Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ERHC Energy Inc | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - ERHC Energy Inc | ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - ERHC Energy Inc | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ERHC Energy Inc | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - ERHC Energy Inc | ex32_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended December 31, 2012

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to ____________

Commission File Number 0-17325

(Exact name of registrant as specified in its charter)

|

Colorado

|

|

88-0218499

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

5444 Westheimer Road

Suite1440

Houston, Texas 77056

(Address of principal executive offices, including zip code)

(713) 626-4700

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and, (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer x

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

The number of shares of common stock, par value $0.0001 per share, outstanding as of January 31, 2013, was 739,458,854

TABLE OF CONTENTS

ERHC ENERGY INC.

|

Part I. Financial Information

|

Page

|

|

|

|

|

|

|

Item 1.

|

5

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

8

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

Item 2.

|

13

|

|

|

|

|

|

|

Item 3.

|

26

|

|

|

|

|

|

|

Item 4.

|

26

|

|

|

|

|

|

|

Part II. Other Information

|

|

|

|

|

|

|

|

Item 1.

|

27

|

|

|

|

|

|

|

Item 6.

|

29

|

|

|

|

|

|

|

|

30

|

|

Forward-Looking Statements

ERHC Energy Inc. (also referred to as “ERHC” or the “Company” and denoted by the use of the pronouns “we,” “our” and “us” as the case may be in this Report) or its representatives may, from time to time, make or incorporate by reference certain written or oral statements of historical fact, statements that include, but are not limited to, information concerning the Company’s possible or assumed future business activities and results of operations and statements about the following subjects:

|

|

●

|

business strategy;

|

|

|

●

|

growth opportunities;

|

|

|

●

|

future development of concessions, exploitation of assets and other business operations;

|

|

●

|

future market conditions and the effect of such conditions on the Company’s future activities or results of operations;

|

|

|

●

|

future uses of and requirements for financial resources;

|

|

|

●

|

interest rate and foreign exchange risk;

|

|

|

●

|

future contractual obligations;

|

|

|

●

|

outcomes of legal proceedings including;

|

|

|

●

|

future operations outside the United States;

|

|

|

●

|

competitive position;

|

|

|

●

|

expected financial position;

|

|

|

●

|

future cash flows;

|

|

|

●

|

future liquidity and sufficiency of capital resources;

|

|

|

●

|

future dividends;

|

|

|

●

|

financing plans;

|

|

|

●

|

tax planning;

|

|

|

●

|

budgets for capital and other expenditures;

|

|

|

●

|

plans and objectives of management;

|

|

|

●

|

compliance with applicable laws; and,

|

|

|

●

|

adequacy of insurance or indemnification.

|

These types of statements and other forward-looking statements inherently are subject to a variety of assumptions, risks and uncertainties that could cause actual results, levels of activity, performance or achievements to differ materially from those expected, projected or expressed in forward-looking statements. These risks and uncertainties include, among others, the following:

|

|

●

|

general economic and business conditions;

|

|

|

●

|

worldwide demand for oil and natural gas;

|

|

|

●

|

changes in foreign and domestic oil and gas exploration, development and production activity;

|

|

|

●

|

oil and natural gas price fluctuations and related market expectations;

|

|

|

●

|

termination, renegotiation or modification of existing contracts;

|

|

|

●

|

the ability of the Organization of Petroleum Exporting Countries, commonly referred to as “OPEC”, to set and maintain production levels and pricing, and the level of production in non-OPEC countries;

|

|

●

|

policies of the various governments regarding exploration and development of oil and gas reserves;

|

|

●

|

advances in exploration and development technology;

|

|

●

|

the political environment of oil-producing regions;

|

|

●

|

political instability in the Democratic Republic of Săo Tomé and Príncipe (“DRSTP”), the Federal Republic of Nigeria, Republic of Kenya, and the Republic of Chad;

|

|

|

●

|

casualty losses;

|

|

|

●

|

competition;

|

|

|

●

|

changes in foreign, political, social and economic conditions;

|

|

|

●

|

risks of international operations, compliance with foreign laws and taxation policies and expropriation or nationalization of equipment and assets;

|

|

|

●

|

risks of potential contractual liabilities;

|

|

|

●

|

foreign exchange and currency fluctuations and regulations, and the inability to repatriate income or capital;

|

|

|

●

|

risks of war, military operations, other armed hostilities, terrorist acts and embargoes;

|

|

|

●

|

regulatory initiatives and compliance with governmental regulations;

|

|

|

●

|

compliance with tax laws and regulations;

|

|

|

●

|

customer preferences;

|

|

|

●

|

effects of litigation and governmental proceedings;

|

|

|

●

|

cost, availability and adequacy of insurance;

|

|

|

●

|

adequacy of the Company’s sources of liquidity;

|

|

|

●

|

labor conditions and the availability of qualified personnel; and,

|

|

|

●

|

various other matters, many of which are beyond the Company’s control.

|

The risks and uncertainties included here are not exhaustive. Other sections of this report and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”) include additional factors that could adversely affect the Company’s business, results of operations and financial performance. Given these risks and uncertainties, investors should not place undue reliance on our statements concerning future intent. Our statements included in this report speak only as of the date of this report. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any of our statements to reflect any change in its expectations with regard to the statements or any change in events, conditions or circumstances on which any forward-looking statements are based.

PART I. FINANCIAL INFORMATION

|

Item 1.

|

Financial Statements

|

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

|

December

31, 2012

|

September

30, 2012

|

|||||||

|

ASSETS

|

|

|||||||

|

|

||||||||

|

Current assets:

|

|

|||||||

|

Cash and cash equivalents

|

$ | 5,421,245 | $ | 7,665,990 | ||||

|

Investment in Oando Energy Resources

|

850,418 | 540,912 | ||||||

|

Prepaid expenses and other

|

187,407 | 320,725 | ||||||

|

Total current assets

|

6,459,070 | 8,527,627 | ||||||

|

Oil and gas concession fees

|

10,054,903 | 10,046,303 | ||||||

|

Furniture and equipment, net of accumulated depreciation of $200,228 and $175,195 at December 31, 2012 and September 30, 2012, respectively

|

321,694 | 47,783 | ||||||

|

Income tax receivable

|

2,018,533 | 2,018,398 | ||||||

|

Total assets

|

$ | 18,854,200 | $ | 20,640,111 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 549,600 | $ | 610,790 | ||||

|

Signing bonus payable - Chad

|

4,000,000 | 5,000,000 | ||||||

|

Total current liabilities

|

4,549,600 | 5,610,790 | ||||||

|

Commitments and contingencies

|

||||||||

|

Shareholders' equity:

|

||||||||

|

Preferred stock, par value $0.0001; authorized 10,000,000 shares; none issued and outstanding

|

- | - | ||||||

|

Common stock, par value $0.0001; authorized 3,000,000,000 shares; issued and outstanding 739,458,854 shares

|

73,947 | 73,947 | ||||||

|

Additional paid-in capital

|

99,487,395 | 99,479,431 | ||||||

|

Accumulated other comprehensive loss

|

(499,582 | ) | (809,087 | ) | ||||

|

Losses accumulated in the development stage

|

(84,757,160 | ) | (83,714,970 | ) | ||||

|

Total shareholders’ equity

|

14,304,600 | 15,029,321 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 18,854,200 | $ | 20,640,111 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

|

September 5, 1995

|

||||||||||||

| Three Months Ended |

(Inception) to

|

|||||||||||

|

December 31,

|

December 31,

|

|||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Costs and expenses:

|

||||||||||||

|

General and administrative

|

$ | 1,017,592 | $ | 1,040,099 | $ | 87,431,618 | ||||||

|

Depreciation

|

25,033 | 3,844 | 1,548,541 | |||||||||

|

Gain on sale of partial interest in

|

||||||||||||

|

DRSTP concession

|

- | - | (30,102,250 | ) | ||||||||

|

Write-offs and abandonments

|

- | - | 7,742,128 | |||||||||

|

Total costs and expenses

|

(1,042,625 | ) | (1,043,943 | ) | (66,620,037 | ) | ||||||

|

Other income and (expenses):

|

||||||||||||

|

Interest income

|

435 | 1,469 | 4,851,039 | |||||||||

|

Gain (loss) from settlements

|

- | 130,178 | ||||||||||

|

Other income

|

- | - | 439,827 | |||||||||

|

Interest expense

|

- | - | (12,145,336 | ) | ||||||||

|

Provision for loss on deposits

|

- | - | (5,292,896 | ) | ||||||||

|

Loss on extinguishment of debt

|

- | - | (5,749,575 | ) | ||||||||

|

Total other income and (expense)

|

435 | 1,469 | (17,766,763 | ) | ||||||||

|

Loss before benefit (provision) for income taxes

|

(1,042,190 | ) | (1,042,474 | ) | (84,386,800 | ) | ||||||

|

Benefit (provision) for income taxes:

|

||||||||||||

|

Current

|

- | - | (1,330,360 | ) | ||||||||

|

Deferred

|

- | - | 960,000 | |||||||||

|

Total benefit (provision)for income taxes

|

- | - | (370,360 | ) | ||||||||

|

Net loss

|

$ | (1,042,190 | ) | $ | (1,042,474 | ) | $ | (84,757,160 | ) | |||

|

Net loss per common share -basic and diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | ||||||

|

Weighted average number of common shares outstanding - basic and diluted

|

739,458,854 | 738,933,854 | ||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

UNAUDITED CONSOLIDATED STATEMENTS OF OTHER COMPREHENSIVE LOSS

|

September 5, 1995

|

||||||||||||

| Three Months Ended |

(Inception) to

|

|||||||||||

| December 31, | December 31, | |||||||||||

| 2012 | 2011 | 2012 | ||||||||||

|

Net loss

|

$ | (1,042,190 | ) | $ | (1,042,474 | ) | $ | (84,757,160 | ) | |||

|

Other comprehensive gain (loss) on Securities

|

309,505 | - | (499,582 | ) | ||||||||

|

Other comprehensive loss

|

$ | (732,685 | ) | $ | (1,042,474 | ) | $ | (85,256,742 | ) | |||

The accompanying notes are an integral part of these unaudited consolidated financial statements

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

September 5, 1995

|

||||||||||||

| Three Months Ended |

(Inception) to

|

|||||||||||

|

December 31,

|

December 31,

|

|||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Cash Flows From Operating Activities:

|

||||||||||||

|

Net loss

|

$ | (1,042,190 | ) | $ | (1,042,474 | ) | $ | (84,757,160 | ) | |||

|

Adjustments to reconcile net loss to

|

||||||||||||

|

Depreciation and depletion expense

|

25,033 | 3,844 | 1,548,538 | |||||||||

|

Provision for loss on deposits

|

- | - | 5,292,896 | |||||||||

|

Write-offs and abandonments

|

- | - | 7,742,128 | |||||||||

|

Deferred income taxes

|

- | - | (2,018,398 | ) | ||||||||

|

Compensatory stock options

|

- | - | 1,332,132 | |||||||||

|

Gain from settlement

|

- | - | (617,310 | ) | ||||||||

|

Gain on sale of partial interest in

|

||||||||||||

|

DRSTP concession

|

- | - | (30,102,250 | ) | ||||||||

|

Amortization of beneficial conversion feature associated with convertible debt

|

- | - | 2,793,929 | |||||||||

|

Amortization of deferred

|

||||||||||||

|

compensation

|

- | - | 1,257,863 | |||||||||

|

Loss on extinguishment of debt

|

- | - | 5,669,500 | |||||||||

|

Stock issued for services

|

- | - | 20,897,077 | |||||||||

|

Stock issued for settlements

|

- | - | 225,989 | |||||||||

|

Stock issued for officer bonuses

|

7,964 | 19,755 | 5,229,602 | |||||||||

|

Stock issued for interest and penalties on convertible debt

|

- | - | 10,631,768 | |||||||||

|

Stock issued for board compensation

|

- | - | 2,725,949 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses and other current assets

|

2,176 | 88,154 | (318,545 | ) | ||||||||

|

Accounts payable and other accrued liabilities

|

(61,187 | ) | (142,359 | ) | (2,598,373 | ) | ||||||

|

Accounts payable and accrued liabilities, related party

|

- | - | 55,844 | |||||||||

|

Accrued retirement obligation

|

- | - | 365,000 | |||||||||

|

Net cash used in operating activities

|

(1,068,204 | ) | (1,073,080 | ) | (54,643,821 | ) | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

September 5, 1995

|

||||||||||||

| Three Months Ended |

(Inception) to

|

|||||||||||

|

December 31,

|

December 31,

|

|||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Cash Flows From Investing Activities:

|

||||||||||||

|

Purchase of long-term investment

|

- | - | (5,292,896 | ) | ||||||||

|

Purchase of oil and gas concessions

|

(1,008,600 | ) | - | (8,789,403 | ) | |||||||

|

Proceeds from sale of partial interest

|

||||||||||||

|

In DRSTP concession

|

- | - | 45,900,000 | |||||||||

|

Proceeds from U.S. Treasury bills

|

- | - | 5,011,000 | |||||||||

|

Purchase of U.S. Treasury bills and accrued interest

|

- | (795 | ) | (5,011,000 | ) | |||||||

|

Purchase of investment in marketable equity securities

|

- | - | (1,350,000 | ) | ||||||||

|

Purchase of restricted certificate of deposit

|

- | - | (131,000 | ) | ||||||||

|

Proceeds from sale of restricted certificate of deposit

|

- | 131,000 | 131,000 | |||||||||

|

Purchase of furniture and equipment

|

(167,941 | ) | - | (1,166,008 | ) | |||||||

|

Net cash provided by (used in)investing activities

|

(1,176,541 | ) | 130,205 | 29,301,693 | ||||||||

|

Cash Flows From Financing Activities:

|

||||||||||||

|

Proceeds from warrants exercised

|

- | - | 160,000 | |||||||||

|

Proceeds from common stock, net of expenses

|

- | - | 8,776,549 | |||||||||

|

Proceeds from line of credit, related party

|

- | - | 2,750,000 | |||||||||

|

Proceeds from non-convertible debt related party

|

- | - | 158,700 | |||||||||

|

Proceeds from convertible debt,related party

|

- | - | 8,207,706 | |||||||||

|

Proceeds from sale of convertible debt

|

- | - | 9,019,937 | |||||||||

|

Proceeds from bank borrowing

|

- | - | 175,000 | |||||||||

|

Proceeds from stockholder loans

|

- | - | 1,845,809 | |||||||||

|

Proceeds from stock subscription receivable

|

- | - | 913,300 | |||||||||

|

Repayment of shareholder loans

|

- | - | (1,020,607 | ) | ||||||||

|

Repayment of long-term debt

|

- | - | (223,021 | ) | ||||||||

|

Net cash provided by financing activities

|

- | - | 30,763,373 | |||||||||

|

Net increase (decrease) in cash and cash equivalents

|

(2,244,745 | ) | (942,875 | ) | 5,421,245 | |||||||

|

Cash and cash equivalents, beginning of period

|

7,665,990 | 7,137,151 | - | |||||||||

|

Cash and cash equivalents, end of period

|

$ | 5,421,245 | $ | 6,194,276 | $ | 5,421,245 | ||||||

|

Supplemental cashflow information Noncassh investing activities

|

||||||||||||

|

Unrealized gain (losses) on securities

|

$ | 309,505 | $ | - | $ | (499,582 | ) | |||||

|

Reclass of prepaid expenses to furniture and equipment

|

$ | 131,000 | $ | - | $ | 131,000 | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND BUSINESS ORGANIZATION

The consolidated financial statements included herein, which have not been audited pursuant to the rules and regulations of the Securities and Exchange Commission, reflect all adjustments which, in the opinion of management, are necessary to present a fair statement of the results for the interim periods on a basis consistent with the annual audited financial statements. All such adjustments are of a normal recurring nature. The results of operations for the interim periods are not necessarily indicative of the results to be expected for an entire year. Certain information, accounting policies and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America, have been omitted pursuant to such rules and regulations, although ERHC Energy Inc. (“ERHC” or the “Company”) believes that the disclosures are adequate to make the information presented not misleading. These financial statements should be read in conjunction with the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2012.

Recent accounting pronouncements

There have been no recently issued accounting pronouncements that have had or are expected to have a material impact on the Company’s consolidated financial statements.

NOTE 2 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company adopted new guidance as of October 1, 2008, related to the measurement of the fair value of certain of its financial assets required to be measured on a recurring basis. Under the new guidance, based on the observability of the inputs used in the valuation techniques, the Company is required to provide the following information according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. Financial assets and liabilities carried at fair value will be classified and disclosed in one of the following three categories:

|

|

●

|

Level 1 — Quoted prices in active markets for identical assets or liabilities.

|

|

|

●

|

Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or, other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

|

|

|

●

|

Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

|

Interest income on cash and cash equivalents is recognized as earned on the accrual basis.

Investments are reported at fair value, determined based on the quoted prices in an active market for identical assets and classified as Level 1 under the ASC 820.

During the three months ended December 31, 2012, the Company’s investment in the common stock and warrants of OER, a Canadian oil and gas company that trades on the Toronto Stock Exchange (TSX) increased in value by $309,505. This increase in value is included as an increase in stockholders' equity in accumulated other comprehensive income.

NOTE 3 – OIL AND GAS CONCESSIONS

The following is an analysis of the cost of oil and gas concessions at December 31, 2012 and September 30, 2012:

|

December 31, 2012

|

September 30, 2012

|

|||||||

|

DRSTP concession

|

$ | 2,839,500 | $ | 2,839,500 | ||||

|

Chad concession

|

6,800,600 | 6,800,600 | ||||||

|

Kenya concession

|

326,073 | 326,073 | ||||||

|

Pending concessions in other African countries

|

88,730 | 80,130 | ||||||

| $ | 10,054,903 | $ | 10,046,303 | |||||

NOTE 4 - STOCKHOLDERS' EQUITY

During the three months ended December 31, 2012, the Company recognized compensation expense of $7,964 related to options granted to the Board of Directors in fiscal year 2012. As of December 31, 2012, there are 4,750,000 options outstanding; none of which are exercisable. These options have aweighted average remaining term of 1 year and an intrinsic value of zero. Unamortized compensation cost related to these options amounted to $31,855 which is expected to be recognized over the remaining one year vesting period.

During the three months ended December 31, 2012, there were no new warrants granted and none were exercised, cancelled or expired. As of December 31, 2012, the Company has 13,777,729 outstanding and exercisable warrants with a weighted average exercise price and remaining term of $0.32 per share and 2.2 years, respectively. As of December 31, 2012, these warrants have an intrinsic value of zero.

Rights Offering

On December 17, 2012 the Company undertook a rights offering wherein each shareholder is entitled to non-transferable subscription rights to purchase shares of common stock at a subscription price of $0.075 per share. Under the rights offering, the Company is offering up to 246,486,285 shares of its common stock (or roughly 33% of its shares currently outstanding). On December 27, 2012 the Company issued one subscription right to current shareholders for every three shares of common stock held at the December 17, 2012 record date. The Rights Offering expired on January 31, 2013 but was further extended to February 28, 2013.

NOTE 5 – COMMITMENTS AND CONTINGENCIES

COMMITMENTS UNDER PRODUCTION SHARE CONTRACTS

Republic of Kenya Concession Fees and Other Financial Commitments

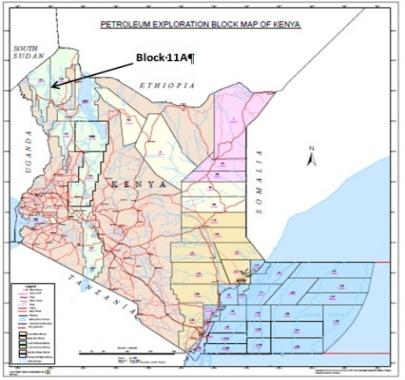

On June 28, 2012, ERHC entered into a production sharing contract ("PSC") with the Government of the Republic of Kenya for certain land based hydrocarbon exploration and production of Block 11A located in northwestern Kenya.

As of December 31, 2012, ERHC had paid in full the requisite signature bonus of $310,000 and is committed under terms of the PCS to spend at least $10,250,000 over the first two years on a minimum work program and an additional $30,000,000 in each of the following two periods of two years each.

Additionally, under the terms of the PSC, during the initial exploration term of two years that started in the first quarter of 2013, ERHC will pay surface fees of $60,000 per year and annual training fees of $175,000 per year.

On June 30, 2011, ERHC entered into a production sharing contract ("PSC") with Chad for certain onshore hydrocarbon exploration and development. Under terms of the PSC as sealed by the Approval Law issued subsequently, a total signature bonus of $6,000,000 is payable by ERHC. The PSC requires that the signature bonus of $6 million be paid as follows: $1 million upon transmittal of an Approval Law by Chad to ERHC, $4 million is due within 90 days of the later of (a) a publication of the Approval Law in Chad’s official gazette and (b) a notification of ERHC of the Award Order, and $1 million is due 120 days after the date of transmittal of the Approval Law to ERHC.

As of December 31, 2012, ERHC has paid or incurred:

|

a.

|

$1,000,000 out of the initial signature bonus commitment, paid additional $1,000,000 during the first quarter of the fiscal year 2013, and accrued for the balance of $4,000,000.

|

|

b.

|

$480,000 as legal fees and costs for the drafting and negotiation of the PSC, as provided for in the PSC

|

|

c.

|

$312,600 in advisers’ and ancillary costs related to the PSC

|

ERHC is also committed under the PSC to:

|

|

a.

|

spend at least $15,000,000 over the first five years on a minimum work program and at least an additional $1,000,000 over a further period of up to three years

|

|

|

b.

|

surface fees of $27,000 per calendar year during the first validity period, and lasting for up to eight years. Surface fees for subsequent periods will depend on the exploration progress as well as on the acreage retained by ERHC.

|

As of December 31, 2012, particular milestones are outstanding including certain financial obligations as provided in the PSC, as indicated above. Management is currently pursuing the formal extension of timelines for the commencement of the work program and meeting of pecuniary obligations under the PSC with the Government of Chad. The formal timeline extensions will enable the conclusion of administrative and other obligations on both sides (including the setting up of a management committee for the exploration) that are a pre-requisite to the effective execution of ERHC’s PSC commitments.

LEGAL PROCEEDINGS

JDZ BLOCKS 5 AND 6

Arbitration and Lawsuit

The Company’s rights in JDZ Blocks 5 and 6 are currently the subject of legal proceedings at the London Court of International Arbitration and the Federal High Court in Abuja, Nigeria. The Company instituted both proceedings in November 2008 against the JDA and the Governments of Nigeria and Săo Tomé and Príncipe. The Company seeks legal clarification that its rights in the Blocks remain intact.

The issue in contention is entirely contractual. The Company was awarded a 15 percent working interest in each of the Blocks in a 2004/5 bid/licensing round conducted by the JDA following the Company’s exercise of preferential rights in the Blocks as guaranteed by contract and treaty. The JDA and the Government of STP contend that certain correspondence issued by a previous CEO/President of the Company in 2006 amount to a relinquishment of the Company’s rights in Blocks 5 and 6 under the Company’s contracts with STP which provide for the rights. The Company contends that no such relinquishment has occurred and has sought recourse to arbitration accordingly. It also filed the suit to prevent any tampering with its said rights in JDZ Blocks 5 and 6 pending the outcome of arbitration.

Suspension of Proceedings on the Arbitration and Lawsuit

Proceedings on the suit and the arbitration are currently suspended while the Company pursues amicable settlement with the Governments of Nigeria and Săo Tomé Príncipe.

Routine Claims

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. ERHC intends to defend these matters vigorously. The Company cannot predict with certainty, however, the outcome or effect of any of the arbitration or litigation specifically described above or any other pending litigation or claims.

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The following discussion should be read in conjunction with the Company’s unaudited consolidated financial statements (including the notes thereto) and Item 1A of Part II; “Risk Factors,” included elsewhere in this report and the Company’s audited consolidated financial statements and the notes thereto, Item 7; and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations” and Item 1A, “Risk Factors” included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2012. The Company’s historical results are not necessarily an indication of trends in operating results for any future period. References to “ERHC” or the “Company” mean ERHC Energy Inc., a Colorado corporation, and, unless expressly stated or the context otherwise requires, its wholly owned subsidiary.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

We are including the following cautionary statement to make applicable and take advantage of the safe harbor provision of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by us, or on our behalf. This Quarterly Report on Form 10-Q contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Certain statements contained herein are forward-looking statements and, accordingly, involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and are believed by us to have a reasonable basis, including without limitations, management's examination of historical operating trends, data contained in our records and other data available from third parties, but there can be no assurance that management's expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements: geopolitical instability where we operate; our ability to meet our capital needs; our ability to raise sufficient capital and/or enter into one or more strategic relationships with one or more industry partners to execute our business plan; our ability and success in finding, developing and acquiring oil and gas reserves; our ability to respond to changes in the oil exploration and production environment, competition, and the availability of personnel in the future to support our activities.

Overview

ERHC Energy Inc., a Colorado corporation, (“ERHC” or the “Company”) was incorporated in 1986. The Company is in the business of exploration for oil and gas resources in Africa. The Company’s business includes working interests in exploration acreage in the Republic of Kenya (“Kenya”), the Republic of Chad (“Chad”), the Joint Development Zone (“JDZ”) between the Democratic Republic of Săo Tomé and Príncipe (“STP”), the Federal Republic of Nigeria (“FRN” or “Nigeria”), and the exclusive economic zone of Săo Tomé and Príncipe (the “Exclusive Economic Zone” or “EEZ”).

ERHC’s strategy in Kenya and Chad is to perform exploration work and further establish the prospectivity of assets acquired through Production Sharing Contracts (PSCs) with the governments of both countries. ERHC plans to raise up to $48 million to cover the projected costs of exploration in the near future. ERHC is simultaneously entertaining discussions with other exploration and production companies which want to farm into ERHC’s interests in Kenya and Chad. ERHC expects that such farm-in arrangements, if entered into, might lower the risk and cost of the exploration programs to ERHC.

The Company’s strategy in the JDZ and EEZ is to farm out its working interests to well established oil and gas operators for valuable consideration including upfront cash payments and being carried for ERHC’s share of the exploration costs. This has already been done successfully on Blocks 2, 3 and 4 of the JDZ where ERHC has benefited from partnerships with Addax Petroleum and Sinopec Corporation, which have operated some of the license areas on behalf of ERHC.

ERHC is now pursuing a similar approach for JDZ Blocks 5, 6 and 9 as well as for blocks in the EEZ.

Apart from its oil and gas exploration activities in Kenya, Chad, the JDZ and the EEZ, ERHC continues to pursue other oil and gas opportunities on the African continent. These opportunities also include the possible acquisition of significant equity stakes in other oil and gas exploration and production companies and the resulting indirect interest in the underlying exploration and production assets of such other companies.

REPUBLIC OF KENYA

ERHC Kenya Acreage

In June 2012, after several months of negotiations between ERHC and the Government of Kenya, the Government awarded block 11A for oil and gas exploration and development in Kenya to the Company. The block is ERHC’s first exploration acreage in East Africa and further diversifies the Company’s portfolio of oil and gas assets.

The Company holds a 90% interest in Block 11A, which encompasses 11,950.06 square kilometers or 2.95 million square acres. The Government of Kenya has a 10% carried participating interest up to the declaration of commerciality and may thereafter acquire an additional 10% interest in the PSC in which case the total Government participation would rise to 20%. Circle Limited (www.circleoilandgas.com) (“Circle”) acted as finder in ERHC’s acquisition of the Block by facilitating ERHC’s entry into Kenya, including the introduction of Dr. Peter Thuo, ERHC’s Kenya-based geoscientist and technical adviser who provided liaison services in the pursuit of ERHC’s application. Circle’s involvement provided significant efficiencies, including substantial cost savings, in ERHC’s application process. By virtue of the terms of the business finder’s agreement reached between Circle and ERHC, Circle is entitled to receive a 5% payment on the value of the acquisition accruing resulting to ERHC from the application. Circle has opted to receive this fee in the form of a carried 5% of ERHC’s total interest.

Kenya Oil Background and Overview

East Africa has emerged in recent years as arguably one of the most exciting, new oil provinces in the world with major discoveries of oil in Uganda’s Block 1 (EA1), and Kenya’s Ngamia-1, and large gas discoveries, including the recent Zafarani find, offshore of Tanzania.

The regional geology and structural evolution of Block 11A in Kenya is dominated by the Cretaceous Central Africa Rift System (CARS) and the Tertiary East Africa Rift System (EARS) with the associated basin depositional trends. The main surface feature of Block 11A is the Lotikipi plain. This broad depression measures approximately 110 km from east to west.

The proximity and in-trend relationship between the Lotikipi plain and the Abu Gabra Rift basins of southern Sudan suggest high oil and gas prospectivity. The southern Sudan basins are established petroleum provinces. Surface exposures of the sedimentary units with potential source and reservoir value, represented by the Cretaceous/Paleogene Lapur Formation of the Turkana Grits, give an indication of the sediments that might be encountered beneath the Lotikipi plain.

Gravity data, acquired earlier in the area, enabled the delineation of a sedimentary basin within the Block 11A area below the Lotikipi plain. The basin-fill is believed to be in excess of 5,000 meters, well above the threshold for sufficiently buried and mature organic matter for oil generation.

Block 11A is in the vicinity of Blocks operated by one of the most prolific notable oil and gas explorers in Africa. Drilling activity in area has resulted in successful wells, including the Eliye Springs in the adjacent Block 10BA and the Loperot and Ngamia-1 in Block 10BB.

Oil and Gas occurrences in the region

Production Sharing Contract (PSC) on ERHC’s Block in Kenya

On June 28, 2012, the Company announced that it had signed a Production Sharing Contract (PSC) on Block 11A with the Government of Kenya. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Kenya in respect of exploration and production in the Block awarded to the Company. The PSC details, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frame for completion of the work commitments, production sharing between the parties and the Government, and how the costs of exploration, development and production will be recovered.

Exploration Term and Key Provisions of the PSC

The initial exploration period is two years from the effective date of the PSC. The effective date falls ninety days after the execution of the PSC. The Company is expected to begin exploration operations within three months of the effective date. The initial exploration period is extendable for two additional two-year exploration periods contingent upon fulfillment of Company’s work and expenditure obligations under the PSC.

If not renewed, the PSC expires automatically at the end of the initial exploration period or at the end of any additional exploration period unless a commercial discovery is made before the exploration period expires. In the case of a commercial discovery of crude oil in a relevant development area, the PSC will run for a development period term of 25 years. In the case of a commercial discovery of natural gas in a relevant development area, the PSC will run for a development period term of 35 years.

The PSC provides for a mandatory surrender of 25% of the original contract area by the end of the initial exploration period and 25% of the remaining contract area by the end of the first additional exploration period. In the case of a commercial discovery of crude oil in a relevant development area, such development area is excluded from the original contract area for the purpose of surrender calculation. Furthermore, ERHC may surrender an additional part of the contract area and such voluntary surrender shall be credited against the next surrender obligation. The PSC will terminate in case of a surrender of the entire contract area.

The PSC requires a signature bonus of $310,000 which the Company paid in full.. The PSC also requires the Company, upon entry into each exploration period, to provide a bank guarantee of 50% and a parent company guarantee of 50% of its full minimum work and expenditure obligations under the work program for each exploration period.

The PSC with the Government of Kenya obliges ERHC to carry out the following minimum work program:

|

(A)

|

During the Initial Exploration Period of Two (2) Contract Years – Minimum Work and Expenditure Obligations:

|

|

|

·

|

Acquire and interpret 1,000 km2 of gravity and magnetic data (at a minimum cost of - US $ 250,000) and

|

|

|

·

|

Acquire and interpret 1,000 Km/line of 2D seismic data (at a minimum cost of – US $ 10,000,000)

|

|

(B)

|

During the First Additional Exploration Period of Two (2) Contract Years: Minimum Work and Expenditure Obligations to:

|

|

|

·

|

Acquire 750 km2 high density of 3D seismic data (at a minimum cost of US $ 30,000,000), or

|

OR

|

|

·

|

Drill one (1) well to a minimum depth of 3,000 m (at a minimum cost of US $30,000,000

|

|

(C)

|

During the Second Additional Exploration Period of Two (2) Contract Years: Minimum Work and Expenditure Obligation to:

|

|

|

·

|

Drill one (1) well to a minimum depth of 3,000m (at an approximate cost of US $ 30,000,000).

|

However, if the Company satisfactorily completes the minimum work obligations without having spent up to the minimum expenditure, the Company will be deemed to have satisfied its obligations under the PSC.

Developments in Kenya in the Three Months Ended December 31, 2012

The Company recently received formal approval for its 2013 work program in Kenya. That work program is focused on conducting a Full Tensor Gravity (FTG) survey to define the major structural elements of our Block 11A. FTG acquisition measures minute changes of the earth's gravity caused by differences in density in the local geology. When combined with known geologic information and other kinds of data, FTG data will be used to assess geological structures and potential resource deposits. This activity will help the Company better identify potential leads and prospects and focus the Company’s acquisition of seismic data.

REPUBLIC OF CHAD

ERHC’s Chad Acreage

In June 2011, after several months of negotiations between ERHC and the Government of Chad, the Government awarded three blocks for oil and gas exploration and development in Chad to the Company. The initial period of exploration of these blocks commenced on July 12, 2012 with the publication, in Chadian Government’s Gazette Principal, of the Exclusive Exploration Authorization, granted to ERHC by the Government of Chad.

The names of the blocks and the sizes of Company's respective interests are as follows:

|

Block

|

|

ERHC Interest

|

|

Net ERHC acreage

|

|

|

|

|

|

|

|

Manga

|

|

100%

|

|

6,477 square kilometers or 1,600,501 acres

|

|

|

|

|

|

|

|

BDS 2008

|

|

100%

|

|

16,360 square kilometers or 4,042,644 acres

|

|

|

|

|

|

|

|

Chari-OuestOust III

|

|

50%

|

|

4,500 square kilometers or 1,111,974 acres

|

Chad Oil Background and Overview

The country covers almost 1,284,000 km2 and is situated in what has become a golden triangle of African oil production. Chad is bordered by Libya, Nigeria and Sudan which are among Africa’s largest producers of crude oil. Cameroon which borders Chad in the South West is also a net exporter of crude oil..

Chad is now amongst Sub-Saharan Africa’s more significant crude oil producers. The country has reported proven oil reserves of 1.5 billion barrels with recent studies indicating that there is the potential for more discoveries. Production came on stream in 2003 when a consortium of Chevron, Esso E&P (Exxon) and PETRONAS brought the Miandoum field into production. Production followed from the Kome and Bolobo fields in 2004 while the Nya, Moundouli and Maikeri fields went into production between 2005 and 2007. In 2007, the Chinese National Petroleum Company (“CNPC”) began producing from the Mimosa and Ronier fields in the Bongor basin in South Western Chad.

Chad began to export oil in 2004. The export route is through the Chad-Cameroon pipeline completed in 2003 at a cost of over $3.7 billion. The pipeline runs 1,000 km from Chad’s prolific Doba basin through Cameroon’s Logone Birni basin to the port of Kribi in the Gulf of Guinea with an estimated capacity of 225,000 bopd. The capacity of the pipeline is significantly larger than Chad’s current production which in 2010 averaged 122,500 bopd. A new 300 km pipeline has been constructed to transport crude oil from the Koudalwa field in the South Western Chari-Buguirmi region to the Djarmaya refinery. The Djarmaya refinery, situated about 40 km North of N’Djamena, Chad’s capital, was built as a joint venture between CNPC and the Chadian state oil company, SHT. The refinery became operational in July 2011 and has an initial capacity of 20,000 barrels of oil per day which is planned to rise to 60,000 barrels of oil per day.

ERHC has a 100% interest in the Manga Block which is north of Lake Chad, along the border with Niger. The Company also has 100% and 50% interests respectively in BDS 2008 and Chari-Ouest Block 3 which lie next to the prolific Doba and Doseo Basin oilfields. In 2010, the Doba and Doseo Basin oilfields had an average production of 122,500 barrels of crude oil per day. BDS 2008 is also bounded by the Bongor basin which hosts the producing Mimosa and Ronier fields. Extensive exploration activity in the three basins has resulted in a large number of recent discoveries, including the Benoy-1 in Chari-Ouest Block 3 by the Taiwanese Company, OPIC. The Benoy-1 discovery, adjacent to ERHC’s license area, is estimated to have the potential for up to 9,800 barrels of high-quality, light crude per day and 1.2 million cubic feet of natural gas per day.

The Doba and Doseo basins are part of the Central African rift system. They contain up to 10 km of non-marine sediments recording the complex tectonic and climatic evolution of the region from Early Cretaceous to the present. The Doba basin is within the oil-proved zone confirmed by the M’biku and Belanga Wells. The Doseo Basin is one of the tertiary–cretaceous Chad rift basins. The basin is bordered by the Central African Republic in the South and South East. Wells drilled in this basin include Kedini-1, Keita-1, Kibea-1, Kikwey-1, Maku-1, Nya-1, North Sako-1, Tega-1, Bambara-1 and Bona Kaba-1. These wells were drilled by Exxon and Conoco and all discovered hydrocarbons except for Keita-1 and Bona Kaba-1

ERHC plans to focus its work program initially on the BDS 2008 and Chari Ouest III Blocks in Southern Chad. ERHC’s holdings in the two Blocks encompass 20,860 square kilometers or 5.155 million acres. Both Blocks are located on the north flank of the Doba/Doseo basin, where Esso and other operators have made significant crude oil discoveries. The regional geology of Chari-Ouest III and BDS 2008 Blocks is dominated by the Pan African Shear Zone and associated rift basins. Esso and partners have been active in exploration and development projects in the area for decades. ERHC recently invited eligible contractors to submit expressions of interest in providing Environmental Impact Assessment (EIA), gravity/magnetic and seismic acquisition services in the focus area. Furthermore, the proximity of the Chad-Cameroon pipeline to these blocks provides necessary infrastructure for the exploitation of potential oil and gas reserves.

Production Sharing Contract (PSC) on ERHC’s Three Blocks in Chad

On July 6, 2011, the Company announced that it had signed a Production Sharing Contract (PSC) on the three oil blocks with the Government of Chad. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Chad in respect of exploration and production in the Blocks awarded to the Company. The PSC details, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frame for completion of the work commitments, production sharing between the parties and the Government, and how the costs of exploration, development and production will be recovered. The PSC requires a signature bonus of $6 million, $1 million of which was paid upon transmittal of an Approval Law by Chad to ERHC in July 2011, $4 million are due within 90 days of the later of (a) a publication of the Approval Law in Chad’s official gazette and (b) a notification of ERHC of the Award Order, and $1 million is due 120 days after the date of transmittal of the Approval Law to ERHC. ERHC is currently pursuing the formal extension of timelines for the commencement of the work program and meeting of pecuniary obligations under the PSC with the Government of Chad.

Exploration Term

During the quarter ended, June 30, 2012 the Government of the Republic of Chad issued an Exclusive Exploration Authorization (EEA) to ERHC in respect to the three blocks covered by ERHC’s PSC in Chad. The EEA authorizes ERHC to undertake oil and gas exploration operations in the Chari-Ouest III, BDS 2008 and Manga Blocks in Chad, which are covered by the PSC. The initial period of exploration of these blocks commenced on July 12, 2012 with the publication, in the Chadian Government’s Gazette Principal, of the Exclusive Exploration Authorization, granted to ERHC by the Government of Chad. The initial term of the Exclusive Exploration Authorization is five years and can be renewed for three more years.

Propose Exploration Work Program

ERHC has proposed a minimum exploration work program on the basis of the full 8-year exploration period subject to such modification as might be required following the exploration work undertaken during the initial 5-year period of the Exclusive Exploration Authorization. The minimum expenditure over the initial period is US $16 million in addition to a balance of US $4 million on the signature bonus.

In the event of a discovery and commercial production from the Company’s blocks, the Company and any partners that have participated in the exploration will be entitled to recover up to 70% of the net hydrocarbon production (less any production royalty) as cost oil, until all the costs for exploration and development have been recovered. Production royalty is 14.25% in the case of crude oil and 5% in the case of natural gas. No guarantee can be given that there will be production in commercial quantities from the Company’s exploration acreage in Chad.

ERHC’s proposed exploration work program covers the three blocks as a whole and broadly is as follows:

Initial Work Phase (4 years)

The first two-year sub-period is intended to cover geological work including regional geology and field studies utilizing existing well logs and 2D seismic data, construction of regional structure isopach and facies maps and cross-sections at key formation tops, acquisition and studying of satellite seep data on a regional scope, organization of G&G database and basin evaluation and modeling to describe petroleum system and migration paths. The sub-period also includes such geophysical work as the acquisition and study of available gravity and magnetic surveys to define the major structural elements, reprocessing of the existing 2D seismic data, interpretation of the existing 2D seismic data to prepare regional structure maps at key formations and tectonic horizons, acquisition of 2D seismic over the prospects and leads based on the outcome of gravity/magnetic and 2D seismic interpretations and mappings, geophysical analysis to enhance the prospects, and acquisition of 3D seismic data over mature prospects.

The second two-year sub-period is expected to include geological and geophysical work such as merging and editing the reprocessed 2D seismic data with newly acquired 3D seismic data, detailed interpretation and mapping of 3D seismic, generation, upgrading and prioritizing of drilling prospects. During this period, the contractor shall also determine the most practical method of drilling applicable to the area, taking into account health, safety, environmental issues and other factors. One exploration well is expected to be drilled during this period.

Second Work Phase (2 years)

This period is intended to cover geological work including the conduct of play analysis to define charge, seal, trap, reservoir, timing, source and maturation. It also covers geophysical work such as the acquisition and interpretation of seismic data over the prospective area to add to or enhance the prospect inventory. One exploration well is expected to be drilled during this period.

Third Work Phase (2 years)

This period is intended to cover geological work including the re-evaluation of the maps and studies with respect to the information from the well, acquisition of 2D seismic data over the prospective area and upgrading and increasing of the prospect inventory utilizing the new seismic data. One exploration well is expected to be drilled during this period.

Status and Developments in Chad at December 31, 2012

The Company’s proposed 2013 work program in Chad will concentrate on focus areas in BDS-2008 with the goal of identifying leads and prospects for future drilling. The Company’s exploration team has delineated two focus areas situated directly north of numerous major discoveries on a rift margin along the Central African Shear Zone. Regional stratigraphic mapping indicates the presence of alluvial fan deltas and lacustrine deltas in ERHC’s areas of interest, which provide both reservoir and seal rocks. As in Kenya, the Company plans to pursue rift margin plays in Chad similar to those that led to recent major discoveries in East Africa.

As of December 31, 2012, particular milestones are outstanding including certain financial obligations as provided in the PSC. Management is currently pursuing the formal extension of timelines for the commencement of the work program and meeting of pecuniary obligations under the PSC with the Government of Chad. The formal timeline extensions will enable the conclusion of administrative and other obligations on both sides (including the setting up of a management committee for the exploration) that are a pre-requisite to the effective execution of ERHC’s PSC commitments.

NIGERIA – SAO TOME AND PRINCIPE JOINT DEVELOPMENT ZONE (“JDZ”)

Background of the JDZ

In the Spring of 2001, the governments of Săo Tomé & Príncipe and Nigeria reached an agreement over a long-standing maritime border dispute. Under the terms of the agreement, the two countries established the JDZ to govern commercial activities within the disputed boundaries. The JDZ is administered by the JDA which oversees all future exploration and development activities in the JDZ. The revenues derived from the JDZ will be shared 60/40 between the governments of Nigeria and Săo Tomé & Príncipe, respectively.

ERHC’s Rights in the JDZ

In April 2003, the Company and the DRSTP entered into an Option Agreement (the “2003 Option Agreement”) in which the Company relinquished certain financial interests in the Joint Development Zone (“JDZ”) in exchange for exploration rights in the JDZ. The Company additionally entered into an Administration Agreement with the Nigeria-Săo Tomé and Príncipe Joint Development Authority (“JDA”). The Administration Agreement is the formal agreement by the JDA that it will fully implement ERHC’s preferential rights to working interests in the JDZ acreage as set forth in the 2003 Option Agreement and describes certain procedures regarding the exercising of these rights. Following the exercise of ERHC’s rights as set forth in the 2003 Option Agreement, the JDA confirmed the award in 2004 of participating interests to ERHC in JDZ Blocks 2, 3, 4, 5, 6 and 9 of the JDZ. Subsequently, ERHC jointly bid with internationally renowned technical partners for additional participating interests in the JDZ during the 2004/5 licensing round conducted by the JDA.

The following represents ERHC’s current rights in the JDZ blocks:

|

JDZ Block

|

|

ERHC Original

Participating Interest

|

|

ERHC Joint Bid

Participating Interest

|

|

Participating

Interest(s) Assigned

|

|

Current ERHC

Retained Participating

Interest

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

30.00%

|

|

35.00%

|

|

43.00%

|

|

22.00%

|

|

3

|

|

20.00%

|

|

5.00%

|

|

15.00%

|

|

10.00%

|

|

4

|

|

25.00%

|

|

35.00%

|

|

40.50%

|

|

19.50%

|

|

5

|

|

15.00%

|

|

-

|

|

-

|

|

15.00% (in arbitration)

|

|

6

|

|

15.00%

|

|

-

|

|

-

|

|

15.00% (in arbitration )

|

|

9

|

|

20.00%

|

|

-

|

|

-

|

|

20.00%

|

The Original Participating Interest is the interest granted pursuant to the 2003 Option Agreement. ERHC has not assigned or transferred any of its participating interests in Blocks 5, 6 and 9.

ERHC’s Participating Agreements in the JDZ

The following are the particulars of the Participating Agreements by which ERHC transferred some of its participating interests in JDZ Blocks 2, 3 and 4 to technical partners so that the technical partners would operate the Blocks and carry ERHC’s proportionate share of costs in the Blocks until production, if any, commenced from the Blocks:

|

Date of Participation

Agreement

|

Party(ies)

to the Participation Agreement

|

|

Participating

Interest(s)

Assigned

|

|

|

Participating

Interest Assigned

Price

|

|

|||

|

|

|

|

|

|

|

|

||||

|

JDZ Block 2 - Participation Agreement - ERHC Retained Interest of 22.00%

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||

|

March 2, 2006

|

Sinopec International Petroleum Exploration Production Co. Nigeria Ltd - a subsidiary of Sinopec International Petroleum and Production Corporation

|

|

|

28.67

|

%

|

|

$

|

13,600,000

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Addax Energy Nigeria Limited - an Addax Petroleum Corporation subsidiary

|

|

|

14.33

|

%

|

|

$

|

6,800,000

|

|

||

|

|

|

|

|

|

||||||

|

JDZ Block 3 - Participation Agreement - ERHC Retained Interest of 10.00%

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

|

February 15, 2006

|

Addax Petroleum Resources Nigeria Limited - a subsidiary of Addax Petroleum Corporation

|

|

|

15.00

|

%

|

|

$

|

7,500,000

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

JDZ Block 4 - Participation Agreement - ERHC Retained Interest of 19.50%

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

|

November 15, 2005

|

Addax Petroleum Nigeria (Offshore 2) Limited - a subsidiary of Addax Petroleum Corporation

|

|

|

40.50

|

%

|

|

$

|

18,000,000

|

|

|

Under the terms of the Participation Agreements Sinopec and Addax agreed to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of ERHC's retained interests in the blocks. Additionally, Sinopec and Addax are entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil from the retained interests on individual blocks until Sinopec and Addax Sub recover 100% of ERHC’s carried costs.

On or about October 2, 2009, Sinopec International Petroleum Exploration and Production Corporation acquired all of the outstanding shares of Addax Petroleum Corporation

OPERATIONS IN THE JDZ

ERHC has working interests in six of the nine Blocks in the JDZ, as follows:

|

|

●

|

JDZ Block 2: 22.0%

|

|

|

●

|

JDZ Block 3: 10.0%

|

|

|

●

|

JDZ Block 4: 19.5%

|

|

|

●

|

JDZ Block 5: 15.0% (in arbitration)

|

|

|

●

|

JDZ Block 6: 15.0% (in arbitration)

|

|

|

●

|

JDZ Block 9: 20.0%

|

The working interest percentages represent ERHC’s share of all the hydrocarbon production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks. Through Exploration Phase 1 in blocks 2, 3 and 4, these costs have been carried by the operators. The operators can only recover their costs by carrying ERHC until production whereupon the operators will recover their costs from production revenues.

ERHC’s interests in the JDZ Blocks are in various stages of exploration. JDZ Blocks 2, 3 and 4 were the focus of an exploration campaign that concluded in January 2010. To date, no Production Sharing Contracts have been signed by ERHC in either JDZ Block 5 or 6, and no operatorship has been awarded in JDZ Block 9.

In 2009, Sinopec and Addax, ERHC’s technical partners and operators in Blocks 2, 3 and 4 undertook an exploratory drilling campaign across the three blocks that was completed in January 2010. That drilling campaign was a coordinated effort made possible by two important transactions undertaken by Addax and Sinopec during 2009: (1) Addax’s acquisition of Anadarko Petroleum’s interest in Block 3, allowing Addax to become the operator in the Block 3 and (2) Sinopec’s acquisition of Addax.

The drilling campaign was completed in January 2010 with a total of five wells drilled as follows:

|

|

●

|

The Kina-1 well in JDZ Block 4

|

|

|

●

|

The Bomu-1 well in JDZ Block 2

|

|

|

●

|

The Lemba-1 well in JDZ Block 3

|

|

|

●

|

The Malanza-1 well and Oki East-1 well in Block 4

|

Biogenic gas was discovered in each block and discussions continue between the Joint Development Authority and the parties, including ERHC, that hold interests in JDZ Blocks 2, 3 and 4, regarding drilling results. The meetings with the JDA are aimed at reaching a definitive agreement on how to proceed with the next stage of exploration in the Blocks following the expiration of Exploration Phase I in March 2012.

General Information on Current Operations in Blocks 2, 3 and 4

Exploration Phase 1 (as extended) in Joint Development Zone (JDZ) Blocks 2, 3 and 4 expired on March 14, 2012.

Under the contractual terms governing the Blocks, the three potential courses of action at the expiration of an Exploration Phase are:

|

|

1.

|

The operators (Addax and Sinopec), the rest of the parties and the JDA could agree to enter into Phase 2 of the exploration program which requires the drilling of at least one more well in each Block.

|

|

|

2.

|

The operators, the rest of the parties and the JDA could agree upon a further extension of Exploration Phase 1.

|

|

|

3.

|

The operators could decide not to pursue future exploration of the Blocks and terminate their involvement in the Blocks, leaving the rest of the parties and the JDA to decide whether to adopt any of the two other courses of action stated before

|

The operators’ decision whether to continue or not will be the key factor in determining what course of action will be adopted next in JDZ Blocks 2, 3 and 4.

ERHC and its technical partners have obtained very valuable information regarding the stratigraphy, sedimentology and structure of JDZ Blocks 2, 3 and 4 in the five-well drilling campaign undertaken between 2009 and 2010. There are still more than a dozen additional prospects identified in the three Blocks as potential exploration targets.

Management also understands that analyzing drilling results and incorporating them into the relevant geologic and fluid models takes time. Further, moving from field appraisal and development to production takes even more time. As has been the practice in the JDZ, accurate material information on the progress in the JDZ Blocks will emanate from the operators or the JDA. ERHC will publish such information in a timely manner in accordance with ERHC’s contractual and regulatory obligations.

Status of ERHC’s Blocks 2, 3 and 4 at December 31, 2012

The Company awaits a final decision as between the remaining parties to the PSC and the Joint Development Authority on how exploration in Blocks 2, 3 and 4 will proceed and the Company expects that decision could be made public at anytime. The three potential courses of action are entry into Phase 2 of the exploration program, further extension of Phase 1 or a withdrawal by some or all of the remaining parties from the PSC and relinquishment of the acreage. The Company intends to remain in the three Blocks and to retain its other interests in the JDZ.

SAO TOME AND PRINCIPE EXCLUSIVE ECONOMIC ZONE (“EEZ”)

Background of the EEZ

An exclusive economic zone is an area beyond and adjacent to the territorial waters of a coastal nation which is subject to specific legal regimes established by international law. In an exclusive economic zone, the coastal nation has sovereign rights established by international law to explore and exploit the natural resources in the zone. The STP EEZ delineates an expanse of waters offshore Săo Tomé and Principe covering approximately 160,000 square km. The EEZ is measured from claimed archipelagic baselines. The territorial waters of STP extend to 12 nautical miles from the coast while the exclusive economic zone extends from the edge of the territorial waters to 200 nautical miles from the coast. The STP EEZ is the largest such zone in the Gulf of Guinea. Oceanic water depths around the two islands exceed 1,524 meters, depths that have only become feasible for oil production in the past few years; however, oil and gas are produced in the neighboring countries of Nigeria, Equatorial Guinea, Gabon and Congo.

ERHC’s Rights and in the EEZ

Under an agreement with the government Sao Tome and Principe (“STP”) prior to the 2003 Option Agreement, ERHC was vested with the rights to participate in exploration and production activities in the EEZ. These rights included (a) the right to receive up to 100% of two blocks of ERHC’s choice and (b) the option to acquire up to a 15% paid working interest in each of two additional blocks of ERHC’s choice in the EEZ. In 2010, ERHC exercised its rights to receive up to 100% of two blocks of ERHC’s choice in the EEZ and was duly awarded Blocks 4 and 11 of the EEZ by the Government of STP. ERHC will decide whether to take up the option to acquire up to a 15% paid working interest in each of two additional blocks of the EEZ when called upon to exercise the option by the Government of STP in accordance with the agreements which provide for the rights and option.

PSC Negotiations for the EEZ

A PSC is an agreement that governs the relationship between the Company (and its joint venture partners) and the Government of Săo Tomé and Príncipe in respect of exploration and production in any Block awarded to the Company. The PSC spells out, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frames for accomplishing the work commitments, how production will be shared between the parties and the government, and how the costs of exploration, development and production will be recovered.

Negotiations for a PSC between ERHC and the National Petroleum Agency of Săo Tomé and Príncipe (ANP-STP) opened on November 14, 2011 in Sao Tome and are continuing. Good progress has been made in the first three rounds of negotiations but the Company expects that it will take several more rounds to conclude the negotiations. The PSCs pertain to ERHC’s 100 percent working interest in Blocks 4 and 11 of the Săo Tomé and Príncipe Exclusive Economic Zone (“EEZ”). ERHC’s management is looking to negotiate PSCs for the EEZ Blocks that will be attractive to potential joint venture partners. Discussions are continuing simultaneously with prospective operating partners for ERHC’s EEZ Blocks.

Overview of ERHC’s EEZ Blocks

The Săo Tomé and Príncipe EEZ is a frontier exploration region that sits south of the Niger Delta and west of the Gabon salt basin, retaining similarities with each of those prolific hydrocarbon regions. The regional seismic database comprises approximately 12,000 kilometers of seismic data. Interpretation of that seismic data shows numerous structures that have similar characteristics to known hydrocarbon accumulations in the area.

EEZ Block 4 is 5,808 square kilometers, situated directly east of the island of Príncipe. The northeastern area near EEZ Block 4 contains a large graben structure, which is bound by the Kribi Fracture Zone.

EEZ Block 11 totals 8,941 square kilometers, situated directly east of the island of Săo Tomé and abuts the territorial waters of Gabon. The southern area of the EEZ, where EEZ Block 11 is situated, contains parts of the Ascension and Fang Fracture Zones.

Status of ERHC’s EEZ Blocks at December 31, 2012

The Company anticipates that Production Sharing Contract negotiations related to our exploration Blocks in São Tomé and Príncipe Exclusive Economic Zone (EEZ) will be completed in the near future. The Company and the ANP-STP continue to negotiate diligently a few key terms that remain on the putative PSC with a view to making resulting provisions mutually satisfactory and equally beneficial to both sides.

INVESTMENT IN OANDO ENERGY RESOURCES (FORMERLY EXILE RESOURCES)

During the three months ended June 30, 2011, ERHC invested $1,350,000 in the stock of Exile Resources Inc, a company listed on the Toronto Stock Exchange’s Ventures Exchange (TSX-V:ERI), in open market purchases. ERHC’s intention was to gain an indirect interest in Exile’s underlying oil and gas exploration and production assets as well as the ability to participate in Exile’s decision making in respect of those assets. ERHC was particularly interested in Exile’s carried interest in the Akepo field in the Niger Delta.

The Akepo field is located in the shallow waters of the southeastern area of Nigeria in OML 90. Exile Resources had 10 percent equity and up to a 17.5% economic interest in the field, with a subsidiary of Oando Plc (“Oando Petroleum”) carrying its costs. From July 2011, Exile Resources commenced a reorganization exercise under agreement with Oando Plc (“Oando”) whereby a reverse takeover (“RTO”) of Exile Resources by Oando occurred. In July 2012, Exile announced the completion of the RTO by Oando and the change of name of the company to Oando Energy Resources Inc, (“OER”). It also announced the approval by the Toronto Stock Exchange (TSX) of the listing of the company’s shares under the symbol “OER” on the TSX and commencement of trading in the shares on the TSX from July 30, 2012.

The approved terms of reorganization on the RTO were that each Exile shareholder received one share OER for every 16.28 shares held in Exile upon the RTO. Each Exile shareholder also received two shares purchase warrants for 16.28 shares held in Exile. The first share purchase warrant entitled the purchase of one OER share at Cdn$1.5 within 12 months and the other entitled the purchase of one OER share at Cdn$2.00 within 24 months.

As a result of the RTO, ERHC now holds 418,889 shares in the common stock of Oando Energy Resources. ERHC also holds warrants for 418,889 common shares exercisable within 12 months of closing of the RTO at Cdn$1.50 per share and for another 418,889 common shares exercisable within 24 months of the closing of the RTO at Cdn$2.00 per share.

ACQUISITION OF OTHER OIL AND GAS EXPLORATION AND PRODUCTION ASSETS

Although ERHC is making considerable progress toward realizing the value of the Company’s oil and gas assets in Kenya, Chad, the JDZ, and the EEZ, it may be some time before any of these oil and gas assets begin to produce revenues. ERHC, therefore, seeks to identify and acquire assets with a shorter time horizon for revenue generation.