Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANDEAVOR | a4q128-kearningspresentati.htm |

4th Quarter Earnings Slides February 7, 2013 Exhibit 99.1

This Presentation includes and references “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, expectations regarding refining margins, revenues, cash flows, capital expenditures, turnaround expenses and other financial items. These statements also relate to our business strategy, goals and expectations concerning our market position, future operations, margins and profitability. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “would” and similar terms and phrases to identify forward- looking statements in this Presentation, which speak only as of the date the statements were made. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward- looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. We have included various estimates of EBITDA, a non-GAAP financial measure, throughout the presentation. These estimates include EBITDA estimates related to our High Return Capital Program, Tesoro Logistics, BP Carson Transaction Synergies and Chevron’s Northwest Products System. Please see Appendix for the definition and reconciliation of these EBITDA estimates. Forward Looking Statements 2

1Q 2013 Guidance 3 Pacific Northwest Mid- Pacific Mid- Continent California Throughput (mbpd) 125 – 135 65 – 75 120 – 130 255-265 Manufacturing Cost ($/bbl) $ 4.85 $ 3.35 $ 3.45 $ 6.25 $ in millions, unless noted Corporate/System Refining Depreciation $ 98 Corporate Expense Before Depreciation $ 52 Interest Expense Before Interest Income $ 29

Net Earnings (Loss) 4 (124) 56 387 273 27 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 Net Earnings (Loss) $ in millions (0.89) 0.39 2.75 1.92 0.19 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 EPS (Diluted) $ per share $ in millions, except per share amounts 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 Refining $ (123) $ 191 $ 645 $ 610 $ 106 Retail 27 (4) 74 18 44 Corporate and Unallocated Costs (59) (53) (38) (122) (69) Interest and Financing Costs, Net1 (37) (36) (35) (66) (29) Other Income (Expense), Net2 1 1 (18) (2) (5) Income Tax (Expense) Benefit 73 (37) (235) (158) (12) Less Net Earnings Attributable to Non-Controlling Interest (6) (6) (6) (7) (8) Net Earnings (Loss) Attributable to Tesoro Corporation $ (124) $ 56 $ 387 $ 273 $ 27 EPS (Diluted) $ (0.89) $ 0.39 $ 2.75 $ 1.92 $ 0.19 1 Interest and financing costs, net includes foreign currency gains and losses. 2 Represents net amount of interest income and other income (expense), as reported.

1,367 1,639 185 459 (185) (236) 49 Beginning Cash EBITDA Working Capital & Other Interest & Tax, Net Capital Expenditures & Turnaround Financing Ending Cash 4Q 2012 Cash Flow 5 $ in millions 1 Reconciliations of EBITDA, a non-GAAP financial measure, to net earnings (loss) and cash flows from (used in) operating activities are included in the press release issued on February 6, 2013 which can be found on our website at www.tsocorp.com. 2 Reported Working Capital & Other excluding Hawaii impairment charges of $248 million and $40 million deposit related to Chevron Northwest Products System acquisition by Tesoro Logistics, LP totaled $251 million for the three months ended December 31, 2012. 1 2

Throughput by Refining Region 6 139 165 160 80 100 120 140 160 180 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual MBPD Pacific Northwest 72 70 72 40 50 60 70 80 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual MBPD Mid-Pacific 115 125 123 80 90 100 110 120 130 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual MBPD Mid-Continent 241 260 249 80 120 160 200 240 280 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual MBPD California

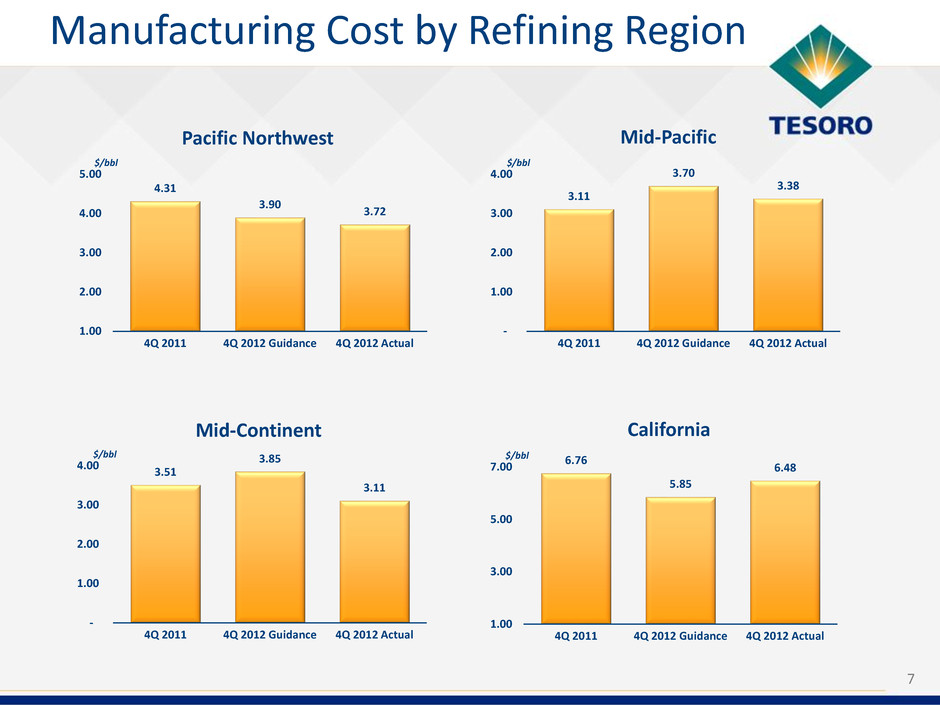

Manufacturing Cost by Refining Region 4.31 3.90 3.72 1.00 2.00 3.00 4.00 5.00 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual $/bbl Pacific Northwest 3.11 3.70 3.38 - 1.00 2.00 3.00 4.00 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual $/bbl Mid-Pacific 3.51 3.85 3.11 - 1.00 2.00 3.00 4.00 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual $/bbl Mid-Continent 6.76 5.85 6.48 1.00 3.00 5.00 7.00 4Q 2011 4Q 2012 Guidance 4Q 2012 Actual $/bbl California 7

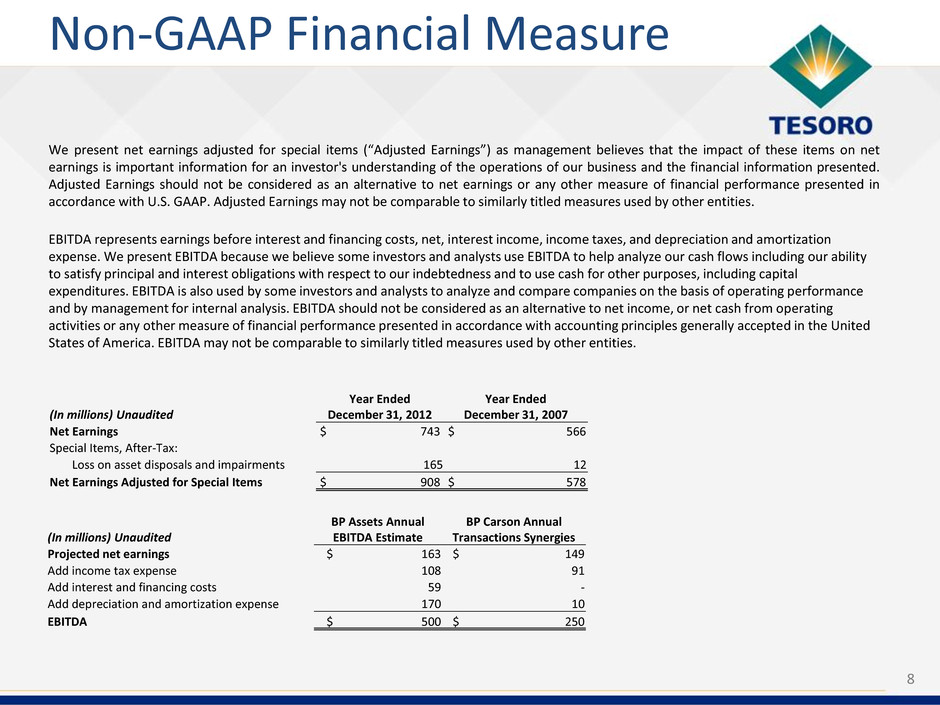

We present net earnings adjusted for special items (“Adjusted Earnings”) as management believes that the impact of these items on net earnings is important information for an investor's understanding of the operations of our business and the financial information presented. Adjusted Earnings should not be considered as an alternative to net earnings or any other measure of financial performance presented in accordance with U.S. GAAP. Adjusted Earnings may not be comparable to similarly titled measures used by other entities. EBITDA represents earnings before interest and financing costs, net, interest income, income taxes, and depreciation and amortization expense. We present EBITDA because we believe some investors and analysts use EBITDA to help analyze our cash flows including our ability to satisfy principal and interest obligations with respect to our indebtedness and to use cash for other purposes, including capital expenditures. EBITDA is also used by some investors and analysts to analyze and compare companies on the basis of operating performance and by management for internal analysis. EBITDA should not be considered as an alternative to net income, or net cash from operating activities or any other measure of financial performance presented in accordance with accounting principles generally accepted in the United States of America. EBITDA may not be comparable to similarly titled measures used by other entities. Non-GAAP Financial Measure 8 (In millions) Unaudited BP Assets Annual EBITDA Estimate BP Carson Annual Transactions Synergies Projected net earnings $ 163 $ 149 Add income tax expense 108 91 Add interest and financing costs 59 - Add depreciation and amortization expense 170 10 EBITDA $ 500 $ 250 (In millions) Unaudited Year Ended December 31, 2012 Year Ended December 31, 2007 Net Earnings $ 743 $ 566 Special Items, After-Tax: Loss on asset disposals and impairments 165 12 Net Earnings Adjusted for Special Items $ 908 $ 578

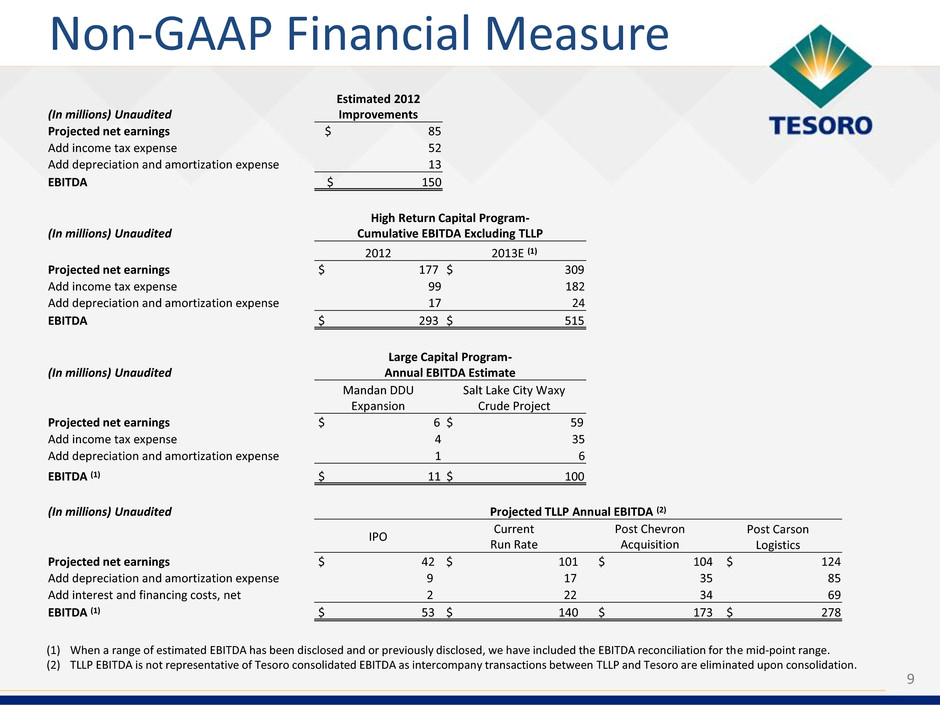

Non-GAAP Financial Measure 9 (1) When a range of estimated EBITDA has been disclosed and or previously disclosed, we have included the EBITDA reconciliation for the mid-point range. (2) TLLP EBITDA is not representative of Tesoro consolidated EBITDA as intercompany transactions between TLLP and Tesoro are eliminated upon consolidation. (In millions) Unaudited Estimated 2012 Improvements Projected net earnings $ 85 Add income tax expense 52 Add depreciation and amortization expense 13 EBITDA $ 150 (In millions) Unaudited High Return Capital Program- Cumulative EBITDA Excluding TLLP 2012 2013E (1) Projected net earnings $ 177 $ 309 Add income tax expense 99 182 Add depreciation and amortization expense 17 24 EBITDA $ 293 $ 515 (In millions) Unaudited Large Capital Program- Annual EBITDA Estimate Mandan DDU Expansion Salt Lake City Waxy Crude Project Projected net earnings $ 6 $ 59 Add income tax expense 4 35 Add depreciation and amortization expense 1 6 EBITDA (1) $ 11 $ 100 (In millions) Unaudited Projected TLLP Annual EBITDA (2) IPO Current Run Rate Post Chevron Acquisition Post Carson Logistics Projected net earnings $ 42 $ 101 $ 104 $ 124 Add depreciation and amortization expense 9 17 35 85 Add interest and financing costs, net 2 22 34 69 EBITDA (1) $ 53 $ 140 $ 173 $ 278