 %

19 %

21 %

26 %

29 %

29 %

43 %

33 %

30 %

28 %

27 %

22 %

22 %

18 %

17 %

15 %

Demand & NOW

Savings & MM

Retail Time

Jumbo Time

$3,473

35%

Non-

Time

52%

Non-

Time

$4,530

45%

Non-

Time

$5,063

55%

Non-

Time

$4,282

58%

Non-

Time

$4,201

$616

$583

$373

$112

$44

$25

35 %

33 %

21 %

6 %

3 %

2 %

< 6

Months

6 Months -

1 Year

1 -

2

Years

2 -

3

Years

3 -

4

Years

4+

Years

($mm)

% of Total Time Deposits

$ 2,785

$ 1,945

$ 1,753

$ 2,278

$ 2,337

$ 2,448

12/31/11

9/30/12

12/31/12

12/31/11

9/30/12

12/31/12 |

22

Provision For Loan Losses

Note: Please refer to the appendix for a reconciliation of non-GAAP financial

metrics. ¹

Adjusted metrics excludes initial public offering related expenses, bargain purchase

gains, related acquisition expense, stock-based compensation expense, and gain or loss on sale of securities.

²

Tax adjustments are calculated at a rate equal to the effective tax rate for each

period, with the exception of the three months ended September 30, 2012, which was calculated at a tax rate of 38.24%, which is

adjusted for the effects of the non-deductibility of the expenses related to our

initial public offering. ²

Other expenses include: professional fees, other real estate owned expenses, problem

loan expenses, and gain or loss from change in fair value of warrant liability.

Adjusted Non-Interest Income ¹

Adjusted Non-Interest Expense ¹

($ in millions)

P&L Metrics

$ 138.0

$ 49.9

Net Interest Margin

$43.1

3.40 %

3.98 %

3.91 %

4.00 %

3.92 %

4.09 %

FY2011

FY2012

1Q12

2Q12

3Q12

4Q12

$ 15.0

$ 9.0

$ 4.6

$ 1.8

$ 1.6

$ 1.1

$ 5.0

$ 19.0

$ 3.3

$ 10.5

$ 3.7

$ 1.6

$ 20.0

$ 28.0

$ 7.8

$ 12.2

$ 5.3

$ 2.7

2011

2012

1Q12

2Q12

3Q12

4Q12

Loan

Pools

Impairment

Non-Loan

Pools

$(4.7)

$ <0.1

$ 1.4

$(1.3)

$(1.9)

$ 29.6

$ 36.7

$ 9.6

$ 10.0

$ 8.1

$ 9.0

16.0 %

15.2 %

15.3 %

16.2 %

14.0 %

15.4 %

FY2011

FY2012

1Q12

2Q12

3Q12

4Q12

FDIC Loss Share Inc.

Adj. Non-Interest Income¹

Adj. Fee Income / Revenue¹

$(1.8)

$ 112.4

$ 149.1

$ 36.0

$ 37.7

$ 38.5

$ 37.0

$ 25.6

$ 46.6

$ 13.9

$ 5.6

$ 14.8

$ 12.2

72.2 %

75.7 %

77.3 %

67.6 %

77.1 %

81.7 %

FY2011

FY2012

1Q12

2Q12

3Q12

4Q12

$ 45.7

$ 187.7

$ 49.2

Oper. Exp.

Other Exp.²

Adj. Efficiency Ratio¹ |

Looking Ahead |

Organic

Earnings Potential 24

ROATA

Note: Please refer to the appendix for a reconciliation of non-GAAP financial

metrics. ¹

Adjusted metric excludes initial public offering related expenses, bargain purchase

gains, stock-based compensation expense, and gain or loss on sale of securities.

Professional fees

decline to normal

operating levels

Continued

expense

efficiencies

Hillcrest Bank

Higher yielding

acquired loans

run-off

Reduction in

work-out

expenses and

loss share income

0.38 %

1.00 % -

1.25 %

Target ROATA

4Q12

Adjusted ¹

Expense

Adjustments

Organic

Growth

Run-off Acquired

Portfolios

Pro Forma

Ramp-up of loan

production

Continue reducing

cost of funds

Securities re-price

downward

Fee business

initiatives |

Key

Long-Term Financial Targets 25

Assets

>$10bn

Efficiency Ratio

<60%

ROATA

1.00% - 1.25%

ROATCE

13% - 16%

Dividend Payout Ratio

25%

Tier 1 Leverage

8%

Fully Levered Targets |

Investment

Highlights 26

Disciplined Focus on Building Meaningful Scale and Market Share in Attractive

Markets Expertise in FDIC-assisted and Unassisted Bank Transactions

with Substantial Future Opportunities

Operating Platform Implemented with Full Conversion of All Acquisitions

Organic Growth Accelerating

Attractive Low-Risk Profile

Available Capital to Support Growth

Experienced and Respected Management Team and Board of Directors

|

Appendix |

28

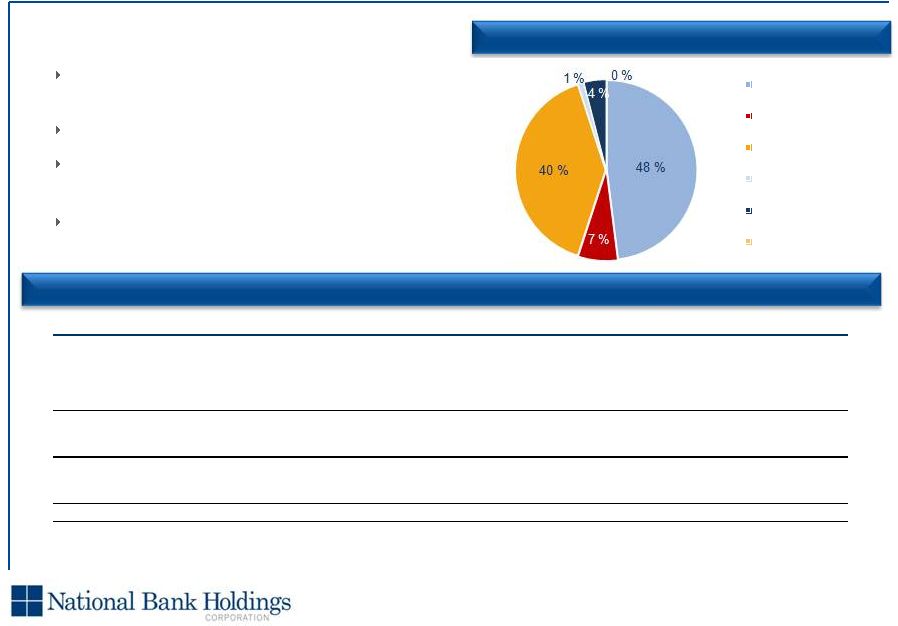

Conservative Investment Portfolio

4Q12 Investments by Asset Class ¹

Portfolio Summary ¹

100% of portfolio AAA rated or U.S. agency

backed ²

Stable duration of 3.2 years

OCI fluctuations minimized by 25% of

portfolio residing in HTM

$90mm in prime auto ABS is AAA rated and

has duration of 0.5 years

($ in millions)

¹

Excludes $29mm, $32mm and $33mm of FHLB / FRB stock as of 31-Dec-11,

30-Sep-12 and 31-Dec-12, respectively. ²

Aaa rated by Moody’s, AAA by Fitch, and AA+ by S&P.

31-Dec-11

30-Sep-12

31-Dec-12

Book Value

Available-for-Sale

$

1,786

$

1,696

$

1,681

Held-to-Maturity

7

612

548

"Locked-in" Gains (HTM)

0

32

29

Total Book Value

$

1,793

$

2,339

$

2,258

Available-for-Sale Unrealized Gains

77

44

37

Fair Market Value of Portfolio

$

1,870

$

2,383

$

2,295

Portfolio Yield (Spot)

3.23

%

2.61

%

2.42

%

Portfolio Duration

3.2

3.3

3.2

Weighted-Average Life

3.4

3.4

3.4

Mortgage Backed

Securities -

Fixed Rate

Mortgage Backed

Securities -

ARMs

Collateralized Mortgage

Obligations -

Fixed Rate

Collateralized Mortgage

Obligations -

Floating Rate

Asset Backed Securities -

Fixed Rate Prime Auto

Other |

29

Net Interest Income Sensitivity

Note: Interest Rate Risk as of 31-Dec-12.

¹

12-month

simulated

net

interest

income

impact

using

management

projected

balance

sheet

and

an

immediate

parallel

shift

in

the

yield

curve.

NBH Balance Sheet positioned to benefit from rising rate environment

Net Interest Income Change ¹

(2.88)%

7.43 %

12.84 %

(5.0)%

(2.0)%

1.0 %

4.0 %

7.0 %

10.0 %

13.0 %

-50 bps

+100 bps

+200bps

Interest Rate Shock |

30

Reconciliation of Non-GAAP Measures

($ in millions)

¹

Net

present

value

(5%

discount

rate)

of

excess

A-T

accretable

yield

and

FDIC

indemnification

asset

yield

/

share.

Excess

A-T

accretable

yield

defined

as

total

accretable

yield

less

4.5%

average

loan

yield

on originations.

For the 12-Months Ended

For the 3-Months Ended

31-Dec-10

31-Dec-11

31-Dec-12

31-Mar-12

30-Jun-12

30-Sep-12

31-Dec-12

Net Income (Loss)

$

6.1

$

42.0

$(0.5)

$

1.6

$

2.7

$(7.9)

$

3.0

Less: After-Tax Bargain Purchase Gain

(25.4)

(36.6)

–

–

–

–

–

Add: After-Tax Impact of Stock-Based Compensation

11.2

7.6

8.2

1.3

1.3

4.3

1.3

Add: After-Tax Impact of Acquisition Costs

9.5

3.0

0.5

0.5

0.0

–

–

Add: Impact of IPO Related Expenses

–

–

8.0

–

0.1

7.6

–

Less: After-Tax Gain / (Loss) on Sale of Investment Securities

(0.0)

0.4

(0.4)

(0.4)

0.0

–

–

After-Tax Adjusted Net Revenue

$

1.3

$

16.3

$

15.7

$

3.1

$

4.1

$

4.0

$

4.3

After-Tax Amortization

0.0

2.6

3.5

0.8

0.8

0.9

0.9

After-Tax Adjusted Cash Net Income

$

1.3

$

19.0

$

19.2

$

3.9

$

4.8

$

4.9

$

5.2

Non-Interest Expense

$

49.0

$

155.5

$

209.6

$

53.0

$

45.3

$

60.0

$

51.4

Less: Pre-Tax Impact of Stock-Based Compensation

(16.6)

(12.6)

(13.1)

(2.2)

(2.1)

(6.7)

(2.2)

Less: Pre-Tax Impact of Acquisition Costs

(14.1)

(4.9)

(0.9)

(0.9)

(0.0)

0.0

–

Less: Impact of IPO Related Expenses

–

–

(8.0)

–

(0.1)

(7.6)

–

Adjusted Non-Interest Expense

$

18.3

$

138.0

$

187.7

$

49.9

$

43.1

$

45.7

$

49.2

Less: Professional Fees

(1.3)

(14.3)

(2.9)

(2.9)

(3.4)

(2.7)

(2.5)

Less: Other Real Estate Owned Expenses

(0.7)

(7.1)

(8.6)

(8.6)

(0.1)

(3.5)

(8.2)

Less: Problem Loan Expenses

(0.6)

(4.4)

(1.7)

(1.7)

(2.7)

(2.3)

(1.8)

Less: Gain (Loss) from Change in Fair Value of Warrant Liability

(0.0)

0.1

1.4

(0.7)

0.6

1.2

0.4

Adjusted Operating Expense

$

15.6

$

112.4

$

175.8

$

36.0

$

37.6

$

38.5

$

37.0

Non-Interest Income

$

42.2

$

89.5

$

37.4

$

10.3

$

10.0

$

8.1

$

9.0

Less: Pre-Tax Bargain Purchase Gain

(37.8)

(60.5)

–

–

–

–

–

Less: Pre-Tax Gain / (Loss) on Sale of Investment Securities

(0.0)

0.6

(0.7)

(0.7)

–

–

–

Adjusted Non-Interest Income

$

4.4

$

29.6

$

36.7

$

9.6

$

10.0

$

8.1

$

9.0

Total Stockholders' Equity

$

993.8

$

1,088.7

$

1,090.6

$

1,091.4

$

1,096.7

$

1,095.8

$

1,090.6

Less: Goodwill & Other Intangible Assets

(79.7)

(92.6)

(87.2)

(91.2)

(89.9)

(88.5)

(87.2)

Tangible Common Equity

914.0

996.2

1,003.4

1,000.2

1,006.9

1,007.3

1,003.4

Common Shares Outstanding

51.9

52.2

52.3

52.2

52.2

52.2

52.3

Tangible Book Value / Share

$

17.60

$

19.10

$

19.17

$

19.16

$

19.29

$

19.30

$

19.17

(+) Excess Accretably Yield ¹

0.50

0.50

Tangible Book Value / Share (incl. Excess Accretable Yield)

$

19.67

$

19.67 |

31

Reconciliation of Non-GAAP Measures (cont'd)

For the 12-Months Ended

For the 3-Months Ended

31-Dec-10

31-Dec-11

31-Dec-12

31-Mar-12

30-Jun-12

30-Sep-12

31-Dec-12

ROAA / ROATA

GAAP ROAA

0.44

%

0.81

%

(0.01)%

0.11

%

0.18

%

(0.56)%

0.22

%

Plus: Adjustments

(0.35)

(0.48)

0.28

0.09

0.10

0.84

0.10

Adjusted ROAA

0.09

%

0.33

%

0.27

%

0.20

%

0.28

%

0.28

%

0.32

%

Plus: Tangible Adjustments

0.00

0.06

0.06

0.05

0.06

0.06

0.06

Adjusted ROATA

0.09

%

0.39

%

0.33

%

0.25

%

0.34

%

0.34

%

0.38

%

ROAE / ROATE

GAAP RAOE

0.62

%

4.01

%

(0.05)%

0.60

%

0.99

%

(2.86)%

1.10

%

Plus: Adjustments

(0.49)

(2.39)

1.49

0.53

0.49

4.31

0.47

Adjusted ROE

0.13

%

1.62

%

1.44

%

1.13

%

1.48

%

1.45

%

1.57

%

Plus: Tangible Adjustments

0.00

0.41

0.45

0.42

0.48

0.46

0.46

Adjusted ROATE

0.13

%

2.03

%

1.89

%

1.55

%

1.96

%

1.91

%

2.03

%

Fee Income Ratio

GAAP Fee Income Ratio

72.6

%

36.5

%

15.5

%

16.2

%

16.2

%

14.0

%

15.4

%

Plus: Adjustments

(51.0)

(20.5)

(0.2)

(0.9)

0.0

0.0

0.0

Adjusted Fee Income Ratio

21.6

%

16.0

%

15.2

%

15.3

%

16.2

%

14.0

%

15.4

%

Efficiency Ratio

GAAP Efficiency Ratio

84.3

%

61.7

%

84.5

%

81.3

%

71.0

%

101.8

%

85.4

%

Plus: Adjustments

5.8

10.2

(8.9)

(4.0)

(3.5)

(24.7)

(3.7)

Adjusted Efficiency Ratio

90.2

%

71.9

%

75.7

%

77.3

%

67.5

%

77.1

%

81.7

%

Net Income

Reported EPS

$

0.11

$

0.81

$(0.01)

$

0.03

$

0.05

$(0.15)

$

0.06

Plus: Adjustments

(0.09)

(0.49)

0.31

0.03

0.03

0.23

0.02

Adjusted EPS

$

0.02

$

0.31

$

0.30

$

0.06

$

0.08

$

0.08

$

0.08 |